Non Refundable Tax Credits Templates

Are you looking for ways to maximize your tax savings? Do you want to take advantage of the various tax credits available to you? Look no further than our collection of non-refundable tax credits documents.

These documents serve as a comprehensive guide to understanding and claiming non-refundable tax credits. They provide essential information on the different types of tax credits you may be eligible for, as well as the specific requirements and calculations involved.

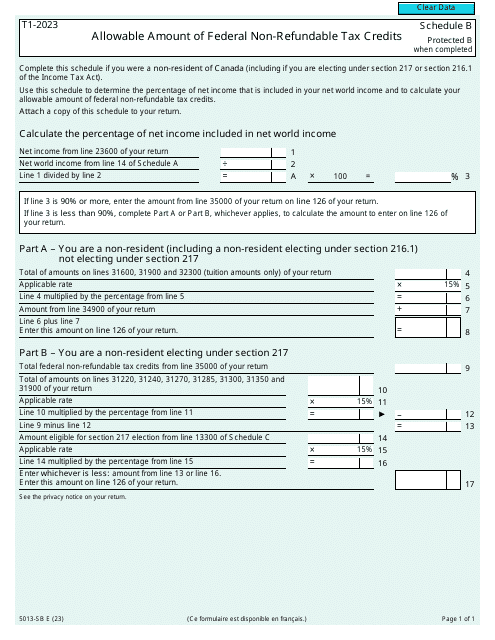

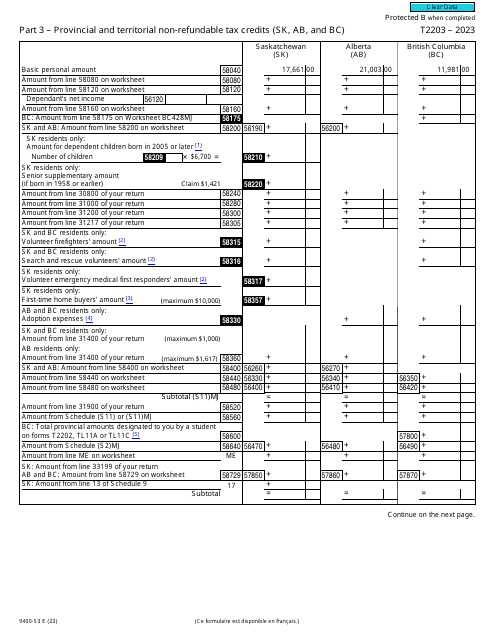

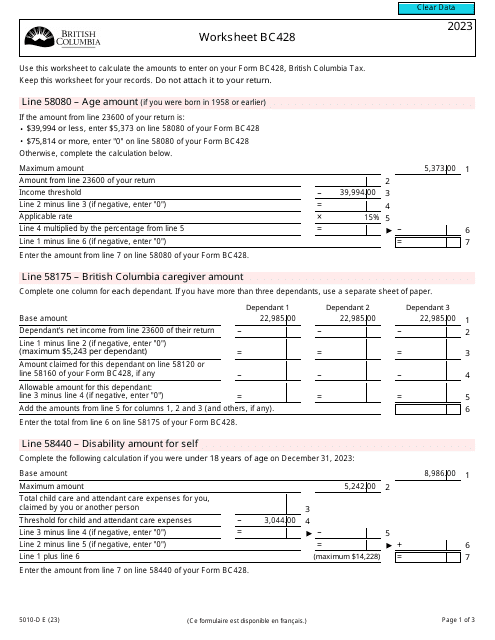

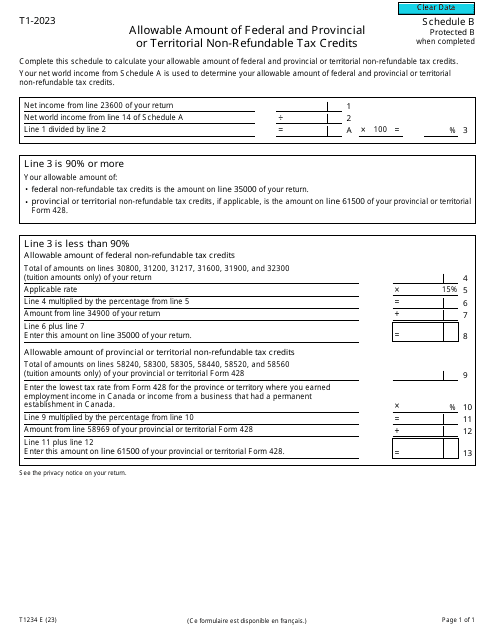

Whether you're an individual or a business owner, our collection of non-refundable tax credits documents has you covered. From Form 5013-SB Schedule B that details the allowable amount of non-refundable tax credits to Form T2203 (9400-S3) Part 3 which focuses on provincial and territorial non-refundable tax credits, these documents contain valuable insights and instructions.

By utilizing these documents, you can navigate the complex world of non-refundable tax credits with ease. Discover the benefits of federal non-refundable tax credits outlined in Form 5013-SB Schedule B Allowable Amount of Federal Non-refundable Tax Credits. Or explore the possibilities of federal and provincial/territorial non-refundable tax credits with Form T1234 Schedule B.

Our collection of non-refundable tax credits documents, also known as non-refundable tax credits resources, is an indispensable tool for individuals and businesses seeking to optimize their tax planning strategies. With clear explanations, detailed forms, and step-by-step instructions, these resources will empower you to make informed decisions and potentially reduce your tax liability.

Don't miss out on the numerous non-refundable tax credits available to you. Take advantage of our comprehensive collection of documents to ensure you're maximizing your tax savings and keeping more money in your pocket. Start exploring our non-refundable tax credits resources today!

Documents:

7