Compensation Report Templates

Are you looking for information about compensation report or compensation reporting? Our website is a comprehensive resource for all your needs. We provide a wide range of documents that cover various aspects of compensation reporting.

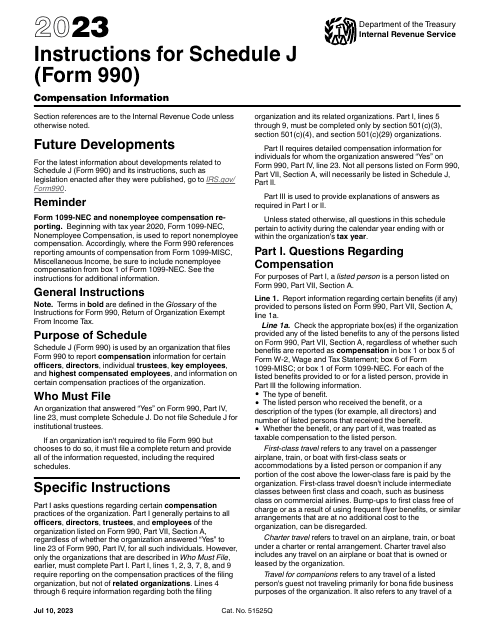

One of the documents we offer is the Instructions for IRS Form 990 Schedule J Compensation Information. This document provides detailed instructions on how to report compensation information for tax purposes. It includes guidelines on filling out the form accurately and ensuring compliance with IRS regulations.

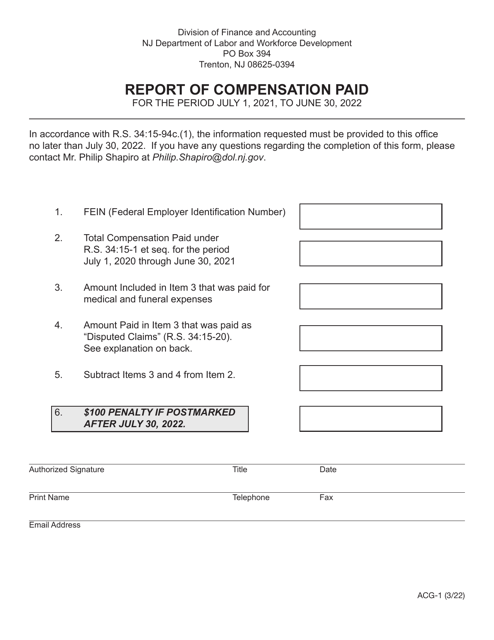

Another document in our collection is the Form ACG-1 Report of Compensation Paid - New Jersey. This document is specific to New Jersey and provides a reporting template for businesses to report compensation paid to their employees. It outlines the required information and provides instructions on how to complete the form correctly.

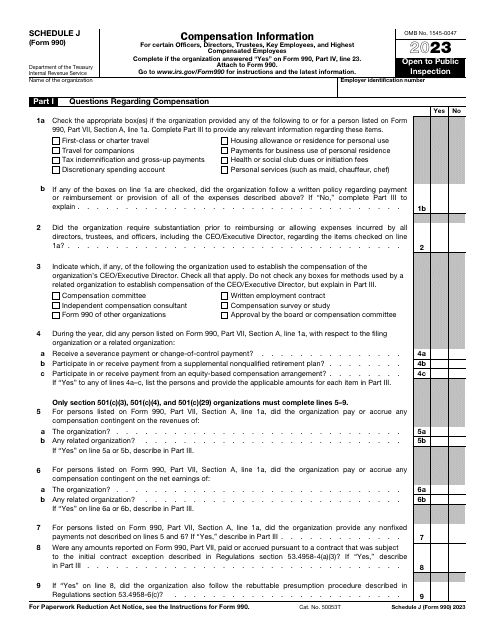

IRS Form 990 Schedule J Compensation Information is also available on our website. This form is used by tax-exempt organizations to report compensation and other financial information to the IRS. The document provides guidance on the reporting requirements and helps organizations fulfill their obligations.

In addition to these specific documents, we offer a wide range of resources related to compensation reporting. Whether you are an individual, a business owner, or a tax professional, our documents can help you navigate the complexities of reporting compensation accurately and effectively.

Browse through our collection today and find the information you need. Our website is a reliable and convenient source for all your compensation reporting needs. Trust us to provide accurate and up-to-date documents that will help you meet your reporting obligations.

Documents:

6

This form is used for reporting compensation paid in the state of New Jersey.