Tax Agreement Templates

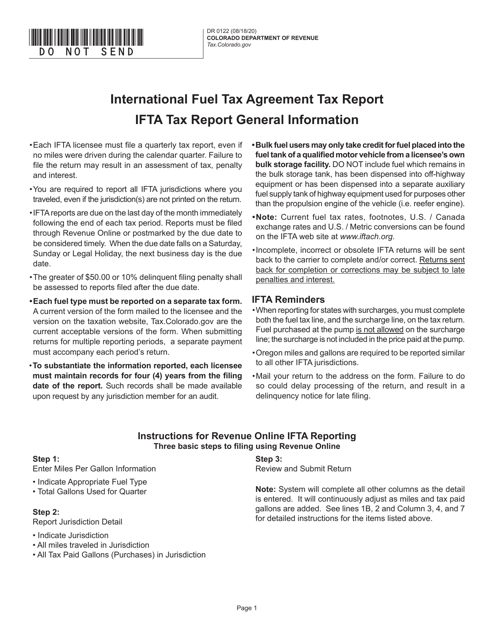

Looking for a reliable resource to navigate through tax agreements? Look no further! Our extensive collection of tax agreement forms and documents has got you covered. Whether you need to file an International Fuel Tax AgreementTax Report, request a Cigarette Tax Installment Agreement, or submit a Property Tax Payment Agreement Application, we have the forms you need. Our tax agreement collection, also known as tax agreement forms or tax agreements, offers a comprehensive range of documents to help you navigate the complexities of tax agreements. Save time and effort by accessing our vast library of tax agreement resources.

Documents:

51

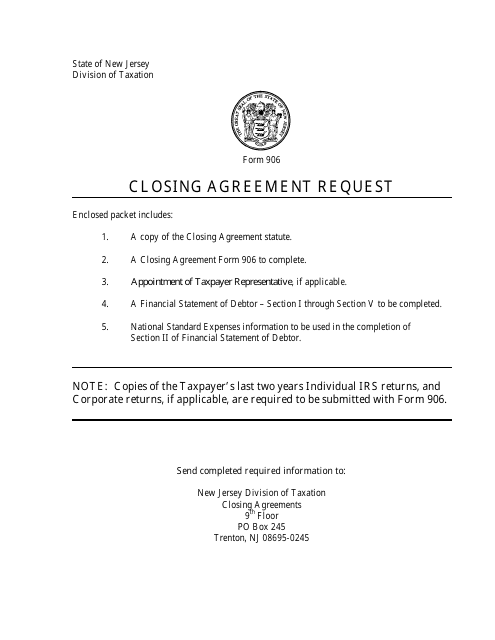

This Form is used for requesting a closing agreement in the state of New Jersey.

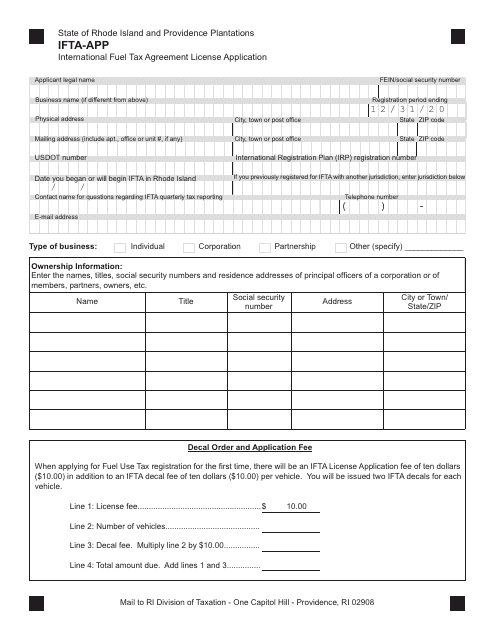

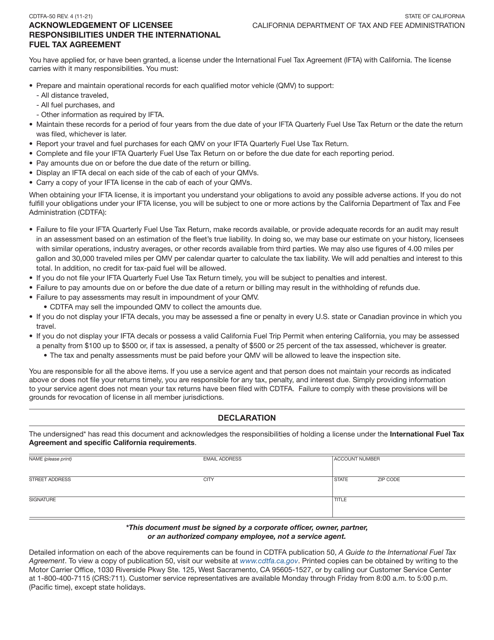

This document is an application form for obtaining an International Fuel Tax Agreement (IFTA) license in Rhode Island. It is used by individuals or businesses engaged in interstate commercial transportation to report and pay fuel taxes.

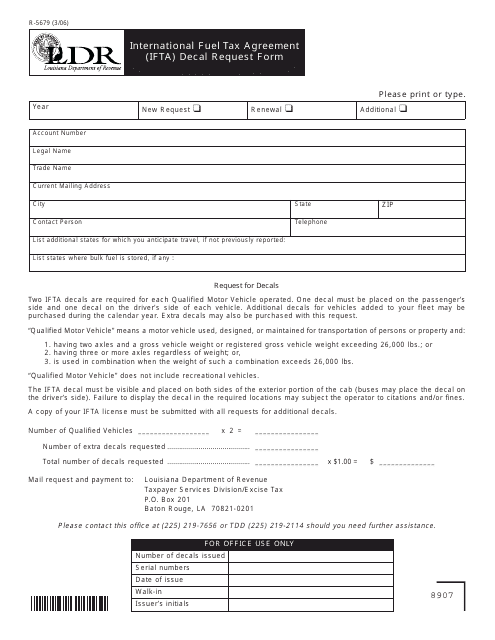

This form is used for requesting International Fuel Tax Agreement (IFTA) decals in Louisiana. It is required for commercial vehicles that operate across state lines and need to report and pay fuel taxes.

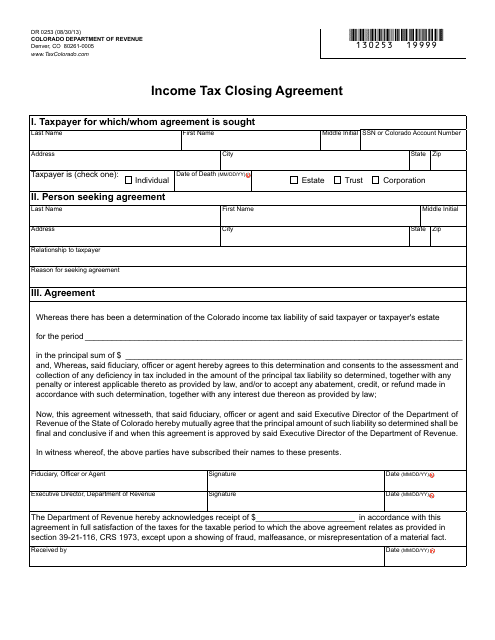

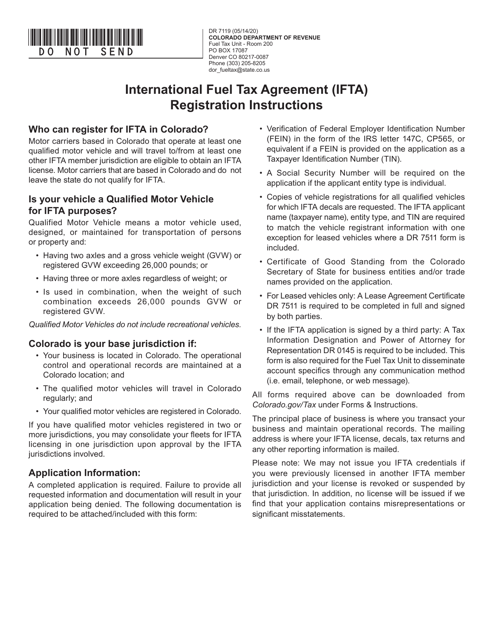

This form is used for filing an income tax closing agreement in the state of Colorado. It is used to resolve any outstanding tax issues with the Colorado Department of Revenue.

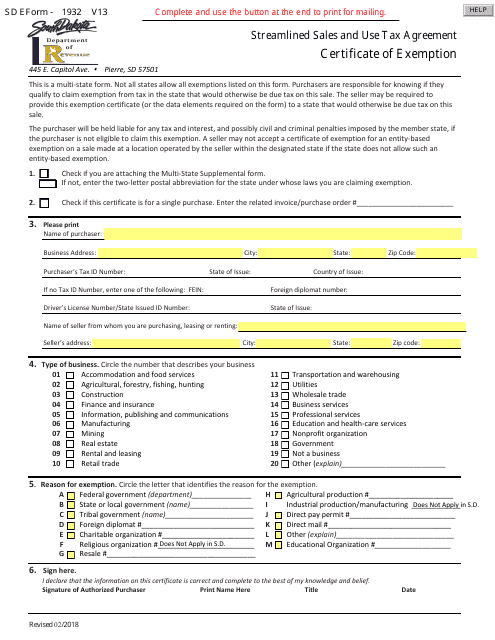

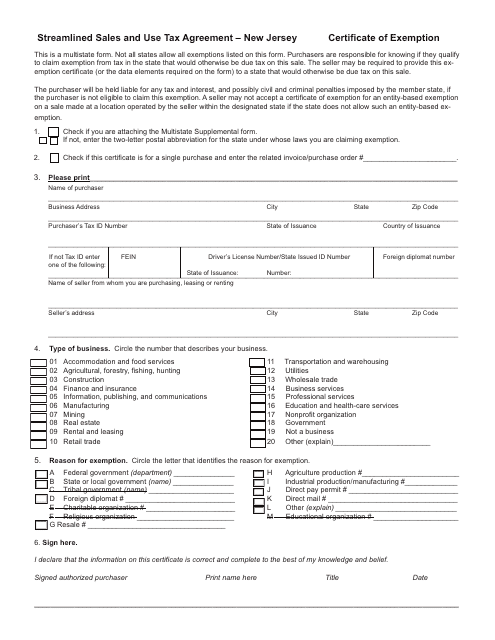

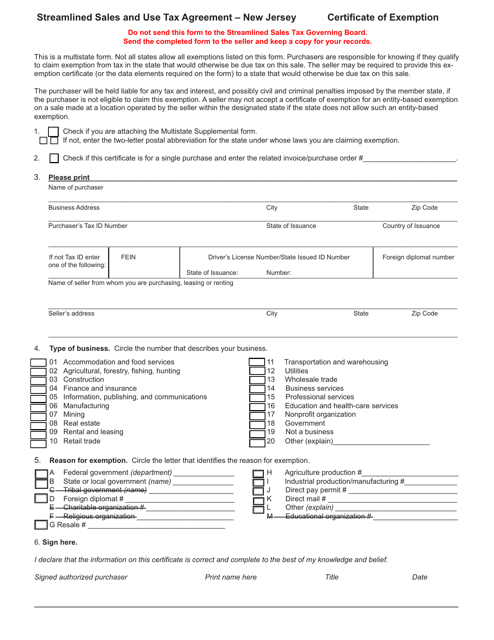

This form is used for applying for an exemption from sales and use tax in the state of New Jersey as part of the Streamlined Sales and Use Tax Agreement.

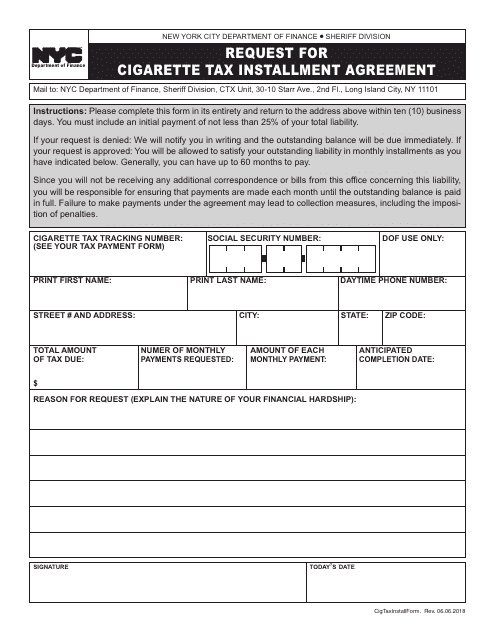

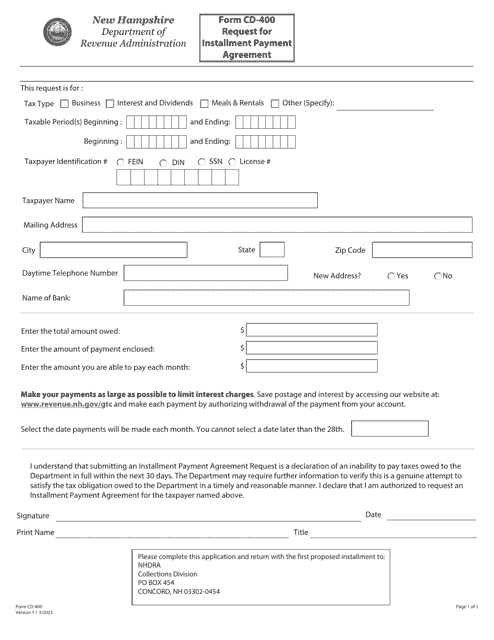

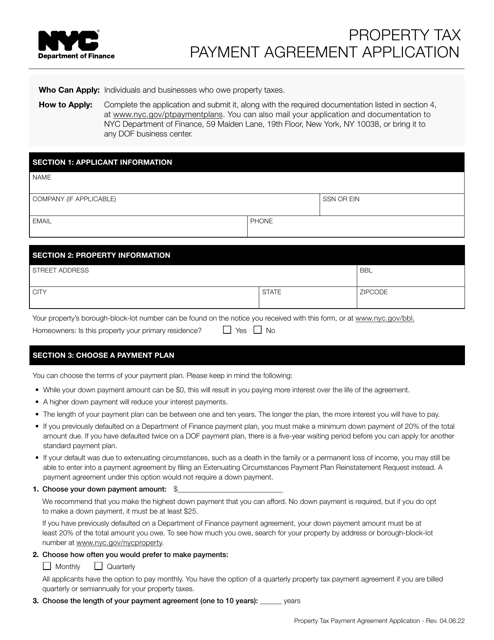

This document is for requesting a installment agreement for paying cigarette taxes in New York City.

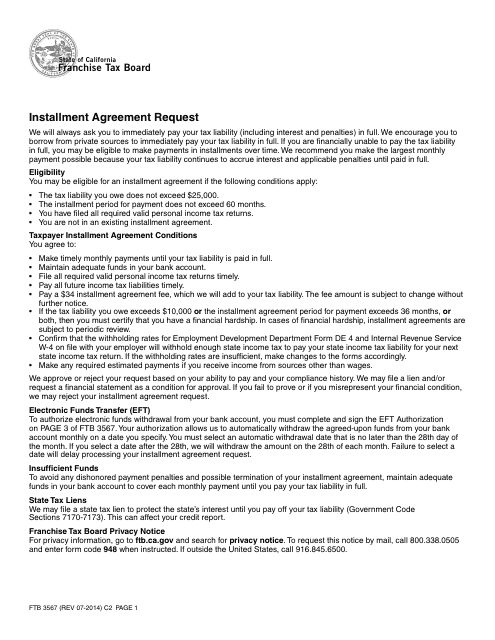

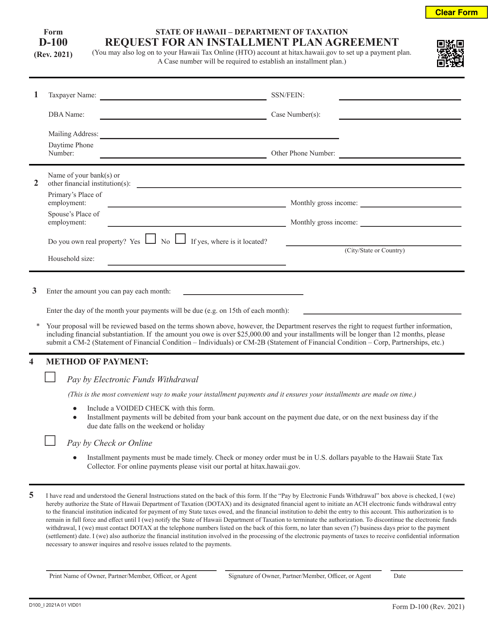

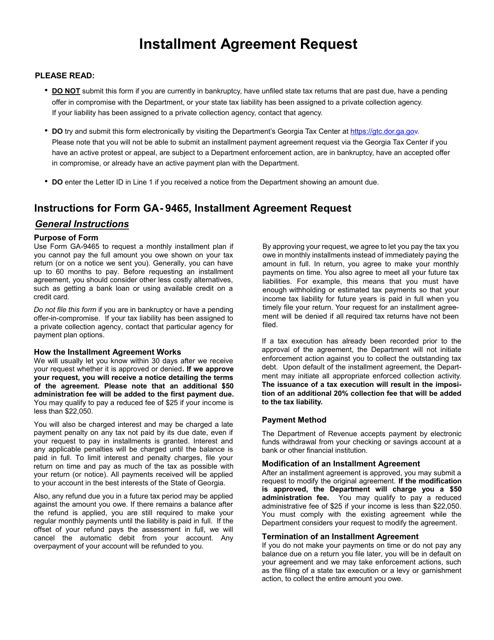

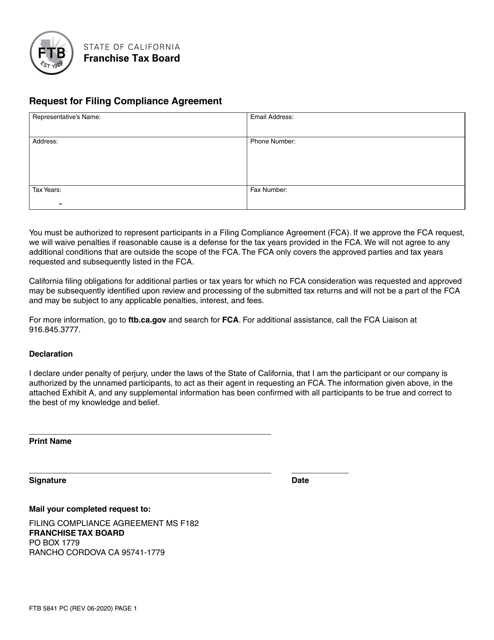

This Form is used for requesting an installment agreement with the California Franchise Tax Board (FTB) to pay taxes owed over time.

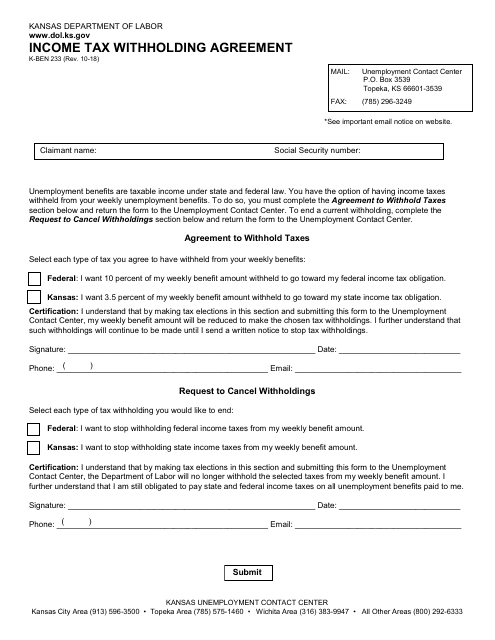

This form is used for an Income Tax Withholding Agreement in the state of Kansas. It allows individuals to authorize employers to withhold a specific amount of income tax from their wages.

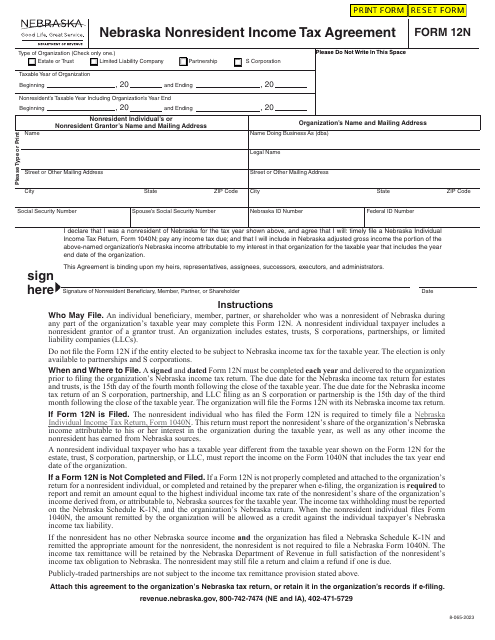

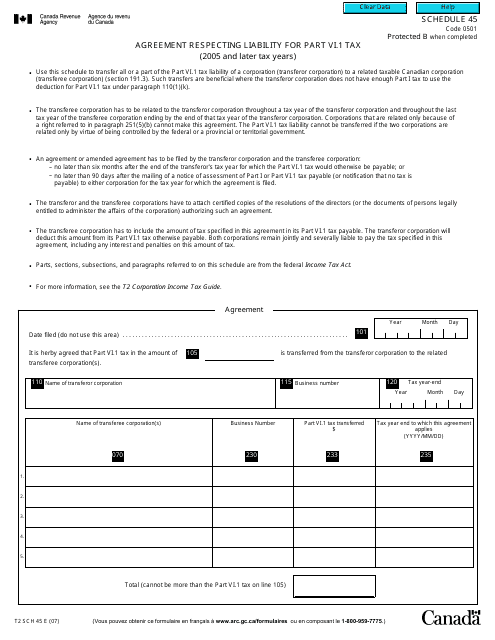

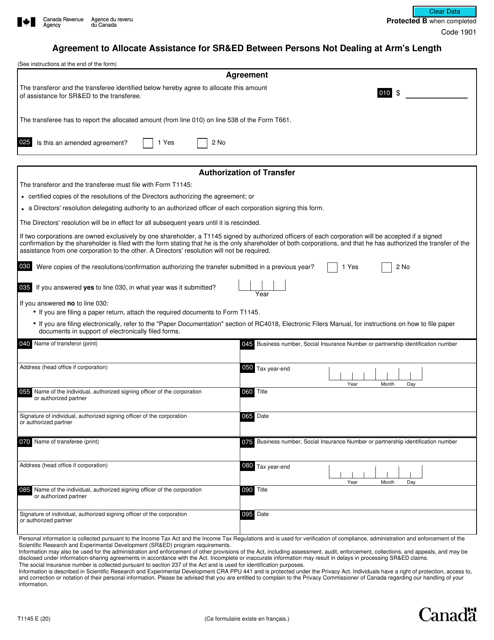

This form is used in Canada for reporting agreements related to liability for Part VI.1 tax for tax years 2005 and later. It is used to document the details of the agreement between the taxpayer and the tax administration.

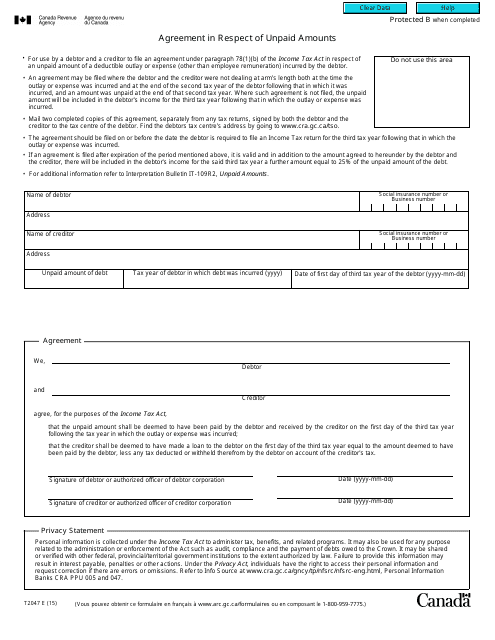

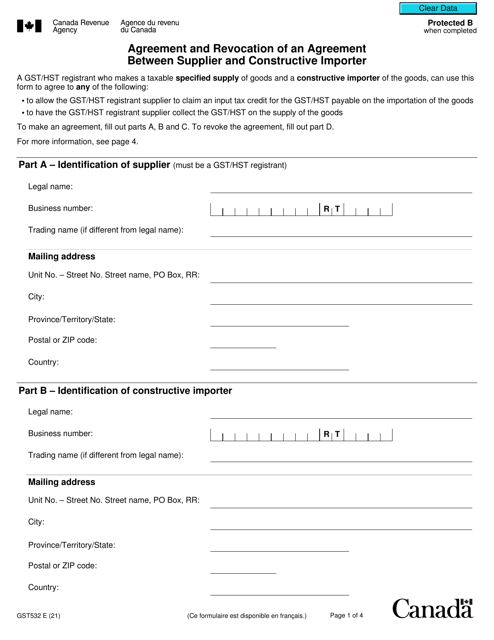

This form is used for an agreement in Canada regarding unpaid amounts.

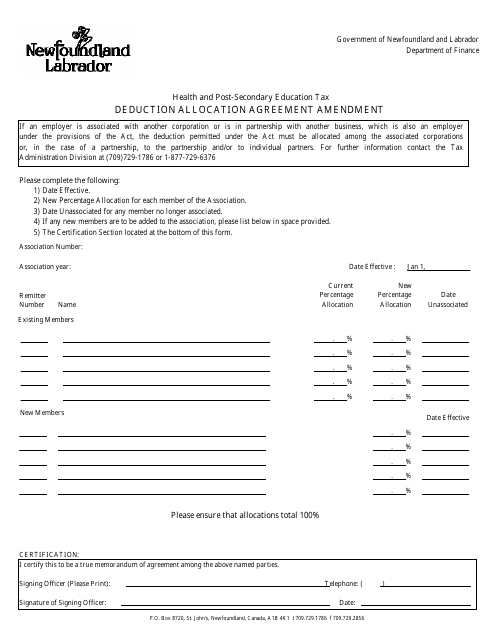

This document is used for amending the Health and Post-secondary Education Tax Deduction Allocation Agreement in Newfoundland and Labrador, Canada.

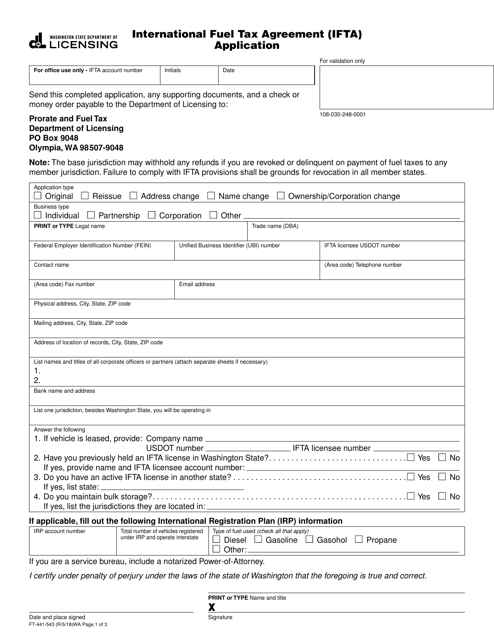

This form is used for applying for the International Fuel Tax Agreement (IFTA) in the state of Washington. It is required for motor carriers who operate vehicles in multiple jurisdictions.

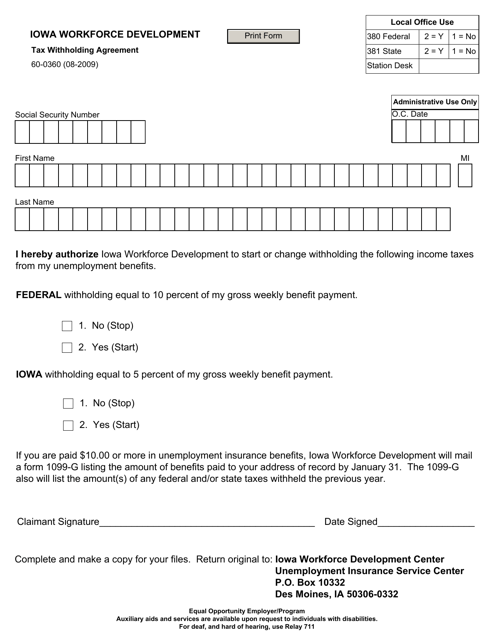

This form is used for establishing a tax withholding agreement in the state of Iowa.

This form is used for applying for a certificate of exemption in New Jersey under the Streamline Sales & Use Tax Agreement.

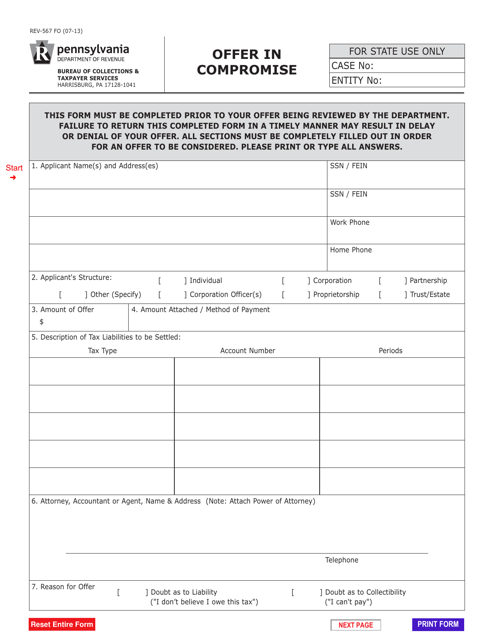

This Form is used for making an offer in compromise with the state of Pennsylvania to settle your tax debt for less than the full amount owed.

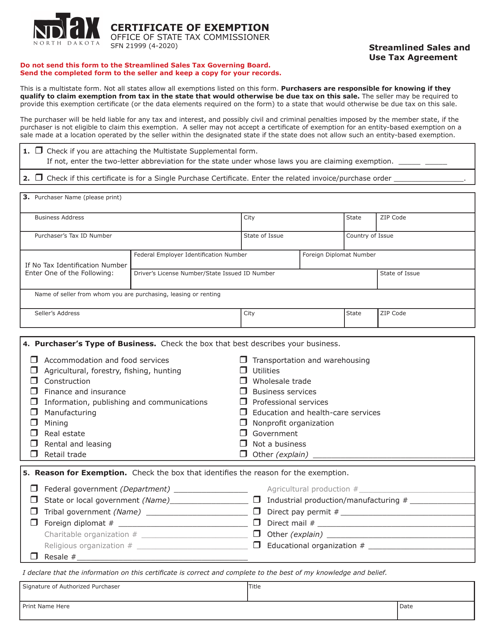

This form is used for claiming exemption from sales and use taxes in North Dakota as part of the Streamlined Sales and Use Tax Agreement.

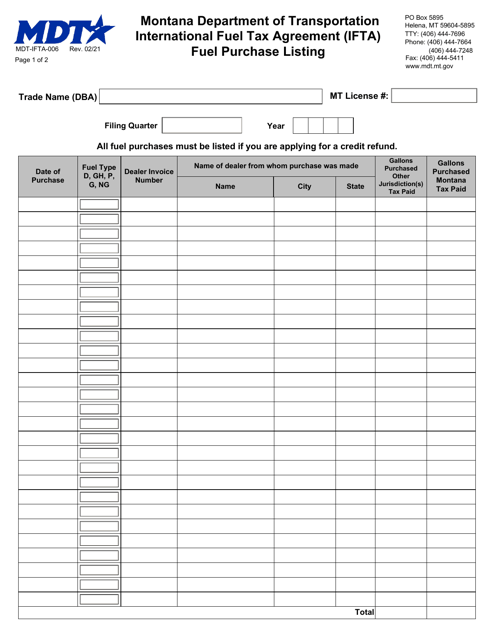

This Form is used for reporting fuel purchases made under the International Fuel Tax Agreement (IFTA) in the state of Montana.

This document is for obtaining a Tax Compliance Certificate and Agreement in the state of Illinois. It is used to ensure compliance with tax regulations and to formalize an agreement between the taxpayer and the state.

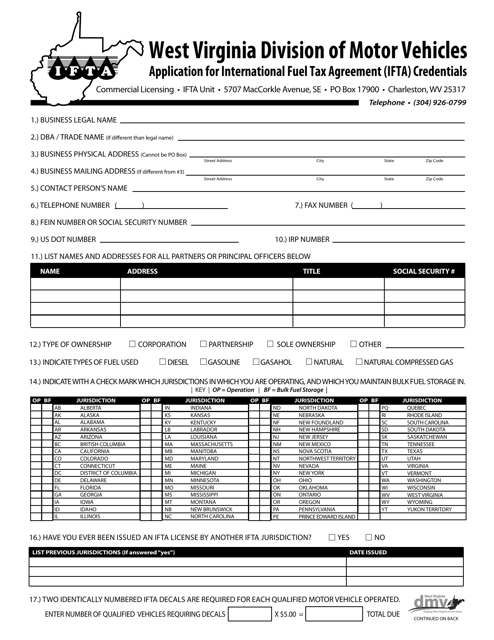

This Form is used for applying for International Fuel Tax Agreement (IFTA) credentials in West Virginia. IFTA allows for the simplified reporting and payment of fuel taxes by interstate motor carriers.

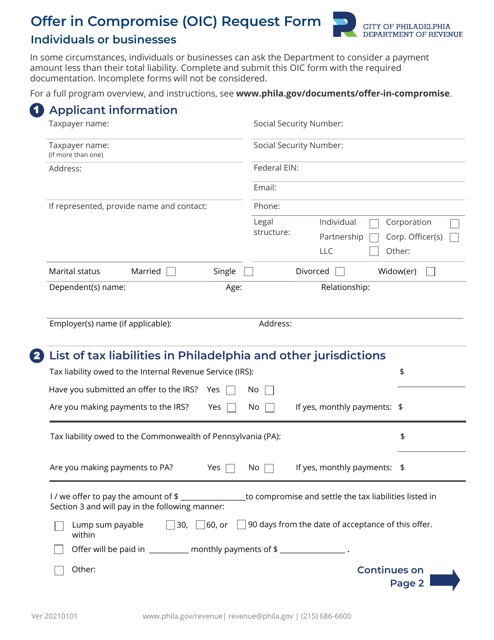

This form is used for requesting an Offer in Compromise (OIC) from the City of Philadelphia, Pennsylvania. An OIC is a way for taxpayers to settle their tax debt for less than the full amount owed.

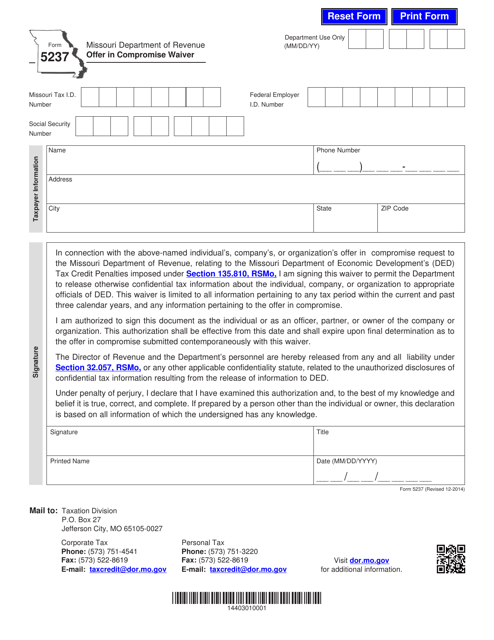

This form is used for applying for an offer in compromise waiver in the state of Missouri.