Reduce Tax Templates

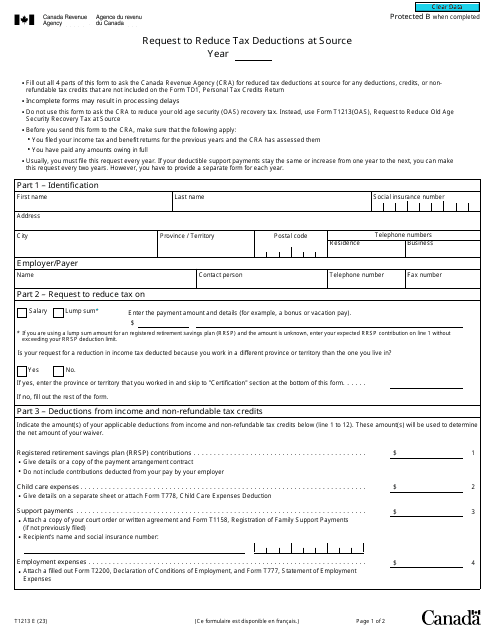

Looking to lower your tax burden? Our reduce tax documents provide you with the resources you need to slash your taxes legally and efficiently. Whether you're an individual or a business, our collection of documents will guide you through the process of requesting reductions in tax deductions at the source. From Form T1213 in Canada to Form H-14 in Texas, we have the forms you need to take advantage of tax-saving opportunities. Don't pay more than you have to - explore our reduce tax documents today and start maximizing your savings.

Documents:

7

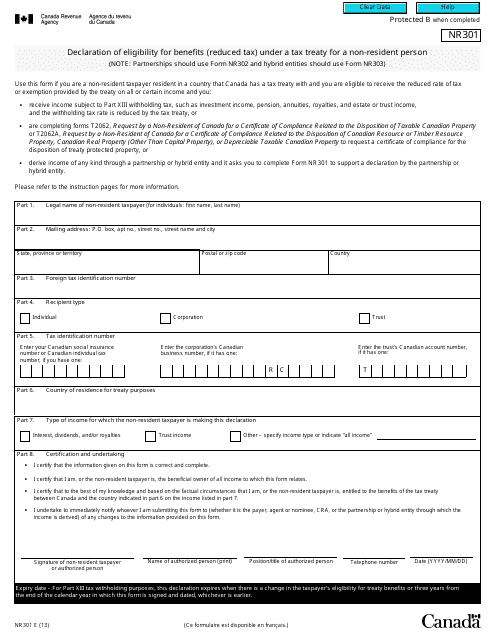

This form is used for declaring eligibility for reduced tax benefits under a tax treaty for non-resident individuals from Canada.

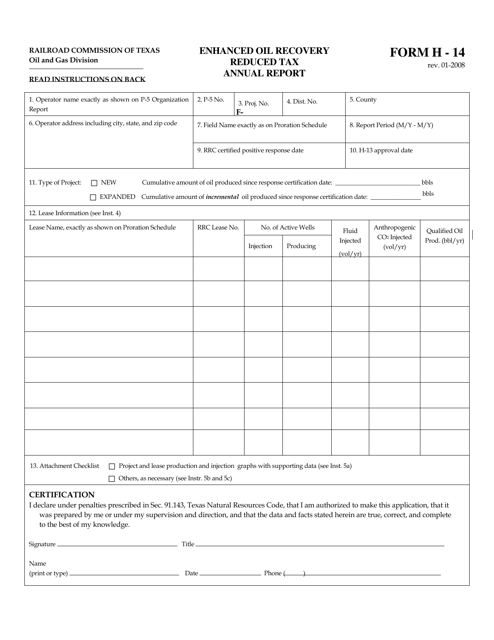

This form is used for submitting an annual report related to reduced tax for enhanced oil recovery in the state of Texas. It provides the necessary information for calculating and reporting the eligible tax reduction.

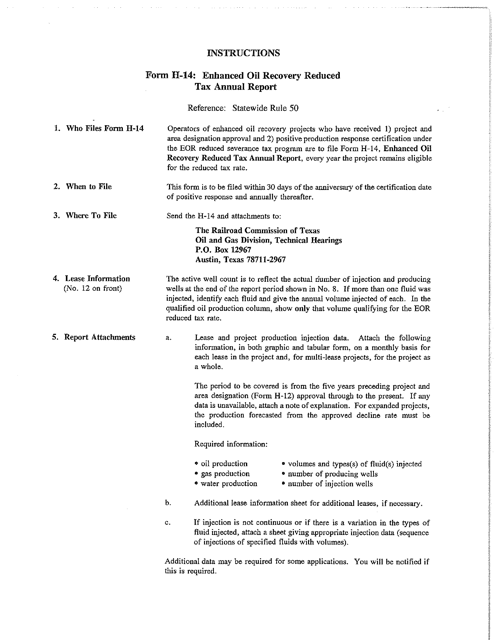

This document is for businesses in Texas that engage in enhanced oil recovery. It provides instructions on how to complete and submit the annual report for reduced tax.

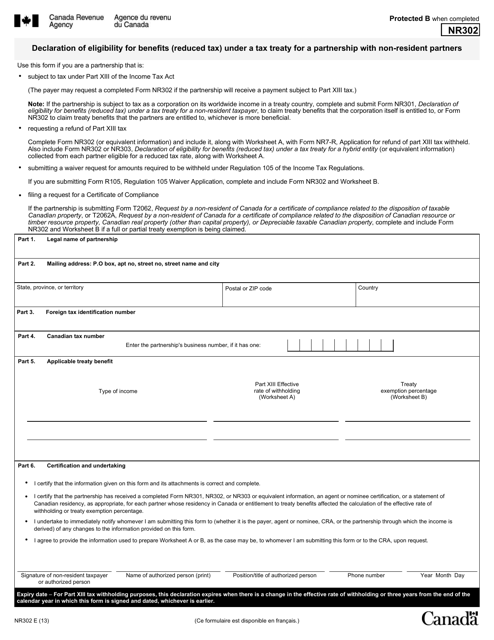

This form is used for declaring eligibility for tax benefits under a tax treaty for a partnership with non-resident partners in Canada.

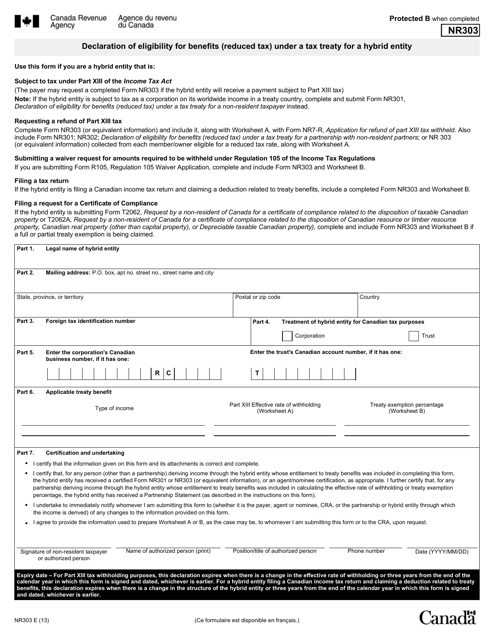

This form is used for declaring eligibility for reduced tax benefits under a tax treaty for a hybrid entity in Canada.