Cooperative Housing Corporation Templates

Are you a shareholder of a cooperative housing corporation? Do you want to understand the tax benefits and exemptions that are available to you? Look no further than our collection of documents for cooperative housing corporations. Whether you are a widowed spouse, a minor child, or a widowed parent, we have the forms that you need to apply for property tax exemptions.

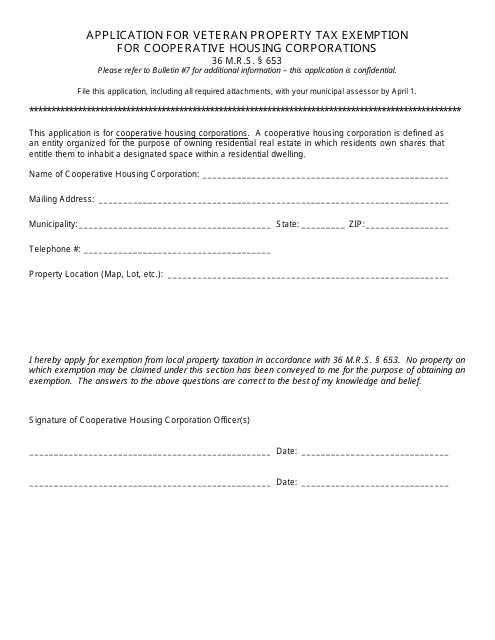

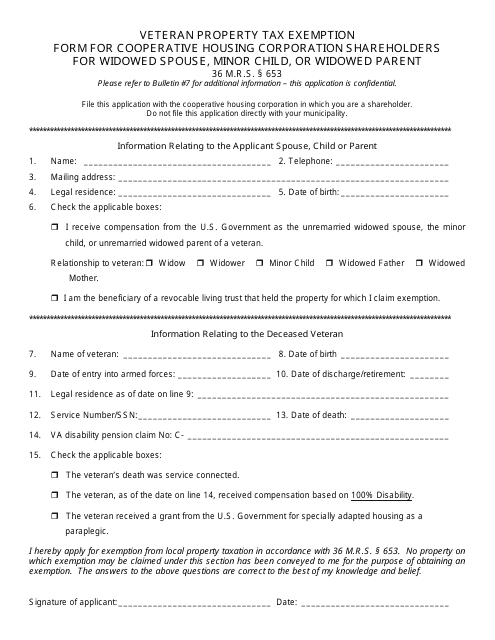

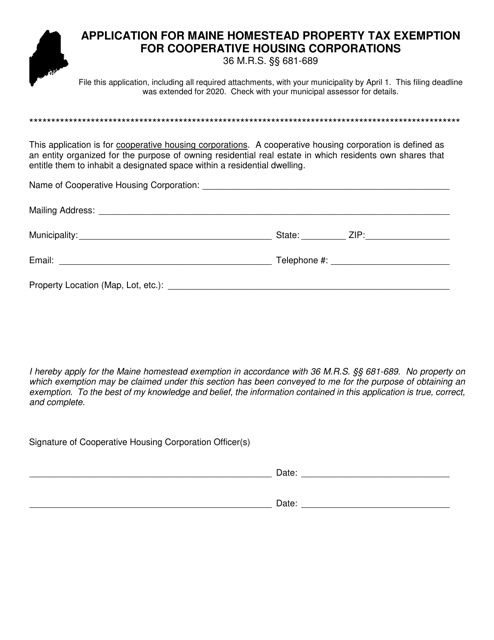

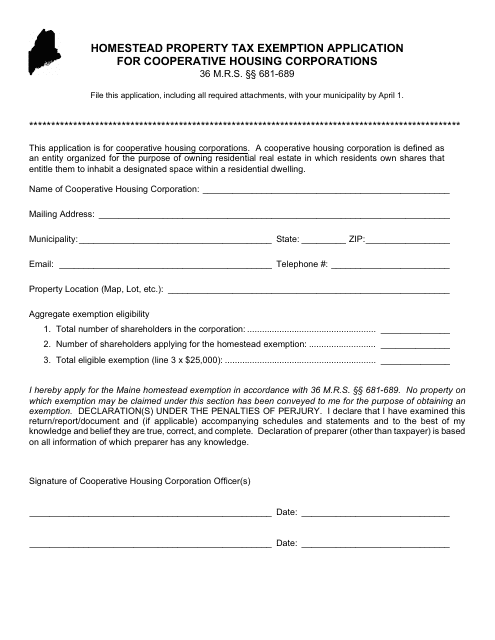

In Maine, for example, we offer the Form PTF-653-2B Veteran Property Tax Exemption Form, which is specifically designed for cooperative housing corporation shareholders who are widowed spouses, minor children, or widowed parents. We also have the Application for Maine Homestead Property Tax Exemption for Cooperative Housing Corporations, which allows you to apply for a homestead property tax exemption.

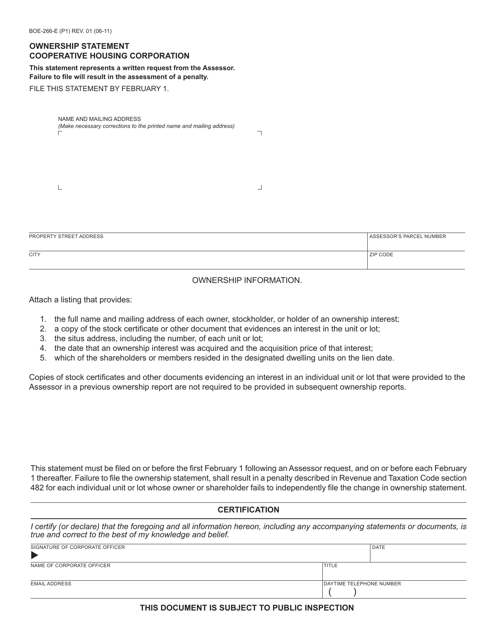

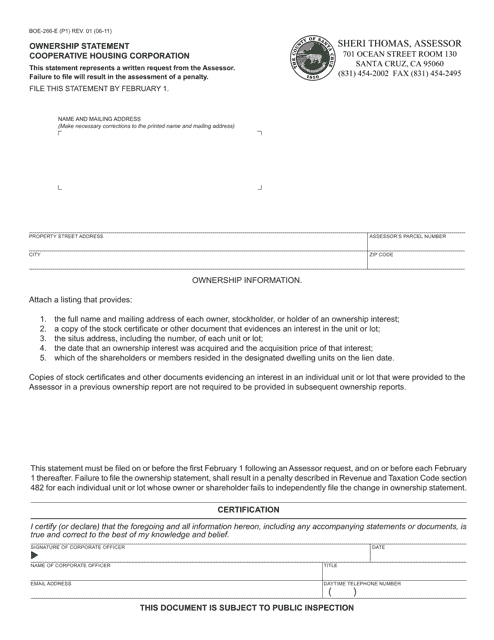

If you are located in California, we have the Form BOE-266-E Ownership Statement, which is specifically for cooperative housing corporations. This form is required to provide a statement of ownership to the state. Additionally, the County of Santa Cruz in California has its own version of this form, called the Form BOE-266-E Ownership Statement Cooperative Housing Corporation.

Our collection of documents for cooperative housing corporations is extensive and designed to assist you in navigating the various tax requirements and exemptions that apply to your situation. We understand that the rules and regulations can be complex, which is why we have consolidated all the necessary forms and information in one place for your convenience.

Don't let the paperwork overwhelm you. Take advantage of our comprehensive collection of documents for cooperative housing corporations and ensure that you are making the most of the tax benefits and exemptions available to you.

Documents:

10

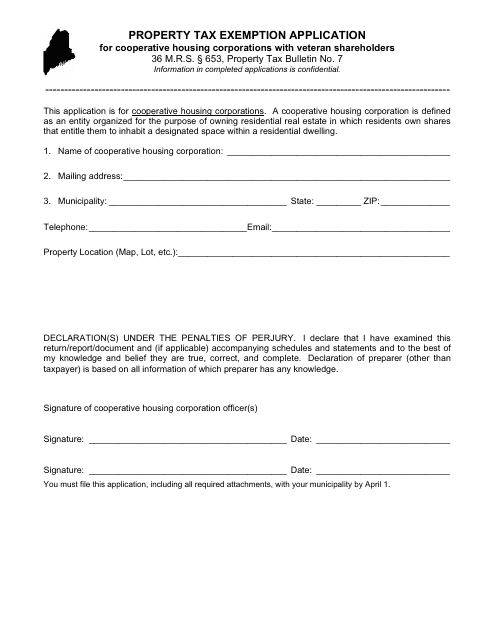

This form is used for applying for a property tax exemption for veteran residents of cooperative housing corporations in the state of Maine.

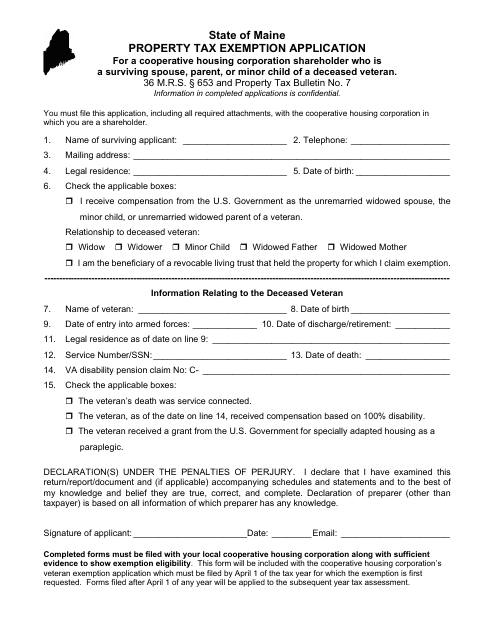

This Form is used for claiming property tax exemption for widowed spouses, minor children, or widowed parents who are shareholders of cooperative housing corporations in Maine.

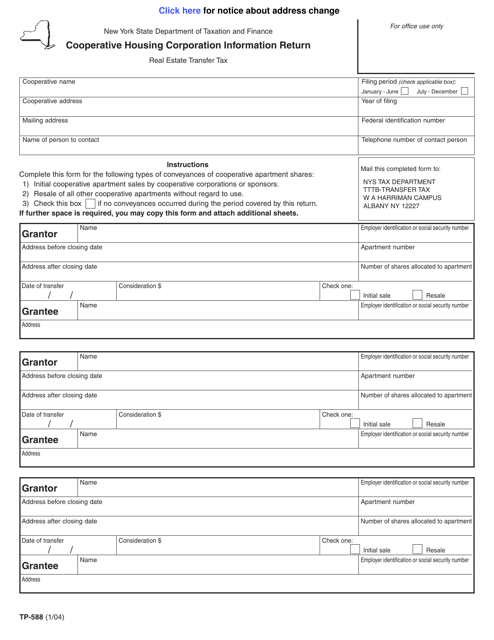

This Form is used for Cooperative Housing Corporations in New York to report their information to the state.

This form is used for Cooperative Housing Corporations in California to provide an ownership statement.

This form is used for Cooperative Housing Corporations in Maine to apply for property tax exemption if they have veteran shareholders.

This form is used for applying for a property tax exemption in Maine if you are a surviving spouse, parent, or minor child of a deceased veteran and a shareholder in a cooperative housing corporation.

This type of document is used for applying for a property tax exemption for cooperative housing corporations in the state of Maine.

This Form is used for the Ownership Statement of a Cooperative Housing Corporation in Santa Cruz County, California.