Education Savings Account Templates

Education Savings Account

Also known as educational savings account or education savings accounts, an Education Savings Account (ESA) is a financial tool designed to help families save for their children's education expenses. It allows parents or guardians to set aside money specifically for educational purposes, such as tuition, books, and other qualified educational expenses.

An Education Savings Account

provides a tax-advantaged way to save for education expenses. Contributions made to an ESA are generally tax-deductible, and any earnings on the account are tax-free as long as the funds are used for qualified education expenses. This means that the money in an ESA can grow over time without incurring additional taxes.With an Education Savings Account

, parents have control over how the funds are invested and spent, giving them the flexibility to choose the educational options that best fit their child's needs. This includes expenses related to K-12 education, as well as higher education expenses such as college or vocational school.Additionally, an ESA can be used in conjunction with other education savings programs, such as a 529 plan or Coverdell ESA, to maximize savings and ensure that all educational expenses are adequately covered.

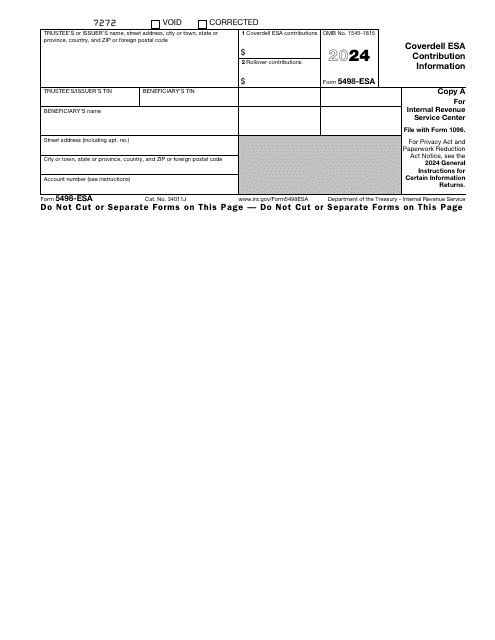

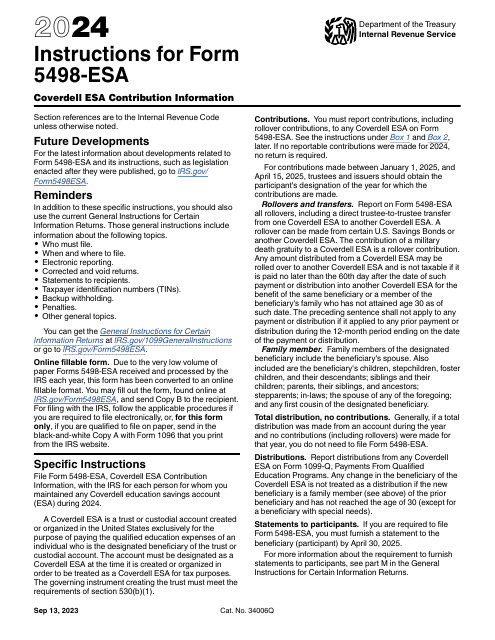

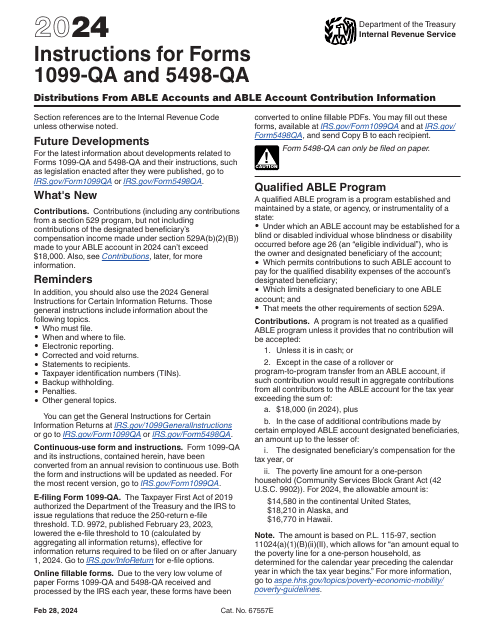

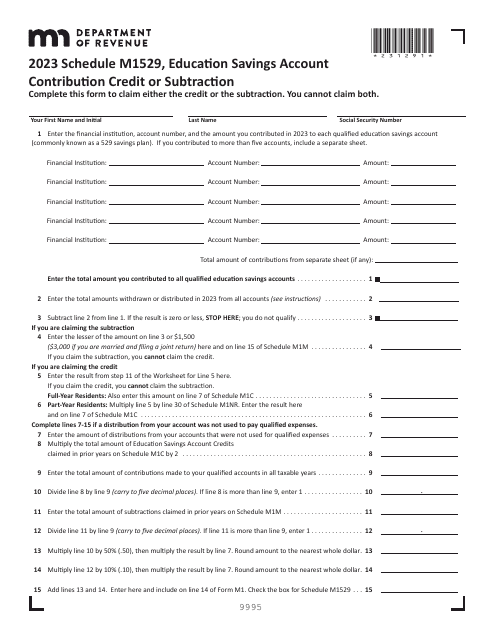

To ensure compliance with tax regulations and reporting requirements, various documents are associated with Education Savings Account

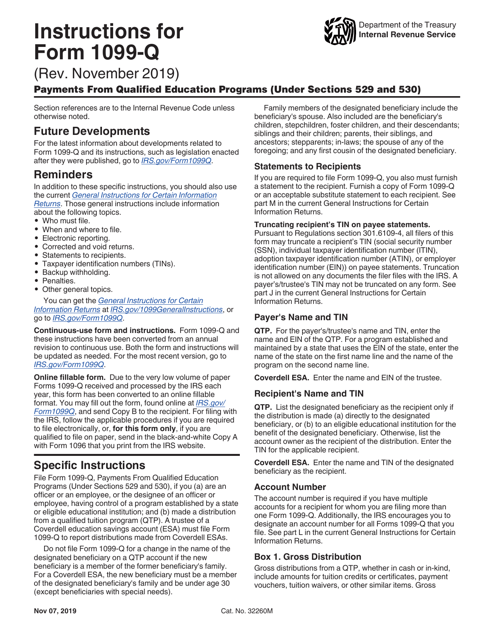

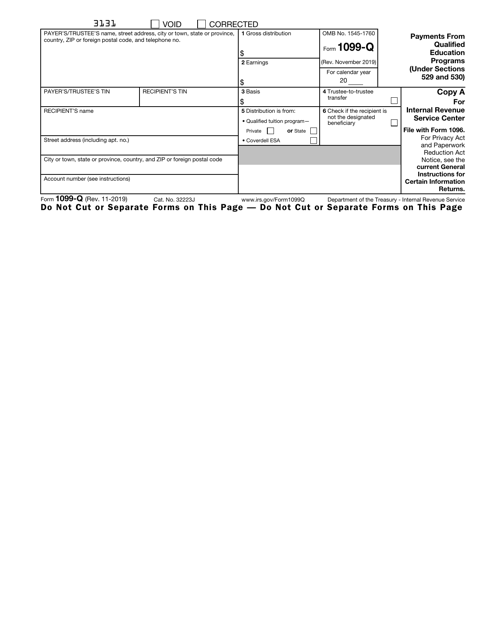

s. These documents include IRS Form 5498-ESA, which provides information on contributions made to the account, and IRS Form 1099-Q, which reports payments received from qualified education programs under sections 529 and 530 of the Internal Revenue Code.Whether you're a parent planning for your child's future education or a financial institution offering education savings accounts, understanding the benefits and requirements of an Education Savings Account

is essential. It is recommended to consult with a tax professional or financial advisor to assess your specific needs and maximize the potential benefits of an ESA.Documents:

11

This is a fiscal document completed by a taxpayer to describe their financial contributions to the qualified education expenses of other people.

This Form is used for reporting payments from qualified education programs under Sections 529 and 530 of the IRS code.