Plan De Pagos Templates

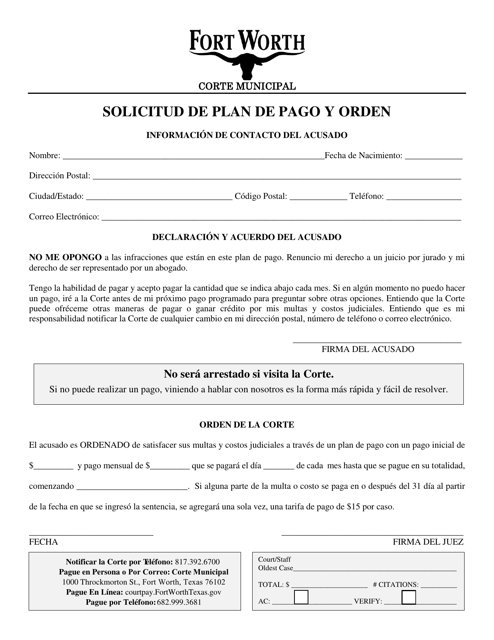

A plan de pagos is a structured payment arrangement that allows individuals and businesses to repay their debts over time. Whether you owe taxes to the IRS or need to make payments to a government agency or protection agent, having a plan de pagos can provide financial relief and ensure that you meet your obligations.

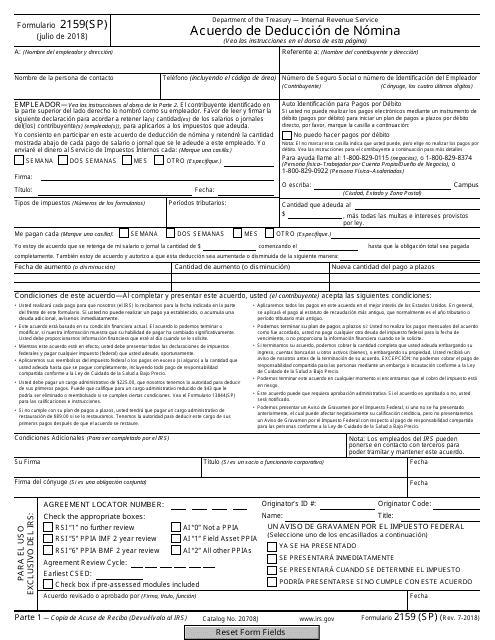

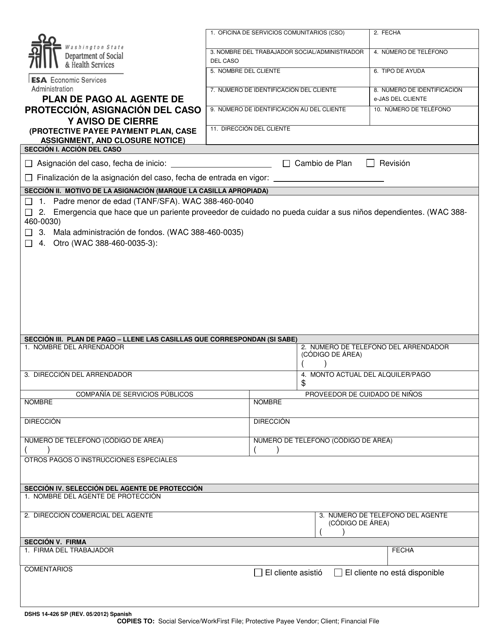

Also known as a plan de pago, this collection of documents offers the necessary forms and instructions to request and establish a plan de pagos with various agencies. For example, you can find IRS Formulario 2159(SP) Acuerdo De Deduccion De Nomina (Spanish) which helps you set up automatic deductions from your paycheck. Similarly, DSHS Formulario 14-426 Plan De Pago Al Agente De Proteccion, Asignacion Del Caso Y Aviso De Cierre - Washington (Spanish) is a document specific to Washington state for creating a payment plan with a protection agent.

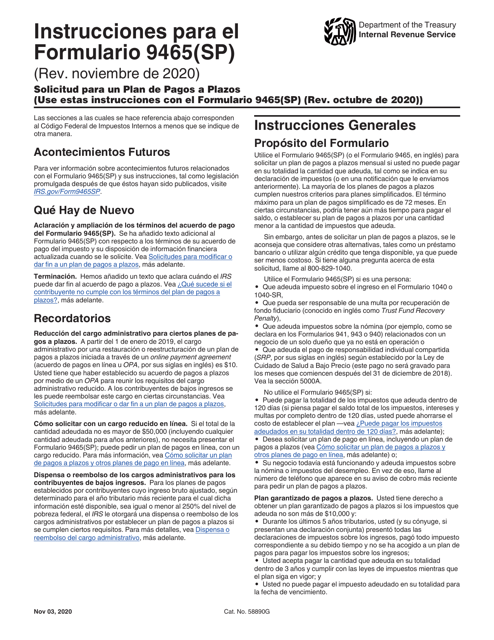

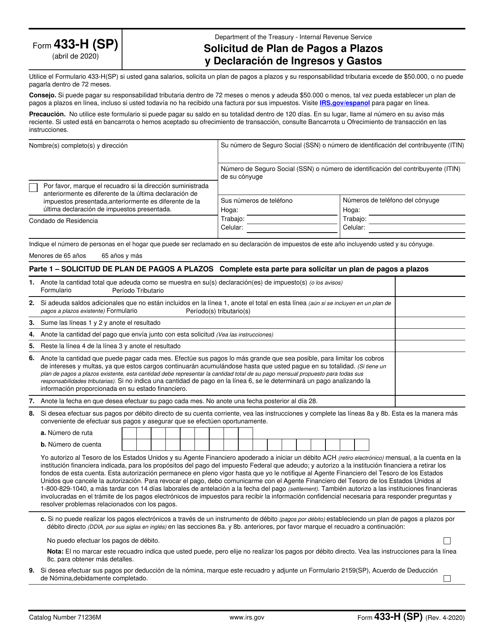

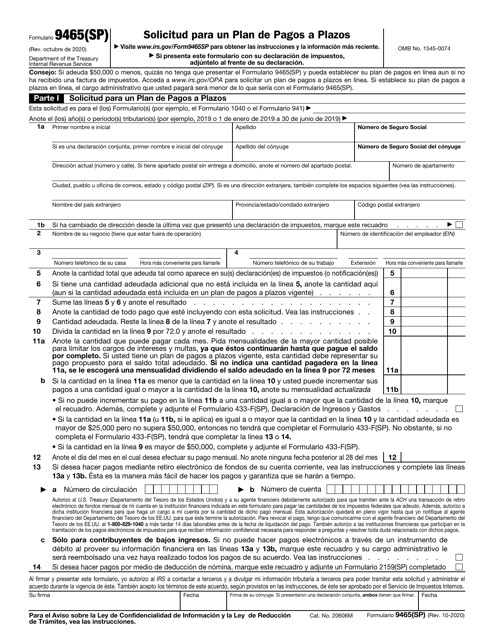

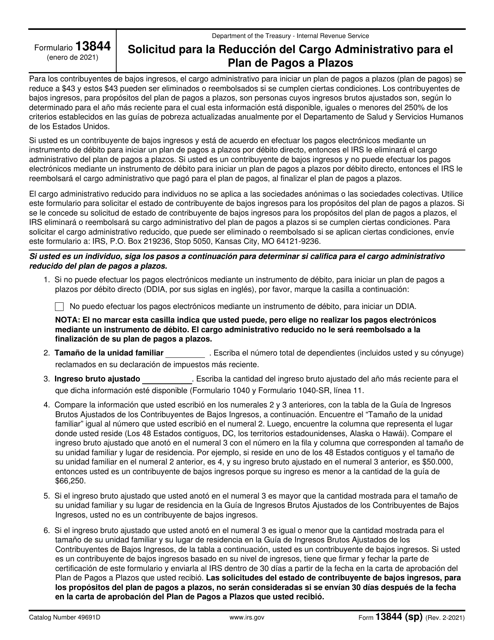

One commonly used form is IRS Formulario 433-H (SP) Solicitud De Plan De Pagos a Plazos Y Declaracion De Ingresos Y Gastos (Spanish). This form allows you to submit your income and expense information, along with a request for a installment payment plan. Additionally, you can refer to the instructions for IRS Formulario 9465(SP) Solicitud Para Un Plan De Pagos a Plazos (Spanish) to ensure you complete the application correctly. It's crucial to provide accurate information to maximize your chances of having your plan de pagos approved.

Establishing a plan de pagos can alleviate financial stress and help you manage your debt effectively. By taking advantage of these forms and instructions, you can take control of your financial obligations and find a sustainable path towards repaying your debts. Whether you're an individual or a business owner, a plan de pagos can be a valuable tool in your financial journey.

Explore this comprehensive collection of plan de pagos documents, including IRS Formulario 2159(SP), DSHS Formulario 14-426, IRS Formulario 433-H (SP), and IRS Formulario 9465(SP). Start building a payment arrangement that suits your needs today and take the first step towards financial freedom.

Documents:

8

This Form is used for making an agreement for payroll deduction with the IRS. It is available in Spanish language.