Schedule Utp Templates

Welcome to our Schedule UTP document collection! This comprehensive compilation of documents is designed to assist individuals and businesses in managing their tax obligations and reporting uncertain tax positions to the Internal Revenue Service (IRS).

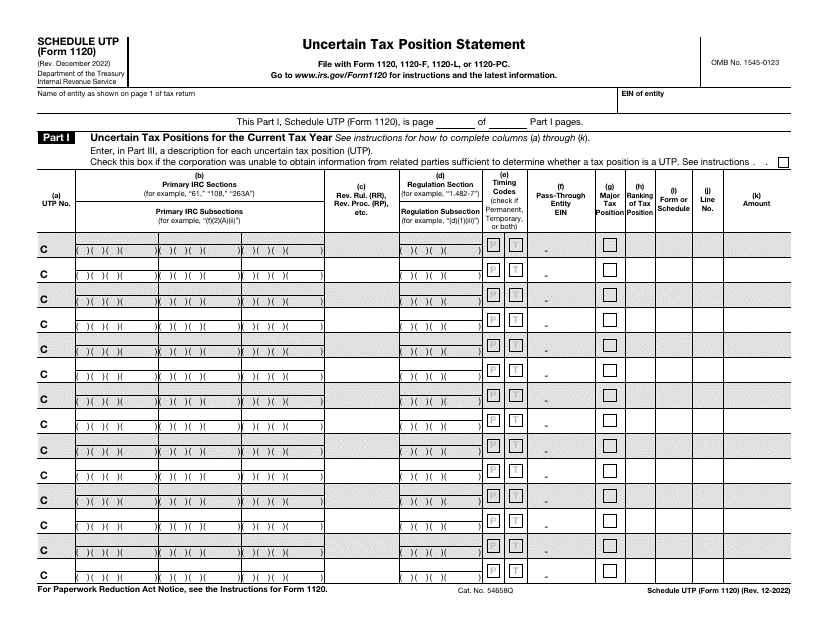

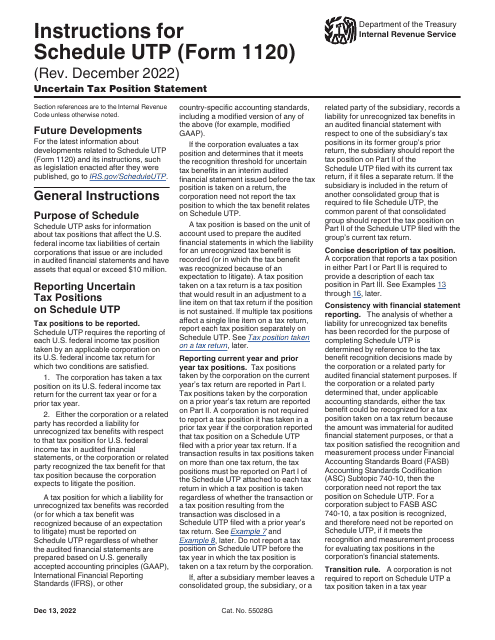

Our Schedule UTP documents include the IRS Form 1120 Schedule UTP Uncertain Tax Position Statement, which provides a structured format for taxpayers to disclose their uncertain tax positions. These positions are defined as tax positions taken on a tax return that are not certain to be sustained upon examination by tax authorities. By reporting these positions, taxpayers are able to proactively address potential tax issues and minimize the risk of penalties and interest.

In addition to the form itself, we provide detailed instructions for completing the IRS Form 1120 Schedule UTP Uncertain Tax Position Statement. These instructions guide taxpayers through the process of accurately identifying and reporting their uncertain tax positions, ensuring compliance with IRS regulations.

By utilizing our Schedule UTP documents, taxpayers can improve transparency, minimize potential tax liabilities, and maintain compliance with tax laws and regulations. Whether you are an individual or a business, our comprehensive collection of Schedule UTP documents will provide you with the guidance you need to effectively manage your tax obligations.

If you need assistance with your uncertain tax positions or have questions about our Schedule UTP documents, please don't hesitate to contact our team of tax professionals. We are here to provide you with expert advice and support to ensure your tax reporting is accurate and compliant.