Direct Pay Permit Templates

A direct pay permit, also known as a direct payment permit or self-accrual authority, is a special authorization granted by certain states in the USA and Canada. This permit allows qualified businesses to remit sales and use taxes directly to the state, rather than paying them to the vendor at the time of purchase.

With a direct pay permit, businesses can streamline their tax reporting and payment process by eliminating the need to pay sales tax upfront and then file for a refund. Instead, they can simply report and remit the tax owed on their own, saving time and resources.

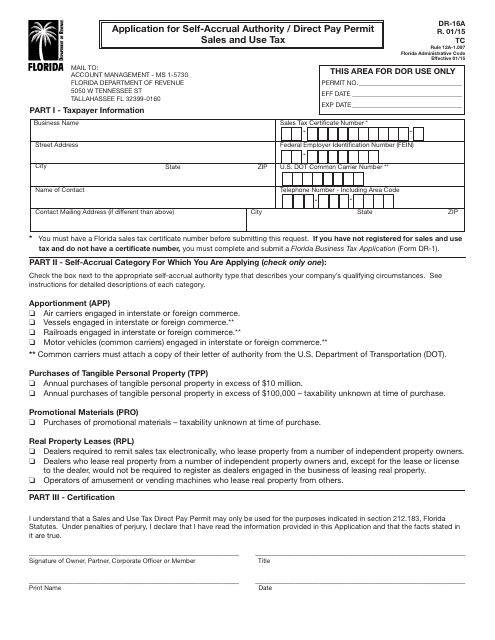

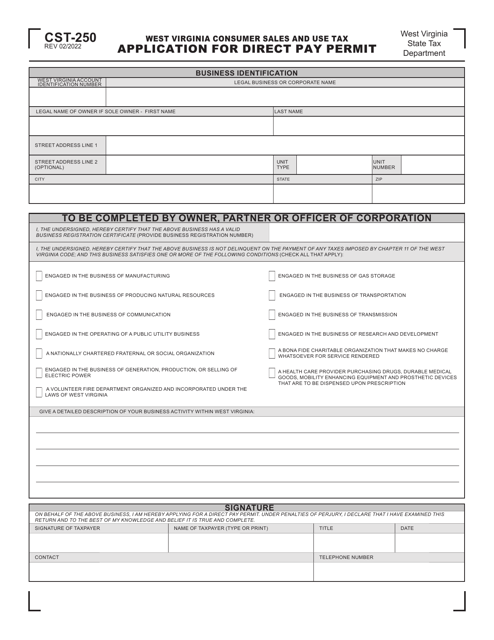

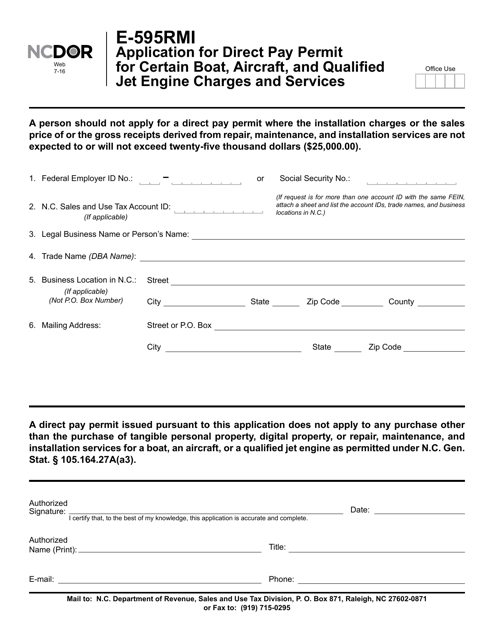

Obtaining a direct pay permit may require filling out an application form specific to the state or province in which the business operates. For example, in Florida, businesses can apply for a Sales and Use Tax Direct Pay Permit using Form DR-16R. In North Carolina, the application form is Form E-595RMI for certain boat, aircraft, and qualified jet engine charges and services.

Using a direct pay permit offers several benefits to eligible businesses. It allows for easier compliance with tax laws and regulations, reduces paperwork, and provides greater flexibility in managing cash flow. Furthermore, it ensures that businesses are in full control of their sales and use tax reporting, helping to minimize the risk of errors or missed filings.

In summary, businesses that frequently purchase goods or services subject to sales and use tax should consider applying for a direct pay permit. By doing so, they can simplify their tax obligations and improve their overall tax management process. Apply for a direct pay permit today and experience the convenience and flexibility it brings to your business.

Documents:

17

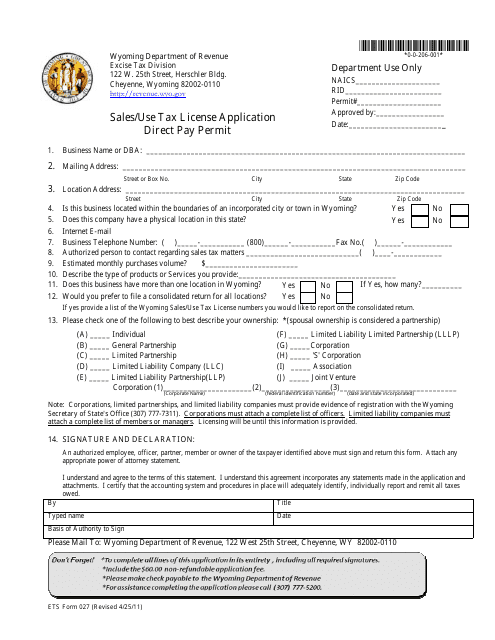

This form is used for applying for a sales use tax license or direct pay permit in the state of Wyoming.

This Form is used for applying for self-accrual authority or a direct pay permit for sales and use tax in Florida.

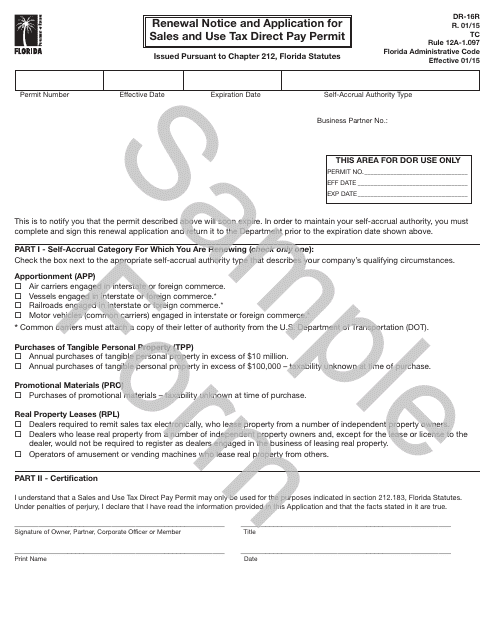

This Form is used for renewing and applying for a Sales and Use Tax Direct Pay Permit in Florida.

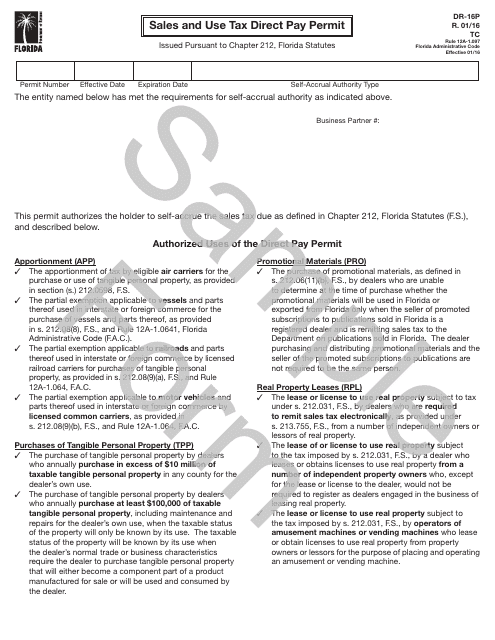

This Form is used for applying for a Sales and Use Tax Direct Pay Permit in the state of Florida. This permit allows businesses to pay sales and use tax directly to the Florida Department of Revenue instead of paying sales tax to their vendors.

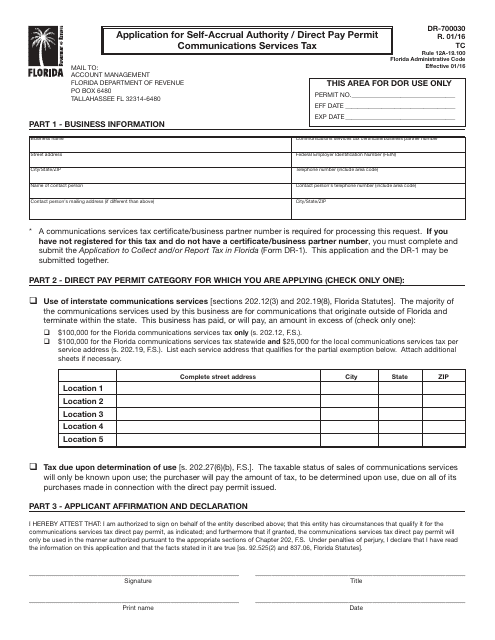

This form is used for applying for self-accrual authority or direct pay permit for the communications services tax in Florida.

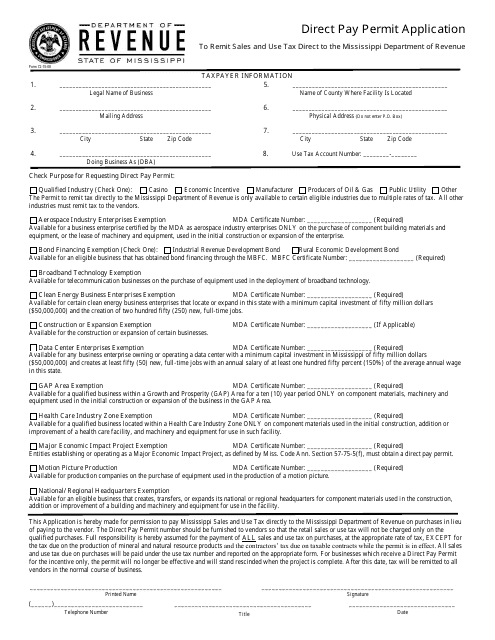

This Form is used for applying for a Direct Pay Permit in the state of Mississippi. The permit allows businesses to pay sales and use tax directly to the state instead of to vendors at the time of purchase.

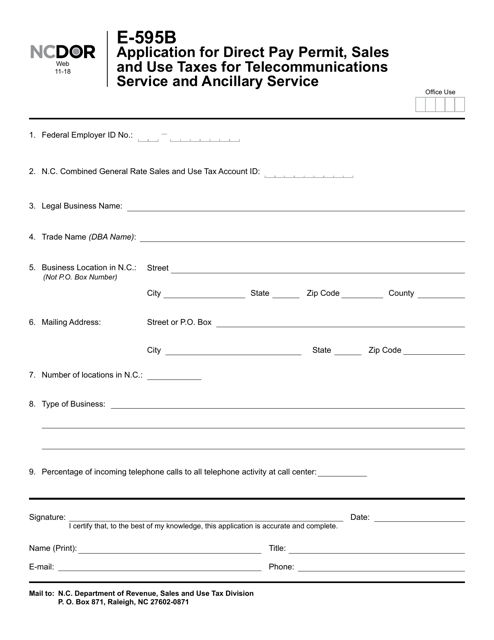

This Form is used for applying for a Direct Pay Permit for sales and use taxes related to telecommunications services and ancillary services in North Carolina.

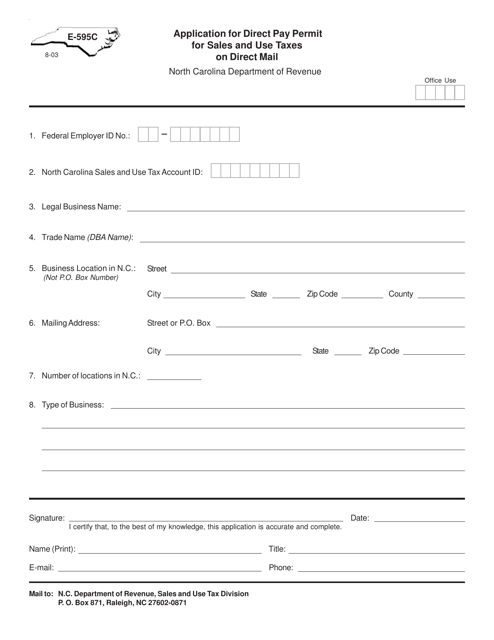

This form is used for applying for a Direct Pay Permit for Sales and Use Taxes on Direct Mail in North Carolina.

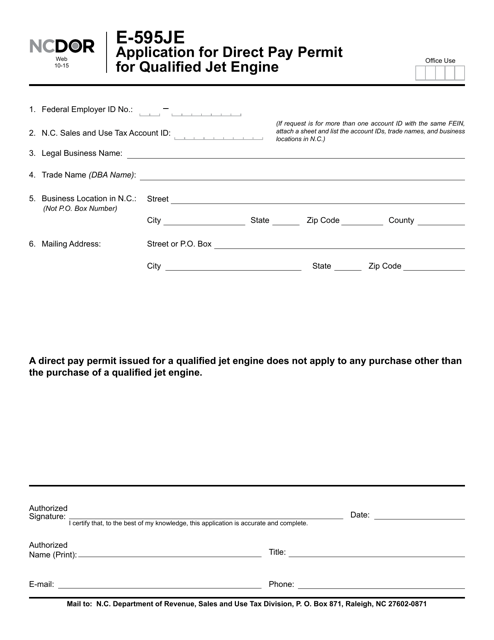

This form is used for applying for a direct pay permit for qualified jet engines in the state of North Carolina.

This Form is used for applying for a Direct Pay Permit in North Carolina for boat, aircraft, and qualified jet engine charges and services.

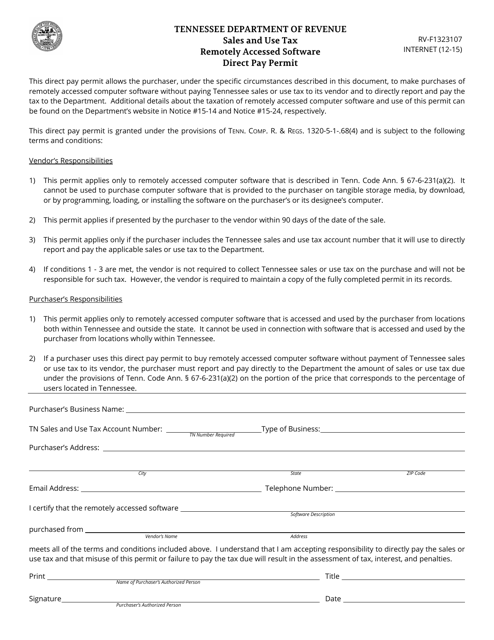

This Form is used for obtaining a Remotely Accessed Software Direct Pay Permit in the state of Tennessee.

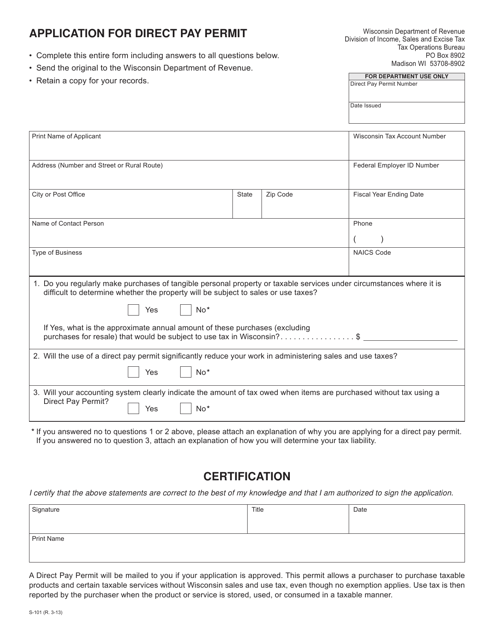

This form is used for applying for a direct pay permit in Wisconsin.

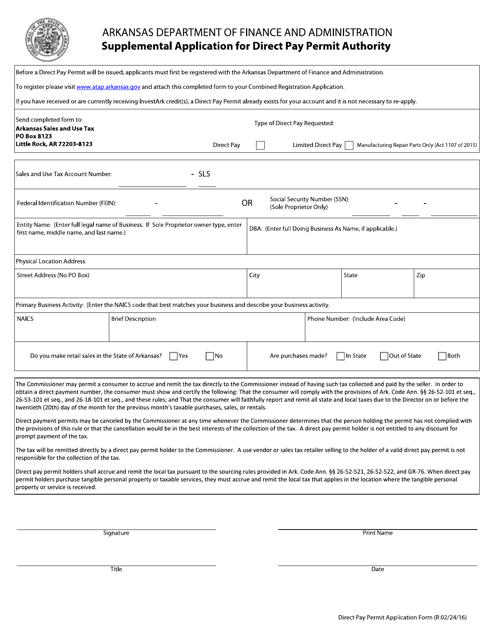

This document is used for applying for direct pay permit authority in the state of Arkansas. A direct pay permit allows a business to pay sales tax directly to the state instead of collecting it from customers.

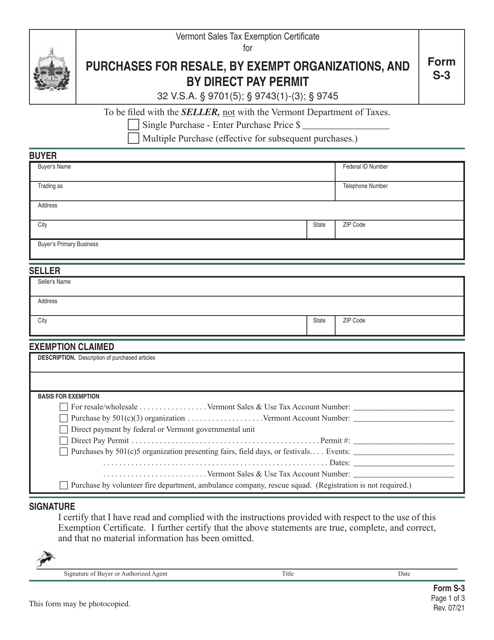

This form is used for claiming a sales tax exemption in Vermont for purchases intended for resale, made by exempt organizations, or made by individuals holding a direct pay permit.