Federal Income Tax Templates

Federal Income Tax

Welcome to our comprehensive guide on federal income tax! Whether you're an individual or a business owner, understanding the ins and outs of federal income taxes is crucial for financial planning and compliance. Our website serves as a one-stop resource providing you with all the information, resources and guidance you need to navigate the complexities of federal income tax.

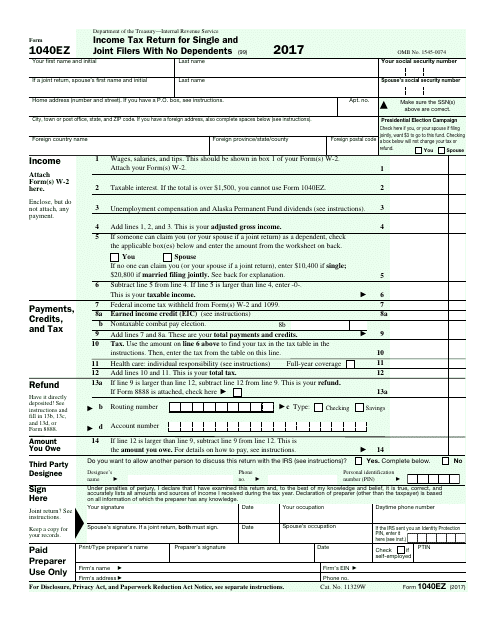

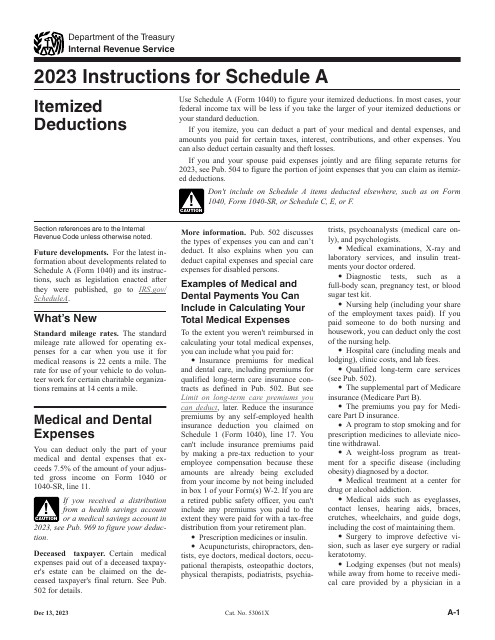

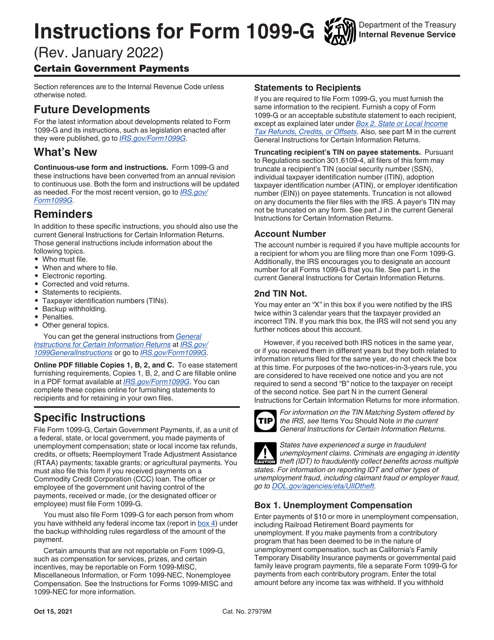

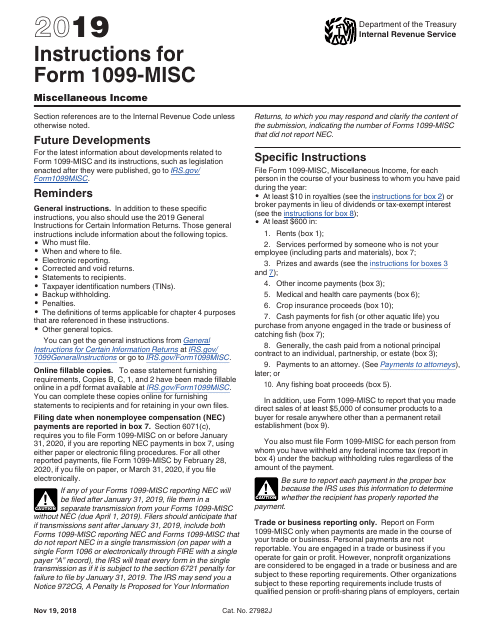

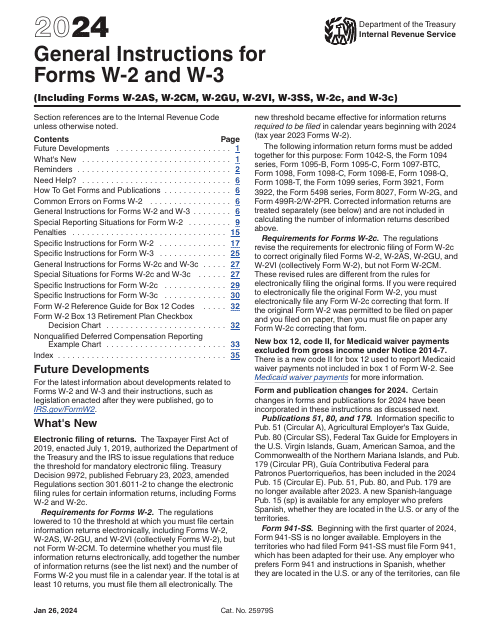

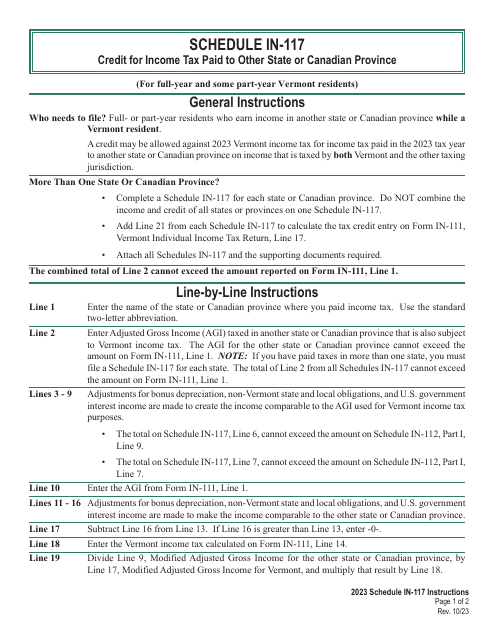

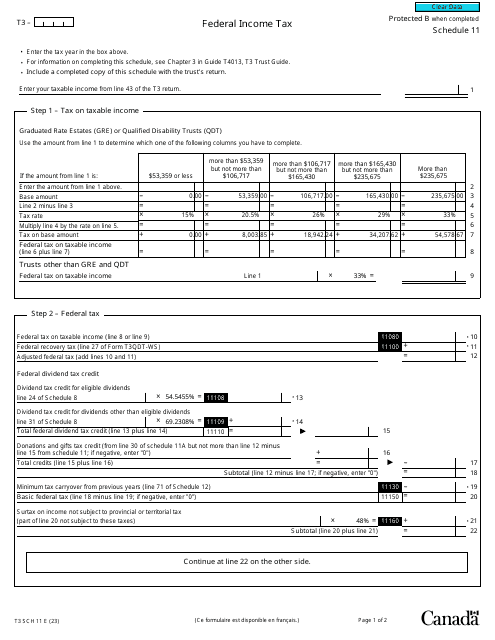

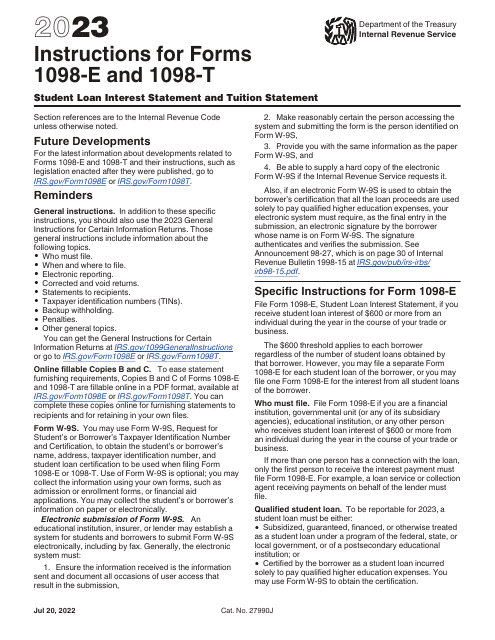

Our extensive collection of documents covers a wide range of topics related to federal income tax. You'll find detailed instructions for various IRS forms such as Form W-2, W-3, 1040, and 1040-SR, ensuring that you have the guidance you need to accurately report your income and claim deductions. We also offer documents specifically tailored to Canadian taxpayers, such as Form T3 Schedule 11, providing valuable insights into federal income tax regulations in Canada.

Understanding and fulfilling your federal income tax obligations can be challenging, but it doesn't have to be overwhelming. Our user-friendly website breaks down complex tax concepts into clear and concise explanations, empowering you to make informed decisions and maximize your tax efficiency. Whether you're looking for guidance on claiming deductions, understanding tax credits, or keeping up with the latest changes to tax laws, our documents provide the information you need.

In addition to serving as a reliable source of information, we also offer practical tips and strategies for optimizing your tax situation. From commonly overlooked deductions to ways to minimize your tax liability, our website offers expert insights and advice to help you make the most of your financial situation.

We understand that federal income tax laws and regulations can differ between countries and jurisdictions. That's why we've included documents that cater to taxpayers in nations beyond the United States. So, regardless of where you're located or where your income is generated, you'll find valuable resources to help you navigate the complexities of federal income tax.

At our website, we believe that knowledge is power when it comes to federal income tax. With our comprehensive collection of documents, expert guidance, and practical tips, you'll be equipped to handle your tax obligations with confidence and ease. Start exploring our collection today and empower yourself to make informed financial decisions.

Documents:

38

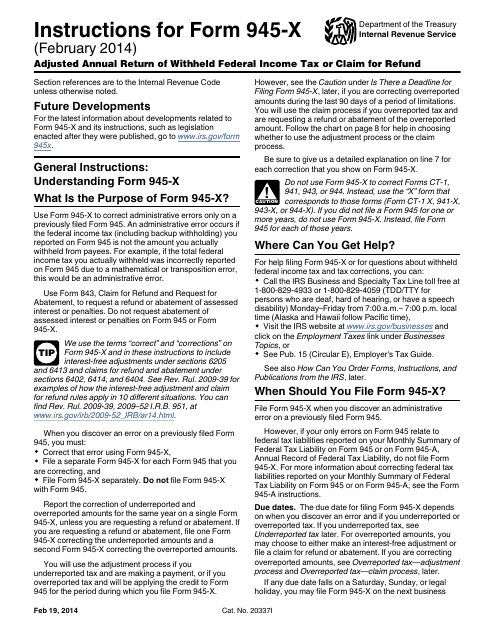

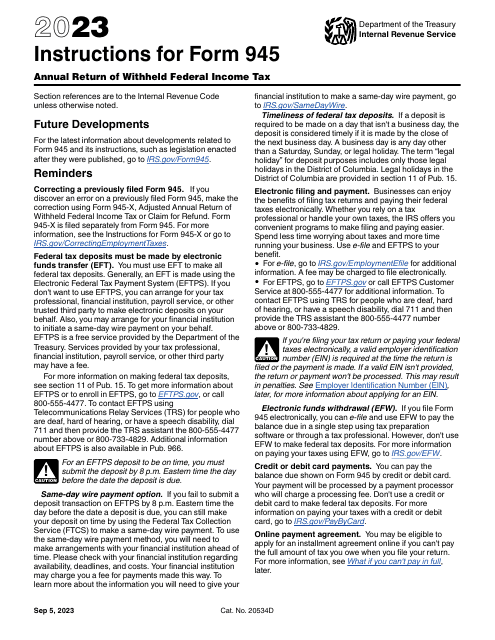

This Form is used for making adjustments to the annual return of withheld federal income tax or claiming a refund. It is specifically designed for the IRS Form 945-X.

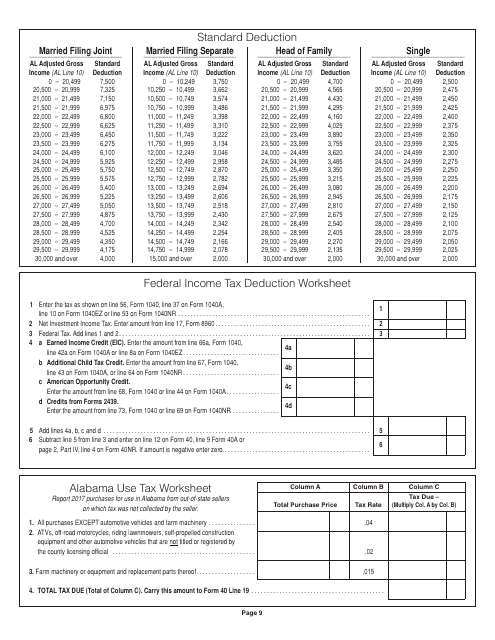

This document provides a worksheet for Alabama residents to calculate their federal income tax deductions.

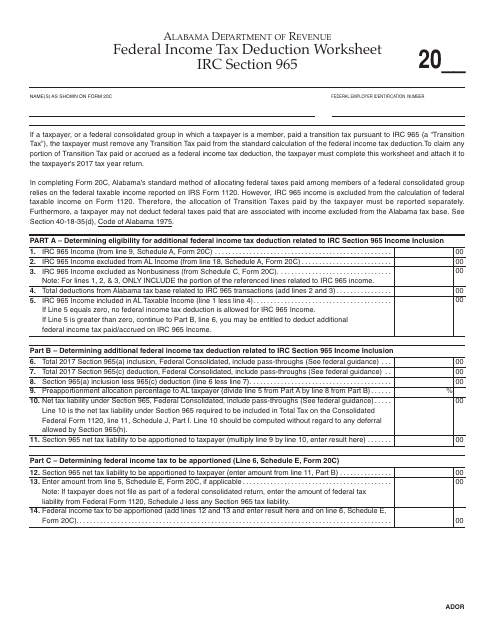

This document provides a worksheet to calculate the federal income tax deduction under IRC Section 965 for residents of Alabama.

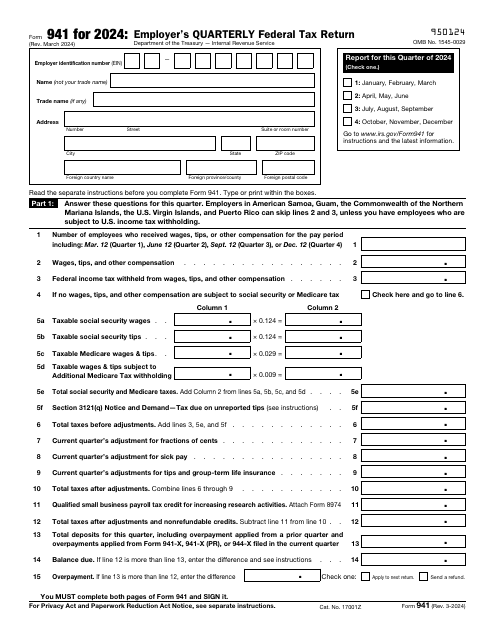

This is a formal statement used by companies to tell tax organizations about the salaries and tips their employees have received over the course of the previous quarter and the tax already subtracted from the workers' salaries.

This is a fiscal IRS document designed for taxpayers that received different types of interest income.

Use this document to report the amount of withheld wages and taxes to the employee and appropriate authorities. The form is also known as a W-2 and is one of the crucial annual tax documents.

This form is used for reporting miscellaneous income received, such as freelance work or rental income. It provides instructions on how to fill out Form 1099-MISC accurately.

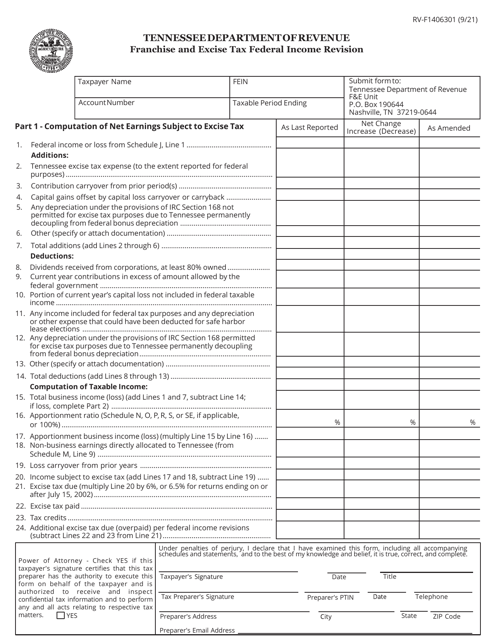

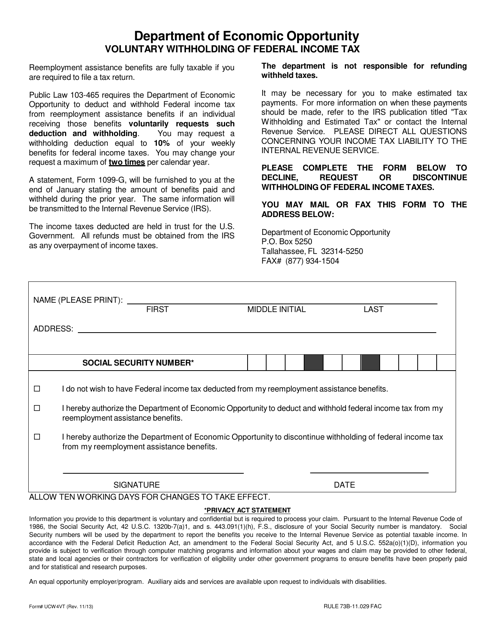

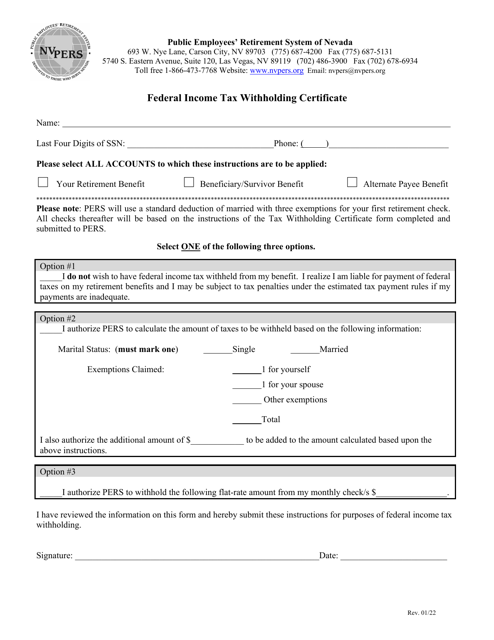

This form is used for voluntary withholding of federal income tax in the state of Florida.

This form is used for notifying individuals in West Virginia about federal income tax withholding, debit cards, and personal identification numbers.

This document provides instructions for filling out IRS Form 1040 and 1040-SR. It guides you through the process of reporting your income, deductions, and credits to calculate your tax liability.

This type of document is used for reporting wages and taxes withheld for employees. It is required by the Internal Revenue Service (IRS) for employers to file annually. The different variations of the form (W-2, W-3, W-2AS, W-2CM, W-2GU, W-2VI, W-3SS, W-2C, W-3C) correspond to specific circumstances and requirements.

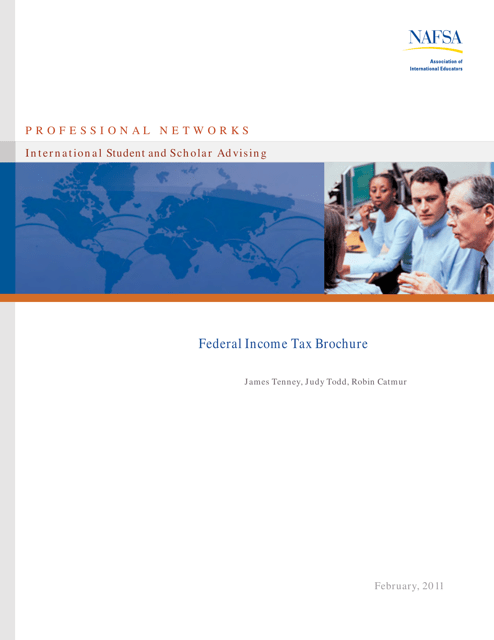

This document provides information for international students and scholars about federal income tax laws and regulations. It is a brochure created by NAFSA, an association dedicated to international education and exchange.

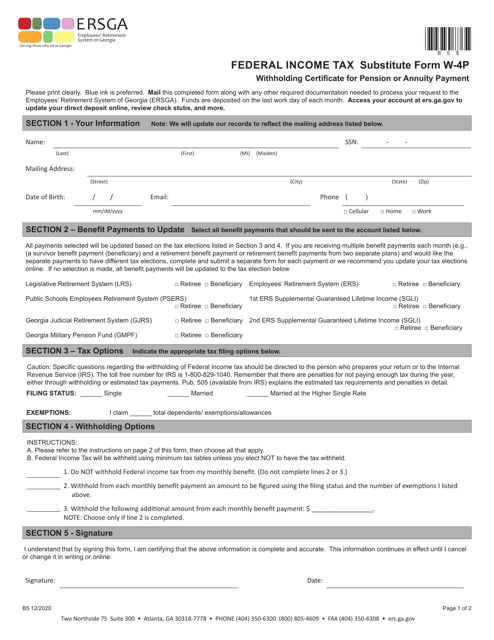

This form is used for reporting and withholding federal income tax for pension and annuity payments in the state of Georgia.

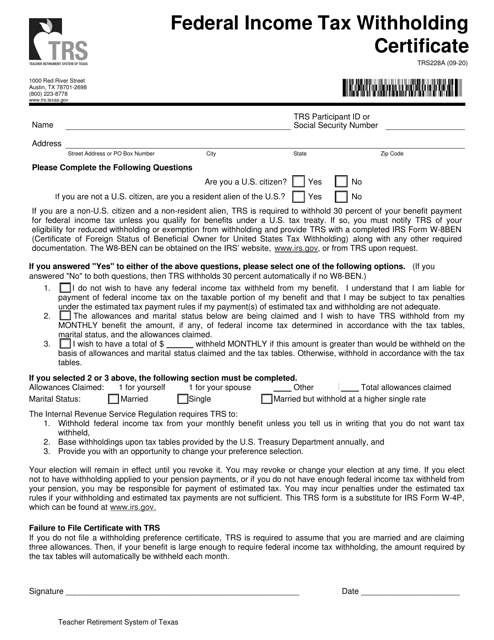

This form is used for the federal income tax withholding in Texas. It helps individuals to determine the correct amount of federal tax to be withheld from their paychecks.

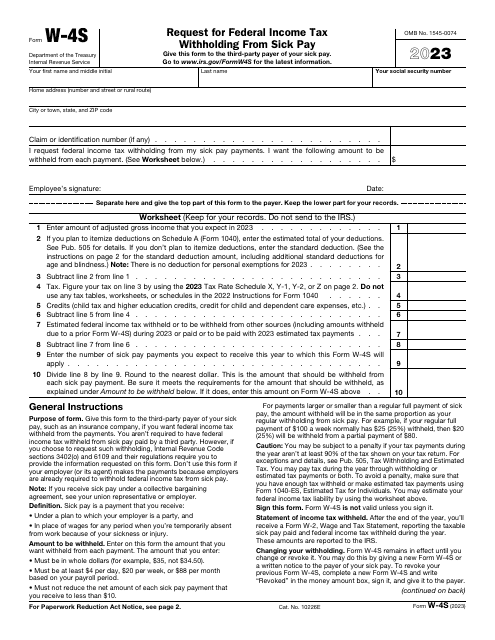

This is a formal statement prepared by an employee after figuring out how much tax an employer has to deduct from their paycheck.

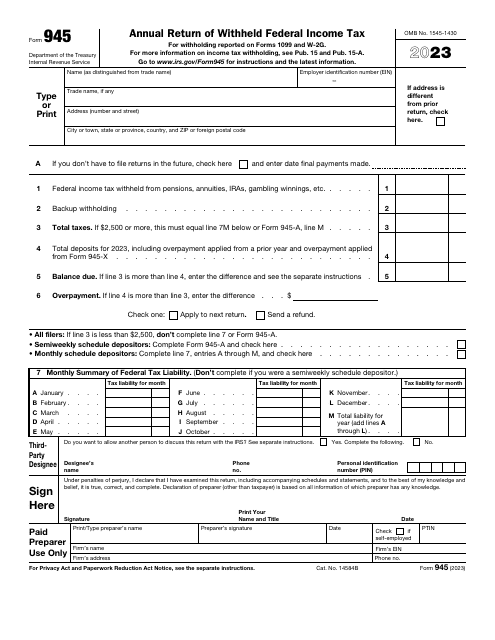

This is a fiscal form taxpayers are obliged to prepare and submit to provide information about nonpayroll payments subject to tax and confirm they are paying an accurate amount of tax for the last year.

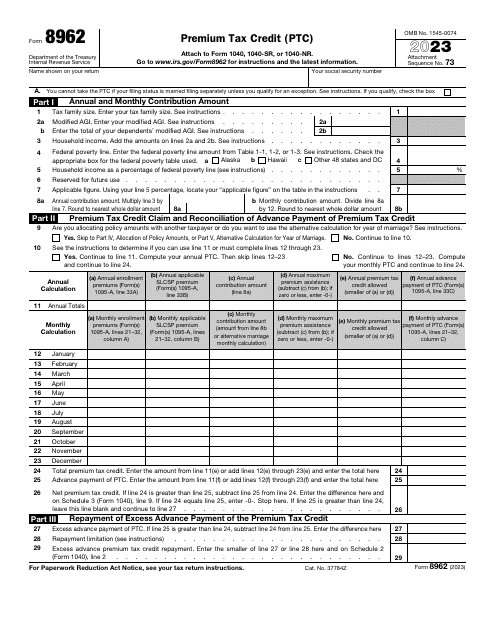

This is an IRS legal document completed by individuals who need to figure out the amount of their Premium Tax Credit and reconcile it with the Advanced Premium Tax Credit (APTC) payments made throughout the reporting year.