Workers Compensation Coverage Templates

Workers Compensation Coverage: Protecting Workers and Employers

At the heart of every business is its workforce - the dedicated individuals who contribute their skills and efforts to drive success. But sometimes, accidents happen, leaving workers injured and businesses liable for medical expenses and lost wages. That's where Workers Compensation Coverage comes in - a vital protection for both employees and employers.

Also known as workers comp, this comprehensive coverage ensures that employees who suffer work-related injuries or illnesses receive proper medical care and compensation, without burdening the employer with crippling legal costs. In essence, workers compensation coverage is a safety net that safeguards the well-being of workers and the financial stability of businesses across various states.

For employers, having workers comp coverage not only fulfills legal requirements but also fosters a healthy and supportive work environment. It gives peace of mind knowing that if an employee is injured on the job, their medical expenses and income replacement are taken care of, reducing the likelihood of expensive lawsuits. Moreover, this coverage is instrumental in attracting and retaining top talent, as it demonstrates a commitment to employee welfare and security.

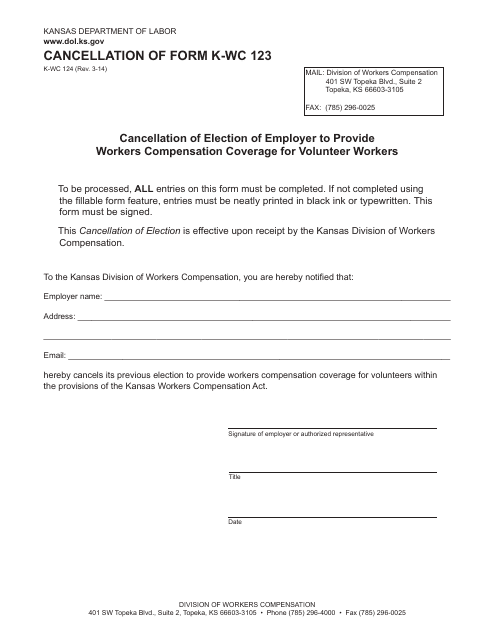

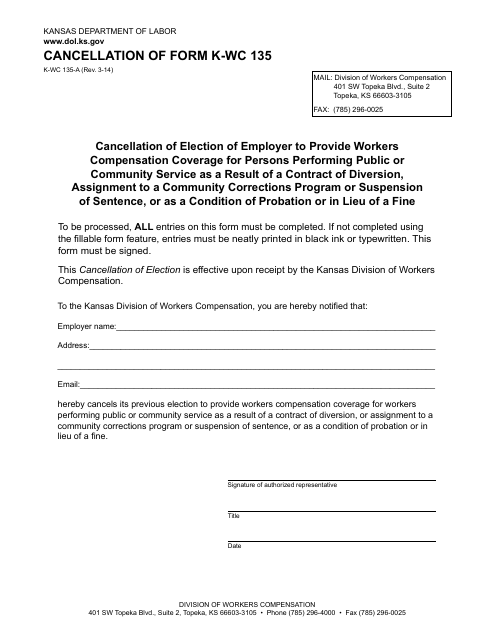

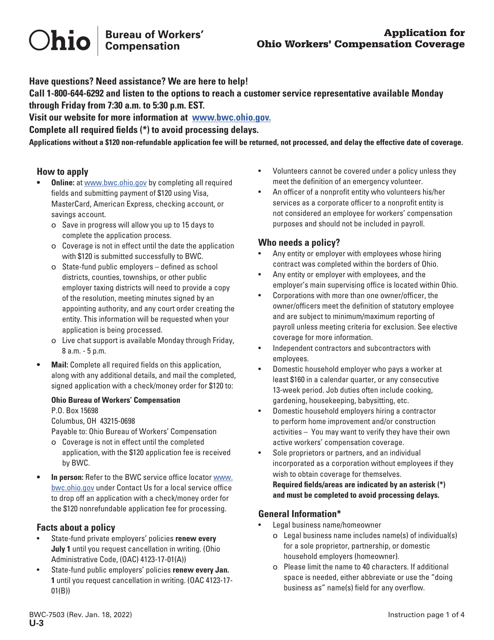

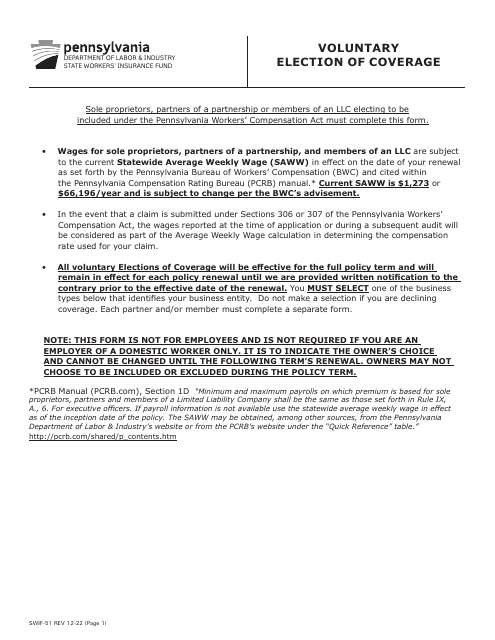

In order to streamline the process, there are various documents associated with workers compensation coverage. Consider the K-WC Form 124 or Form U-3 (BWC-7503), which are applications specific to certain states. These forms allow employers to establish or cancel workers compensation coverage, ensuring compliance with state regulations and providing a clear record of coverage.

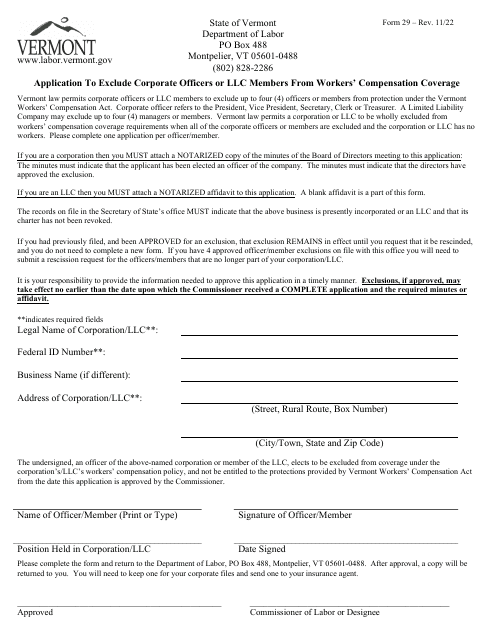

Another essential document is the DOL Form 29, designed for employers who seek to exclude corporate officers or LLC members from workers compensation coverage. This form enables businesses to customize their coverage according to their specific organizational structure and ensure that the right individuals are protected under the policy.

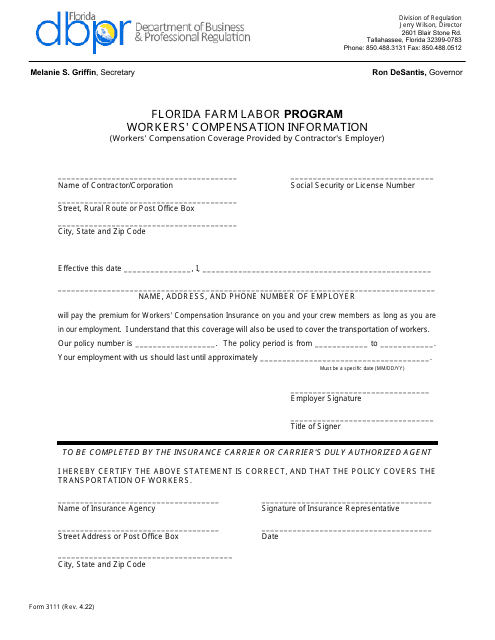

The importance of workers compensation coverage extends to specialized sectors as well. For instance, the Form 3111 Workers' Compensation Information is particularly relevant for the Florida Farm Labor Program. In this unique context, the form outlines the necessary details regarding workers compensation coverage provided by a contractor's employer, ensuring that all farmworkers are appropriately protected.

A web of legal requirements, paperwork, and alternate names can make navigating workers compensation coverage seem daunting. However, with the right resources and knowledge, businesses can confidently fulfill their obligations while safeguarding their employees and financial stability. The workers comp system is a crucial aspect of a well-functioning society, ensuring fairness, protection, and peace of mind for workers and employers alike.

So, whether you refer to it as workers compensation coverage, workers comp, or any other alternate name, remember that it stands as a vital pillar of support for workers and businesses across the United States and Canada.

Documents:

11

This document is used for cancelling the previous form filled to elect an employer to provide workers' compensation coverage for volunteer workers in the state of Kansas.

This Form is used for the cancellation of employer's election to provide workers compensation coverage for individuals performing public or community service under certain circumstances in Kansas.

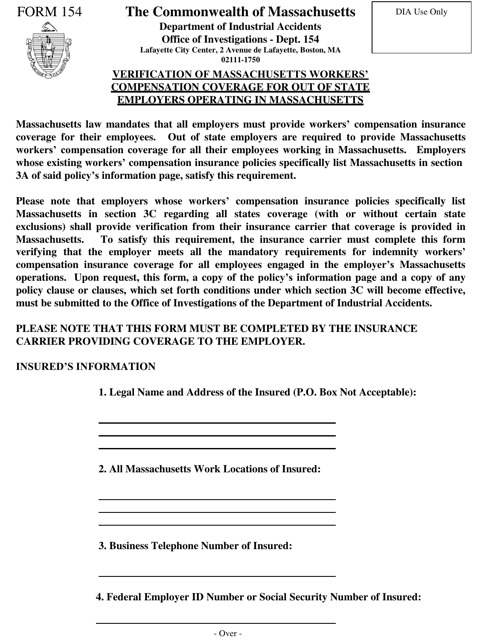

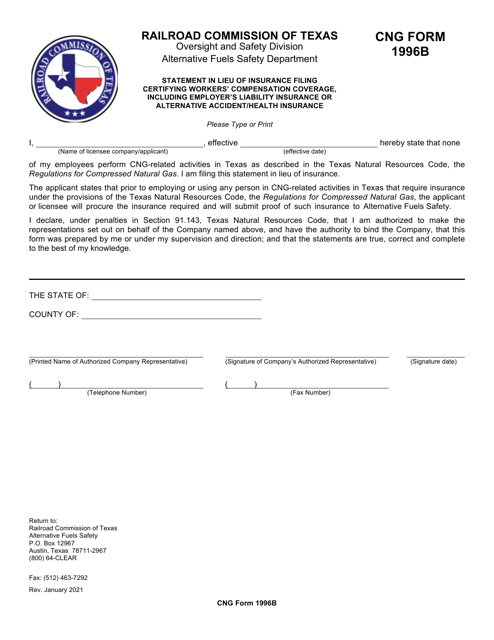

This form is used for certifying that an employer has workers' compensation coverage, including employer's liability insurance or alternative accident/health insurance in Texas.

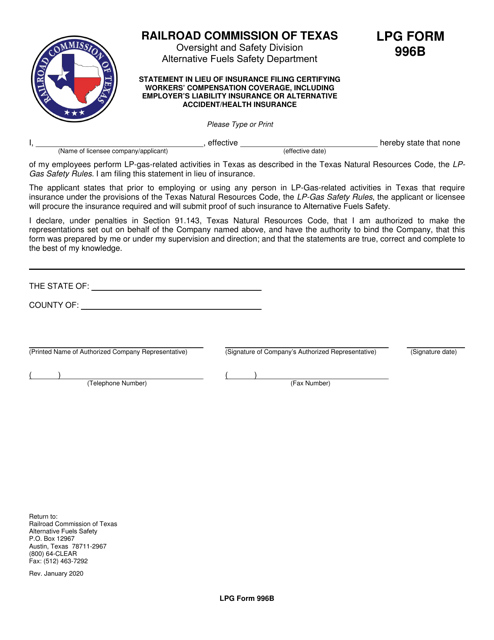

This type of document is used for certifying workers' compensation coverage, including employer's liability insurance or alternative accident/health insurance in Texas.

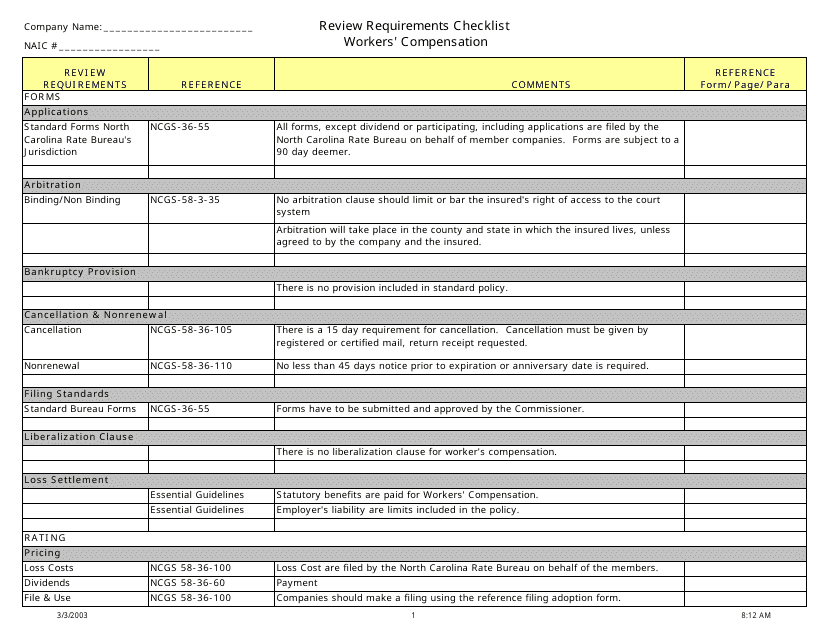

This document is a checklist that outlines the requirements for workers' compensation in North Carolina. It provides information on the necessary steps and documentation needed to comply with the state's workers' compensation laws.

This form is used to apply for excluding corporate officers or LLC members from workers' compensation coverage in Vermont.