Deductible Expenses Templates

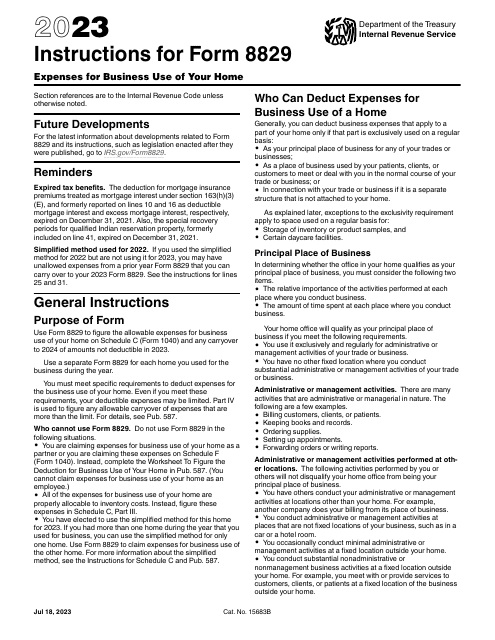

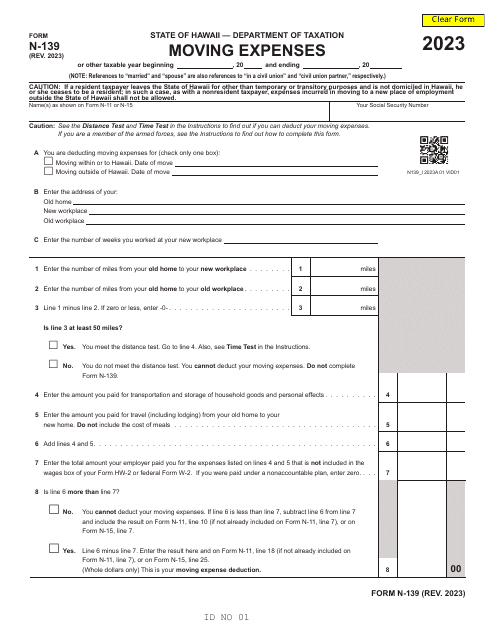

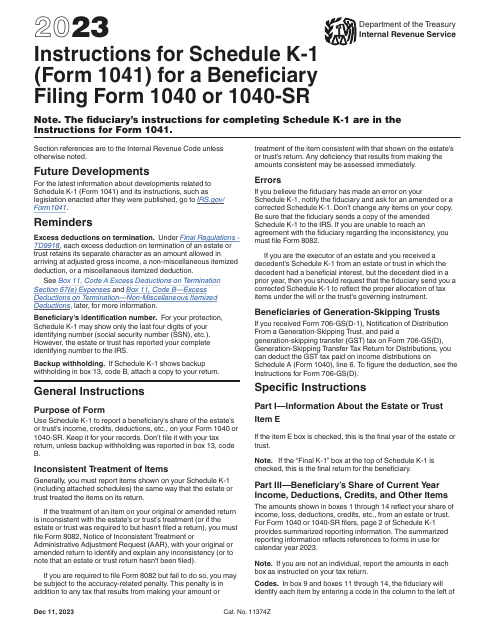

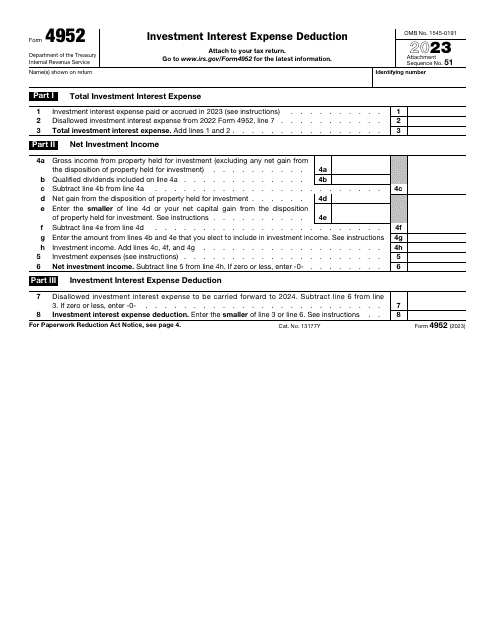

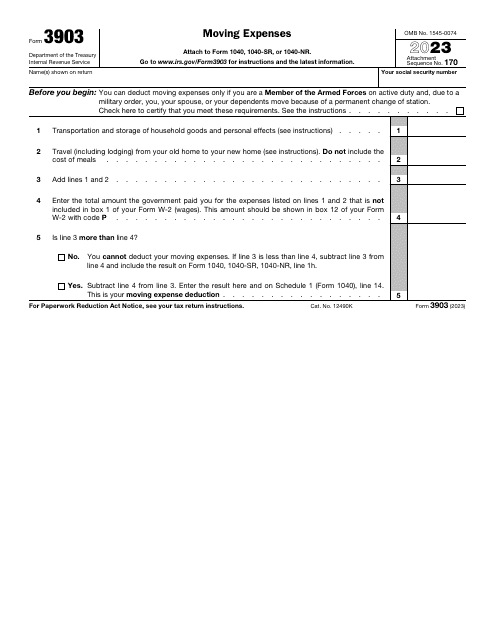

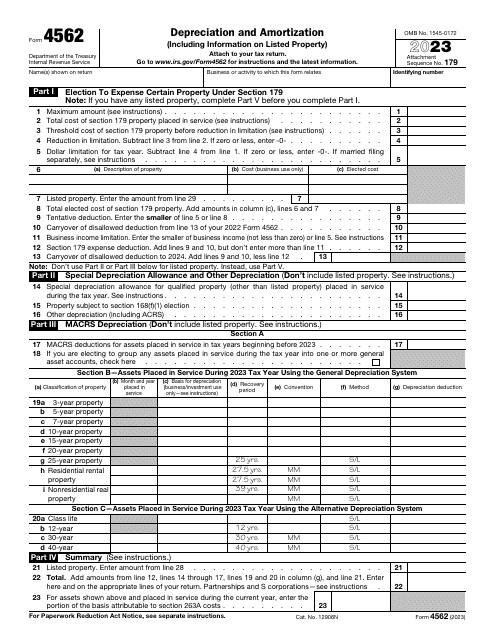

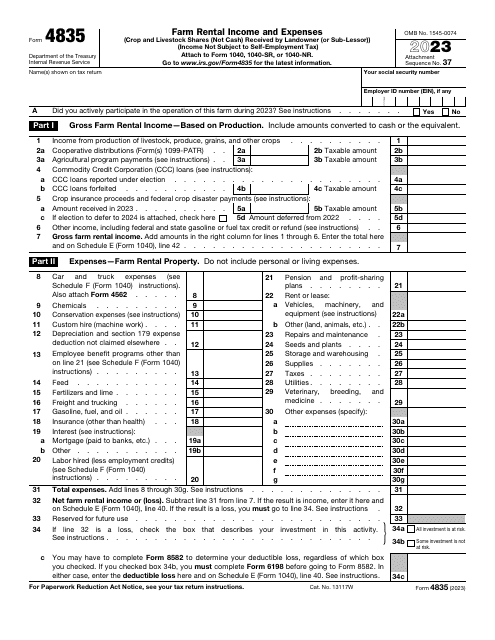

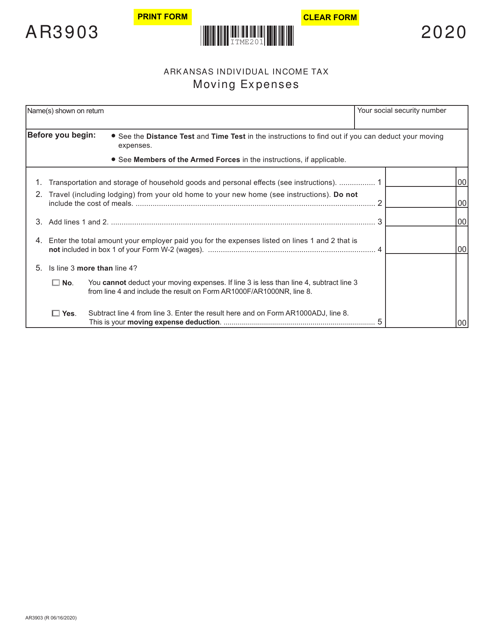

Are you aware of the various deductible expenses that you can claim? Deductible expenses refer to the costs that can be subtracted from your taxable income, reducing your overall tax liability. These expenses can include a wide range of items, such as business expenses, medical expenses, moving expenses, and investment interest.

At USA, Canada, and other countries, we understand the importance of maximizing your deductible expenses to ensure you pay the least amount of taxes possible. Our collection of documents provides you with the necessary resources to navigate through the complex world of deductible expenses.

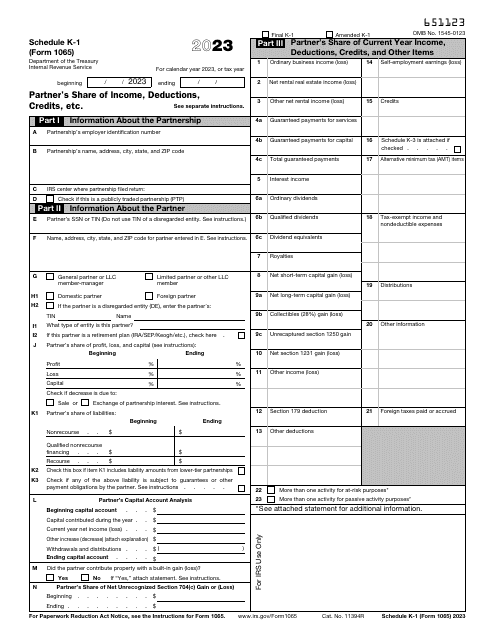

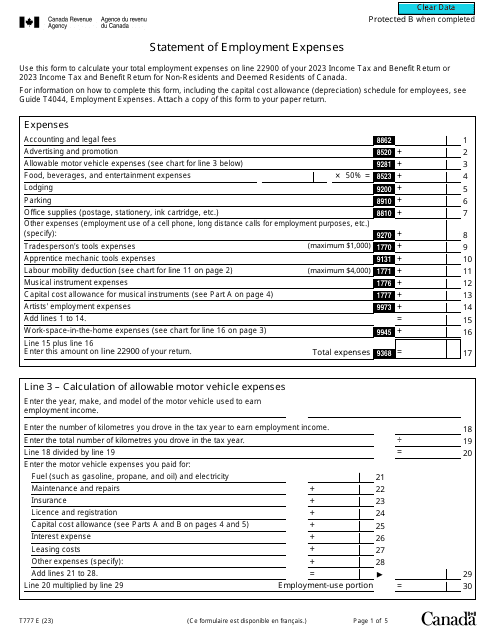

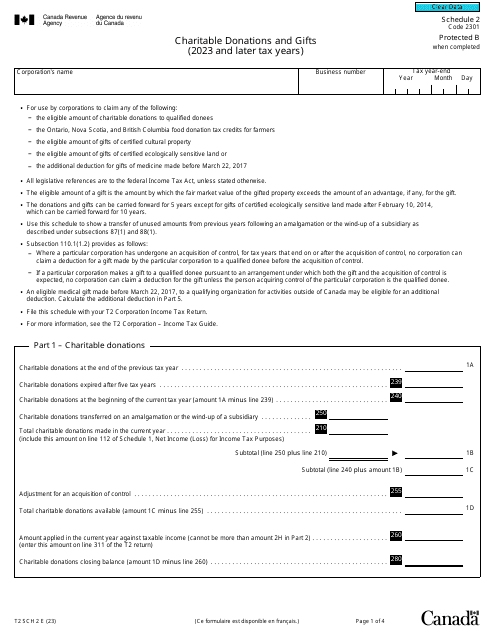

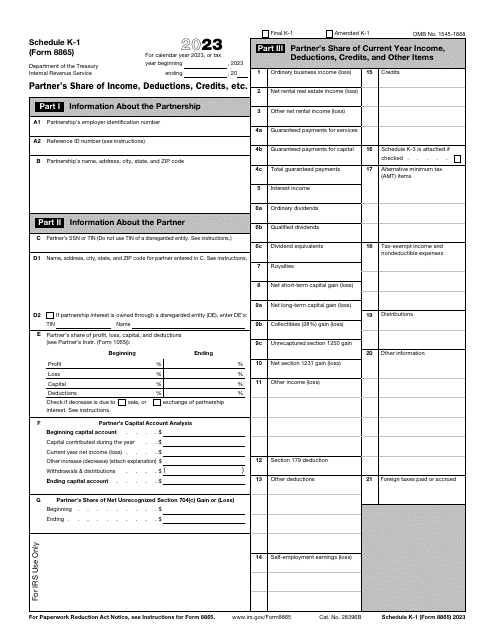

Explore our documents, such as IRS Form 1065 Schedule K-1 Partner's Share of Income, Deductions, Credits, Etc., which helps partners report their share of deductions. For our Canadian users, we offer Form T777 Statement of Employment Expenses, allowing individuals to claim deductions related to employment. If you reside in Arkansas, you can access Form AR3903 Moving Expenses, specifically tailored to claim moving-related deductions within the state.

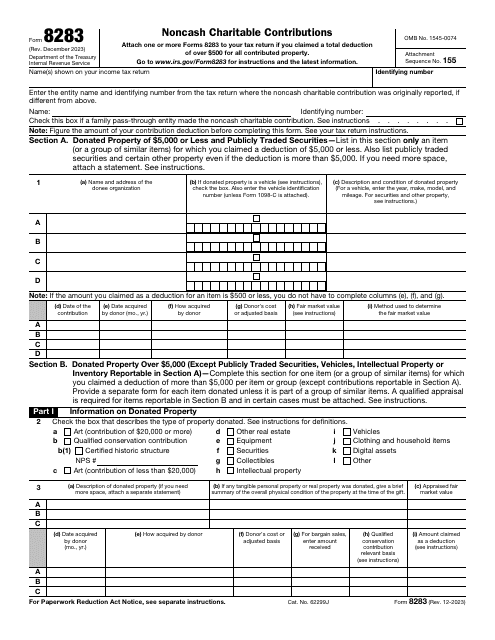

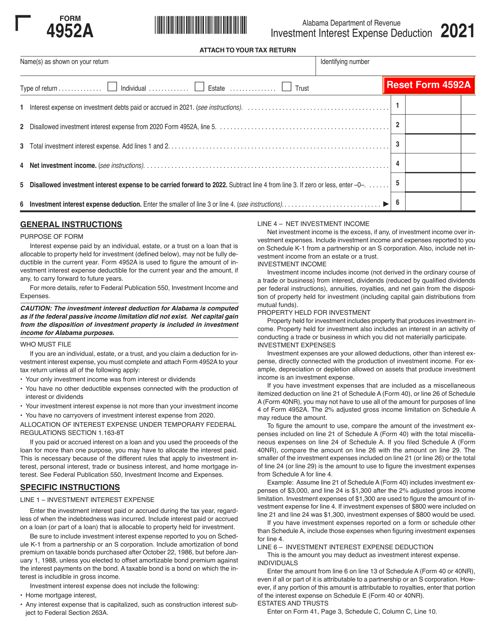

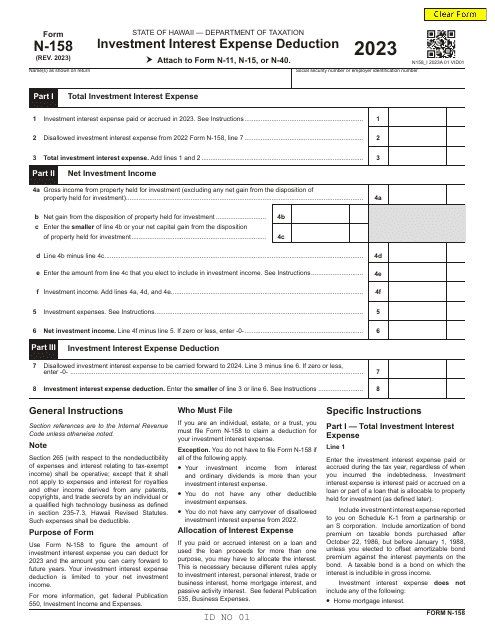

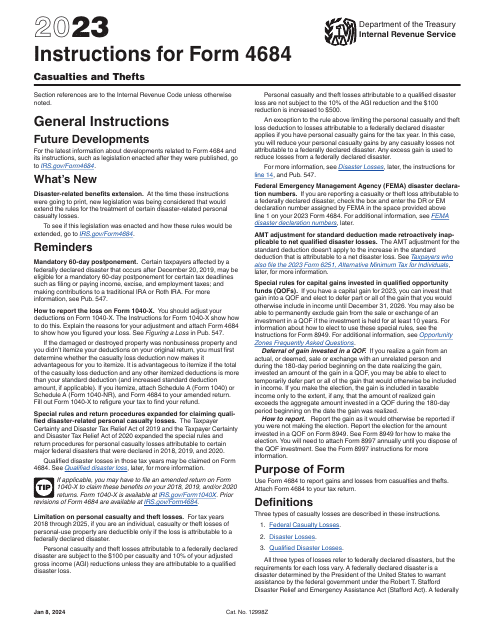

Furthermore, our comprehensive instructions for IRS Form 4684 Casualties and Thefts outline the procedure for reporting deductions related to losses from casualties or thefts. Lastly, we provide IRS Form 4952 Investment Interest Expense Deduction to assist you in claiming deductions on investment interest expenses.

Whether you refer to deductible expenses as expense deductions, expense deduction, or simply deductible expenses, our documents collection ensures you have the tools you need to accurately report and maximize your deductions. Start exploring now and reduce your tax burden with our documents on deductible expenses.

Documents:

32

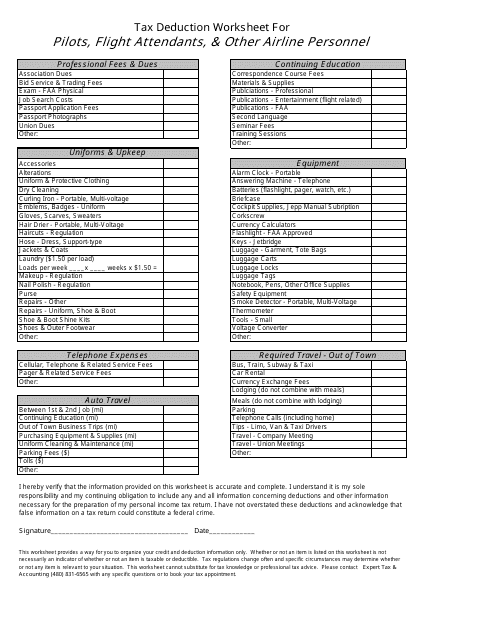

This form is used for calculating tax deductions specific to pilots, flight attendants, and other airline personnel. It helps ensure that eligible expenses related to work in the aviation industry are properly accounted for.

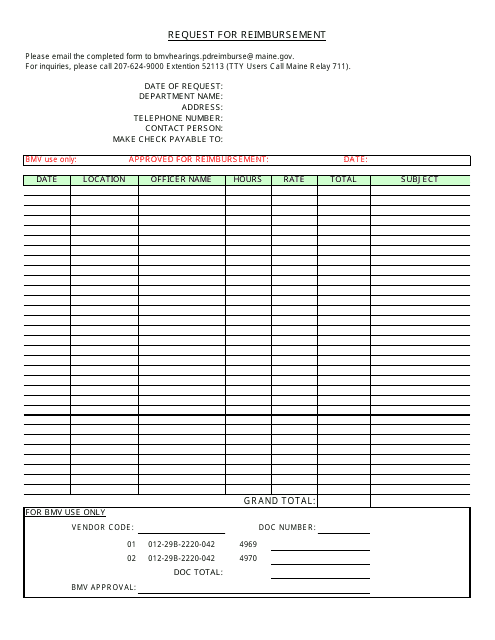

This document is used for requesting reimbursement in the state of Maine.

This is a detailed form a partnership sends to every partner that participates in joint management of the entity to let the partner determine what to include in their personal tax returns.

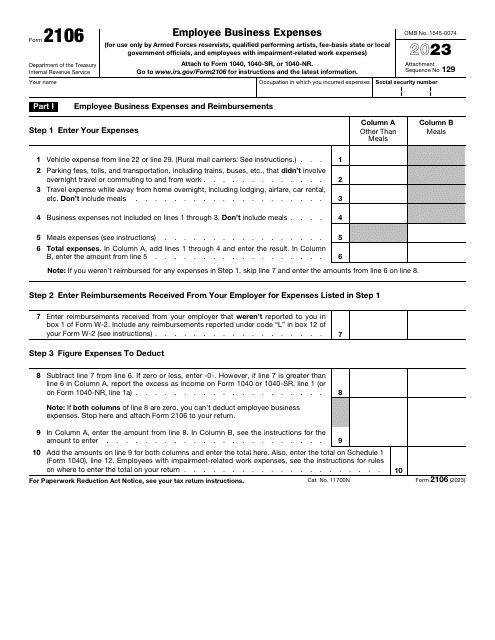

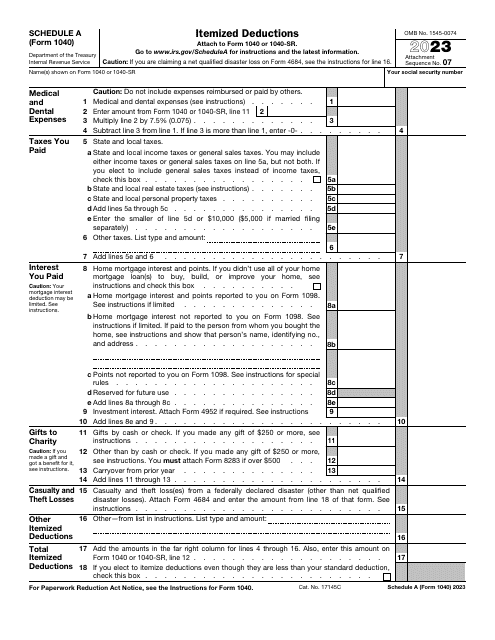

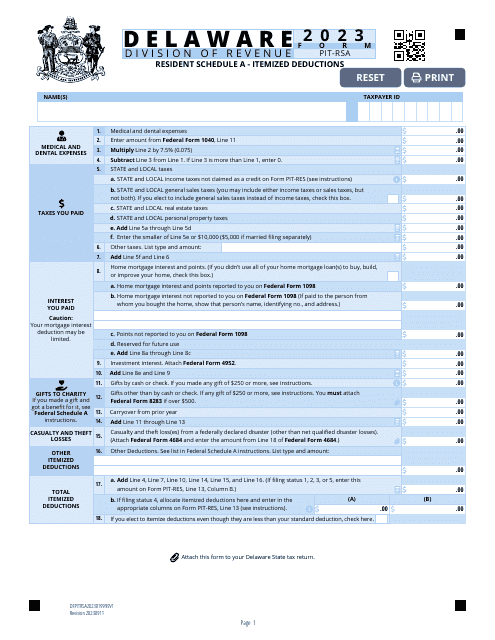

This form is also known as the IRS itemized deductions form. It belongs to the IRS 1040 series. This document is used in order to calculate the amount of your itemized deductions.

Canadian employees may use this form when they often need to supply themselves with materials necessary to complete their work, but are not reimbursed through their place of work for these expenses.

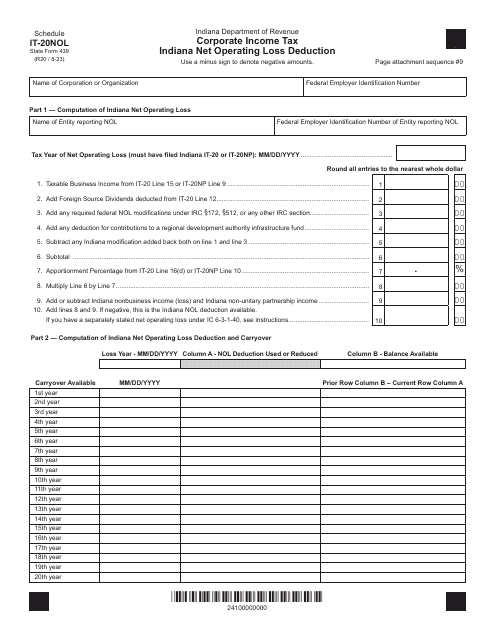

This is a formal document prepared by business owners whose intention is to ask for tax deductions due to depreciation of assets they used to carry out business operations and amortization of this property.

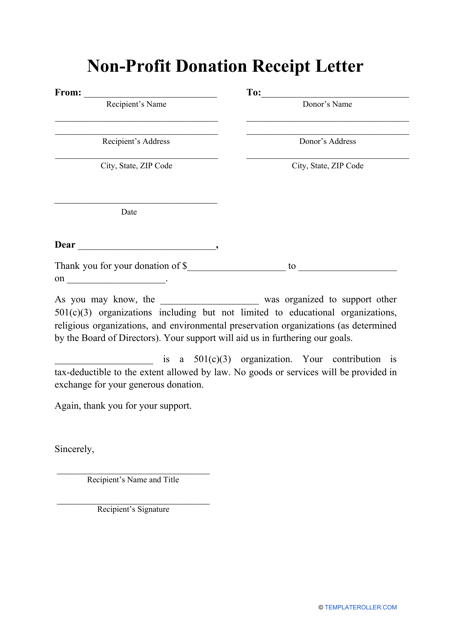

A non-profit organization may prepare and send this letter to a donor to confirm that a donation or a gift was received and to thank the donor or sponsor for their financial support or tangible property they have donated.

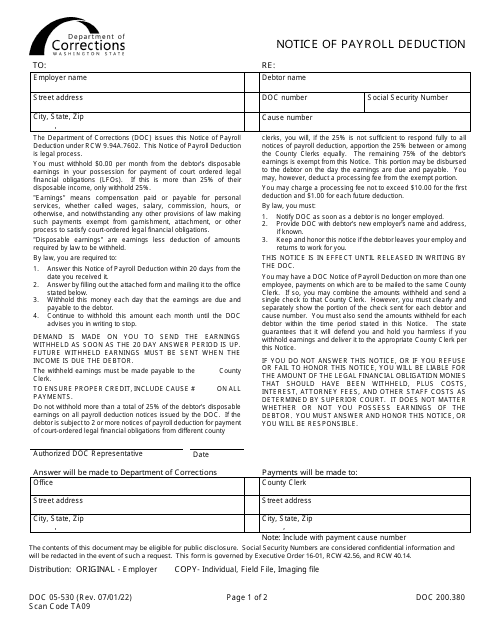

This form is used for informing employees in Washington about upcoming payroll deductions.