Electric Power Templates

Electric Power Documents Collection

Discover a comprehensive collection of documents related to electric power, including tax forms, certifications, and industry reports.

Our electric power documents cover a wide range of topics and requirements to keep you informed and compliant in the ever-evolving electric power sector.From estimating and filing business and occupation taxes to applications for certification and sales tax exclusions, our electric power documents provide you with the necessary tools to navigate the complex landscape of compliance requirements.

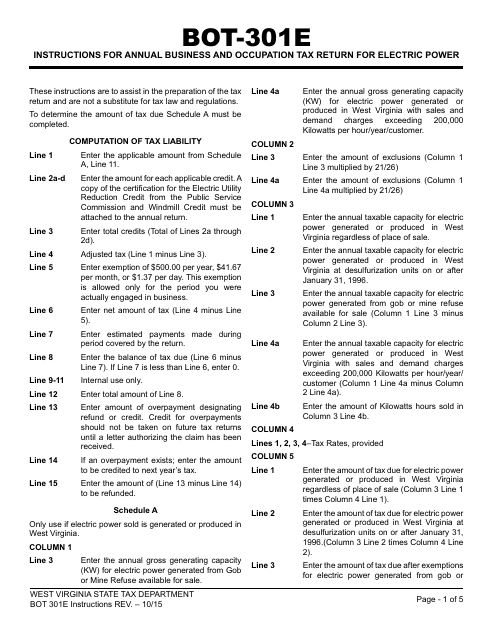

Whether you are a business owner, a tax professional, or an energy industry enthusiast, our extensive collection has you covered.Explore instructions for tax forms, such as the WV/BOT-301e Annual Business & Occupation Tax Return for Electric Power in West Virginia, to ensure accurate and timely filings.

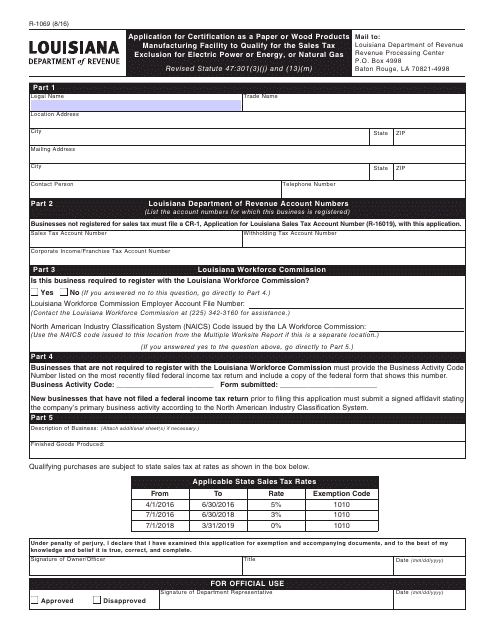

Stay up to date with the latest guidelines and regulations provided in the Instructions for Form WV/BOT-301e. Our electric power documents are designed to simplify the tax filing process and help you maximize your deductions and exemptions.Looking to qualify for sales tax exclusions for electric power, energy, or natural gas? Our documents include the Form R-1069 Application for Certification as a Paper or Wood Products Manufacturing Facility, specifically tailored to help you navigate Louisiana's sales tax exclusion requirements.

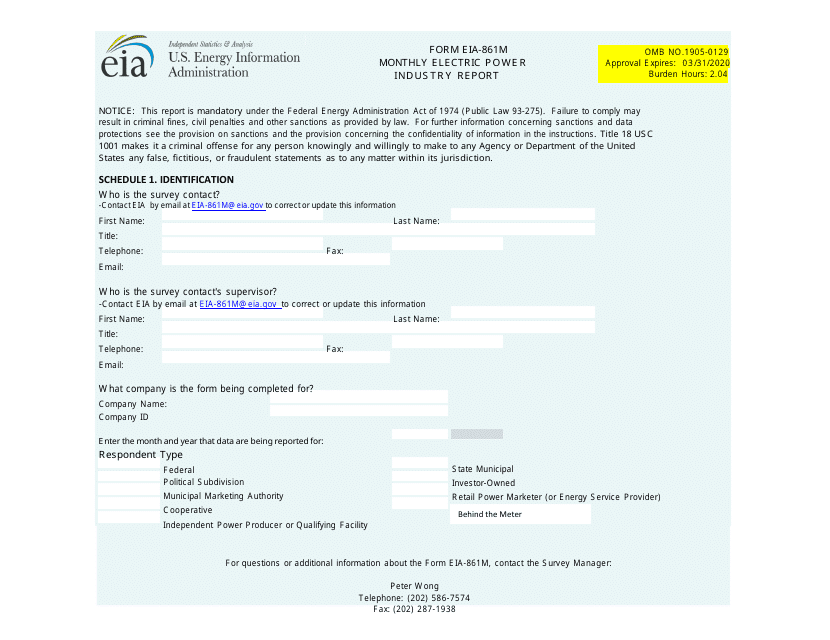

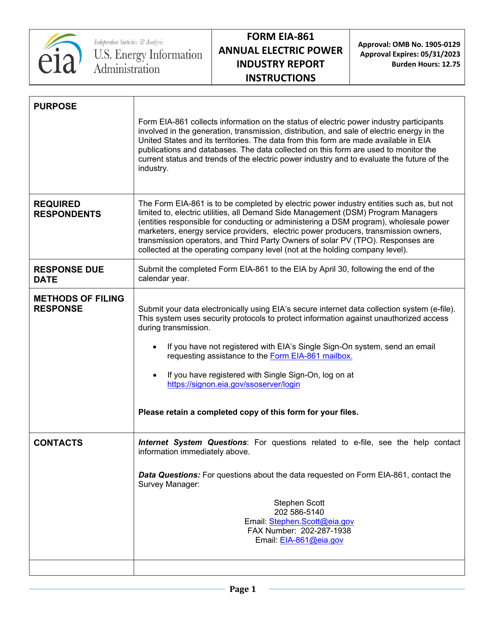

For those interested in gaining insights into the annual electric power industry report, our collection also features the Instructions for Form EIA-861S.

This report provides a short form summary of the electric power industry's performance, trends, and forecasts.Whether you are a tax expert, an industry professional, or a business owner, our electric power documents collection is your go-to resource.

Stay informed, meet compliance requirements, and make the most of the opportunities in the electric power sector with our comprehensive selection of documents..

Documents:

15

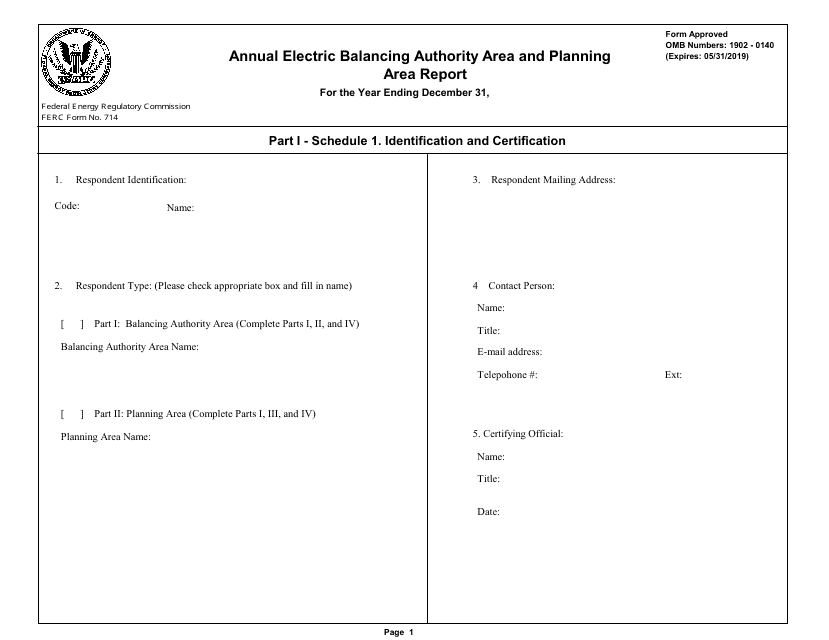

This document is used for submitting the annual report on electric balancing authority area and planning area.

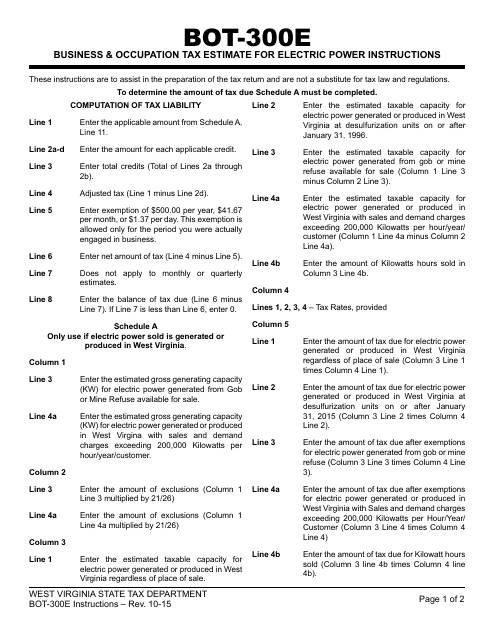

This Form is used for estimating the Business & Occupation Tax for Electric Power in West Virginia. It provides instructions on how to calculate and report the estimated tax amount.

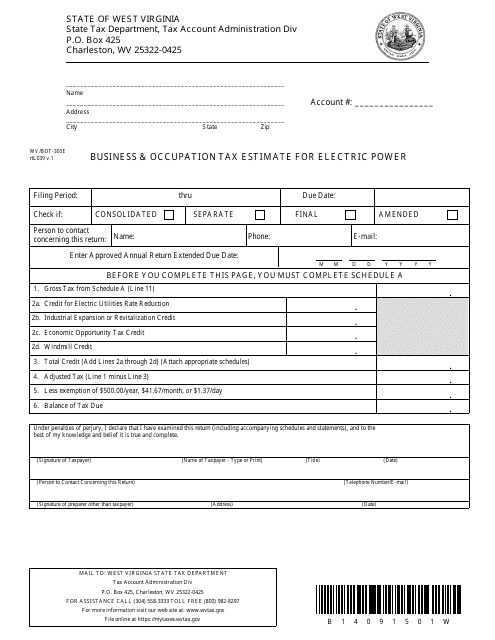

This form is used for estimating the business and occupation tax for electric power in West Virginia.

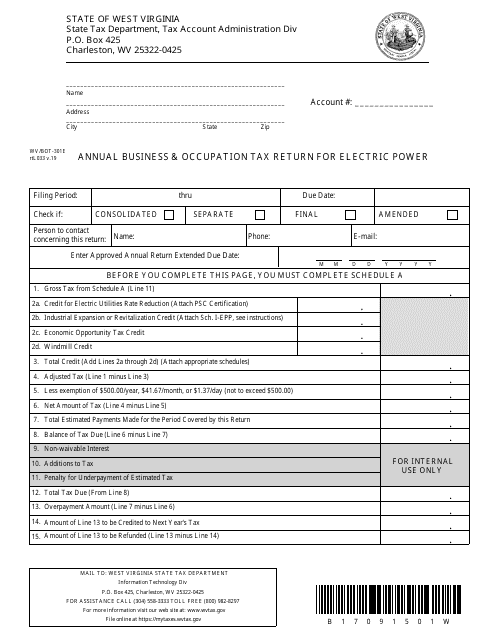

This form is used for filing the annual business and occupation tax return specifically for electric power companies operating in West Virginia.

This Form is used for filing the Annual Business and Occupation Tax Return specifically for Electric Power companies in West Virginia. It provides instructions for completing the necessary tax paperwork.

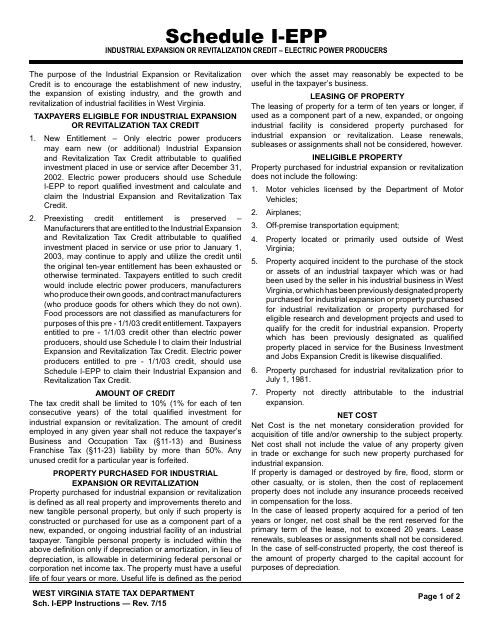

This document provides instructions for completing Schedule I-EPP for claiming the Industrial Expansion or Revitalization Credit for electric power producers in West Virginia.

This form is used for applying for certification as a paper or wood products manufacturing facility in Louisiana to qualify for the sales tax exclusion for electric power, energy, or natural gas.

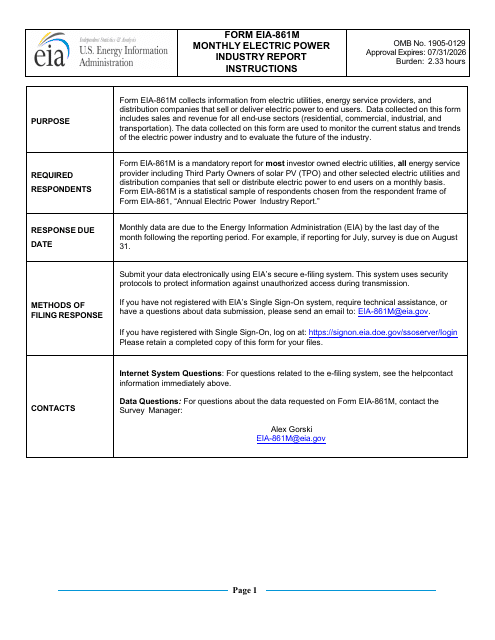

This form is used for submitting monthly reports on the electric power industry.

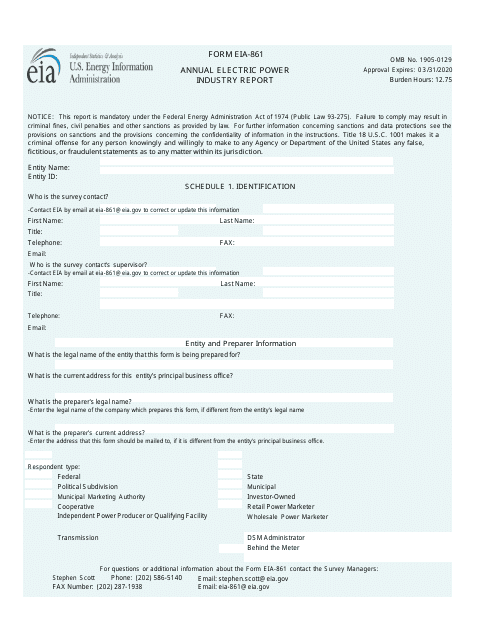

This form is used for collecting annual data on the electric power industry in the United States. It provides information on electricity generation, sales, and consumption, as well as utility and customer-level data.

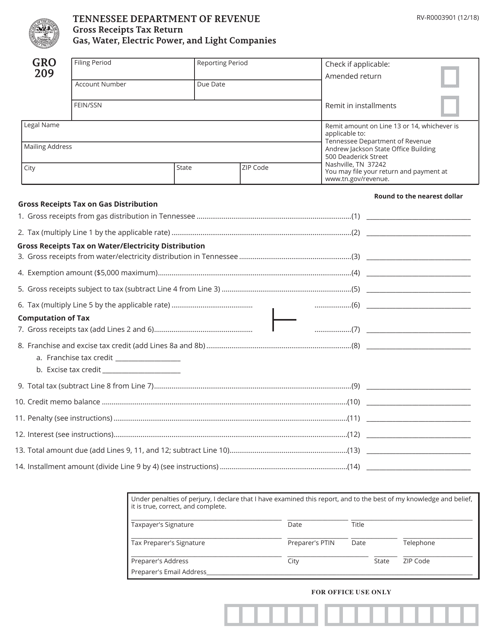

This Form is used for filing Gross Receipts Tax Return for Gas, Water, Electric Power, and Light Companies in Tennessee.

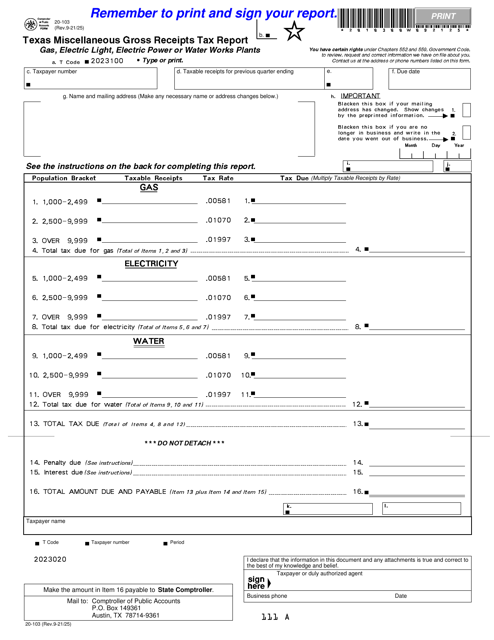

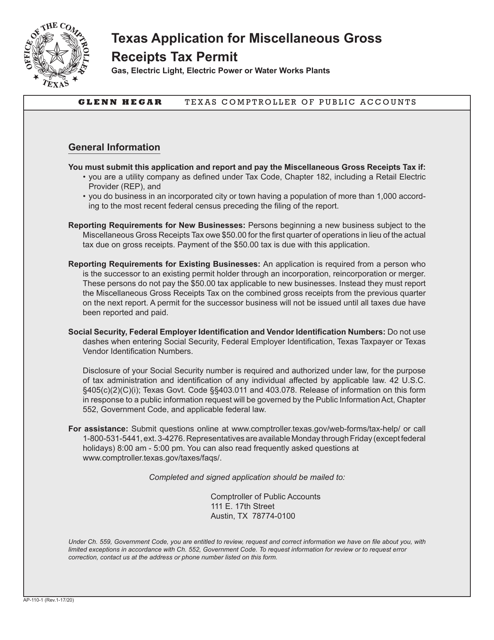

This form is used for applying for a miscellaneous gross receipts tax permit for gas, electric light, electric power, or water works plants in Texas.

This Form is used for submitting the Annual Electric Power Industry Report, providing information about the electric power industry in the United States. The form includes instructions on how to fill out and submit the report.

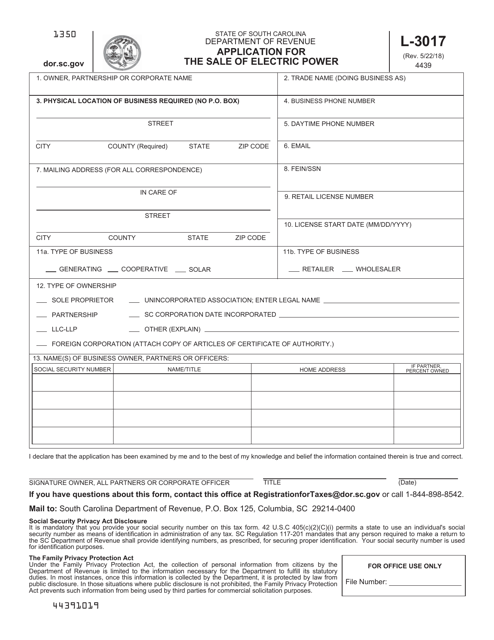

This form is used for applying to sell electric power in South Carolina.