Tax Reconciliation Templates

Tax Reconciliation Services for Individuals and Businesses

Achieve accurate and compliant tax filing with our comprehensive tax reconciliation services. Our team specializes in assisting individuals and businesses in reconciling their income tax accounts and ensuring all necessary adjustments are made.

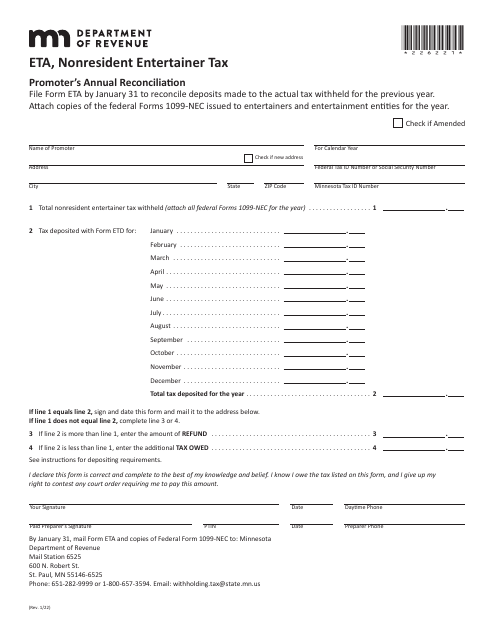

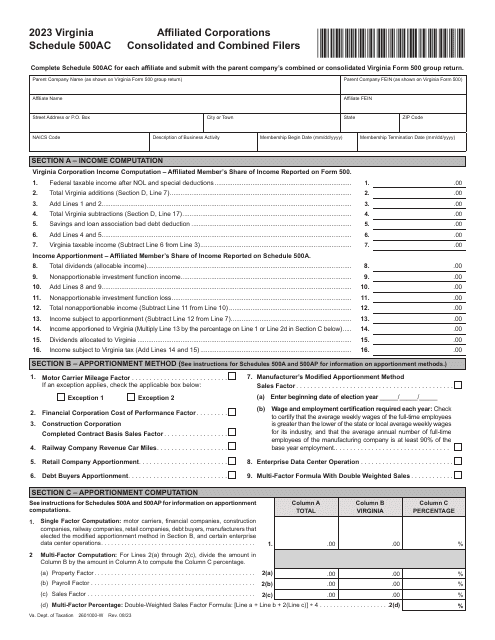

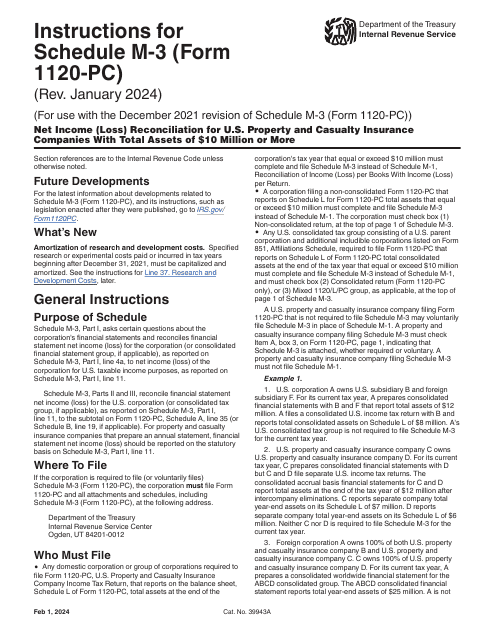

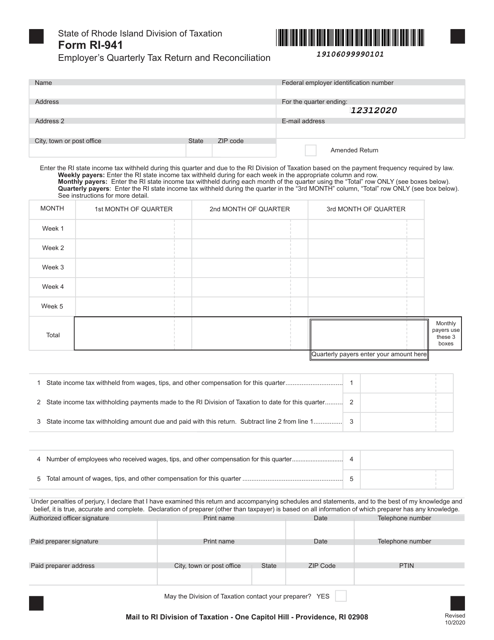

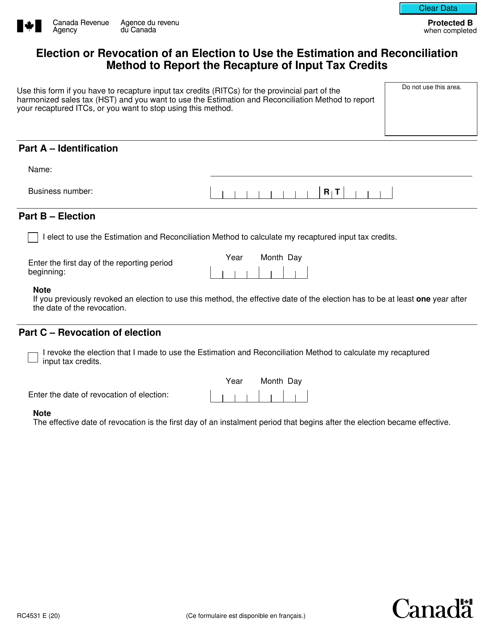

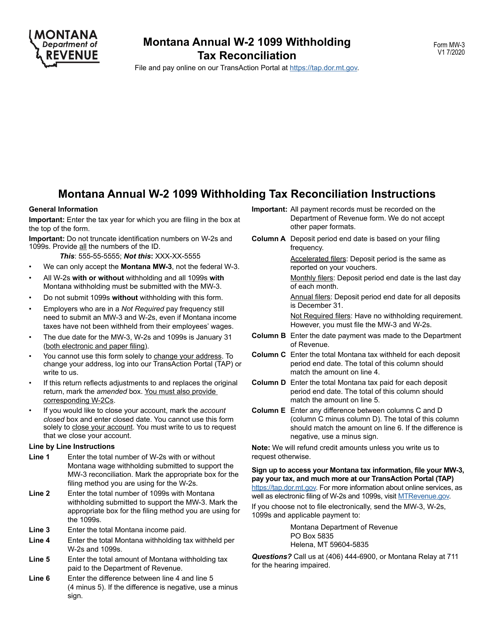

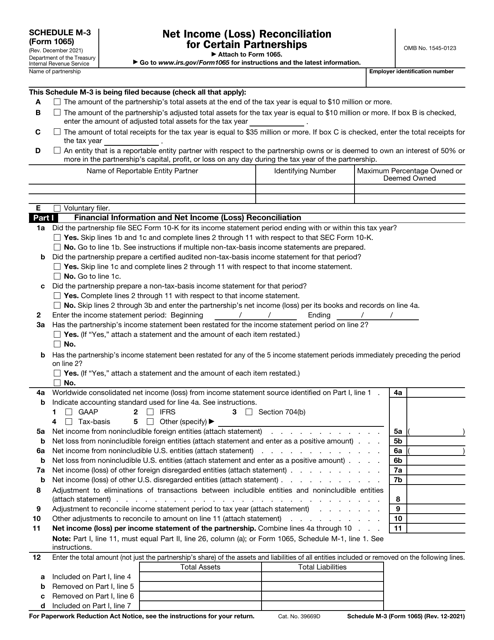

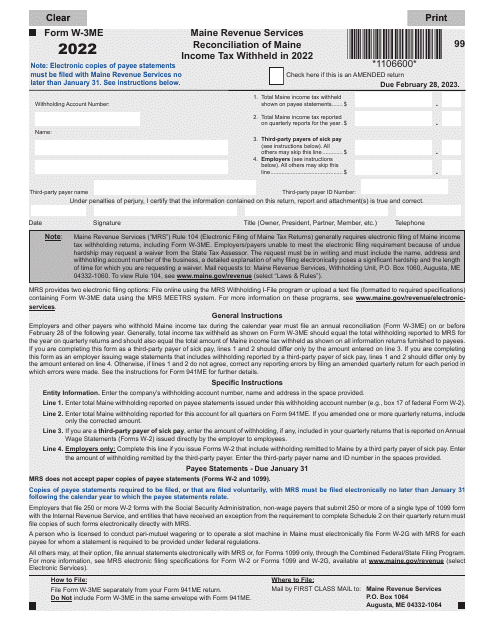

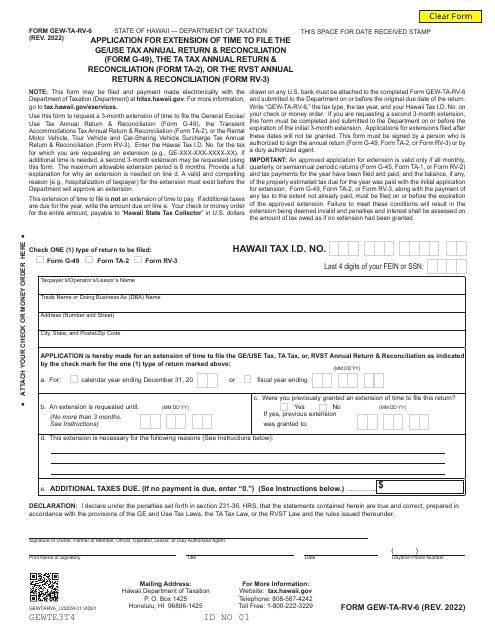

Our tax reconciliation services help you navigate through complex tax laws and regulations, minimizing the risk of penalties or audits. Whether you are a fiduciary, employer, or affiliated corporation, our experienced professionals can guide you through the process, ensuring your tax obligations are met.

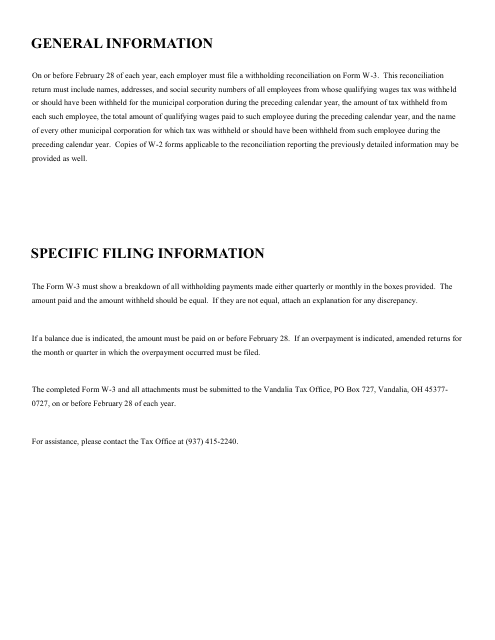

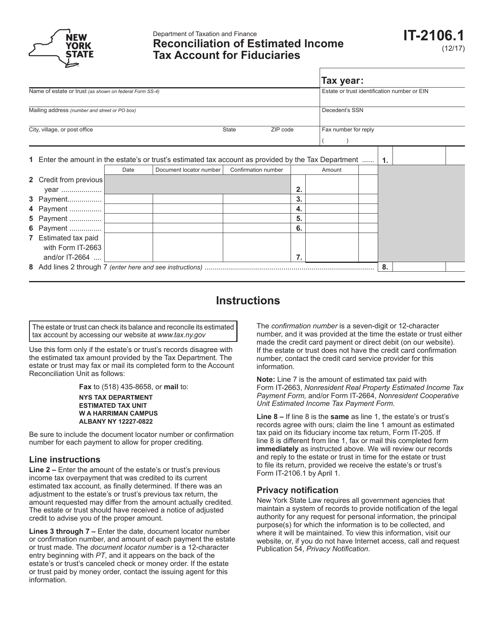

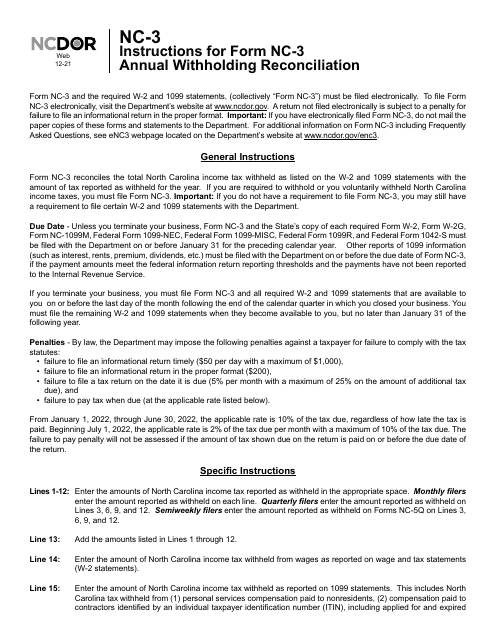

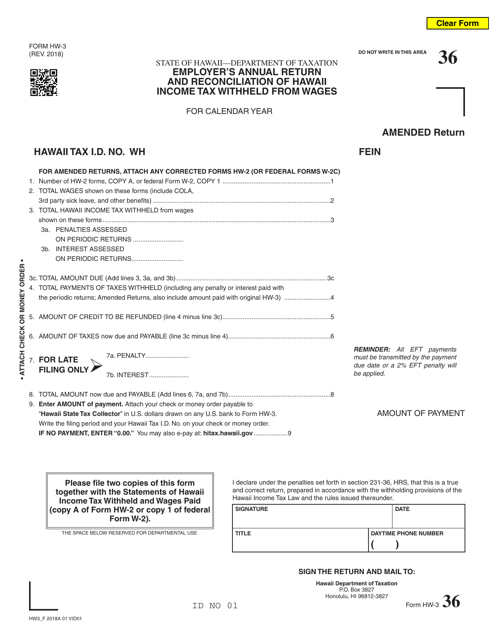

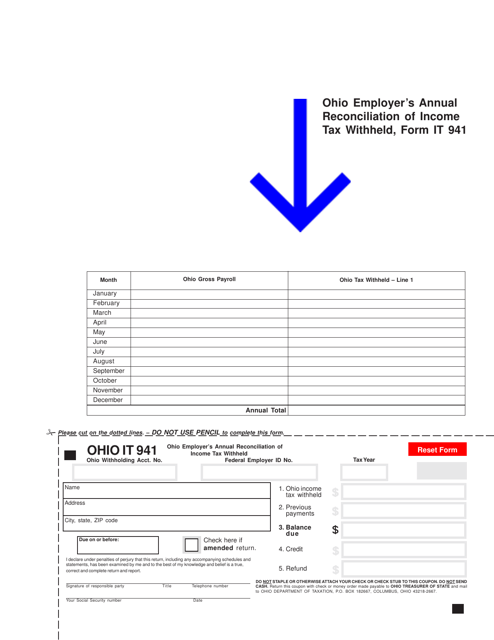

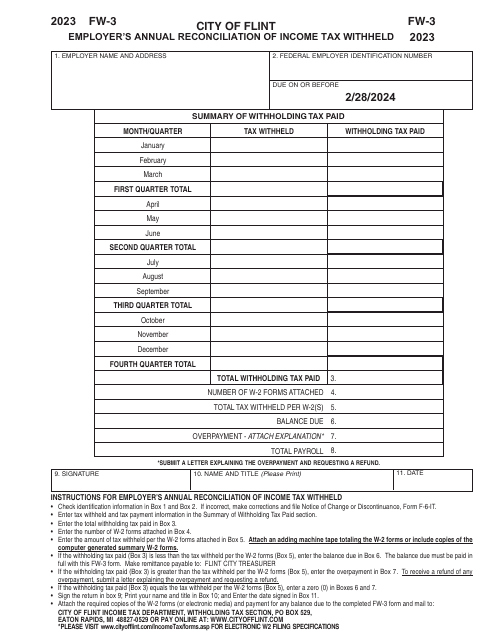

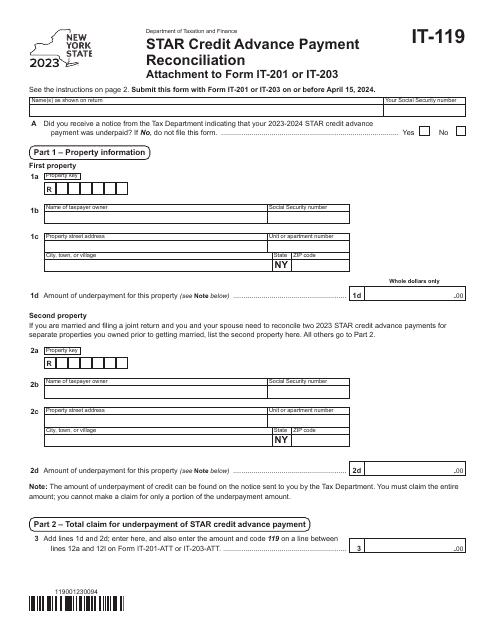

With our expert knowledge of state and federal tax codes, we can assist you in completing the required documentation. From Form IT-2106.1 in New York to Form IT941 in Ohio, we have extensive experience in handling various tax reconciliation forms across different states.

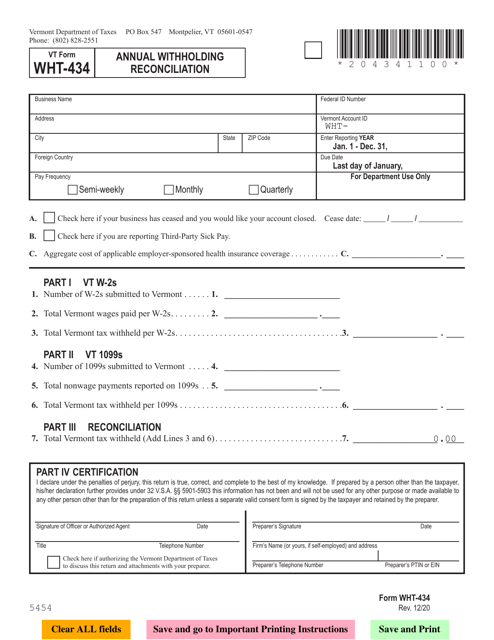

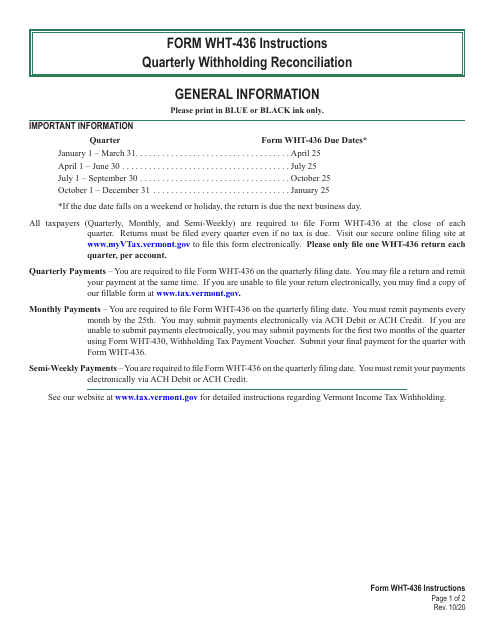

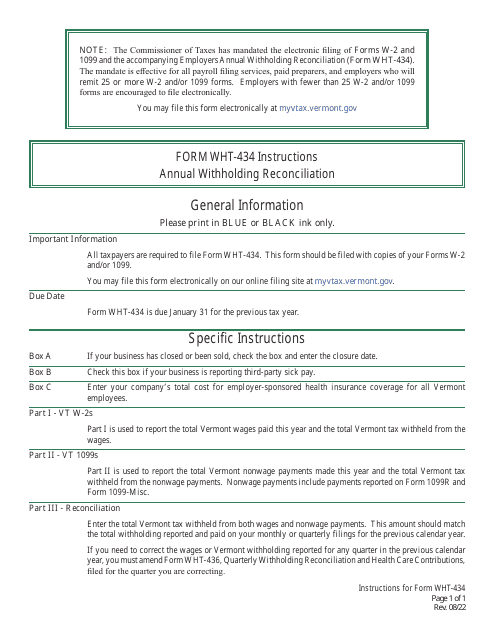

When it comes to IRS Form 941-X or an annual withholding reconciliation like VT Form WHT-434 in Vermont, our team can provide precise instructions and assistance in accurately reporting any adjustments or claims for refund.

Our tax reconciliation services not only ensure compliance but also help uncover potential savings and opportunities for optimizing your tax liabilities. We work closely with you, reviewing your financial records and identifying any discrepancies or overlooked deductions to maximize your tax benefits.

Trust our team of tax professionals to ensure your tax reconciliation process is smooth, efficient, and cost-effective. Let us handle your tax obligations, allowing you to focus on what matters most – running your business or managing your personal finances.

Contact us today for reliable and comprehensive tax reconciliation services tailored to your specific needs.

Documents:

33

This Form is used for reconciling withholding taxes for the City of Vandalia, Ohio.

This form is used for reconciling the estimated income tax account for fiduciaries in the state of New York.

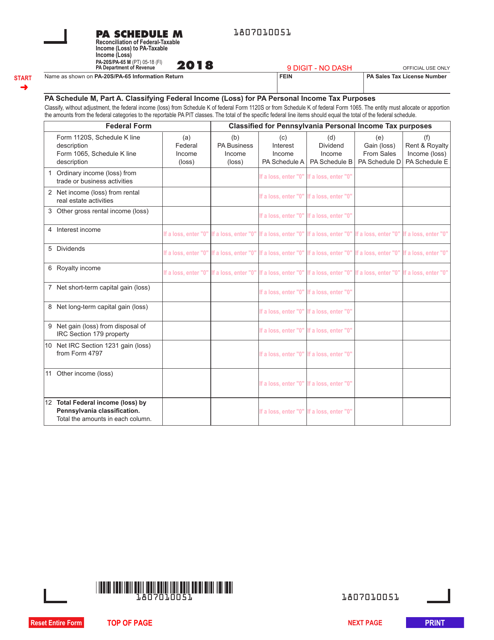

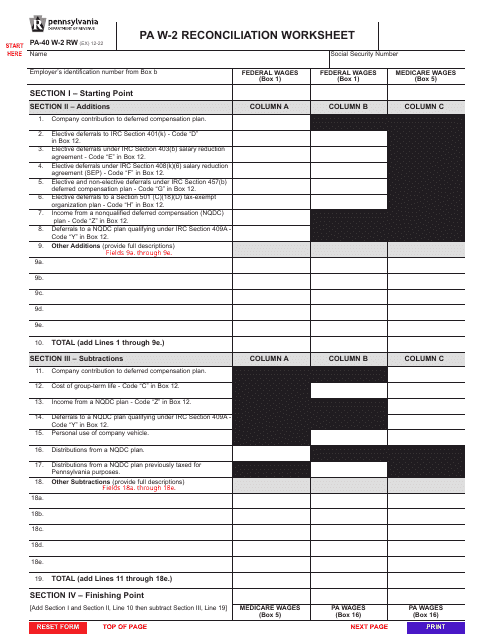

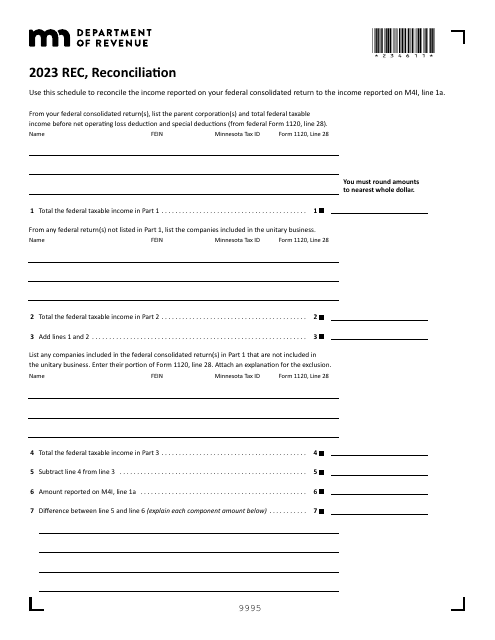

This Form is used for reconciling federal-taxable income (loss) to Pennsylvania taxable income (loss) in Pennsylvania.

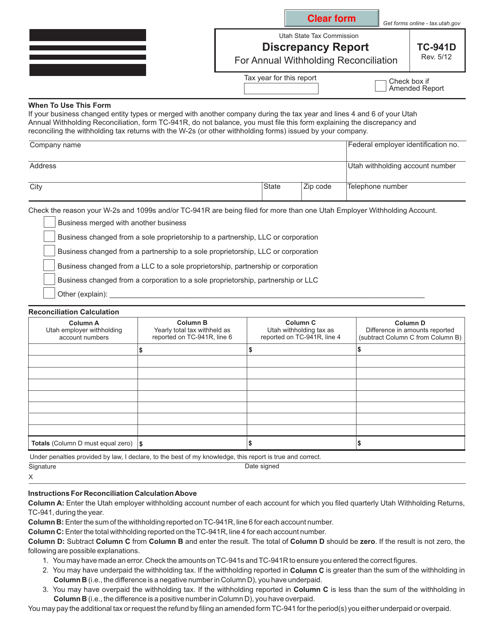

This form is used for reporting discrepancies in annual withholding reconciliation in the state of Utah.

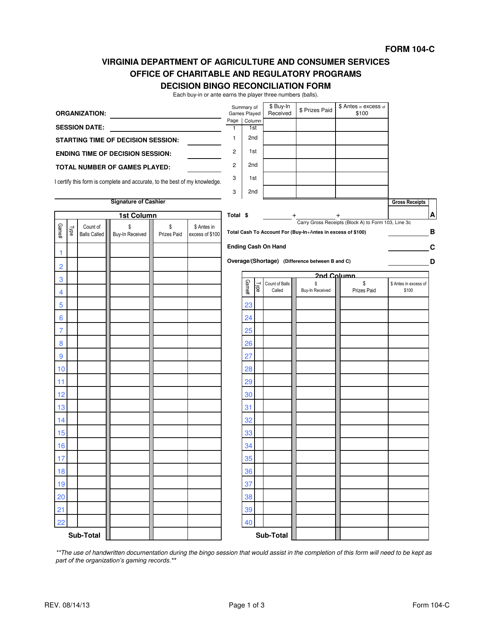

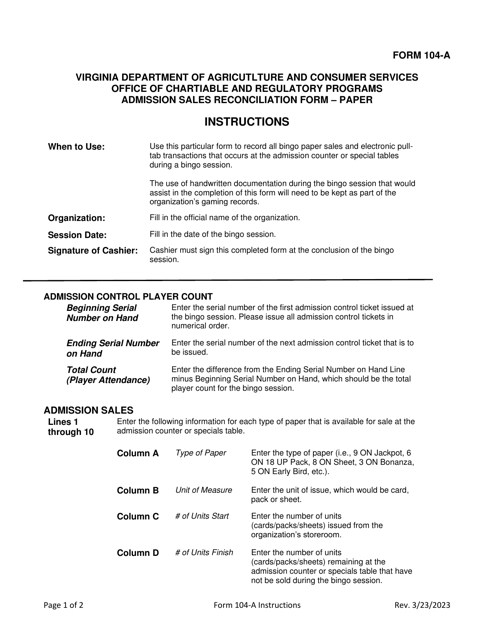

This Form is used for reconciling decisions made during a game of bingo in the state of Virginia.

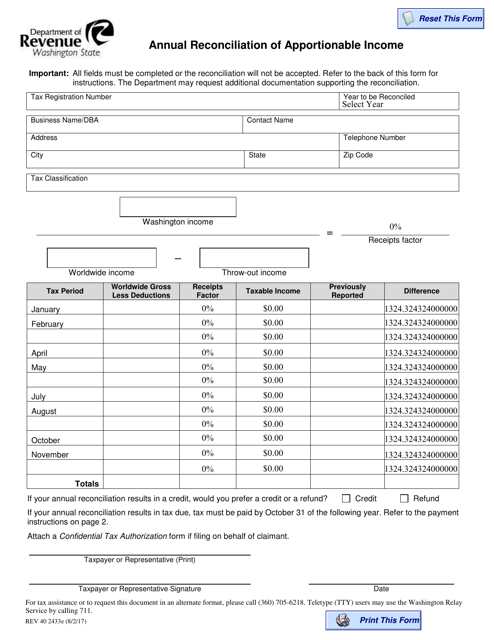

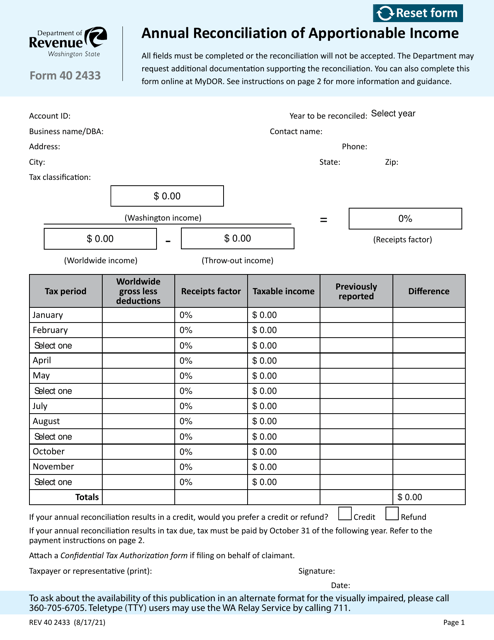

This form is used for the annual reconciliation of apportionable income in the state of Washington. It is used to determine the amount of income that is subject to taxation in the state.

This is a formal instrument used by taxpayers that need to fix the mistakes they have discovered upon filing IRS Form 941, Employer's Quarterly Federal Tax Return.

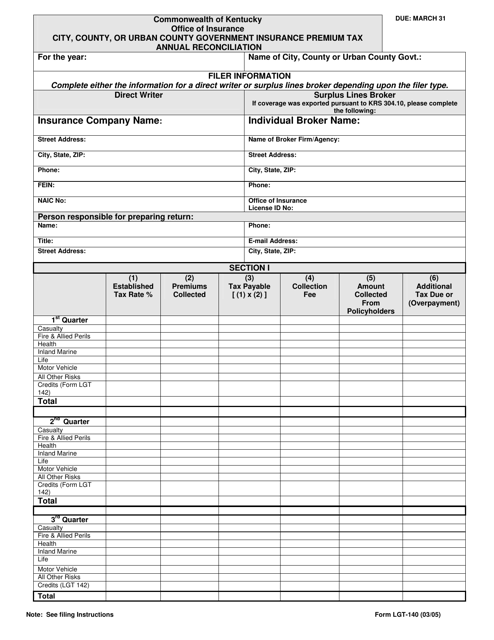

This form is used for the annual reconciliation of insurance premium taxes for city, county, or urban county governments in Kentucky.

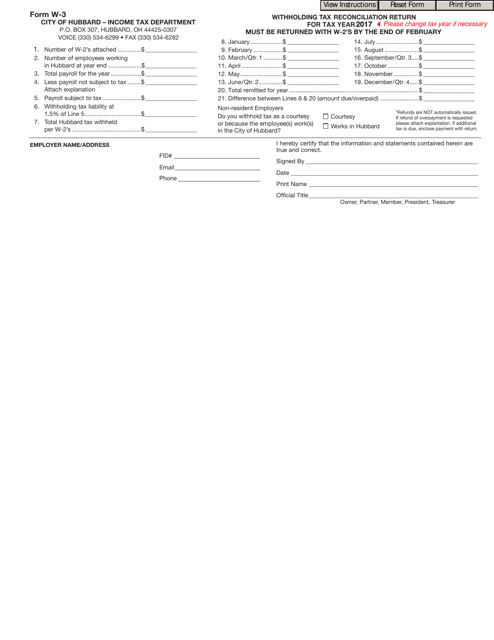

This form is used for reconciling and reporting withholding taxes for the City of Hubbard, Ohio.

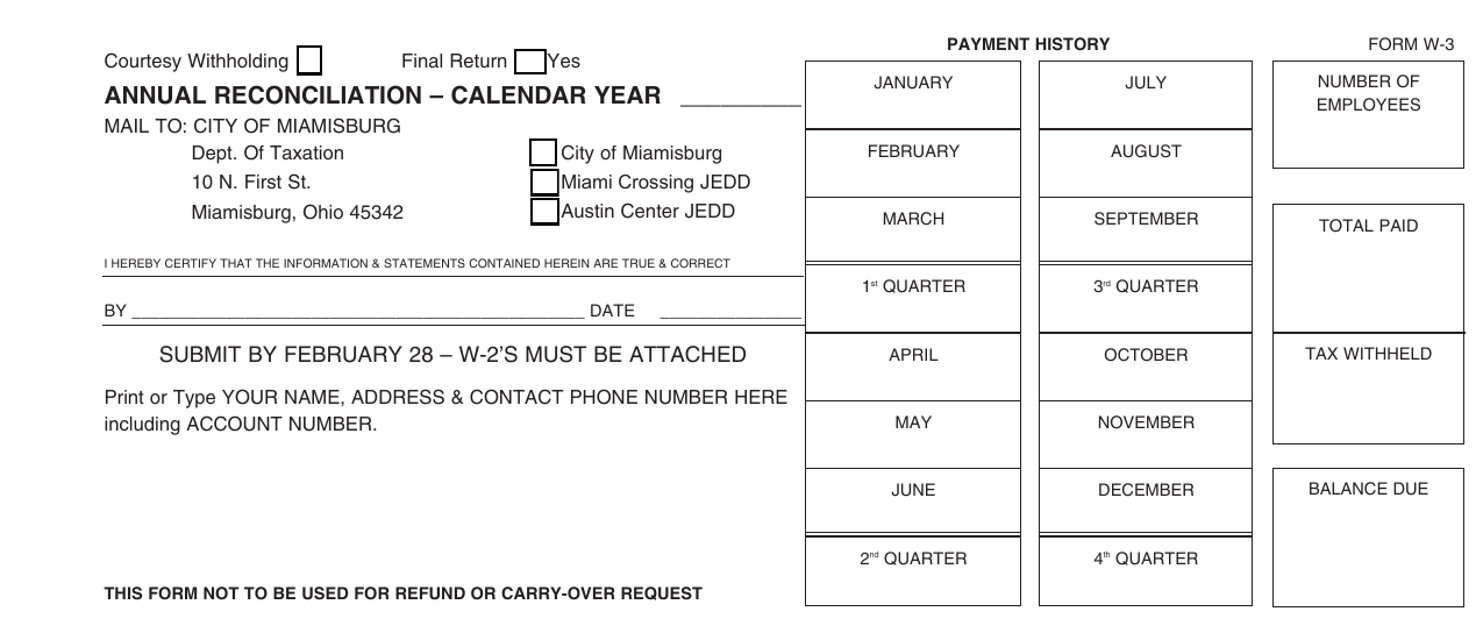

This form is used for the annual reconciliation of city taxes in Miamisburg, Ohio.

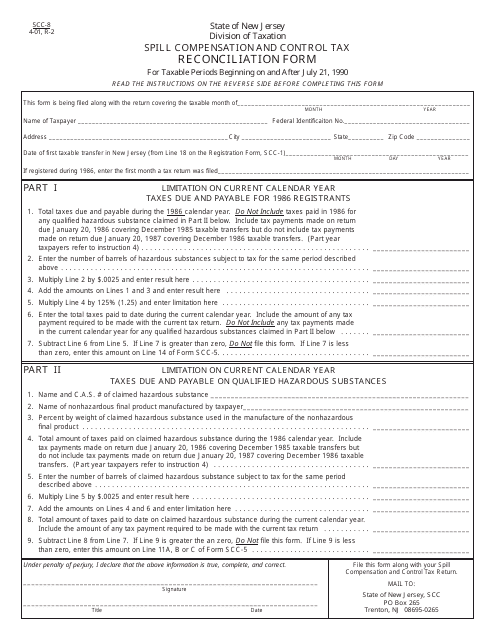

This Form is used for reconciling spill compensation and control tax in the state of New Jersey.