Mining Tax Templates

Are you in the mining industry and wondering about the tax requirements for your company? Look no further! Our Mining Tax resource is the perfect place for you to find all the information you need regarding taxes related to mining operations. Whether you call it mining tax, mining taxes, or mine tax, we've got you covered.

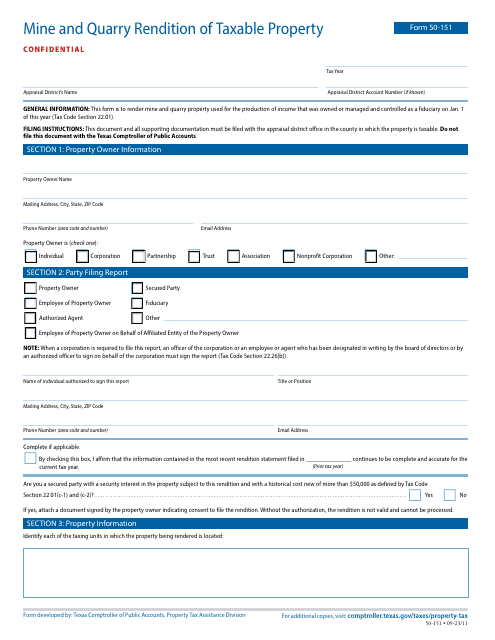

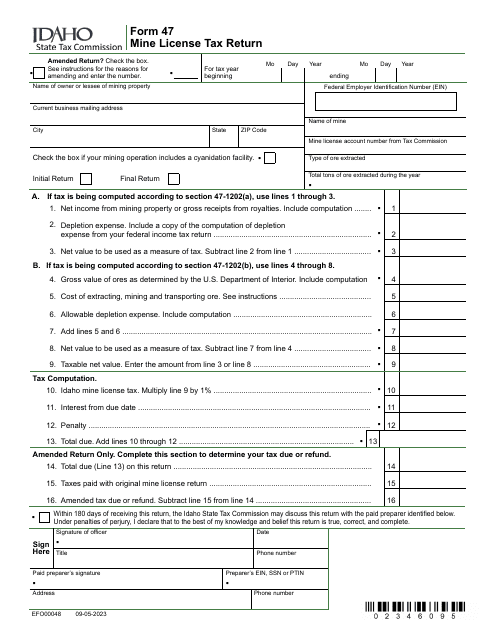

Our comprehensive collection of documents provides a wealth of information on mining tax regulations from various states across the USA. From the Form 50-151 Mine and Quarry Rendition of Taxable Property in Texas to the Form 47 (EFO00048) Mine License Tax Return in Idaho, our documents cover a wide range of requirements and forms to help you stay compliant.

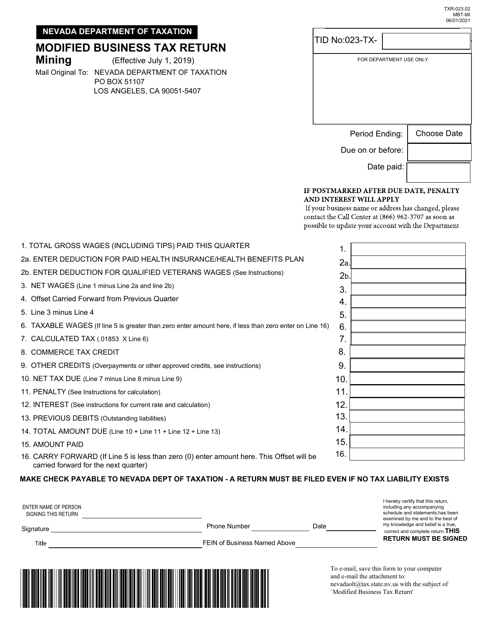

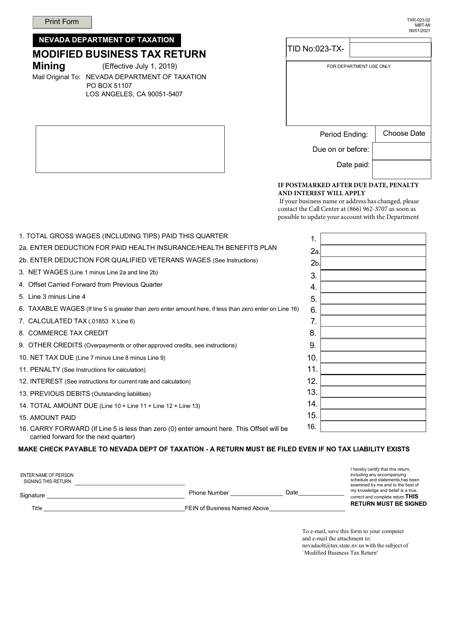

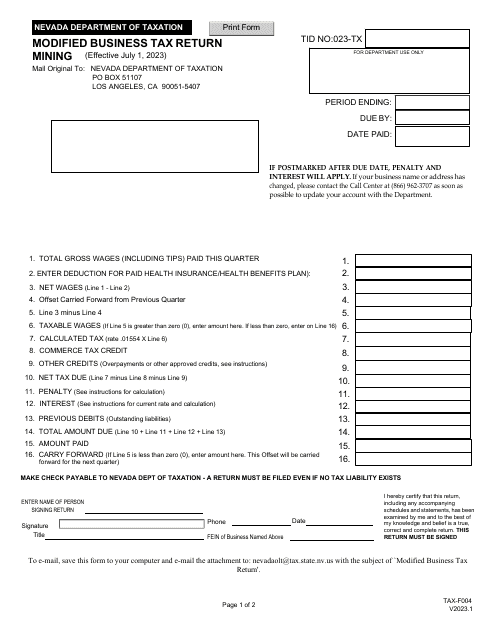

If you're based in Nevada, make sure to check out the Form TXR-023.02 (MBT-MI) Modified Business Tax Return - Mining, or the Form TAX-F004 Modified Business Tax Return - Mining. These documents cater specifically to the unique tax regulations in Nevada and will assist you in accurately reporting your mining-related tax obligations.

Don't let the complexities of mining tax overwhelm you. With our extensive collection of mining tax resources, you can easily navigate the regulations and stay on top of your tax obligations. Whether you're a small mining operation or a large corporation, our documents provide the guidance you need to ensure compliance and avoid any potential penalties.

So, save yourself the headache of trying to figure out the mining tax requirements on your own. Explore our Mining Tax resource today and take the first step towards meeting your tax obligations with ease.

Documents:

5