Net Income Templates

Net Income

Net Income

refers to the profit a company or individual earns after deducting all expenses from their total revenue. It is a key financial metric that indicates the overall financial health and profitability of a business or individual. Net Income is calculated by subtracting all expenses, including taxes, salaries, operating costs, and interest payments, from the total revenue generated.At times, Net Income

is also referred to as net profit, bottom line, or earnings. It is an important figure for investors, lenders, and stakeholders as it gives them insight into the financial performance and profitability of a company or individual. A higher Net Income indicates a more profitable venture, while a lower Net Income may suggest financial challenges or inefficiencies in managing expenses.Understanding and accurately calculating Net Income

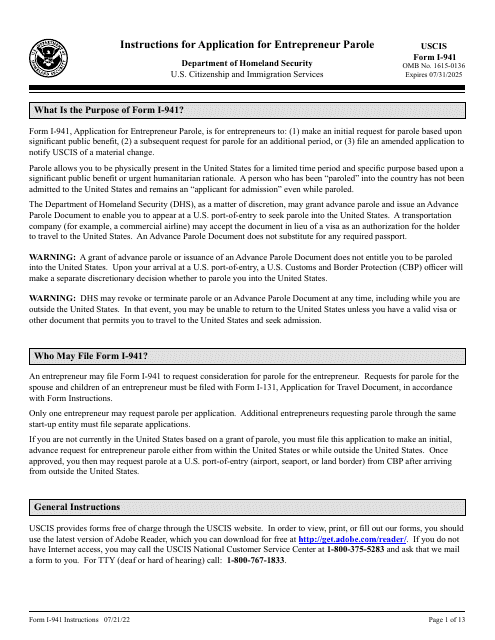

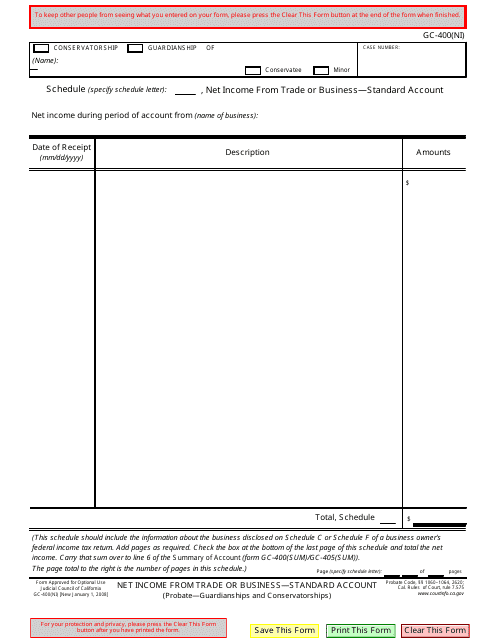

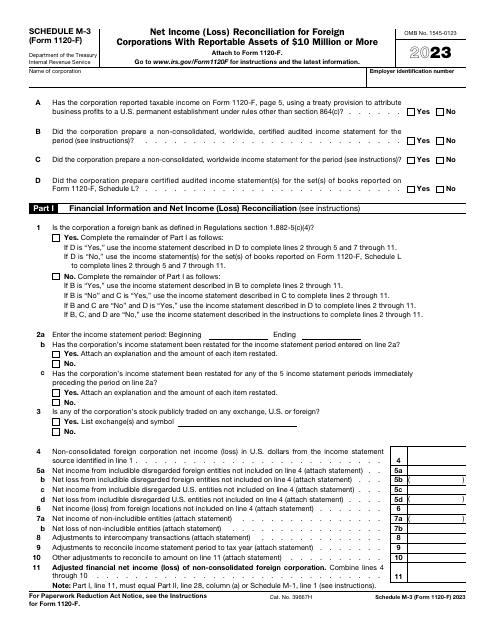

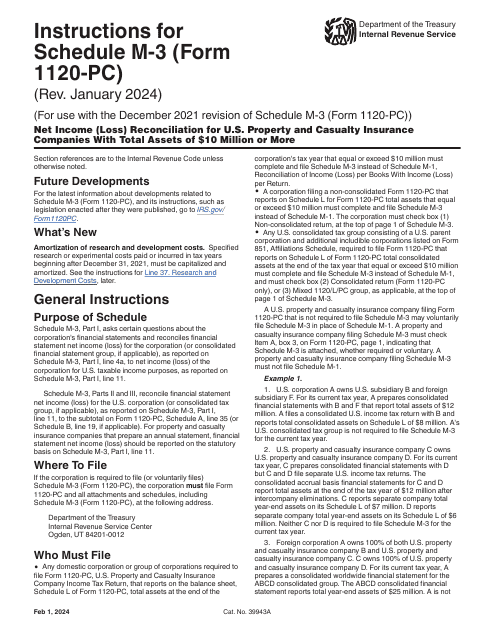

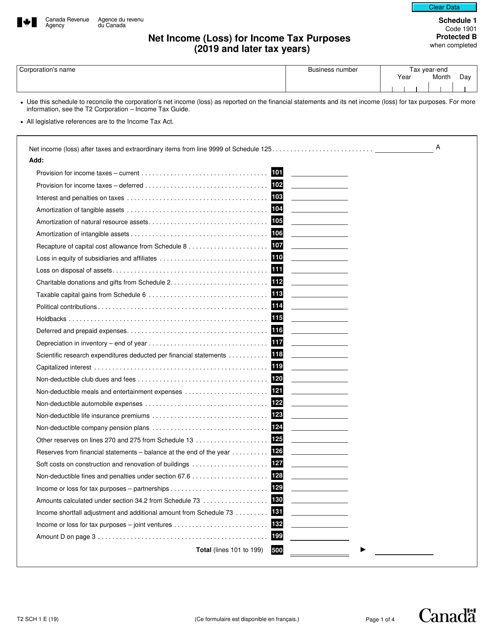

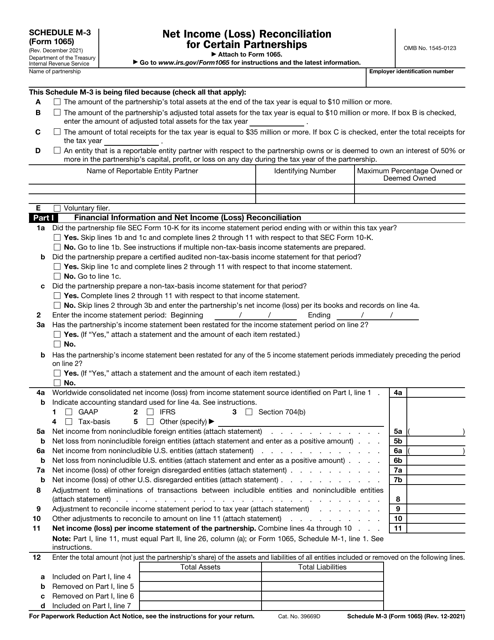

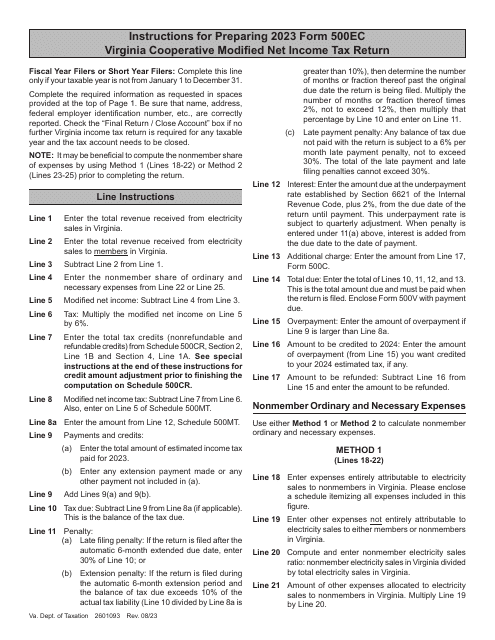

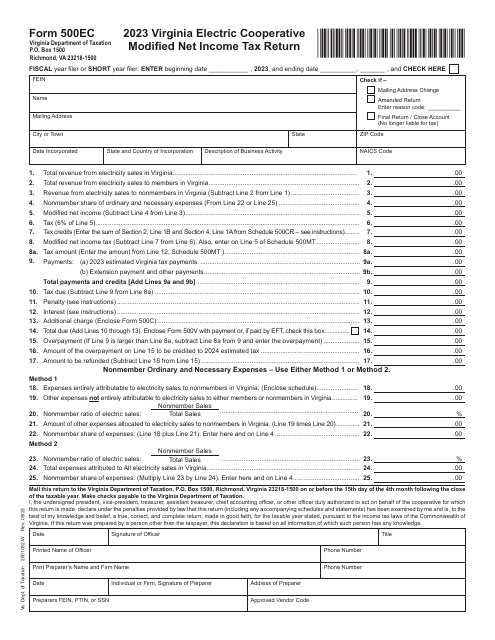

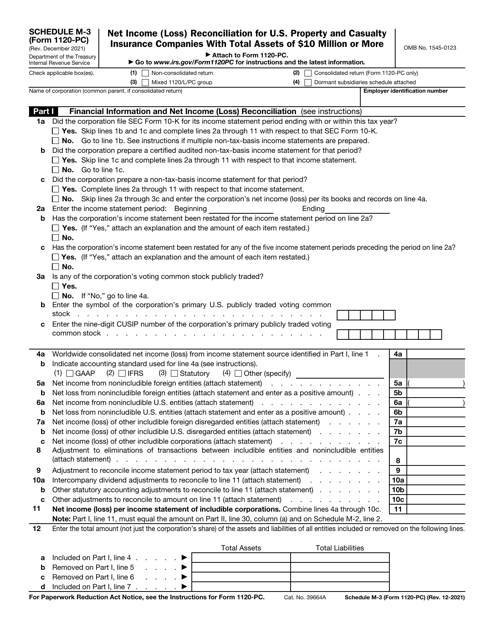

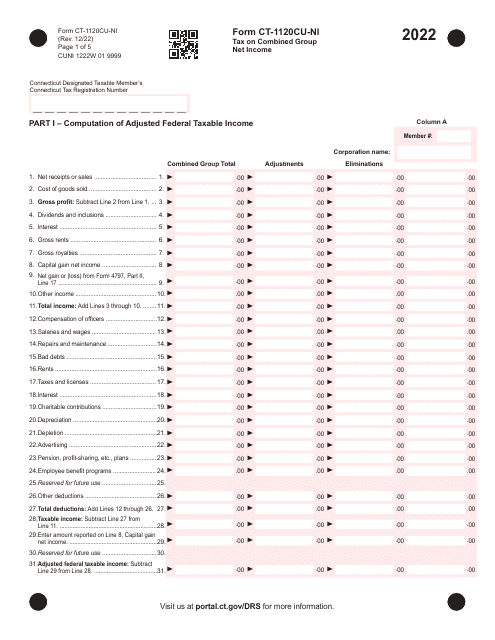

is crucial for tax purposes, as it affects the amount of tax owed. Governments at various levels, including the federal, state, and local governments, often require different forms and schedules to report Net Income for tax filing purposes. These forms include Form GC-400(NI) Net Income From a Trade or Business - Standard Account - California and Form 500EC Virginia Electric Cooperative Modified Net Income Tax Return - Virginia.For certain entities, such as foreign corporations or partnerships, specialized forms and schedules, like IRS Form 1120-F Schedule M-3 Net Income

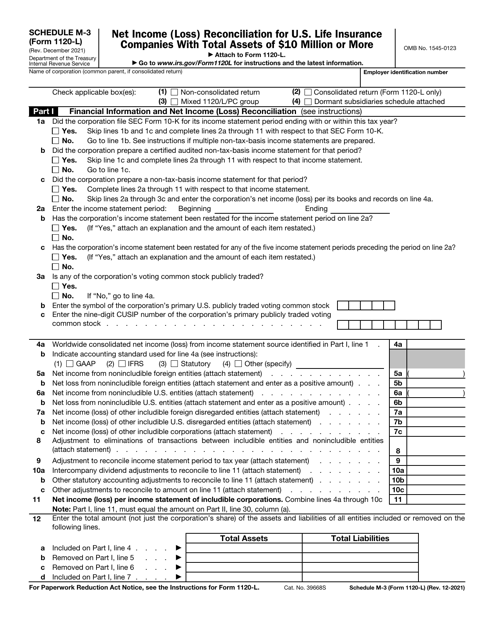

(Loss) Reconciliation for Foreign Corporations With Reportable Assets of $10 Million or More and Instructions for IRS Form 1065 Schedule M-3 Net Income (Loss) Reconciliation for Certain Partnerships, are used to reconcile and report Net Income accurately.In summary, Net Income

is a critical financial metric that reflects the profitability of a company or individual. It is a key factor in financial decision-making, tax reporting, and evaluating the financial health of an entity.Documents:

54

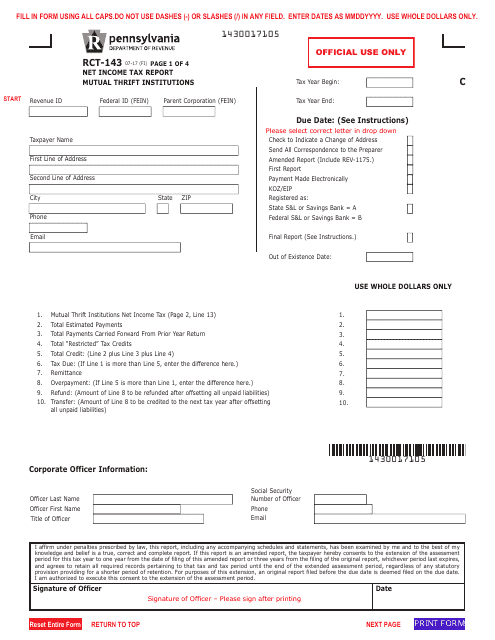

This form is used for reporting net income tax for mutual thrift institutions in Pennsylvania.

This Form is used for reporting the net income from a trade or business for tax purposes in California.

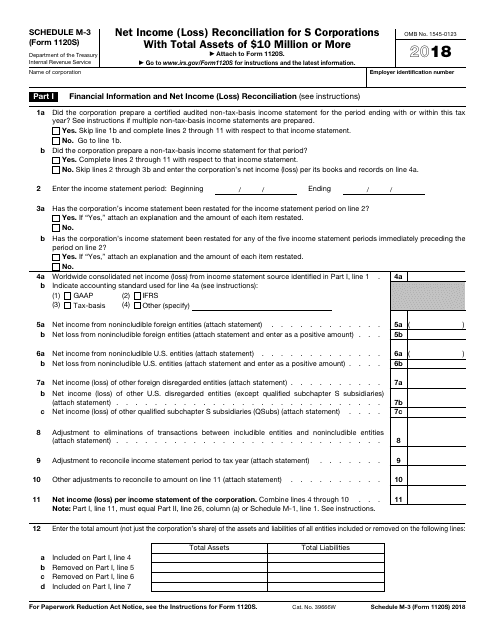

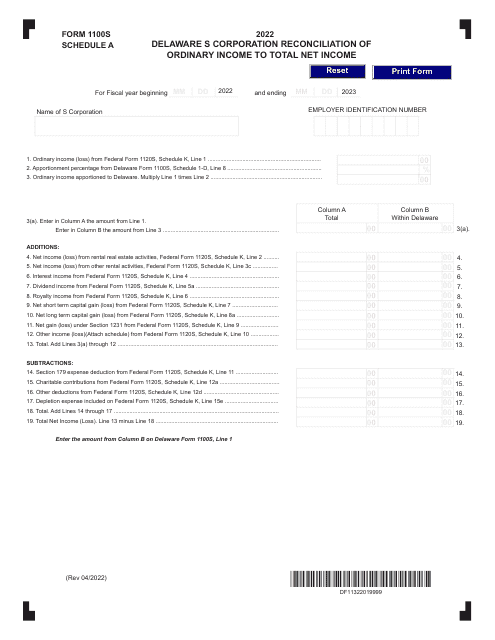

This Form is used for reconciling the net income (loss) of S corporations with total assets of $10 million or more on Schedule M-3.

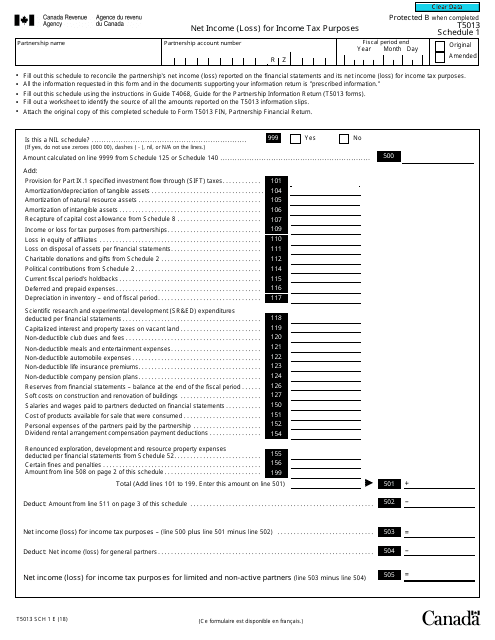

This Form is used for reporting the net income or loss for income tax purposes in Canada.

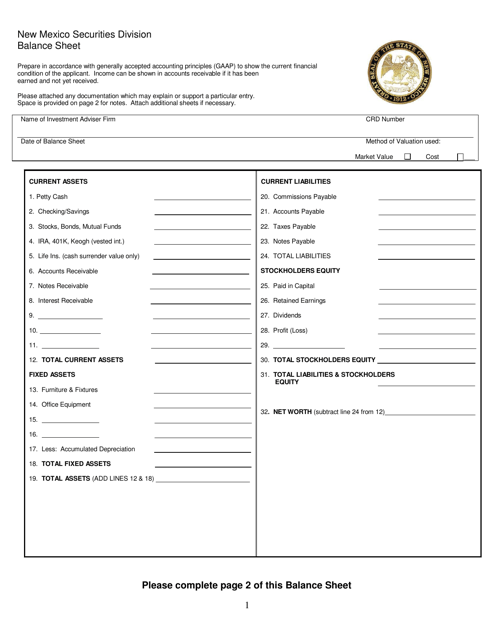

This document provides a snapshot of the financial position of a company or organization in the state of New Mexico. It includes information about their assets, liabilities, and equity.

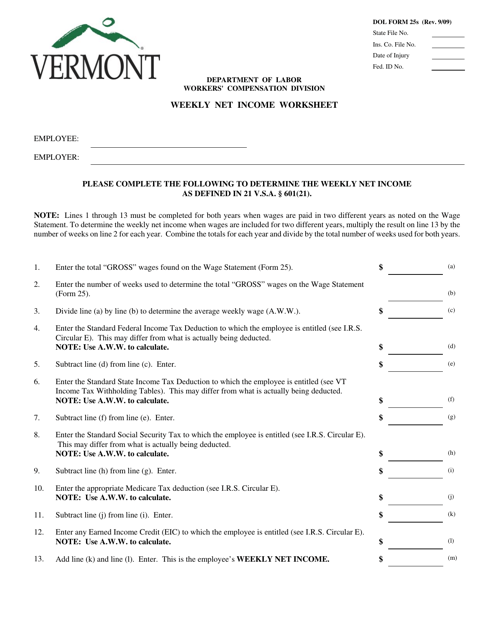

This document is used for calculating weekly net income in Vermont.

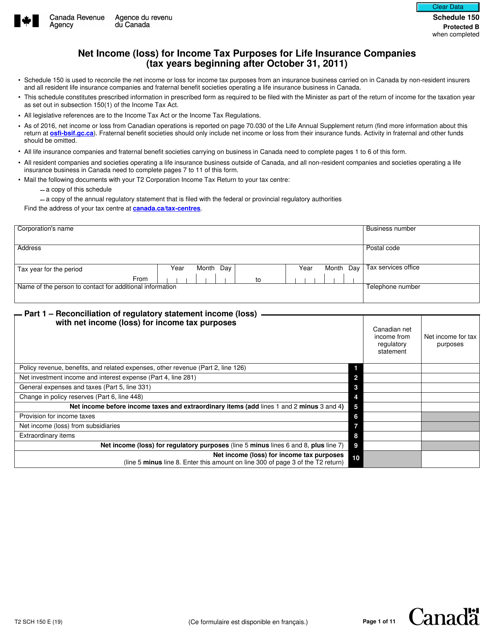

This form is used for calculating the net income or loss for life insurance companies for income tax purposes in Canada. It applies to tax years beginning after October 31, 2011.

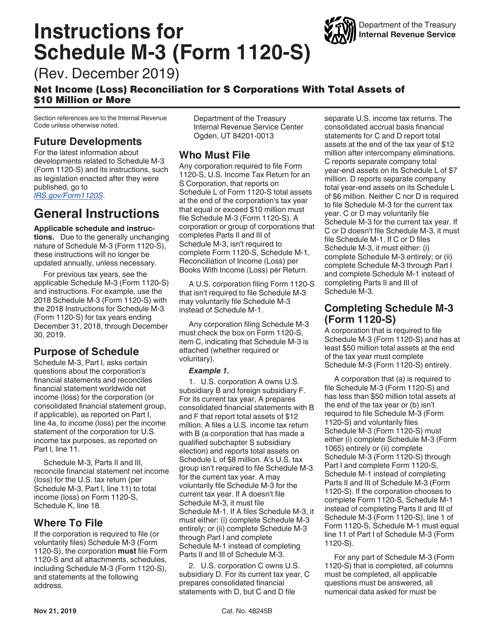

This Form is used for S corporations with total assets of $10 million or more to reconcile net income (loss) for tax purposes. It provides instructions for completing IRS Form 1120-S Schedule M-3.

This form is used for calculating the net income or loss for income tax purposes in Canada for the tax years 2019 and later.

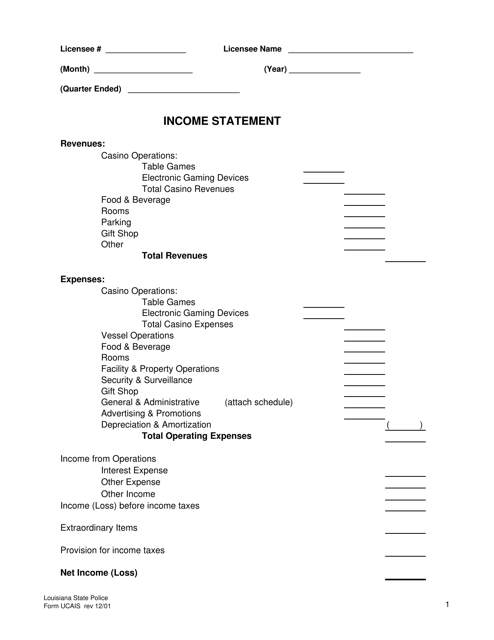

This Form is used for reporting income statements in the state of Louisiana.

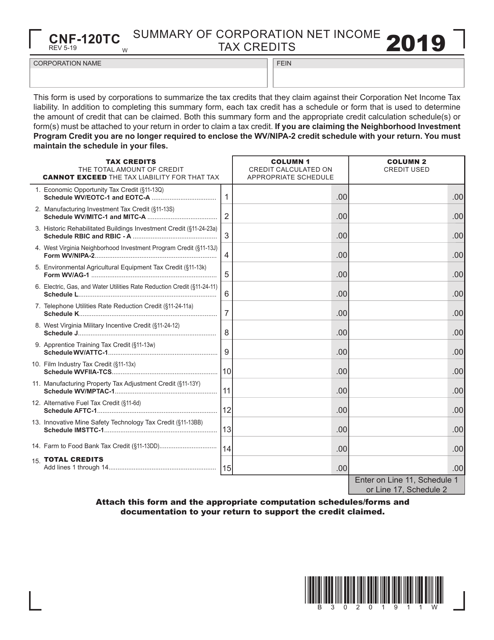

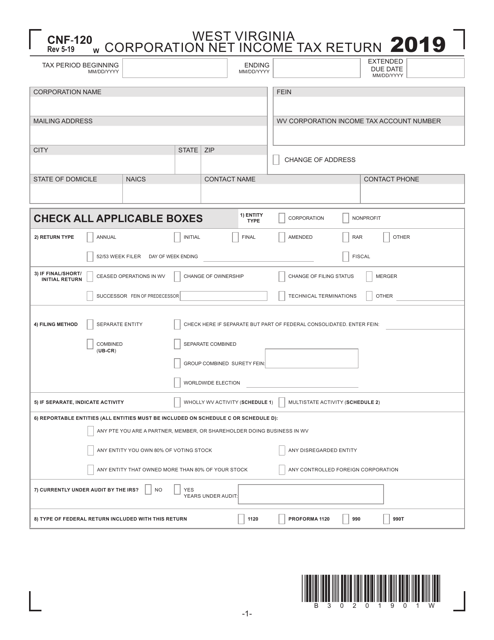

This Form is used for reporting and paying net income tax for corporations in West Virginia. The form, CNF-120, must be filled out and submitted to the West Virginia Department of Revenue. It includes instructions on how to calculate and report your corporation's net income tax liability.

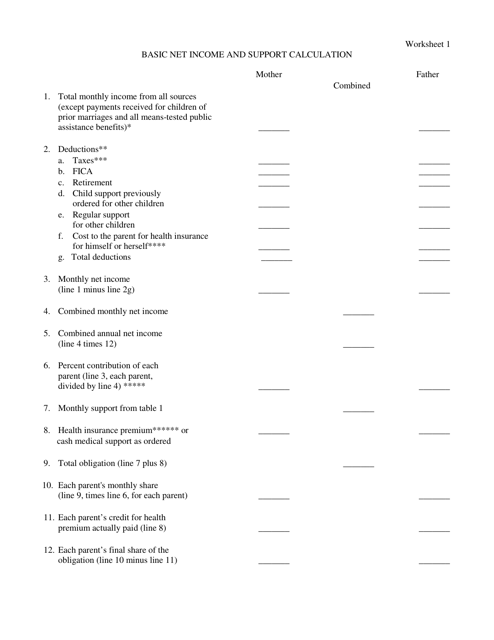

This document is a worksheet for calculating basic net income and support in the state of Nebraska. It helps individuals determine their income and potential support obligations.

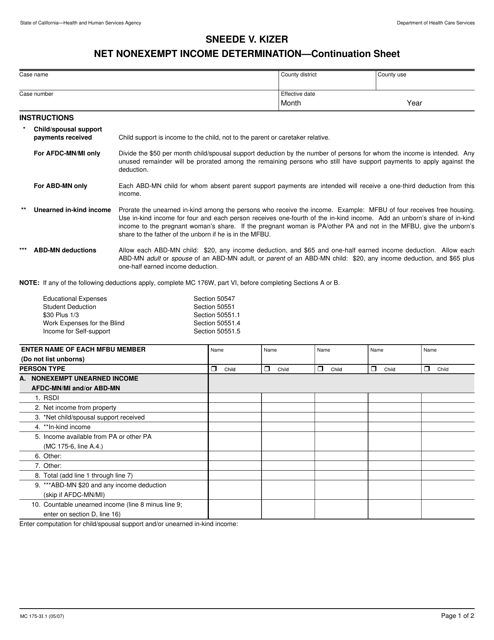

Form MC175-3I.1 Sneede V. Kizer Net Nonexempt Income Determination - Continuation Sheet - California

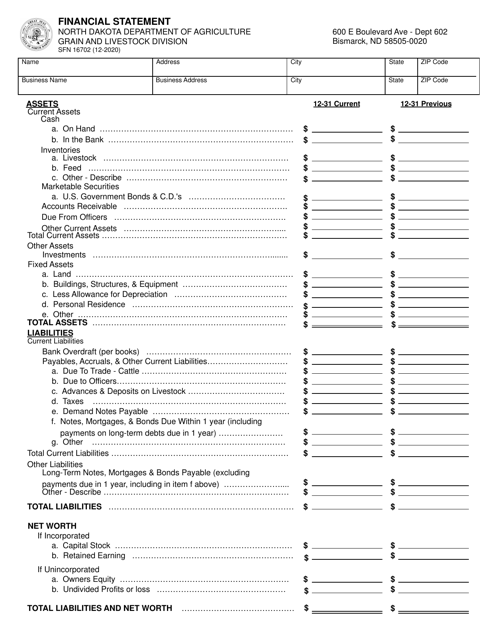

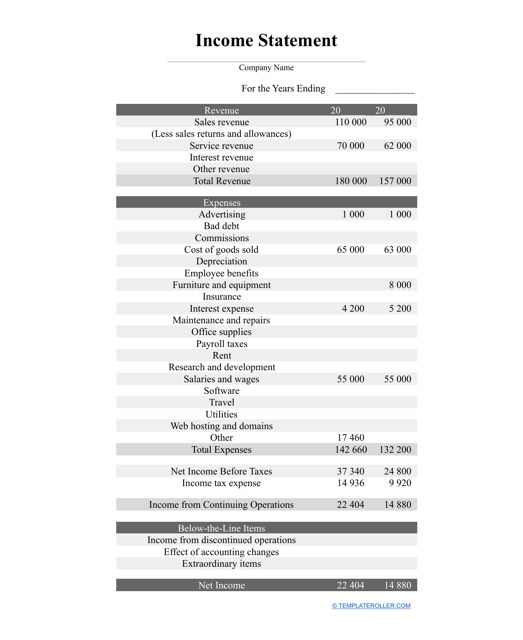

This statement contains information about the activities of a business and the income it generates.