Casual Sale Templates

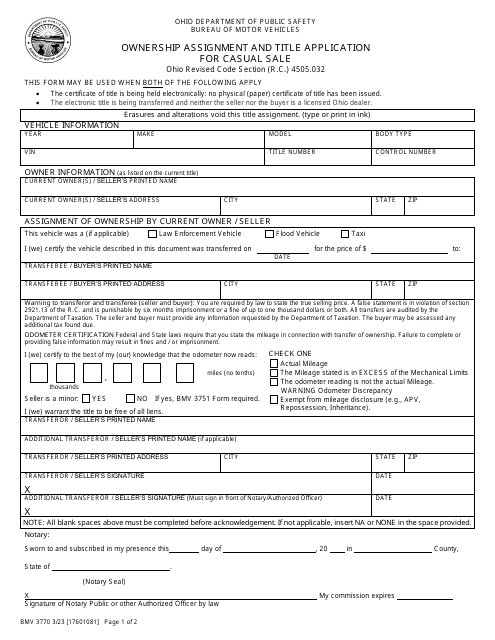

Are you looking to report a casual sale or an isolated sale of a specific item? Whether you are in Tennessee, New York, or Maine, it is essential to comply with the appropriate regulations and complete the necessary documentation for these types of transactions.

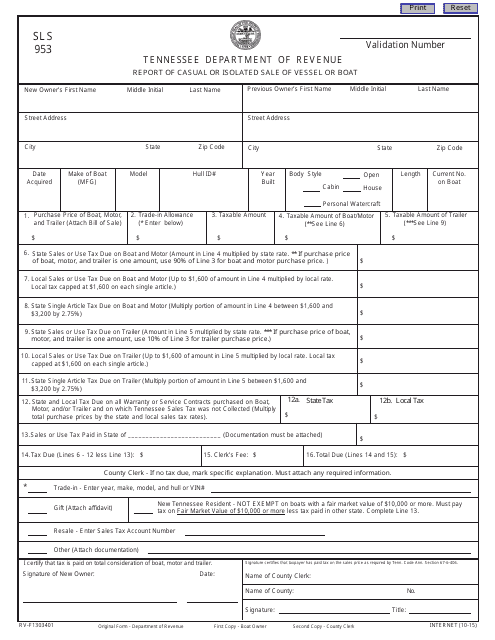

In Tennessee, you can use Form SLS953 - Report of Casual or Isolated Sale of Vessel or Boat to report any casual sale involving a vessel or boat. This form ensures that the necessary information is provided to the authorities and that you are in compliance with state laws.

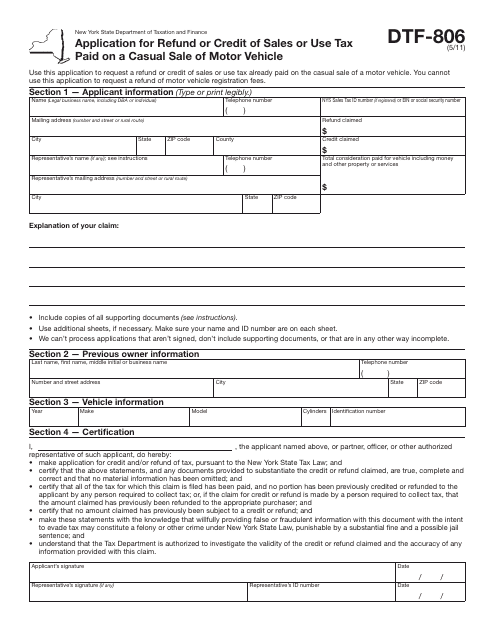

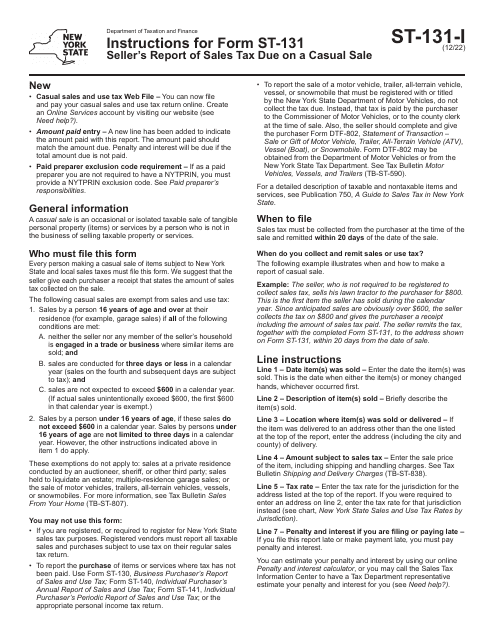

If you reside in New York and have made a casual sale of a motor vehicle, you will need to complete Form DTF-806 - Application for Refund or Credit of Sales or Use Tax Paid on a Casual Sale of Motor Vehicle. By properly submitting this form, you may be eligible for a refund or credit on the sales or use tax paid.

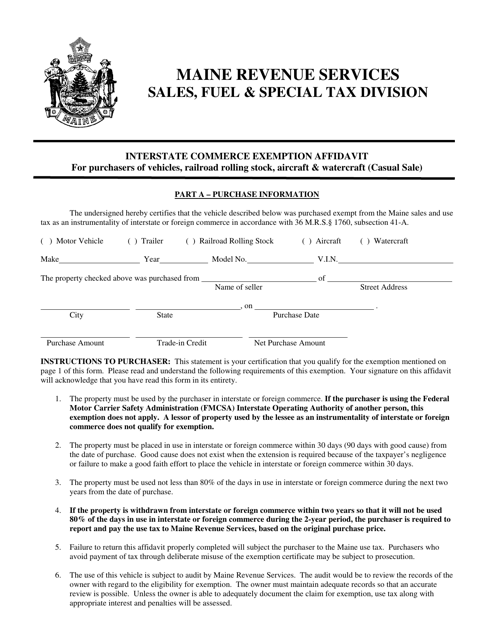

In Maine, casual sales may be exempt from interstate commerce regulations. However, to benefit from this exemption, you need to submit either Form ST-A-110 - Interstate Commerce Exemption Affidavit or Form ST-A-110 - Interstate Commerce Affidavit, depending on the specific requirements in your situation.

Remember, each state may have different forms, requirements, and alternate names for casual sale documentation. It is crucial to consult the appropriate resources and fully understand the process to ensure compliance.

Documents:

8

This form is used for reporting the casual or isolated sale of a vessel or boat in the state of Tennessee.

This form is used for applying for a refund or credit of sales or use tax paid on a casual sale of a motor vehicle in New York.