Recordation Tax Templates

Are you looking for information on recordation tax? Or perhaps you're interested in learning more about tax records or the recording tax. Whatever the case may be, our webpage is here to provide you with all the details you need.

Recordation tax, also known as the recording tax or tax record, is an important aspect of the taxation system in many countries. It is a tax that is levied on certain documents that are recorded or filed in public records, such as deeds, mortgages, or liens. This tax is usually calculated as a percentage of the value of the document being recorded.

On our webpage, you'll find a wealth of information about recordation tax, its purpose, and how it affects individuals and businesses alike. We'll explain the different types of documents that may be subject to this tax, as well as any exemptions or credits that may be available.

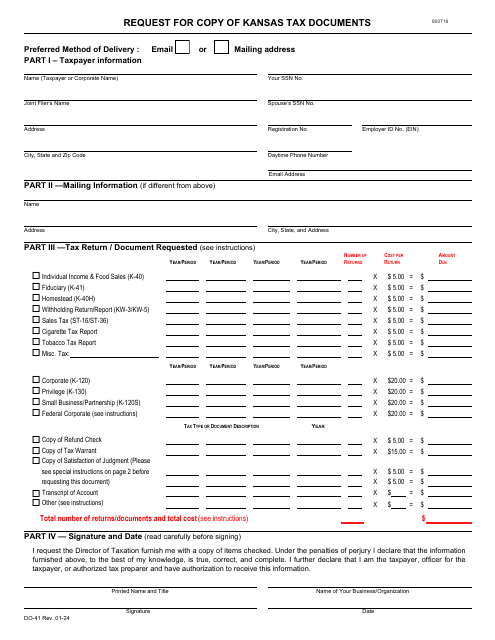

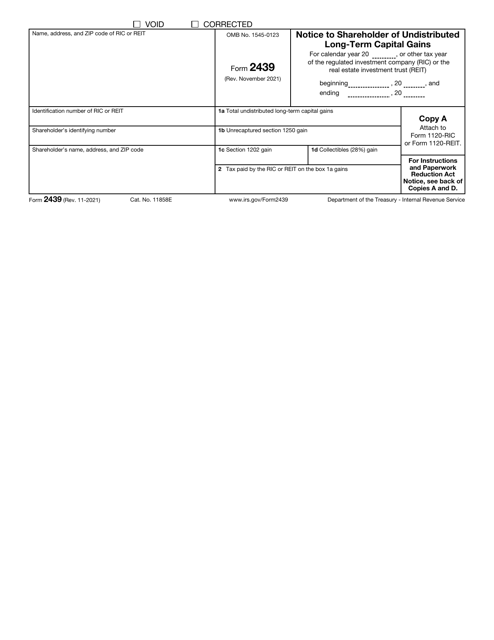

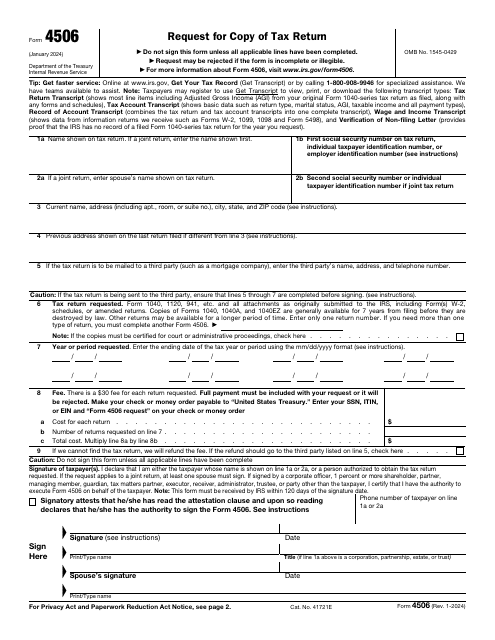

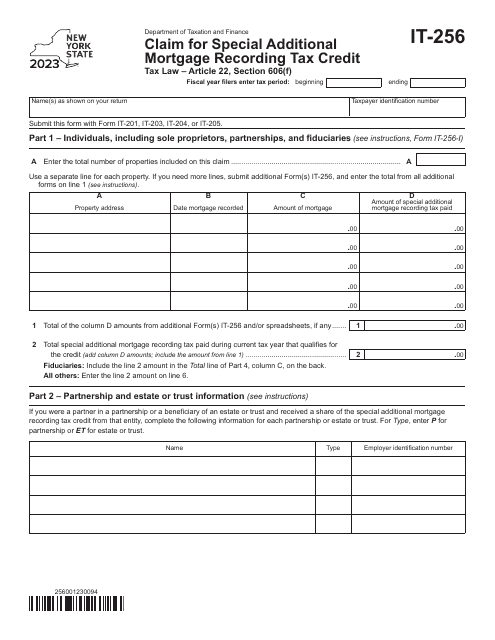

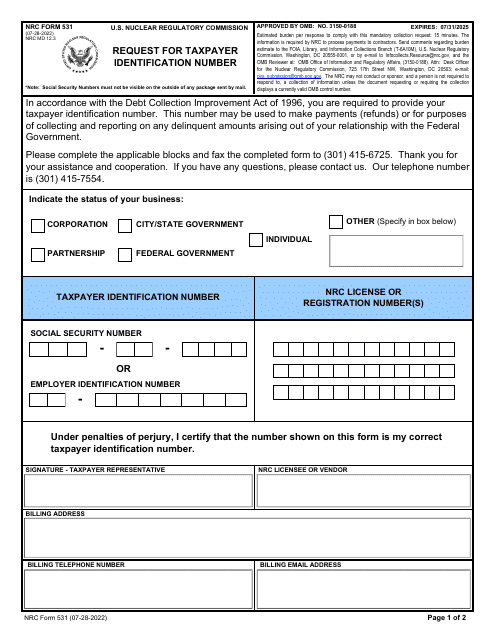

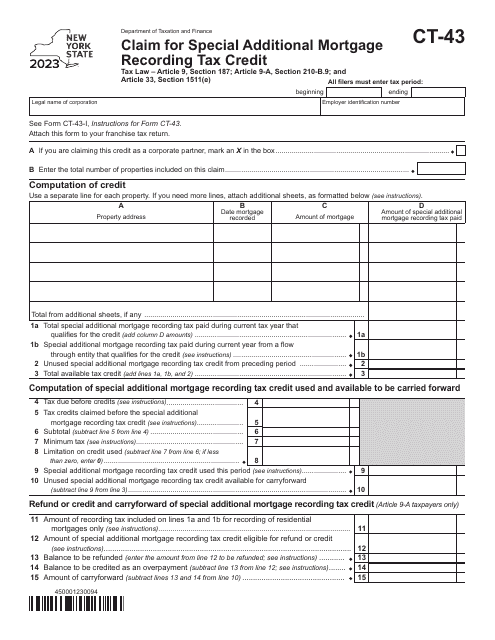

Additionally, we'll delve into the specific requirements and procedures for filing recordation tax documents in various jurisdictions, including the United States and Canada. We'll walk you through the necessary forms, such as Form IT-256 Claim for Special Additional Mortgage Recording Tax Credit in New York or IRS Form W-2 Wage and Tax Statement, and provide guidance on how to complete them correctly.

Our goal is to make recordation tax and tax records more accessible and understandable to the general public. We believe that by providing comprehensive information and resources, we can empower individuals and businesses to navigate the complexities of this tax efficiently and effectively.

So, whether you're a homeowner looking to understand the recordation tax on your mortgage or a business owner seeking guidance on filing tax records, our webpage is your one-stop destination. Browse through our articles, FAQs, and helpful resources to gain a better understanding of this important aspect of the taxation system.

Documents:

64

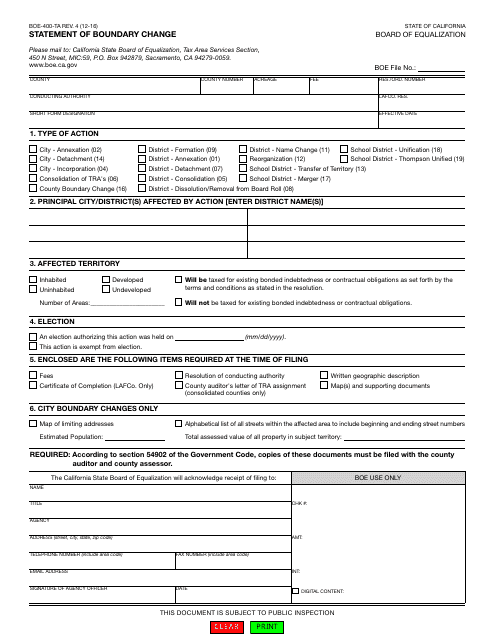

This form is used for reporting boundary changes in California.

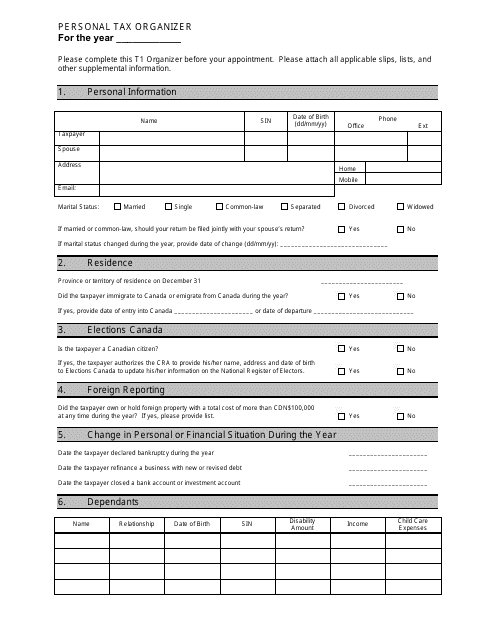

This document is a template that helps individuals organize their personal tax information for filing taxes. It provides sections to record income, expenses, deductions, and other relevant details. Using this template can help simplify the tax filing process.

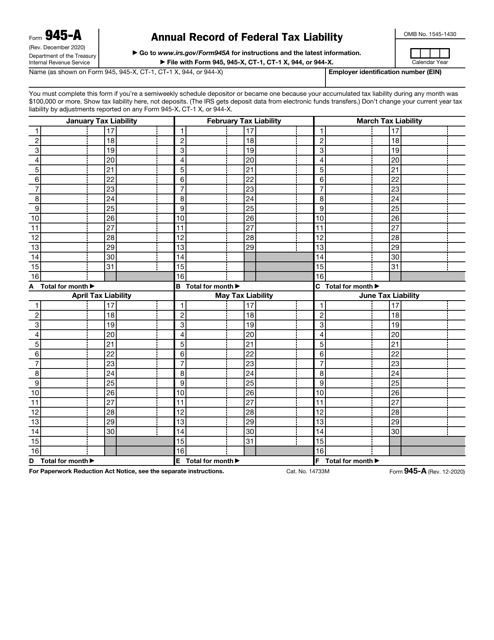

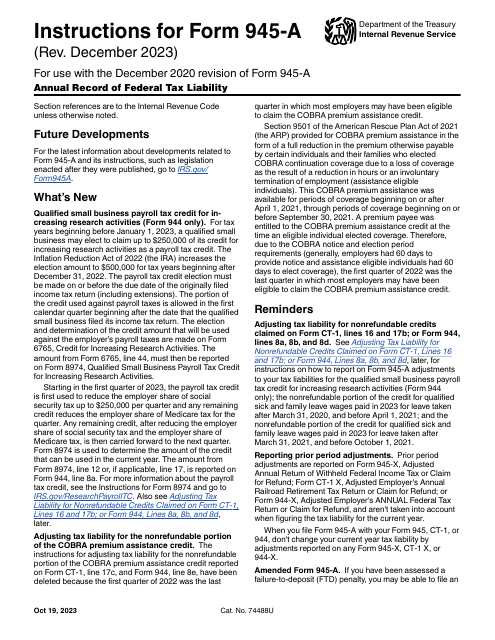

This is a formal document employers use to reconcile their tax liability over the course of the calendar year.

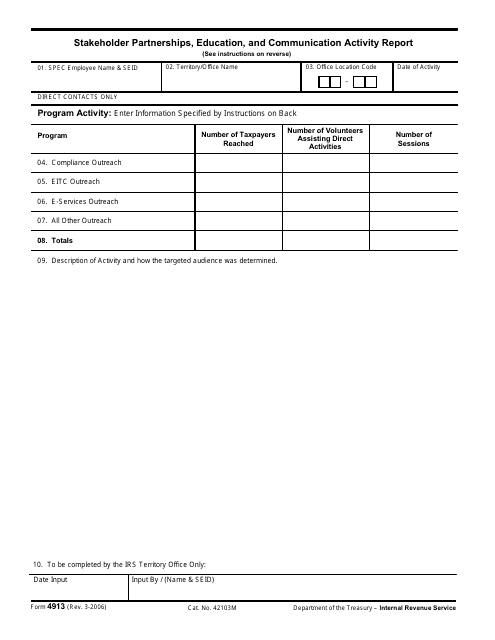

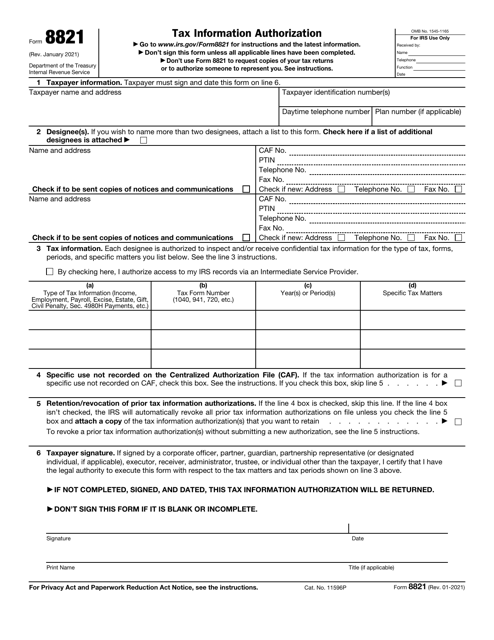

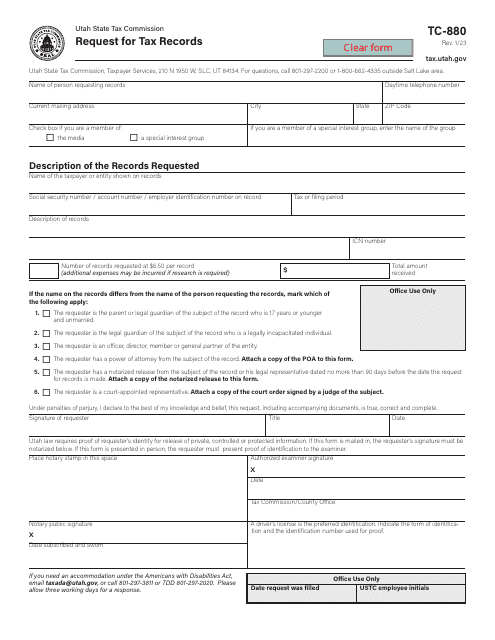

This is a formal document filled out by a taxpayer who wants another individual or company to obtain access to their tax information.

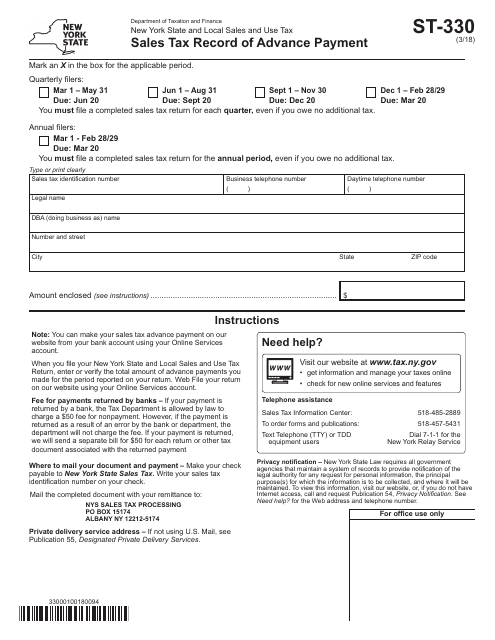

This form is used for recording advance payments of sales tax in the state of New York.

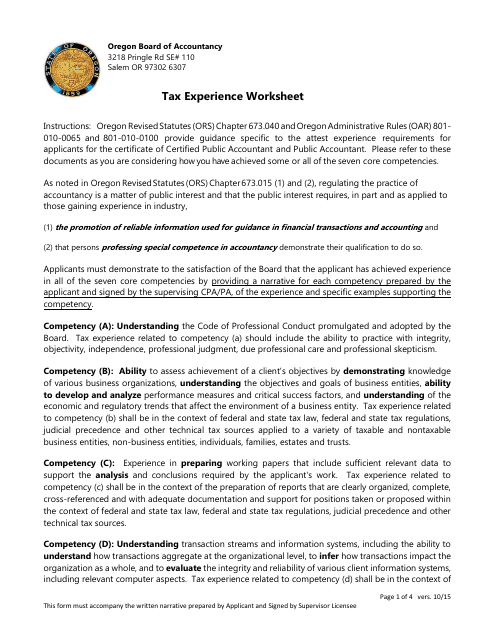

This document is a worksheet specifically for individuals with tax experience in Oregon. It can be used to organize and track relevant information when preparing state taxes in Oregon.

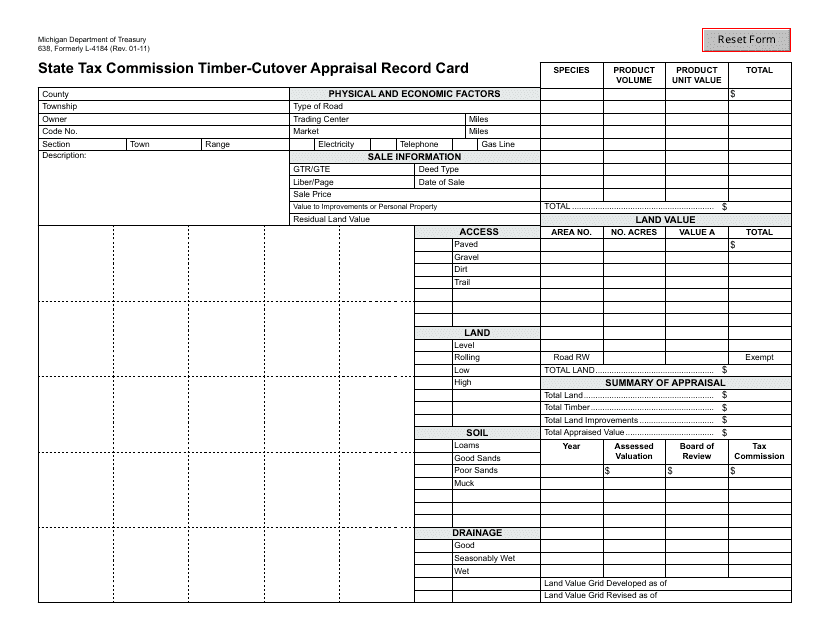

This form is used for recording information related to timber-cutover appraisal in Michigan for state tax commission purposes.

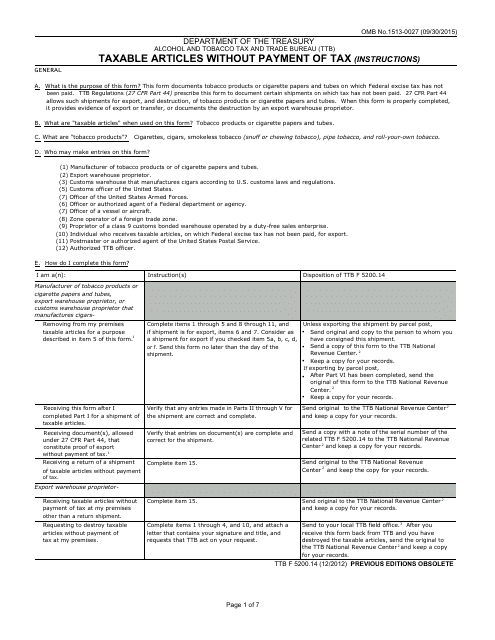

This document is used for reporting the taxable articles that are not paid for with tax.

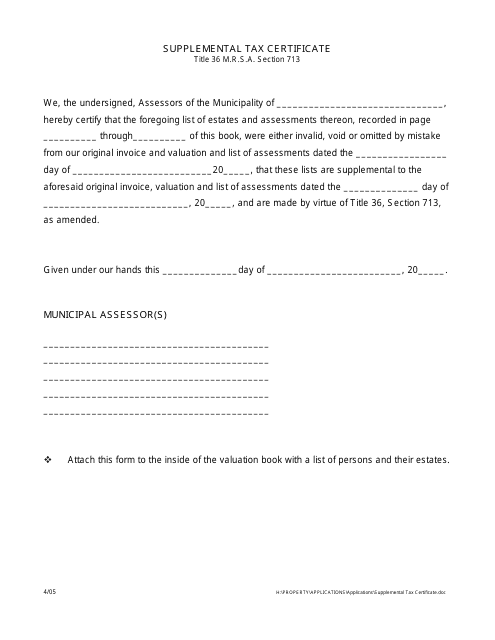

This type of document is used for reporting supplemental taxes in the state of Maine.

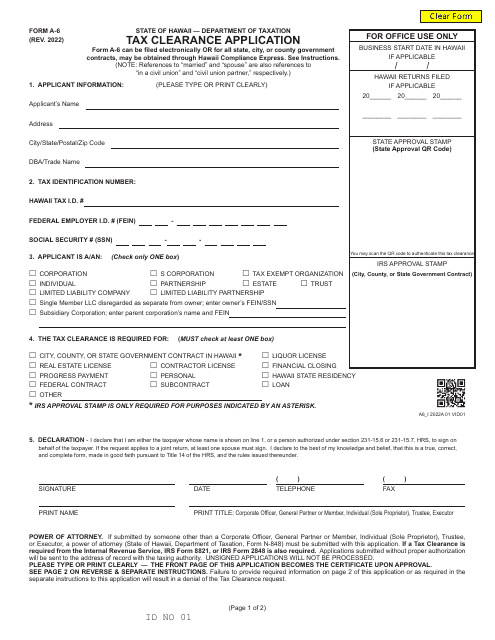

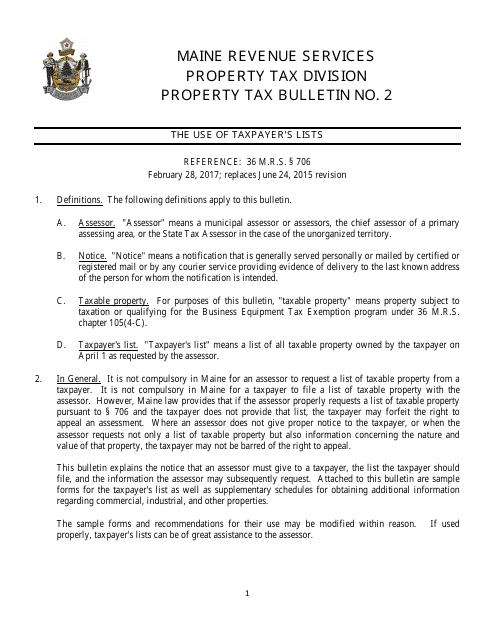

This document is a request for a list of taxable property in the state of Maine. It is used to gather information on properties that are subject to taxation.

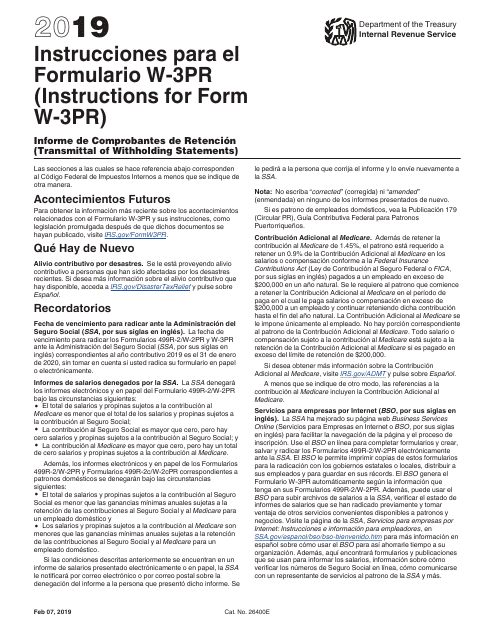

This document provides instructions for completing the IRS Form W-3PR, which is used to transmit withholding statements. The instructions are available in both English and Spanish.

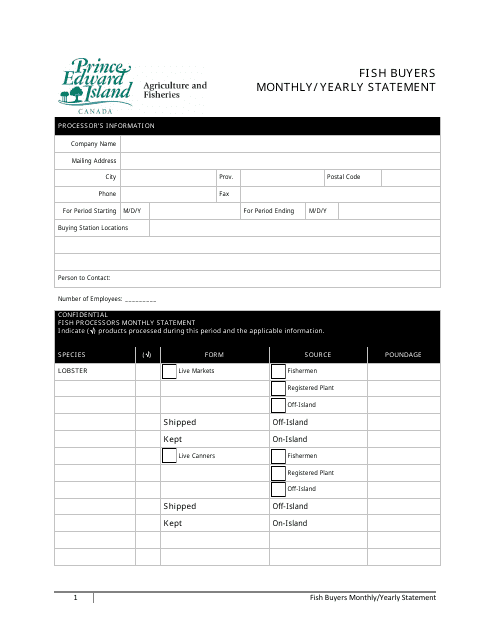

This document is a monthly/yearly statement for fish buyers located in Prince Edward Island, Canada. It provides an overview of the buying activities related to fish in the specified period.

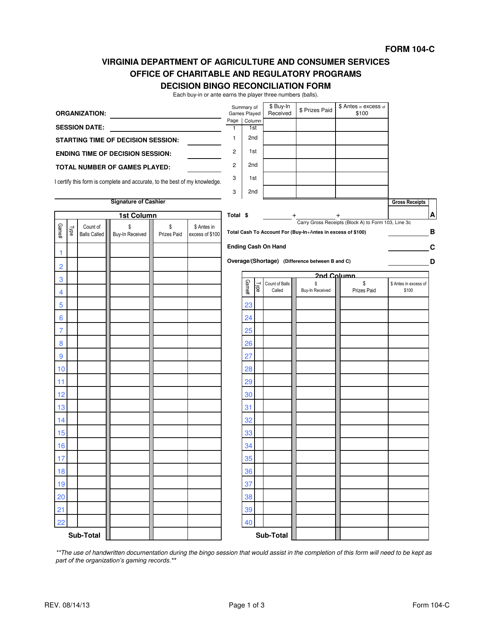

This Form is used for reconciling decisions made during a game of bingo in the state of Virginia.

Use this document to report the amount of withheld wages and taxes to the employee and appropriate authorities. The form is also known as a W-2 and is one of the crucial annual tax documents.

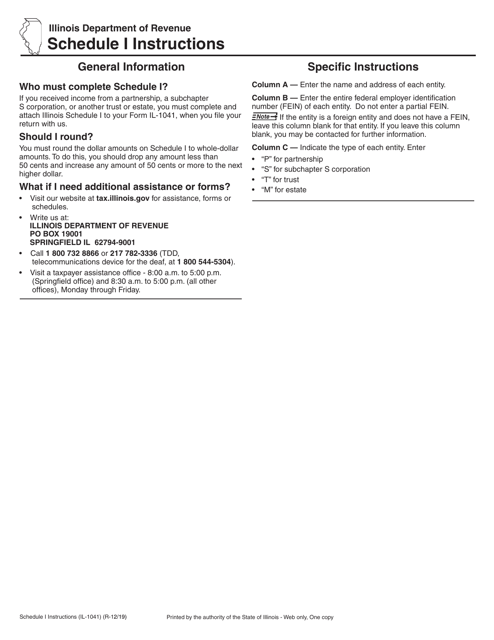

This Form is used for reporting income received in the state of Illinois when filing Form IL-1041. It provides instructions for filling out Schedule I, which is used to report various types of income.

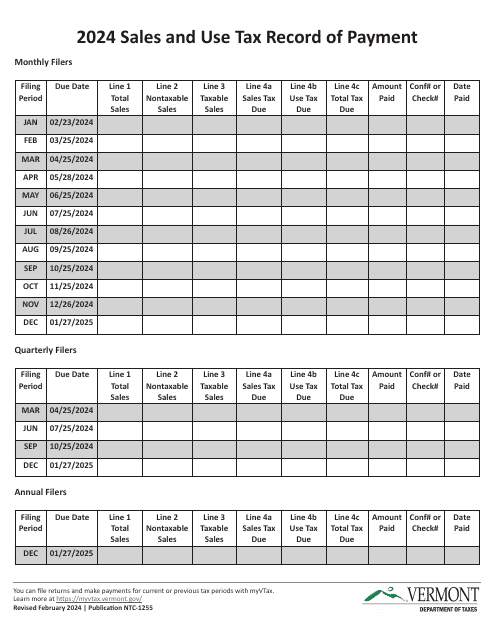

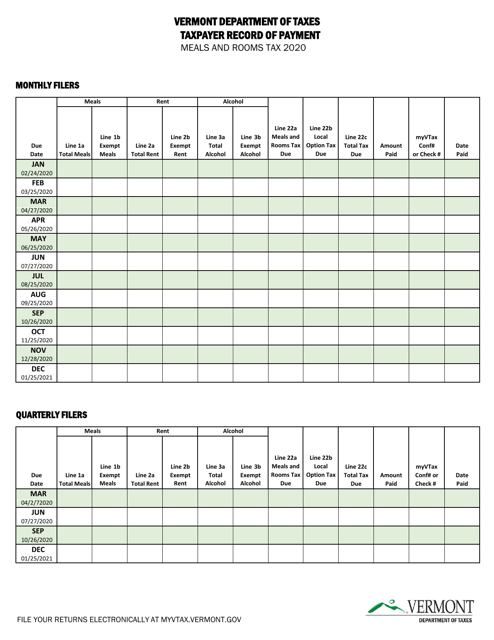

This document is used to record payments for the meals and rooms tax in the state of Vermont.

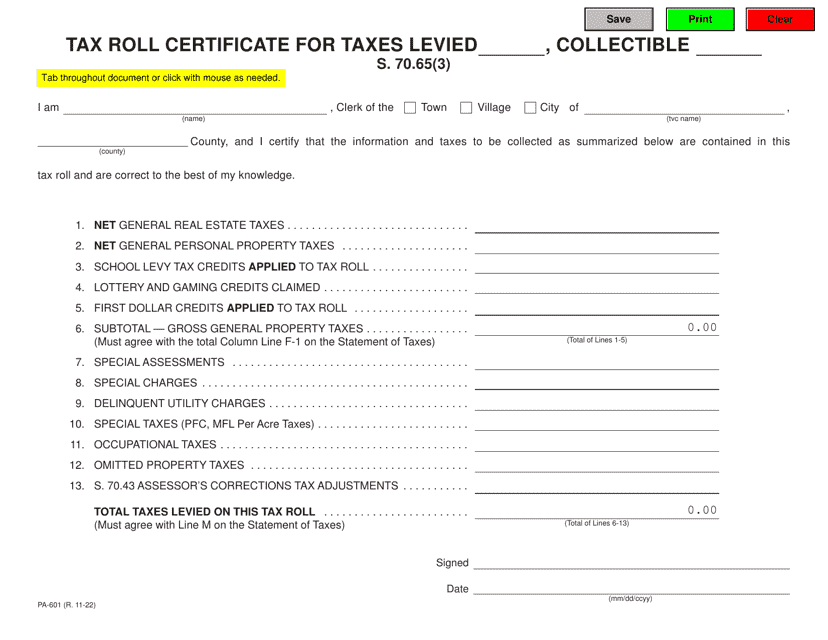

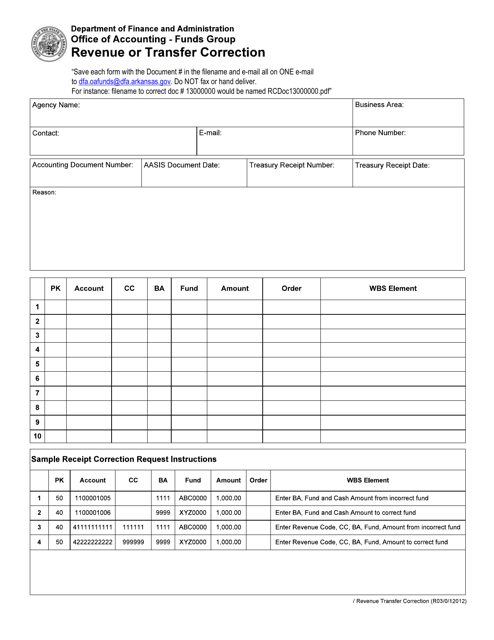

This form is used for correcting revenue or transfers in the state of Arkansas.

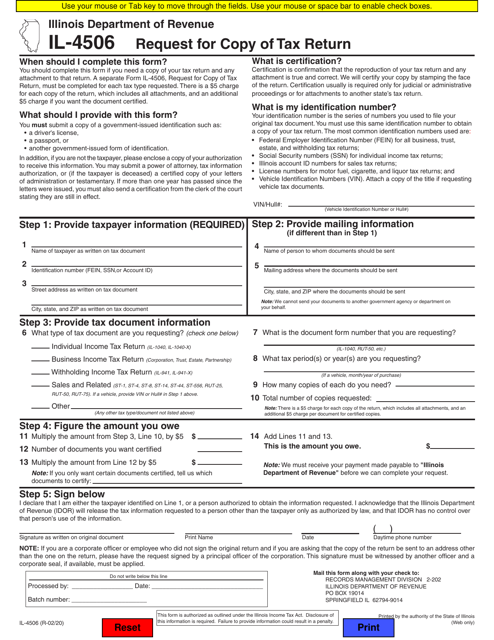

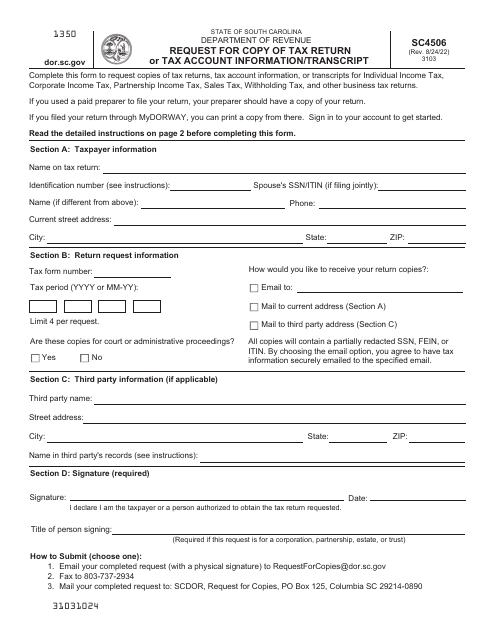

This form is used for requesting a copy of your tax return in the state of Illinois.

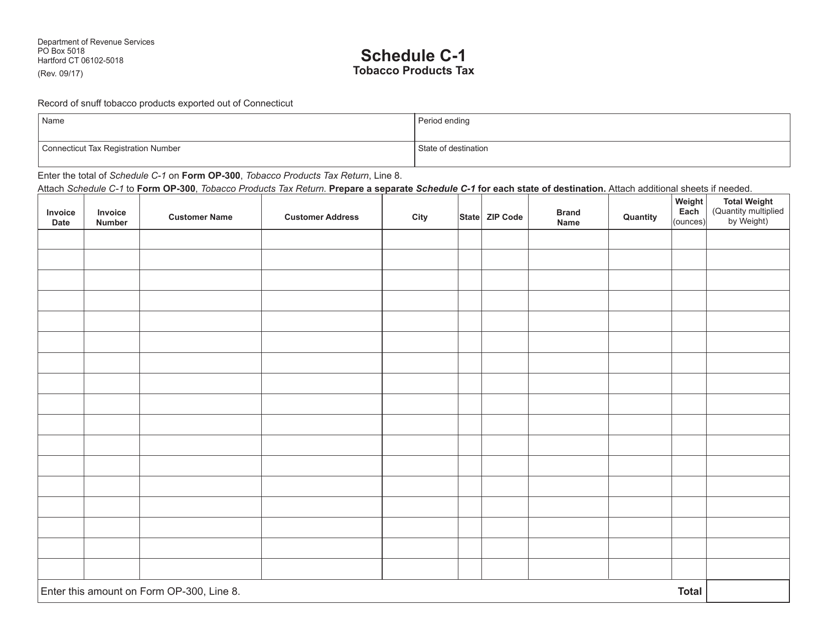

This type of document is used to record the exportation of snuff tobacco products out of Connecticut for the purposes of taxation.

This is a formal instrument used by taxpayers that need to fix the mistakes they have discovered upon filing IRS Form 941, Employer's Quarterly Federal Tax Return.

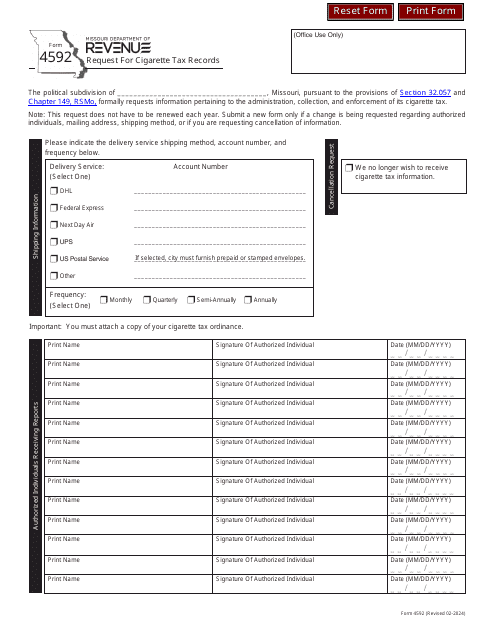

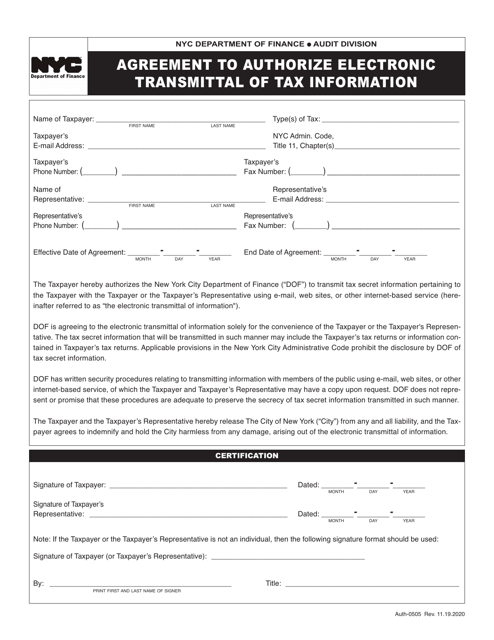

This form is used for authorizing the electronic transmittal of tax information in New York City.

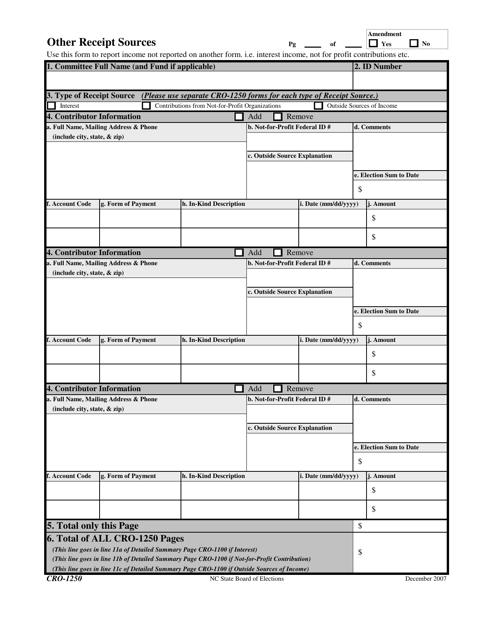

This Form is used for reporting other sources of revenue in North Carolina. It is used by businesses to provide details about income from sources other than regular sales or services.

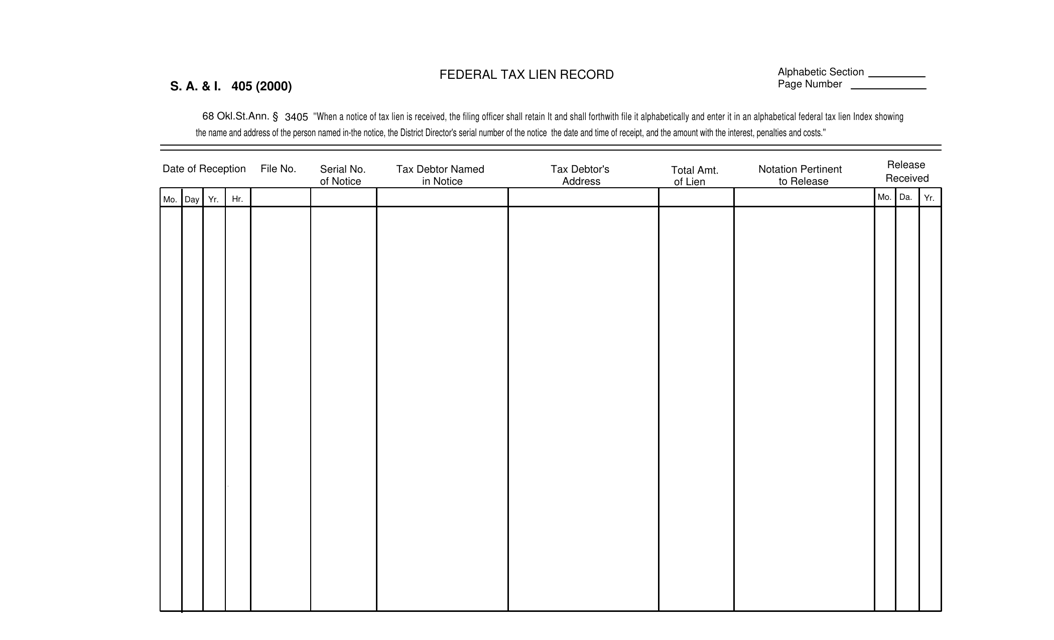

This form is used for recording federal tax liens in the state of Oklahoma. It is used to notify the public of the government's legal claim against a taxpayer's property.