Business Deductions Templates

Business Deductions: Maximize Your Profitability

Are you a business owner looking to reduce your tax liability and increase your profits? Look no further than business deductions. These valuable tax-saving opportunities can significantly impact your bottom line.

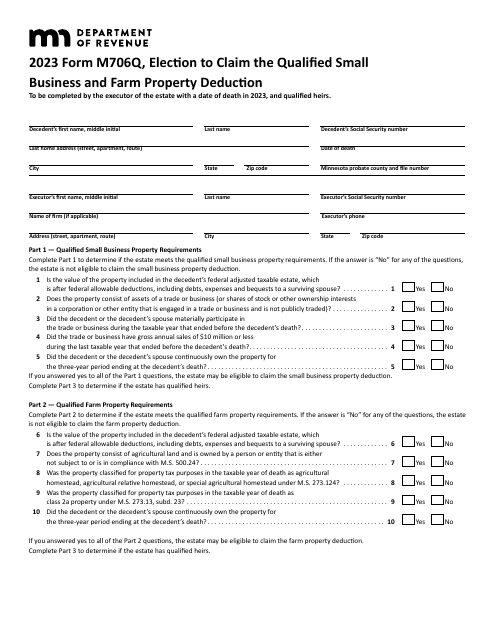

At USA, Canada, and other countries, we have compiled a comprehensive collection of documents that provide guidance on various business deductions. Whether you operate as a sole proprietorship, run a business or profession in Pennsylvania, or are subject to specific state regulations in Illinois, Iowa, or Minnesota, our documents cover it all.

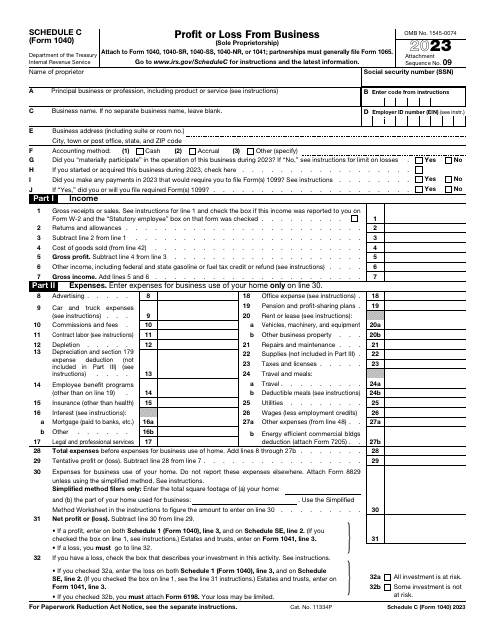

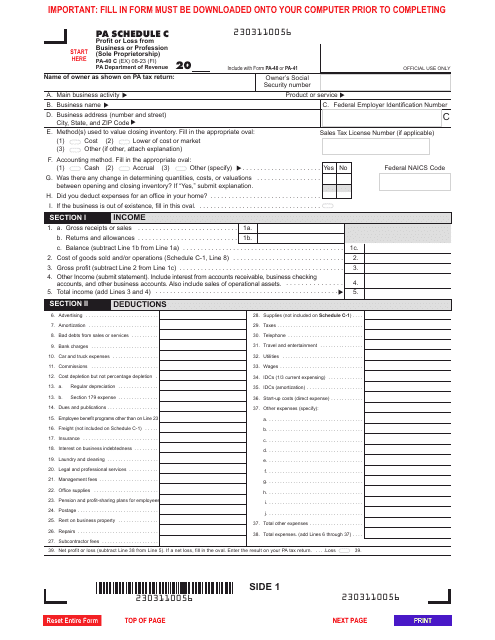

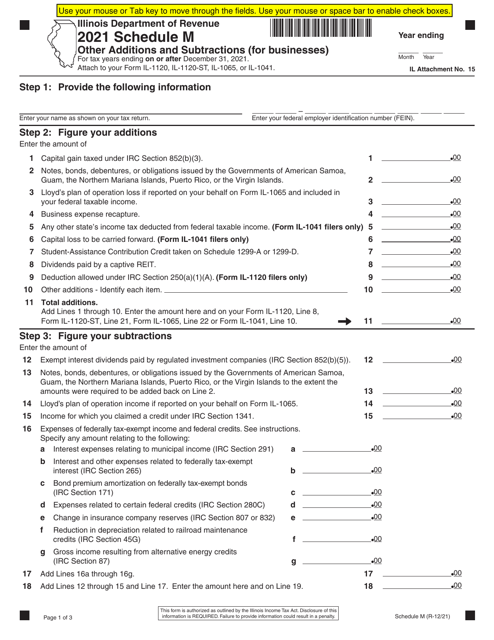

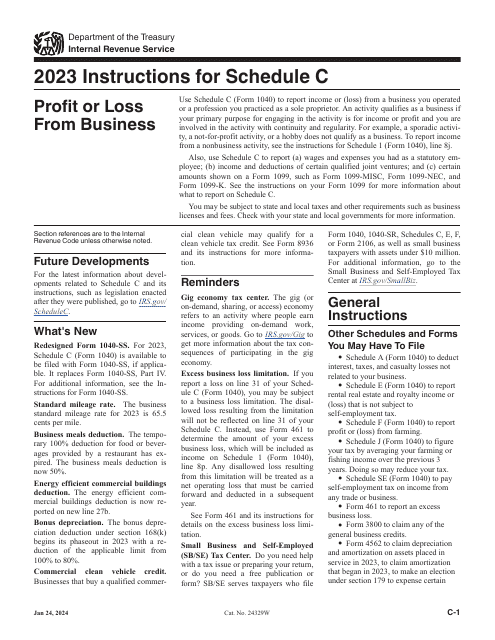

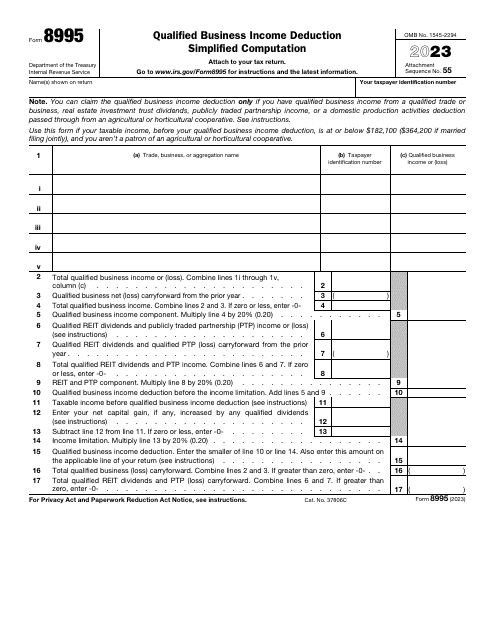

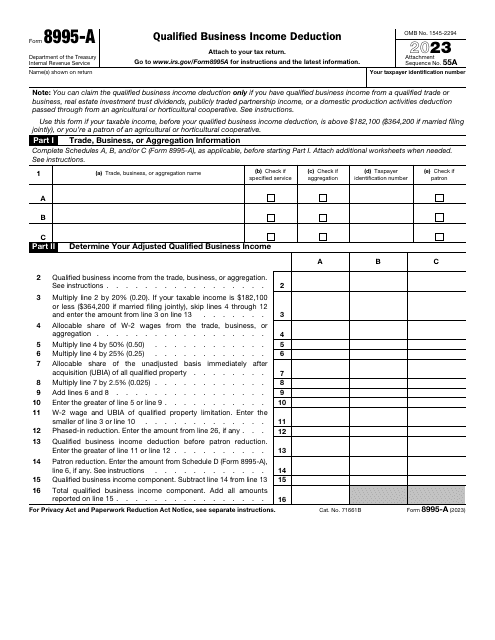

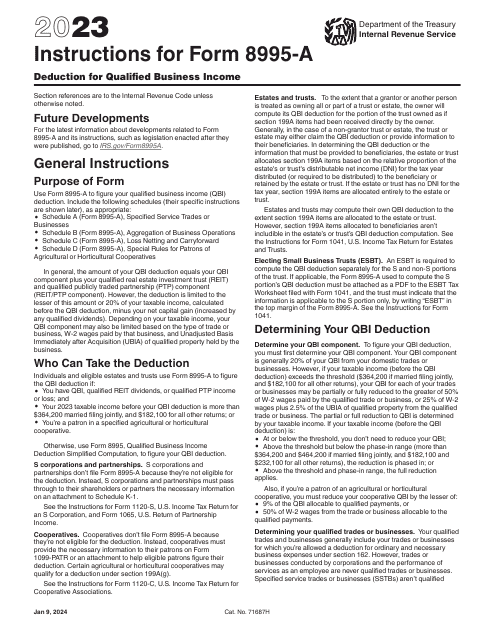

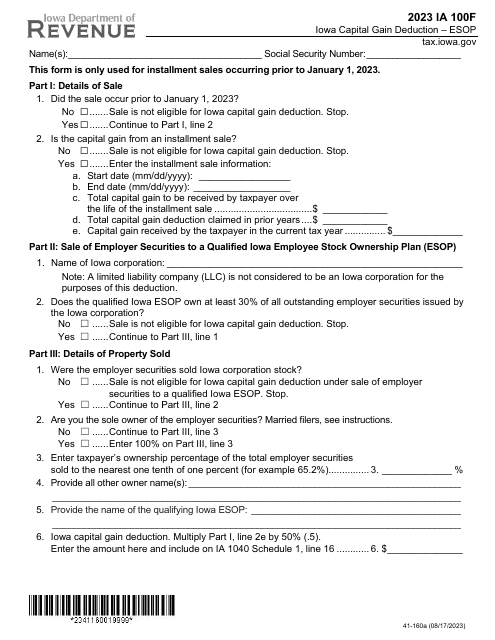

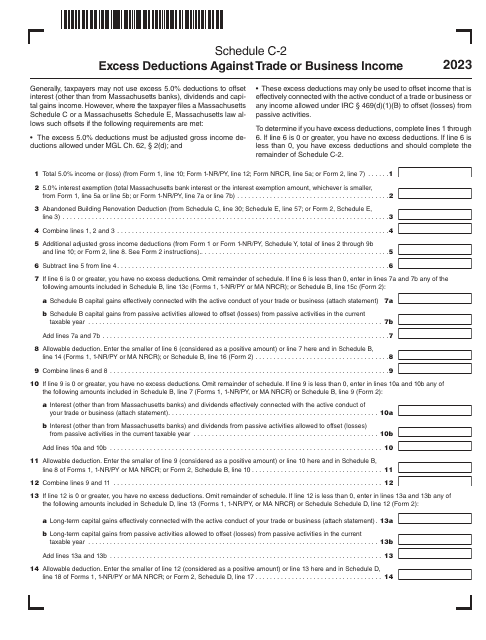

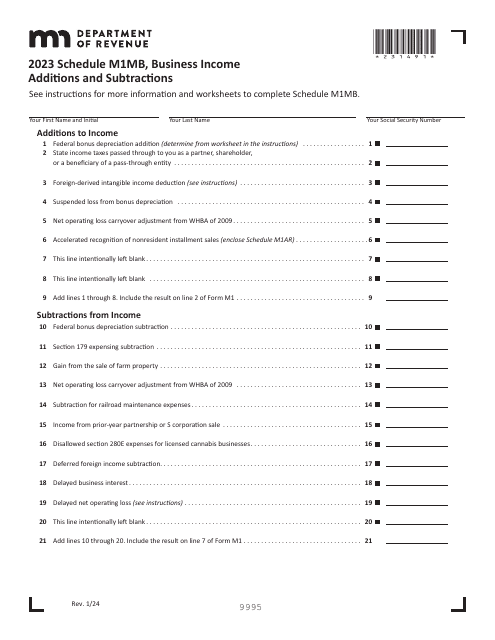

Discover the power of IRS Form 1040 Schedule C Profit or Loss from Business (Sole Proprietorship) to accurately report your income and expenses. Uncover Pennsylvania's Form PA-40 Schedule C, tailored specifically for sole proprietors in the state. Find out how to make the most of Illinois' Schedule M, which offers additional deductions for your business. Iowa business owners can take advantage of Form IA100F (41-160), which allows for capital gain deductions for ESOPs. And don't forget Minnesota's Schedule M1MB, which provides valuable additions and subtractions for business incomes.

Our diverse collection of documents ensures that you have access to the most up-to-date information on business deductions tailored to your specific needs. We understand that every penny counts when it comes to running a successful business, which is why we have compiled this valuable resource. No need to spend hours scouring the internet for relevant information – we've done the work for you.

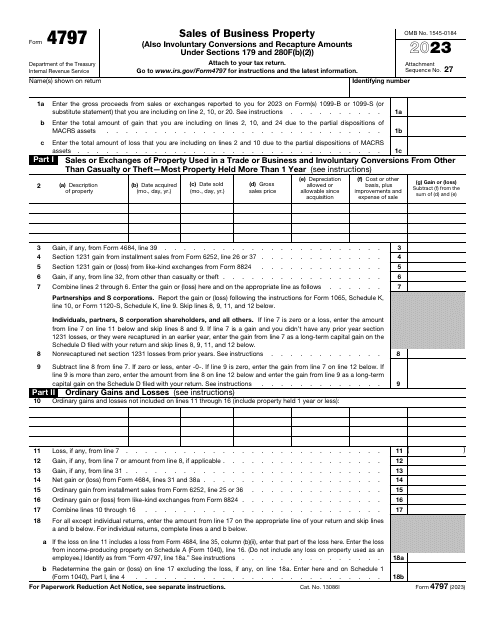

By leveraging these business deductions, you can reduce your taxable income, lower your tax liability, and position your business for success. From expenses related to operations, equipment, supplies, and travel, to specialized deductions for different industries, our documents cover it all. We are committed to providing you with the tools and resources you need to make informed financial decisions for your business.

Don't miss out on potential savings. Take advantage of our collection of business deduction documents today and unlock the full potential of your business's profitability. Don't let these deductions slip through your fingers – start maximizing your savings now.

(Note: This is a fictional text and does not provide accurate or specific information about the mentioned documents. It is solely created for the purpose of demonstrating the generation of SEO-friendly text based on the given input.)

Documents:

26

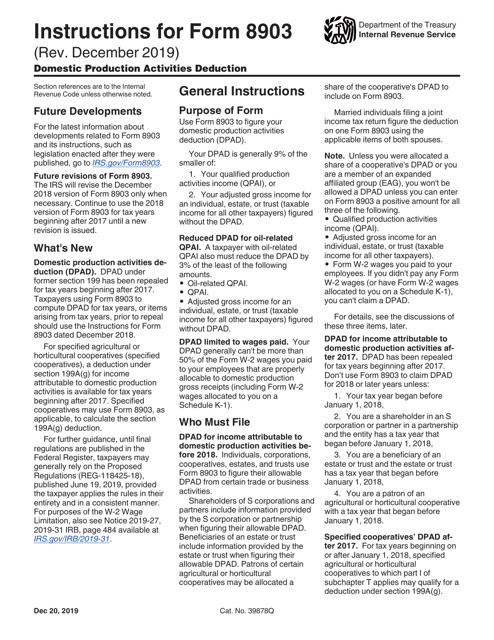

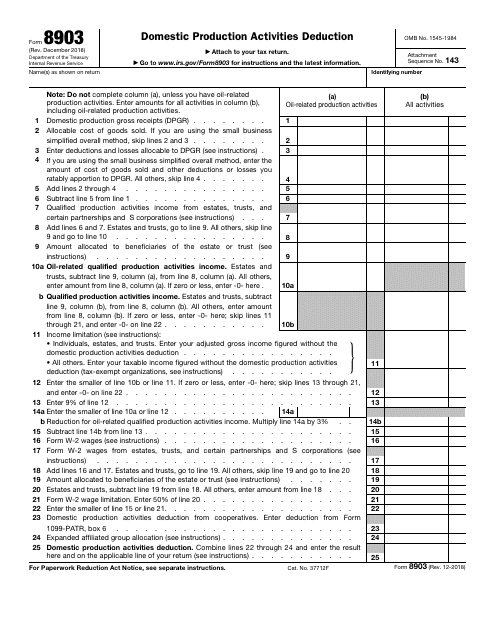

This Form is used for claiming the Domestic Production Activities Deduction on your federal tax return. It is for businesses that engage in certain qualified production activities within the United States.

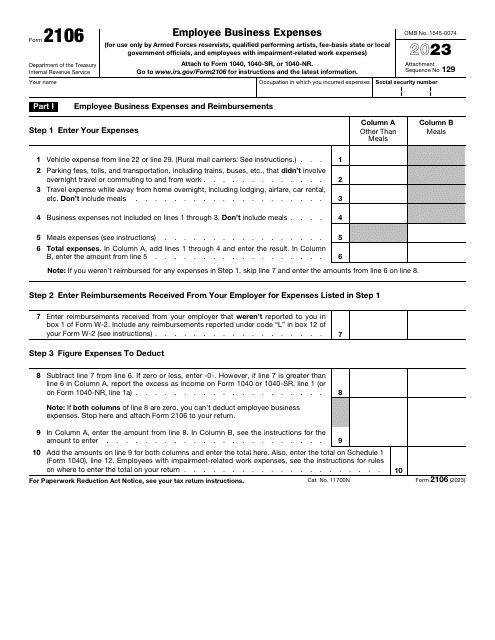

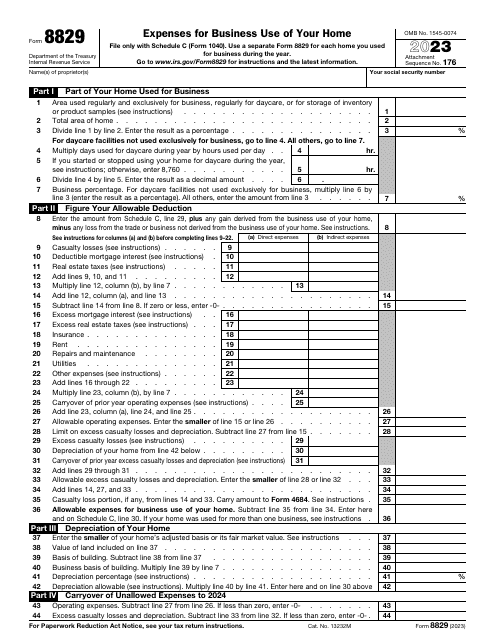

This is an IRS form used by taxpayers who work from home and want to inform tax organizations about the business expenses they wish to deduct from their taxes.