Pago De Impuestos Templates

Welcome to our webpage dedicated to pago de impuestos, also known as pagos de impuestos. This collection of documents provides valuable information and resources for individuals and businesses who need to make tax payments.

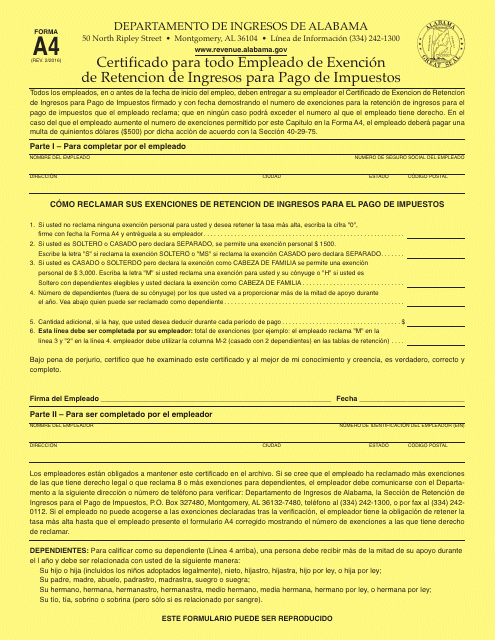

Whether you're an employee seeking an exemption from income tax withholding or an individual looking to set up a payment plan, we have the documents you need. For example, Formulario A4 Certificado Para Todo Empleado De Exencion De Retencion De Ingresos Para Pago De Impuestos - Alabama (Spanish) is a comprehensive form specifically tailored for employees seeking a withholding exemption in Alabama.

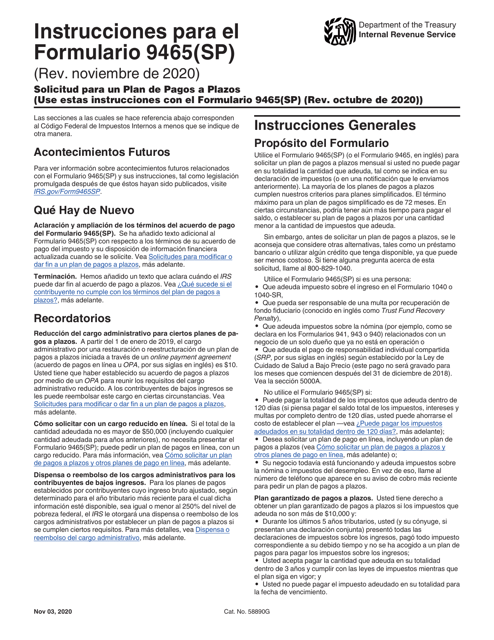

We also provide instructions for IRS Formulario 9465(SP) Solicitud Para Un Plan De Pagos a Plazos (Spanish), which is a vital resource for those who want to set up a payment plan with the IRS. This document outlines the steps and requirements for individuals to make monthly payments towards their tax obligations.

For individuals in California, Formulario FTB3519 SP Pago Por La Extension Automatica Para Individuos - California (Spanish) is a must-have document. It allows individuals to request an automatic extension for filing their taxes, providing them with additional time to make their payments.

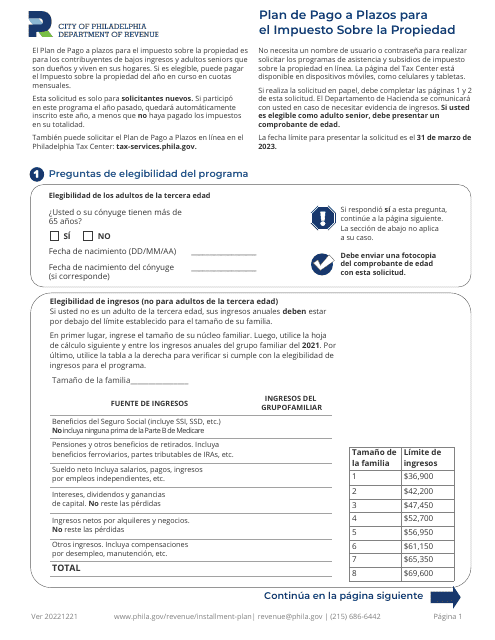

Additionally, we offer resources for property owners in the City of Philadelphia, Pennsylvania. Our Plan De Pago a Plazos Para El Impuesto Sobre La Propiedad (Spanish) provides guidance and assistance for individuals seeking a payment plan for their property taxes.

If you're facing uncertainty regarding your tax obligations, IRS Formulario 656-L (SP) Ofrecimiento De Transaccion (Duda Sobre La Obligacion) (Spanish) can provide clarity and guidance. This document outlines the specifics of making an offer in compromise to resolve any doubts about your tax liability.

At our website, you can find all the necessary documents and information to navigate the pago de impuestos process effectively. We understand that tax payments can be complex and overwhelming, but our collection of documents aims to simplify the process and provide you with the necessary resources to meet your obligations.

Documents:

10

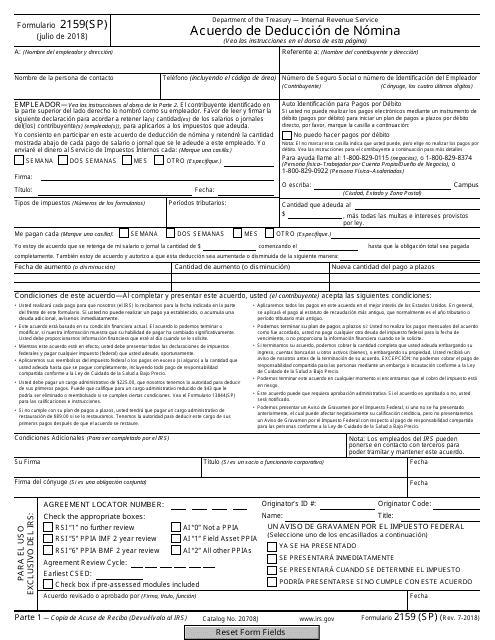

This Form is used for making an agreement for payroll deduction with the IRS. It is available in Spanish language.

This document is a Form A4 Certification for employees in Alabama to claim exemption from income tax withholding for the payment of taxes.

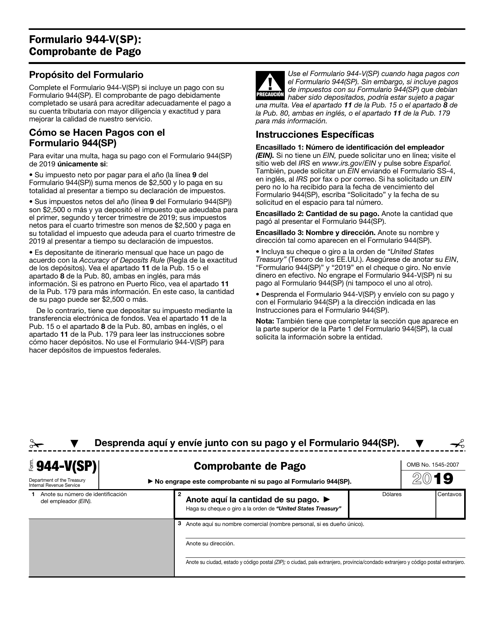

This type of document is a Spanish version of the IRS Form 944-V Payment Voucher. It is used by Spanish-speaking individuals or businesses to make payment arrangements with the IRS.

This type of document is a Plan de Pago a Plazos (Installment Payment Plan) for the Impuesto Sobre La Propiedad (Property Tax) in the City of Philadelphia, Pennsylvania.