Income Exclusion Templates

Are you looking for information on income exclusion? Look no further! Income exclusion refers to the ability to exclude certain types of income from being taxed. This can be a valuable tax strategy for individuals and businesses alike.

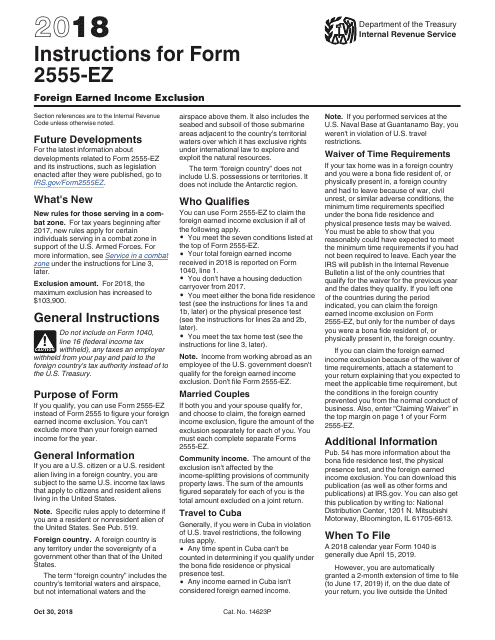

At the federal level, the Internal Revenue Service (IRS) provides various forms and instructions to help taxpayers take advantage of income exclusion options. For example, if you are a U.S. citizen or resident living and working abroad, you may be eligible for the Foreign Earned Income Exclusion under IRS Form 2555-EZ. This allows you to exclude a certain amount of your income earned abroad from U.S. taxation.

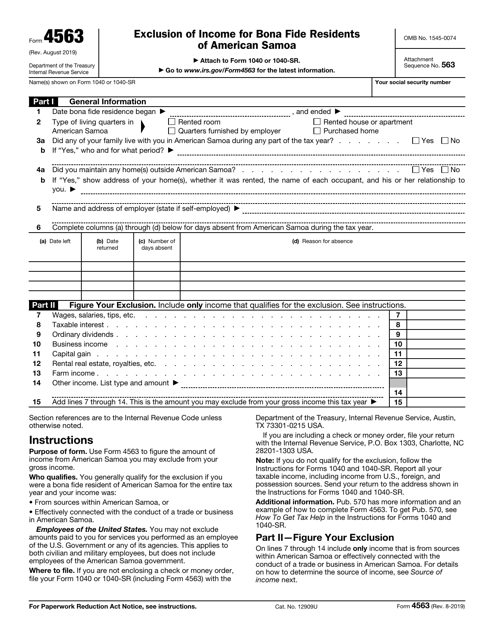

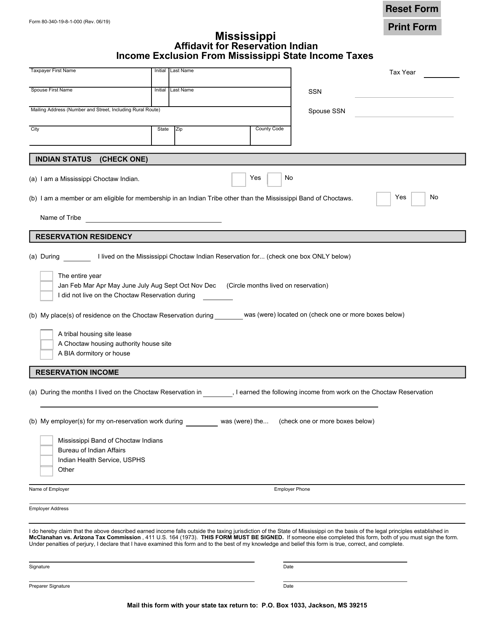

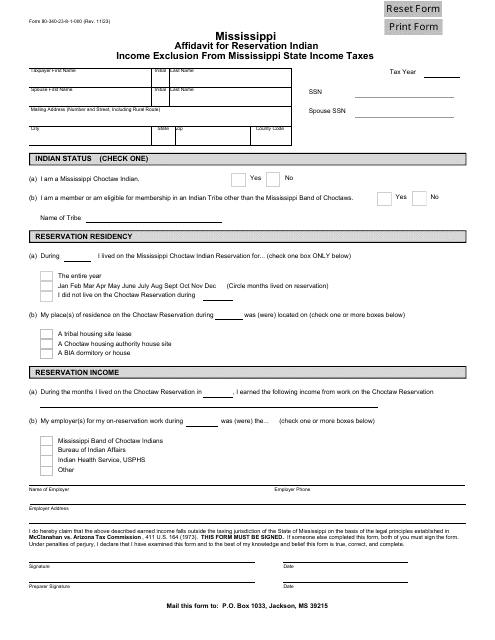

In certain circumstances, individuals or entities may also qualify for specific income exclusions based on their residency. For instance, residents of American Samoa can take advantage of the Exclusion of Income for Bona Fide Residents of American Samoa under IRS Form 4563. Similarly, Native Americans in Mississippi may be eligible for the Mississippi Affidavit for Reservation Indian Income Exclusion, which allows them to exclude certain income from state taxes.

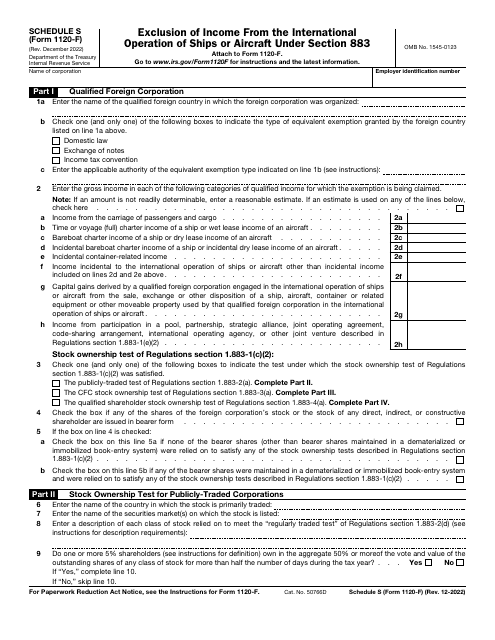

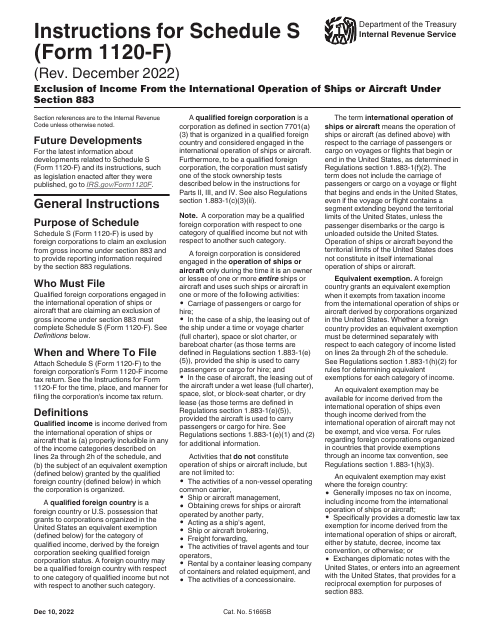

If you're involved in international business, you may also qualify for the Exclusion of Income From the International Operation of Ships or Aircraft Under Section 883. This exclusion, outlined in the instructions for IRS Form 1120-F Schedule S, can help reduce your tax liabilities when operating ships or aircraft internationally.

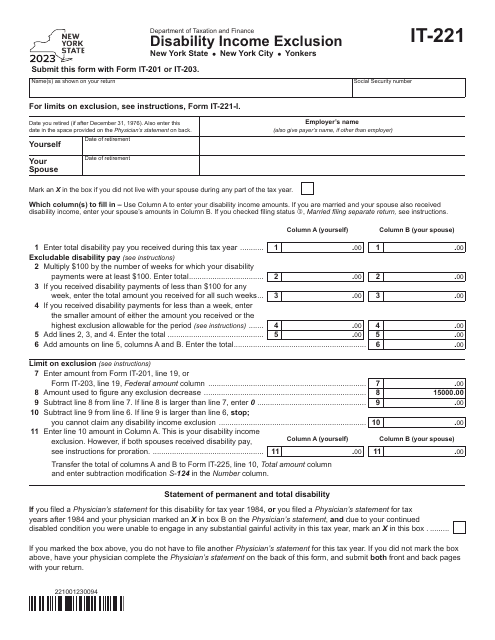

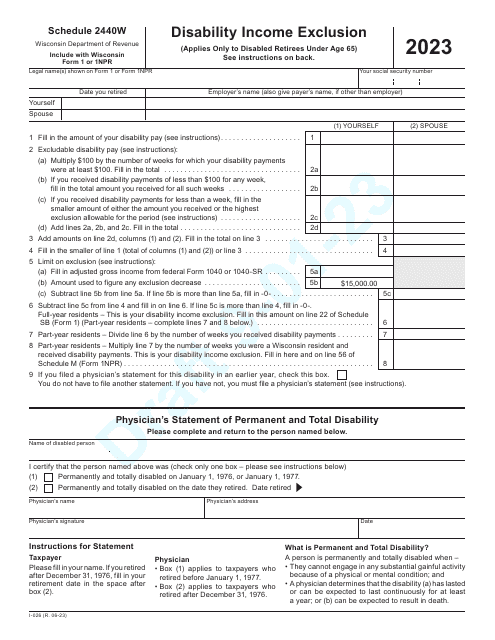

Lastly, some states offer income exclusion options that allow taxpayers to exclude specific types of income from state taxation. For example, New York residents with disabilities may qualify for the Disability Income Exclusion under Form IT-221.

Whether you're an individual taxpayer or a business owner, understanding and utilizing income exclusion options can help you minimize your tax burden. To learn more about income exclusion and how it applies to your specific situation, consult the appropriate forms and instructions provided by the IRS and your state tax agency. Don't miss out on potential tax savings – explore the income exclusion options available to you today!

Documents:

14

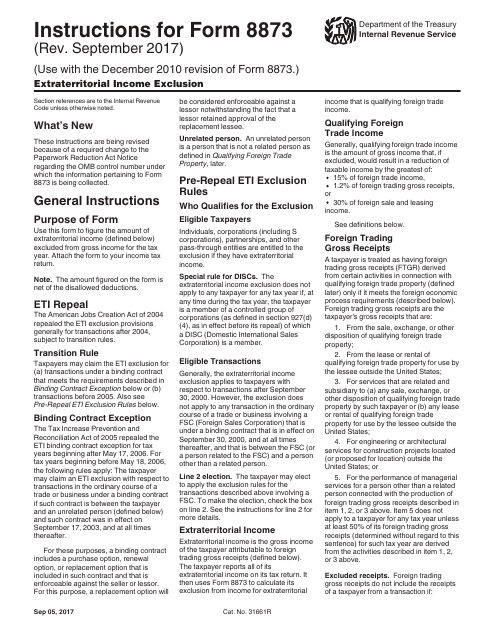

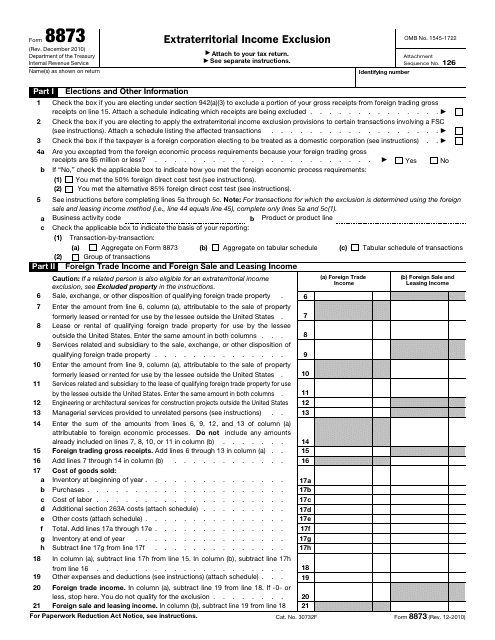

This form is used for reporting and claiming the extraterritorial income exclusion. It provides instructions on how to accurately complete IRS Form 8873.

This Form is used for claiming the exclusion of certain foreign-earned income from your taxable income.

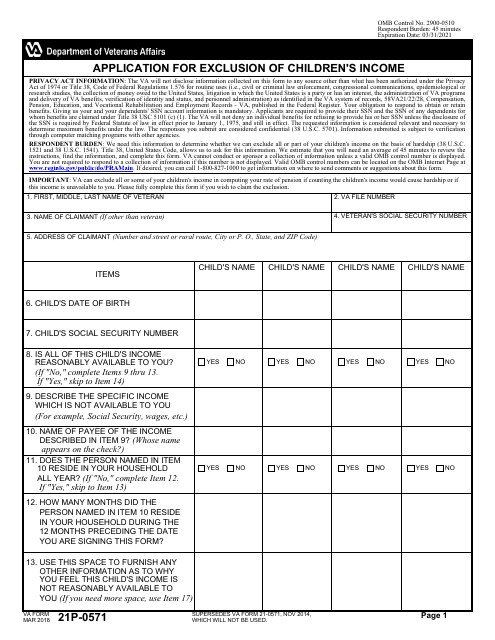

This form is used for applying to exclude children's income from the calculation of a veteran's pension.

This is a tax form people permanently residing in American Samoa can use to exclude certain income from their gross income.

This document provides instructions for completing IRS Form 2555-EZ, which is used to report and claim the foreign earned income exclusion for taxpayers who qualify.

This document is used for claiming a tax exclusion on Indian income in the state of Mississippi.