Refundable Credits Templates

Refundable credits, also known as credit refunds or refundable credit, are a type of tax credit that can result in a refund to the taxpayer. These credits differ from non-refundable tax credits, which can only reduce the amount of tax owed but cannot generate a refund.

Refundable credits are designed to provide financial assistance to individuals or businesses in certain circumstances. They can help offset various tax obligations or encourage specific activities, such as the generation of electricity by zero-emission facilities or participation in economic developmentincentive programs.

By claiming refundable credits, taxpayers can potentially receive a refund even if their tax liability is zero or they have already paid more in taxes than they owe. This can provide a much-needed financial boost and help individuals and businesses meet their financial obligations.

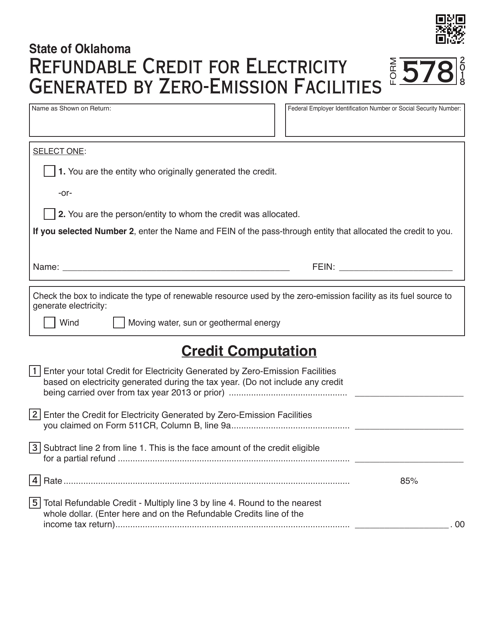

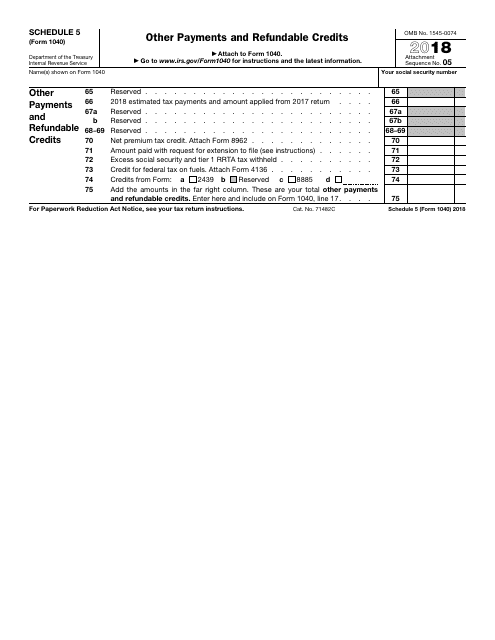

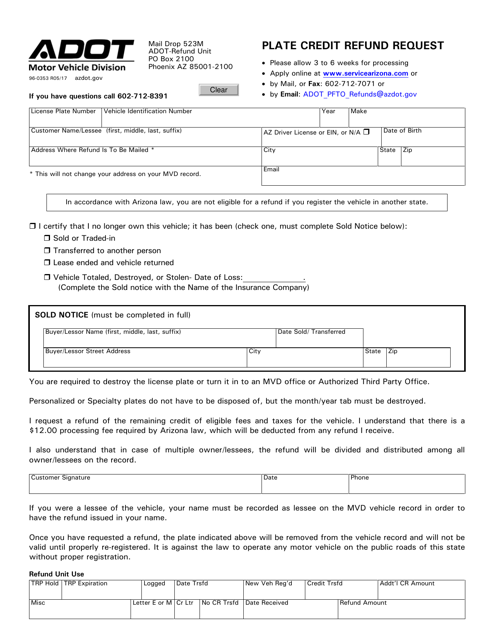

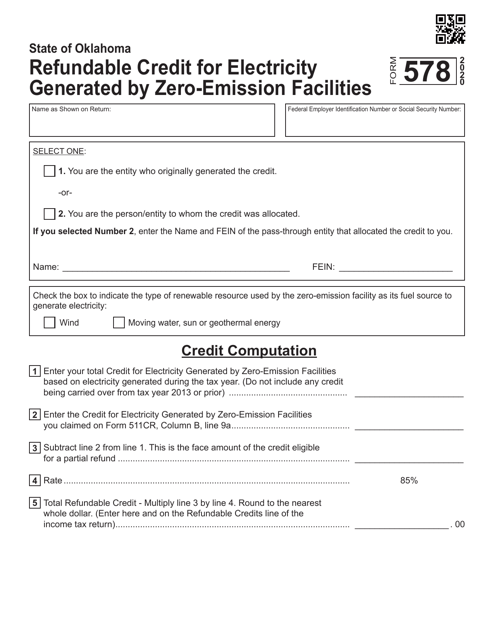

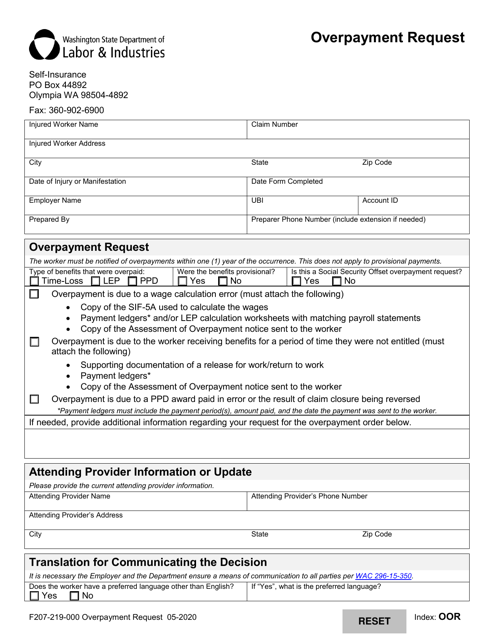

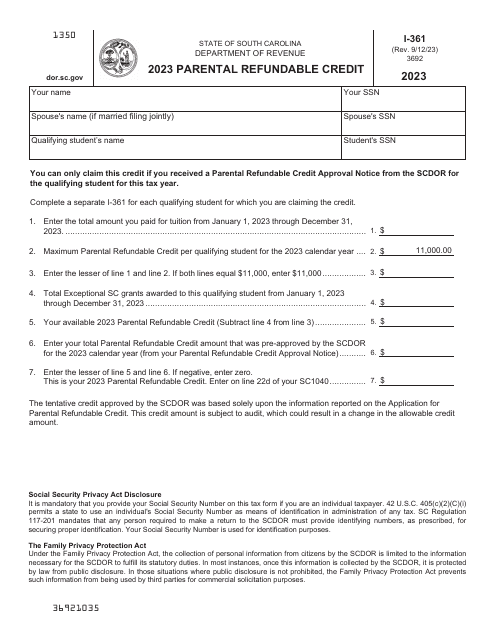

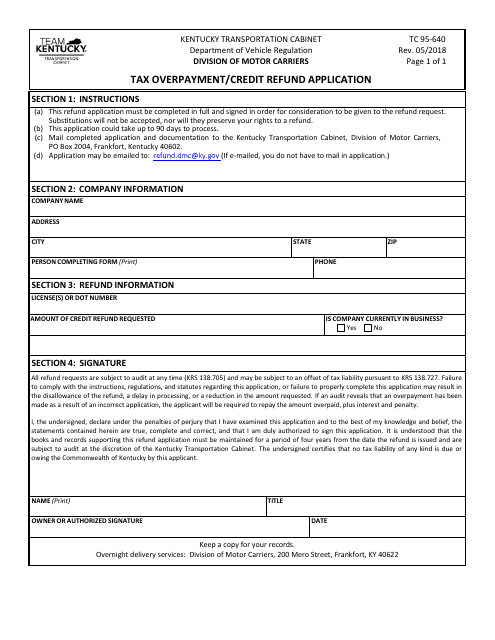

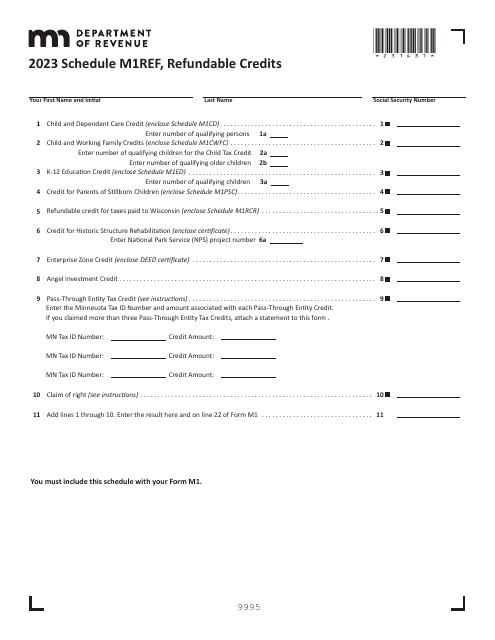

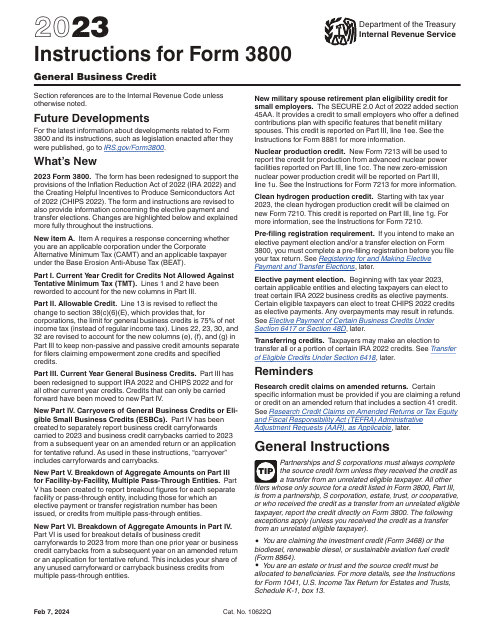

To claim refundable credits, taxpayers generally need to complete and submit the appropriate forms or schedules, such as the OTC Form 578 for electricity generated by zero-emission facilities in Oklahoma, the IRS Form 1040 Schedule 5 for other payments and refundable credits at the federal level, or state-specific forms like the Form F207-219-000 Overpayment Request in Washington or the Schedule M1REF for refundable credits in Minnesota.

It is important to stay informed about the eligibility criteria, filing requirements, and deadlines associated with refundable credits. Utilizing these tax benefits can help individuals and businesses maximize their savings and potentially receive a refund that can make a significant difference in their financial situation.

Whether you are a taxpayer, accountant, or tax professional, understanding and navigating the complexities of refundable credits is crucial. Our comprehensive collection of documents related to refundable credits provides the resources and information you need to stay up to date and make the most of these valuable tax benefits. Explore our extensive library of forms, schedules, and guides to ensure you are fully equipped to claim the refundable credits you are entitled to.

Documents:

11

This form is used for reporting other types of payments and refundable credits that are not included in the standard IRS Form 1040.

This Form is used for requesting a refund of plate credit in Arizona.

This Form is used for requesting overpayment refunds in Washington state.

This Form is used for applying for a tax overpayment or credit refund in the state of Kentucky.