Loan Duration Templates

Are you looking for information about the duration of loans? Look no further! Our comprehensive collection of documents on loan duration has got you covered. Whether you're in the United States, Canada, or any other country, we have the resources you need to understand the different aspects of loan duration.

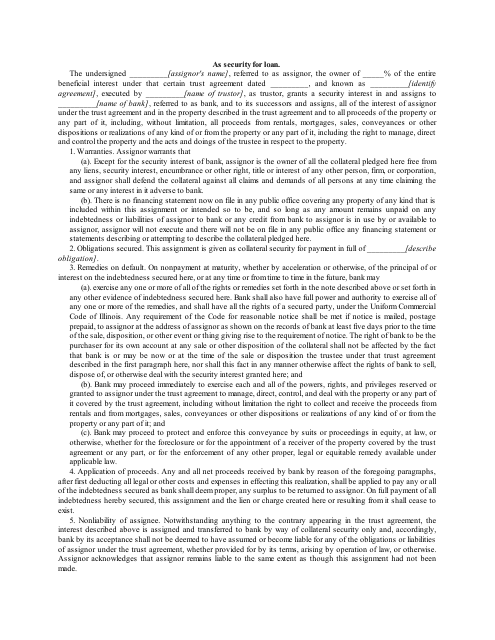

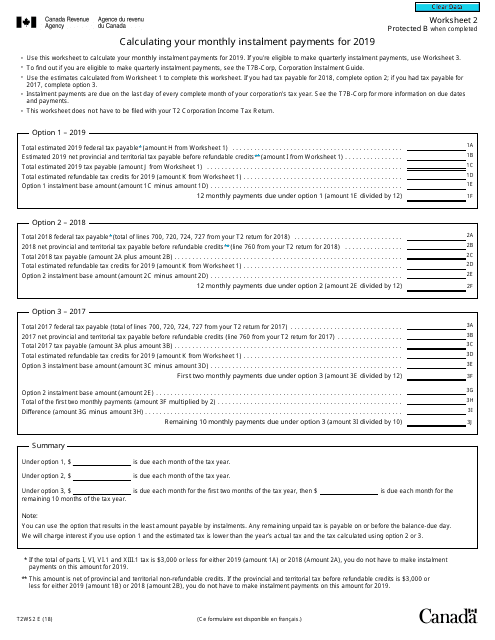

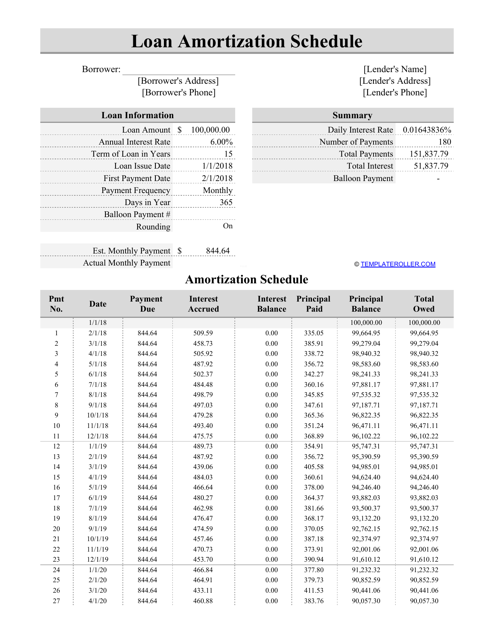

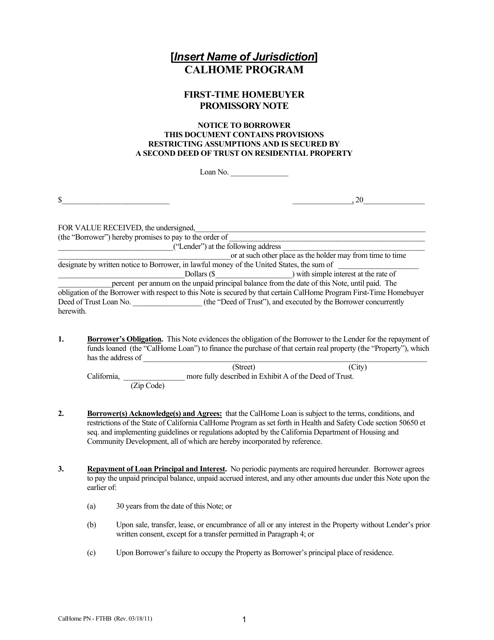

Our documents include templates like "As Security for Loan - Template" and "First-Time Homebuyer Promissory Note - Calhome Program - California" that provide a solid foundation for drafting loan agreements. We also offer practical tools like the "Loan Amortization Schedule Template" and the "Form T2WS2 Worksheet 2 Calculating Your Monthly Instalment Payments - Canada" to help you calculate and keep track of your loan payments.

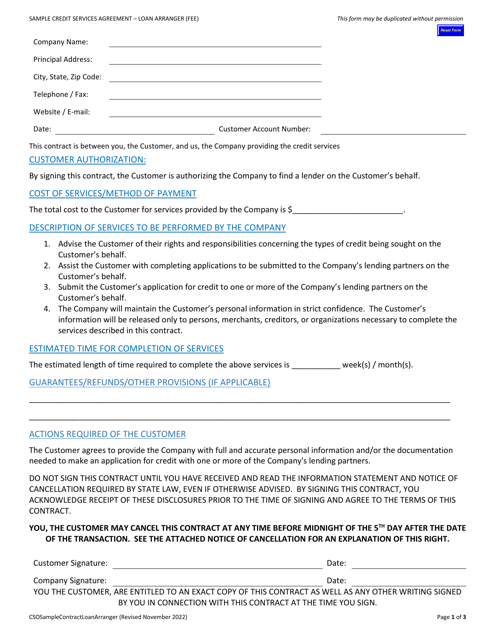

With our diverse collection of documents, you can explore various loan duration topics, such as understanding the terms and conditions of loans, learning how to calculate loan repayments, and even exploring credit services agreements for loan arrangers.

So, whether you're a borrower, lender, or simply looking to expand your knowledge on loan duration, our document collection has everything you need. Start exploring now and take control of your loan journey!

(Note: The above text is a sample SEO text and does not contain proper legal or financial advice. Please consult with a professional for accurate information.)

Documents:

5

This document is a template that is used when providing security for a loan. It helps outline the terms and conditions of the security agreement between the lender and the borrower.

This form is used for calculating your monthly installment payments in Canada. It helps you determine how much you need to pay each month for various types of loans or financing arrangements.

An individual can use this spreadsheet to outline payments for a loan, to calculate the money that goes towards the lender and to the interest until the borrower has paid off the entire amount of a loan.

This document is for first-time homebuyers participating in the CalHome Program in California. It is a promissory note that outlines the terms of the loan, repayment schedule, and other details related to the home purchase.

This agreement is used when loan arrangers in Wisconsin provide credit services for borrowers. It outlines the terms and conditions of the credit arrangement.