Personal Property Taxes Templates

Are you a taxpayer wondering about personal property taxes? Look no further! Personal property taxes, also known as personal property tax or personal property tax form, are taxes imposed on tangible and intangible assets owned by individuals. These taxes are often assessed on items such as vehicles, boats, equipment, inventory, and other personal belongings.

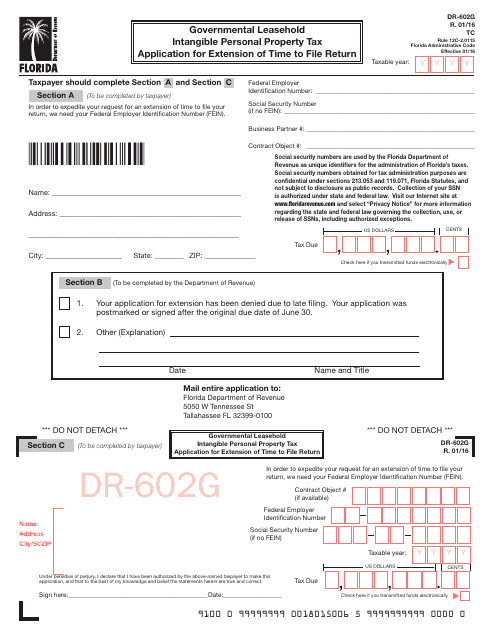

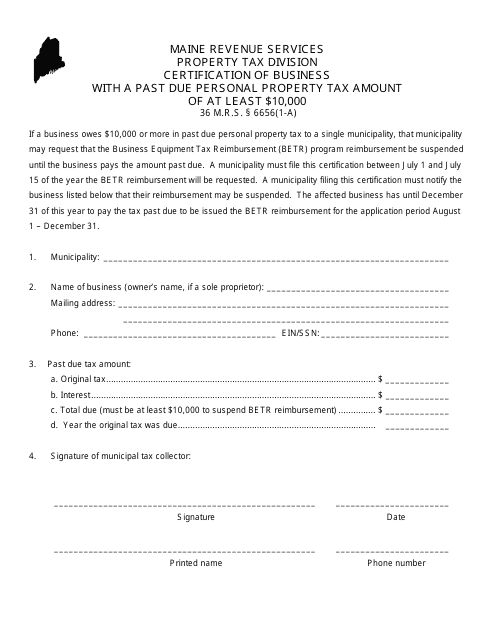

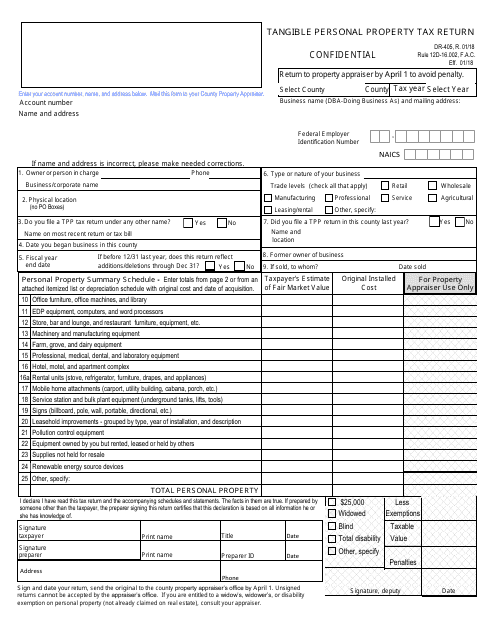

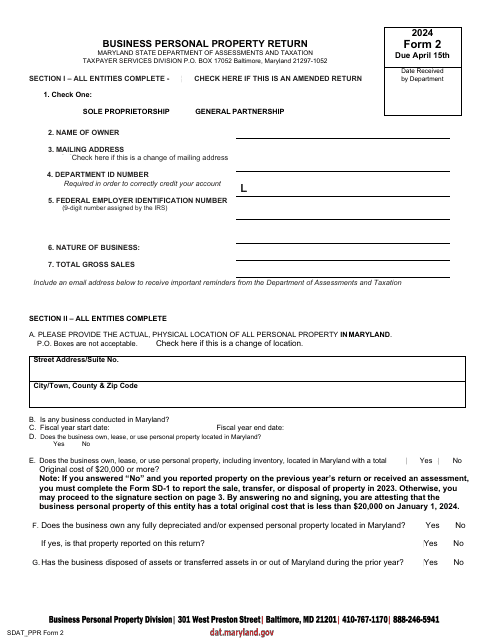

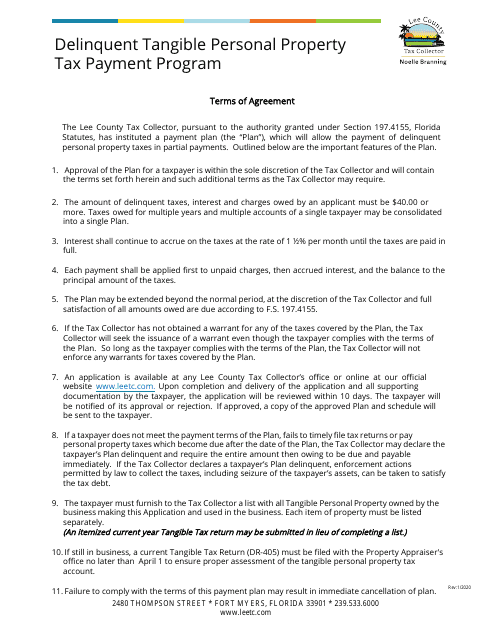

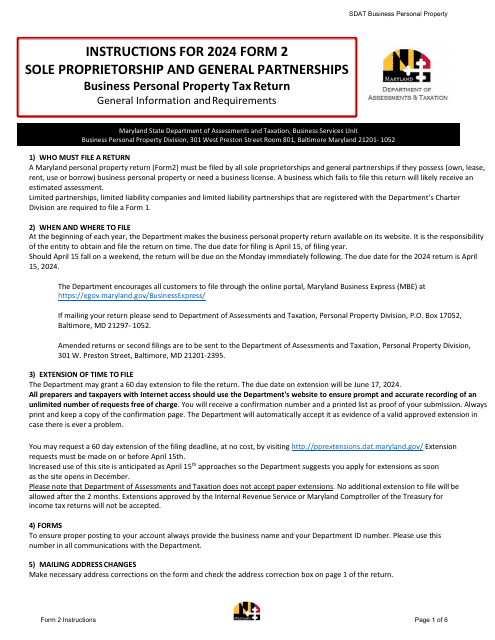

To comply with personal property tax regulations, you may need to fill out various forms and applications depending on your location. For instance, in Florida, you might come across Form DR-602G Governmental Leasehold Intangible Personal Property Tax Application for Extension of Time to File Return or Form DR-405 Tangible Personal Property Tax Return. Meanwhile, in Maine, you may encounter a Certification of Business With a Past Due Personal Property Tax Amount of at Least $10,000.

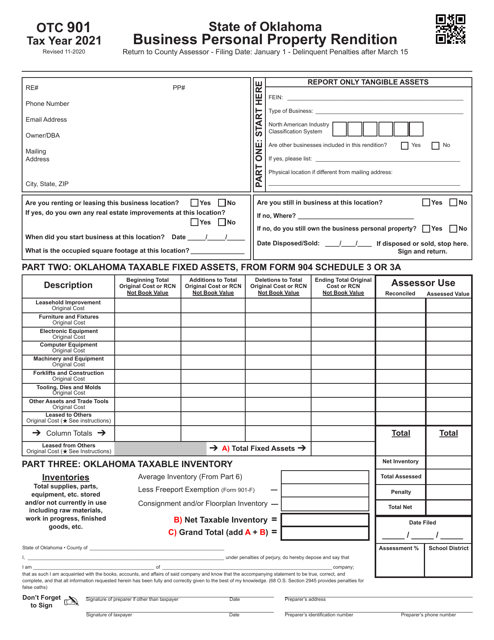

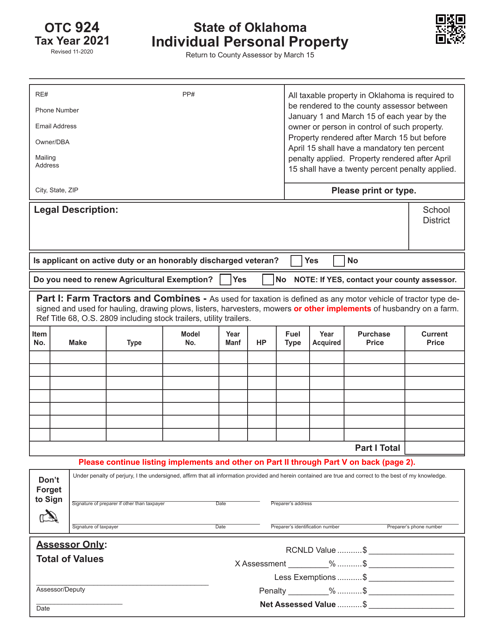

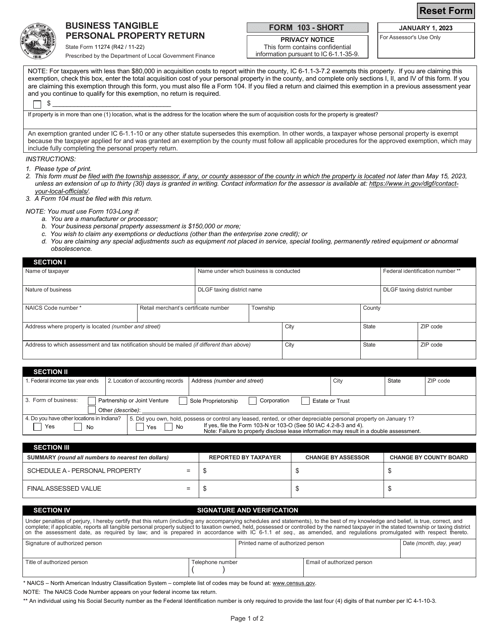

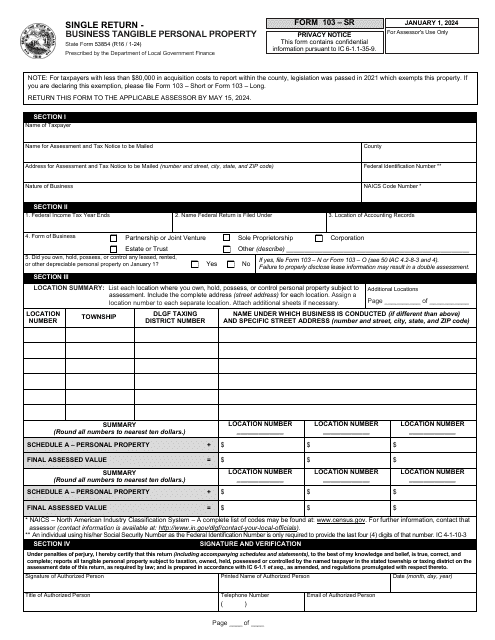

Other states, like Indiana, may require businesses to submit the State Form 11274 (103-SHORT) Business Tangible Personal Property Return. Individuals in Oklahoma, on the other hand, might need to complete OTC Form 924 Individual Personal Property.

Navigating personal property taxes can be challenging, but understanding the necessary documents and requirements is essential. Ensure compliance and avoid penalties by seeking the right information and filing the appropriate forms. Stay informed about your obligations and responsibilities when it comes to personal property taxes.

Documents:

28

This form is used for requesting an extension of time to file a return for the Governmental Leasehold Intangible Personal Property Tax in Florida.

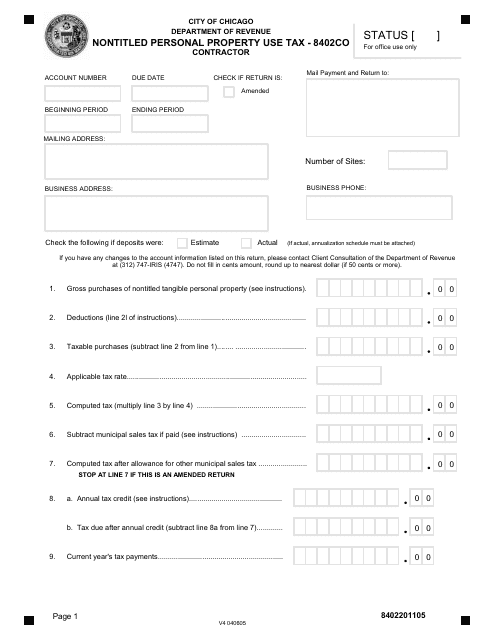

This form is used for reporting and paying the nontitled personal property use tax in the City of Chicago, Illinois.

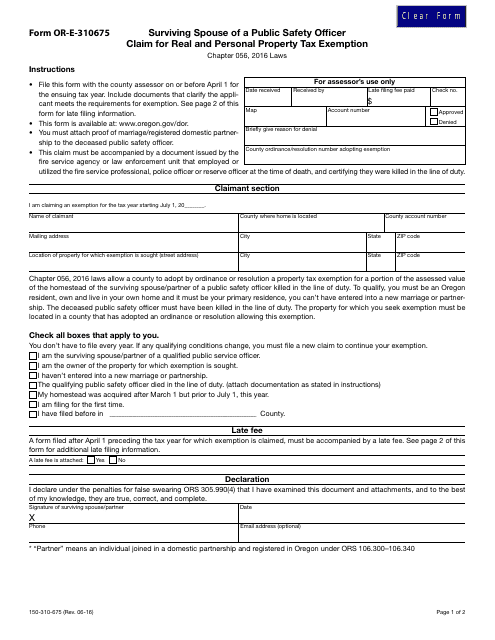

This form is used for a surviving spouse of a public safety officer to claim a real and personal property tax exemption in the state of Oregon.

This document certifies a business with a past due personal property tax amount of at least $10,000 in the state of Maine.

This Form is used for reporting tangible personal property and calculating tax owed in the state of Florida.

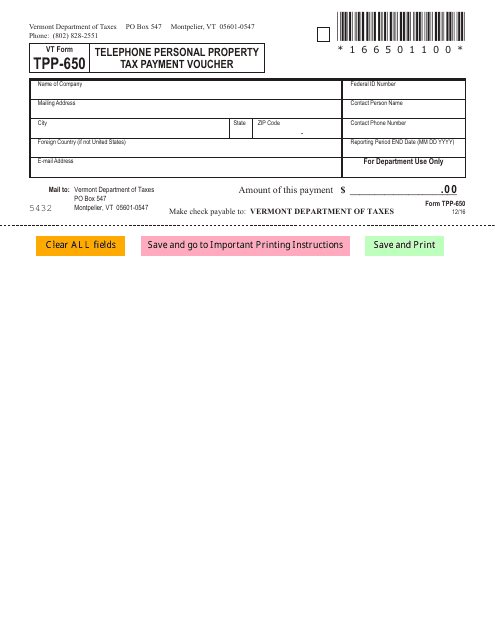

This Form is used for making telephone personal property tax payments in the state of Vermont.

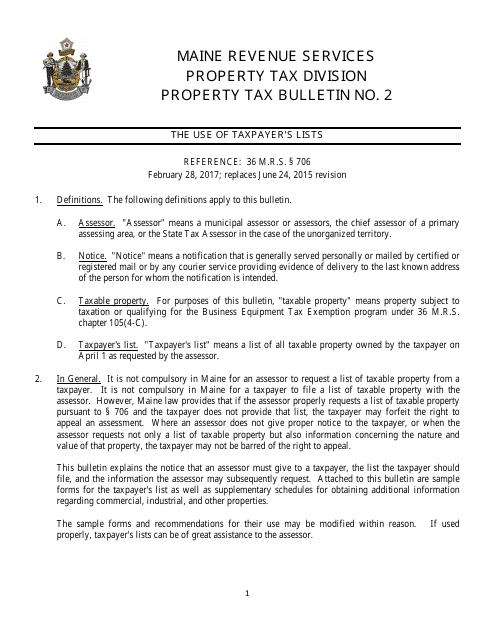

This document is a request for a list of taxable property in the state of Maine. It is used to gather information on properties that are subject to taxation.

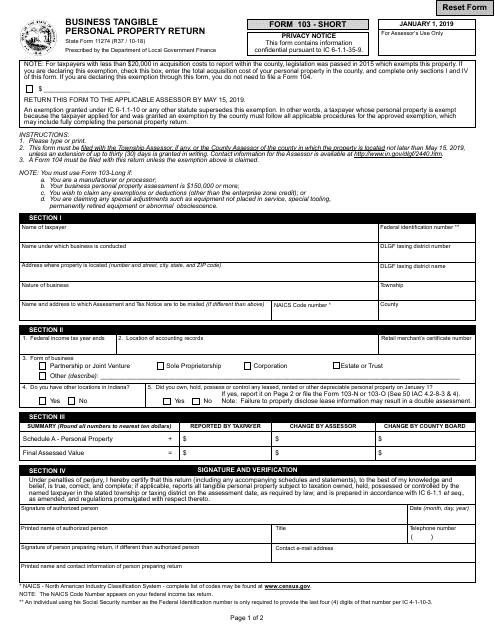

This form is used for reporting and assessing the value of tangible personal property owned by businesses in the state of Indiana.

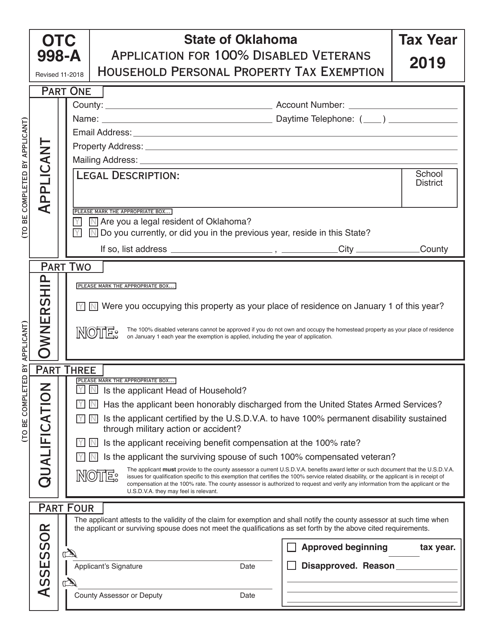

This form is used for applying for a 100% Disabled Veterans Household Personal Property Tax Exemption in Oklahoma.

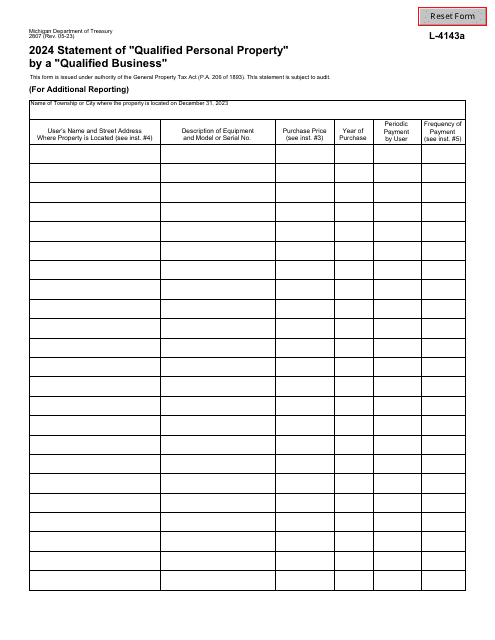

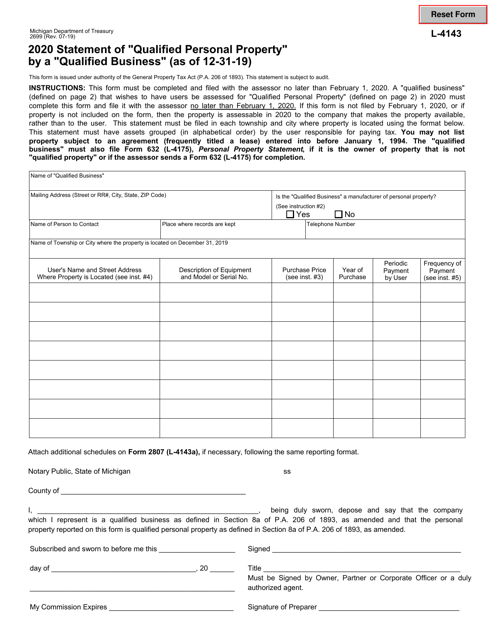

This Form is used for businesses in Michigan to report their qualified personal property as of December 31, 2019.

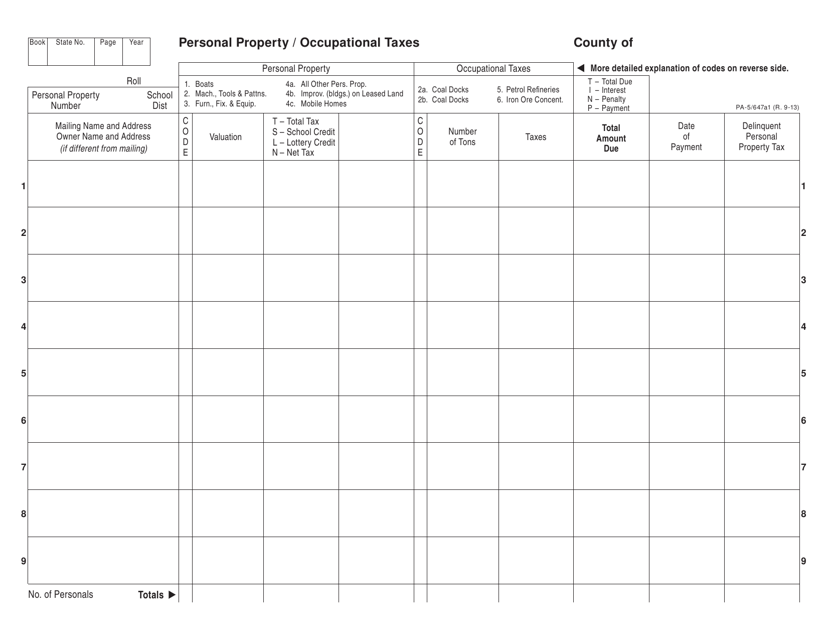

This form is used for reporting personal property and occupational taxes in the state of Wisconsin.

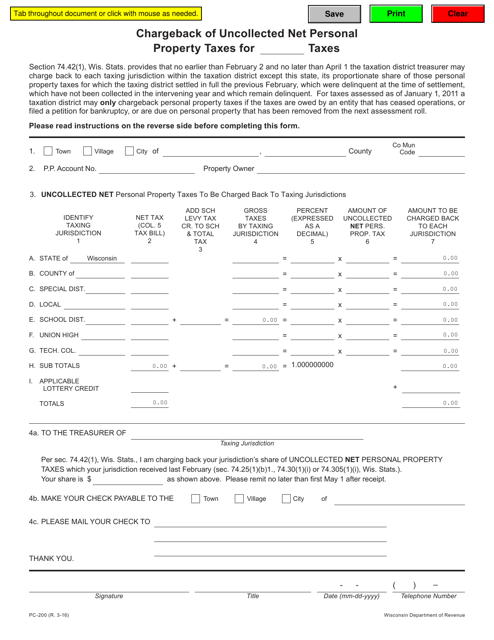

This Form is used for requesting a chargeback of uncollected net personal property taxes in the state of Wisconsin.

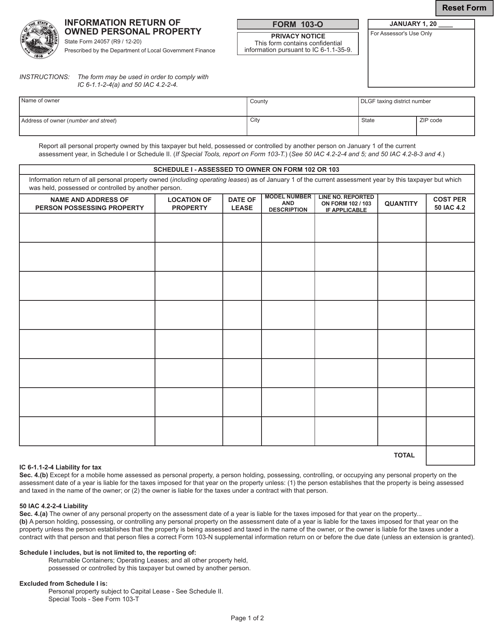

This Form is used for reporting owned personal property to the state of Indiana.

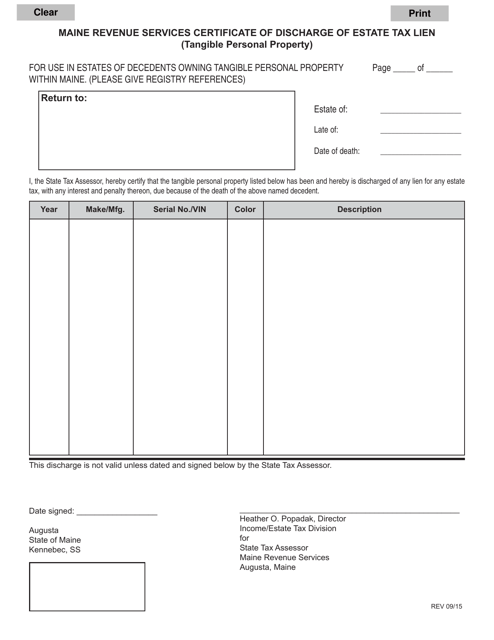

This document is a certificate issued by the Maine Revenue Services to discharge a lien on tangible personal property for estate taxes in the state of Maine.

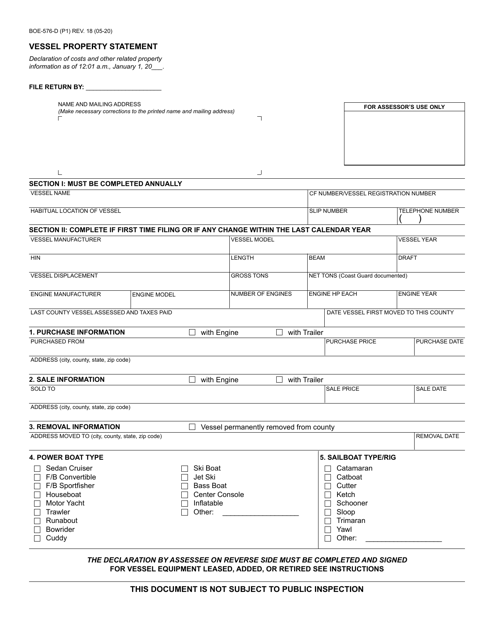

This Form is used for reporting the property information related to vessels in the state of California.

This document is for applying for a payment plan to pay delinquent tangible personal property taxes in Lee County, Florida.

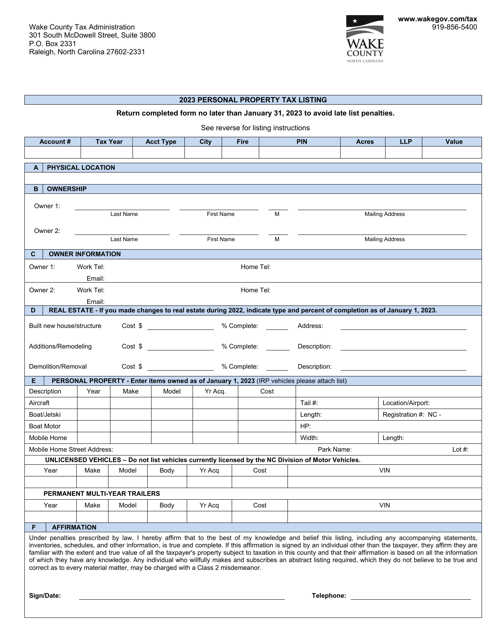

This document is used for listing personal property taxable in North Carolina. It provides a detailed record of personal property that is subject to tax in the state.

This Form is used for reporting business tangible personal property in Indiana. It is used to calculate and report the value of tangible assets owned by a business for taxation purposes.