Harmonized Sales Tax Templates

The harmonized sales tax (HST), also known as the Goods and Services Tax (GST), is a system in place in several countries, including Canada. This comprehensive tax combines both federal and provincial sales taxes, streamlining the taxation process for businesses and consumers alike.

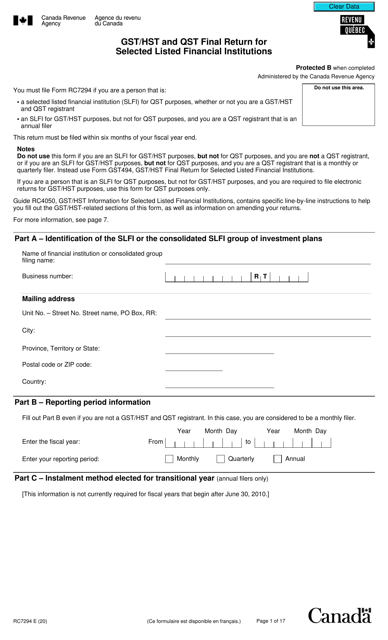

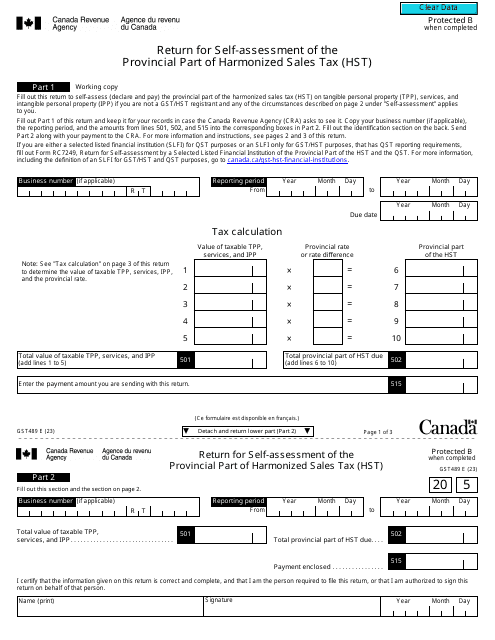

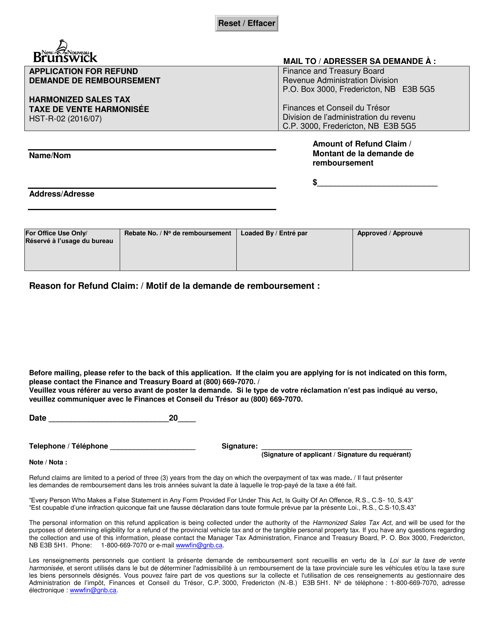

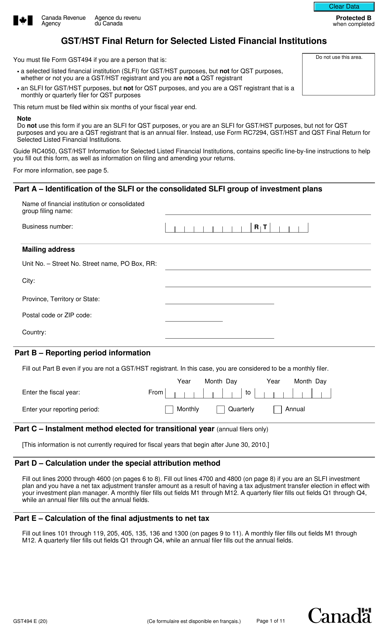

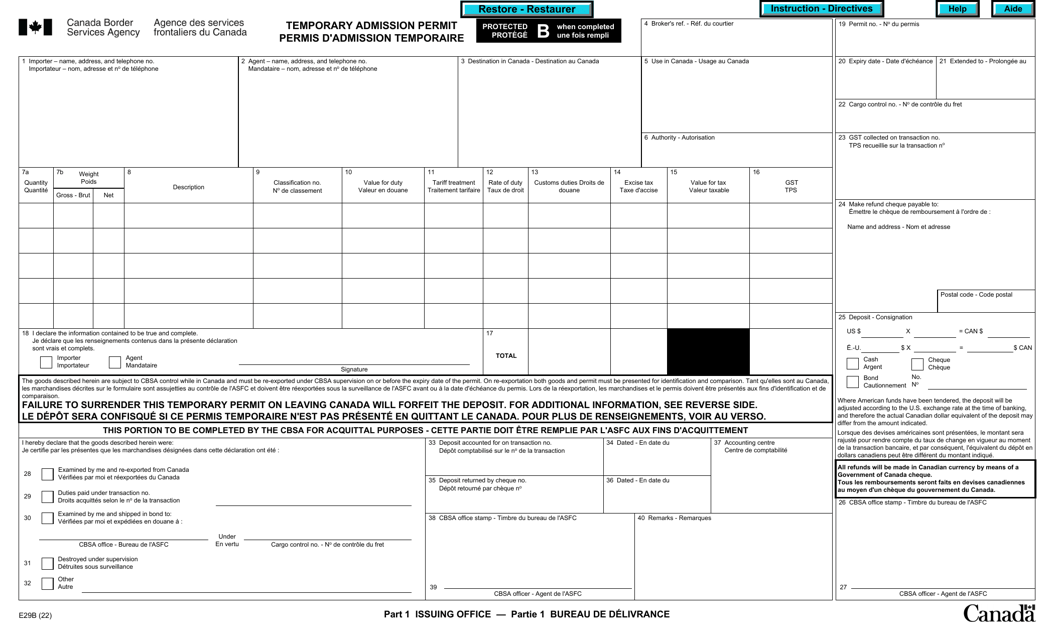

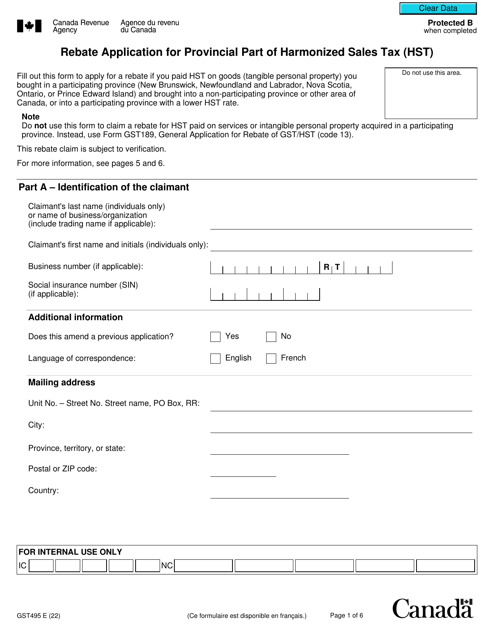

Under the harmonized sales tax system, businesses are required to file various forms and returns to accurately report their sales and remit the appropriate amount of tax. For example, Form RC7294 is used by listed financial institutions in Canada to file their final return for the GST/HST and Quebec Sales Tax (QST). Similarly, Form GST489 is used for self-assessment of the provincial part of the HST, and Form HST-R-02 is an application for refund of the harmonized sales tax in New Brunswick.

The harmonized sales tax has been implemented to provide a simplified method of taxation, reducing the administrative burden on businesses and ensuring a fair and equitable tax system. By consolidating the federal and provincial taxes into a single tax, it helps to eliminate duplication and streamline the tax collection process.

Whether you are a business owner or an individual consumer, understanding the harmonized sales tax and its associated forms is essential for compliance and accurate reporting. By staying informed and meeting your tax obligations, you can contribute to the stability and growth of the economy.

So, if you are looking for information on the harmonized sales tax or need assistance with filing the necessary forms, you have come to the right place. Our website provides comprehensive resources and guidance on the HST, helping you navigate the complexities of this taxation system. From explaining the application process for refunds to providing step-by-step instructions on completing the various forms, we strive to be your one-stop destination for all things related to the harmonized sales tax.

Documents:

8

Form GST489 Return for Self-assessment of the Provincial Part of Harmonized Sales Tax (Hst) - Canada

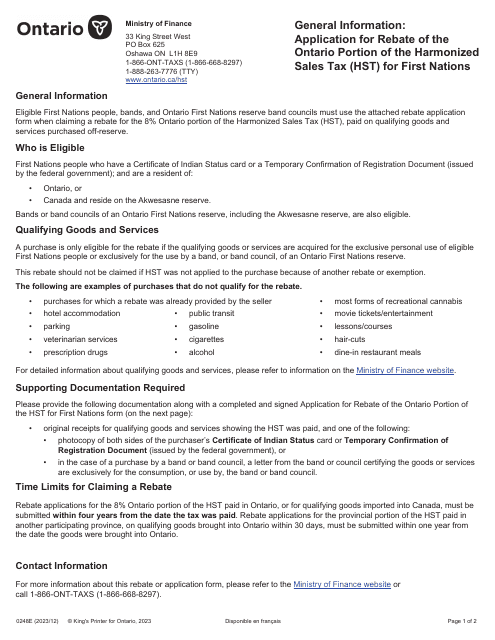

Form HST-R-02 Application for Refund - Harmonized Sales Tax - New Brunswick, Canada (English/French)

This document is used for applying for a refund of harmonized sales tax (HST) in New Brunswick, Canada. It is available in both English and French languages.