Indirect Costs Templates

When it comes to managing finances, businesses often focus on the direct costs that are directly attributed to a specific project or product. However, it is equally important to consider the indirect costs that are incurred as a result of conducting business operations. These indirect costs, also known as overhead costs or operational expenses, can have a significant impact on the overall financial health of a company.

Understanding and managing indirect costs is crucial for businesses of all sizes and industries. These costs encompass a wide range of expenses that are not directly tied to a particular project or product but are necessary for the overall functioning of the organization. Examples of indirect costs include rent, utilities, administrative salaries, and insurance.

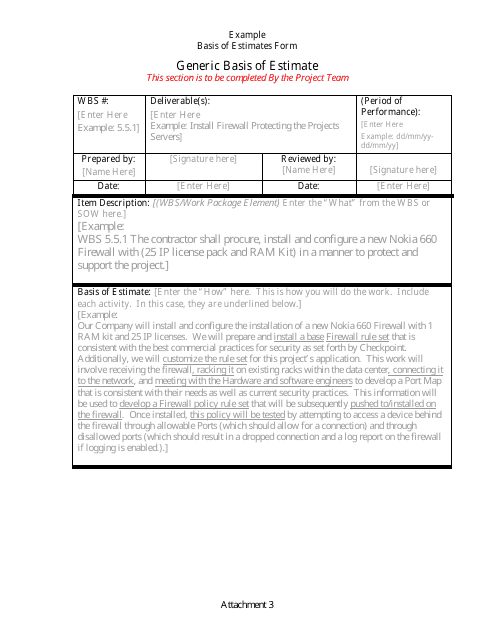

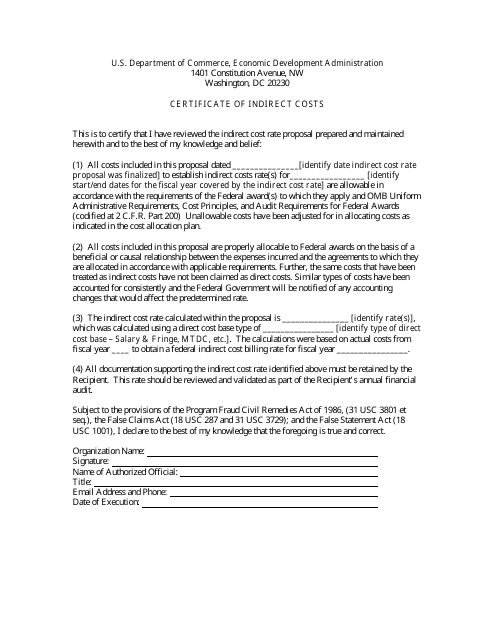

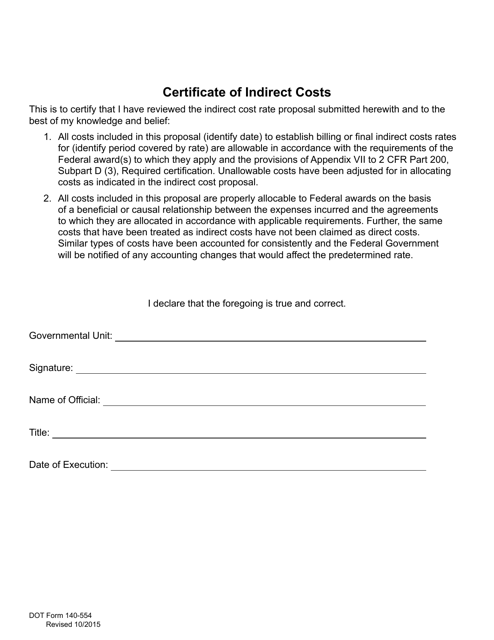

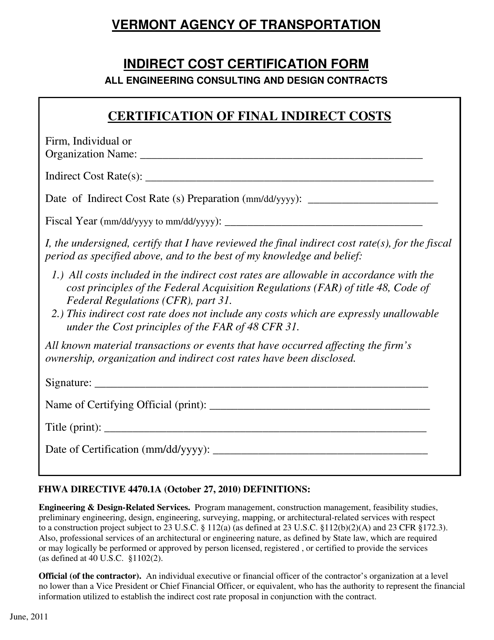

To help businesses accurately account for and manage their indirect costs, a variety of documents and tools are available. These documents serve as a record of the indirect costs incurred by the business and provide a basis for estimating and tracking these expenses. Some common documents in this category include Sample Generic Basis of Estimate Form, Certificate of Indirect Costs, DOT Form 140-554 Certificate of Indirect Costs - Washington, Indirect Cost Certification Form - Vermont, and Indirect Cost Rate Proposal - Wyoming.

Whether you are a small business owner or a financial manager responsible for overseeing a larger organization's indirect costs, having a solid understanding of these expenses is essential. Implementing effective strategies to control and minimize indirect costs can lead to improved financial performance and increased profitability. By utilizing the right documents and tools, businesses can gain better insights into their indirect costs and make informed decisions to optimize their operations.

So, if you're looking for ways to manage your indirect costs and improve your bottom line, explore the various documents available that cater specifically to this aspect of financial management. Start taking control of your business's overhead expenses and set the stage for long-term financial success.

Documents:

6

This document is used for creating a basis of estimate for various projects. It helps in estimating costs, resources, and timelines for a project.

This document is used to certify the indirect costs incurred by an organization. It provides information on the allocation and calculation of indirect costs for budgeting and financial reporting purposes.

This form is used for certifying indirect costs in Washington. It is required by the Department of Transportation (DOT) for certain financial reporting purposes.

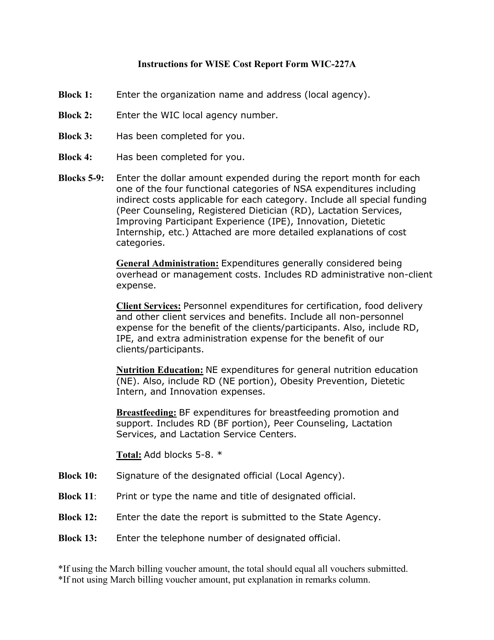

This form is used for reporting wise cost information under the Women, Infants, and Children (WIC) program in Texas.

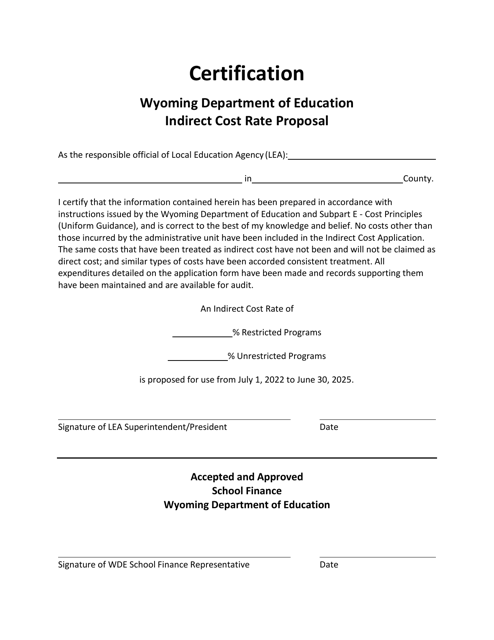

This document is used to propose the indirect cost rate for organizations in Wyoming.