Other Tobacco Product Templates

Welcome to our webpage dedicated to Other Tobacco Products! Here, you will find all the information you need regarding the regulation and taxation of other tobacco products (OTPs).

OTPs refer to all tobacco products that are not cigarettes or traditional tobacco products. This includes items such as cigars, cigarillos, pipe tobacco, smokeless tobacco, and even electronic cigarettes or vaping products.

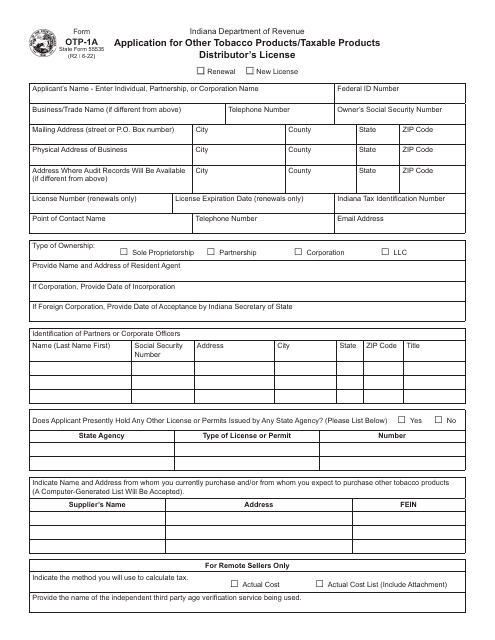

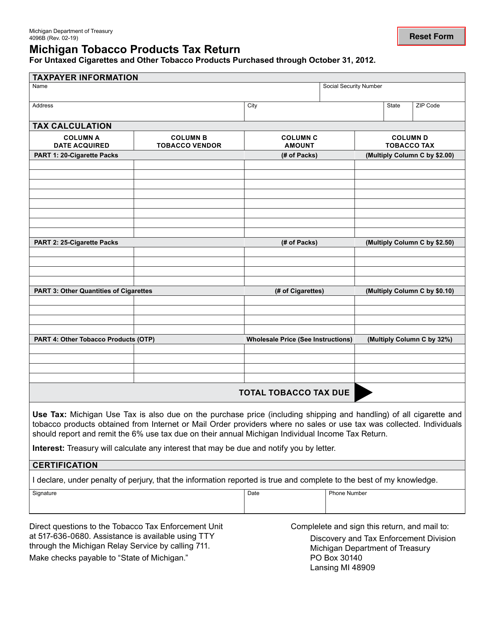

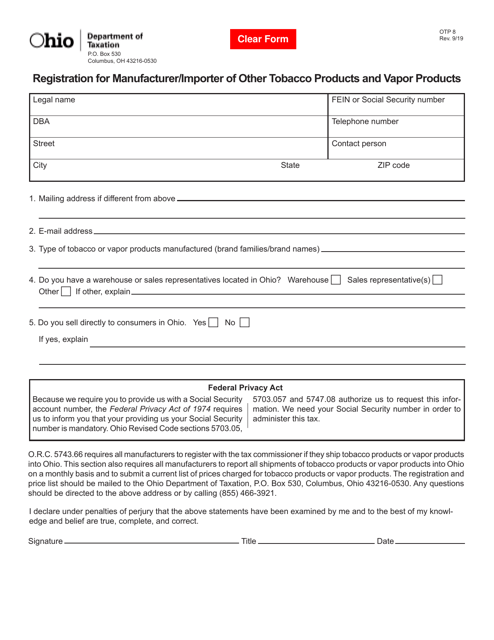

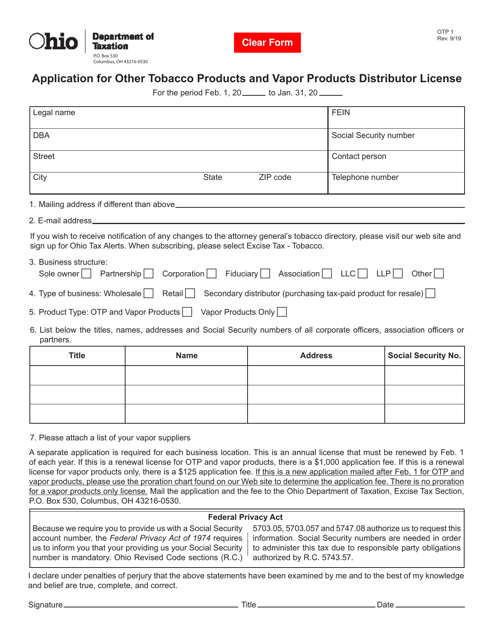

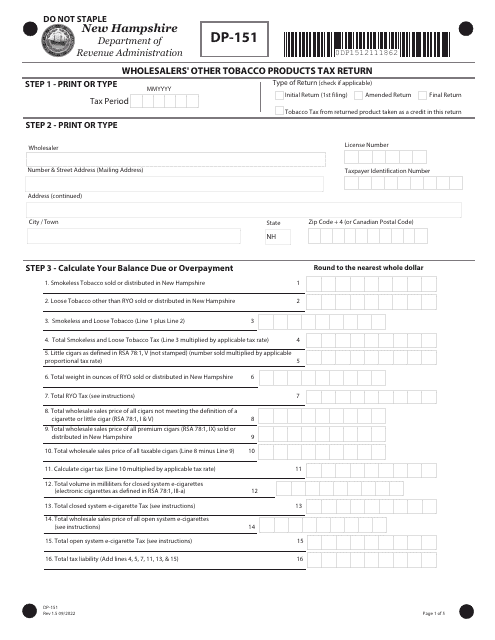

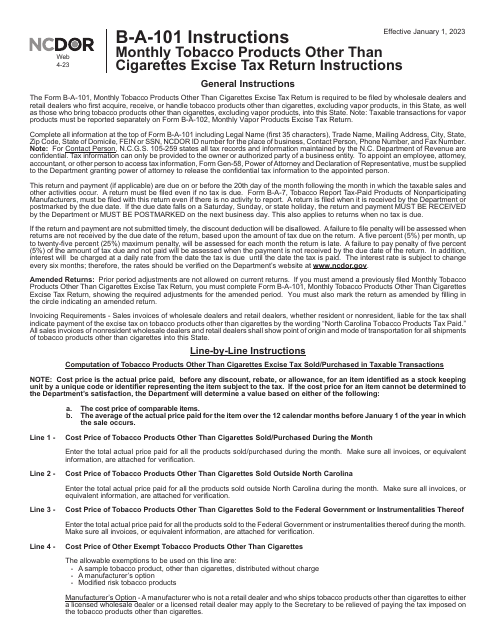

At our webpage, you can find a variety of resources related to OTPs. We provide comprehensive guides and forms to help you understand the licensing and taxation requirements for OTP distributors and retailers. For instance, we have forms like State Form 50831 (OTP-902) Other Tobacco Products Distributor's License Bond in Indiana, Form OTP-6 Other Tobacco Products (OTPs) Tax Return in Ohio, Form OTP1 Application for Other Tobacco Products and Vapor ProductsDistributor License also in Ohio, Form DP-151 Wholesalers' Other Tobacco Products Tax Return in New Hampshire, and Form OTP-1A (State Form 55535) Application for Other Tobacco Products/Taxable Products Distributor's License in Indiana.

Our webpage offers detailed information on the application process for obtaining OTP licenses, as well as advice on compliance with state and federal regulations. We understand that navigating the complexities of OTP regulations can be overwhelming, so we strive to provide clear and concise information to make the process easier for you.

Whether you are a distributor, retailer, or an individual looking for information on OTPs, our webpage is your one-stop resource center. Stay informed and compliant with the latest laws and requirements regarding other tobacco products. Browse through our collection of documents and resources related to OTPs, and let us help you navigate the regulatory landscape of other tobacco products.

Please note that the documents listed above are just a few examples of what you can find on our webpage. We have an extensive collection of forms, guides, and resources to assist you. So, explore our site today and gain the knowledge you need to comply with OTP regulations effectively.

Documents:

40

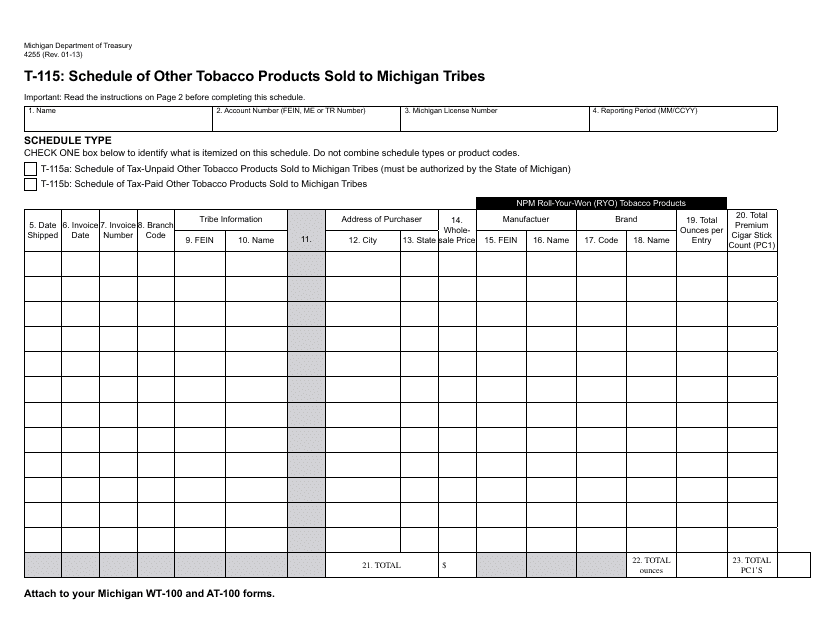

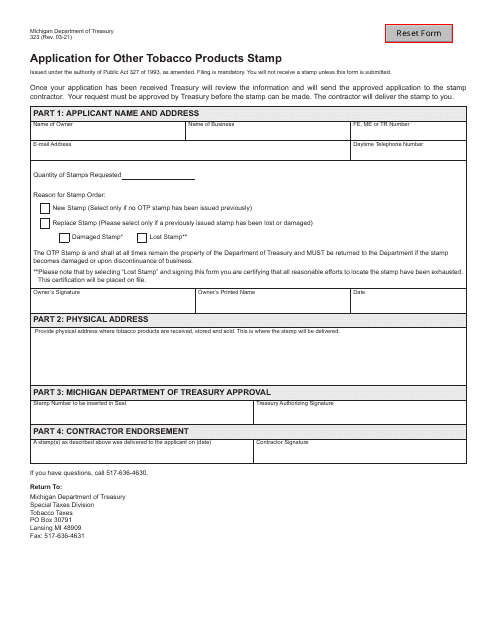

This form is used for reporting the sale of other tobacco products to Michigan tribes.

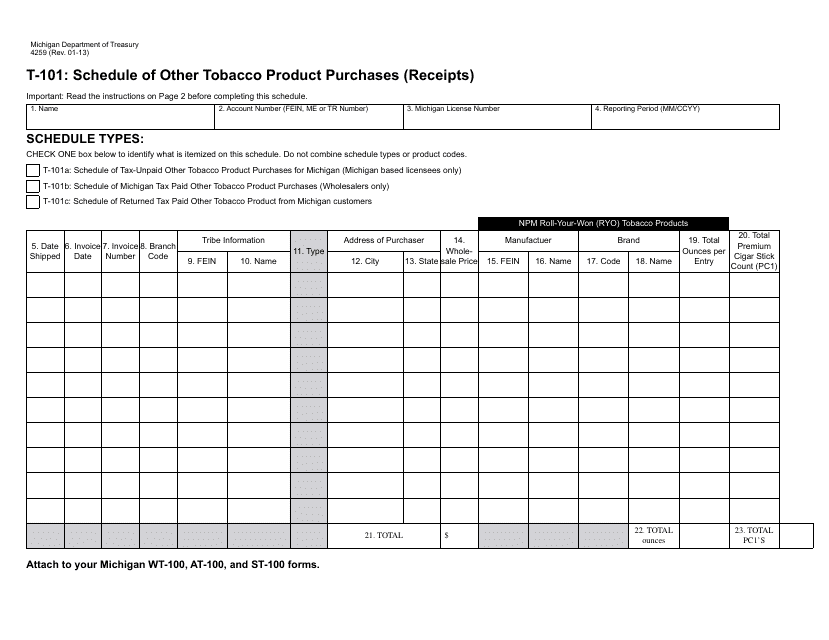

This form is used for reporting the purchase and receipt of other tobacco products in the state of Michigan.

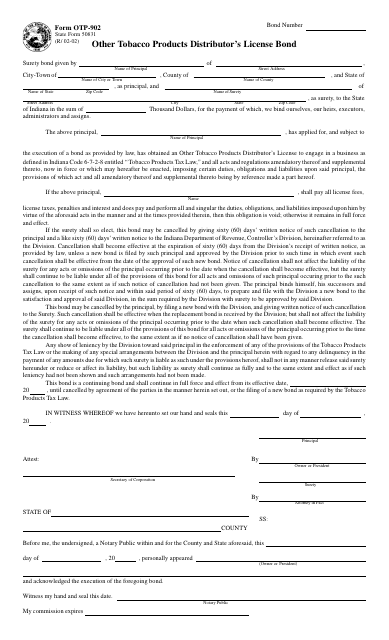

This Form is used for obtaining a distributor's license bond for selling Other Tobacco Products in Indiana.

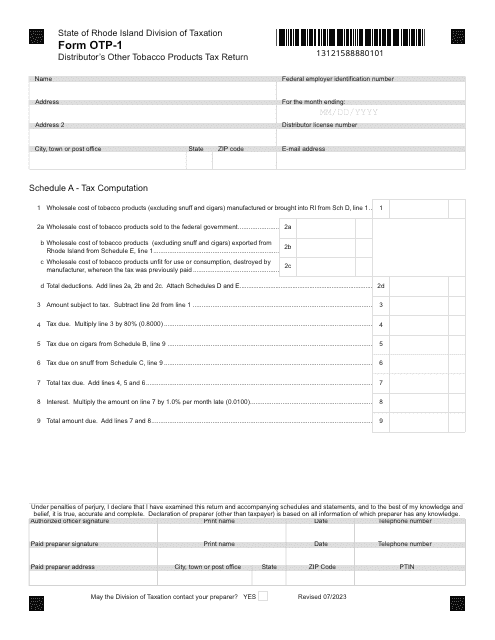

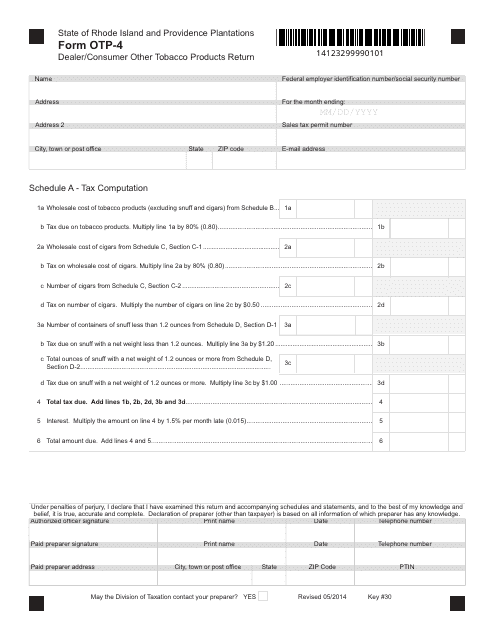

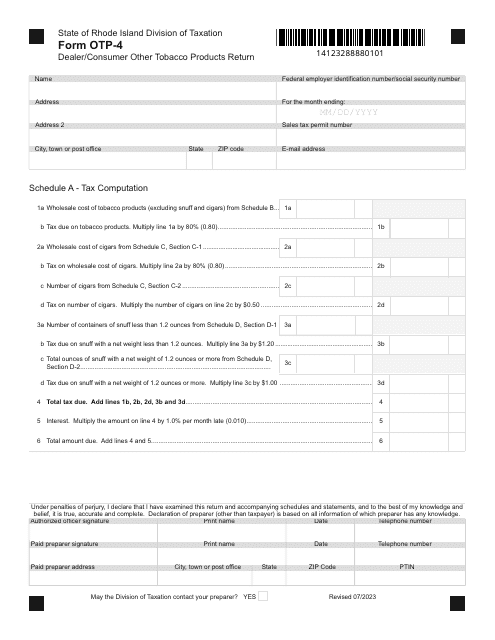

This form is used for Rhode Island dealers and consumers to report and return other tobacco products.

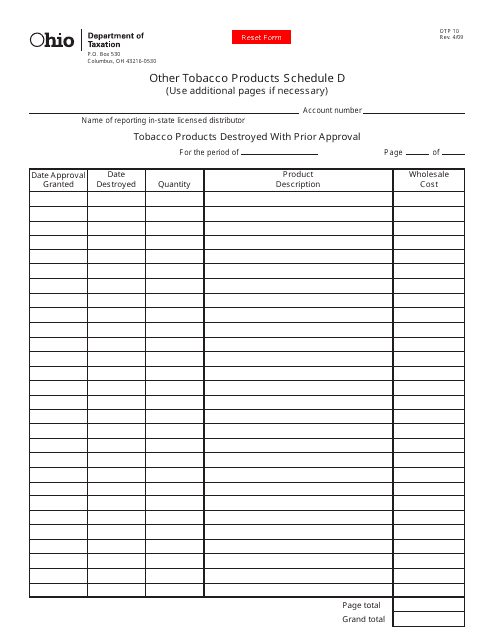

Form OTP10 Other Tobacco Products Schedule D - Tobacco Products Destroyed With Prior Approval - Ohio

This Form is used for reporting tobacco products that have been destroyed with prior approval in the state of Ohio.

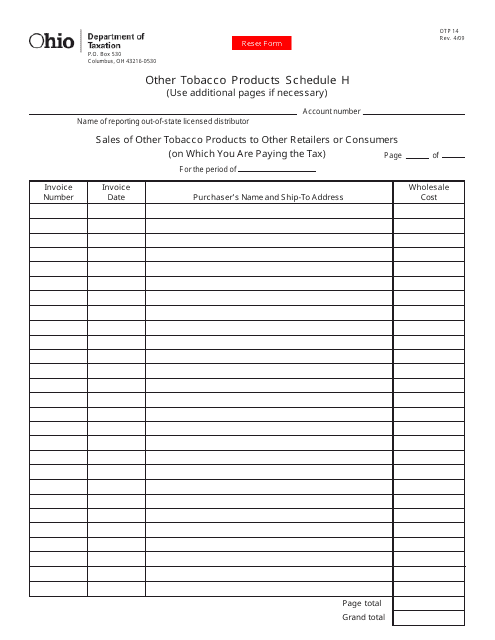

This document form is used for reporting sales of other tobacco products to other retailers or consumers in Ohio, on which you are paying the tax.

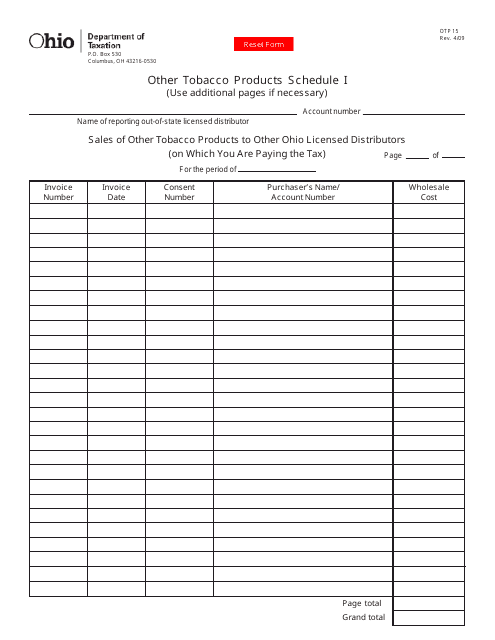

This form is used for reporting and scheduling other tobacco products in Ohio, as required by law. It is part of the state's efforts to regulate the sale and distribution of tobacco products.

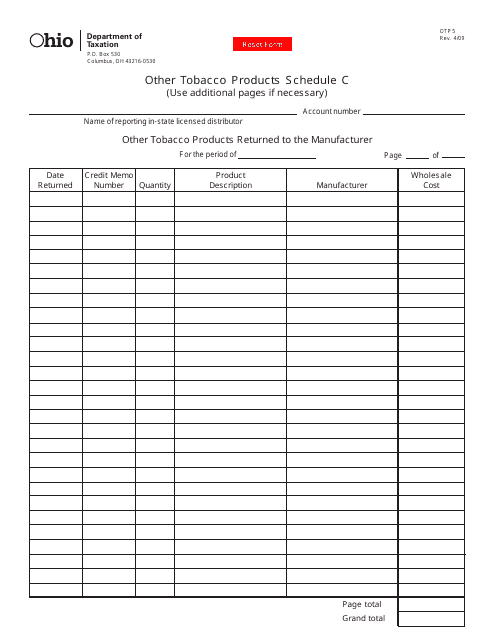

This form is used for reporting other tobacco products sales in Ohio. It is specifically for Schedule C of the OTP5 form.

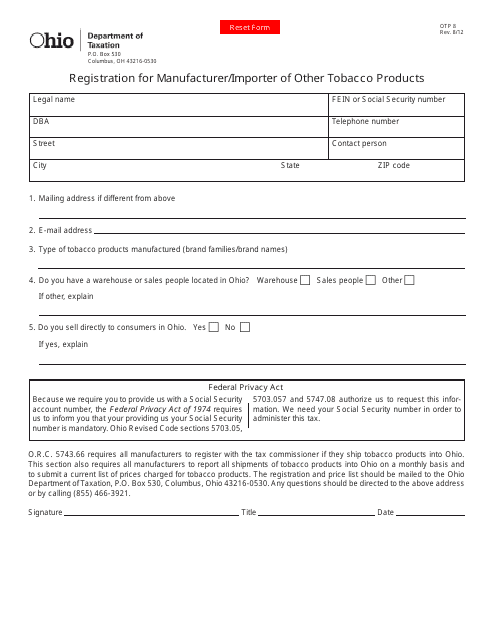

This form is used for registering as a manufacturer or importer of other tobacco products in Ohio.

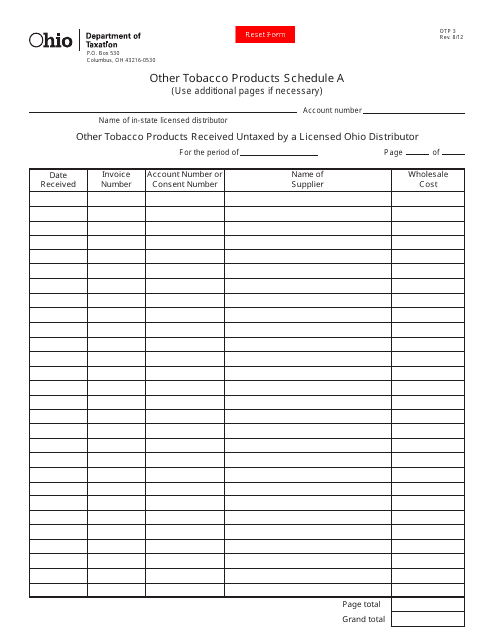

This form is used for reporting other tobacco products received untaxed by a licensed Ohio distributor in Ohio.

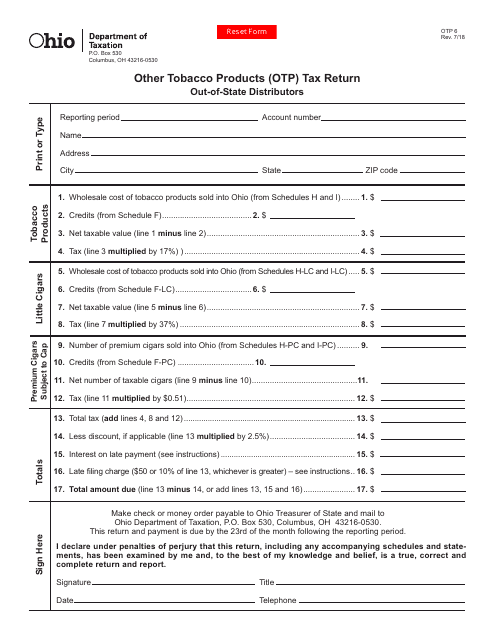

This form is used for reporting and paying taxes on other tobacco products in the state of Ohio.

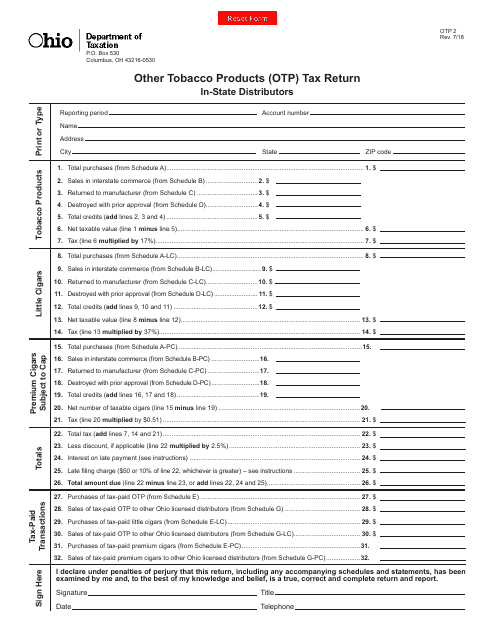

This Form is used for in-state distributors in Ohio to file their Other Tobacco Products (OTP) Tax Return.

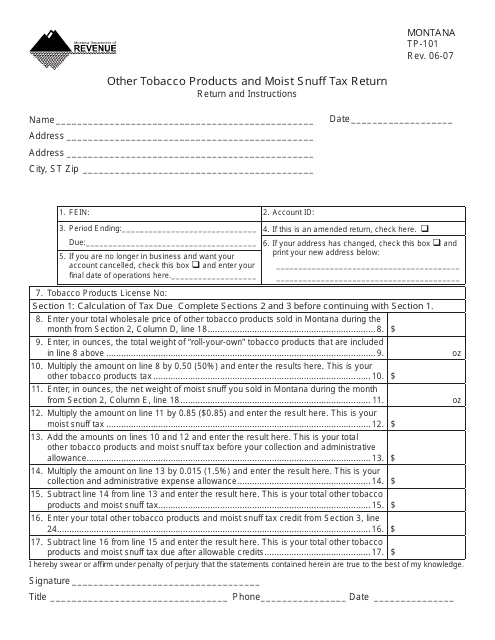

This form is used for reporting and paying taxes on other tobacco products and moist snuff in the state of Montana.

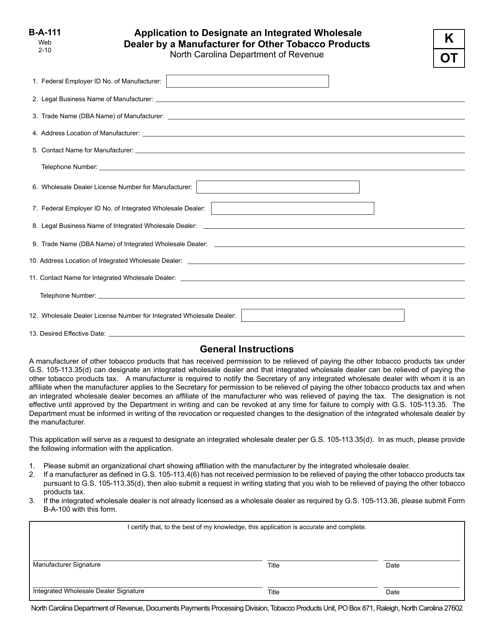

This form is used for manufacturers of other tobacco products in North Carolina to apply for designation as an integrated wholesale dealer.

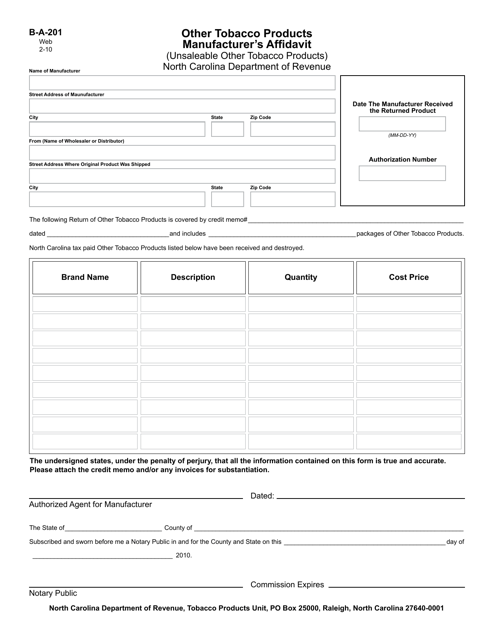

This form is used for other tobacco product manufacturers in North Carolina to submit an affidavit for unsaleable products.

Form OTP8 Registration for Manufacturer/Importer of Other Tobacco Products and Vapor Products - Ohio

This Form is used for registering manufacturers and importers of other tobacco products and vapor products in Ohio.

This form is used for applying for a distributor license for other tobacco products and vapor products in the state of Ohio.

This form is used for applying for a refund on the excise tax paid for other tobacco products in North Carolina, when those products have been returned to the manufacturer.

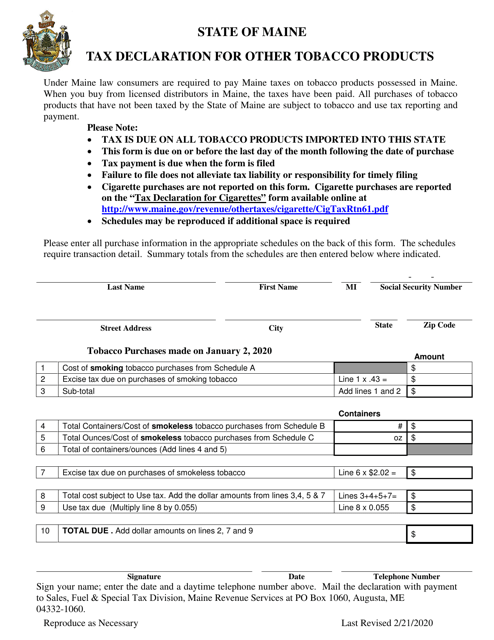

This document is used to declare taxes on other tobacco products in the state of Maine.

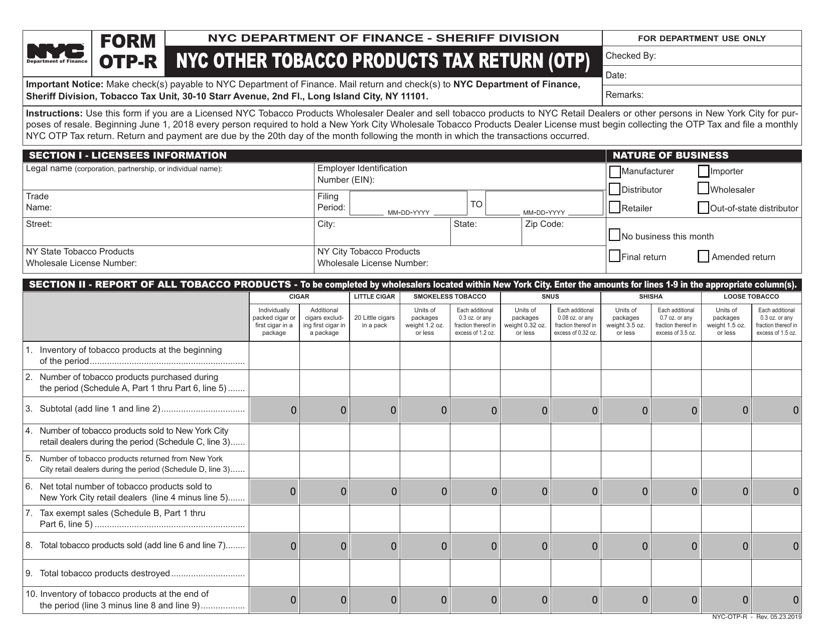

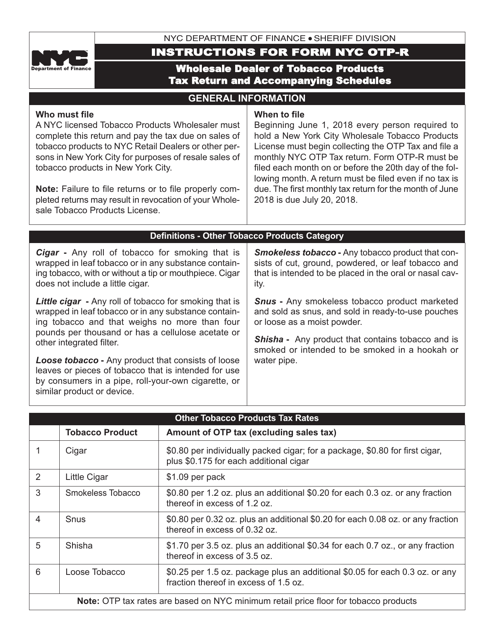

This Form is used for filing the Other Tobacco Products Tax Return (OTP) in New York City. It provides instructions on how to properly complete and submit the form for the payment of taxes on other tobacco products.

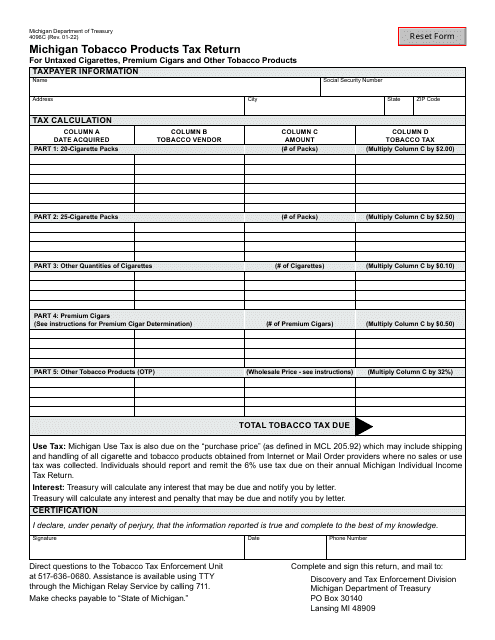

This form is used for reporting and paying taxes on untaxed cigarettes, premium cigars, and other tobacco products in the state of Michigan.

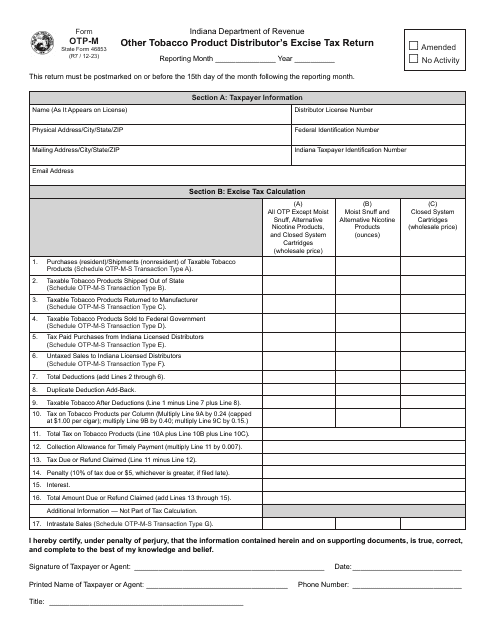

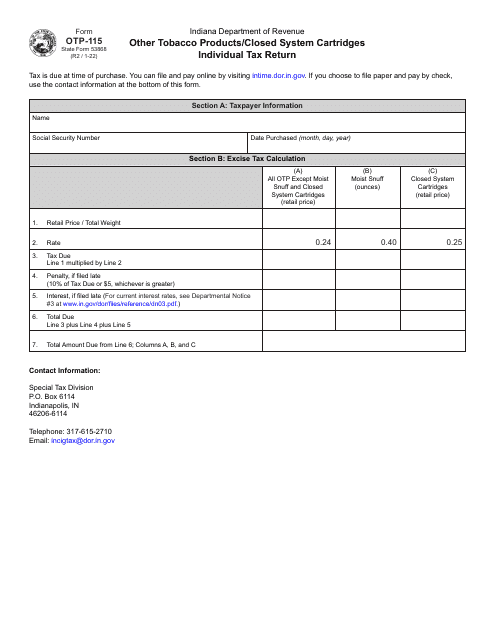

This form is used for filing an individual tax return for other tobacco products and closed system cartridges in the state of Indiana.

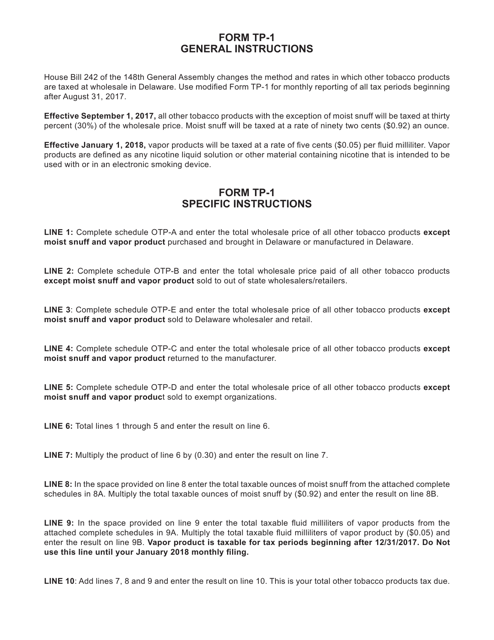

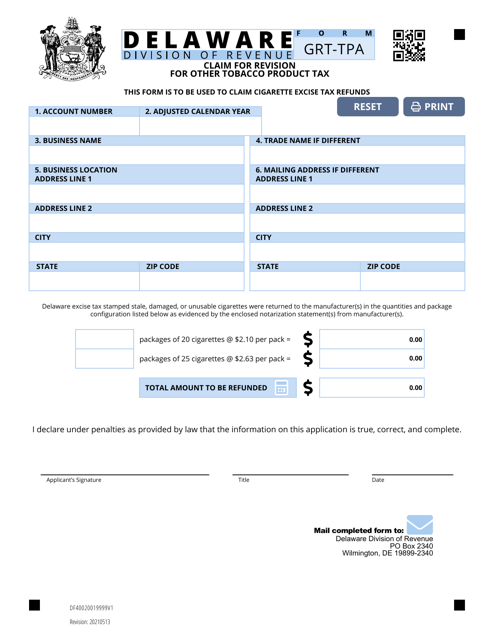

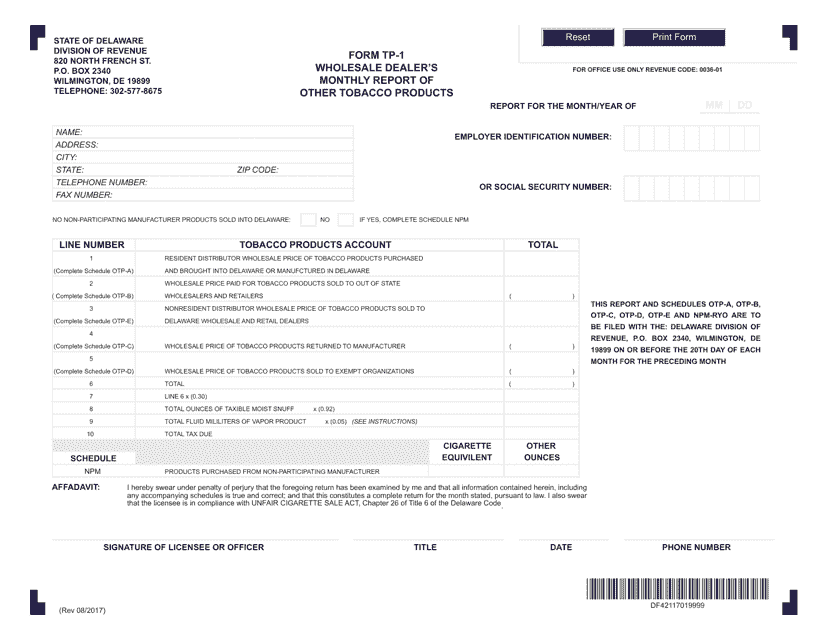

This form is used for wholesale dealers in Delaware to report their monthly sales of other tobacco products.