Governmental Entity Templates

Are you looking for information on governmental entities? Look no further! This webpage serves as your comprehensive guide to all things related to governmental entities, also known as governmental entity or governmental entities.

What is a governmental entity, you may ask? A governmental entity refers to any organization or institution that is established and operated by the government. These entities play a crucial role in the functioning of a country, state, province, or city, as they are responsible for implementing and enforcing various laws and regulations.

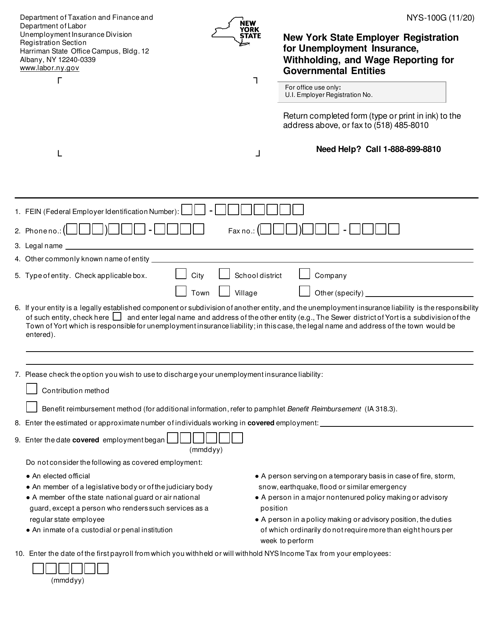

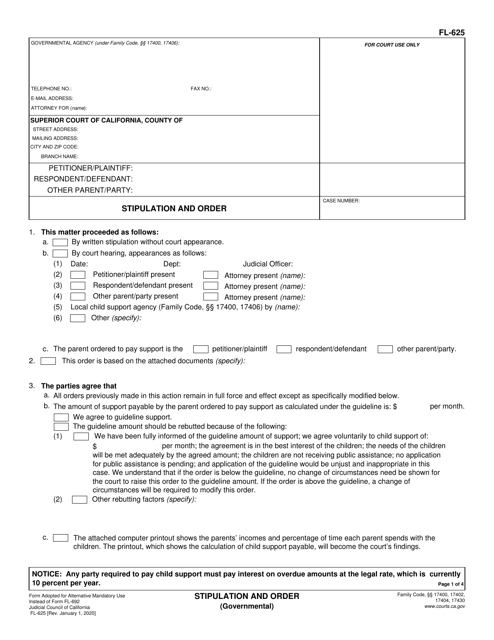

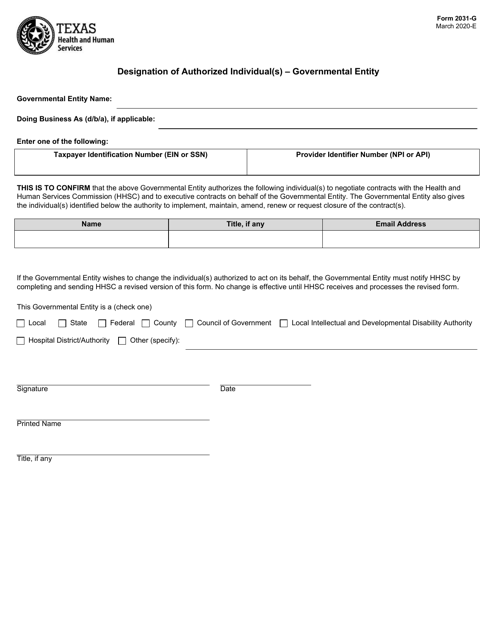

Whether you are a nonprofit organization or a government agency, there are certain documents that you may need to be familiar with. For instance, in North Carolina, you may come across the "Form E-585 Nonprofit and Governmental Entity Claim for Refund State, County, and Transit Sales and Use Taxes", which is used to claim a refund on sales and use taxes. Meanwhile, in Texas, you might need to fill out the "Form 2031-G Designation of Authorized Individual(S) - Governmental Entity" to designate authorized individuals within your governmental entity.

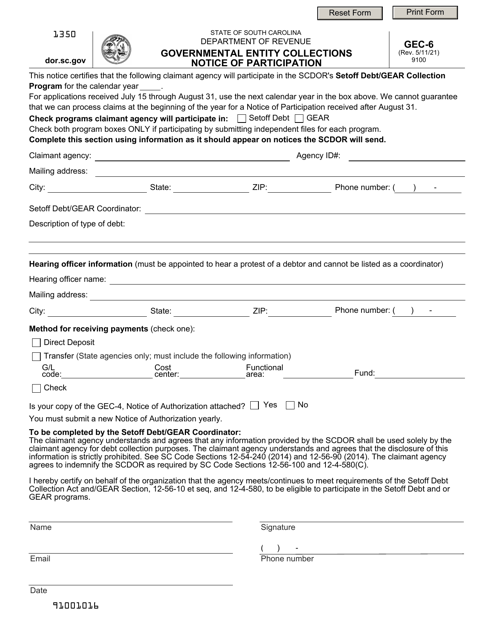

It is important to note that different states may have their own specific forms and procedures for governmental entities. For example, in South Carolina, a governmental entity may receive a "Governmental Entity Collections Notice of Protest by Debtor" or be referred to as a "Designated Governmental Entity".

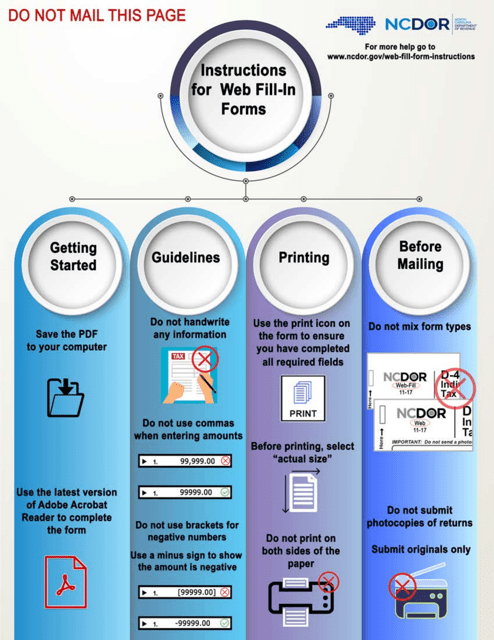

Navigating through the various requirements and paperwork for governmental entities can be complex and overwhelming. That's why this webpage is here to assist you. It provides you with valuable information, resources, and guidance to ensure that you are well-informed and equipped to meet the obligations that come with being a governmental entity.

Whether you are seeking information on taxation, legal requirements, or administrative processes, this webpage has got you covered. Stay up to date with the latest news and changes in government regulations that may impact your organization or agency. Access helpful guides and tools that can simplify your operations and enhance your compliance with governmental regulations.

In conclusion, if you are looking for information on governmental entities, this webpage is the ultimate resource for you. Explore the various documents, forms, and procedures related to governmental entities, and ensure that your organization or agency stays in compliance with government regulations. Empower yourself with the knowledge and tools necessary to navigate the complexities of being a governmental entity.

Documents:

19

This is a North Carolina legal document used to request semiannual refunds of sales and use taxes paid on direct purchases and leases of tangible property and services from the Department of Revenue.

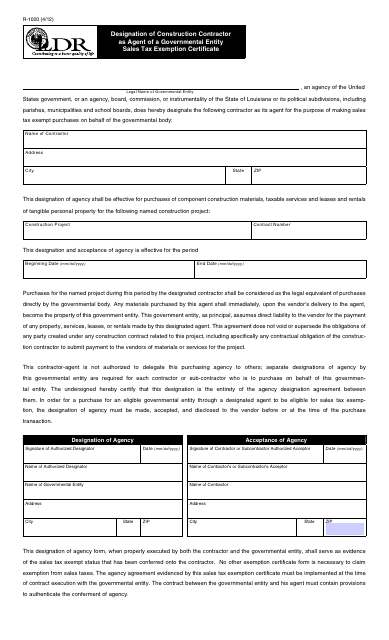

This document certifies that a construction contractor has been designated as an agent of a governmental entity for sales tax exemption in Louisiana.

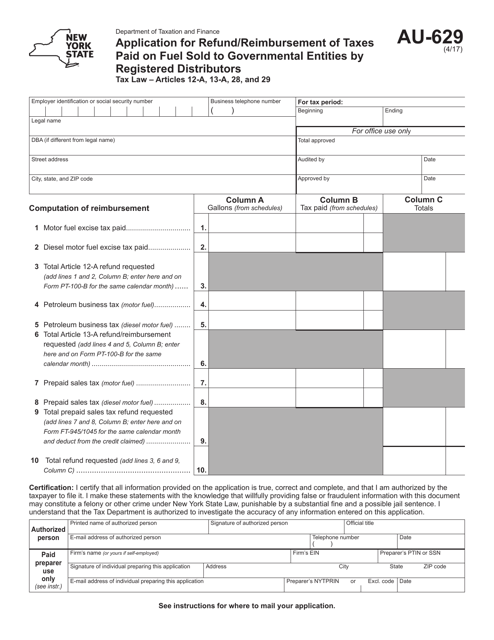

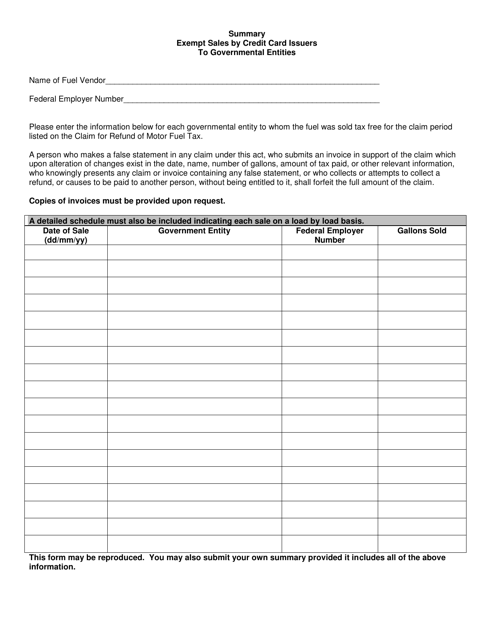

This form is used for applying for a refund or reimbursement of taxes paid on fuel sold to governmental entities by registered distributors in New York.

This form is used for designating authorized individuals within a governmental entity in Texas.

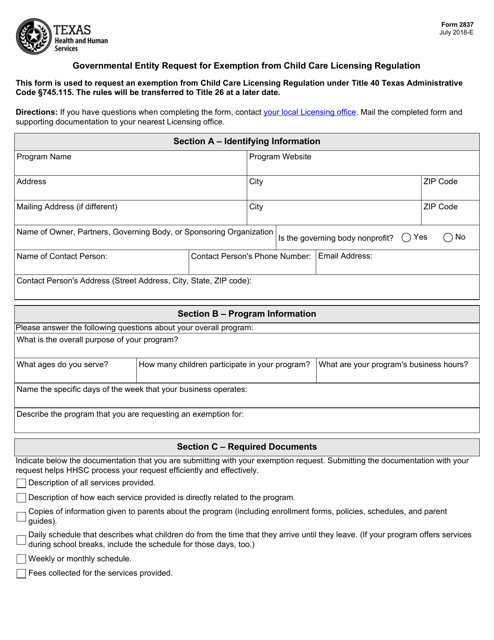

This document is used for governmental entities in Texas to request an exemption from child care licensing regulations.

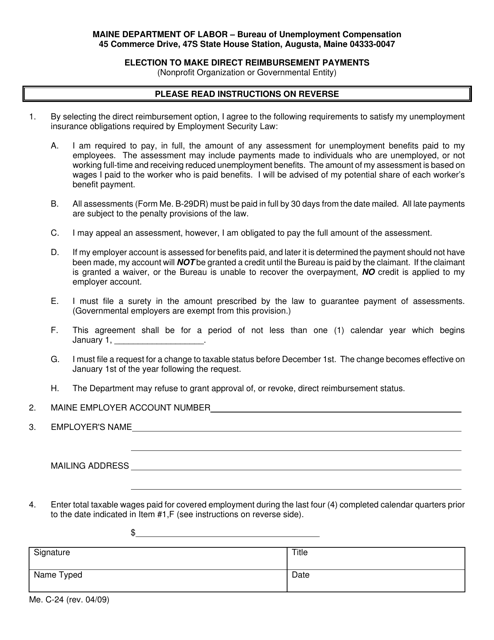

This form is used for making direct reimbursement payments by nonprofit organizations or governmental entities in Maine.

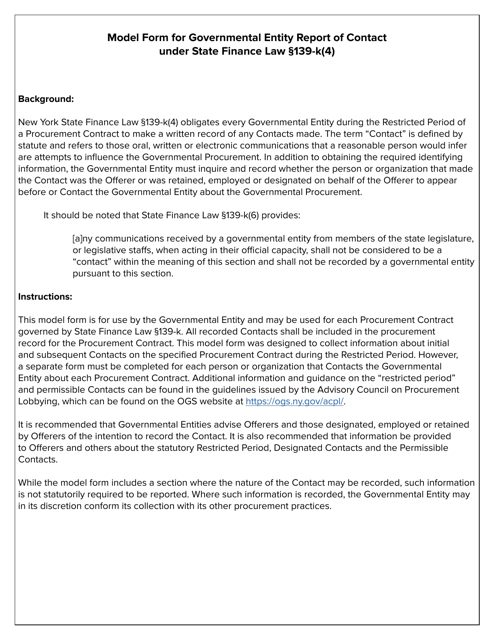

This form is used for governmental entities to report contact made under State Finance Law 139-k(4) in New York.

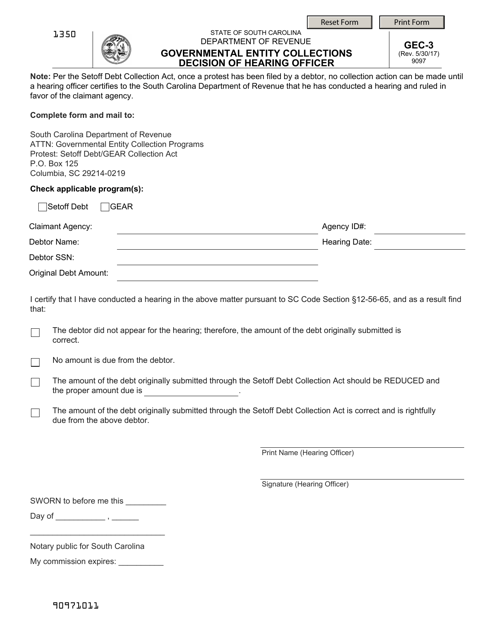

This Form is used for the decision made by a hearing officer regarding collections made by a governmental entity in South Carolina.

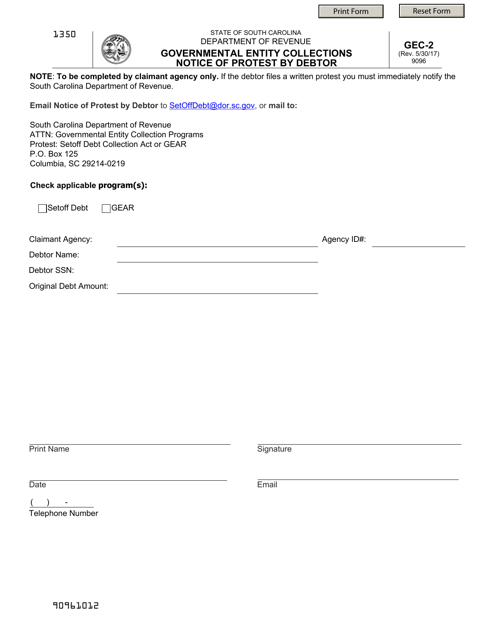

This form is used for debtors in South Carolina to file a protest against a governmental entity collections notice.

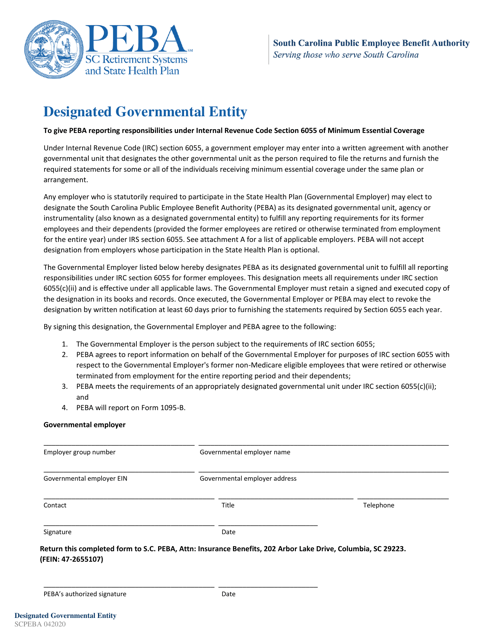

This document is for the Designated Governmental Entity in South Carolina. It refers to a specific government agency or organization authorized to carry out certain functions or responsibilities within the state of South Carolina.

This form is used for notifying governmental entities in South Carolina of their participation in collections.

This document provides a summary of exempt sales made by credit card issuers to governmental entities in the state of Michigan. It highlights the specific sales that are exempt from certain taxes and provides important information for credit card issuers and governmental entities.

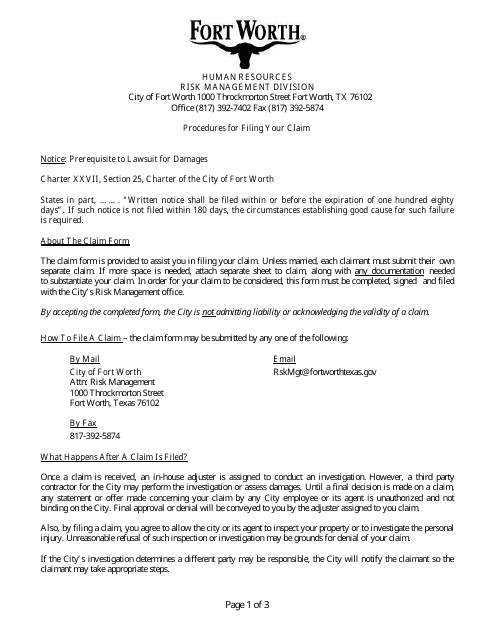

This document is used for filing a claim for damages against the City of Fort Worth, Texas.