International Fuel Tax Agreement Templates

Documents:

61

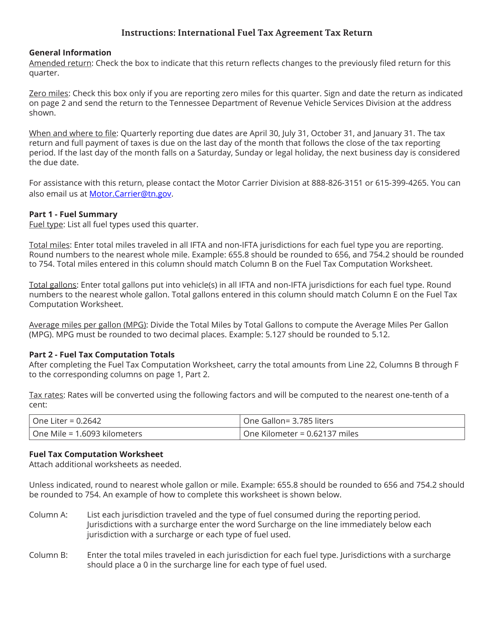

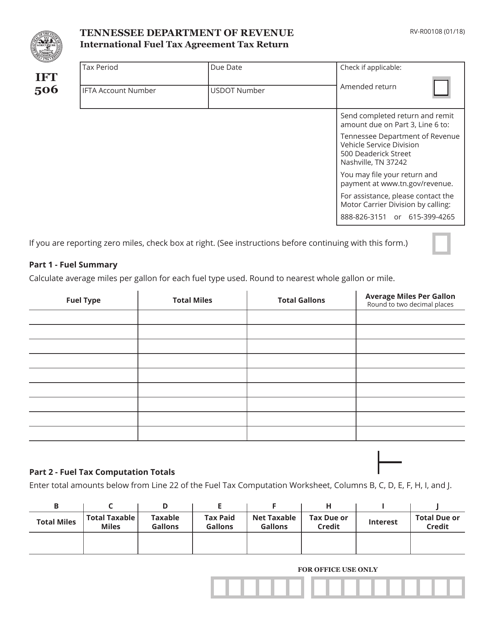

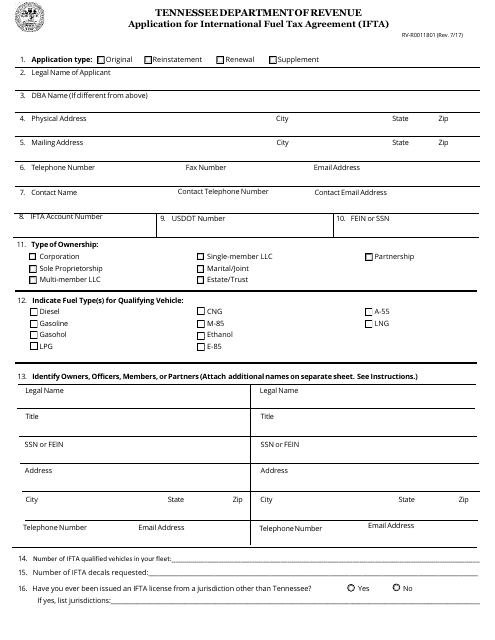

This document is used for filing the International Fuel Tax Agreement Tax Return specifically for the state of Tennessee. It provides instructions on how to properly complete and submit the form.

This Form is used for filing the International Fuel Tax Agreement Tax Return specifically for the state of Tennessee.

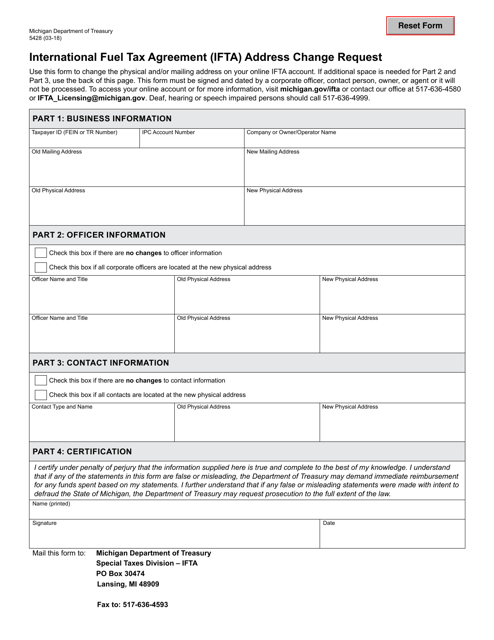

This Form is used for requesting an address change for the International Fuel Tax Agreement (IFTA) in the state of Michigan.

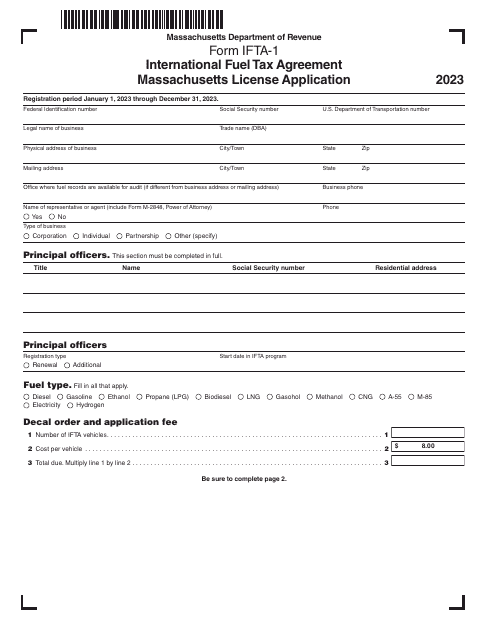

Form IFTA-1 International Fuel Tax Agreement Massachusetts License Application - Massachusetts, 2023

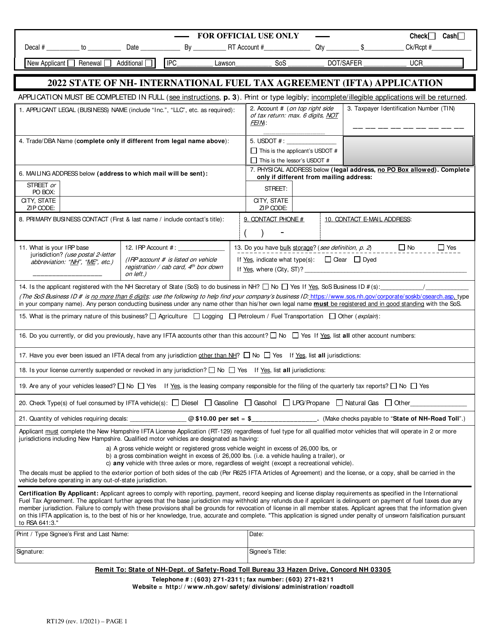

This form is used for applying for the International Fuel Tax Agreement (IFTA) in the state of Tennessee. IFTA is an agreement among the 48 contiguous United States and 10 Canadian provinces that simplifies the reporting and payment of fuel taxes by motor carriers operating in multiple jurisdictions.

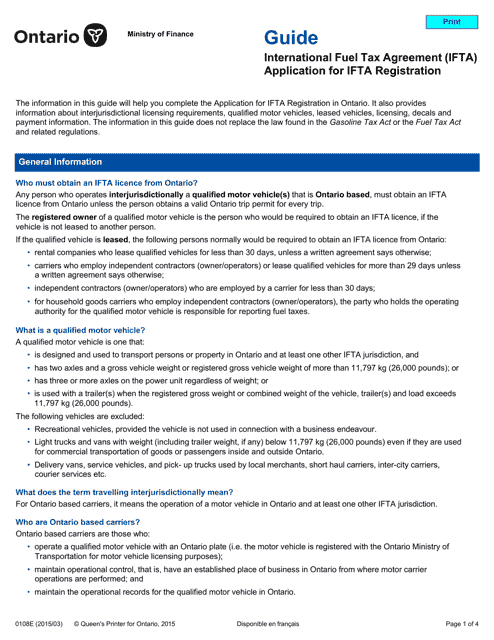

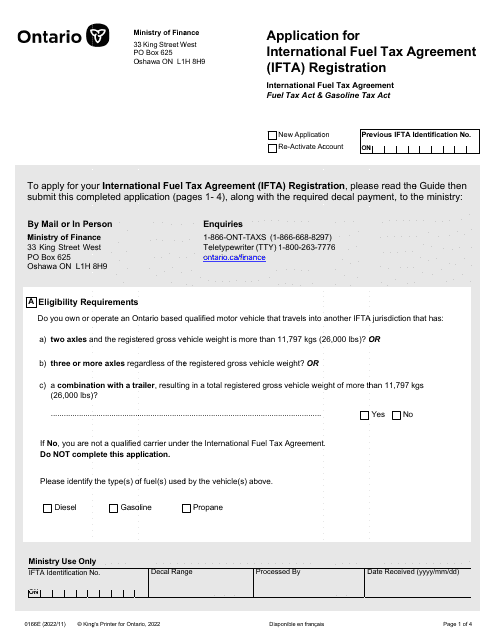

This Form is used for applying for International Fuel Tax Agreement (IFTA) registration in Ontario, Canada. It provides instructions on how to complete the form and apply for IFTA registration. Follow the instructions carefully to ensure a smooth application process.

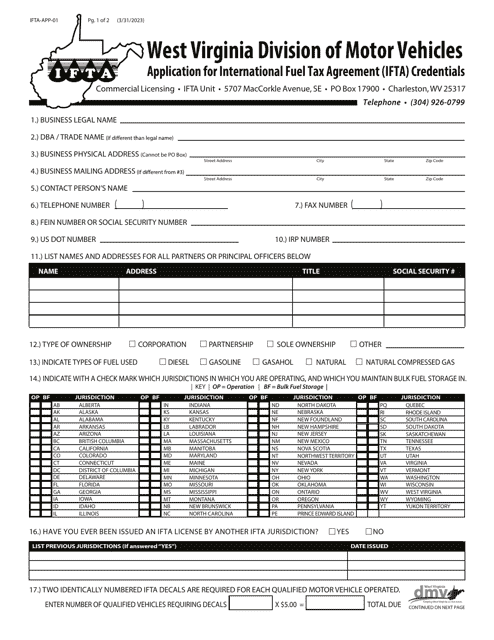

Form IFTA-APP-01 Application for International Fuel Tax Agreement (Ifta) Credentials - West Virginia

This Form is used for applying for International Fuel Tax Agreement (IFTA) credentials in West Virginia.

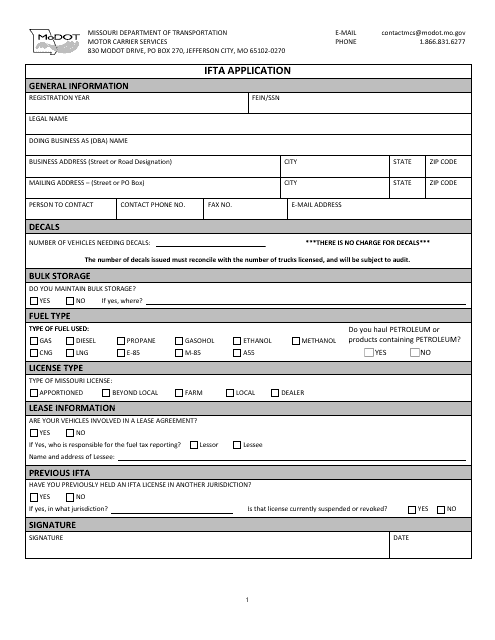

This document is used to apply for the International Fuel Tax Agreement (IFTA) in the state of Missouri. IFTA is an agreement among several US states and Canadian provinces to simplify the reporting and payment of fuel taxes by interstate motor carriers.

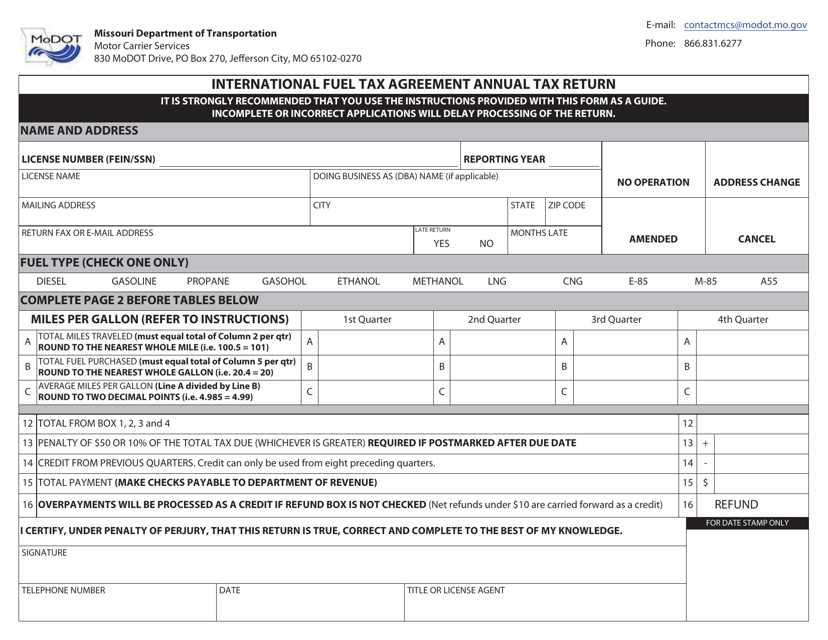

This document is used for filing the annual tax return related to the International Fuel Tax Agreement in the state of Missouri.

This Form is used for applying for International Fuel Tax Agreement (IFTA) Registration in Ontario, Canada.