Deemed Resident Templates

As a deemed resident, you may have specific tax obligations and benefits that apply to your situation. Whether you are a non-resident or a deemed resident of Canada, it's important to understand and fulfill your tax responsibilities. The Canada Revenue Agency (CRA) offers various forms and certificates to help you navigate this complex process.

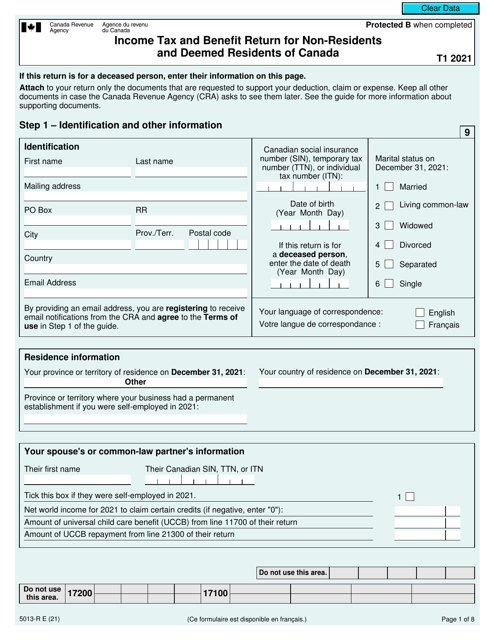

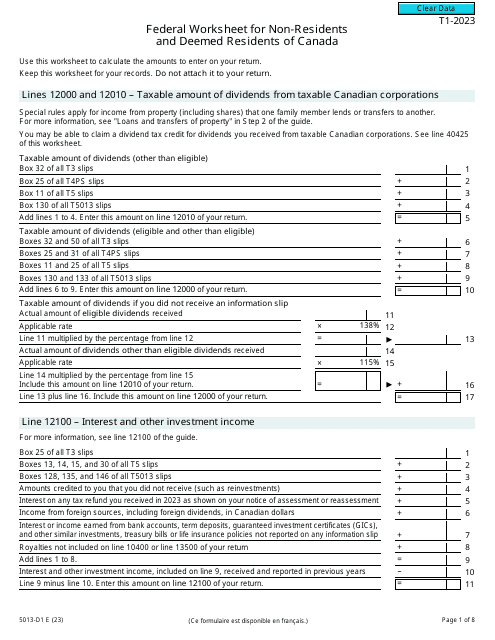

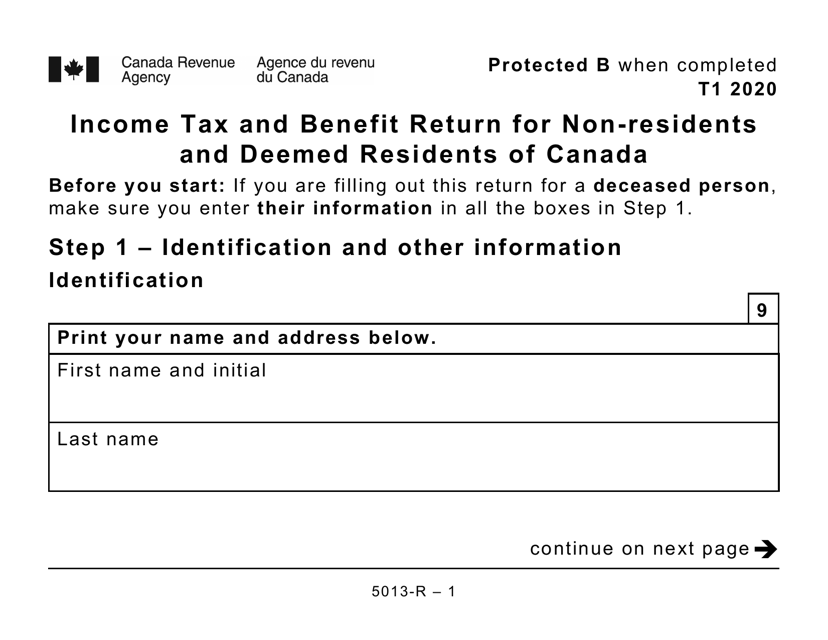

One such document is the Form 5013-R Income Tax and Benefit Return for Non-residents and Deemed Residents of Canada. This form is designed specifically for individuals who are deemed residents for the purpose of taxation. By filling out this form accurately and timely, you can ensure that you are reporting your income correctly and taking advantage of any applicable tax benefits.

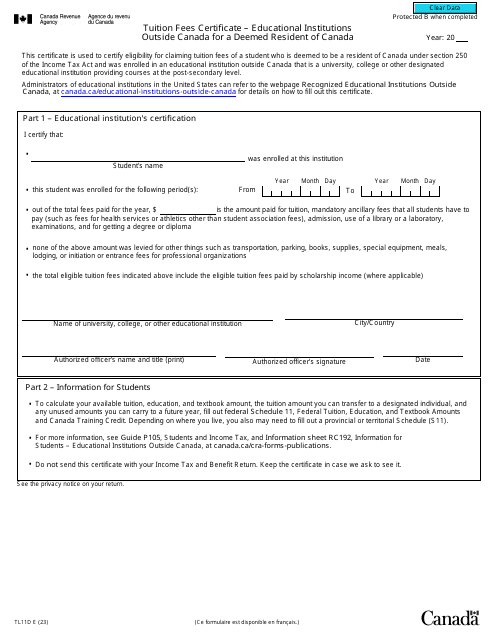

Another important document is the Form TL11D Tuition Fees Certificate - Educational Institutions Outside Canada for a Deemed Resident of Canada. This form is specifically for deemed residents who have paid tuition fees at educational institutions outside of Canada. By submitting this form, you can claim eligible tuition expenses and potentially reduce your tax liability.

At times, navigating the tax landscape as a deemed resident can be challenging. However, the CRA provides resources and support to help you understand your obligations. In addition to the documents mentioned above, there are other forms and certificates available to ensure that you meet your tax requirements.

Take advantage of the resources available to you as a deemed resident to ensure that you are fulfilling your tax obligations and maximizing any applicable tax benefits. By understanding and utilizing the appropriate forms and certificates, you can navigate the Canadian tax system with confidence.

Documents:

10

This type of document is used for filing income tax and benefit returns for non-residents and deemed residents of Canada. It is in large print format for easier readability.