Trade Compliance Templates

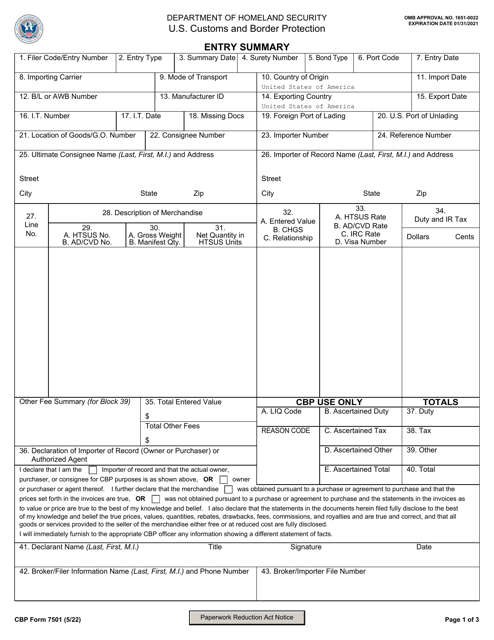

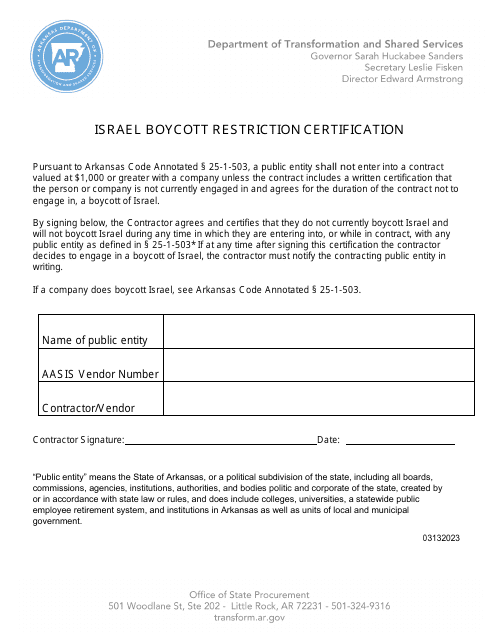

Are you engaged in international trade? Ensuring compliance with trade regulations is crucial to avoid hefty fines and other penalties. Our comprehensive trade compliance solutions offer the support you need to navigate the complex web of regulations and document requirements. Whether it's the Israel Boycott Restriction Certification in Arkansas or CBP Form 7501 Entry Summary, we have the expertise to guide you through the process.

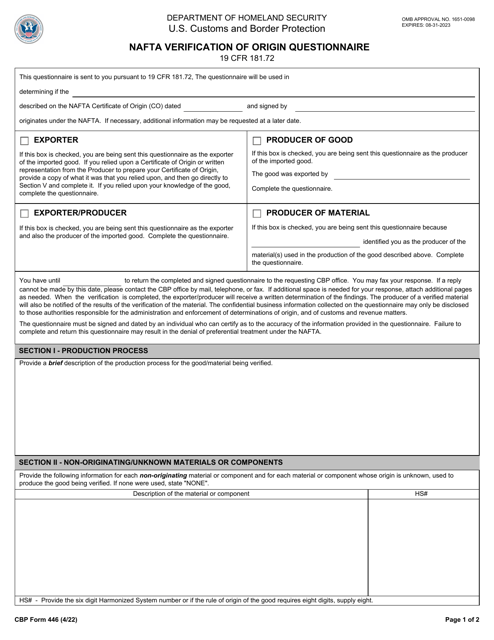

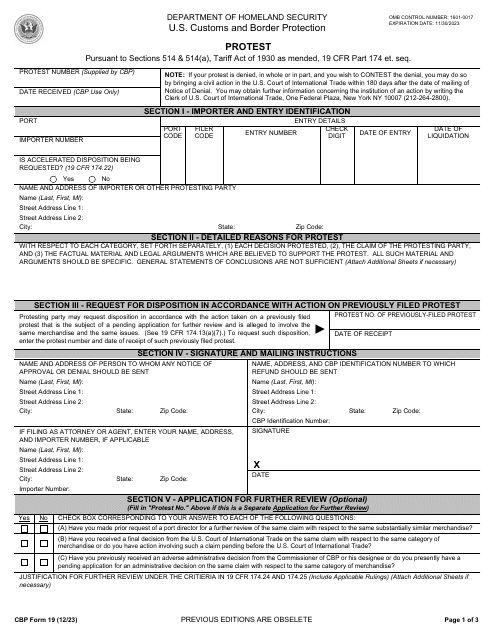

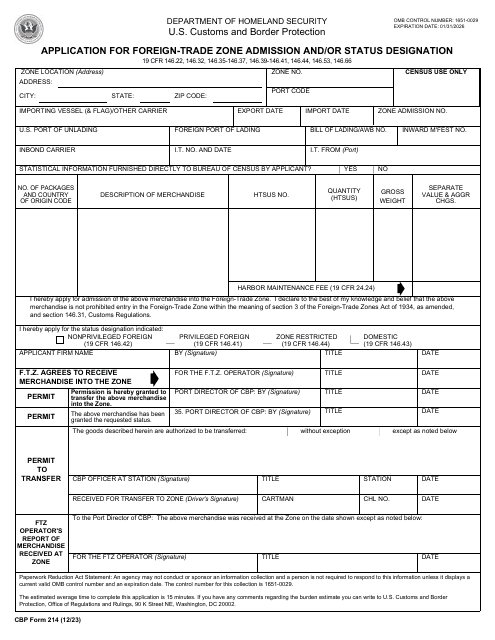

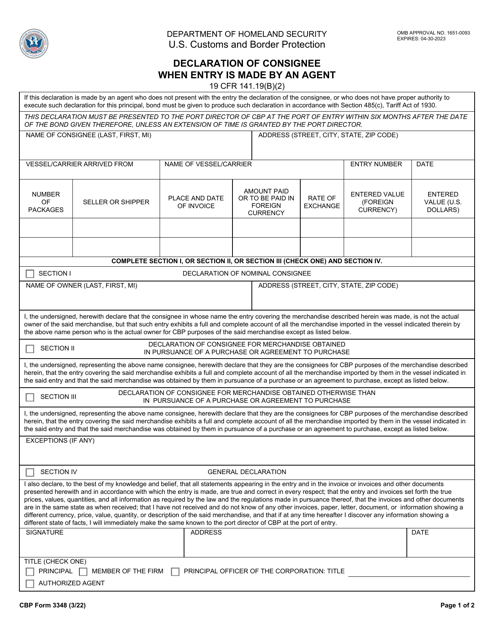

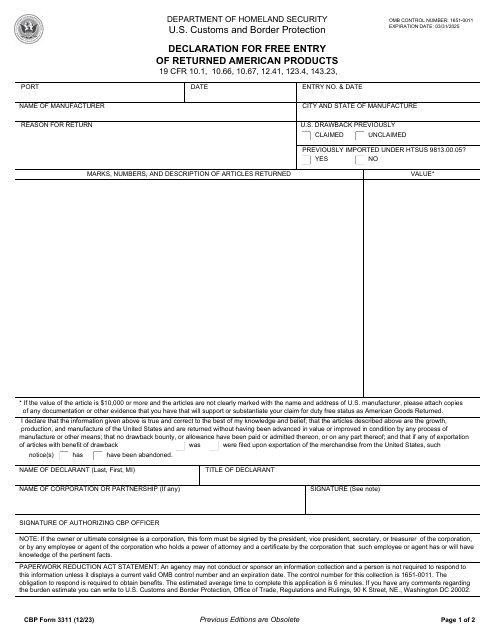

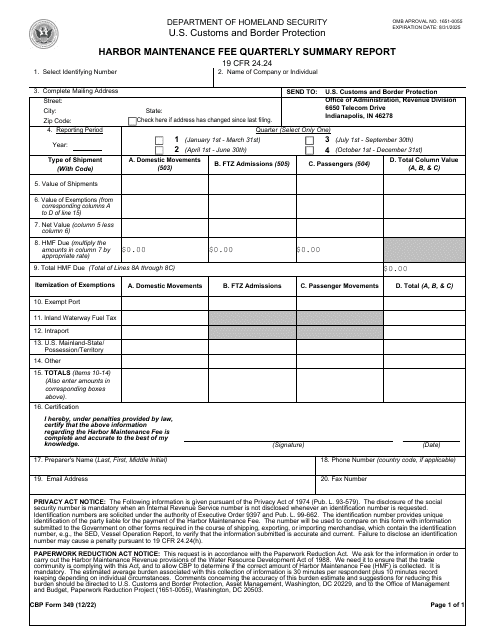

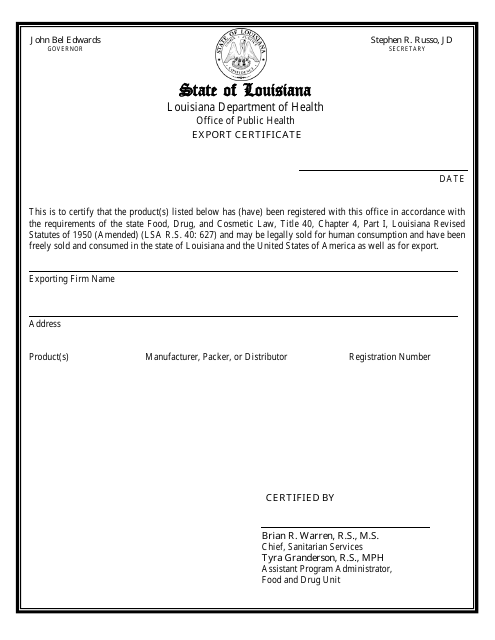

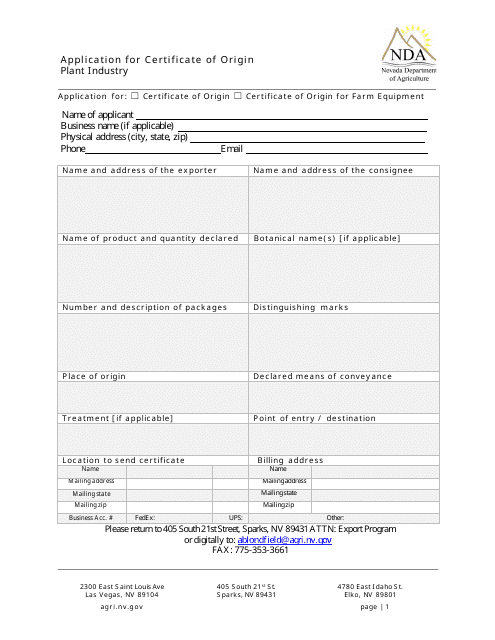

Our services cover a wide range of trade compliance documents, such as the CBP Form 349 Harbor Maintenance Fee Quarterly Summary Report and Form FD-37 Export Certificate in Louisiana. We also provide assistance with applications for a Certificate of Origin in Nevada and other essential documents. With our guidance, you can streamline your trade operations and ensure your compliance with all relevant regulations.

Trade compliance, sometimes referred to as trade regulation adherence, is an essential aspect of international business. By adhering to the required paperwork, you can minimize the risk of delays, customs issues, and non-compliance penalties. Our team of experts is well-versed in the intricacies of trade compliance and can help you navigate the documentation maze.

Whether you're a small business or a multinational corporation, our trade compliance services are tailored to meet your specific needs. From assisting with completing forms and certifications to offering guidance on best practices, we're here to simplify the trade compliance process for you.

Don't let trade compliance hold you back. Contact us today to learn more about how our services can help you stay on top of your trade documentation requirements and ensure a seamless international trade experience.

Documents:

23

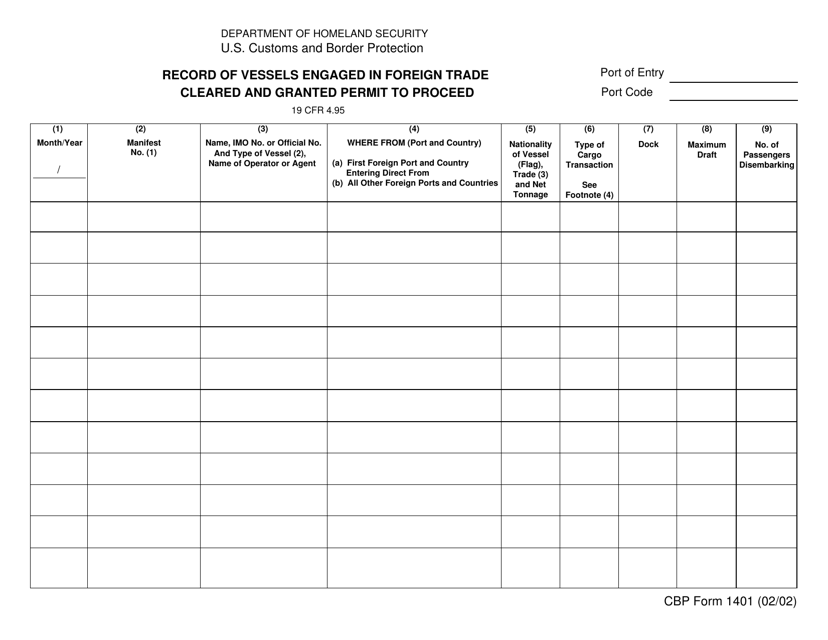

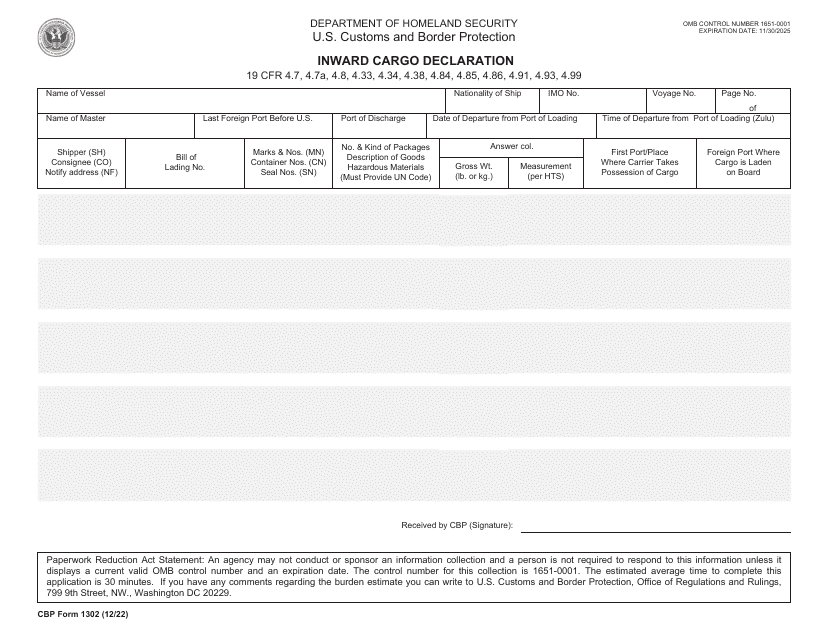

This form is used for keeping a record of vessels engaged in foreign trade that have been cleared and granted permission to proceed. It is a document used by the U.S. Customs and Border Protection (CBP).

This form serves to describe relevant information about the imported commodity, such as its origin, classification, and appraisement. The information is used to record the amount of tax and duty paid.

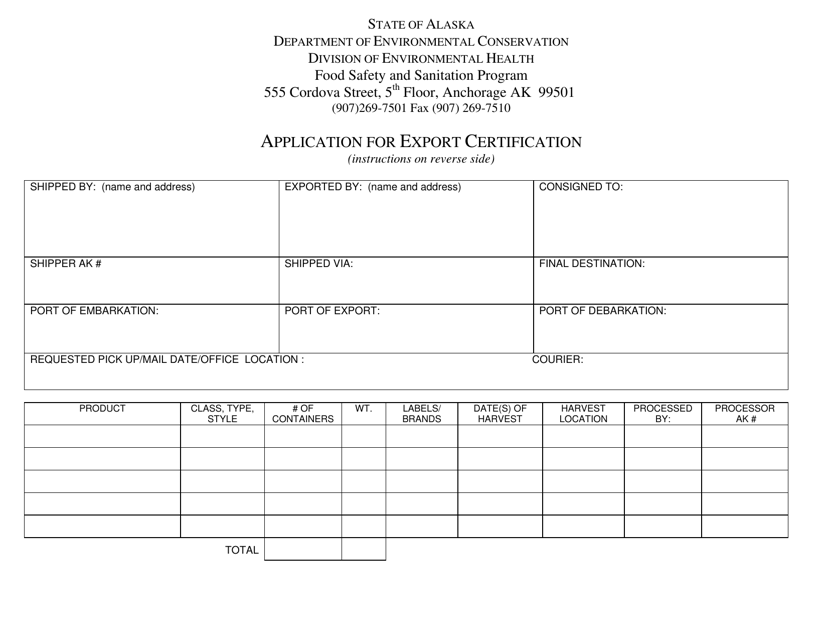

This form is used for applying for an export certification in Alaska. It is required when exporting goods from Alaska to other countries.

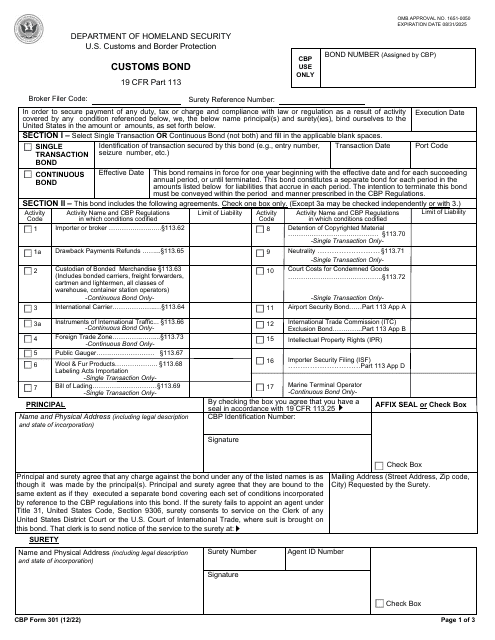

This form is an agreement between a principal, obligee, and surety. Fill it out as a proof of payment of fees, taxes, and duties, and to make sure you comply with the law regarding goods and activities.