Payment Arrangement Templates

A payment arrangement, also commonly referred to as a payment plan or payment agreement, is a formal agreement between a payer and a payee to facilitate the payment of a debt or obligation over a specified period of time. This arrangement allows the payer to make scheduled payments towards the total amount owed, helping to alleviate the immediate financial burden.

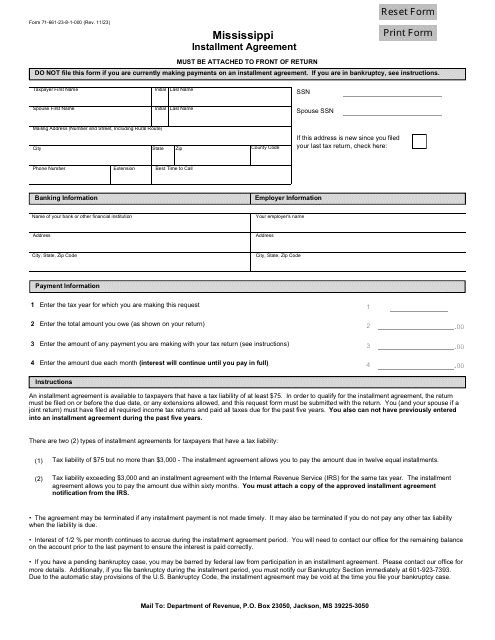

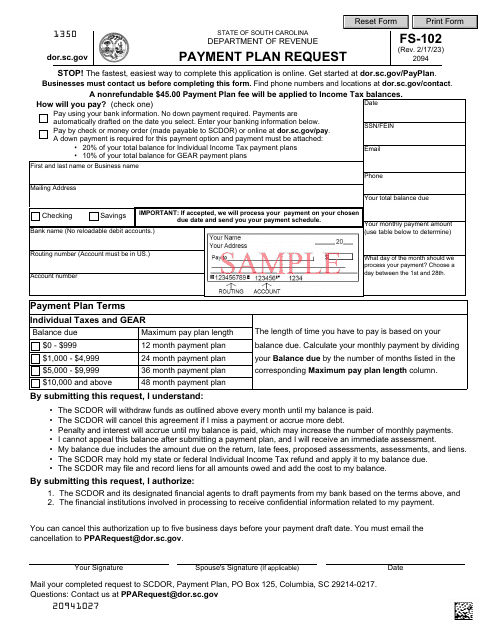

Payment arrangements are used in various scenarios, such as property tax payment agreements, individual income installment requests, and other similar arrangements. These agreements provide a structured framework for individuals and organizations to meet their financial obligations in a more manageable and structured manner.

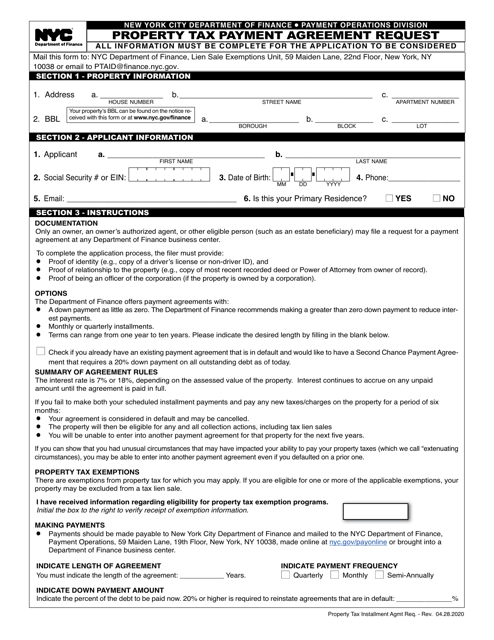

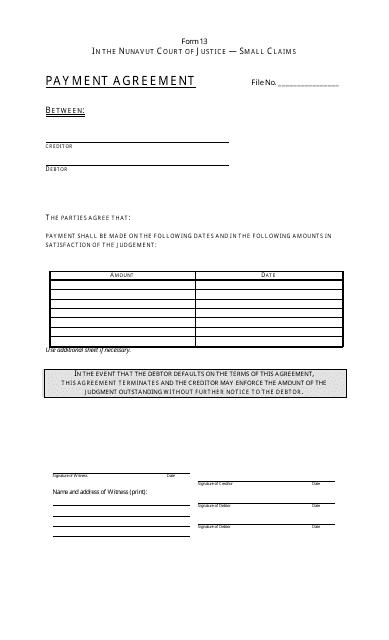

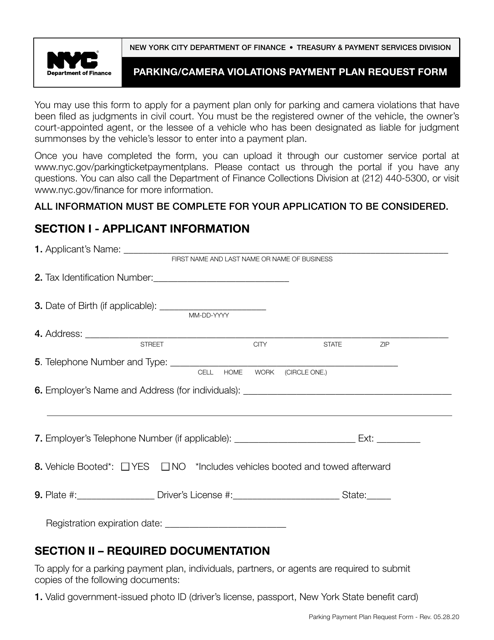

For example, in New York City, property owners can request a Property Tax Payment Agreement. This allows them to spread out their property tax payments over a set period rather than making a lump sum payment. Similarly, in Nunavut, Canada, Form 13 Payment Agreement is used to establish a payment plan for individuals who owe money to the government.

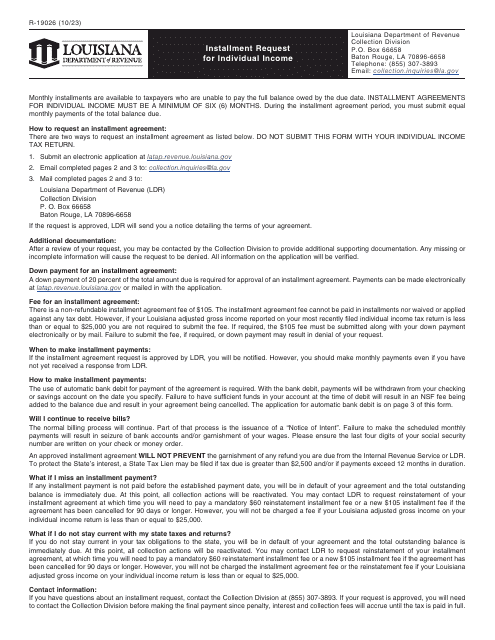

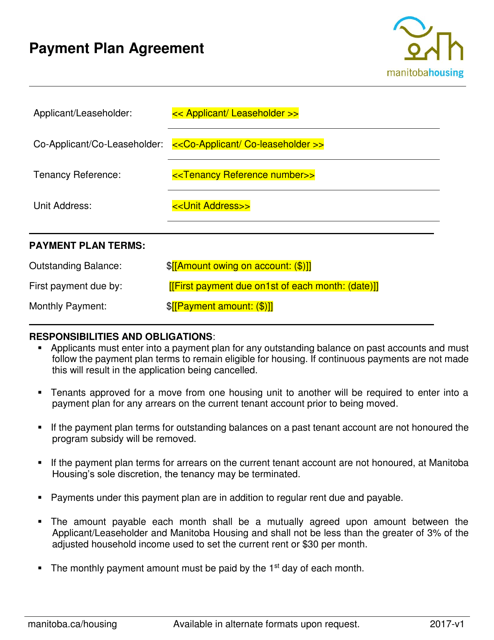

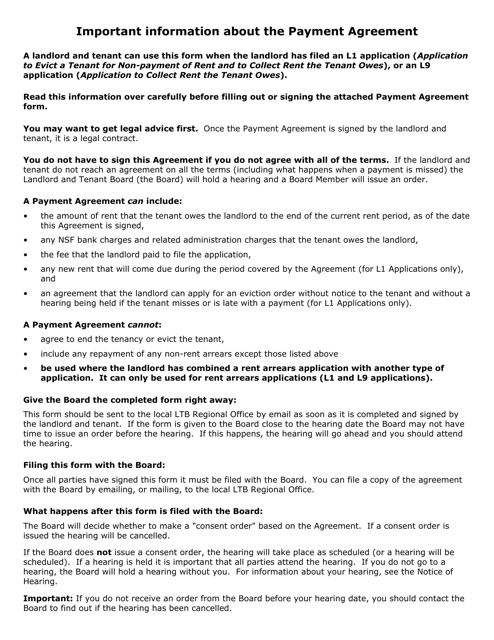

In Louisiana, Form R-19026 Installment Request for Individual Income assists individuals in arranging installment payments for their personal income tax. In Manitoba, Canada, a Payment Plan Agreement is used to establish a payment plan for individuals or businesses with outstanding debts. Ontario, Canada also utilizes a Payment Agreement to facilitate manageable repayment options for individuals or businesses with financial obligations.

Payment arrangements provide flexibility and peace of mind to both parties involved. By formalizing a structured payment schedule, individuals can budget effectively, ensuring that their financial obligations are met without causing undue strain or hardship. At the same time, payees benefit from receiving regular, predictable payments, helping them manage their own financial needs.

Whether it's for property taxes, income tax, or other financial obligations, the use of payment arrangements offers an effective means to manage debt and establish a clear path towards financial stability. These agreements provide a win-win situation for both parties, promoting financial responsibility and ensuring that debts are promptly and conveniently addressed.

If you find yourself in a situation where you require assistance in managing your financial obligations, consider exploring the option of a payment arrangement or payment plan. It is always advisable to consult with the relevant authorities or seek professional advice to understand the specific process and requirements applicable in your jurisdiction.

Documents:

17

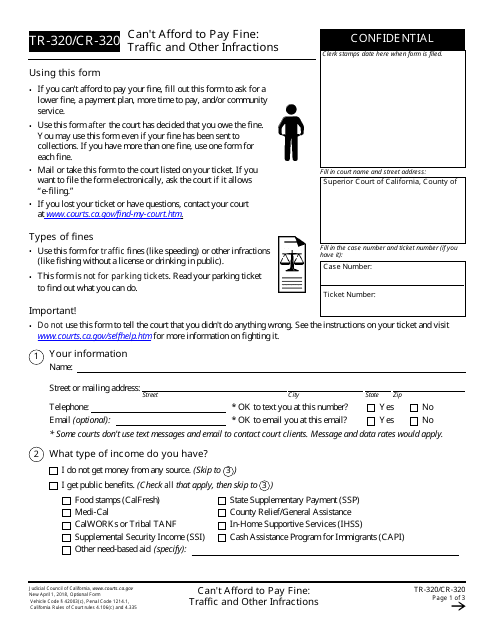

This form is used to request a court hearing to explain why the individual cannot afford to pay a fine for traffic or other infractions in California.

This form is used for creating a payment agreement in Nunavut, Canada.

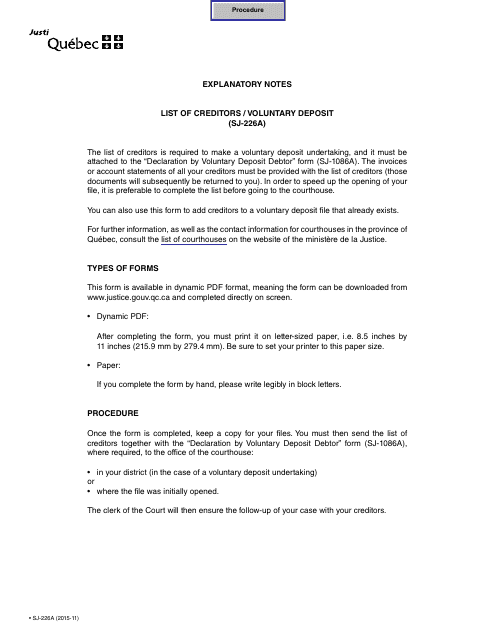

This form is used for submitting a list of creditors during the voluntary deposit process in Quebec, Canada.

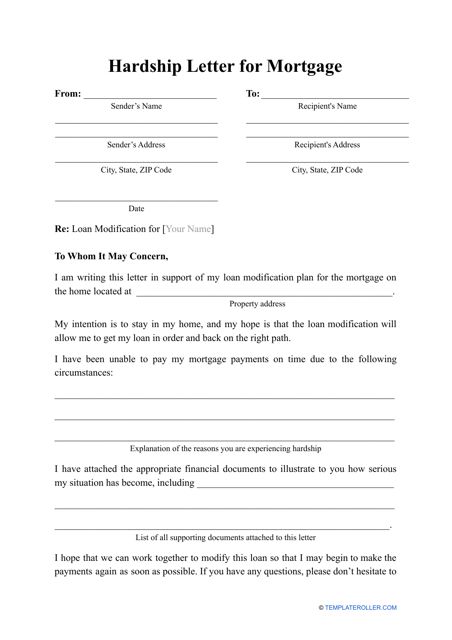

Complete this ready-made template to explain to the bank why you're defaulting on your mortgage.

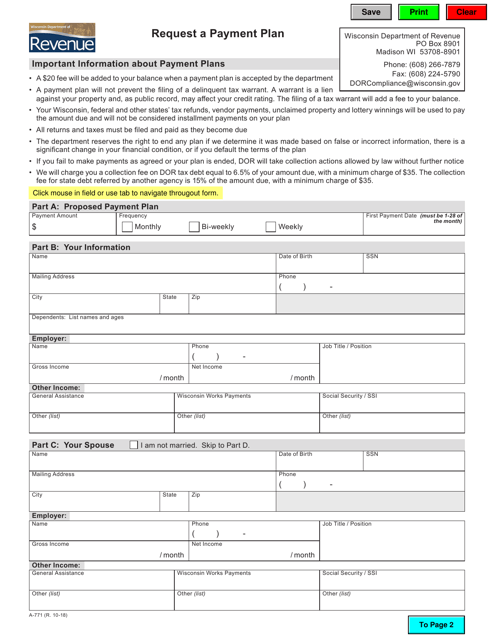

This form is used to request a payment plan in the state of Wisconsin. It allows individuals to make installment payments for certain obligations, such as taxes or fines.

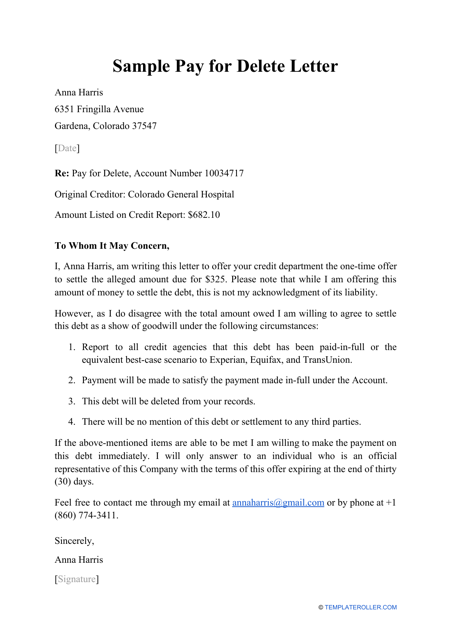

Use this letter to ask a creditor to agree to remove the negative information from your credit report.

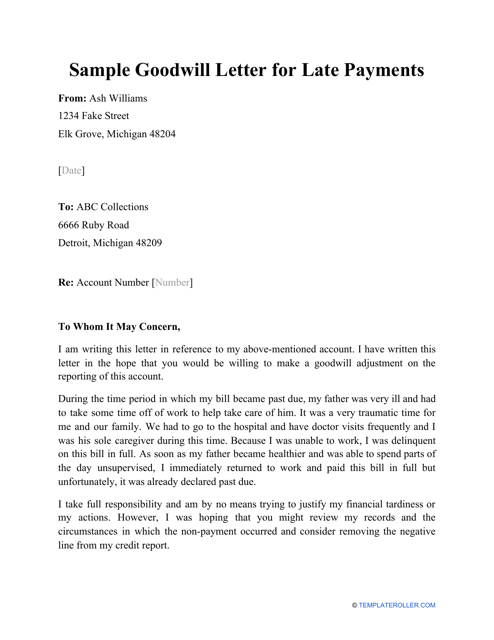

Individuals may use this type of letter when they want to try to remove late payments from their credit history.

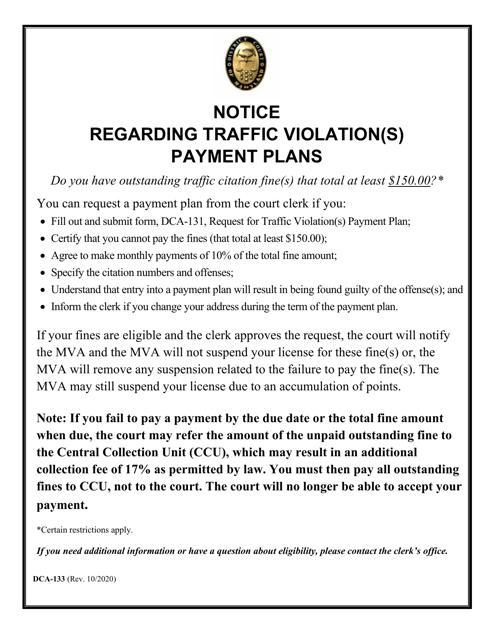

This form is used for notifying individuals in Maryland about installment payment plans for traffic violations.

This type of document is used for creating a legal agreement between parties in Manitoba, Canada for a payment plan.

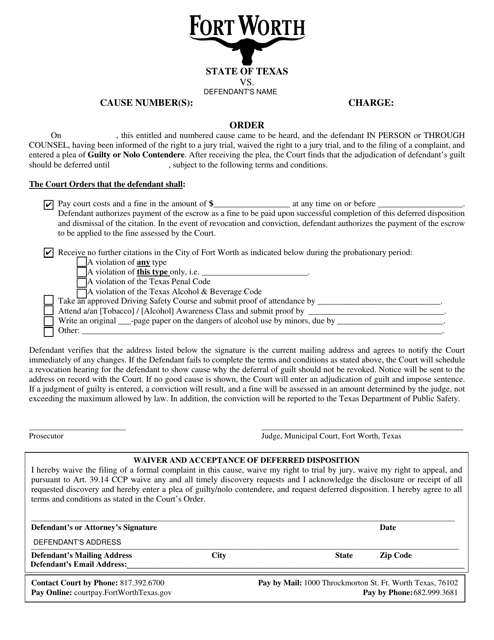

This document is a deferred order from the City of Fort Worth, Texas. It contains information about a postponed or delayed purchase or payment.