International Income Templates

Are you an expat earning income abroad or a non-resident who is required to report world income? The International Income documentation is here to guide you through the necessary steps and forms to ensure compliance with tax regulations in various countries.

Whether you're a U.S. citizen living and working overseas or a non-resident earning income in Canada, it is crucial to understand the requirements and properly report your international income. The International Income documents provide you with the necessary tools to navigate through the complexities of tax filing.

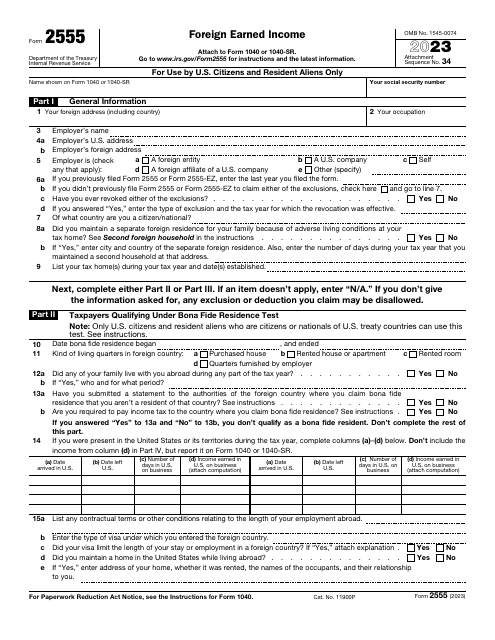

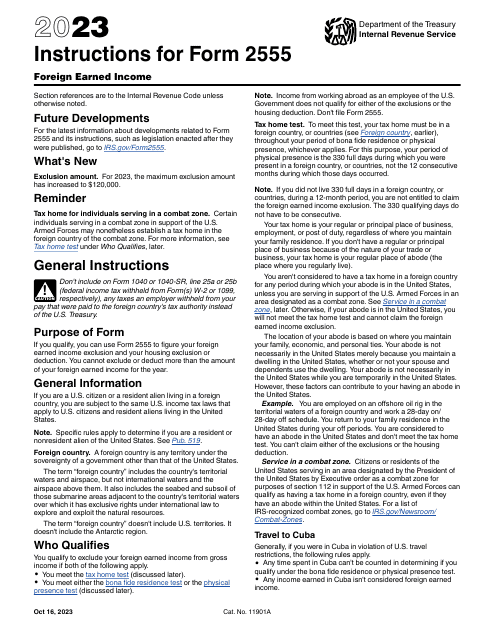

One of the key documents in this collection is the IRS Form 2555 Foreign Earned Income. This form allows U.S. citizens living abroad to exclude a portion of their foreign income from U.S. taxation. The accompanying instructions for IRS Form 2555 help you properly fill out the form and understand the eligibility criteria.

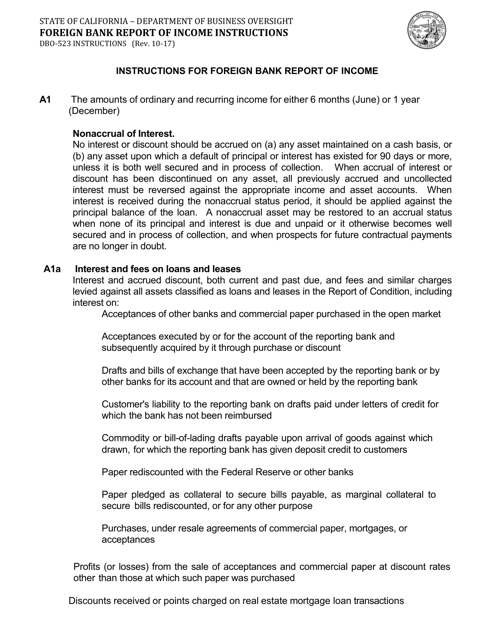

For residents of California, the Instructions for Form DBO-523 Foreign Bank Report of Income are of utmost importance. This form ensures that non-residents accurately report their foreign income to the California Department of Business Oversight.

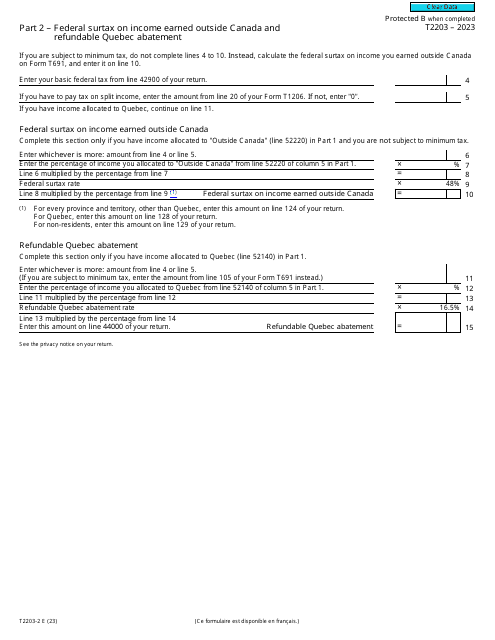

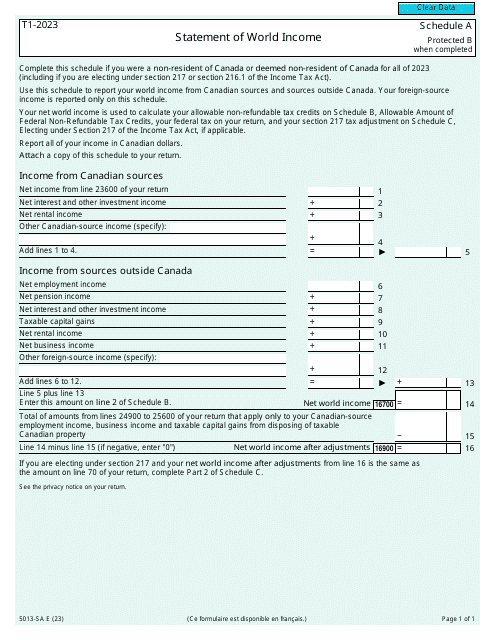

If you are a non-resident of Canada, the Form 5013-SA Schedule A Statement of World Income provides a comprehensive overview of reporting requirements for individuals who earn income outside of Canada. It includes details on various income sources, deductions, and social benefits.

Optimized for search engines: International income documentation, international income forms, reporting foreign income, tax forms for expats, non-resident income reporting, IRS form 2555, form DBO-523, form 5013-SA, international income tax filing.

Documents:

11

This Form is used for reporting income from foreign banks in California.

This form is used for reporting world income for Canadian taxpayers who are visually impaired and require a large print format. It is specifically for Schedule A of Form 5013-SA.