Realty Transfer Tax Templates

Realty Transfer Tax Services

Welcome to our Realty Transfer Tax Services webpage, your one-stop destination for all your realty transfer tax needs. Whether you are a buyer, seller, or a real estate professional, understanding and complying with realty transfer tax regulations is crucial to ensuring a smooth and successful property transaction.

At Realty Transfer Tax Services

, we provide comprehensive resources and services to help you navigate through the complex world of realty transfer taxes. Our team of experts is dedicated to assisting you in accurately and efficiently completing all required documentation and compliance procedures.Our Services Include:

-

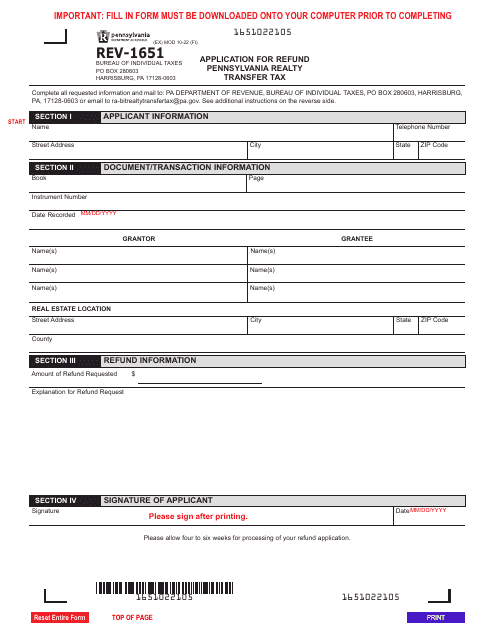

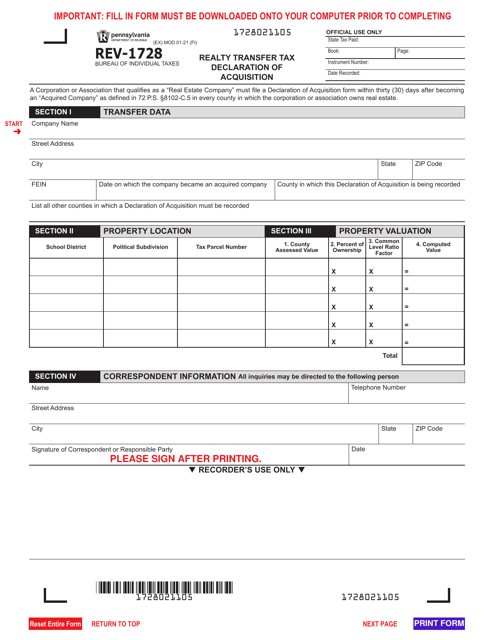

Document Assistance: We offer a wide range of helpful resources, including downloadable forms and step-by-step guides, to help you complete various realty transfer tax documents. Whether you need to prepare a Realty Transfer Tax Declaration of Acquisition or an Application for Refund of Pennsylvania Realty Transfer Tax, our site provides everything you need to ensure the completion of your paperwork is accurate and hassle-free.

-

Expert Guidance: Our knowledgeable professionals are available to answer your questions and provide personalized guidance throughout the realty transfer tax process. We understand that each property transaction is unique, and we are committed to helping you navigate any challenges or complexities that may arise.

-

State-Specific Assistance: Realty transfer tax regulations vary from state to state, and it's important to stay up-to-date with the specific requirements of your jurisdiction. Our website provides state-specific information and resources, ensuring that you have access to the most relevant and accurate information for your location, whether you're in Pennsylvania or Delaware.

-

Refund Processing: If you believe you may be eligible for a realty transfer tax refund, our team can assist you in preparing and submitting the necessary documentation. We will guide you through the refund application process, ensuring that you meet all requirements and increasing your chances of a successful refund.

-

Educational Resources: We believe that knowledge is power, especially when it comes to complex topics like realty transfer taxes. Our website offers a plethora of educational resources, including articles, FAQs, and guides, to help you better understand the intricacies of realty transfer tax laws.

Don't let realty transfer taxes become a stumbling block in your property transactions. Trust Realty Transfer Tax Services

to provide you with the expertise, resources, and support you need to navigate the world of realty transfer taxes with confidence. Start exploring our website today to access our helpful resources and ensure a smooth and successful real estate transaction.Documents:

12

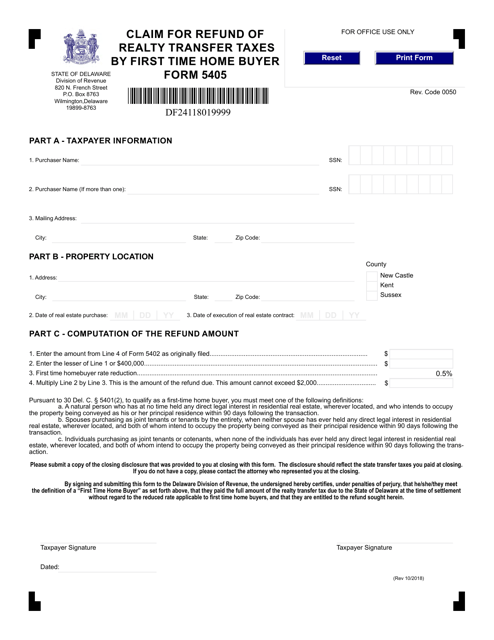

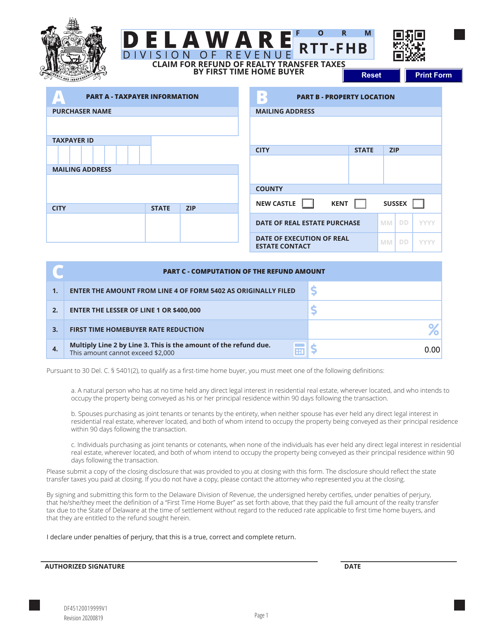

This Form is used for claiming a refund of realty transfer taxes by first-time home buyers in Delaware.

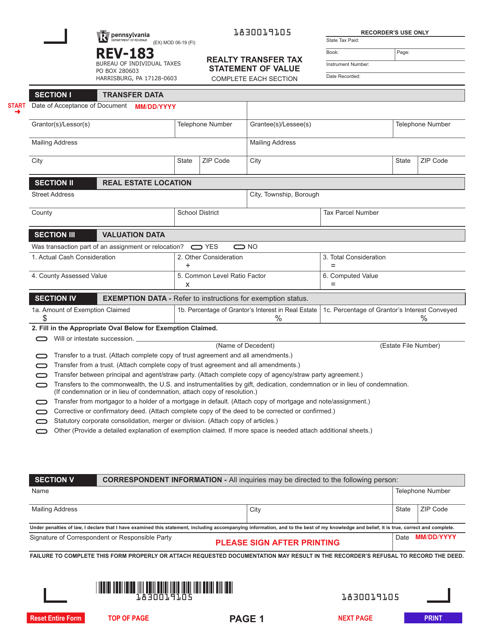

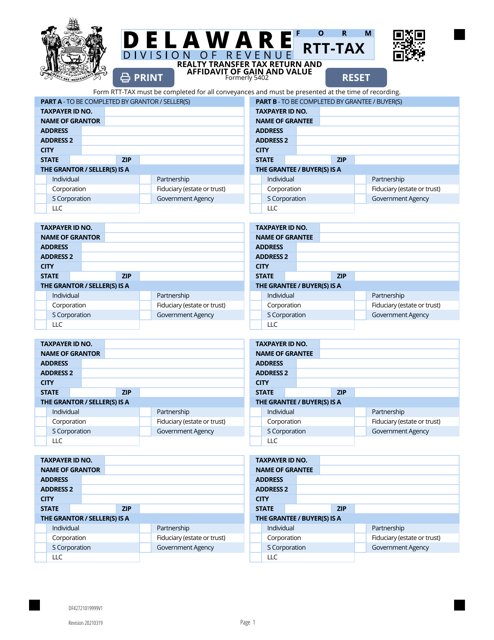

This form is used for reporting the value of a real estate transfer in Pennsylvania for tax purposes.

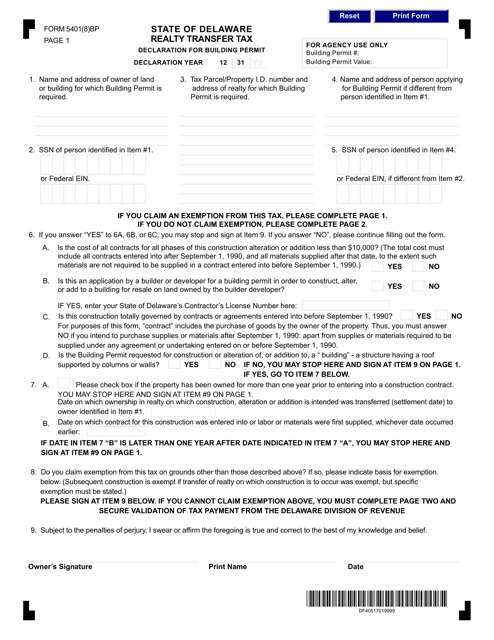

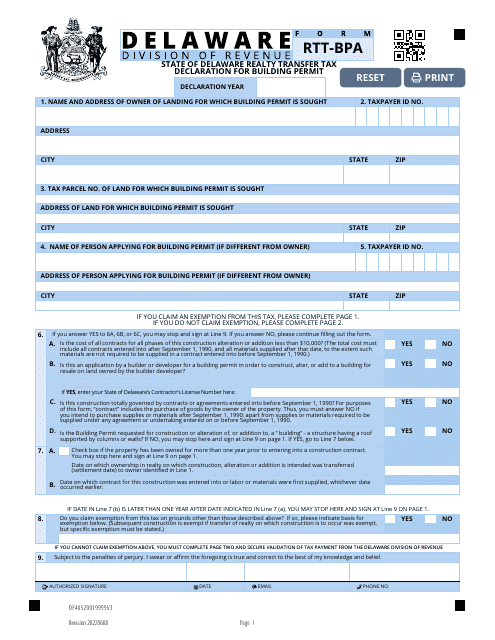

This document is used for declaring the realty transfer tax for building permits in the state of Delaware.

This form is used for first-time home buyers in Delaware who want to claim a refund for realty transfer taxes paid during the purchase of a property.