Taxable Distribution Templates

When it comes to taxable distributions, there are a few important documents that you need to be familiar with. These documents provide details on the various types of taxable distributions and help ensure that you are complying with the necessary tax regulations.

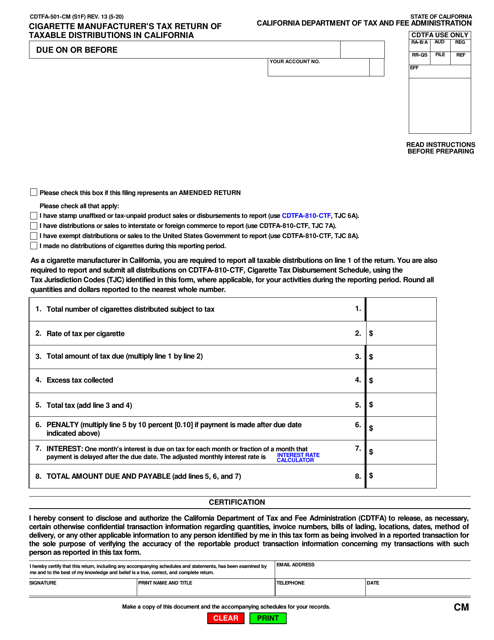

One such document is the Form CDTFA-501-CM, which is the Cigarette Manufacturer's Tax Return of Taxable Distributions in California. This form is specific to manufacturers in California and provides a comprehensive overview of taxable distributions related to cigarette production.

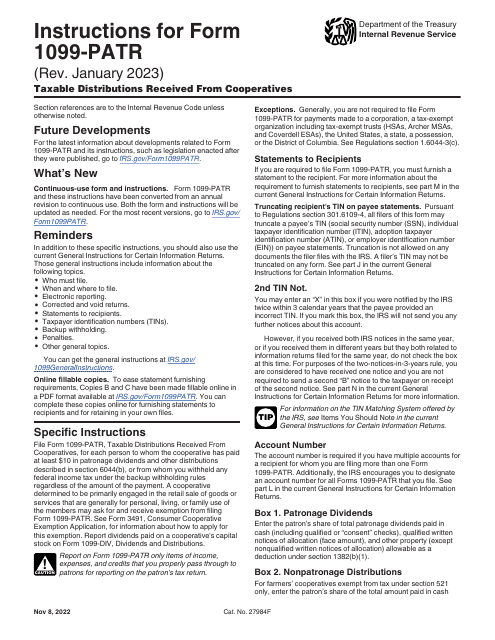

Another important document is the IRS Form 1099-PATR, which covers taxable distributions received from cooperatives. This form is used to report distributions from cooperatives, such as agricultural cooperatives, that are subject to taxation.

In addition, the IRS Form 1099-R is another essential document that deals with distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts, and more. This form allows individuals to report and account for taxable distributions received from these various sources.

Furthermore, if you require additional information about taxes on qualified plans, including IRAs, and other tax-favored accounts, you can refer to the Instructions for IRS Form 5329. These instructions provide guidance on reporting and calculating any additional taxes associated with these accounts.

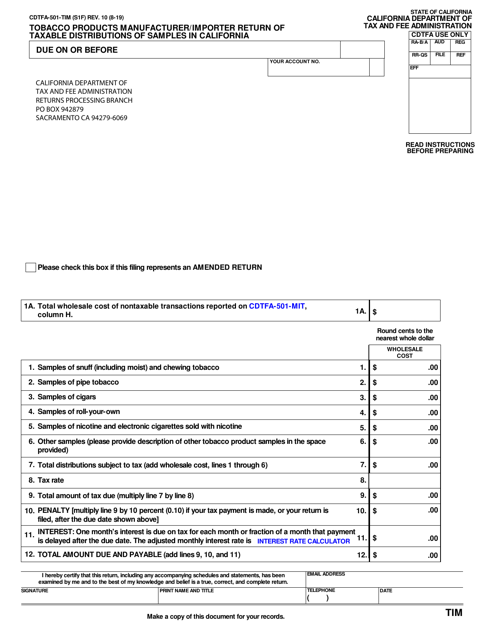

By understanding and utilizing these documents, you can ensure that you are accurately reporting and documenting taxable distributions that you have received. Whether you are a manufacturer, cooperative member, or have retirement or profit-sharing plans, these documents are essential for maintaining compliance and avoiding any potential penalties.

So, whether you refer to them as taxable distributions, taxable distribution forms, or any other related terms, these documents play a crucial role in properly reporting and managing your taxable distributions.

Documents:

23

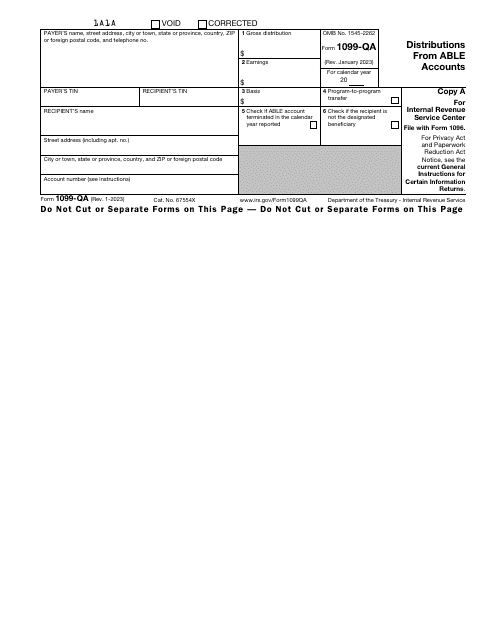

This is a fiscal IRS form filled out by the cooperative that paid patronage dividends during the tax year.

This is a formal statement filled out by the organization that manages certain retirement accounts to inform the recipient of the distribution about the income they generated and report the details to tax organizations.