Domestic Production Activities Deduction Templates

The Domestic Production Activities Deduction, also known as the domestic manufacturing deduction or DPAD, is a tax benefit designed to incentivize businesses engaged in certain production activities within the United States. This deduction allows eligible companies to reduce their taxable income, potentially leading to significant tax savings.

To help businesses understand and claim this deduction, various documents have been created by government agencies such as the Internal Revenue Service (IRS) and state tax authorities. These documents provide detailed instructions and guidelines for calculating and claiming the domestic production activities deduction.

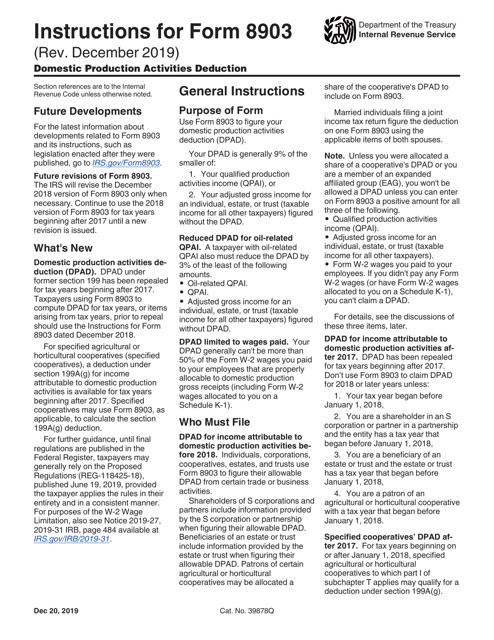

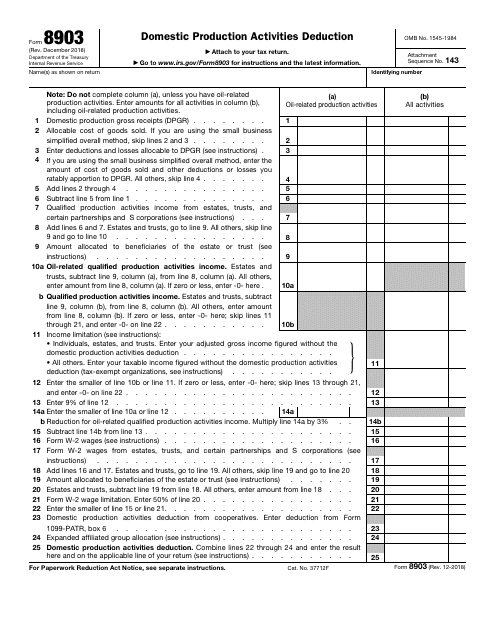

One such document is the Instructions for IRS Form 8903 Domestic Production Activities Deduction. This comprehensive guide explains the eligibility requirements, calculation methods, and reporting procedures for businesses seeking to claim the DPAD on their federal tax returns. It provides step-by-step instructions, examples, and definitions to ensure accurate and compliant reporting.

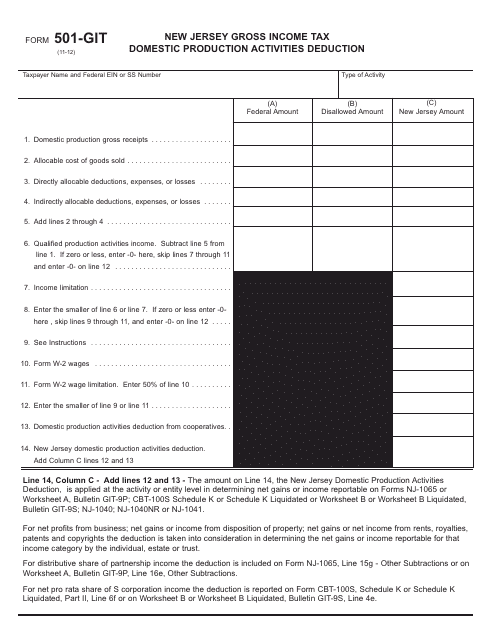

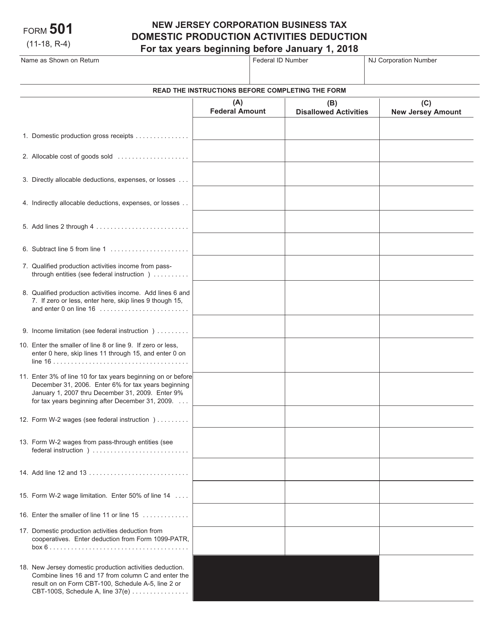

For companies operating in specific states, there may be additional documents related to the domestic production activities deduction. For instance, the Form 501-GIT New Jersey Gross Income Tax Domestic Production Activities Deduction is a state-specific document that provides instructions and forms for businesses claiming the DPAD in New Jersey.

Whether you're a manufacturer, producer, or contractor, understanding and navigating the domestic production activities deduction can be complex. These documents serve as invaluable resources that help businesses optimize their tax position and comply with applicable laws and regulations.

Please note that the specific documents mentioned above are just a few examples from the extensive collection of materials available on this topic. Various resources, such as IRS publications, state-specific forms, and professional tax guides, provide further information and guidance related to the domestic production activities deduction.

Documents:

6

This form is used for claiming the New Jersey Gross Income Tax Domestic Production Activities Deduction in New Jersey. It helps individuals or businesses calculate and report the deduction.

This Form is used for claiming the Domestic Production Activities Deduction on your federal tax return. It is for businesses that engage in certain qualified production activities within the United States.

This form is used for claiming the Domestic Production Activities Deduction in the state of New Jersey. The deduction allows businesses to reduce their taxable income based on certain production activities that take place within the state.