Small Arms Templates

Small Arms Document Collection

Our small arms document collection features a comprehensive range of resources pertaining to small arms. These documents provide valuable information and guidance for individuals and organizations involved in the small arms industry. With alternate names such as small arms files and small arms paperwork, our collection covers a diverse range of topics.

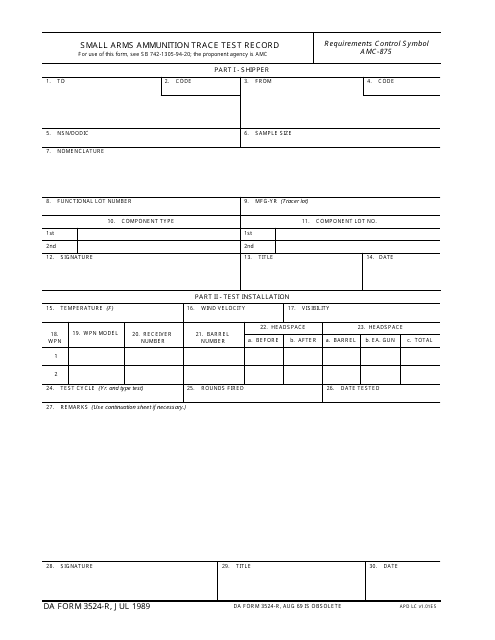

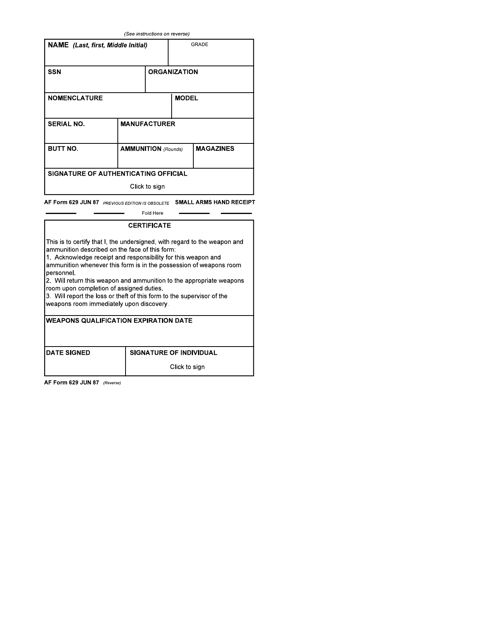

From the DA Form 3524-r Small Arms Ammunition Trace Test Record to the AF Form 629 Small Arms Hand Receipt, our documents provide valuable record-keeping tools for small arms owners and operators. These records ensure accountability and help maintain accurate inventory management.

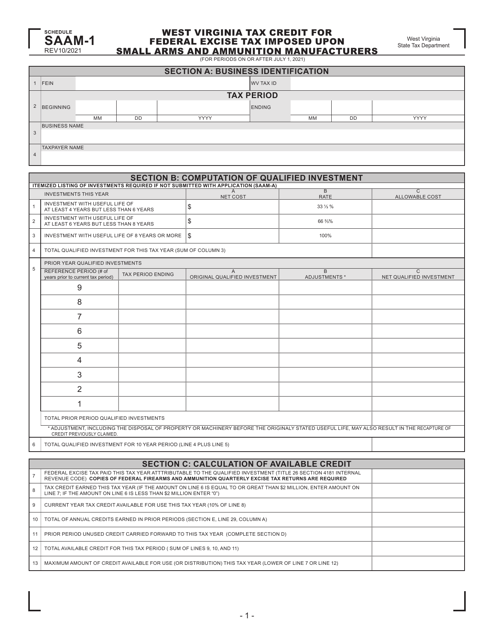

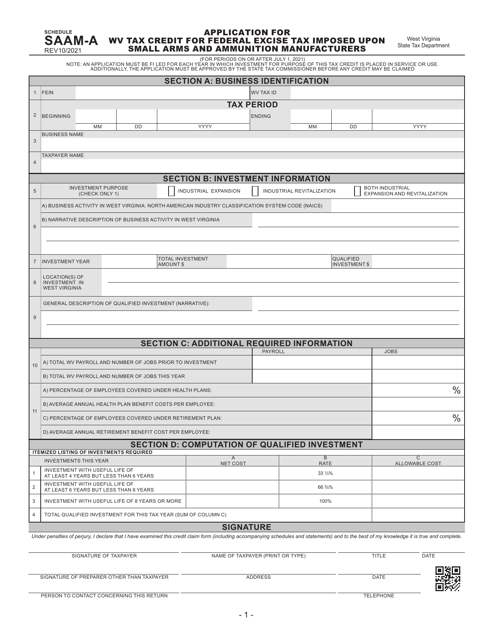

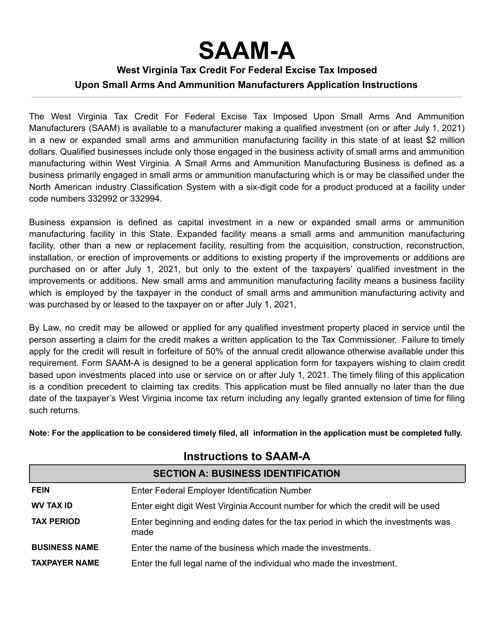

Our collection also includes documents related to regulatory compliance and taxation. For example, the Schedule SAAM-1 West Virginia Tax Credit for Federal Excise Tax Imposed Upon Small Arms and Ammunition Manufacturers details the tax credit available to manufacturers in West Virginia. To simplify the application process for this tax credit, we provide detailed instructions in the Instructions for Schedule SAAM-A Application for WV Tax Credit for Federal Excise Tax Imposed Upon Small Arms and Ammunition Manufacturers.

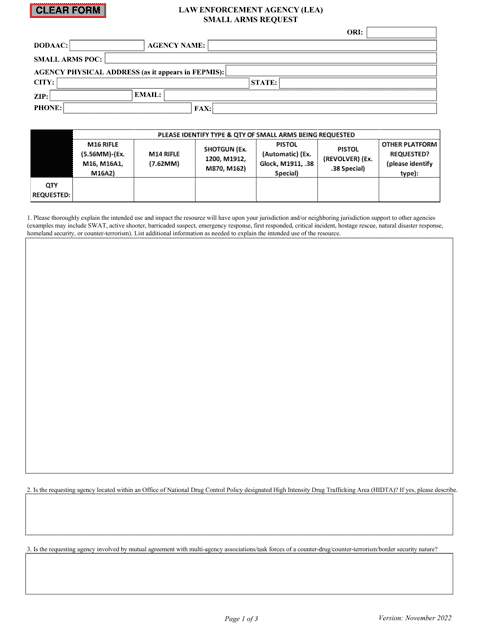

Law enforcement agencies can also benefit from our small arms documents, such as the Small Arms Request - Law Enforcement Agency (LEA). This document facilitates the procurement process, ensuring that law enforcement agencies have the necessary small arms and ammunition to carry out their duties effectively.

Whether you are a small arms enthusiast, a manufacturer, a law enforcement agency, or involved in any other aspect of the small arms industry, our collection of small arms documents is a valuable resource for staying informed, compliant, and organized. Explore our wide range of small arms documents to access the information you need.

Documents:

6

This form is used for recording the trace test results of small arms ammunition on DA Form 3524-R.

This document is used for recording the receipt and accountability of small arms weapons in the USAF.

This Form is used for claiming the SAAM-1 West Virginia Tax Credit for the federal excise tax imposed upon small arms and ammunition manufacturers in West Virginia.

This Form is used for applying for a tax credit in West Virginia for federal excise tax imposed upon small arms and ammunition manufacturers.

This form is used for applying for a tax credit in West Virginia for federal excise tax imposed upon small arms and ammunition manufacturers.

This document is used for requesting small arms by a Law Enforcement Agency (LEA).