Fuel Receipts Templates

Fuel Receipts: Keeping Track of Your Fuel Expenses

Tracking your fuel expenses is essential for individuals and businesses alike. Whether you need to keep accurate records for tax purposes, reimbursement, or simply to manage your finances, maintaining a detailed log of your fuel receipts is crucial.

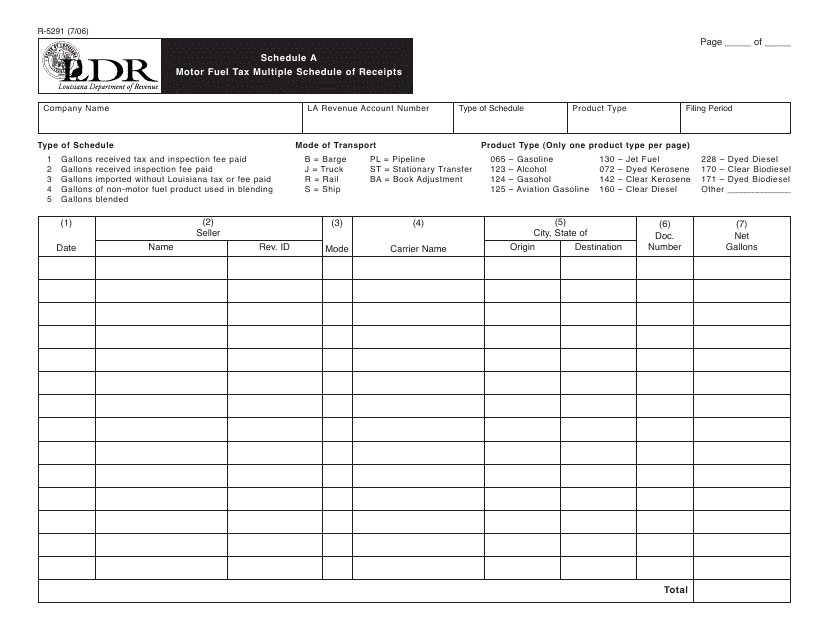

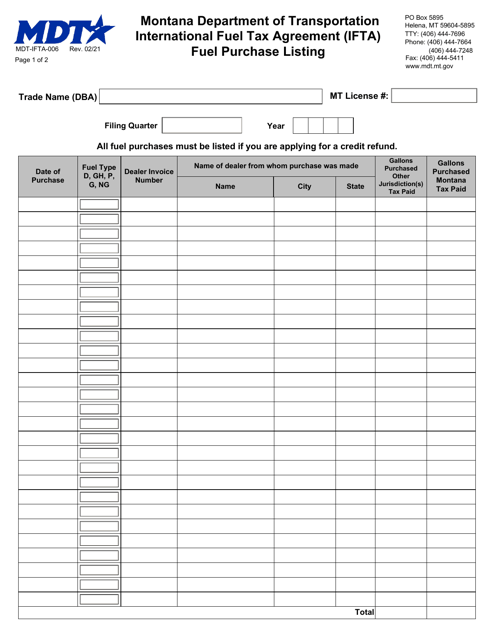

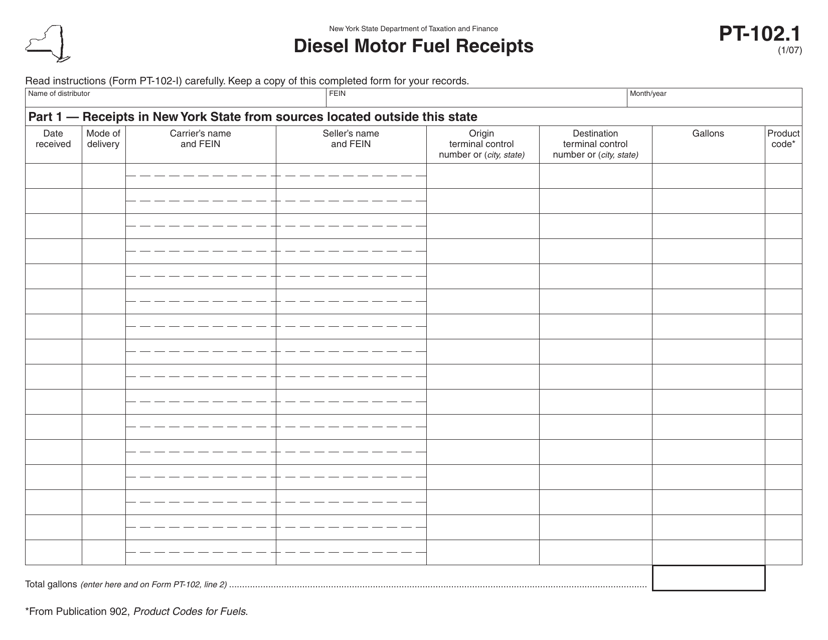

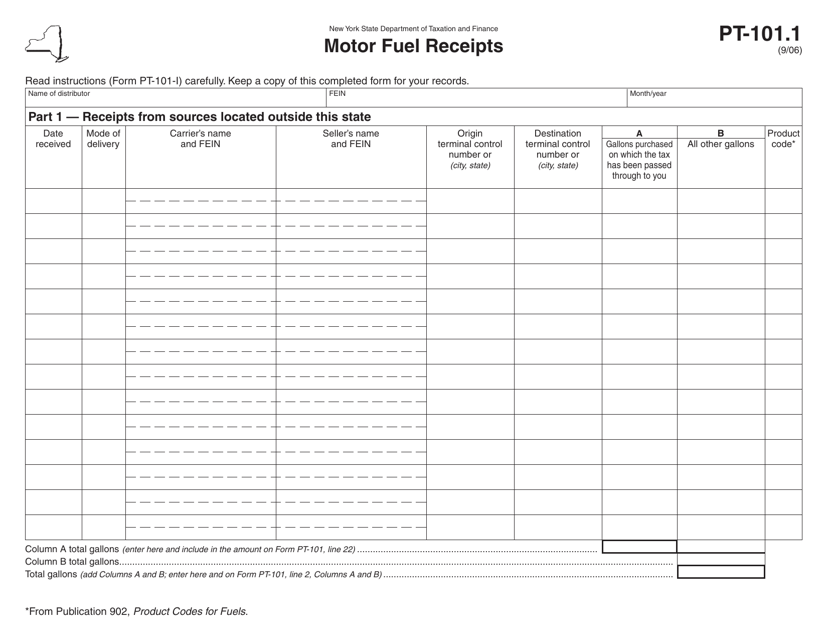

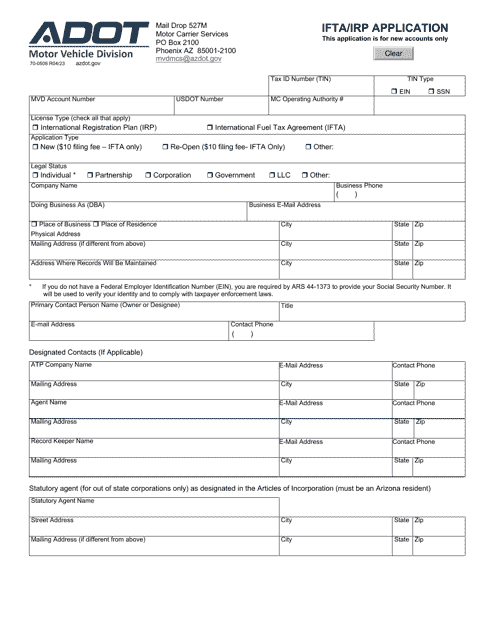

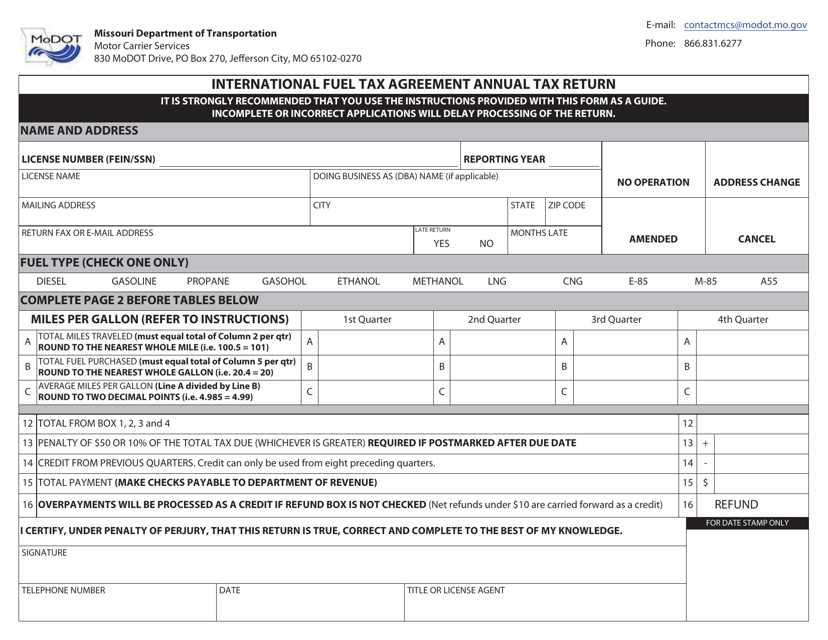

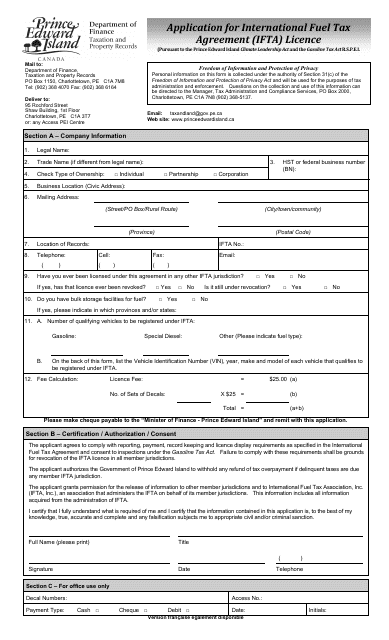

Our Fuel Receipts collection provides you with a range of templates and forms to help streamline the process. From state-specific forms like the Louisiana Form R-5291 Schedule A Motor Fuel Tax Multiple Schedule of Receipts and the New York Form PT-101.1 Motor Fuel Receipts, to nationally recognized documents such as the International Fuel Tax Agreement (IFTA) Fuel Purchase Listing (e.g., Montana Form MDT-IFTA-006) and IFTA/Irp Application (e.g., Arizona Form 70-0508), we have all the resources you need to stay organized.

Whether you're an individual with a single vehicle or a fleet manager responsible for multiple vehicles, our Fuel Receipts collection ensures that you have all the necessary documentation to comply with tax regulations and monitor your fuel expenditure.

Featuring a variety of templates and forms, our collection offers the flexibility to choose the one that suits your specific needs. With our user-friendly templates, you can easily record important details, such as date, fuel quantity, fuel type, vehicle identification number (VIN), and more.

Take the hassle out of managing fuel expenses with our Fuel Receipts collection. Start organizing your receipts today and stay on top of your fuel expenditure in a convenient and efficient manner.

Examples of documents in this collection:

- Form R-5291 Schedule A Motor Fuel Tax Multiple Schedule of Receipts - Louisiana

- Form MDT-IFTA-006 International Fuel Tax Agreement (IFTA) Fuel Purchase Listing - Montana

- Form PT-101.1 Motor Fuel Receipts - New York

- Form 70-0508 IFTA/Irp Application - Arizona

- International Fuel Tax Agreement Annual Tax Return - Missouri

Documents:

9

This form is used for reporting multiple motor fuel tax receipts in Louisiana.

This Form is used for reporting fuel purchases made under the International Fuel Tax Agreement (IFTA) in the state of Montana.

This form is used for reporting diesel motor fuel receipts in the state of New York.

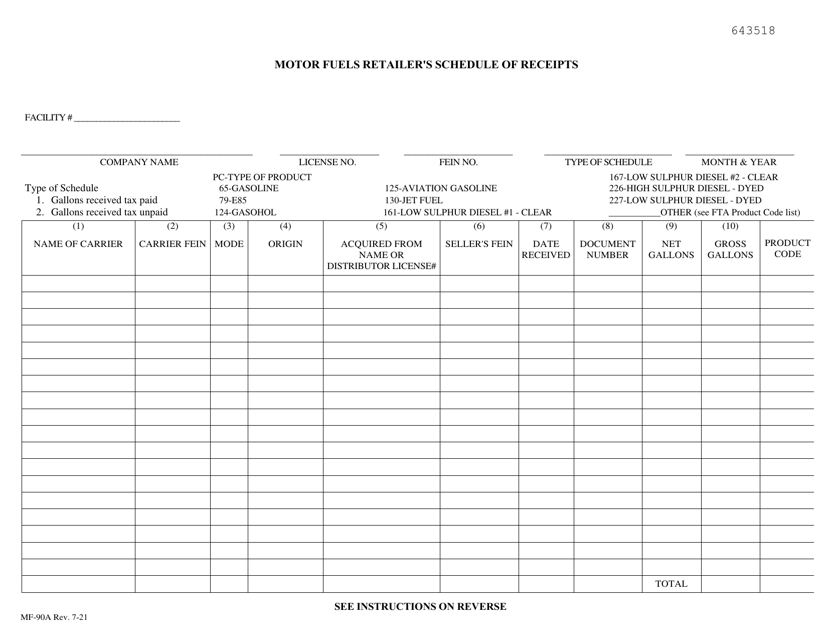

This form is used for reporting motor fuel receipts in the state of New York.

This document is used for filing the annual tax return related to the International Fuel Tax Agreement in the state of Missouri.