Fill and Sign Legal Forms and Templates

Documents:

152222

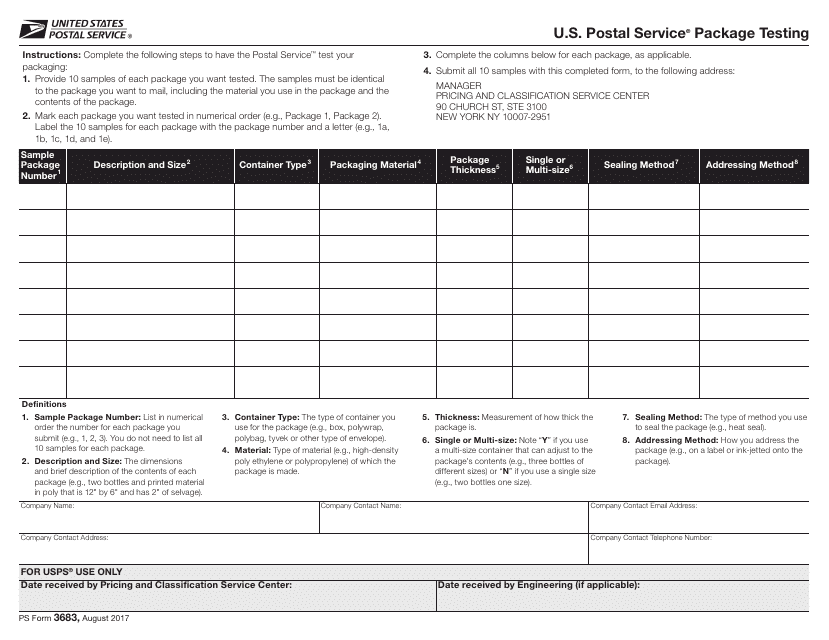

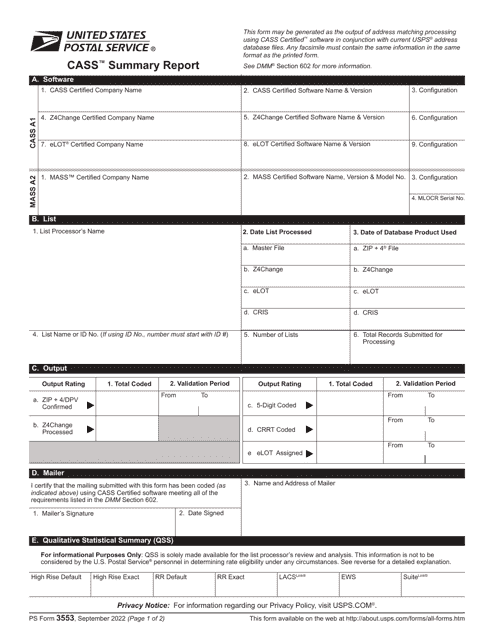

This form is used for U.S. Postal Service package testing.

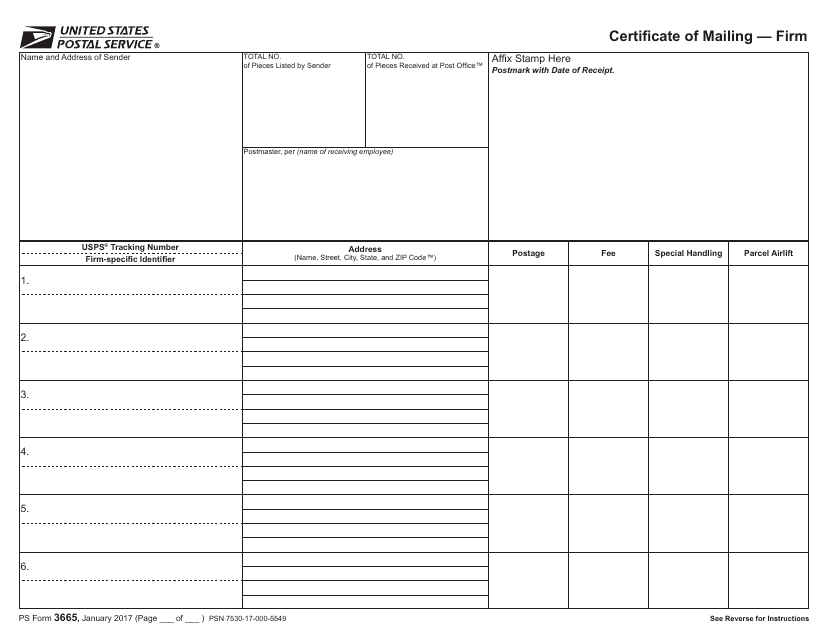

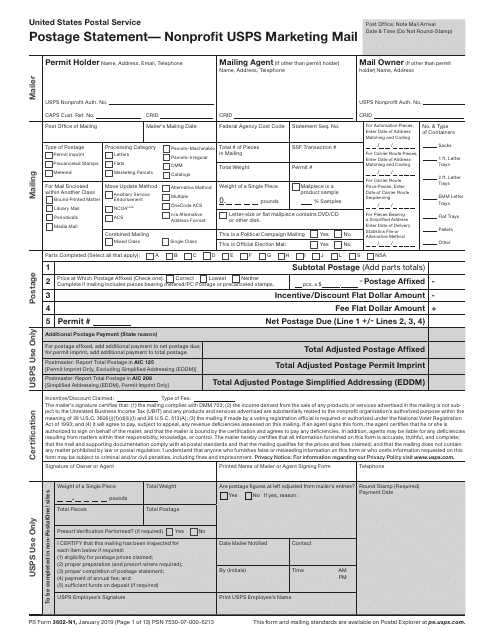

This document is used to provide proof of mailing for businesses or organizations.

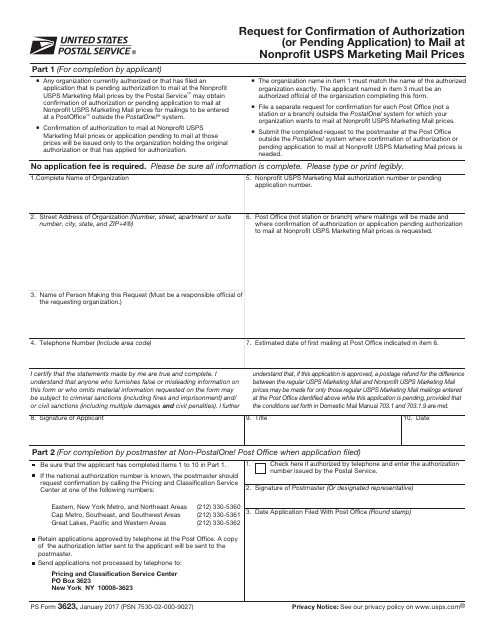

This form is used for requesting confirmation of authorization or pending application for mailing at nonprofit USPS marketing mail prices.

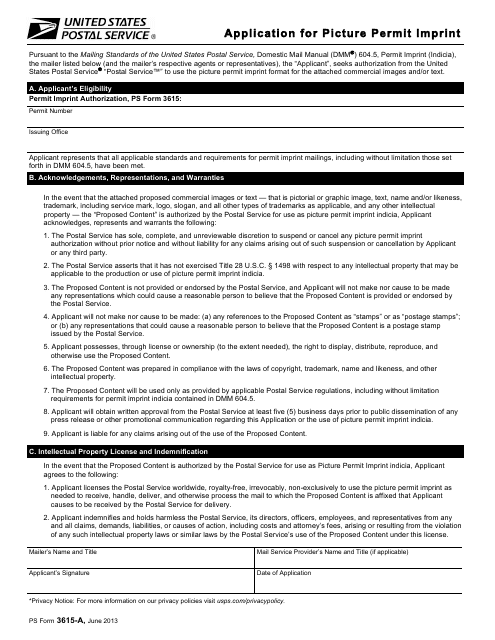

Fill out this form to obtain a picture permit imprint authorization for a commercial image and text.

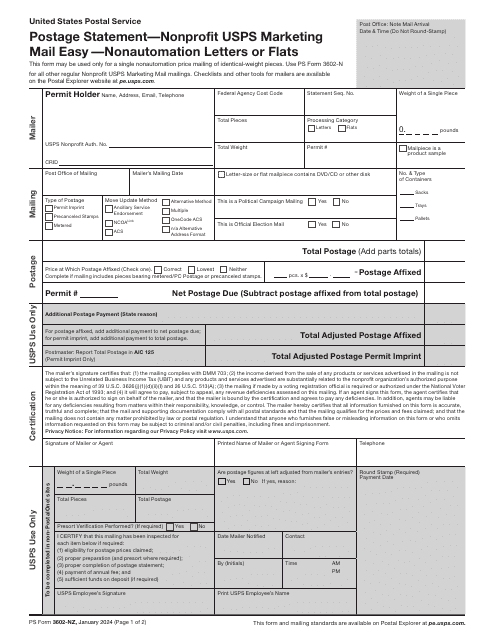

This form accompanies all easy non-automation form letters, flyers or newsletters of the same weight for non-profit purposes.

This form is used in the United States Postal Service (USPS) for sending USPS Marketing Mail postage at reduced prices, which are available for non-profit organizations authorized by the USPS.

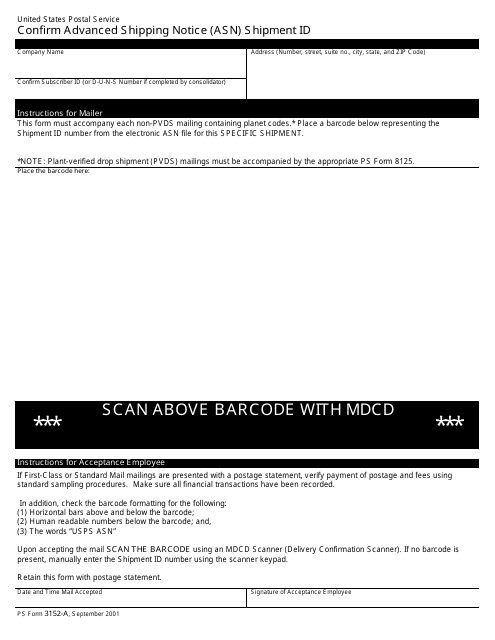

This document is used for confirming the shipment identification in an Advanced Shipping Notice (ASN) using PS Form 3152-A.

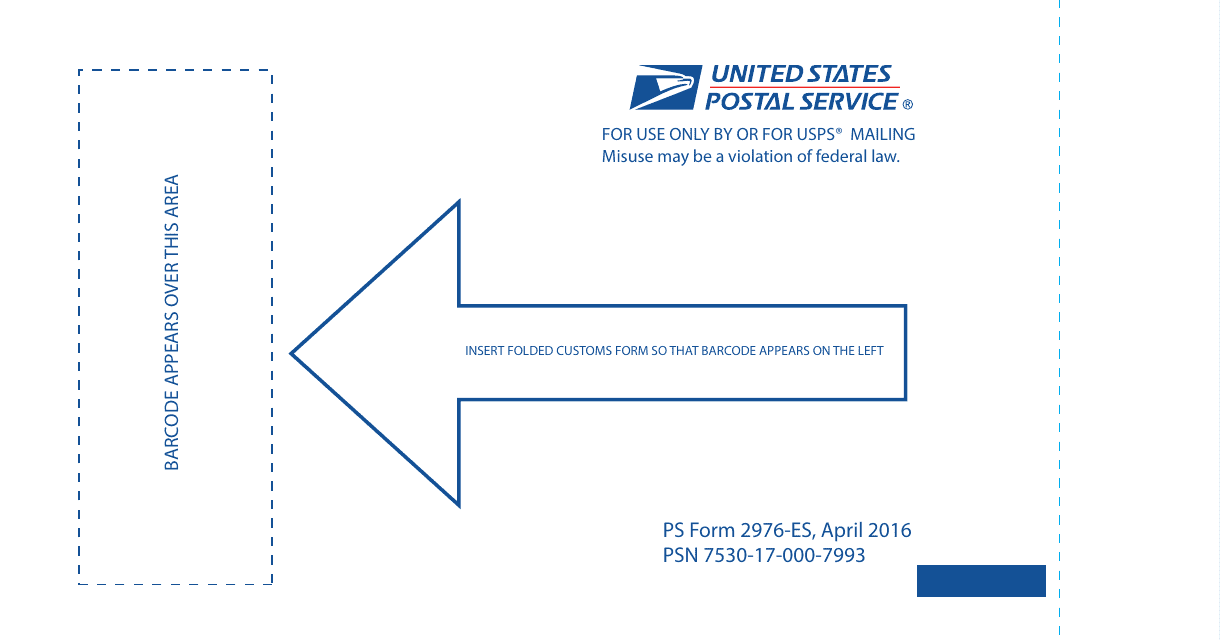

This is a small plastic envelope or pouch designed for small parcels. It is used by the United States Postal Service (USPS) carrying and protecting customs forms and other documentation.

This Form is used for requesting web access to certain USPS applications.

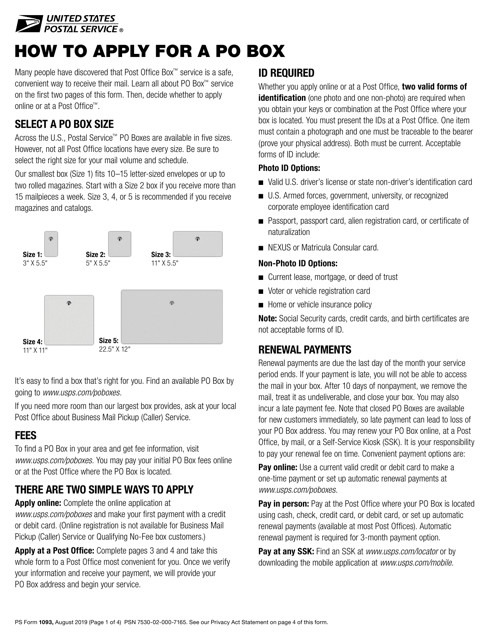

Use this form if you need to get a unique post office box. You can obtain it at a post office or online.

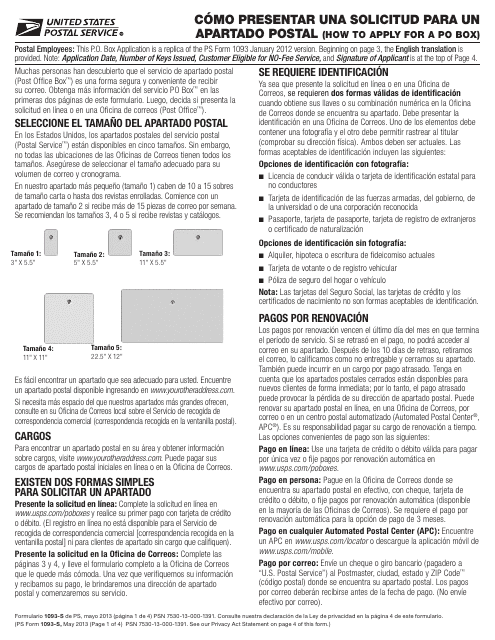

Download this form if you wish to get your own Post Office Box at a post office.

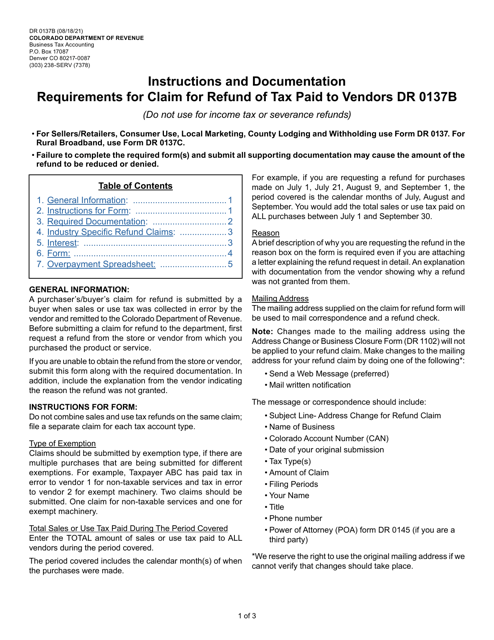

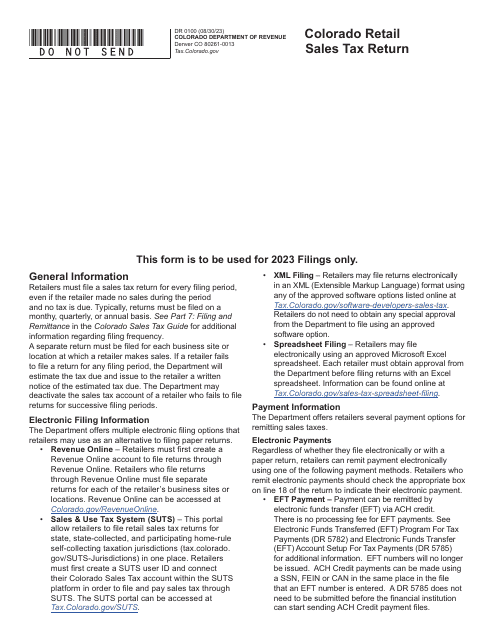

This form is required for any retail establishment within the state of Colorado and must be filed every quarter, even if no tax has been collected or no tax is due.

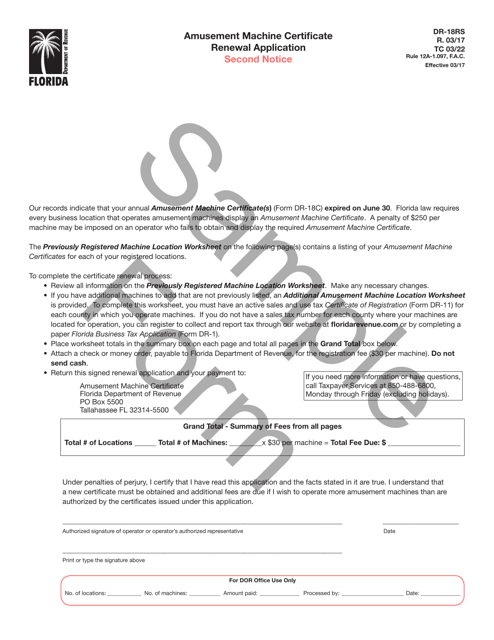

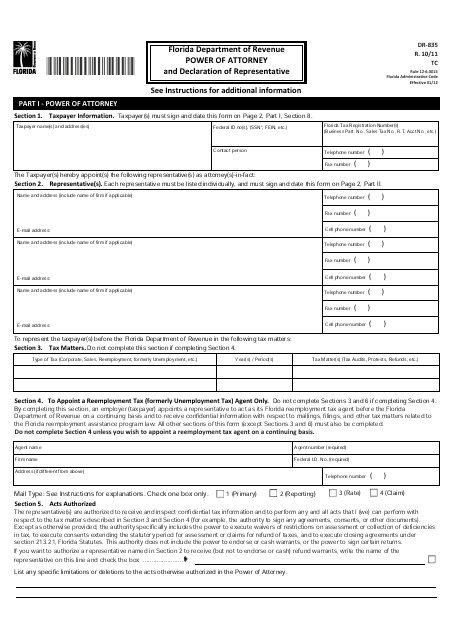

This form is used for appointing a representative to act on your behalf for tax matters in the state of Florida.

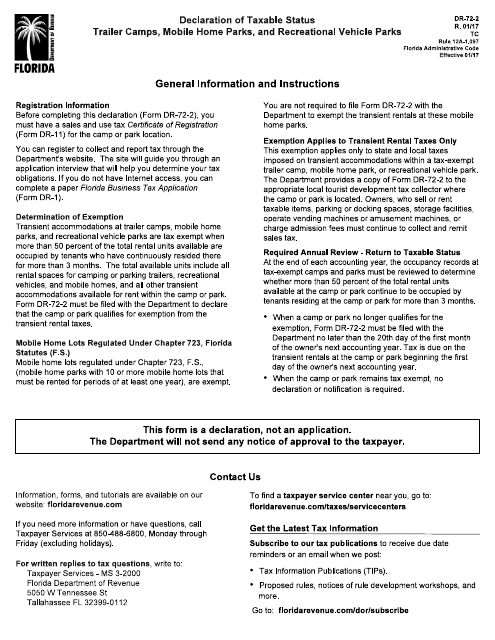

This form is used for declaring the taxable status of trailer camps, mobile home parks, and recreational vehicle parks in Florida.

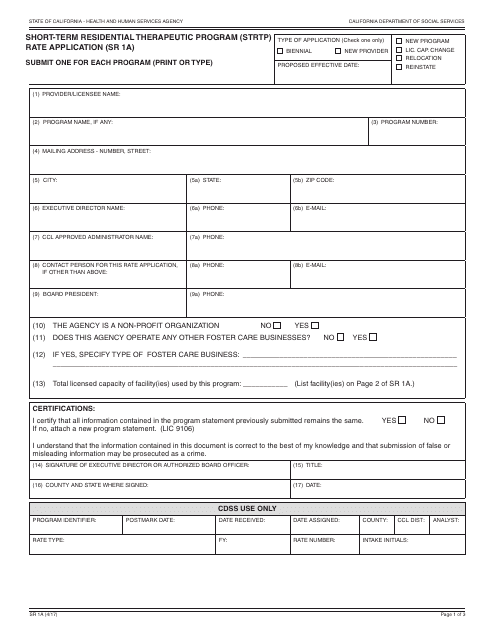

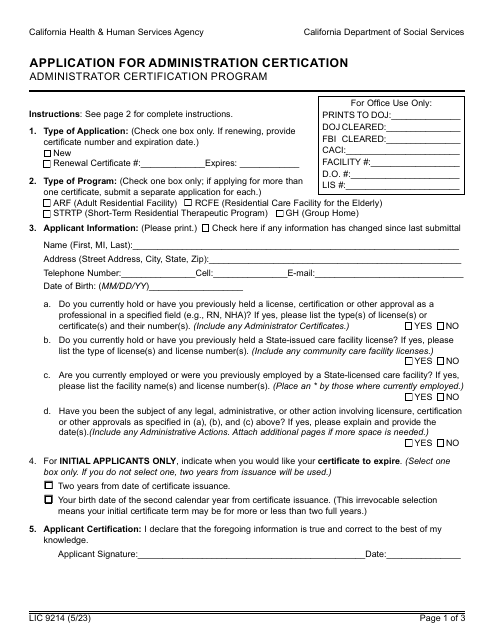

This Form is used for applying for rates in the Short-Term Residential Therapeutic Program (STRTP) in California.

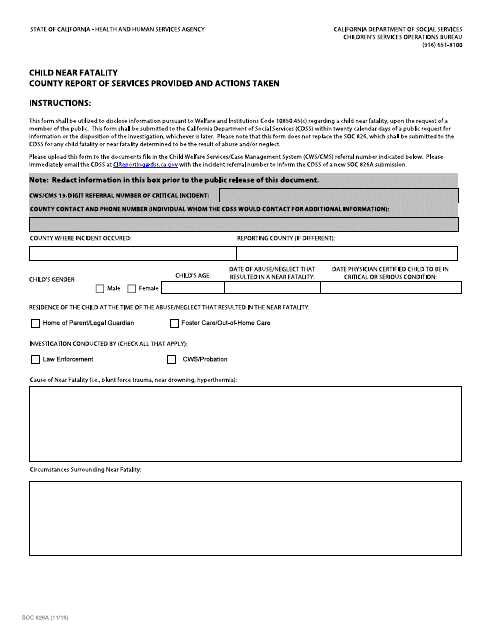

Form SOC826A Child Near Fatality - County Report of Services Provided and Actions Taken - California

This form is used for reporting child near fatality cases in California. It documents the services provided and actions taken by the county to address the situation.

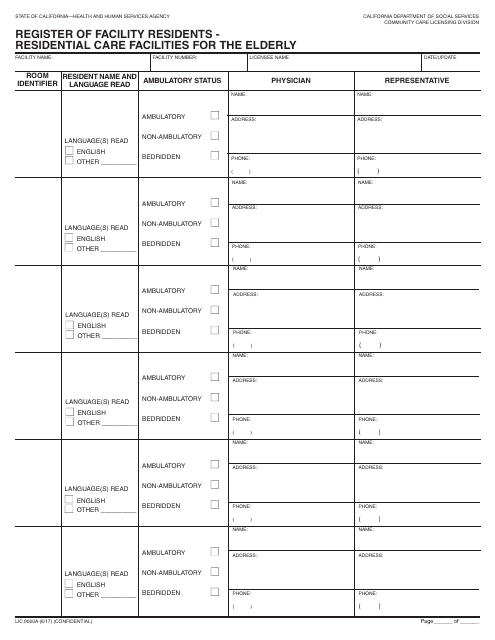

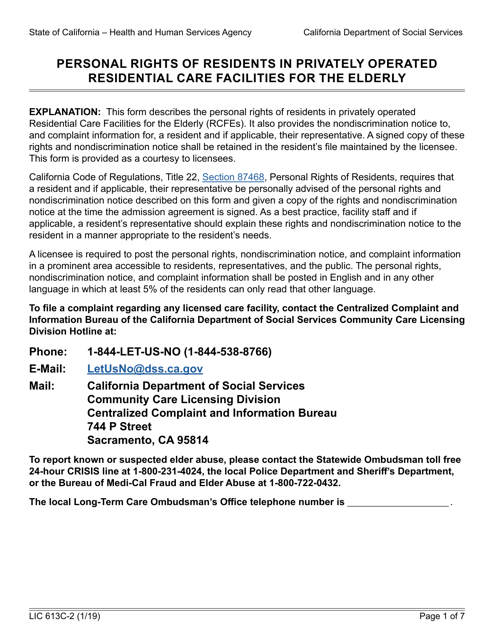

This form is used for registering the residents of residential care facilities for the elderly in California. It helps keep track of the individuals living in these facilities.

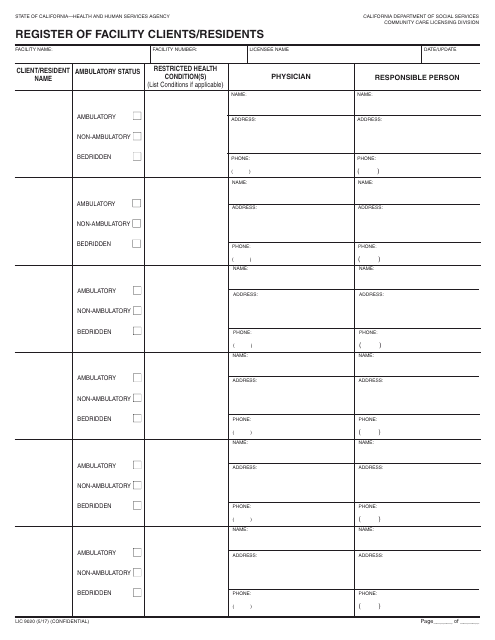

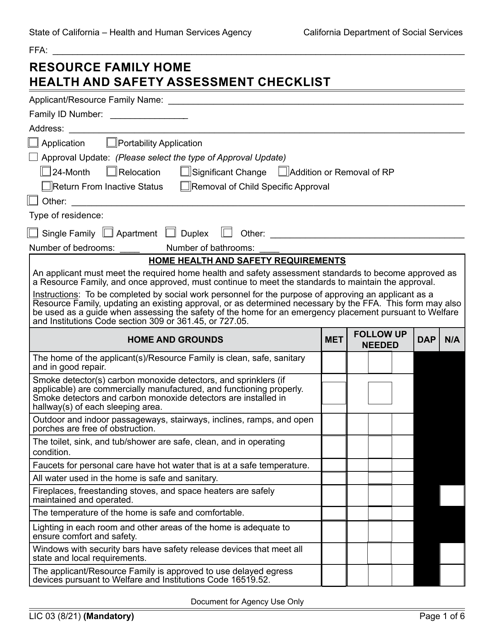

This form is used for registering clients or residents in facilities in the state of California.

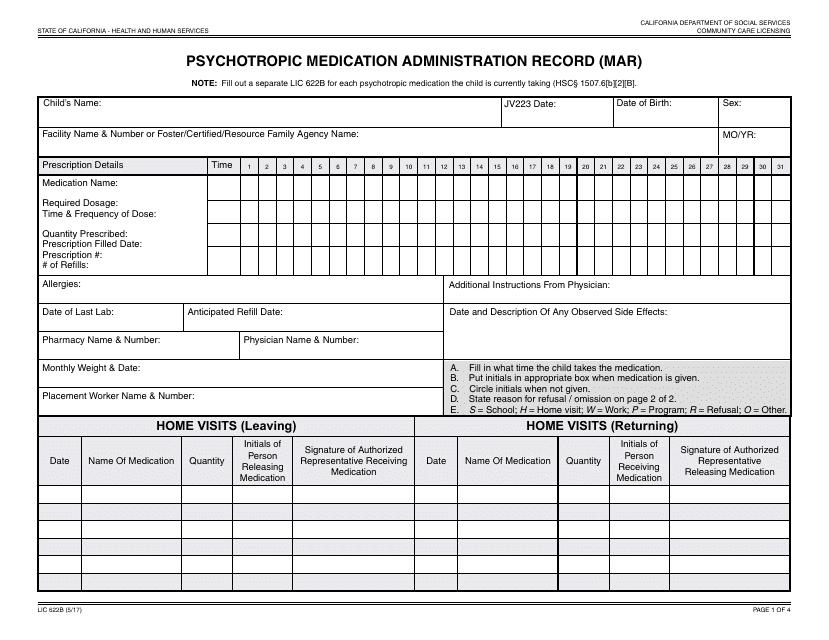

This form is used for recording the administration of psychotropic medication in California. It helps to track and monitor the usage of medication for individuals.

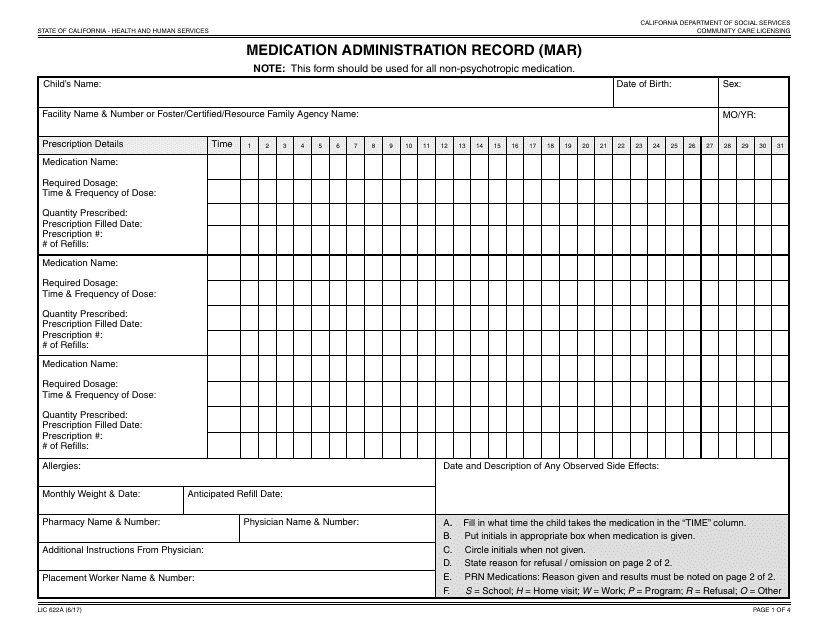

Use this form if you are health care professional to keep track of non-psychotropic medications prescribed to a child. This four-page record sheet is often referred to as a drug chart.

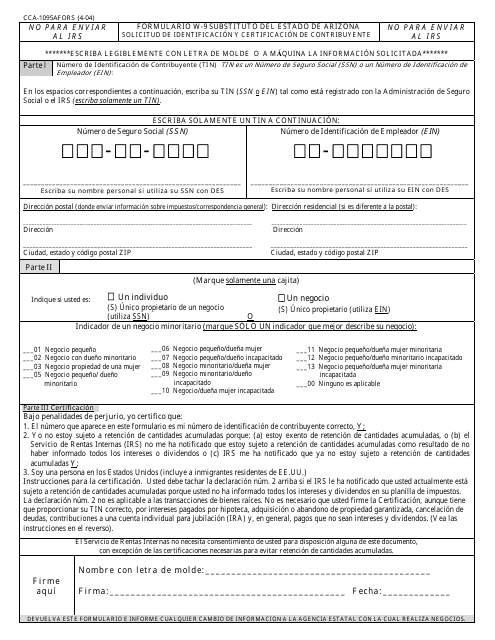

This document is a substitute for the W-9 form used in the state of Arizona. It is used to request identification and certification of a taxpayer's information.

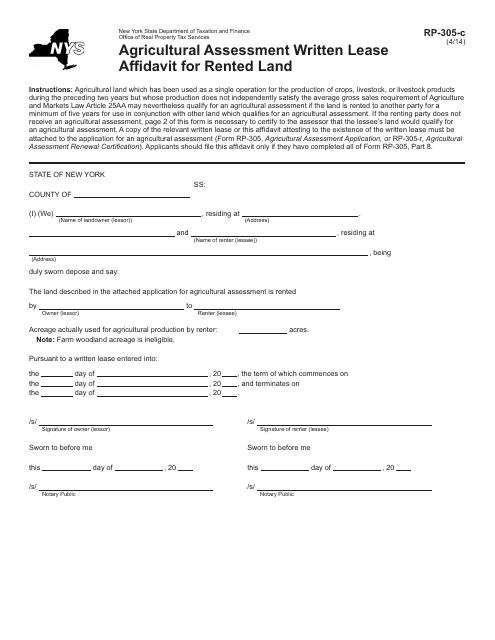

This form is used for reporting a written lease agreement for rented agricultural land in New York to qualify for agricultural assessment.

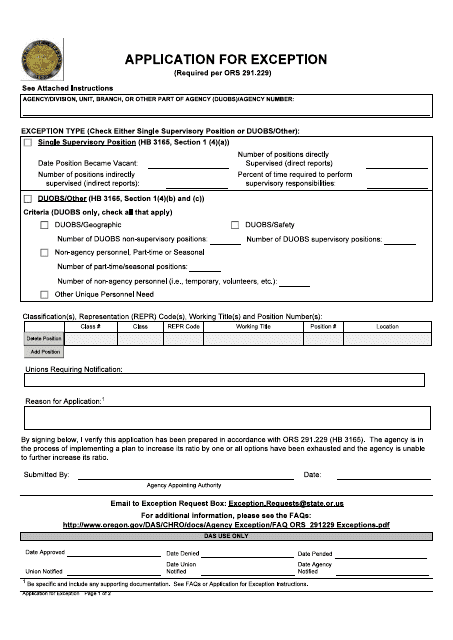

This form is used for requesting an exception to the standard span of control in Oregon state agencies.

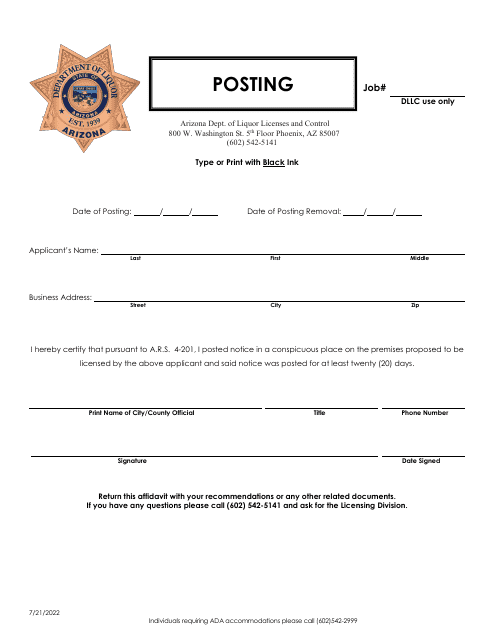

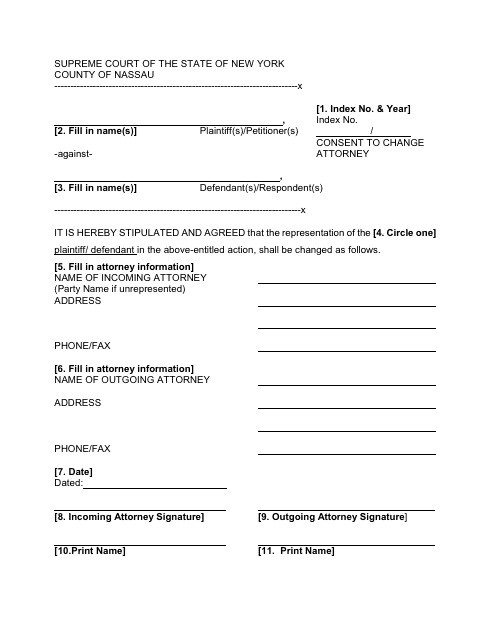

This Form is used for obtaining consent from a client to change their attorney in Nassau County, New York.

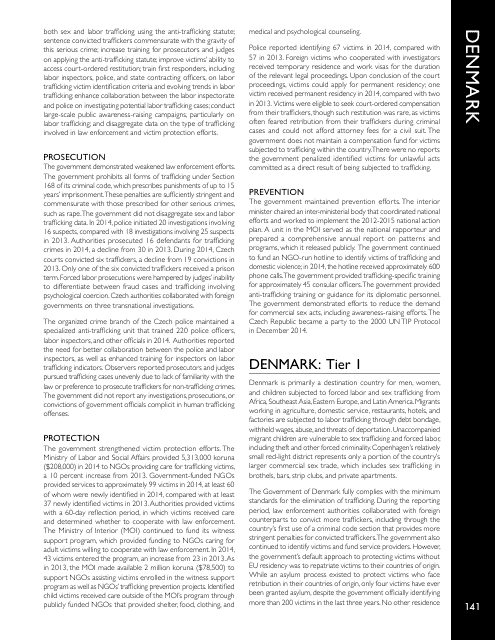

This report highlights the issue of human trafficking in Denmark and provides insights into the country's efforts to combat this crime.