Fill and Sign Legal Forms and Templates

Documents:

152222

This is an IRS form that includes the details of an installment sale.

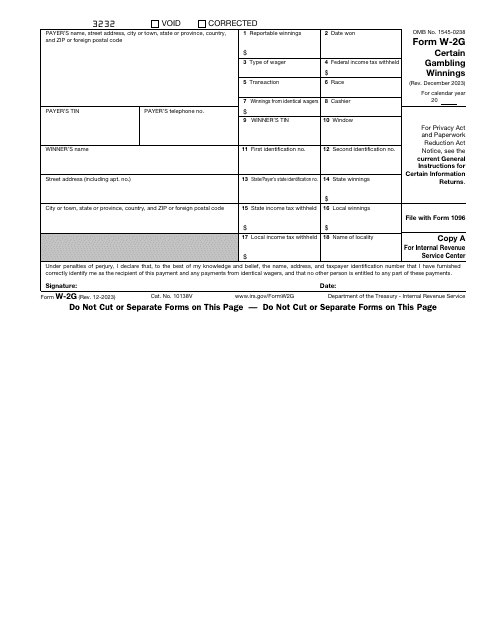

This is a formal report filed by gambling facilities to outline the winnings of their clients and certify they deducted taxes from the sum of money won.

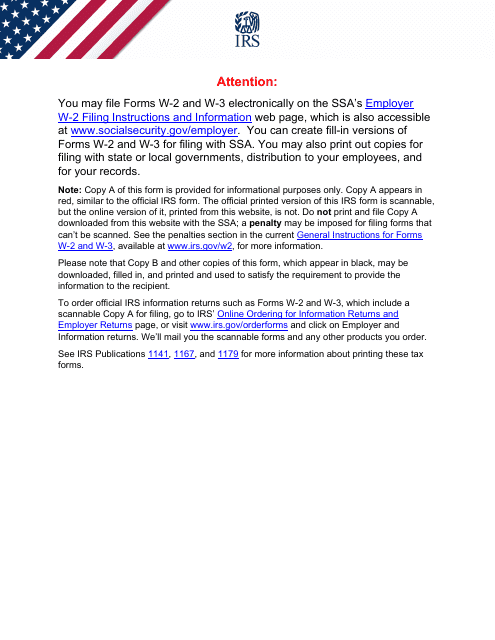

If you are an employer and have to file Form W-2, Wage and Tax Statement, you need to fill out this form. This form is needed for transmitting a paper Copy A of Form W-2, to the SSA. Make sure you supply your employees with a copy of Form W-2.

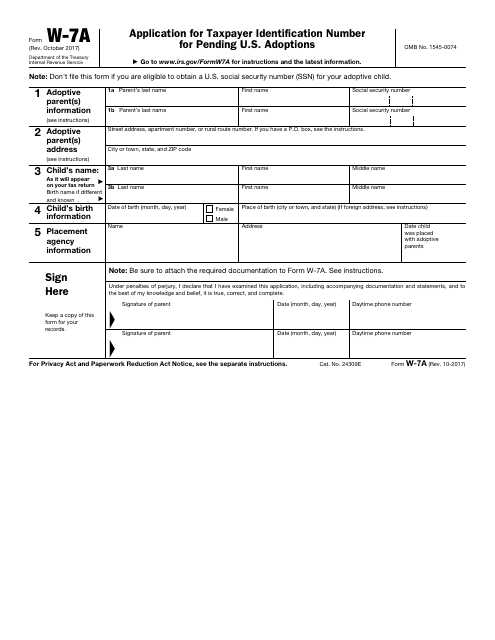

This form is used for applying for a taxpayer identification number for pending U.S. adoptions. It is required to establish the adoptive parent's identity for tax purposes.

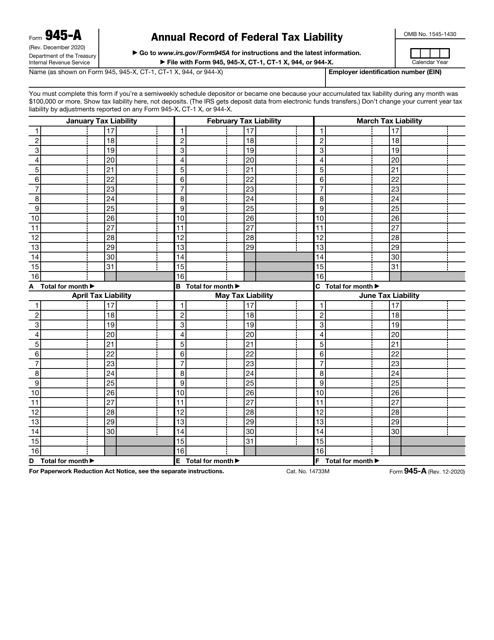

This is a formal document employers use to reconcile their tax liability over the course of the calendar year.

This form is used to report a mortgage interest paid by an individual or sole proprietor during a tax year to the government, in order to receive a mortgage interest deduction on the borrower's federal income tax return.

This is a formal IRS document that outlines the details of a property foreclosure.

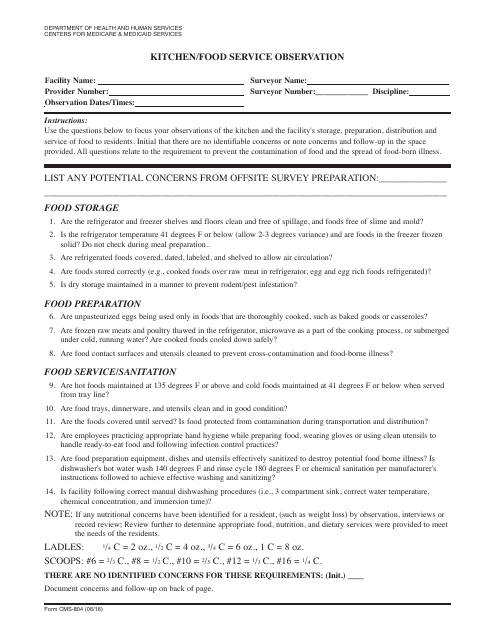

This Form is used for observing and evaluating the kitchen and food service areas in healthcare facilities to ensure compliance with relevant regulations and standards.

Download this form if you are an educational institution and need information about qualified tuition and related fees paid during the tax year. The information can be used by the paying student to calculate their education-related tax deductions and credits.

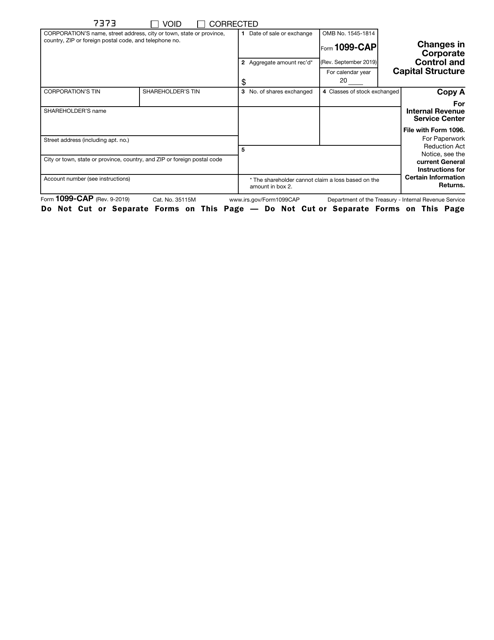

This is a formal IRS document used by entities that charge their customers a commission or fee for handling buy and sell orders to report how much capital gain or loss every client has got.

This form is a fiscal instrument used by creditors to inform their debtors about the debts they canceled over the course of the calendar year.

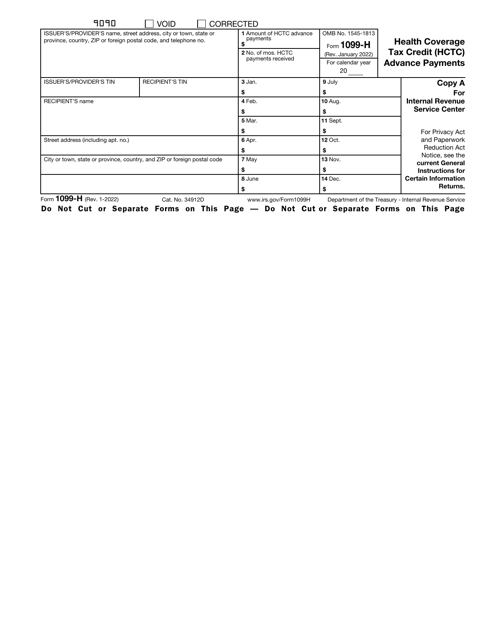

This is an IRS document released for those individuals who got payments during the calendar year of qualified health insurance payments for the benefit of eligible trade adjustment assistance.

This is a detailed form a partnership sends to every partner that participates in joint management of the entity to let the partner determine what to include in their personal tax returns.

This is a formal IRS document business entities need to file with the fiscal authorities to outline the income they received during the tax year via methods that involve third parties.

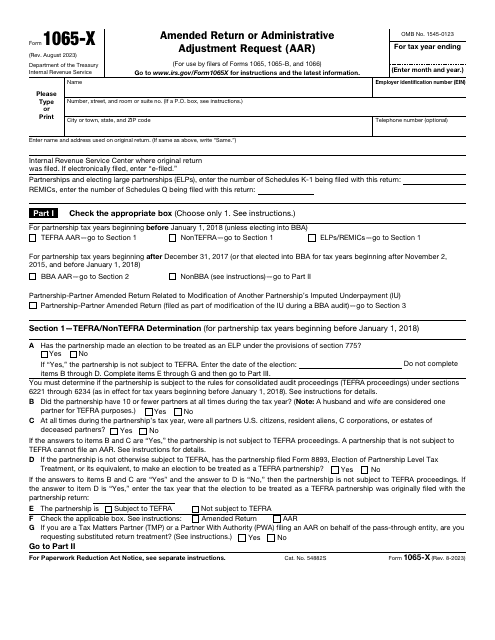

This is a fiscal statement used by partnerships and real estate mortgage investment conduits to fix the errors in previously filed IRS Form 1065, IRS Form 1065-B, IRS Form 1066.

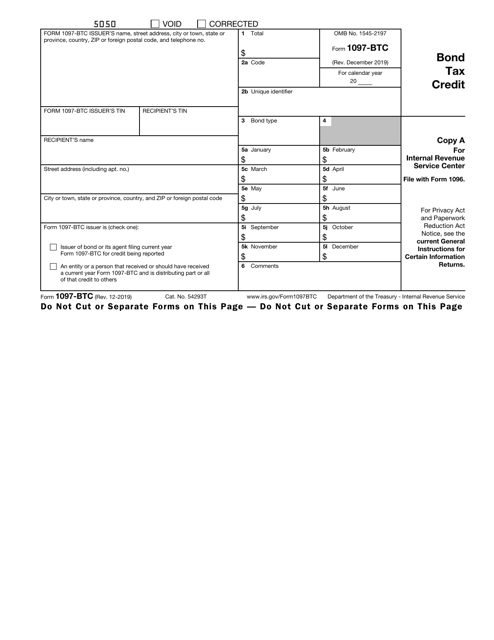

This is a formal IRS document prepared by tax credit bond issuers and taxpayers that distribute the credit in question.

Submit this form to the Internal Revenue Service (IRS) if you are a corporation that offers their employees an incentive stock option (ISO) to report to the IRS about your transfers of stock made to any transferee when that transferee exercises an ISO under Section 422(b).

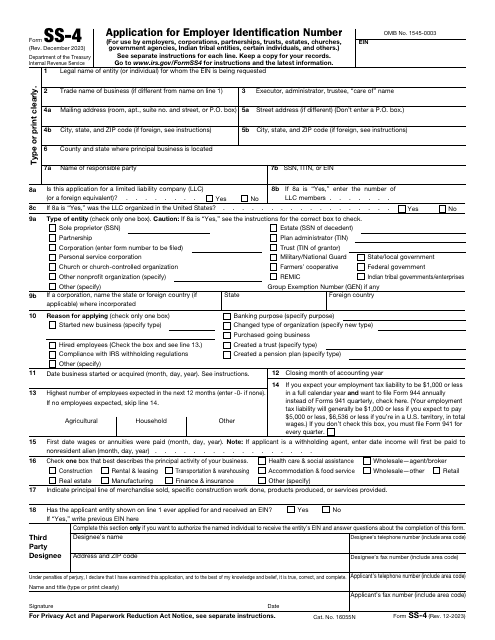

This is a fiscal document used by taxpayers - from sole proprietors to corporations - to ask tax organizations for a unique identification number.

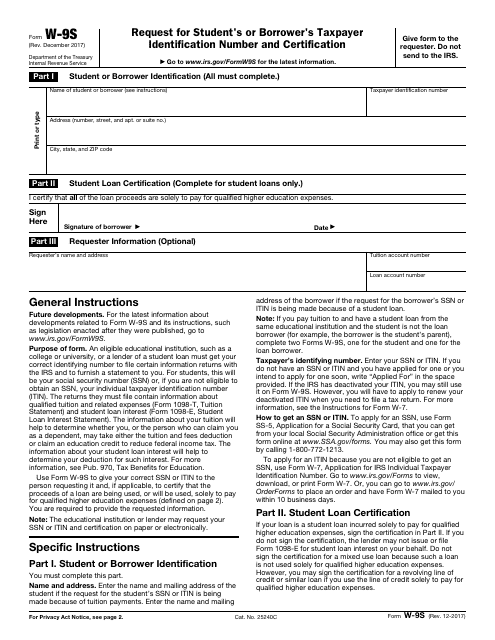

This is an IRS application requested from students to provide their taxpayer information to an educational institution (a college or university) or a lender of a student loan.

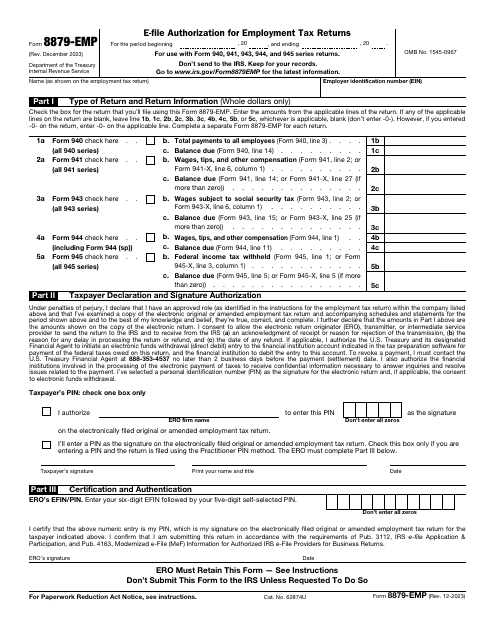

This is a supplementary form taxpayers may sign if they want to confirm their willingness to utilize a personal identification number that will allow them to provide an electronic signature when certifying employment tax returns or asking for a filing extension.

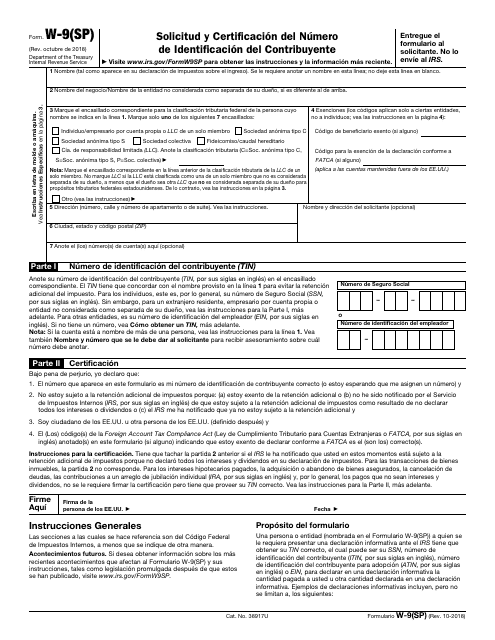

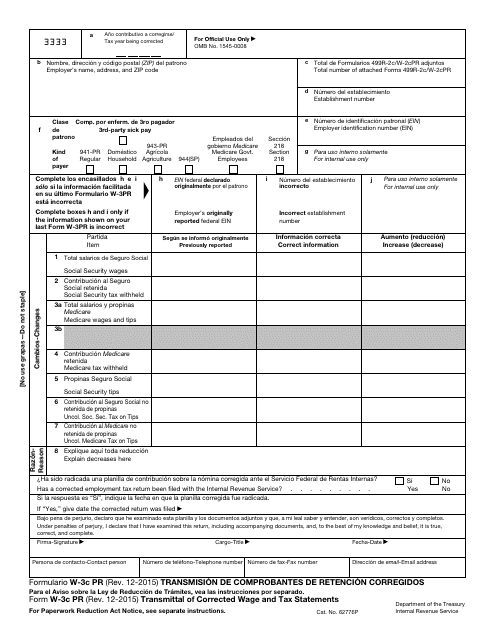

This document is used for transmitting corrected withholding statements in Puerto Rican Spanish.

This is a supplementary form used by employers to handle errors they have made upon filing IRS Form W-2, Wage and Tax Statement.

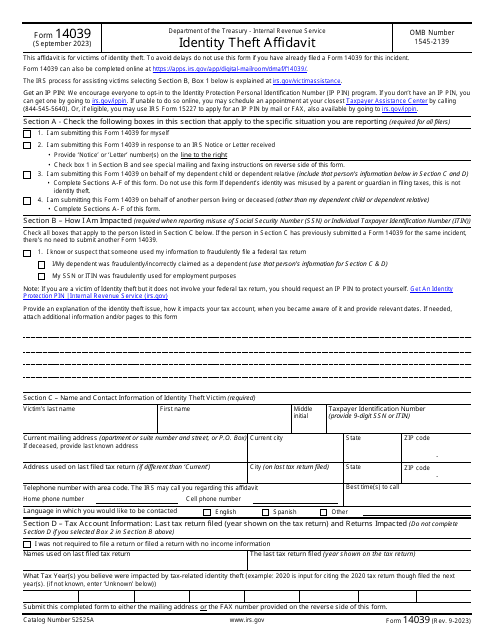

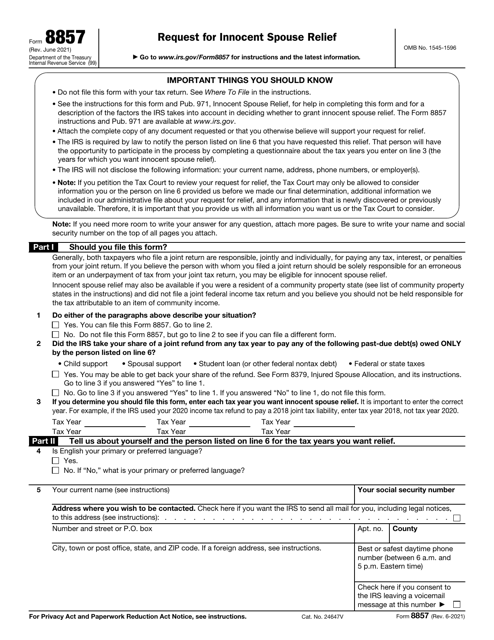

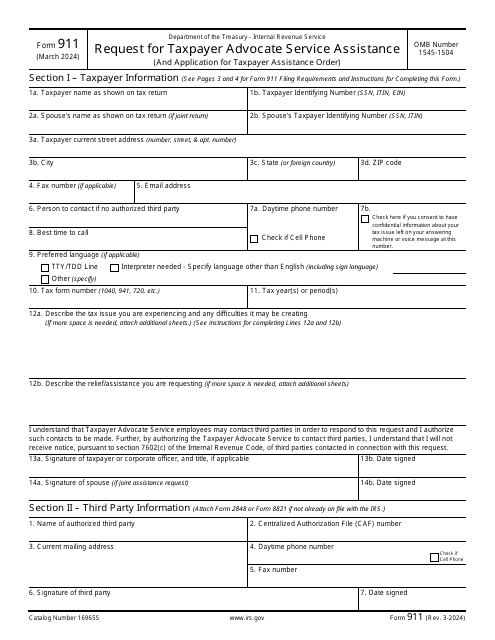

This is a fiscal form used by taxpayers that have already exhausted all other options when dealing with a tax issue.

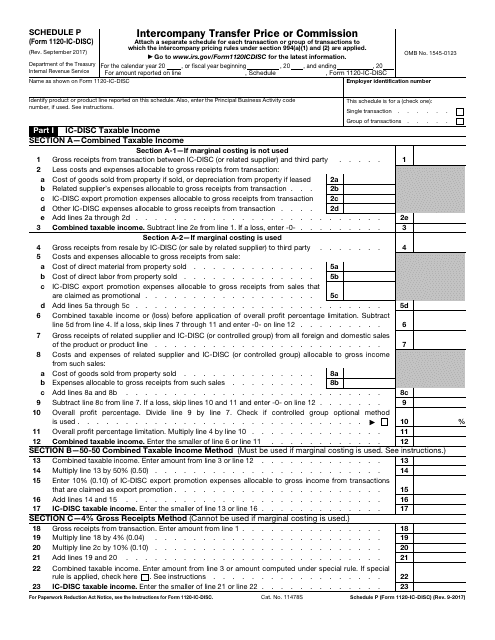

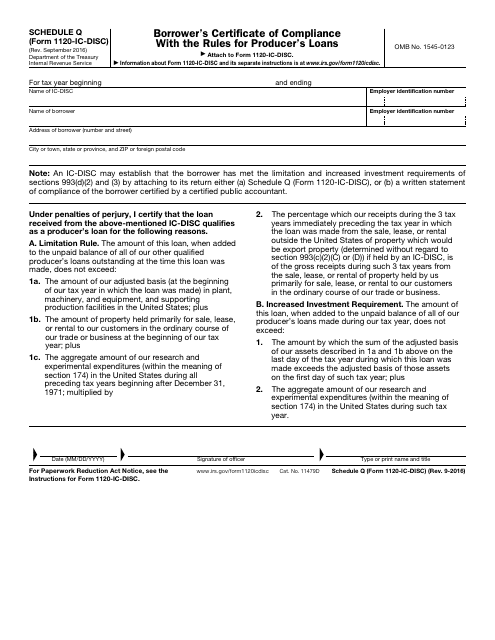

This Form is used for borrowers to certify their compliance with the rules for producer's loan related to IRS Form 1120-IC-DISC Schedule Q.