Fill and Sign Legal Forms and Templates

Documents:

152222

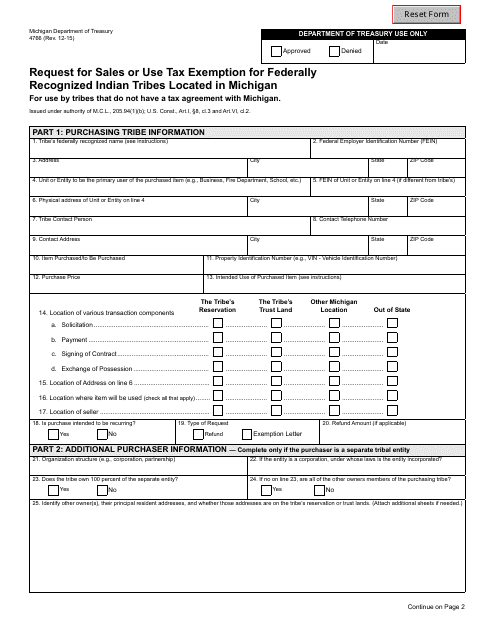

This form is used for requesting sales or use tax exemption for federally recognized Indian tribes located in Michigan.

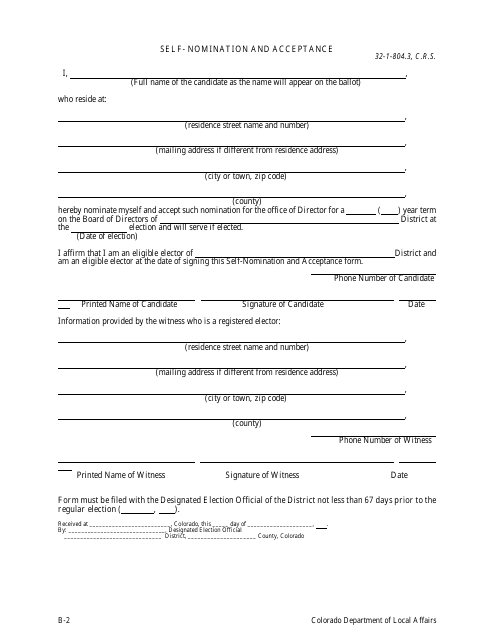

This Form is used for self-nomination and acceptance in the state of Colorado.

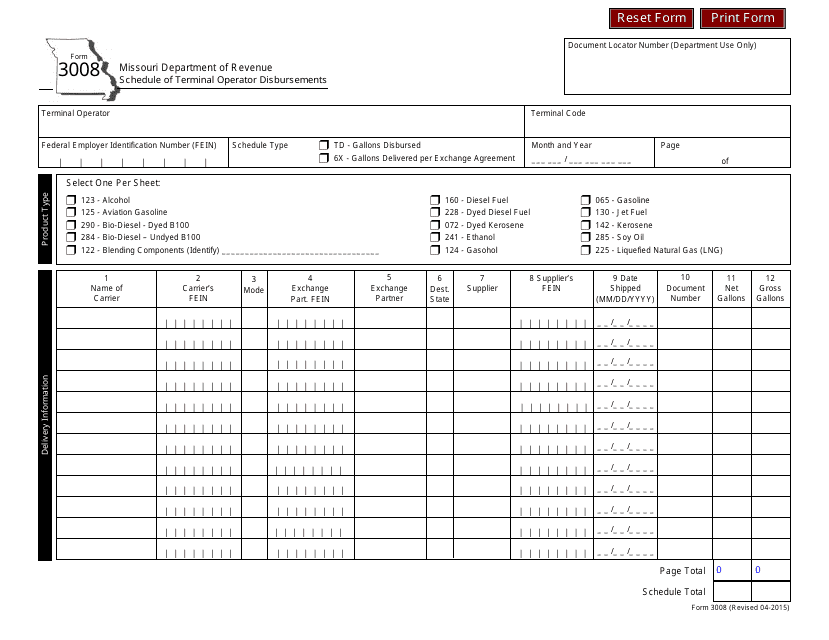

This form is used for detailing the disbursements made by terminal operators in Missouri.

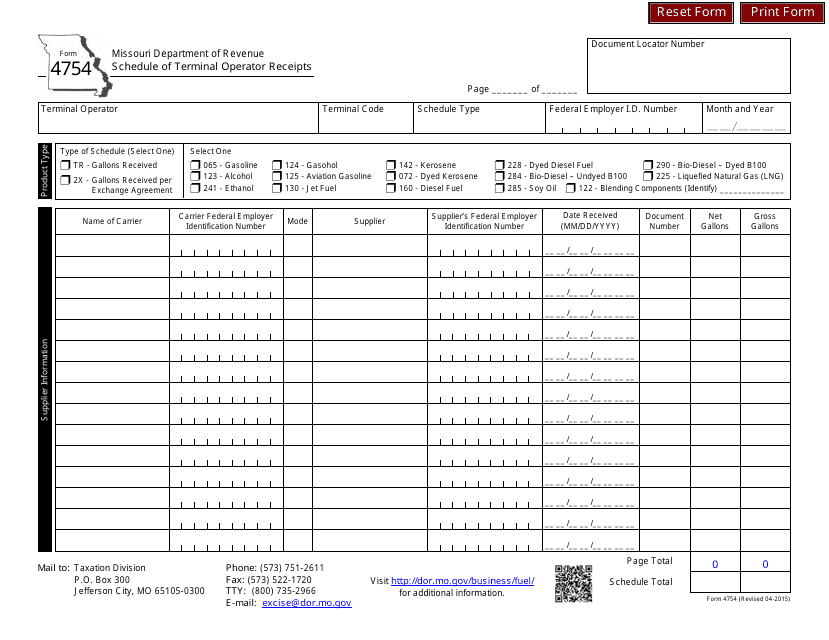

This form is used for reporting the receipts of terminal operators in Missouri. It helps to track and calculate the revenue generated by terminal operators in the state.

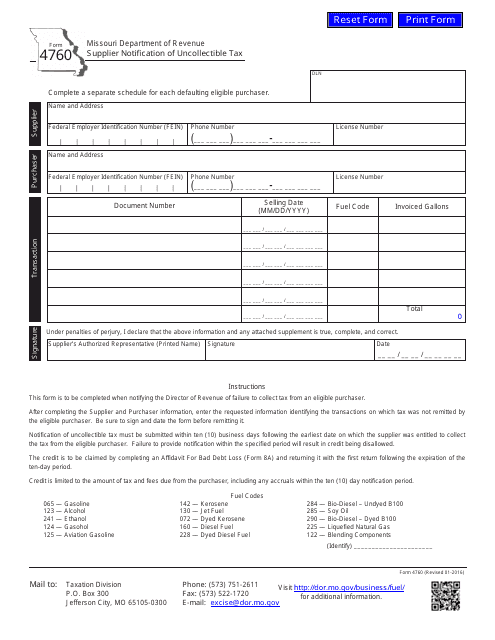

This form is used for suppliers in Missouri to notify the state about uncollectible tax.

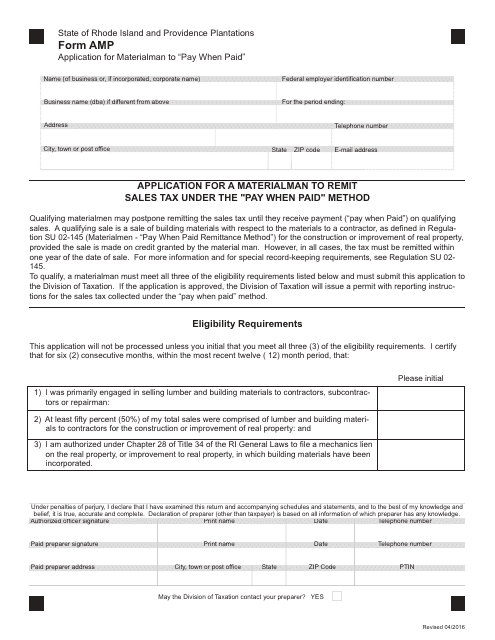

This form is used for materialmen in Rhode Island to remit sales tax under the "pay when paid" method. It allows them to report and pay the appropriate sales tax on their transactions.

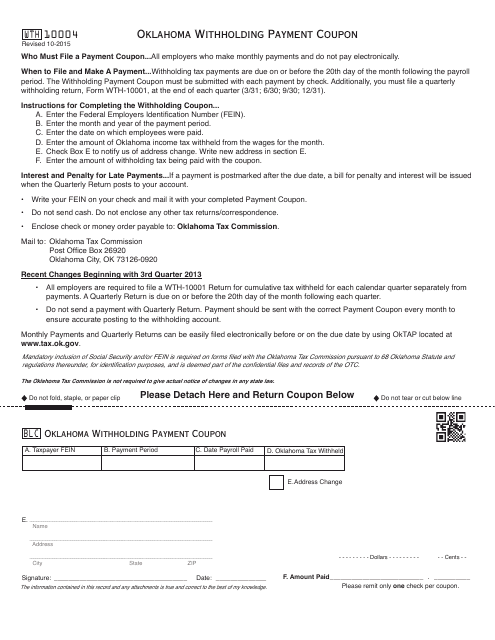

This document is a payment coupon specifically used for Oklahoma state withholding taxes. It is used to make payments for withholding taxes to the state of Oklahoma.

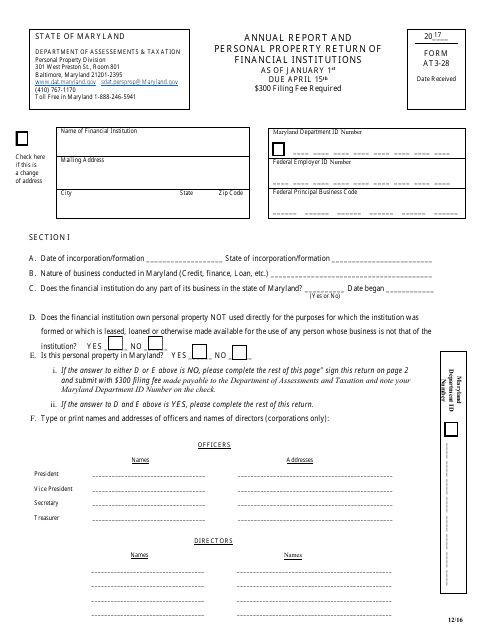

This Form is used for financial institutions in Maryland to file their annual report and personal property return.

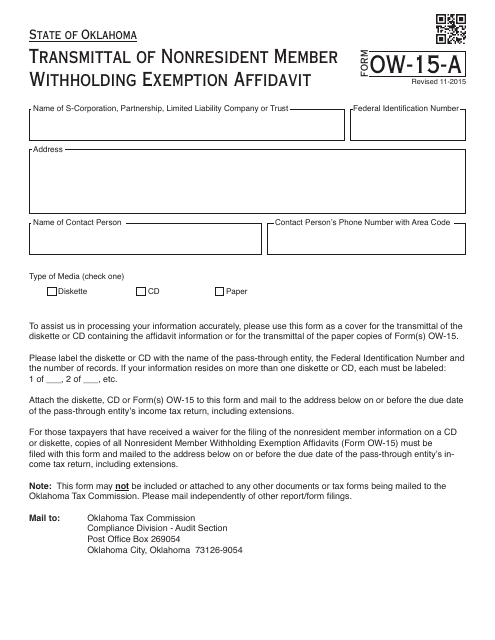

This document is used for transmitting the Nonresident Member Withholding Exemption Affidavit in Oklahoma.

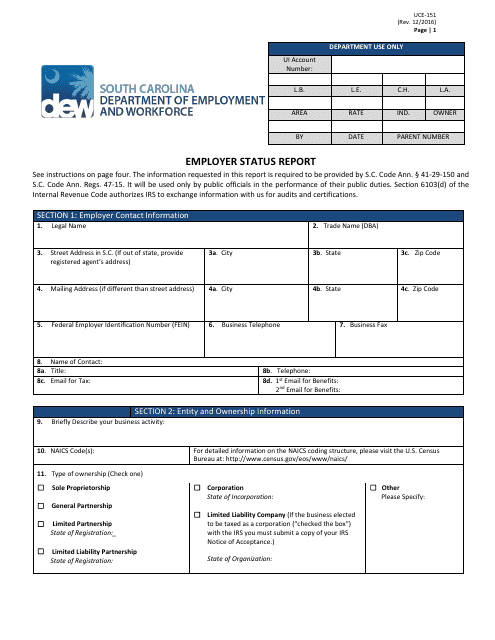

This form is used for employers in South Carolina to report their status.

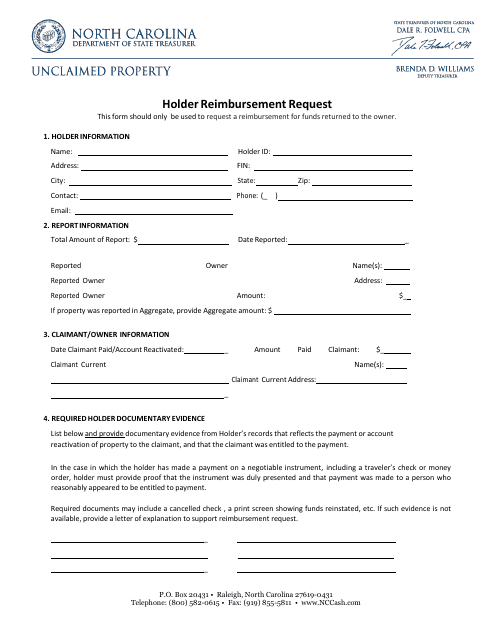

This form is used to request reimbursement for expenses incurred by the holder of a specific program in North Carolina.

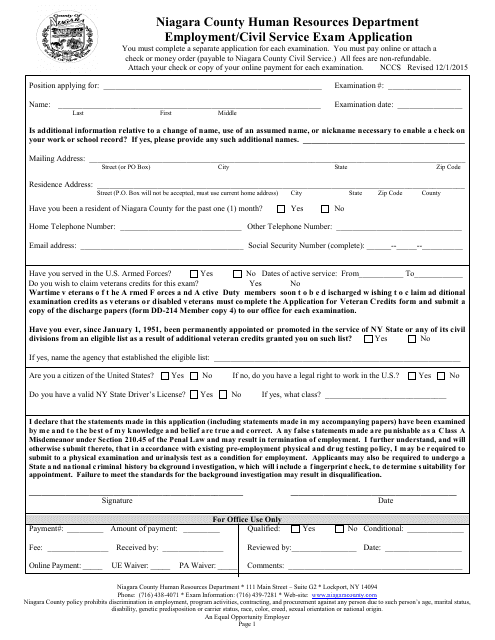

This form is used for applying for employment or civil service exams in Niagara County, New York.

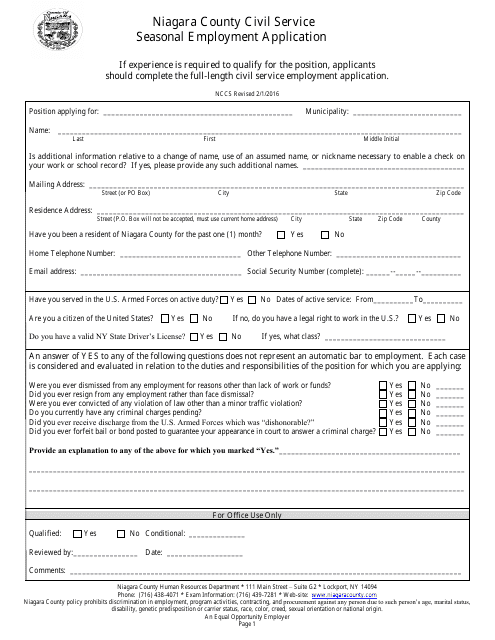

This Form is used for applying for seasonal employment in Niagara County, New York.

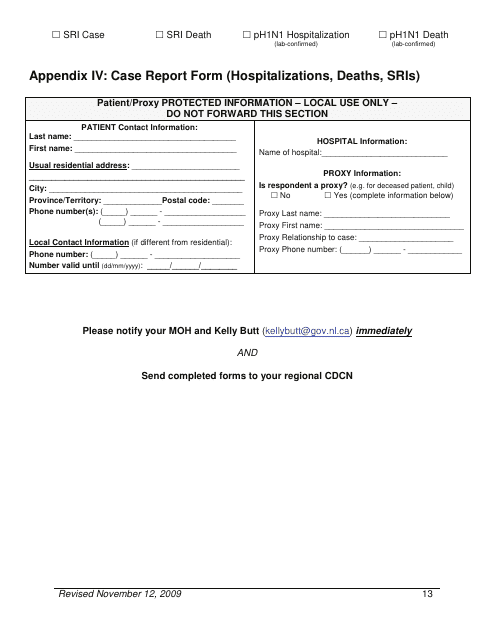

This document is an Appendix IV Case Report Form specifically for reporting hospitalizations, deaths, and serious adverse events in the context of healthcare in Newfoundland and Labrador, Canada.

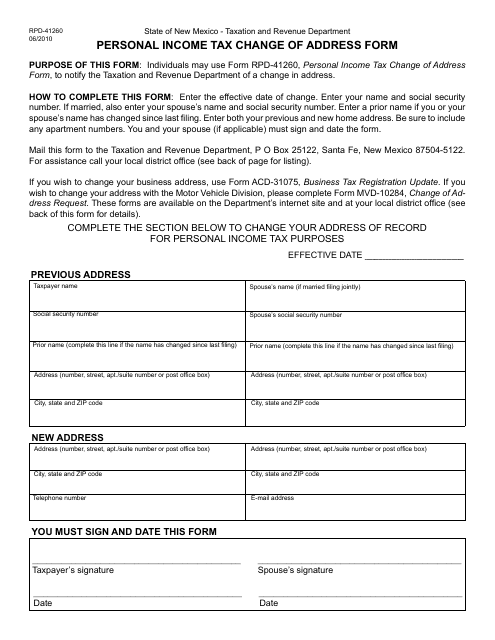

This Form is used for changing your address for personal income tax purposes in the state of New Mexico.

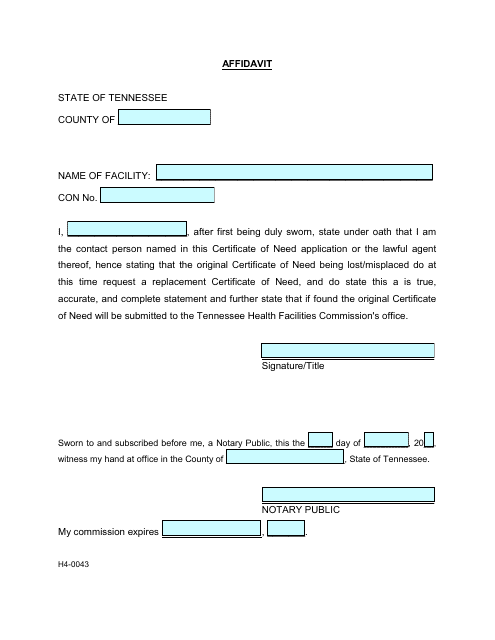

This form is used for filing an affidavit for a lost driver's license in the state of Tennessee.

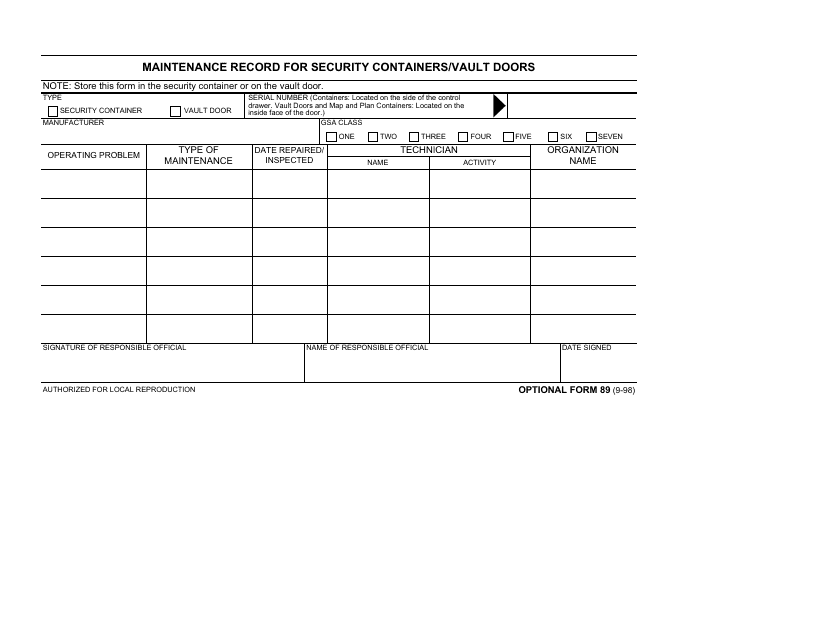

This Form is used for keeping track of maintenance records for security containers and vault doors.

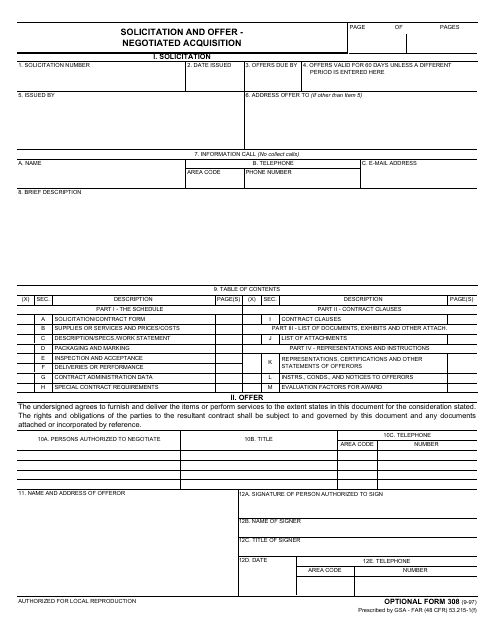

This form is used for the solicitation and offer of a negotiated acquisition. It provides a standardized format for the procurement process and aids in the negotiation and awarding of contracts.

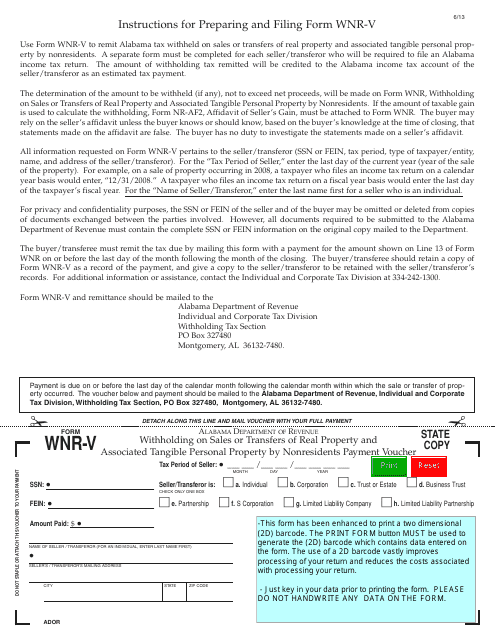

This form is used for making payment vouchers for nonresidents who are withholding on sales or transfers of real property and associated tangible personal property in Alabama.

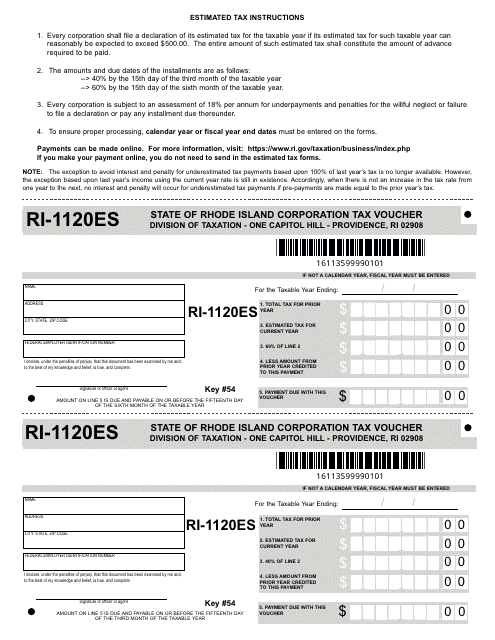

This form is used for submitting corporation tax payments to the State of Rhode Island.

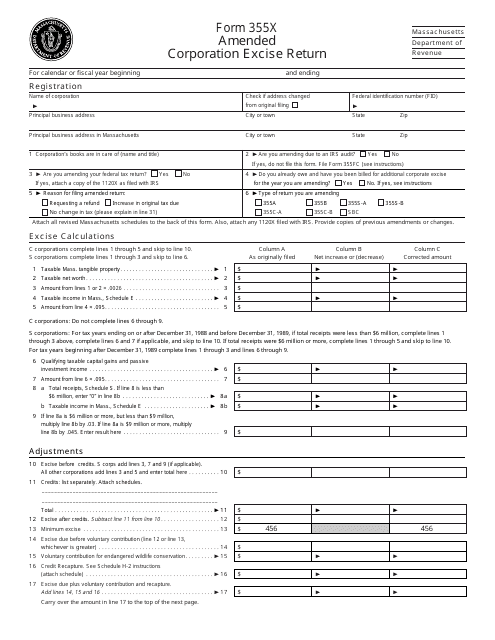

This form is used for filing an amended corporation excise return in the state of Massachusetts.

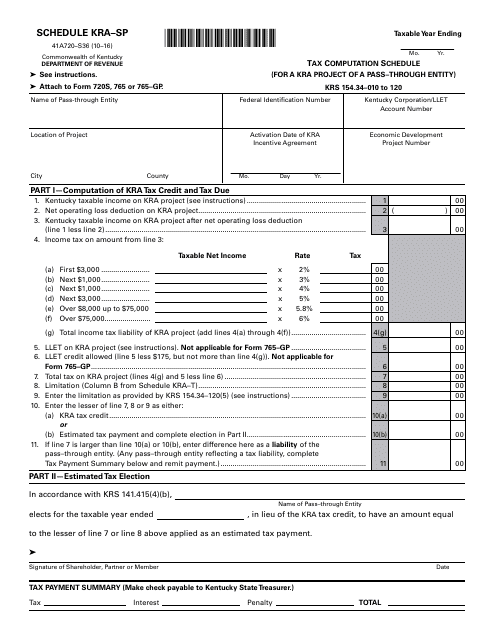

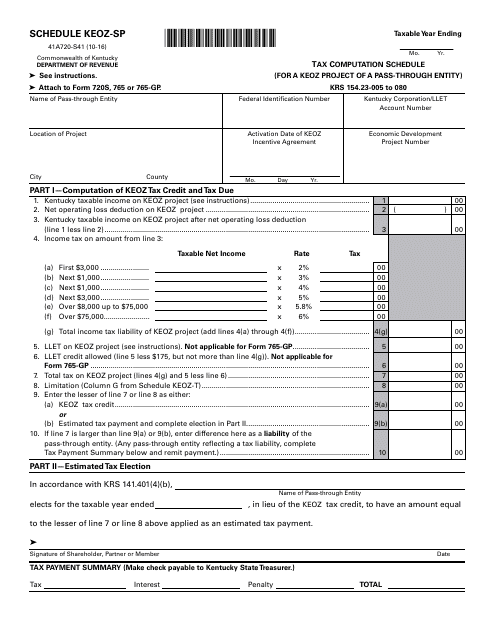

This Form is used for tax computation for a Kra project of a pass-through entity in Kentucky.

This Form is used for calculating the tax for a specific type of project in Kentucky that is owned by a pass-through entity.

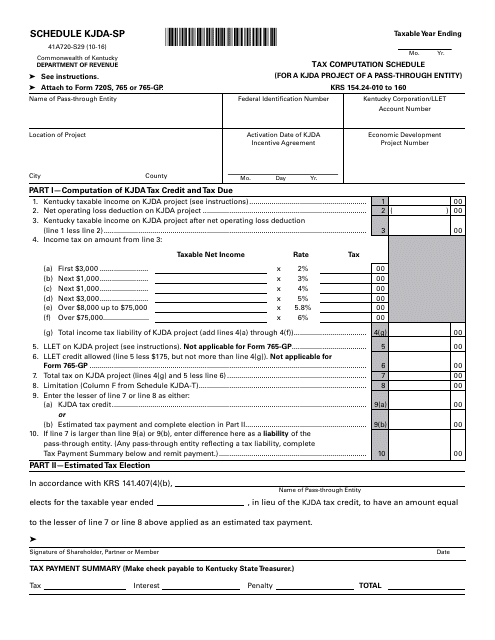

This document is used for tracking schedules for a Kjda Project in Kentucky.

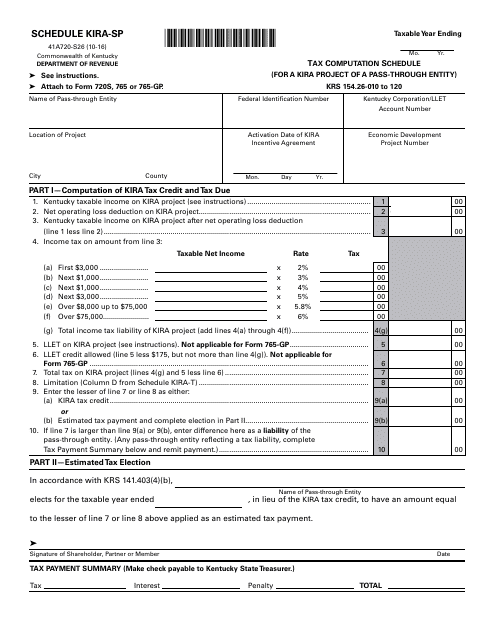

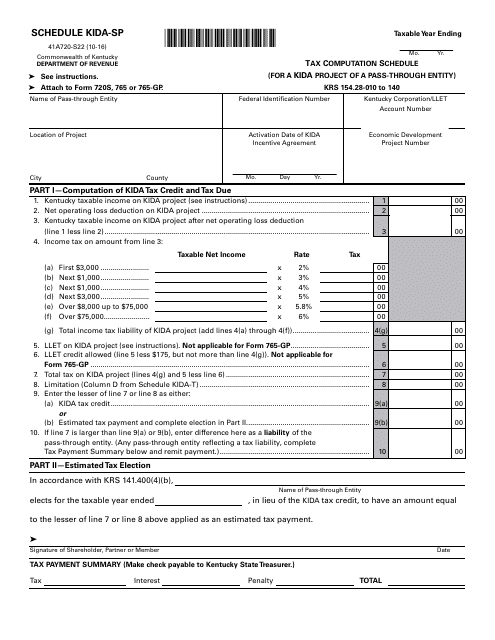

This form is used for calculating and reporting taxes for a Kira Project of a pass-through entity in Kentucky.

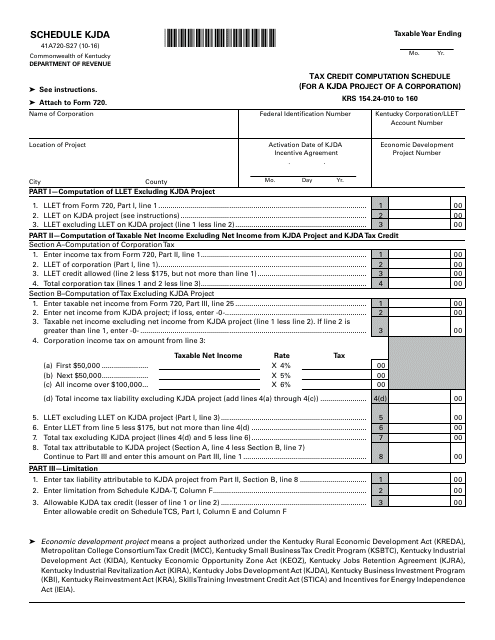

This form is used for calculating tax credits for a KJDA project of a corporation in Kentucky.

This form is used for tracking schedules related to a Kira project in the state of Kentucky.

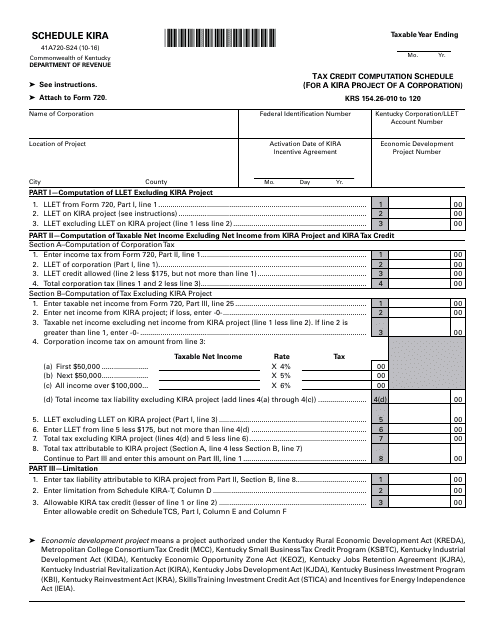

This form is used for calculating tax credits for a Kira project of a corporation in Kentucky.

This Form is used for calculating tax for a Kida project of a pass-through entity in Kentucky.

This Form is used for tracking a Kida Project in Kentucky.

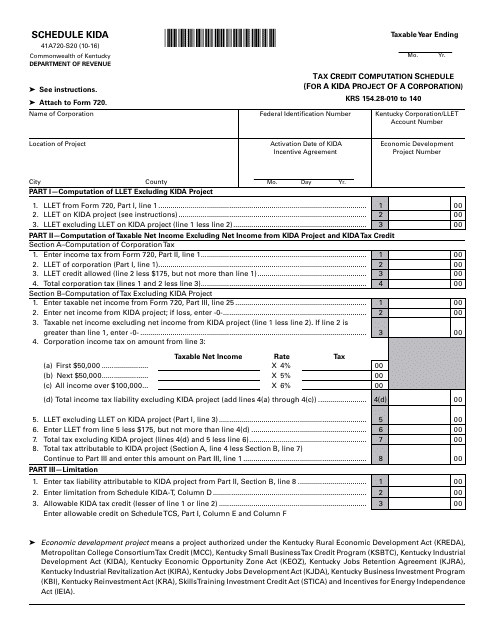

This form is used for calculating tax credits for a KIDA project of a corporation in Kentucky.

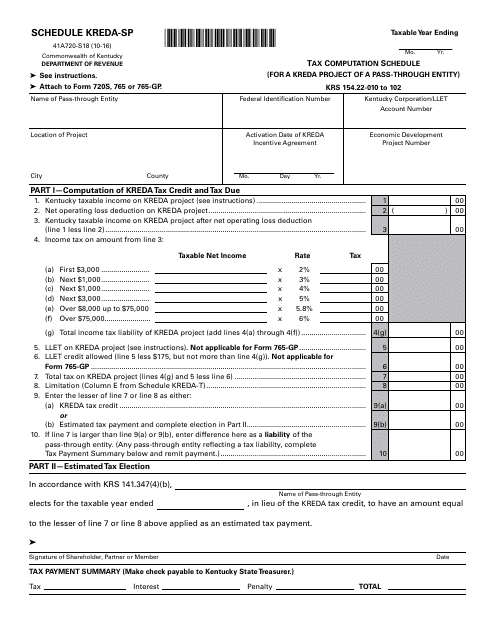

This form is used for calculating tax for a Kreda project of a pass-through entity in Kentucky.

This document is used for calculating the tax for a Keoz project of a pass-through entity in the state of Kentucky.