Fill and Sign Legal Forms and Templates

Documents:

152222

Form TC0047 Notice of the Requirement to Register as a Sex Offender - Massachusetts (Haitian Creole)

Download this form to report the interest amount paid on a qualified student loan during the past calendar year in cases when the amount exceeded $600.

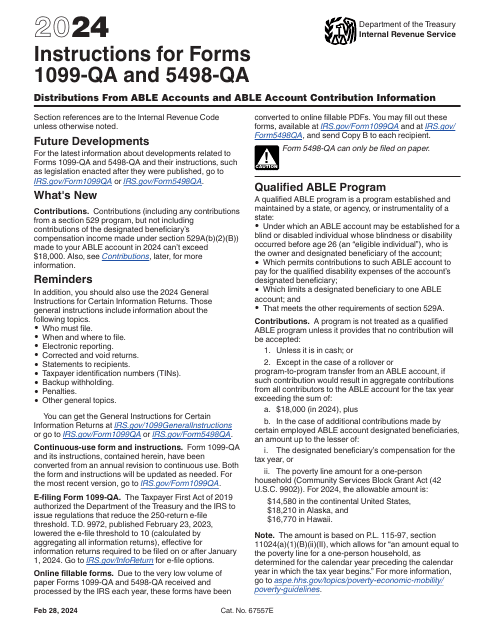

This form is completed by federal, state, and local government units (payers) and sent to the Internal Revenue Service (IRS), state tax department, and taxpayers (recipients) if certain payments were made over the previous year.

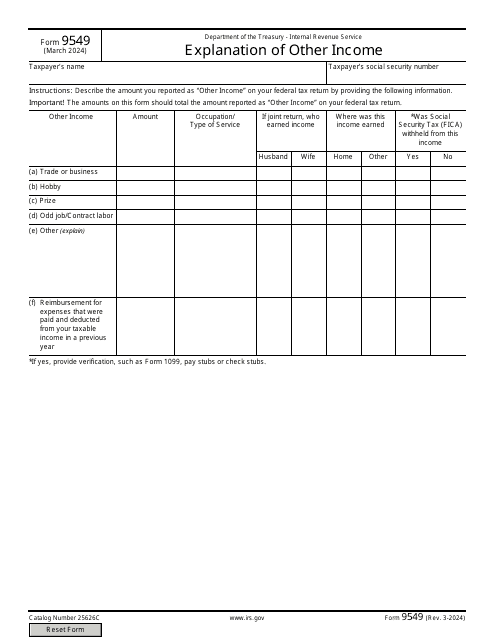

This is a formal IRS document business entities need to file with the fiscal authorities to outline the income they received during the tax year via methods that involve third parties.

Download this form if you are an educational institution and need information about qualified tuition and related fees paid during the tax year. The information can be used by the paying student to calculate their education-related tax deductions and credits.