Fill and Sign Legal Forms and Templates

Documents:

152222

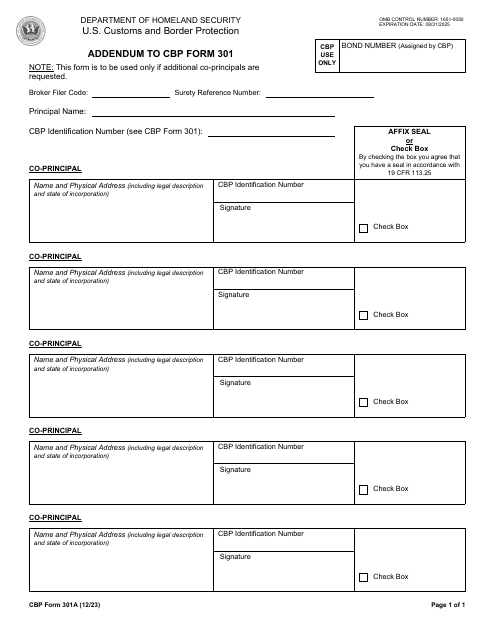

Use this Customs and Border Protection (CBP) form to provide information about additional co-principals. This document is part of the CBP Form 301 and cannot be filed separately.

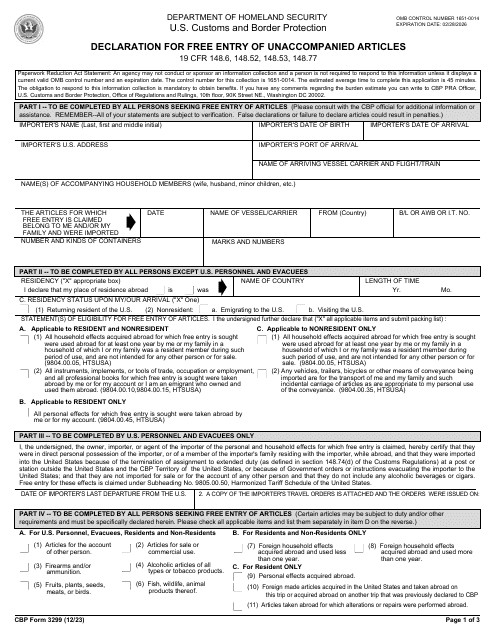

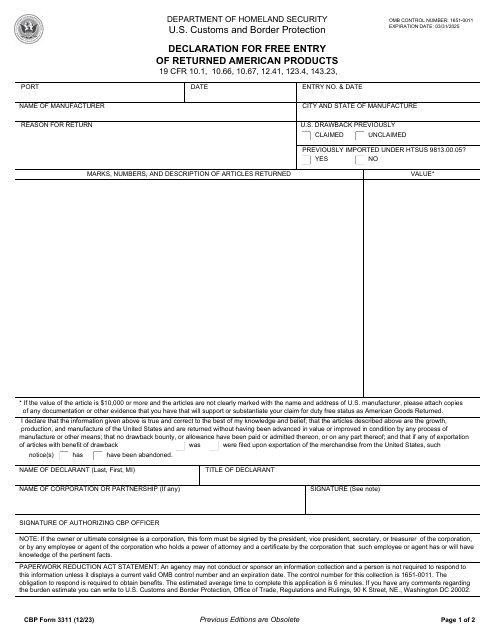

You have to provide a detailed description of your unaccompanied articles, as only a complete inventory of imported goods will be accepted by the Customs and Border Protection (CBP).

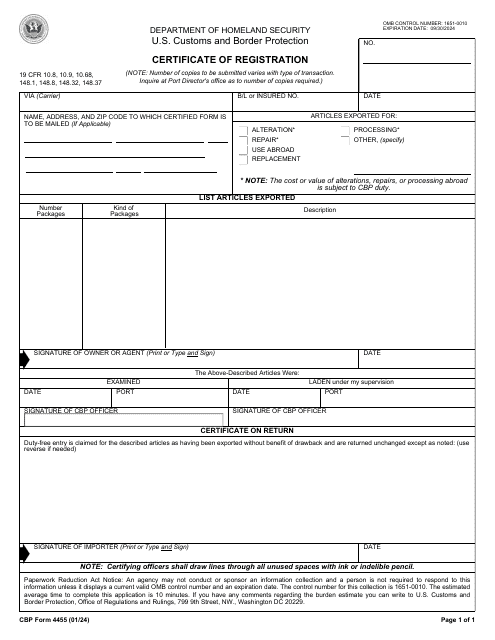

Fill out this form prior to departure if you are a traveler and wish to provide supporting documentation for the temporary export of your gear and equipment. This will facilitate the return to the States with the items you are leaving the country.

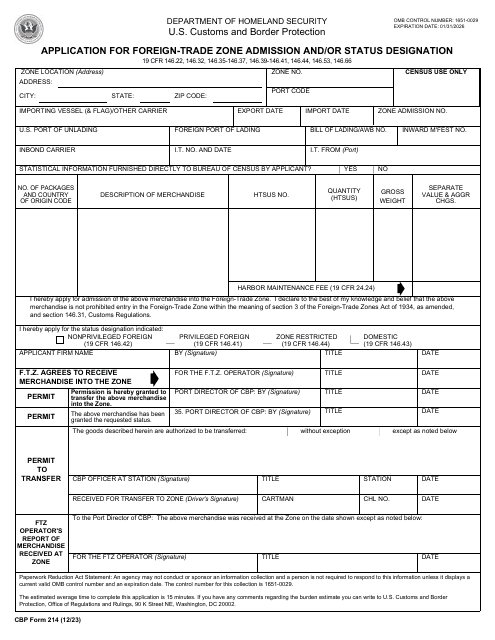

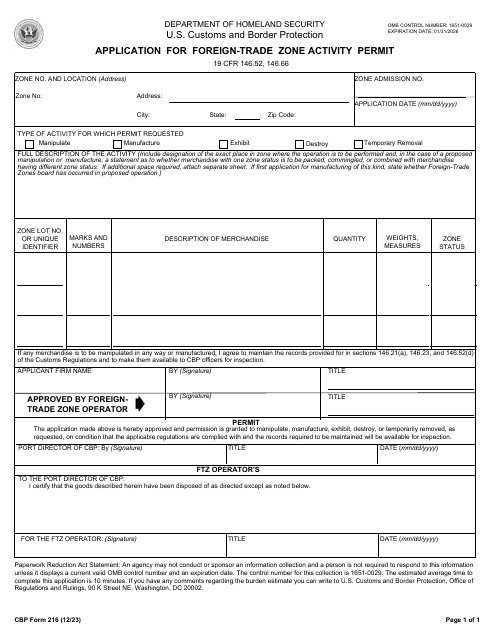

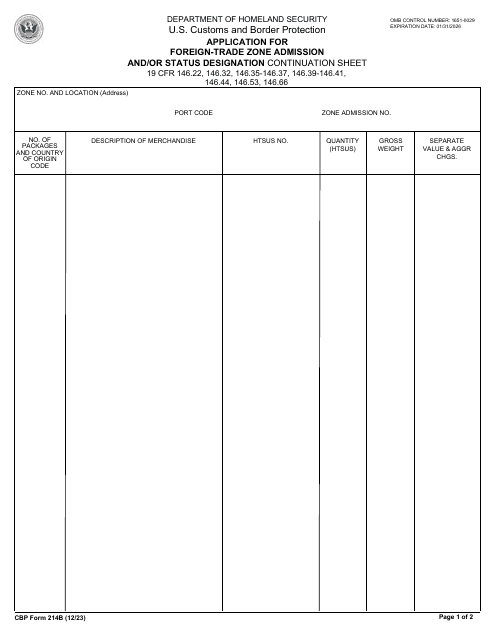

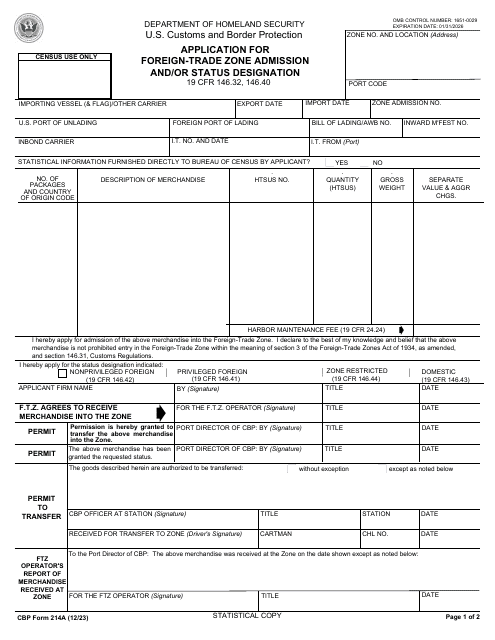

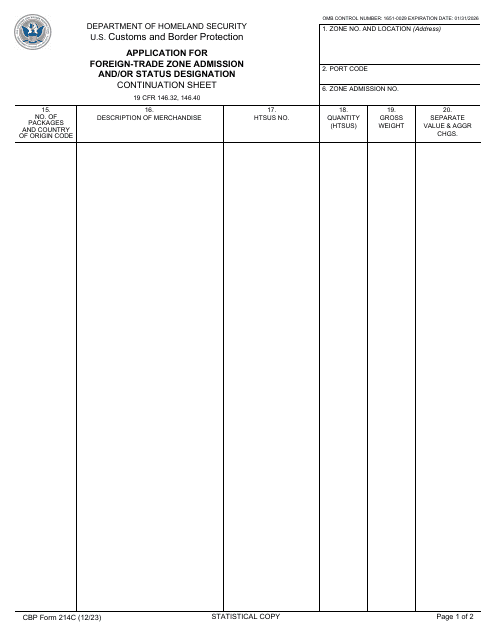

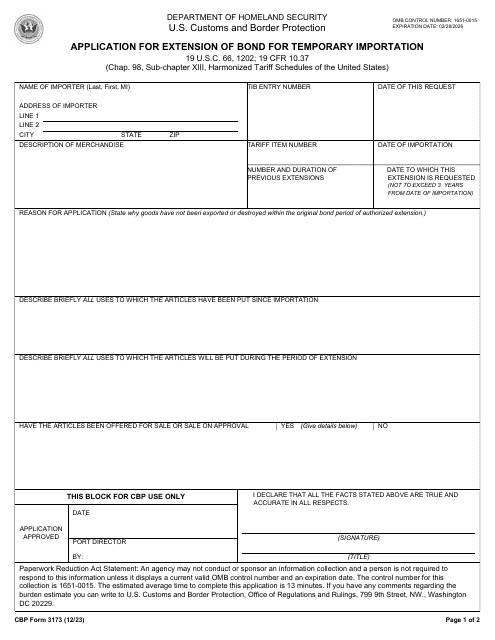

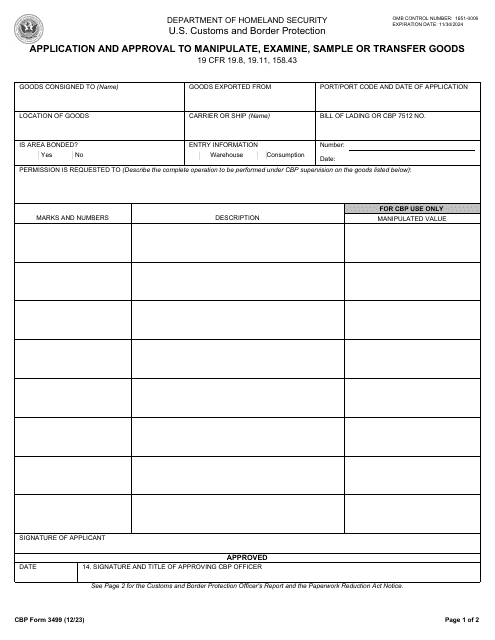

File this application if you are an importer, transferees, consignee, or owner of the merchandise that you transport to the United States in order to perform various operations on your merchandise while at Customs and Border Protection (CBP) facilities.

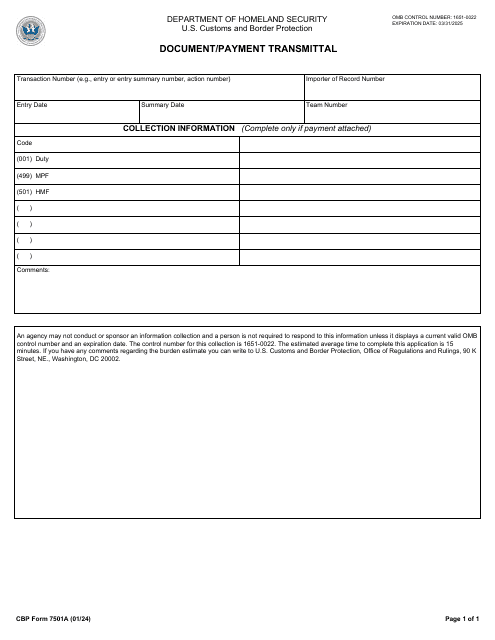

The Customs and Border Protection (CBP) uses this form to link a supplemental payment after an original automated clearing house payment with the associated entry. It verifies the respondent's account.

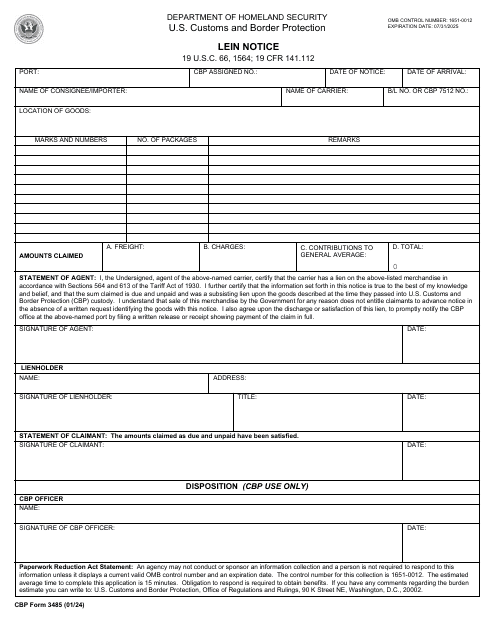

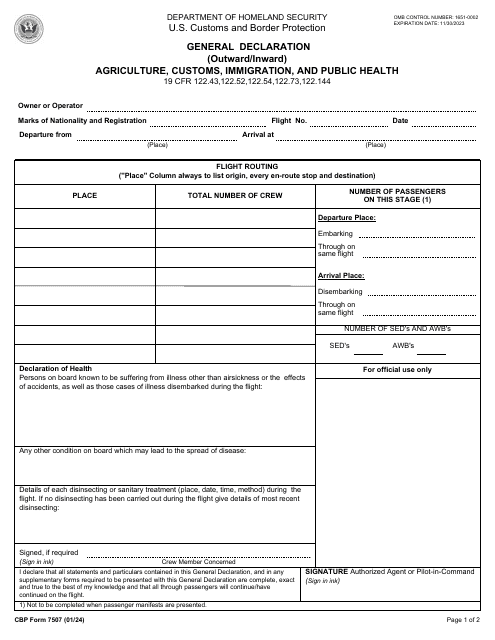

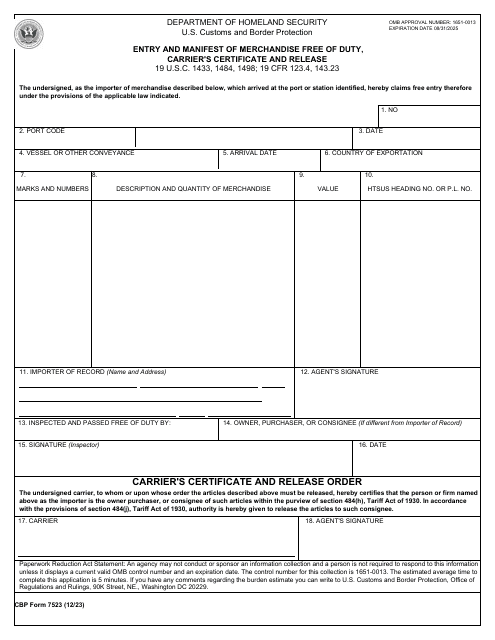

This form is required by the Customs and Border Protection (CBP) and is only used in certain situations by importers and carriers as a manifest for the entry of merchandise free of duty into the United States.