Fill and Sign Legal Forms and Templates

Documents:

152222

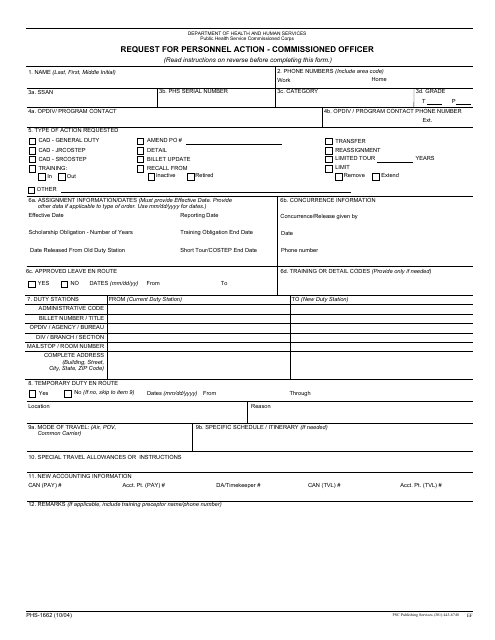

This form is used for requesting personnel actions for commissioned officers.

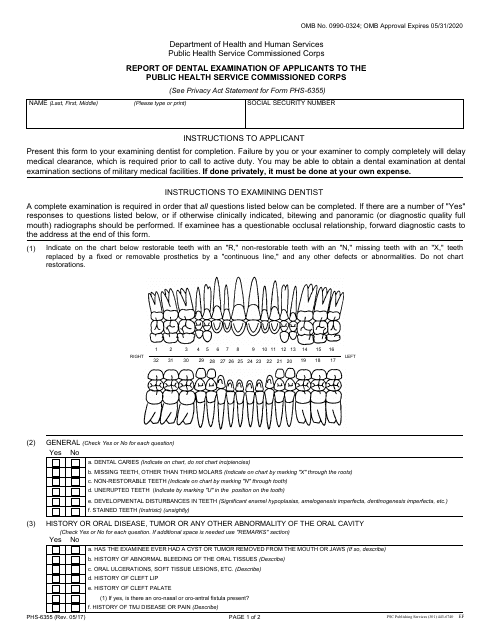

This form is used for reporting the dental examination of applicants to the Public Health Service Commissioned Corps.

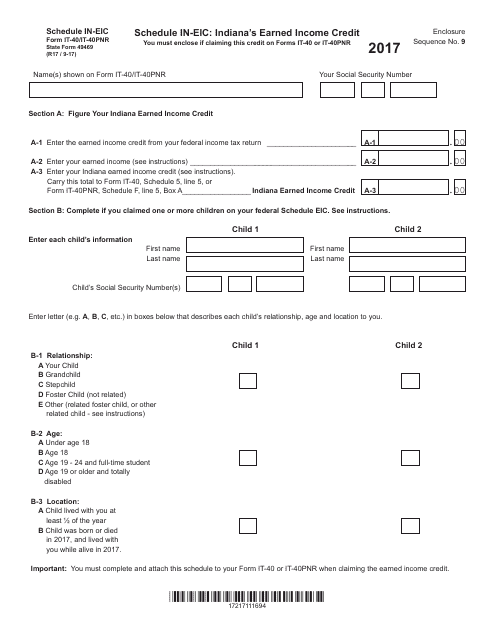

This form is used for claiming Indiana's Earned Income Credit on your state tax return if you are a resident or part-year resident of Indiana.

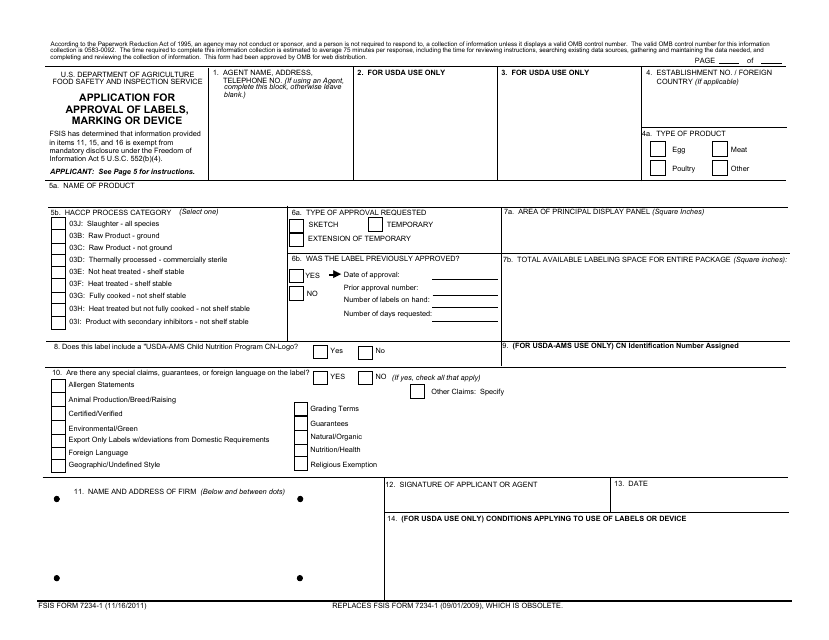

This Form is used for applying for approval of labels, marking, or device for food products.

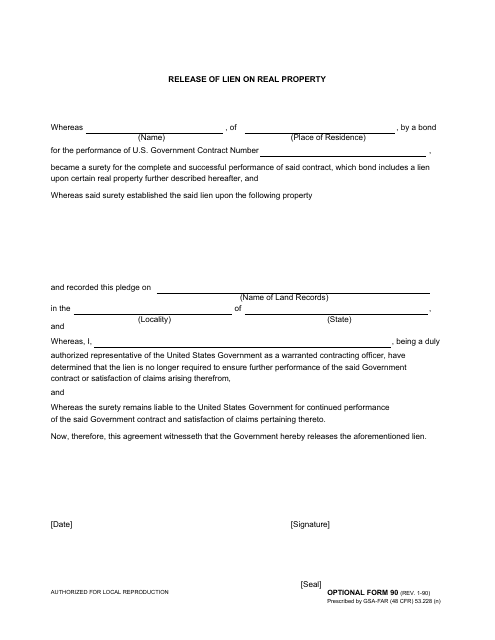

This document is used to release a lien on a piece of real property.

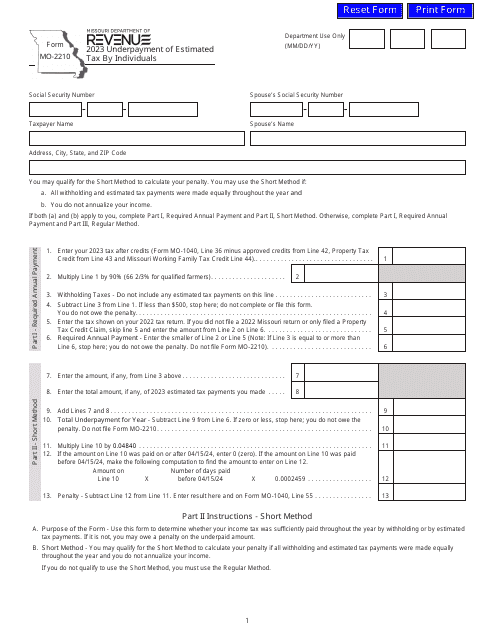

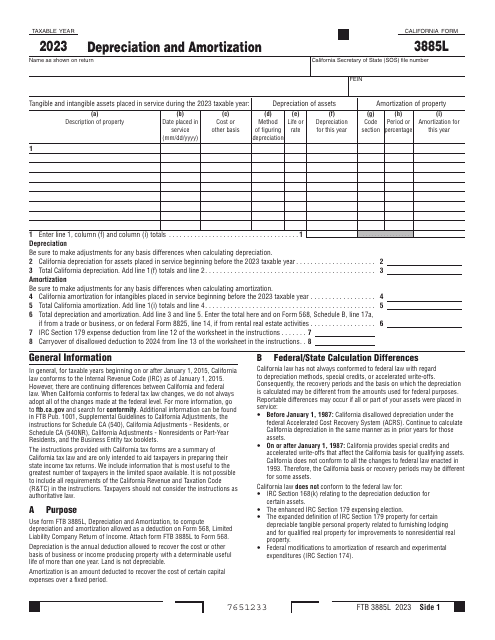

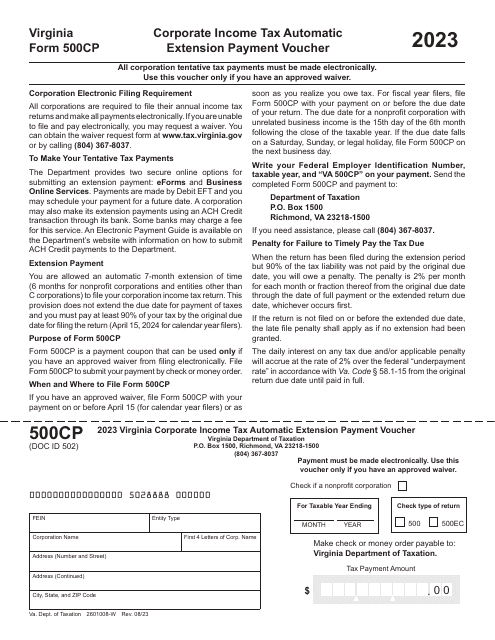

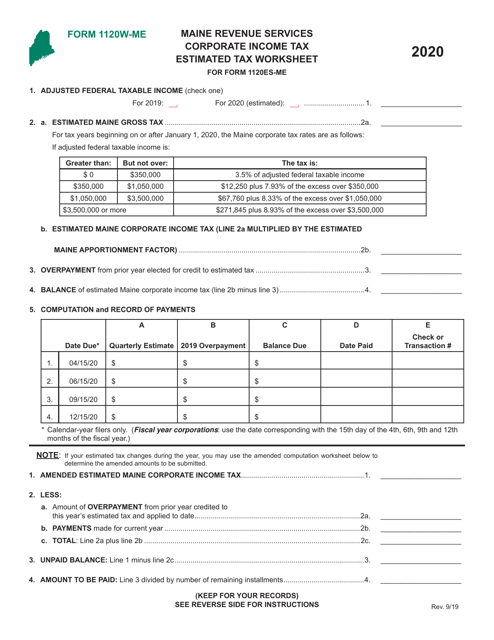

This is a supplementary form corporations were expected to fill out to compute the amount of estimated tax they owe to fiscal authorities.

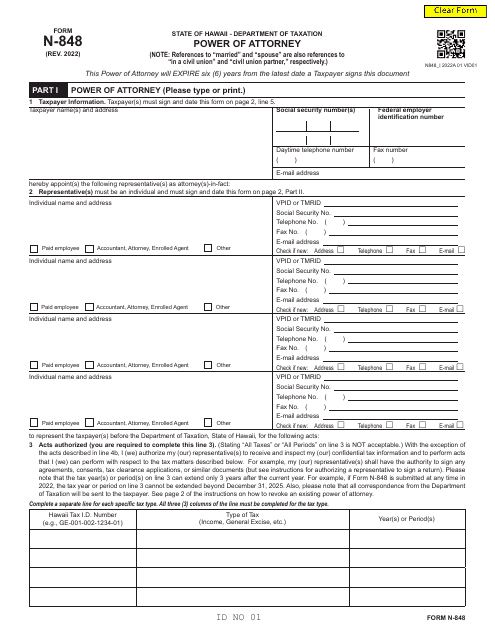

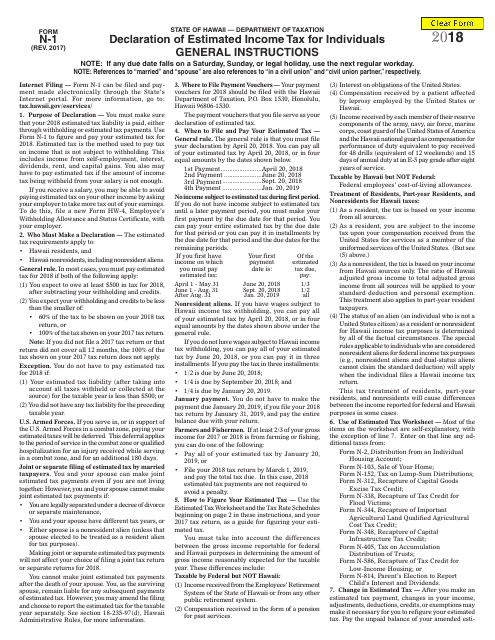

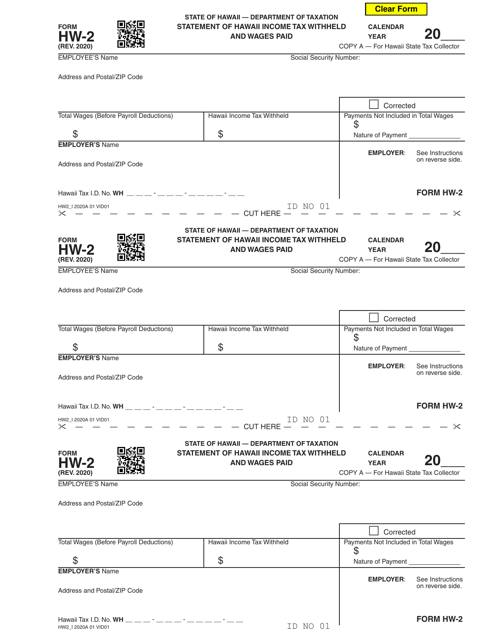

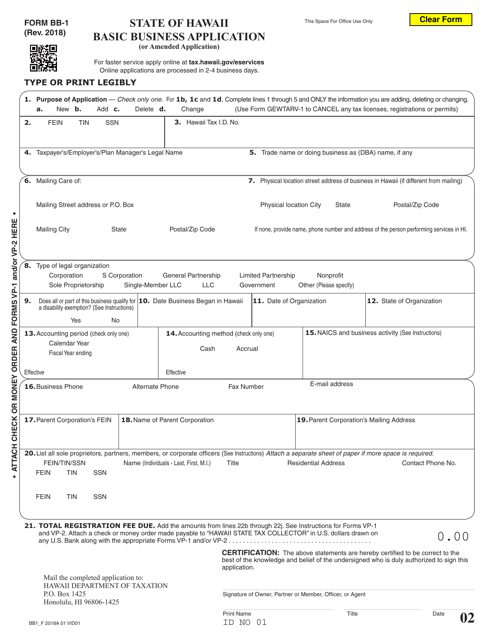

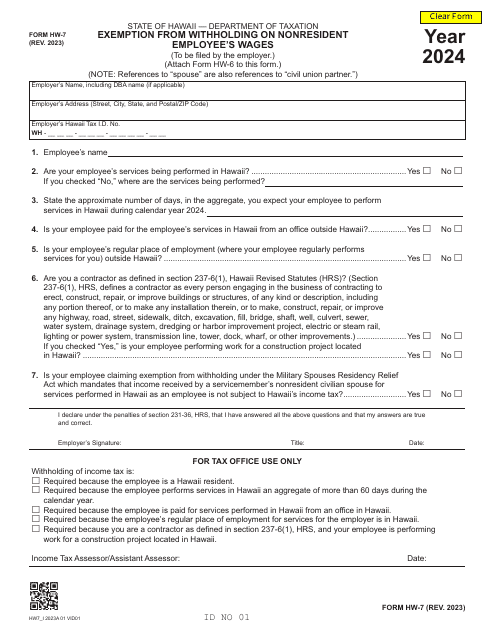

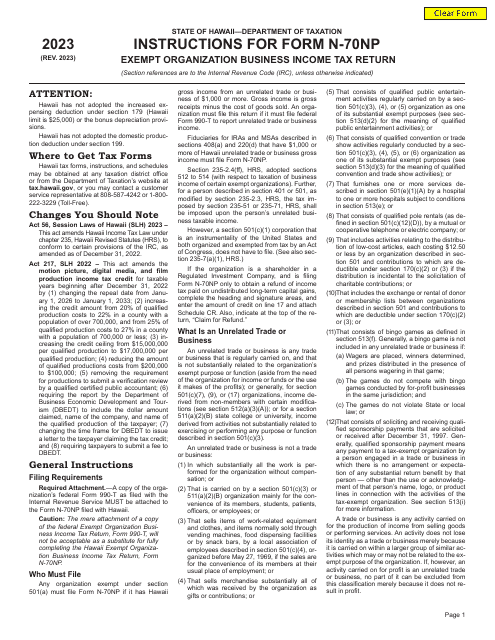

This form is used for individuals in Hawaii to declare their estimated income tax for the year. It is used to estimate and pay taxes throughout the year, rather than waiting until the tax return is due.

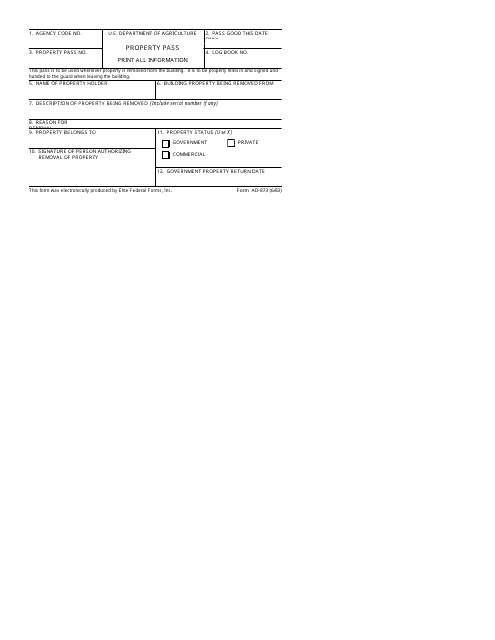

This form is used for requesting and documenting the transfer of government property within an organization.

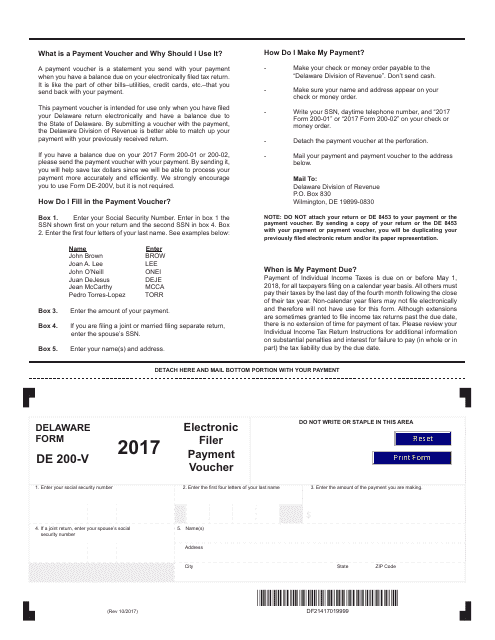

This form is used for making electronic payments for various taxes to the state of Delaware.

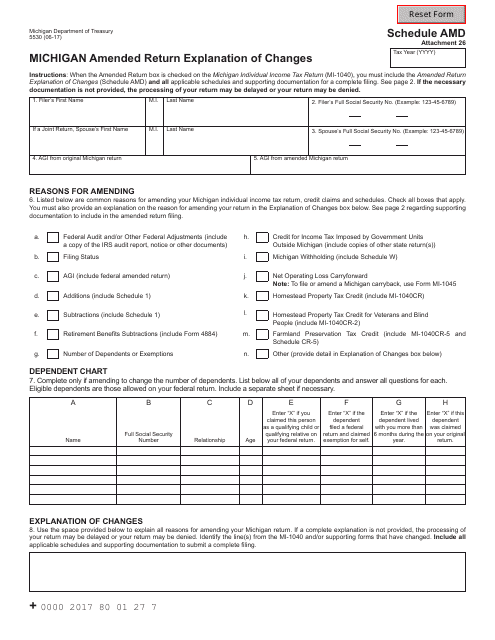

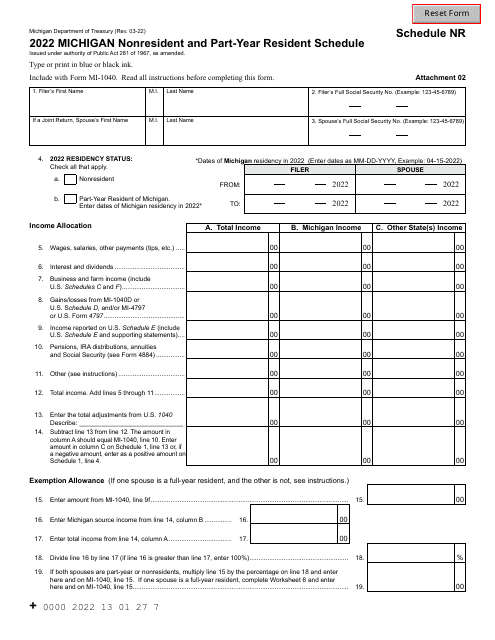

This form is used for explaining the changes made to an amended tax return in the state of Michigan.

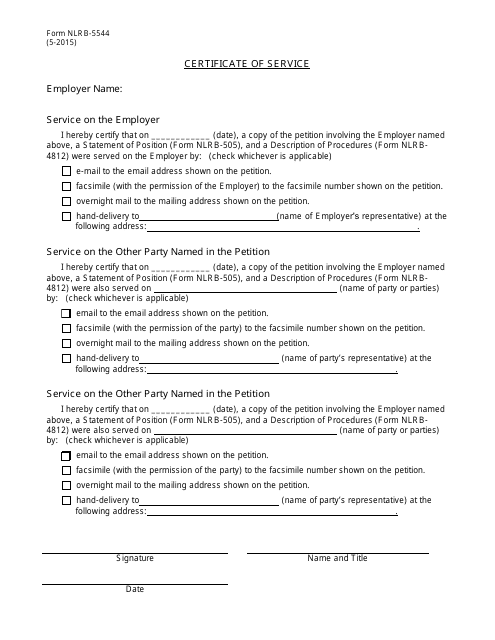

This document is used to certify the service of a petition to the National Labor Relations Board. It confirms that the petition has been properly delivered to all required parties.

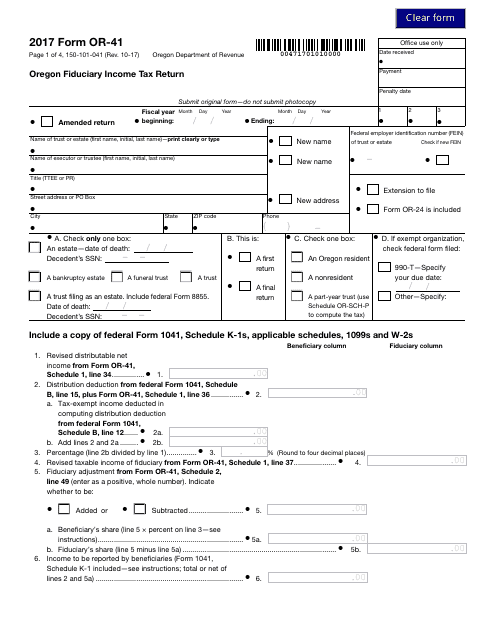

This form is used for filing the Oregon Fiduciary Income Tax Return in the state of Oregon. It is specifically used by fiduciaries to report income earned by an estate or trust.

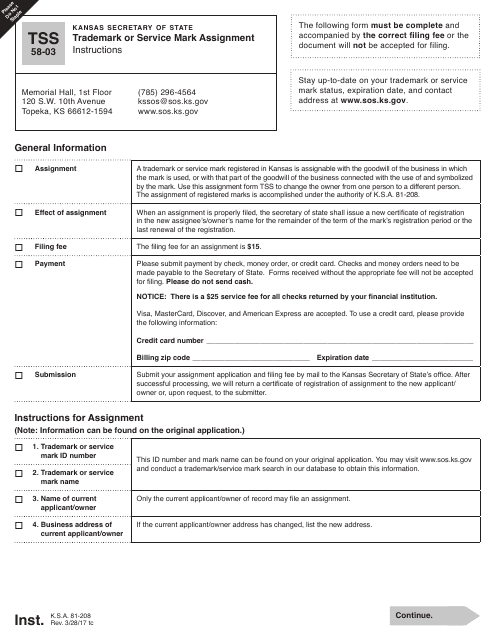

This Form is used for assigning a trademark or service mark in the state of Kansas.

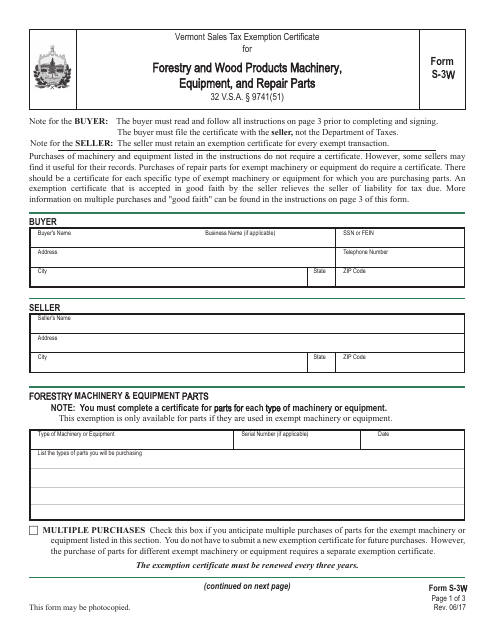

This Form is used for reporting forestry and wood products machinery, equipment, and repair parts in the state of Vermont.

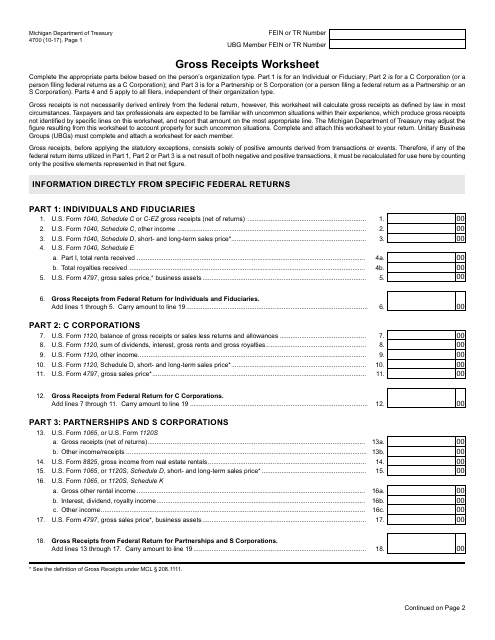

This form is used for calculating gross receipts in the state of Michigan. It helps businesses determine their total income for tax purposes.

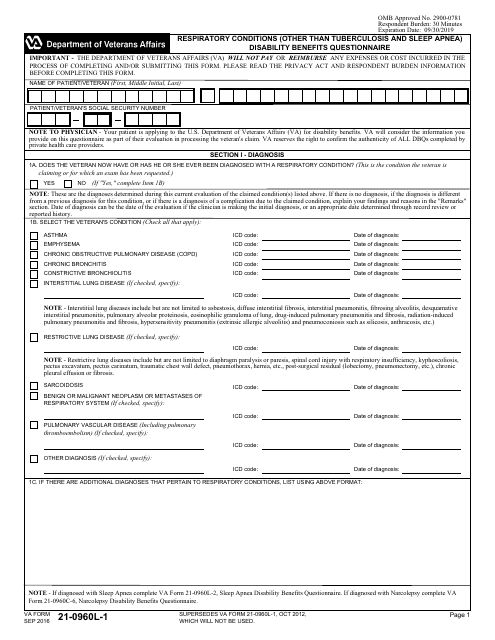

This document is a form used for evaluating respiratory conditions (excluding tuberculosis and sleep apnea) for disability benefits.

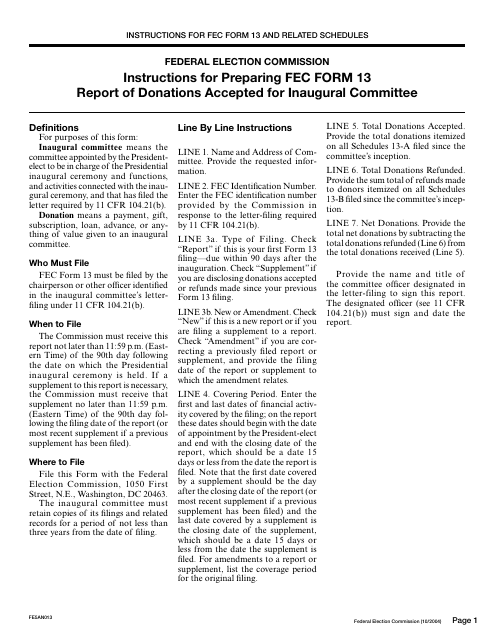

This document is used for reporting donations accepted by an inaugural committee for a presidential inauguration. It provides instructions on how to fill out FEC Form 13.