Fill and Sign Legal Forms and Templates

Documents:

152222

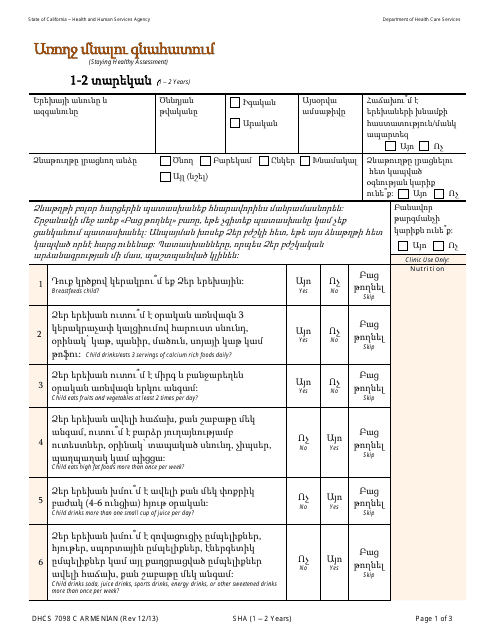

This form is used for conducting a Staying Healthy Assessment for children aged 1-2 years in California. It is available in Armenian language.

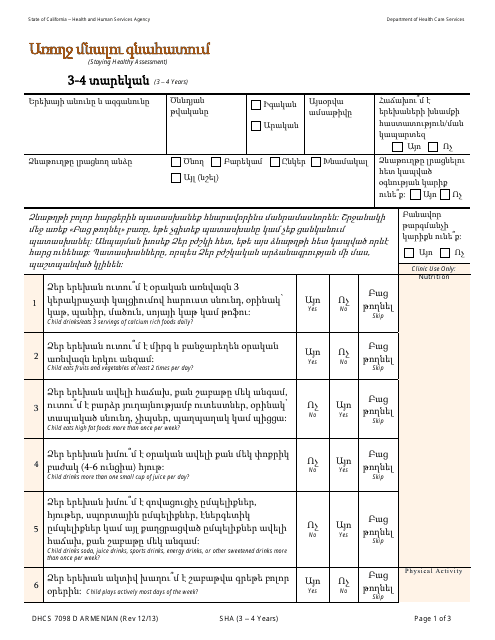

This Form is used for the Staying Healthy Assessment for children aged 3-4 years in California with Armenian language instructions.

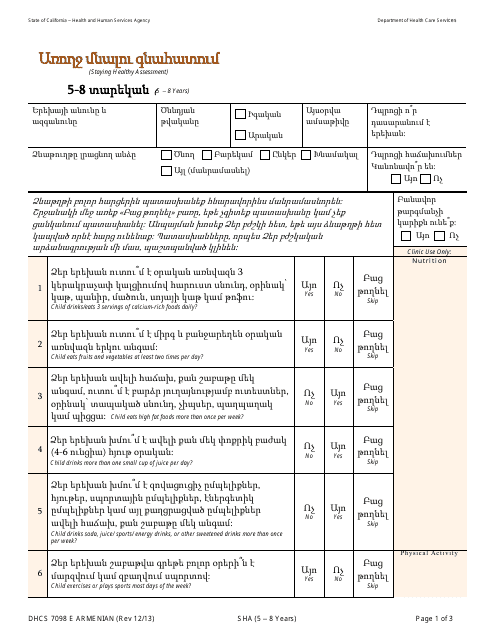

This form is used for conducting a Staying Healthy Assessment for children between the ages of 5-8 years in California. It is specifically designed for Armenian-speaking individuals.

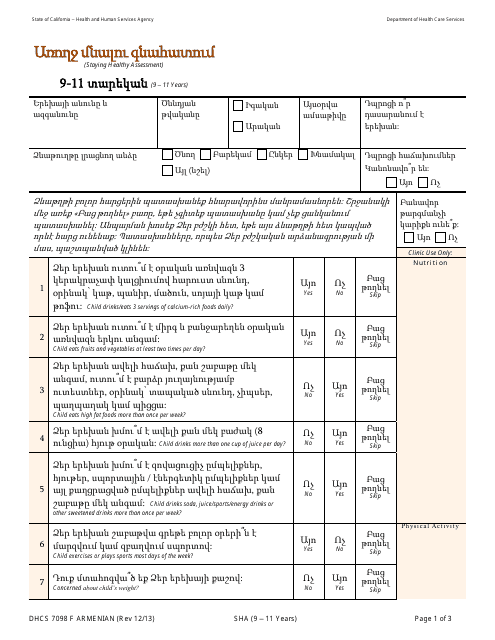

This form is used for conducting a health assessment for children aged 9-11 years in California who speak Armenian. It helps to evaluate their overall health and identify any potential health issues.

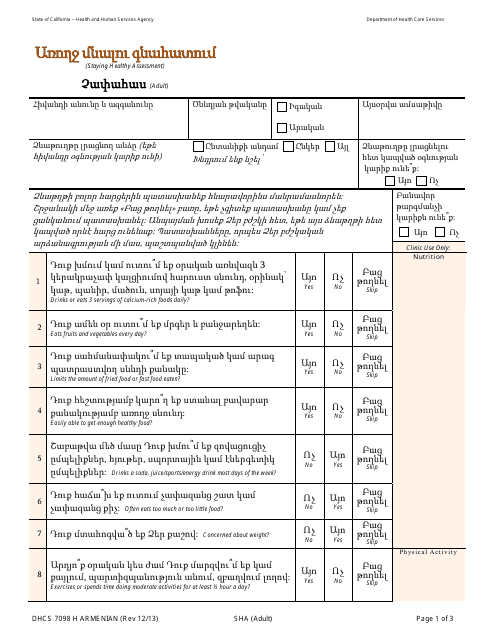

This Form is used for the Staying Healthy Assessment for adults in California. It is available in Armenian language.

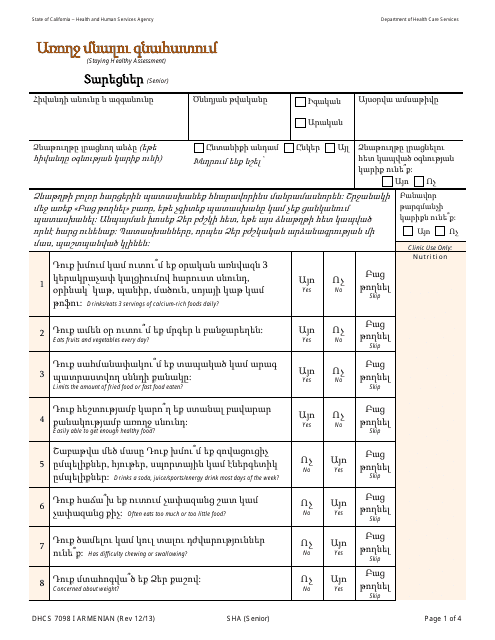

This form is used for completing a Staying Healthy Assessment for Senior individuals in California who speak Armenian.

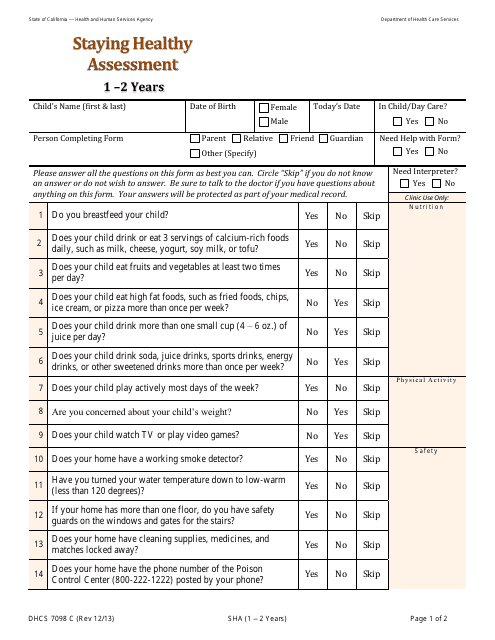

This Form is used for conducting a health assessment for children aged 1-2 years in California.

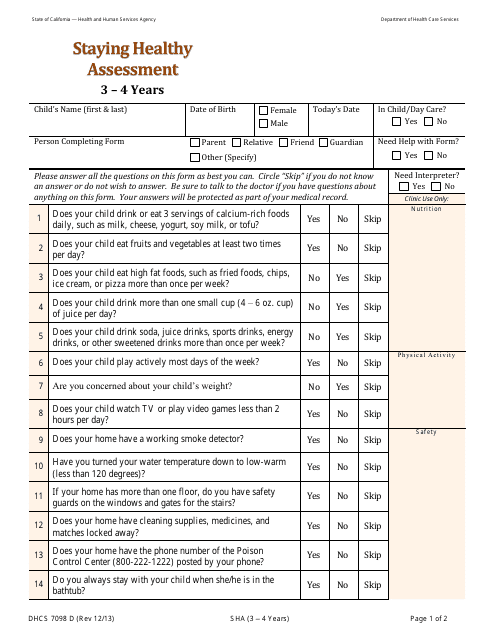

This form is used for conducting a Staying Healthy Assessment for children between the ages of 3-4 years in the state of California.

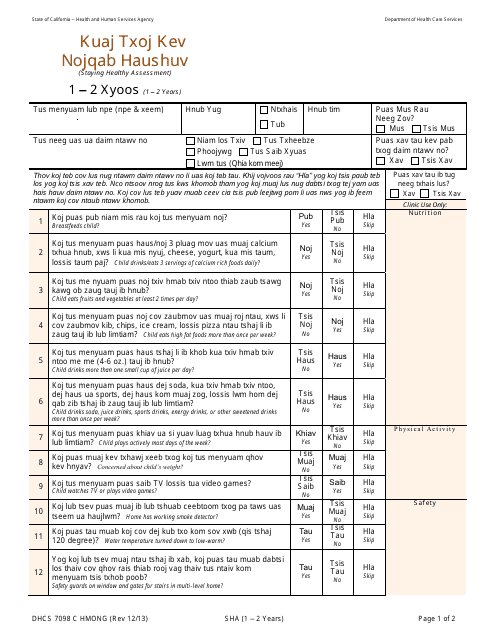

This document is a form used in California for conducting a Staying Healthy Assessment for children between the ages of 1-2 years. It is available in the Hmong language.

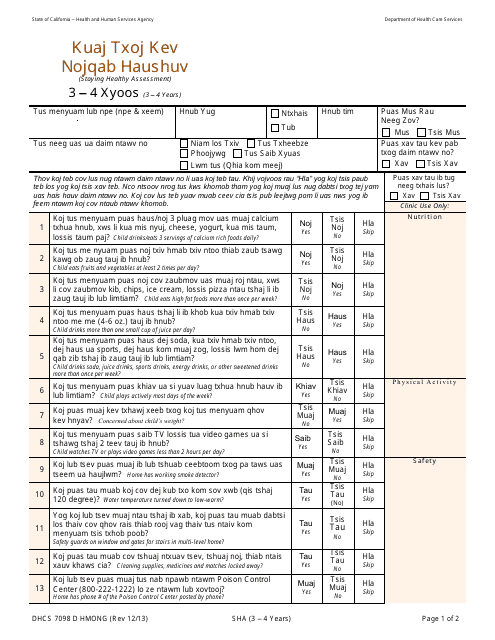

This Form is used for completing the Staying Healthy Assessment for children between the ages of 3-4 years old in California.

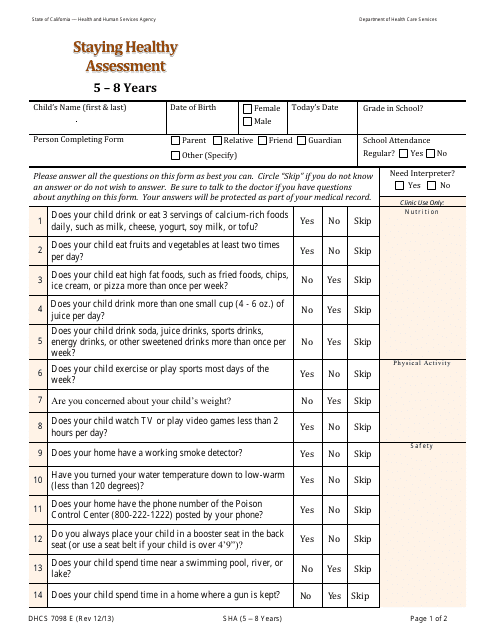

This form is used for conducting a health assessment for children between the ages of 5-8 years in California.

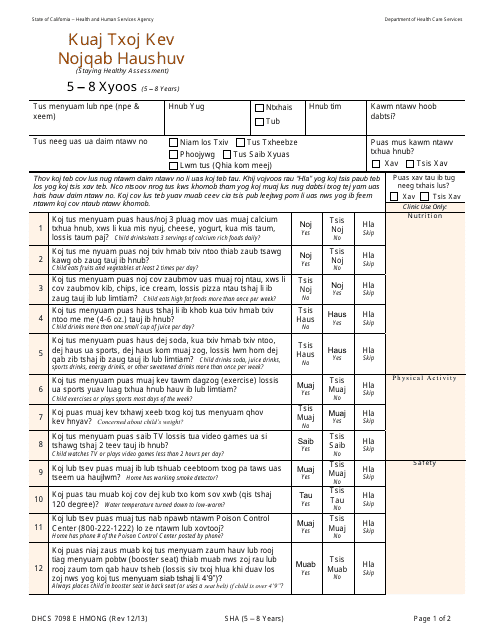

This form is used for conducting a Staying Healthy Assessment specifically for children aged 5-8 years in California. It is available in the Hmong language.

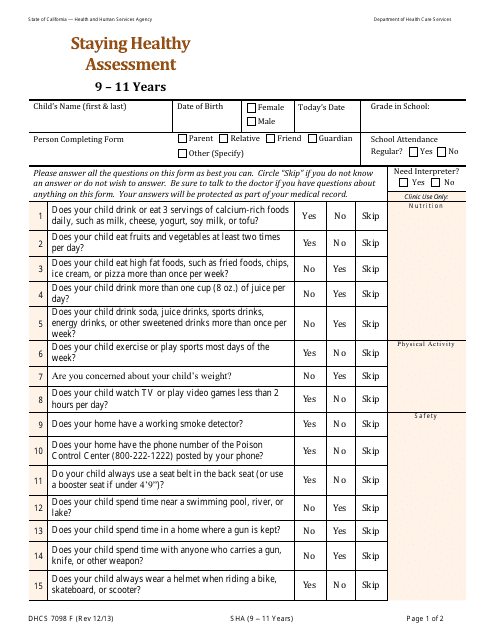

This form is used for conducting a health assessment for children between the ages of 9 and 11 in California. It helps to ensure their overall well-being and identify any potential health issues.

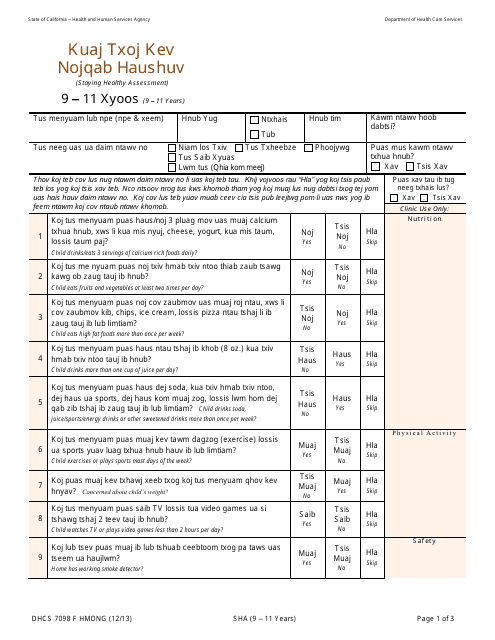

This form is used for conducting a health assessment for children between the ages of 9 and 11 in California who belong to the Hmong community.

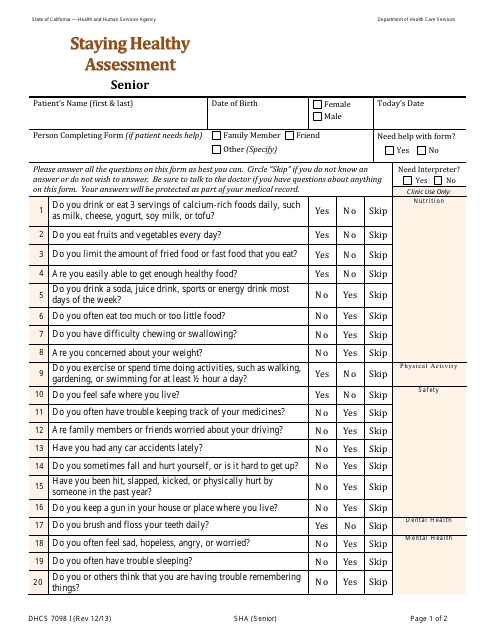

This Form is used for conducting a health assessment for senior individuals in California to ensure they are staying healthy and receiving the necessary care and support.

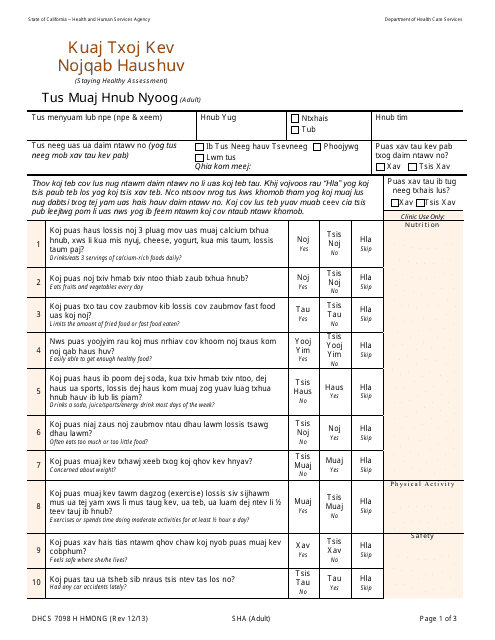

This form is used for conducting a health assessment for adults in California who belong to the Hmong community. It helps in evaluating their overall health and identifying any potential health risks or issues.

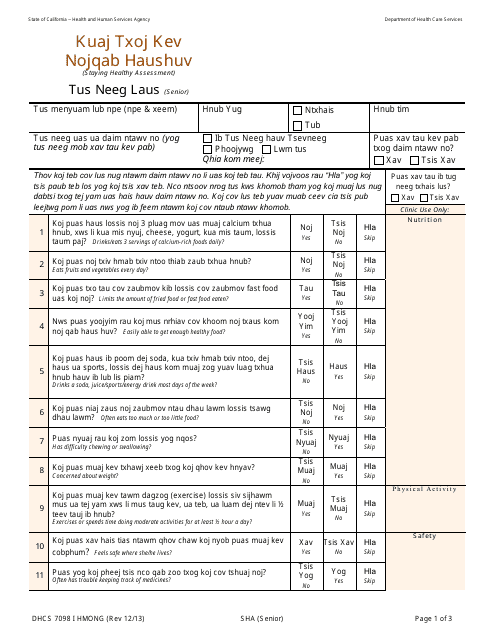

This Form is used for the Staying Healthy Assessment for Seniors in California, specifically for the Hmong community.

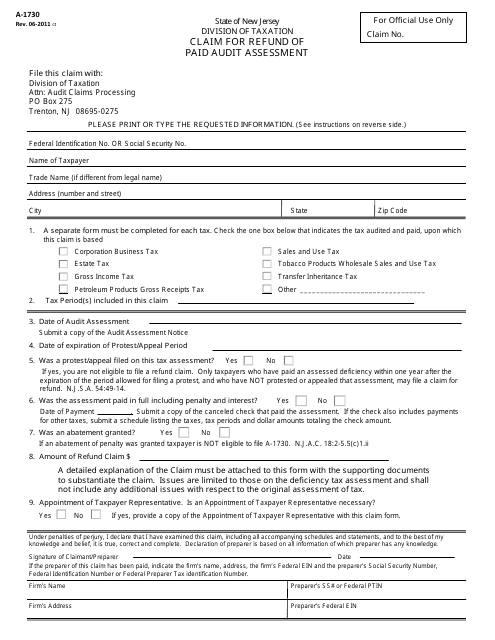

This Form is used for residents of New Jersey to claim a refund for a paid audit assessment.

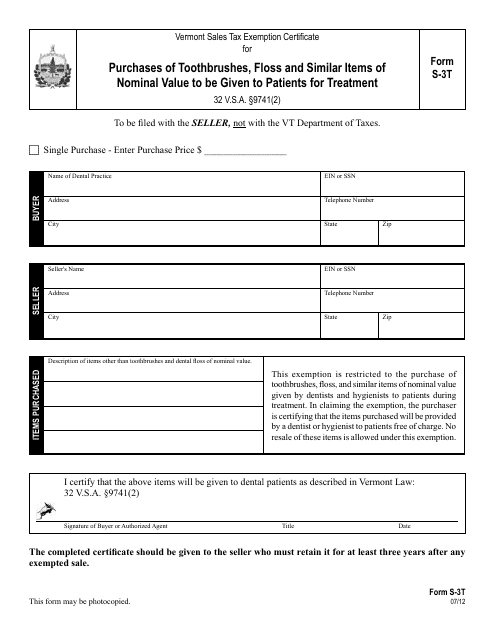

This form is used for claiming sales tax exemption on purchases of toothbrushes, floss, and similar items that are given to patients for treatment in Vermont.

This Form is used for claiming sales and use tax exemption on purchases made by qualifying governmental agencies in Connecticut.

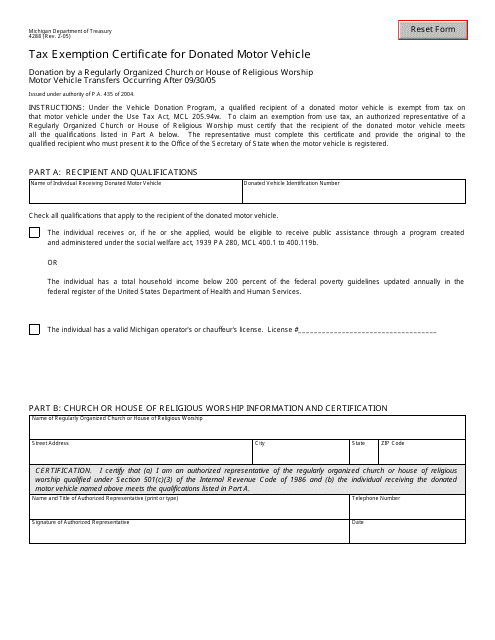

This form is used for obtaining a tax exemption for donating a motor vehicle in Michigan.

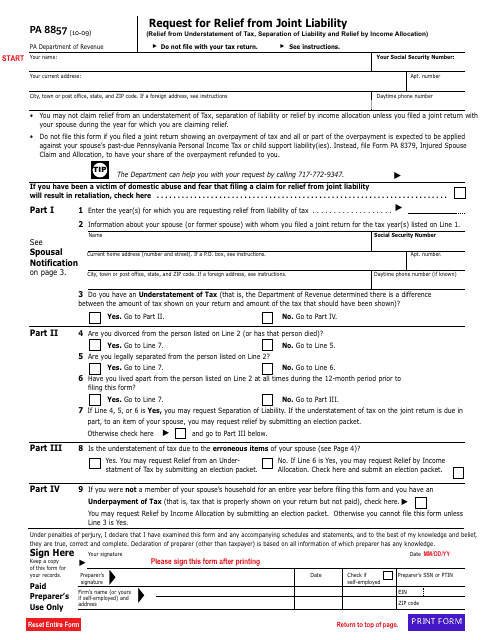

This form is used for requesting relief from joint liability for tax obligations in the state of Pennsylvania.

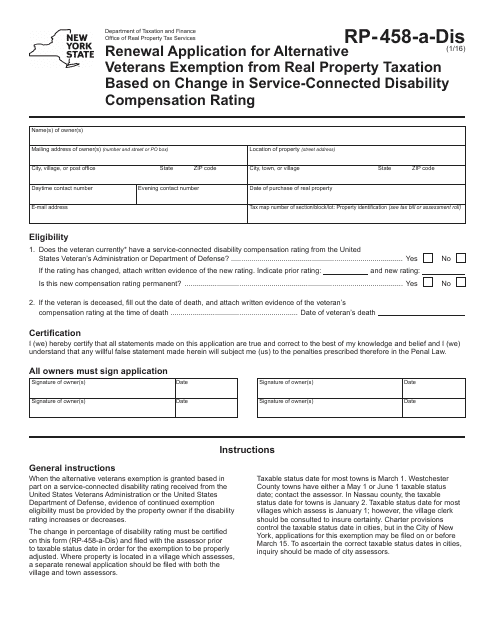

This form is used for renewing the Alternative Veterans Exemption from Real Property Taxation for residents of New York based on a change in their service-connected disability compensation rating.

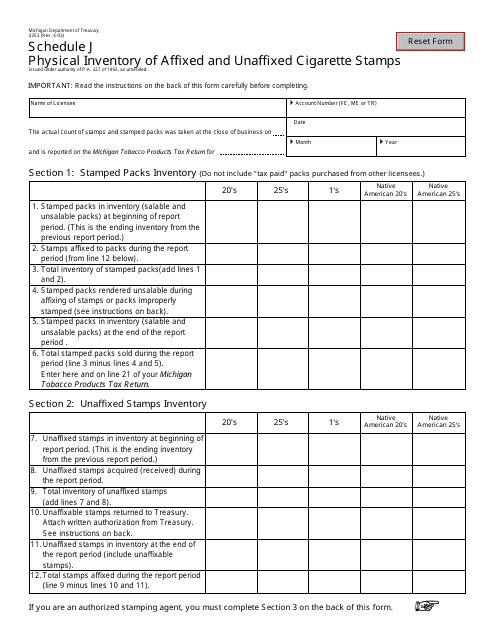

This form is used for reporting the physical inventory of affixed and unaffixed cigarette stamps in the state of Michigan.

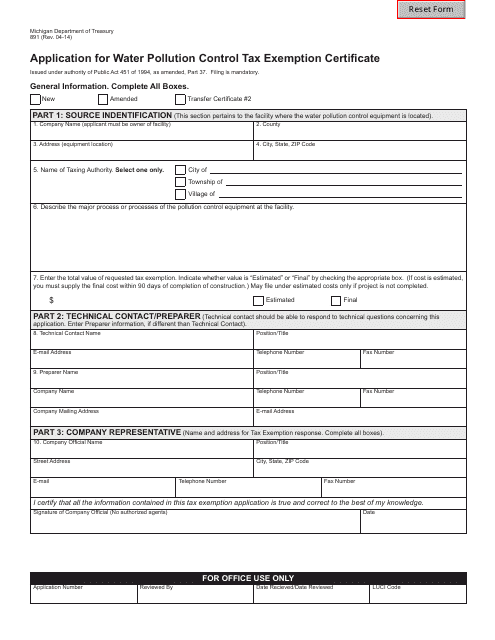

This form is used for applying for a tax exemption certificate for water pollution control in the state of Michigan.

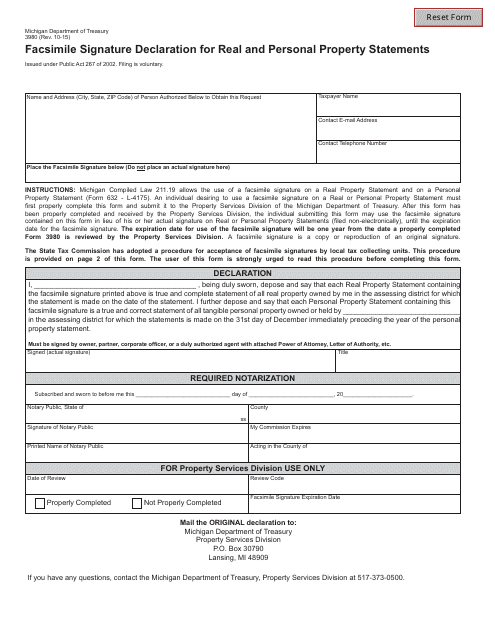

This form is used for declaring facsimile signatures on real and personal property statements in Michigan.

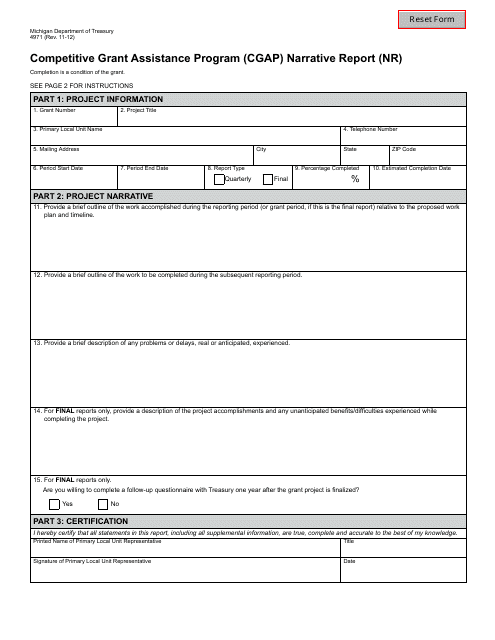

This form is used for submitting a narrative report for the Competitive Grant Assistance Program (CGAP) in Michigan.

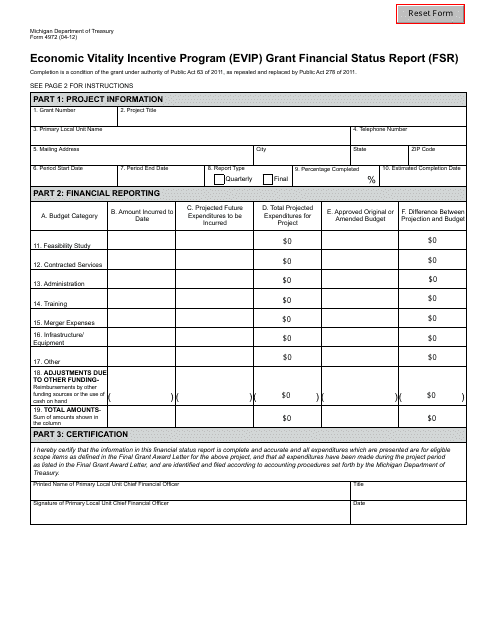

This form is used for reporting the financial status of an Economic Vitality Incentive Program (EVIP) grant in Michigan. It helps organizations track and report their grant funding and how it is being used.

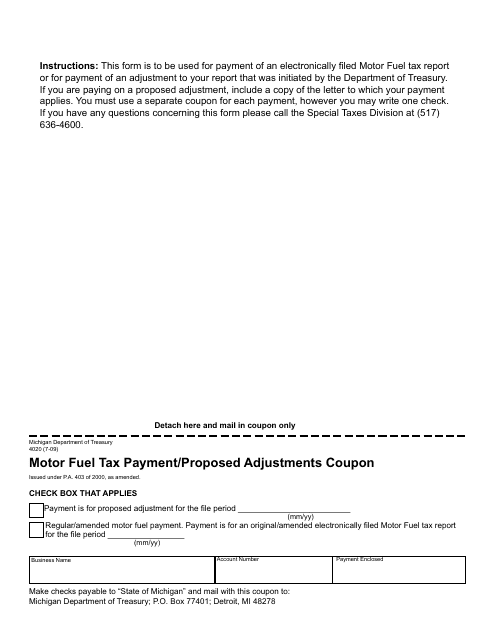

This Form is used for making motor fuel tax payments and proposing adjustments in Michigan.

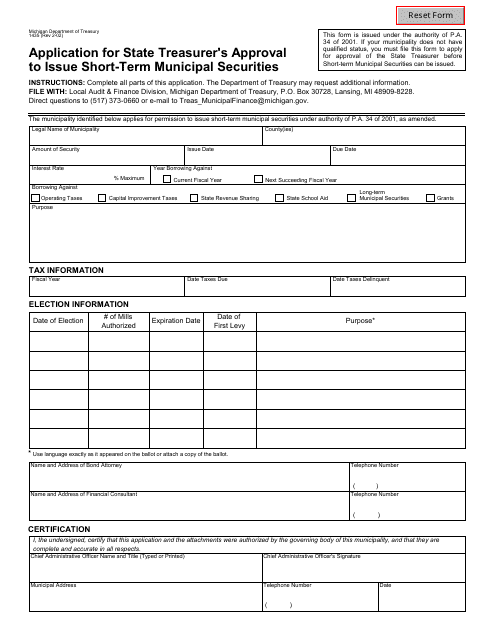

This Form is used for applying to the Michigan State Treasurer for approval to issue short-term municipal securities.

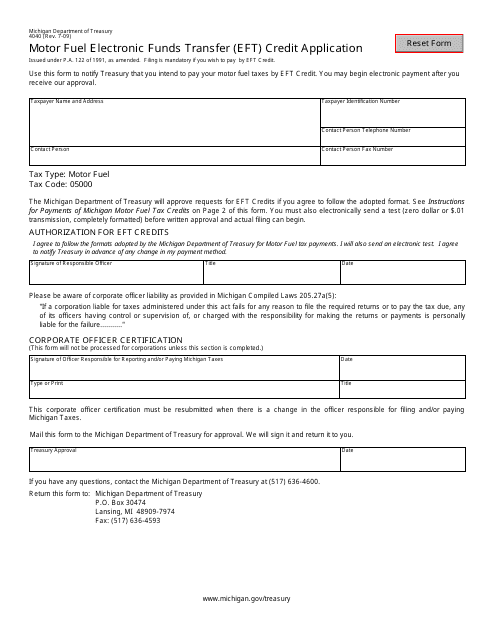

This Form is used for applying for electronic funds transfer (EFT) credit for motor fuel in the state of Michigan.

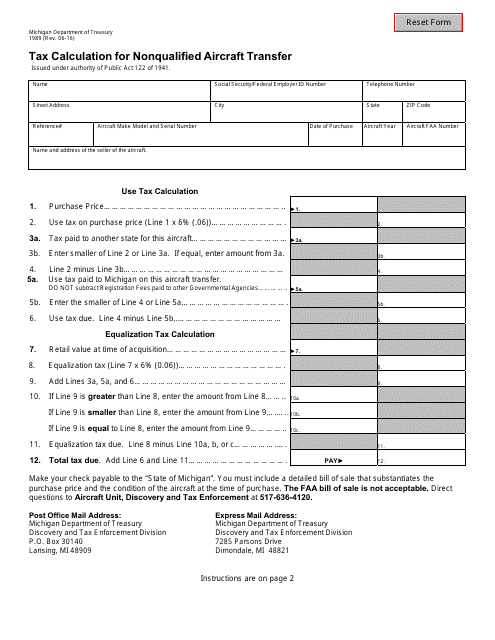

This form is used for calculating the tax for transferring nonqualified aircraft in the state of Michigan for the year 1989.

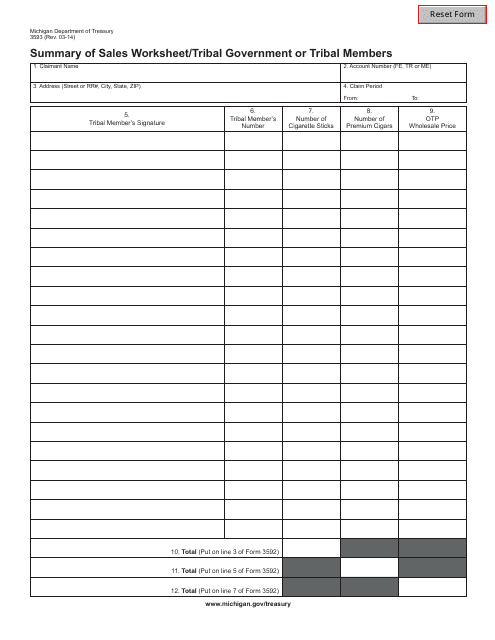

This form is used for summarizing sales worksheets related to tribal government or tribal members in the state of Michigan.

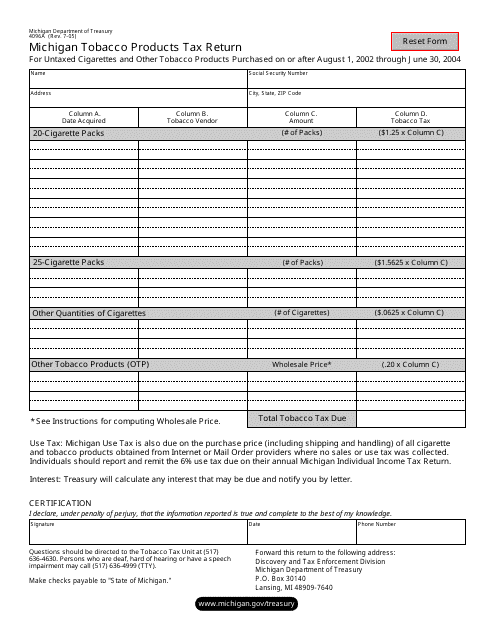

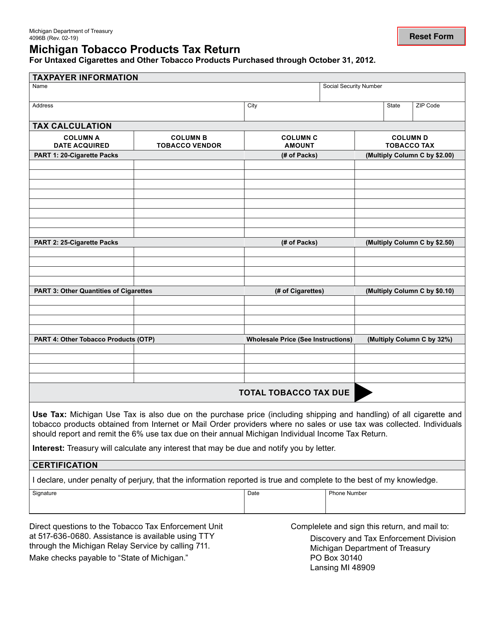

This document is used for filing the Michigan Tobacco Products Tax Return in the state of Michigan. It is required for businesses that sell tobacco products in Michigan to report and pay the applicable taxes on those products.

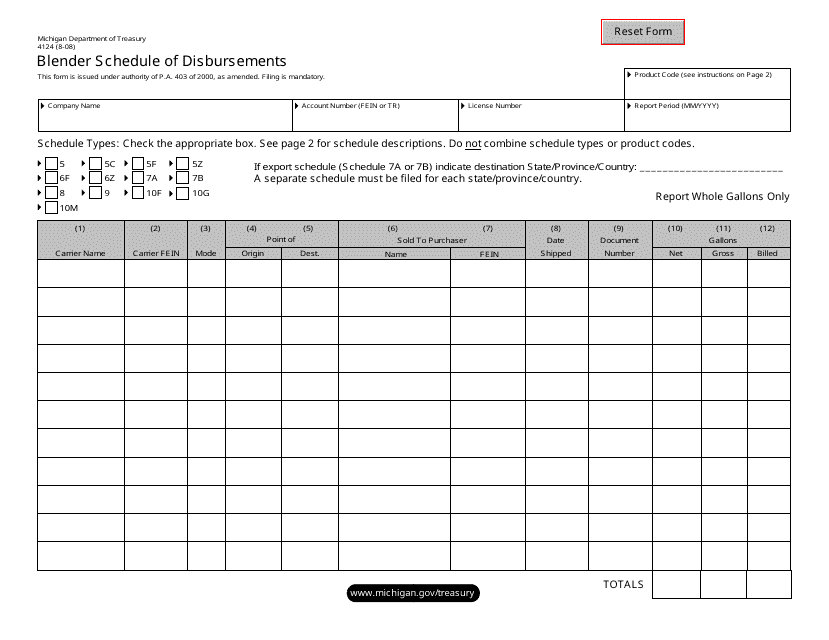

This form is used for reporting the schedule of disbursements for blender fuel in the state of Michigan.

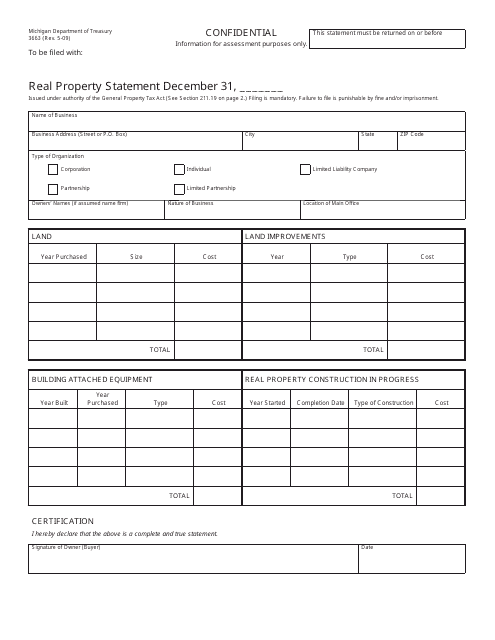

This form is used for reporting real property information in the state of Michigan. It is essential for property owners to provide accurate details about their real estate holdings to comply with state regulations.

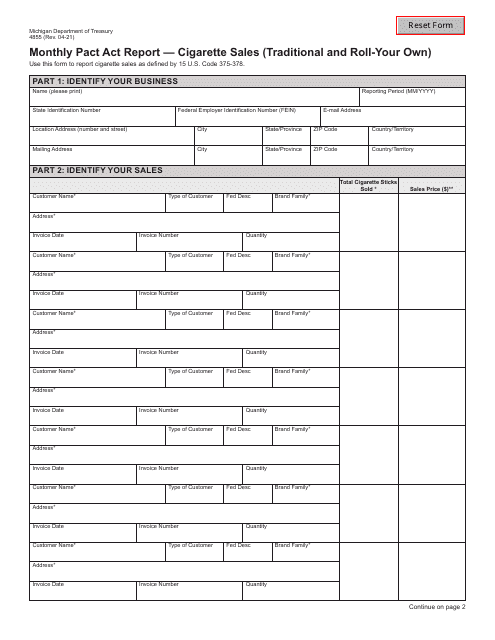

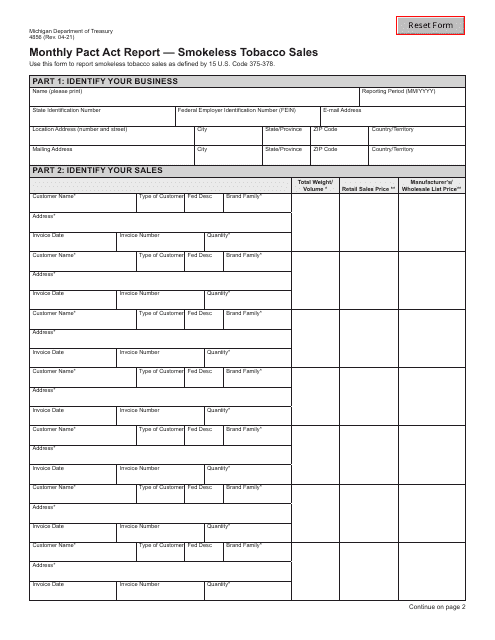

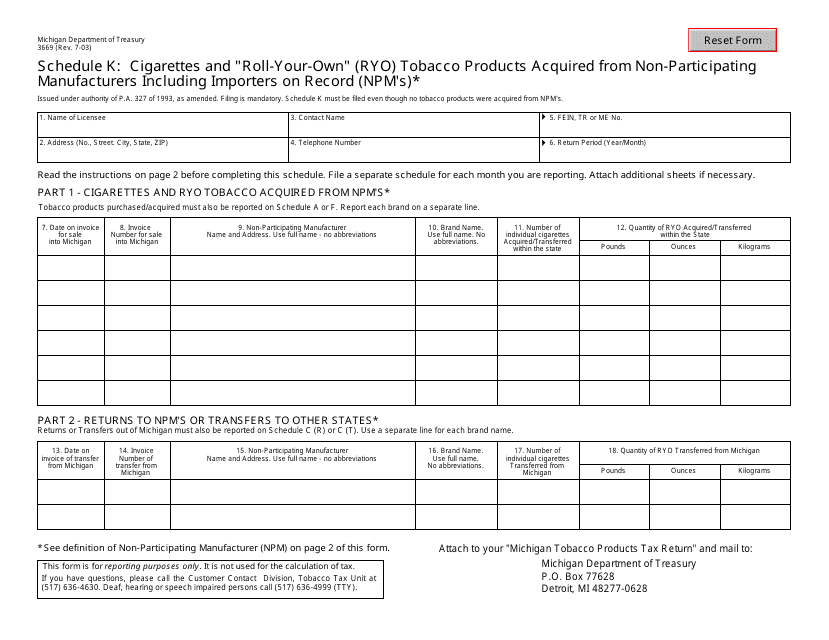

This form is used for reporting the acquisition of cigarettes and "roll-your-own" tobacco products from non-participating manufacturers and importers on record in the state of Michigan.