Fill and Sign Legal Forms and Templates

Documents:

152222

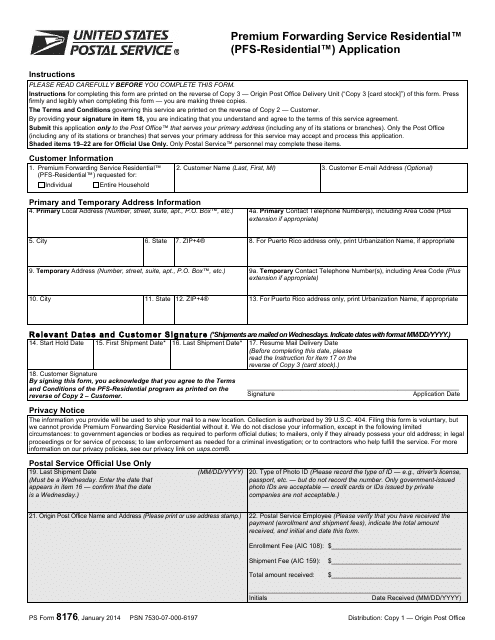

This document is used for applying for the Premium Forwarding Service Residential (PFS-Residential) in the United States Postal Service. PFS-Residential allows customers to temporarily forward their mail to a different address.

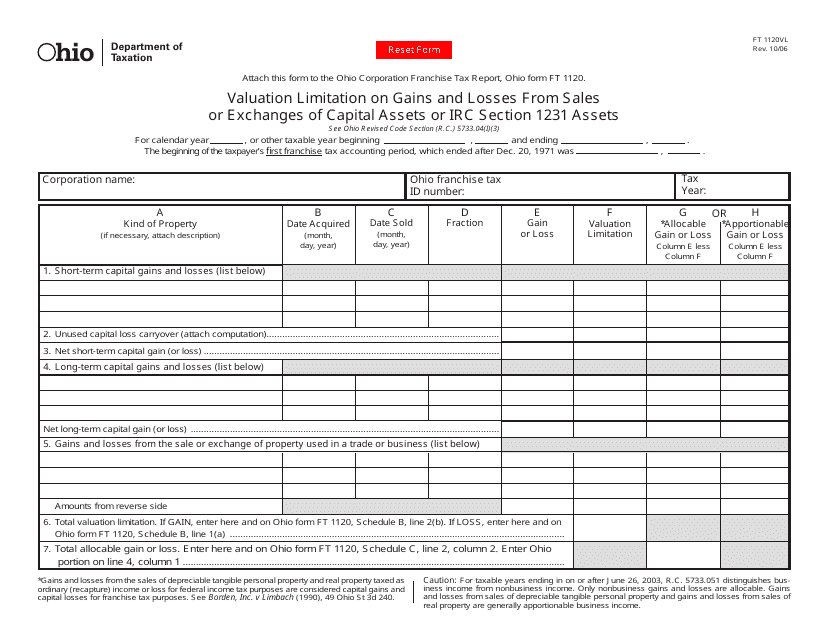

This form is used in Ohio to calculate the valuation limitation on gains and losses from sales or exchanges of capital assets or IRC Section 1231 assets.

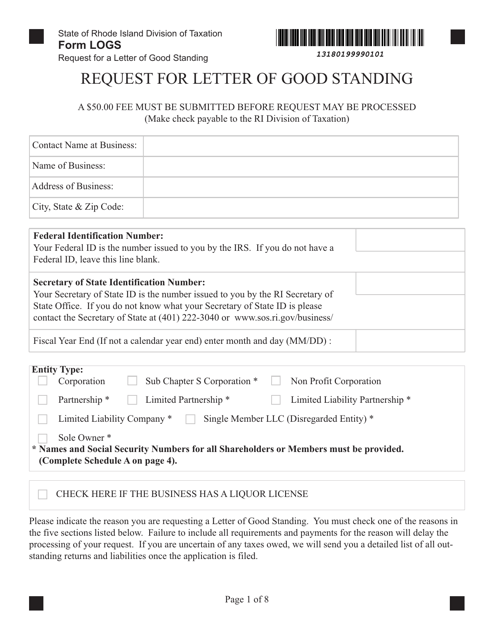

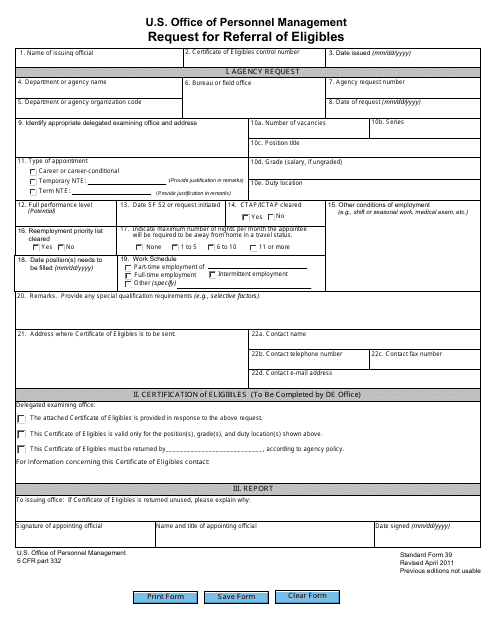

This form is used for requesting the referral of eligible candidates for job vacancies.

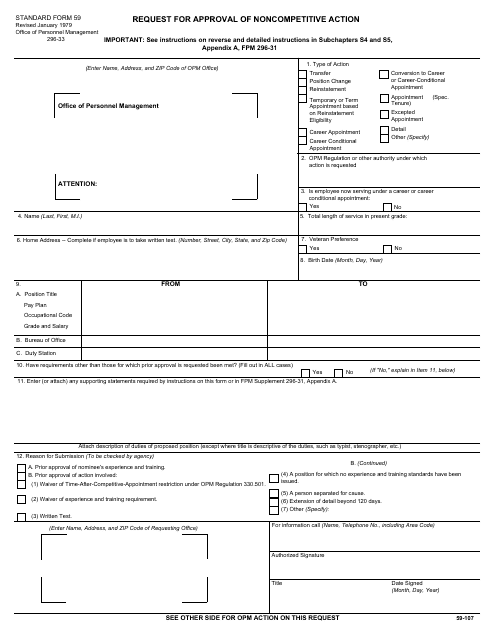

This Form is used for requesting approval for noncompetitive actions. It is used to justify the selection of a specific vendor or individual without competitive bidding or competition.

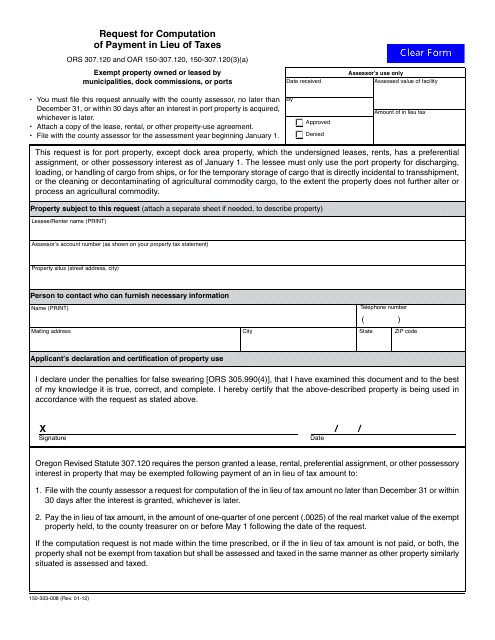

This form is used for requesting the computation of payment in lieu of taxes in the state of Oregon.

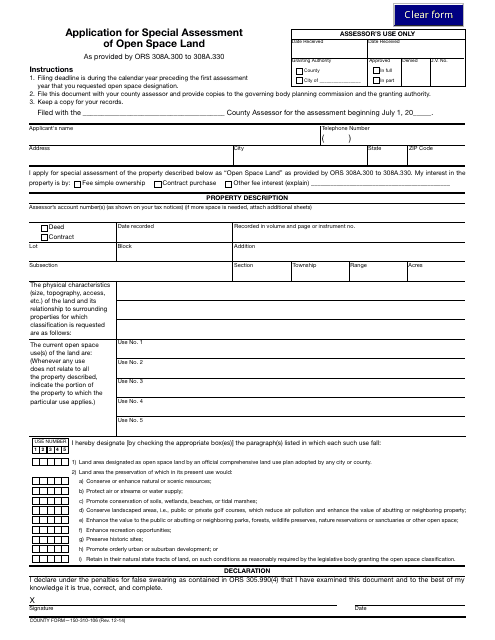

This Form is used for applying for special assessment of open space land in Oregon.

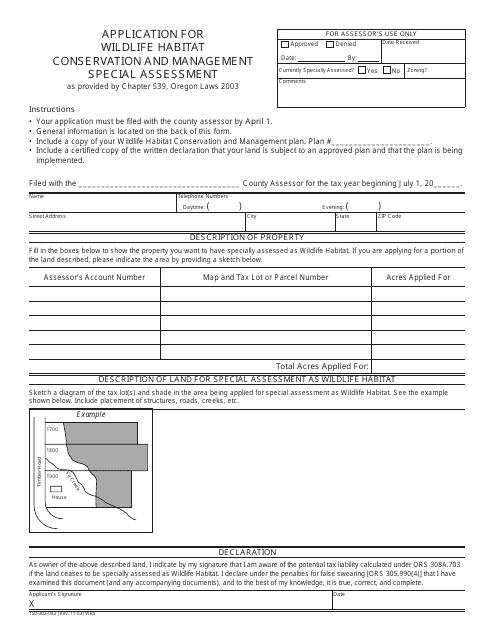

This form is used for applying for the Wildlife Habitat Conservation and Management Special Assessment in Oregon.

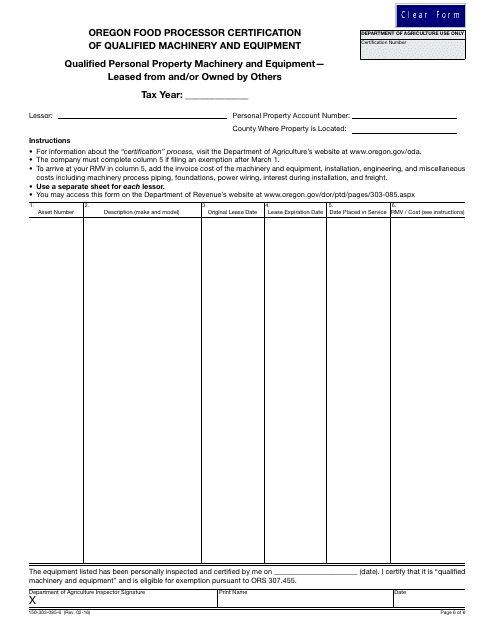

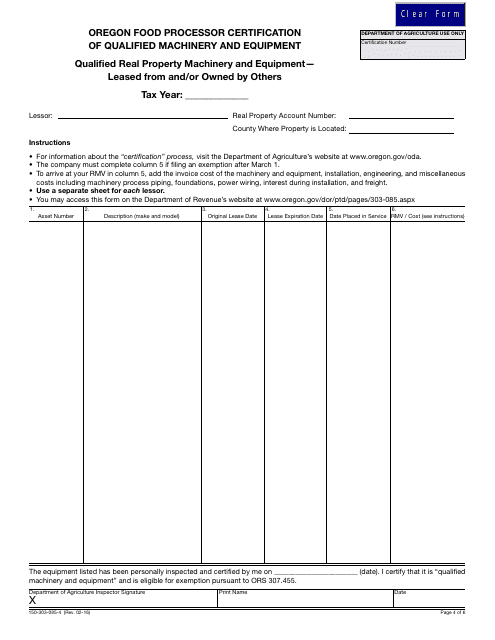

This Form is used for Oregon food processors to certify their qualified machinery and equipment that is leased or owned by others for tax purposes.

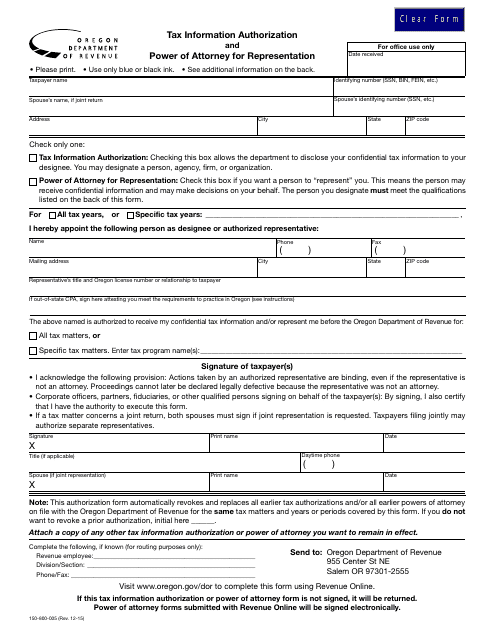

This form is used for authorizing someone to act on your behalf for tax matters in Oregon. It allows them to access your tax information and represent you before the Oregon Department of Revenue.

This Form is used for Oregon food processors to certify their leased or owned machinery and equipment.

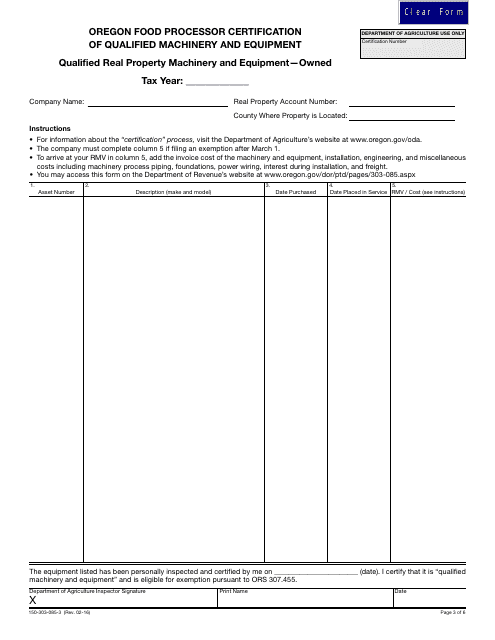

This Form is used for Oregon food processors to certify their qualified machinery and equipment that they own.

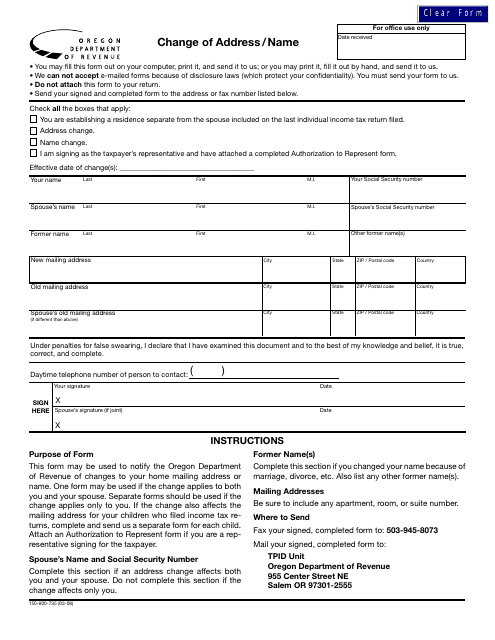

This form is used for changing your address or name in Oregon.

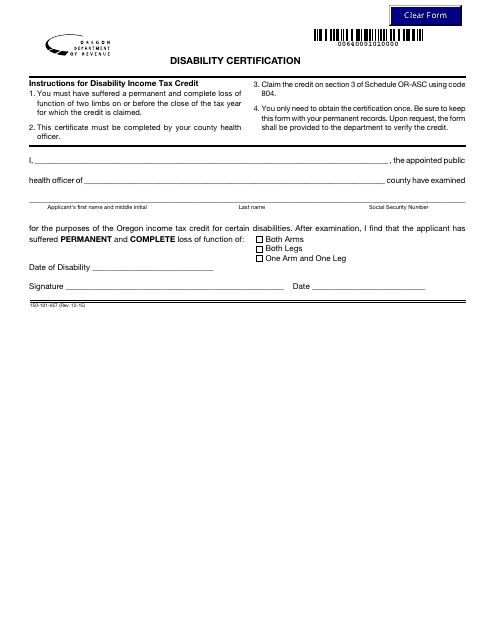

This Form is used for Disability Certification in the state of Oregon. It is used to determine if an individual qualifies for disability benefits in Oregon.

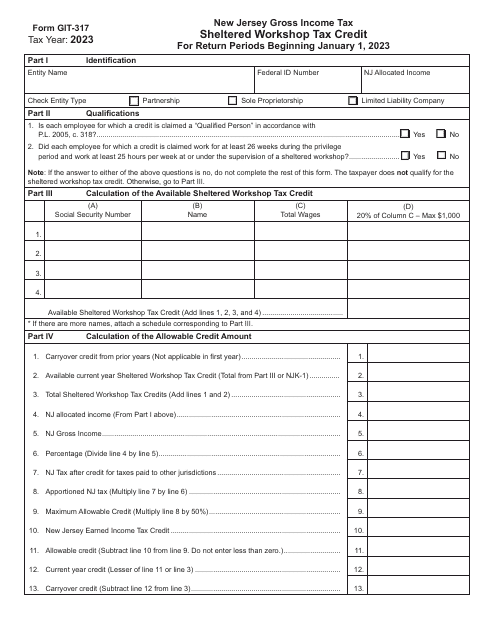

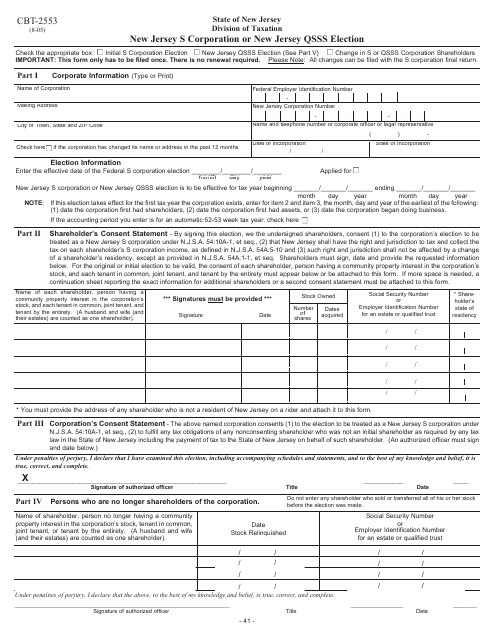

This form is used for electing New Jersey S Corporation or New Jersey Qsss status.

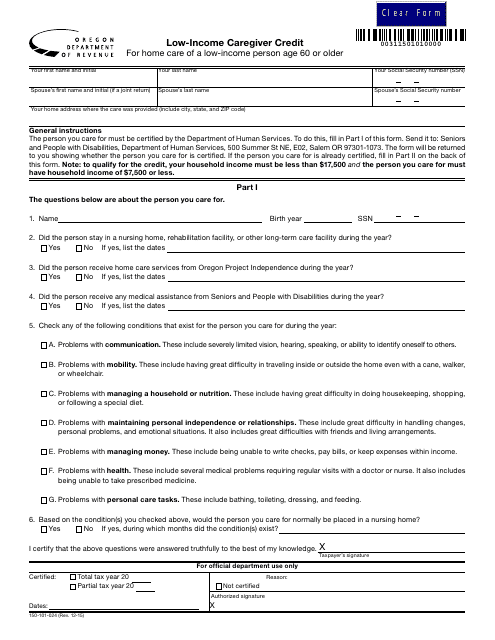

This form is used for claiming the Low-Income Caregiver Credit in the state of Oregon.

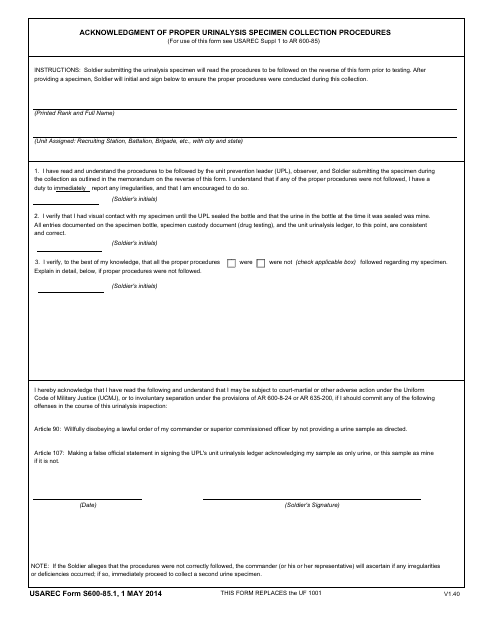

This form is used for acknowledging the proper procedures for collecting a urine specimen for drug testing.

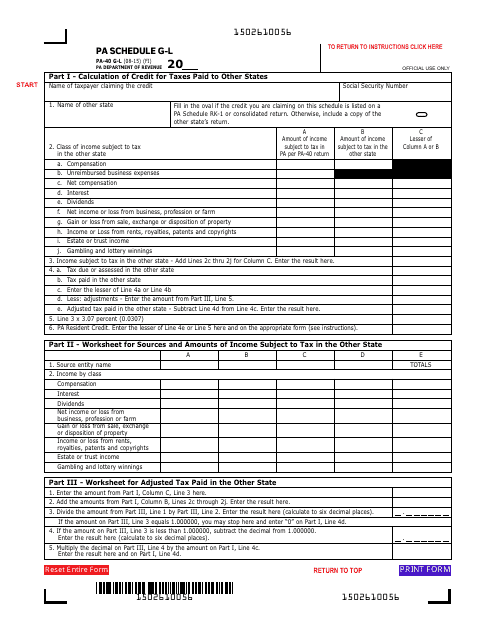

This form is used for claiming the Resident Credit for Taxes Paid in Pennsylvania for individuals filing their Pennsylvania state income tax return.

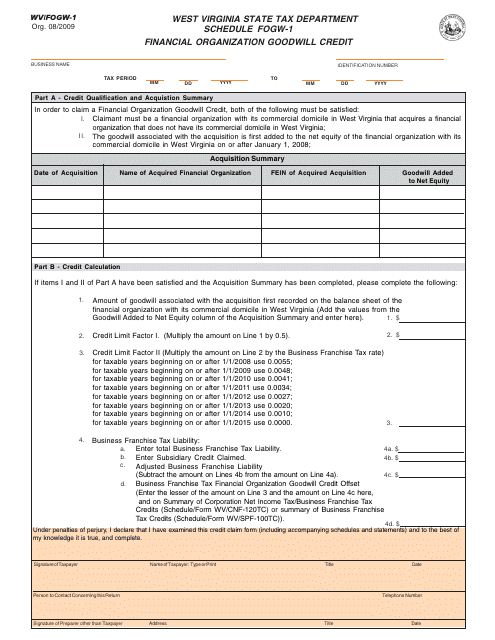

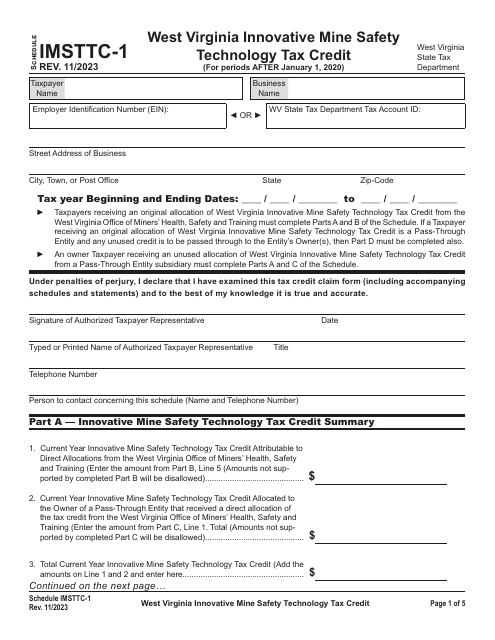

This document is used to report financial organization goodwill credit in West Virginia.

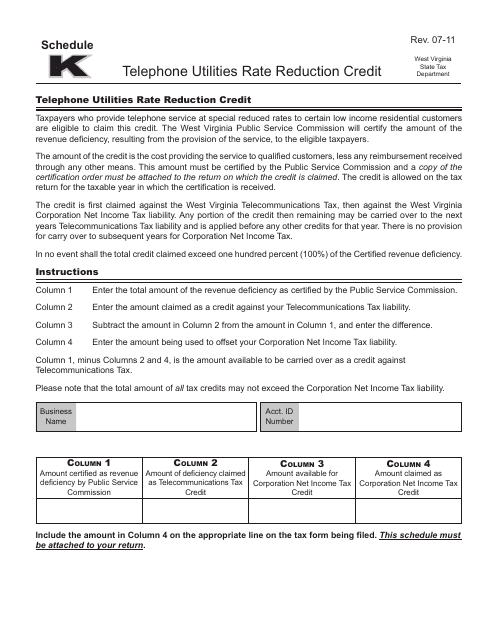

This Form is used for claiming the Telephone Utilities Rate Reduction Credit in West Virginia. This credit may help reduce the amount of tax you owe on your telephone bill.

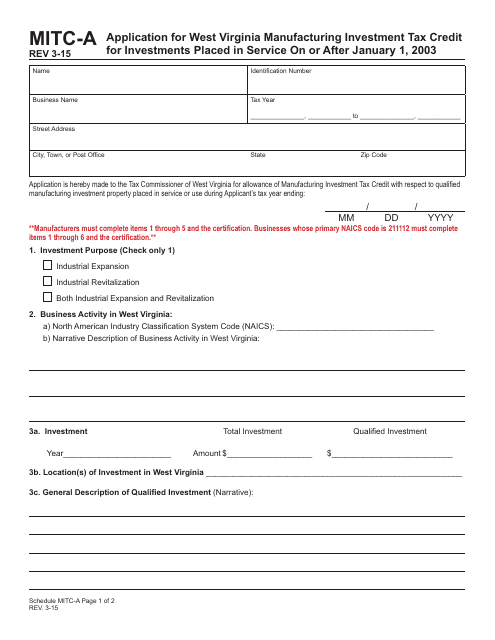

This Form is used for applying for the West Virginia Manufacturing Investment Tax Credit for investments made after January 1, 2003.

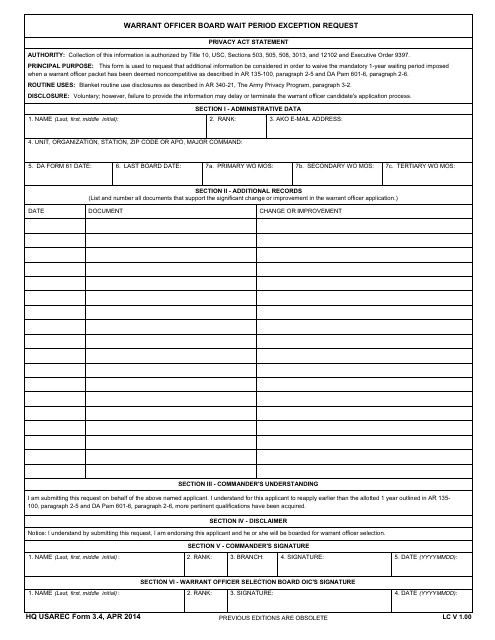

This form is used for requesting an exception to the wait period for the Warrant Officer Board.

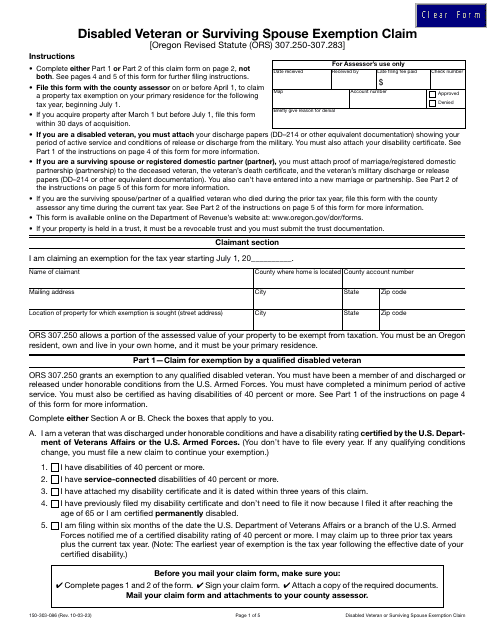

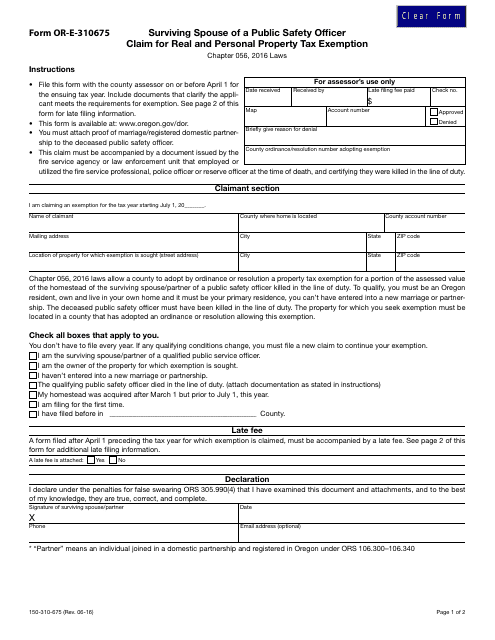

This form is used for a surviving spouse of a public safety officer to claim a real and personal property tax exemption in the state of Oregon.

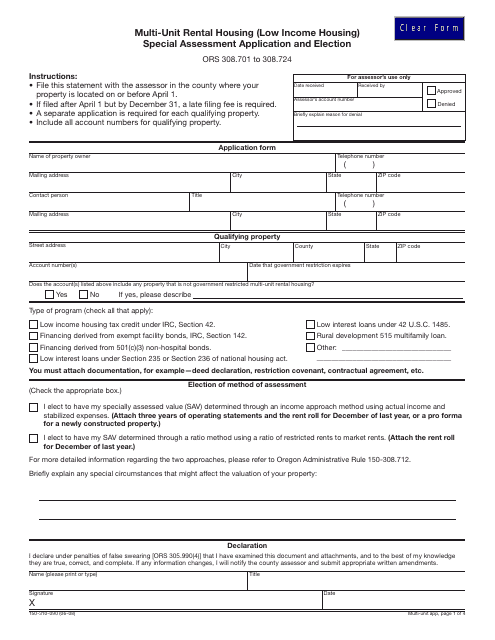

Form 150-310-090 Multi-Unit Rental Housing Special Assessment Application and Election Form - Oregon

This Form is used for applying for special assessment and conducting elections for multi-unit rental housing in Oregon.

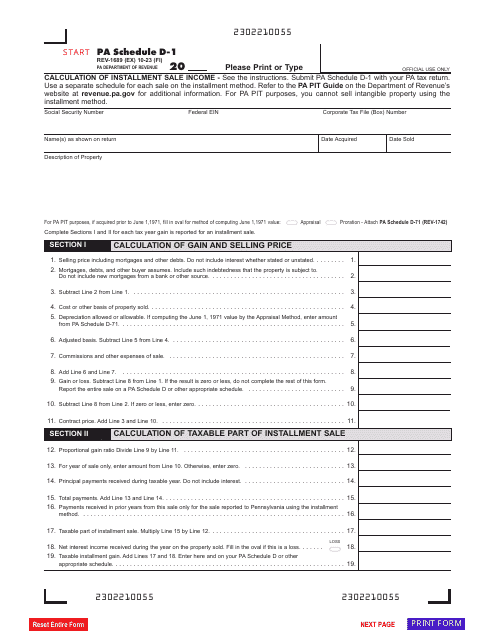

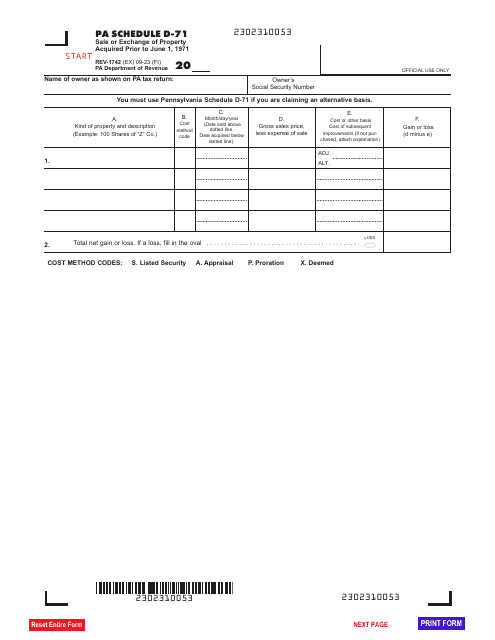

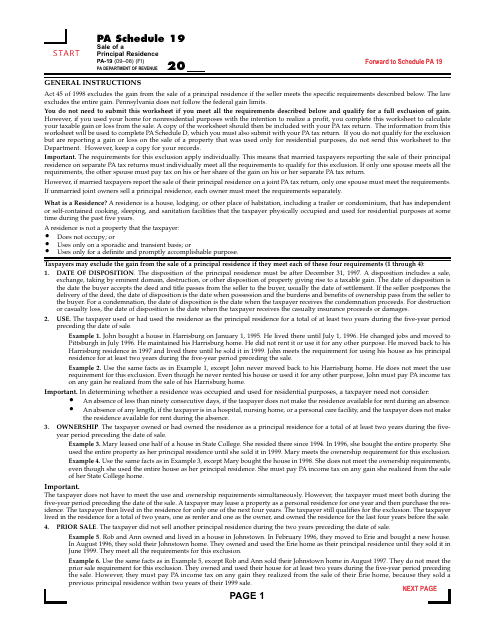

This document is used for reporting the sale of a primary residence in Pennsylvania for tax purposes. It is specific to Pennsylvania residents.

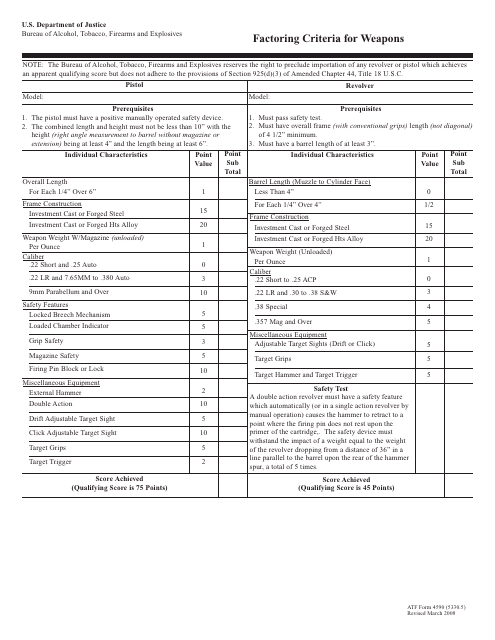

This form is used for determining the criteria for factoring weapons in accordance with ATF regulations.

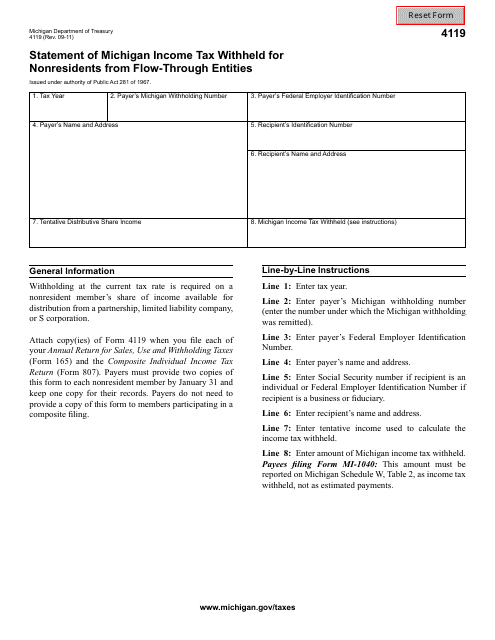

This Form is used for reporting income tax withheld from nonresidents in Michigan by flow-through entities.

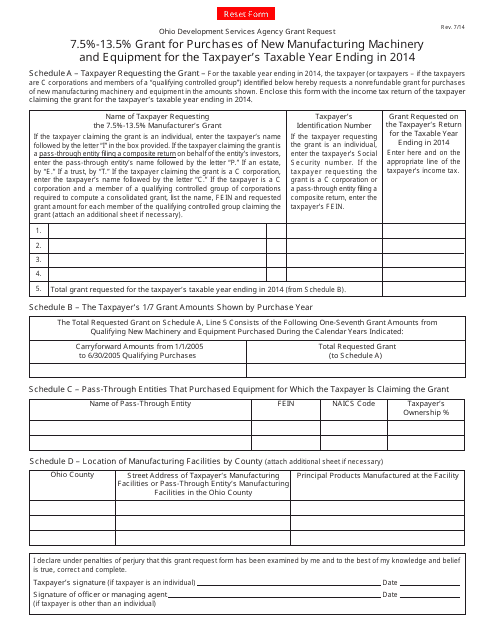

This form is used to apply for a grant of 7.5%-13.5% for the purchase of new manufacturing machinery and equipment in Ohio for the taxpayer's taxable year ending in 2014.

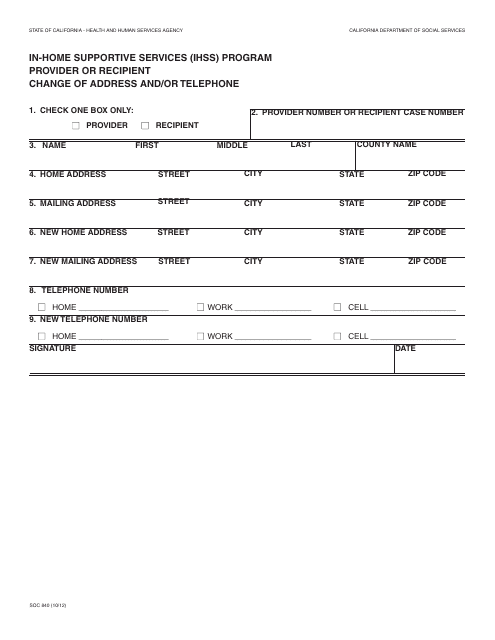

This form is used for changing the address and/or telephone number of providers or recipients in the In-Home Supportive Services (IHSS) Program in California.

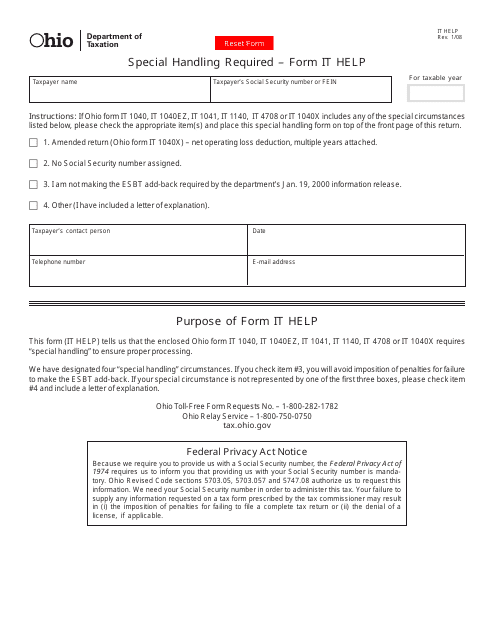

This Form is used for IT support requests from Ohio residents that require special handling.

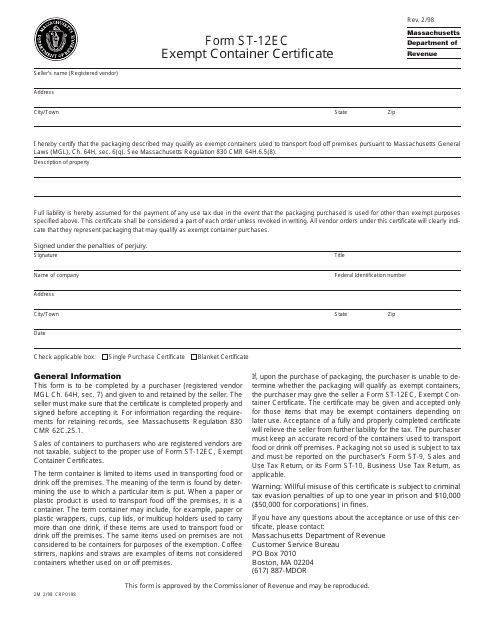

This form is used for obtaining an exempt container certificate in Massachusetts.