Fill and Sign Legal Forms and Templates

Documents:

152222

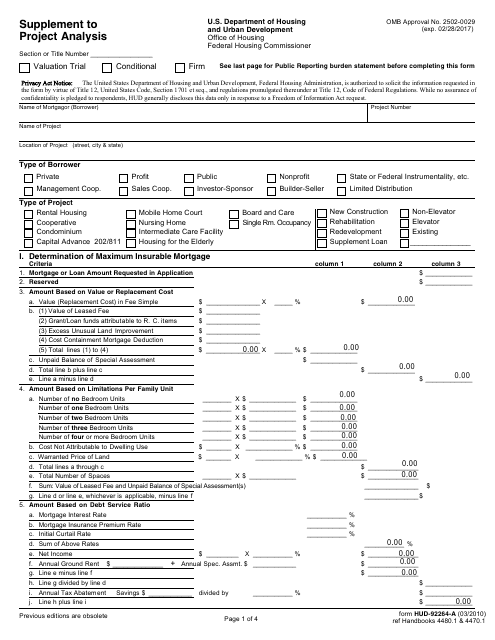

This form is used as a supplement to the Project Analysis for HUD-92264-A. It provides additional information and details related to the project being analyzed.

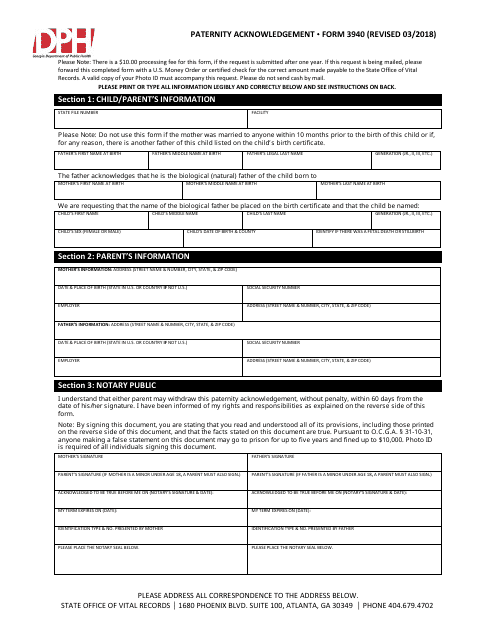

This Form is used for acknowledging paternity in the state of Georgia, United States. It allows individuals to establish legal fathership for a child.

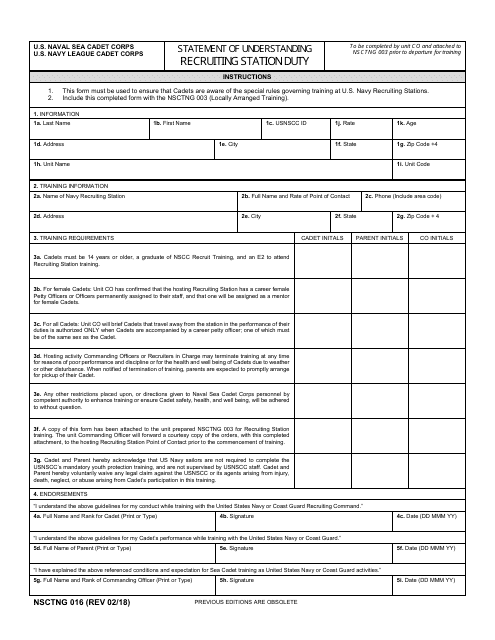

This form is used for the Statement of Understanding related to recruiting station duty.

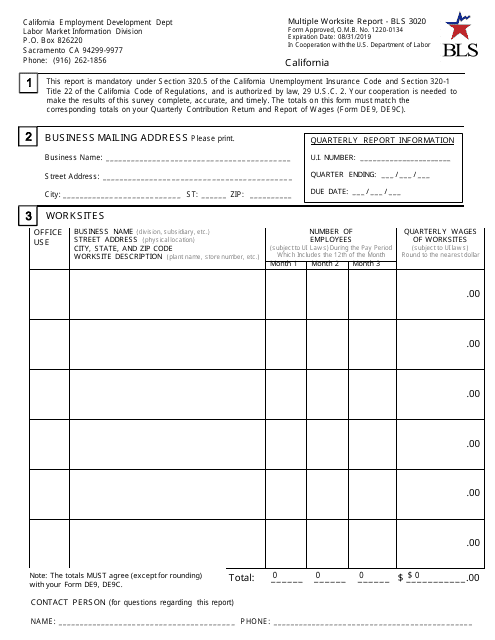

This form is used for reporting multiple worksites in California. It helps employers comply with state regulations regarding worksite reporting.

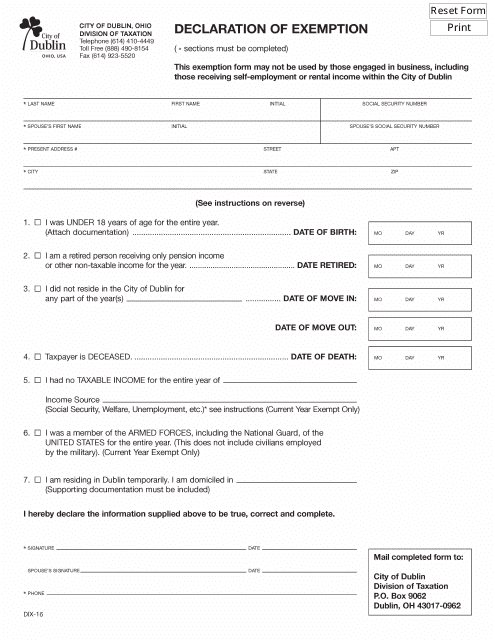

This form is used to declare exemption from certain taxes in the City of Dublin, Ohio.

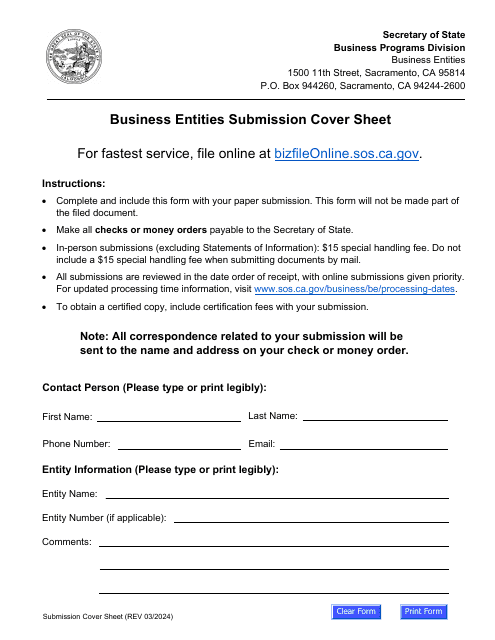

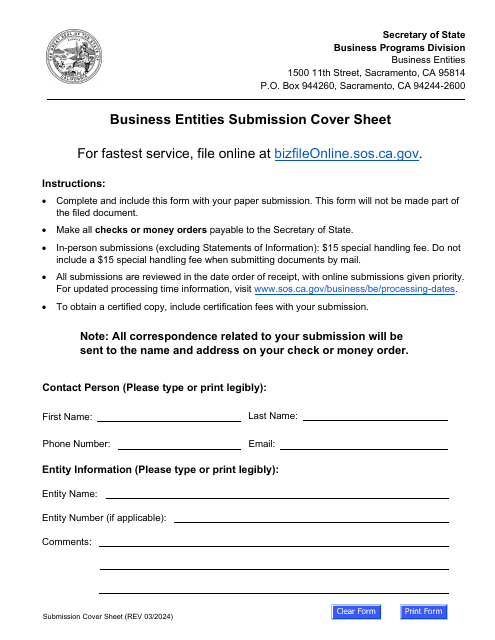

This is an official document that all California limited liability companies may use to report important details about the managers and addresses of their business.

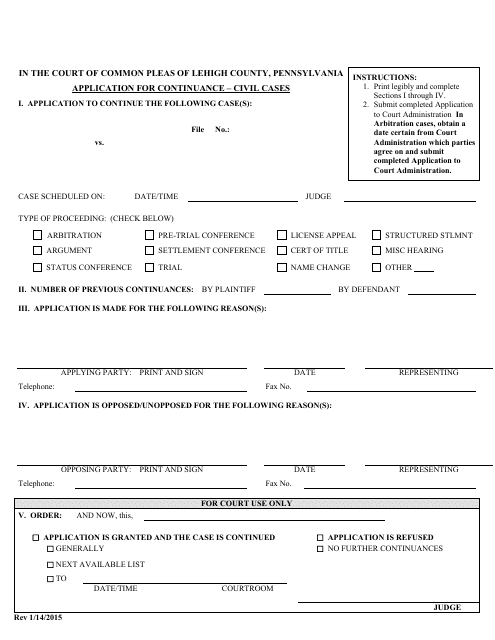

This document is used for requesting a continuance of civil cases in Lehigh County, Pennsylvania.

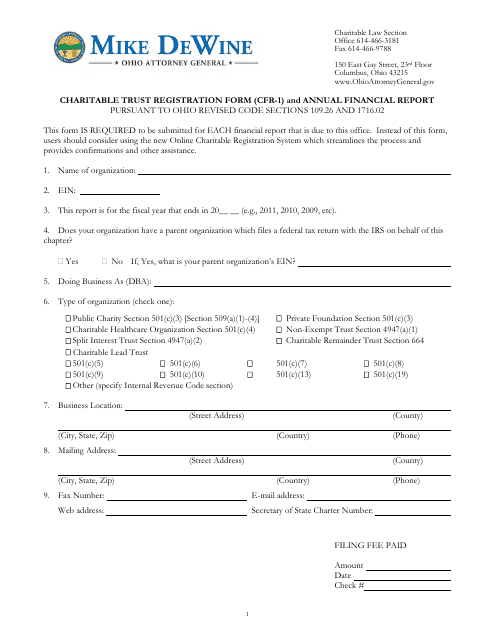

This form is used for registering and reporting financial information for charitable trusts in Ohio.

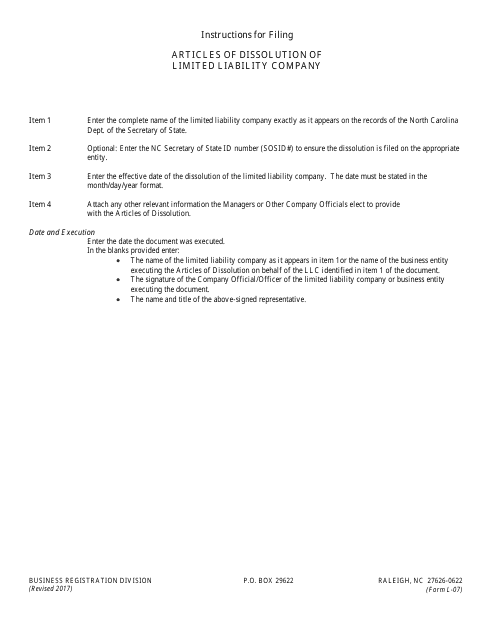

This Form is used for filing the Articles of Dissolution to legally dissolve a Limited Liability Company (LLC) in the state of North Carolina.

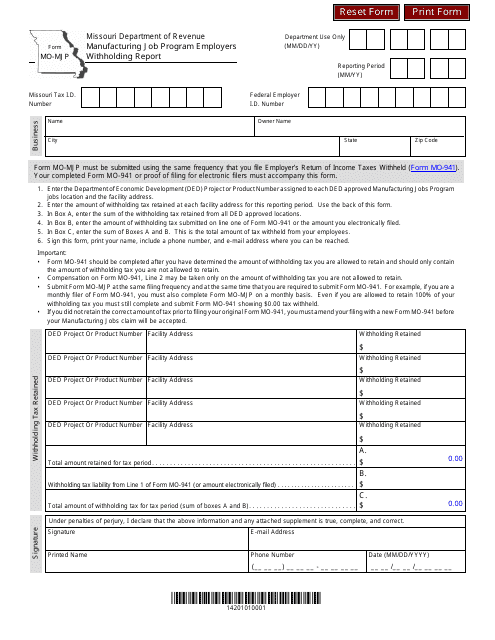

This form is used for businesses participating in the Missouri Manufacturing Job Program to report income tax withheld from employees' wages.

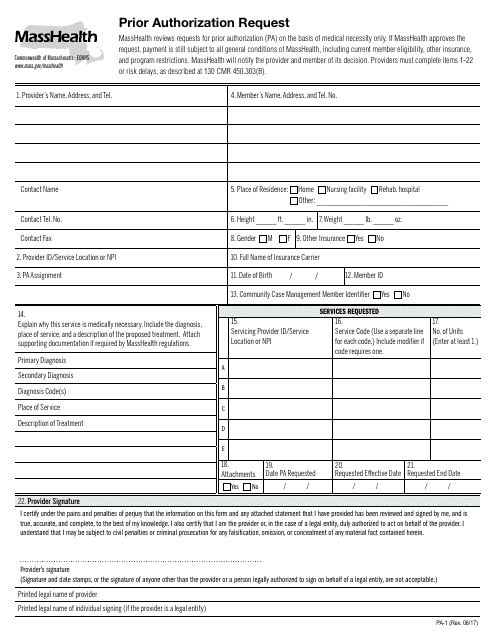

This form is used for requesting prior authorization in Massachusetts.

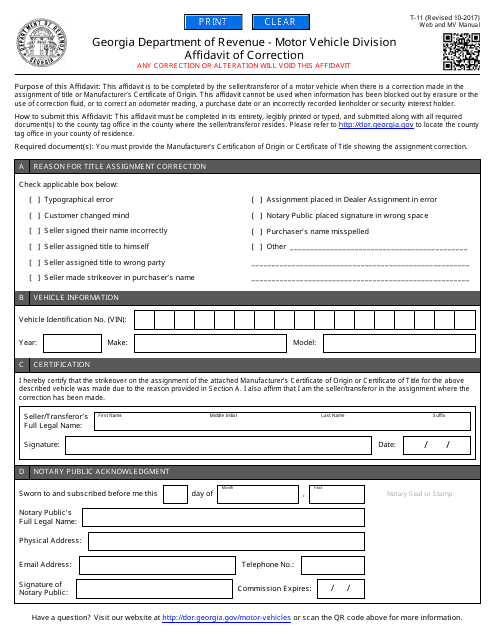

This form is used for correcting errors on a title or registration document in the state of Georgia, United States.

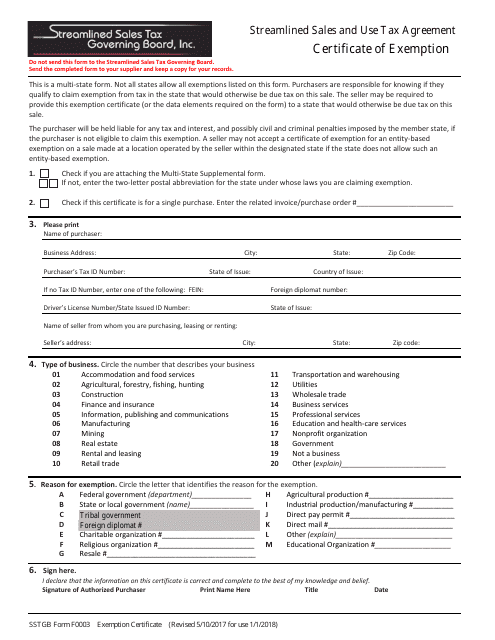

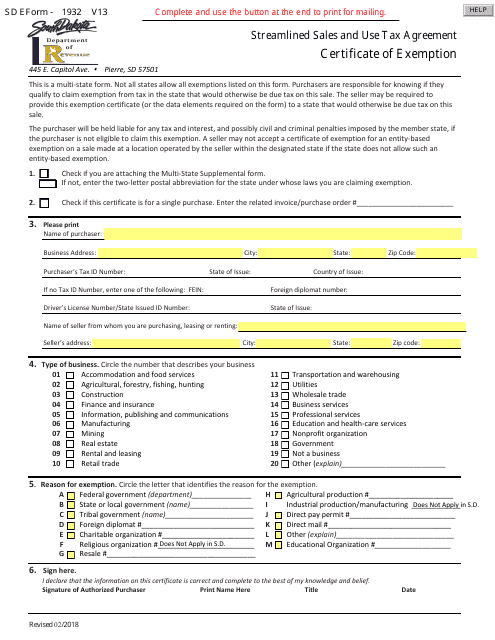

This form is used for applying for a Certificate of Exemption under the Streamlined Sales and Use Tax Agreement in West Virginia.

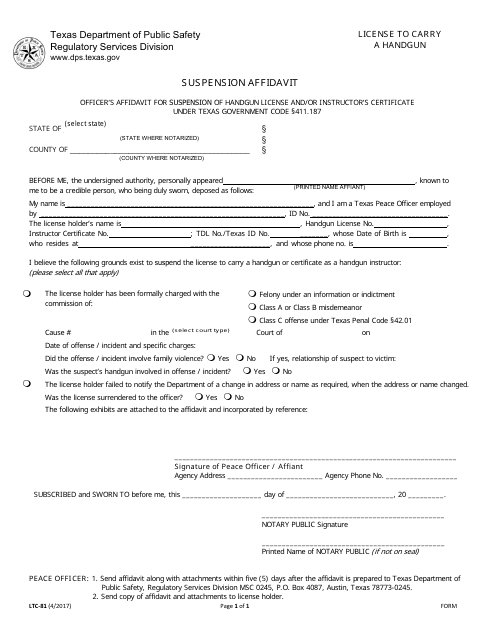

This form is used for suspending a Long-Term Care facility's license in Texas.

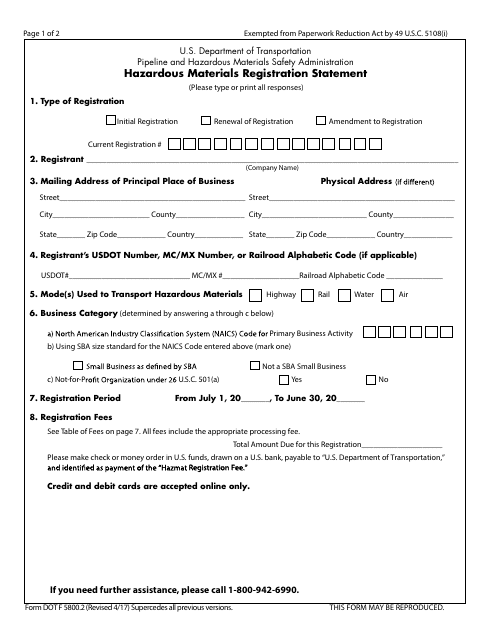

This Form is used for registering hazardous materials.

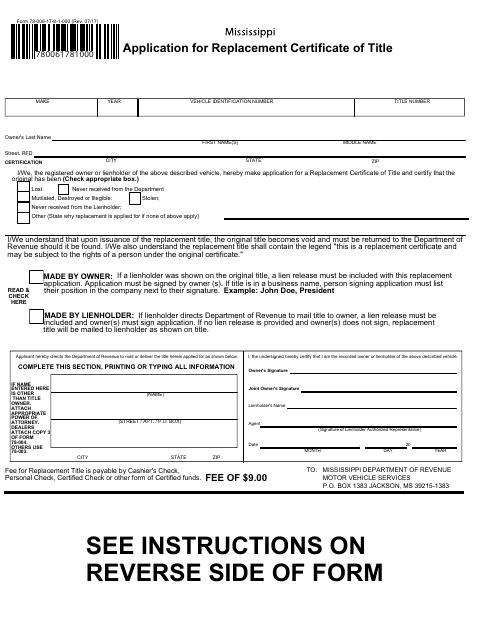

This form is used for applying for a replacement certificate of title in the state of Mississippi.

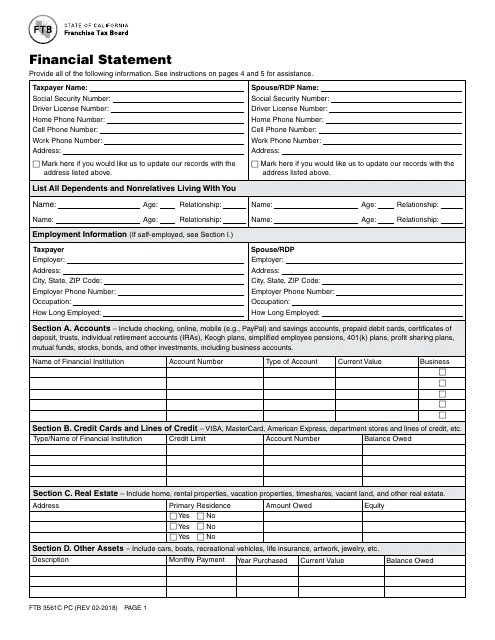

This form is used for filing a financial statement in California.

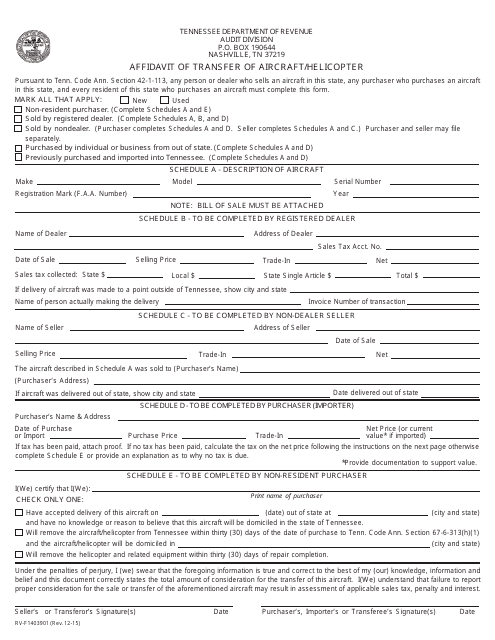

This Form is used for transferring ownership of an aircraft or helicopter in the state of Tennessee. It is an affidavit that confirms the details of the transfer.

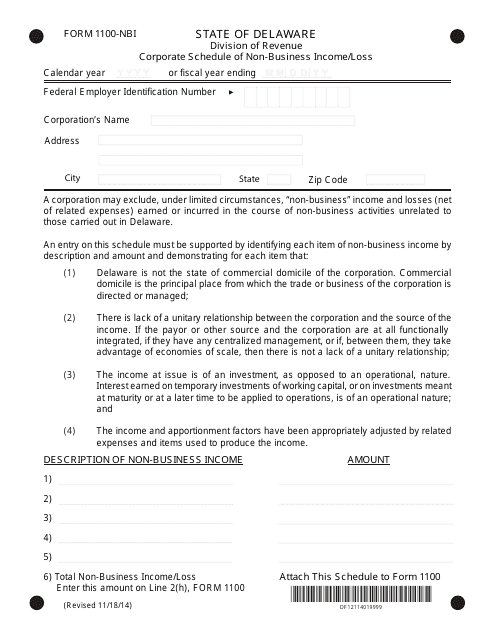

This form is used for reporting non-business income or loss for corporations in Delaware.

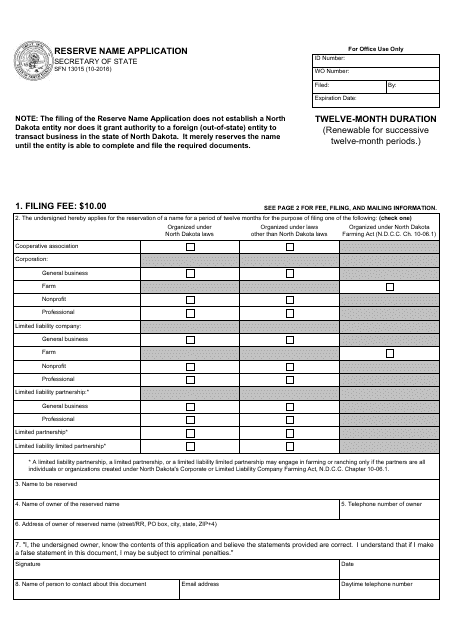

This form is used for reserving a business name in the state of North Dakota.

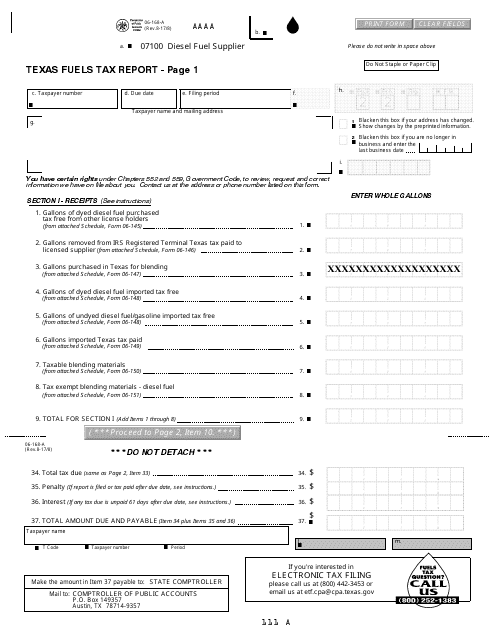

This form is used for reporting fuels tax in the state of Texas. It is required for businesses that sell, distribute, or use motor fuel in Texas.

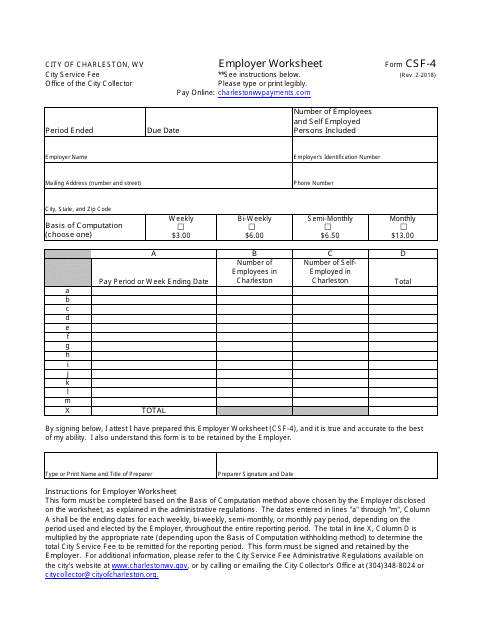

This form is used for employers in the City of Charleston, West Virginia to fill out and provide information related to their business.

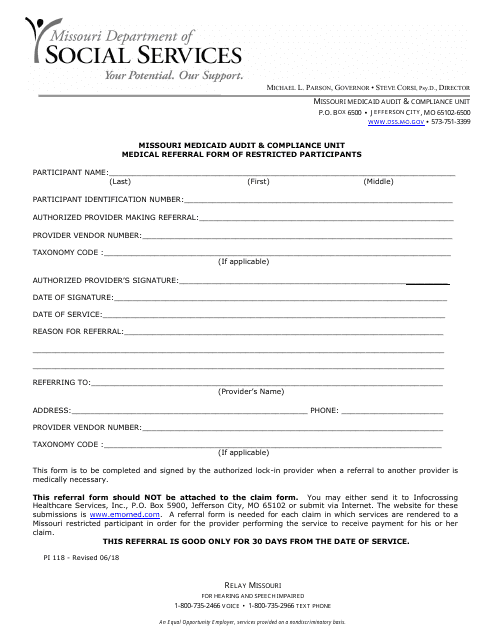

This form is used for referring restricted participants in Missouri for medical treatment.

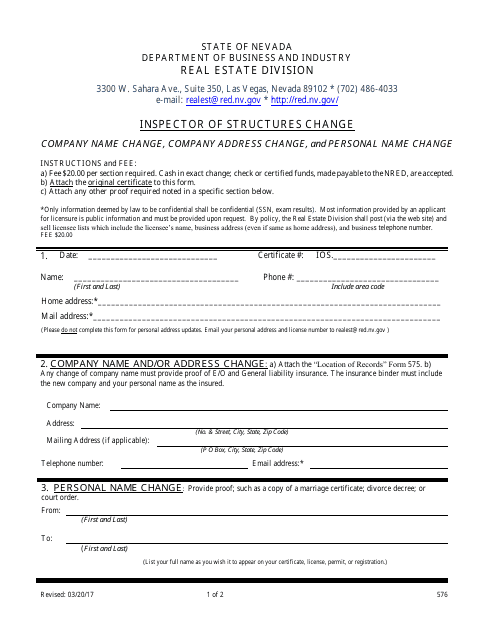

This Form is used for requesting changes to the Inspector of Structures in Nevada.

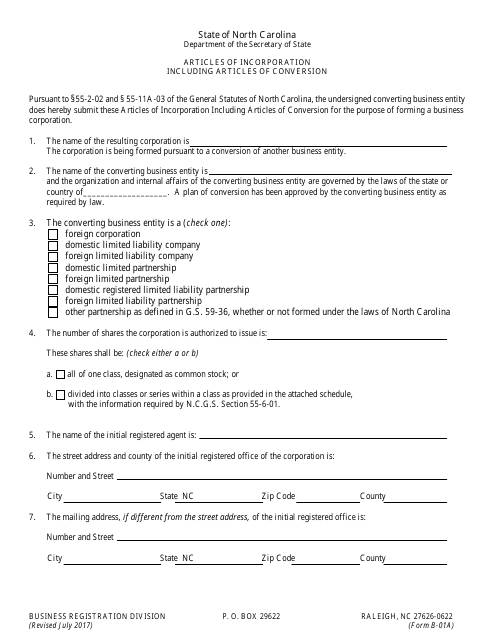

This document is for registering a corporation in North Carolina and converting the corporation's legal status.

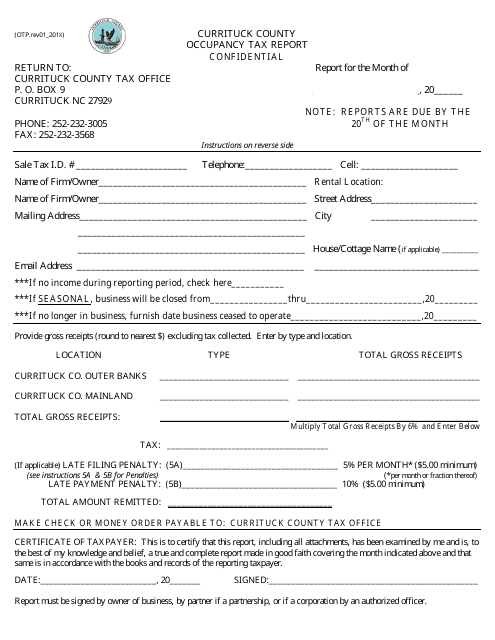

This Form is used for reporting occupancy taxes in Currituck County, North Carolina.

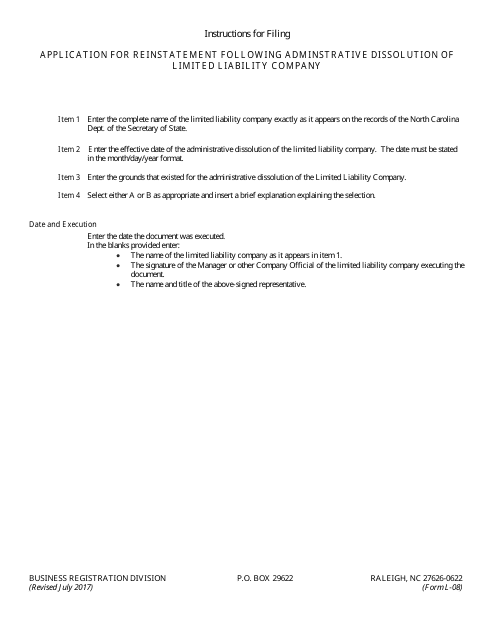

This Form is used for applying to reinstate a Limited Liability Company in North Carolina after it has been administratively dissolved.

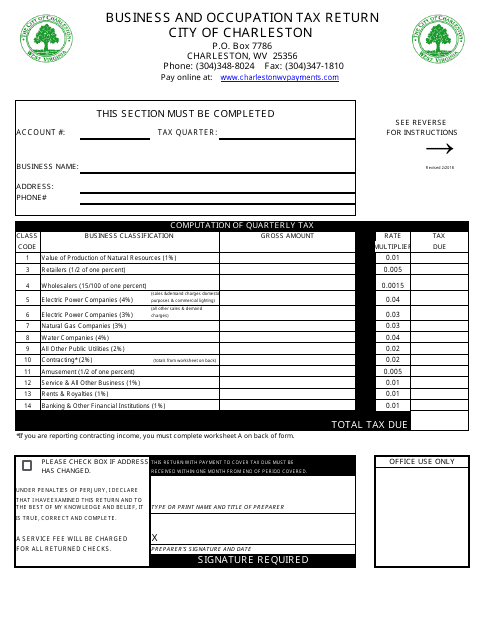

This Form is used for filing the Business and Occupation Tax Return in West Virginia. Businesses are required to report their income and calculate their tax liability using this form.

This is a North Carolina legal document used to request semiannual refunds of sales and use taxes paid on direct purchases and leases of tangible property and services from the Department of Revenue.

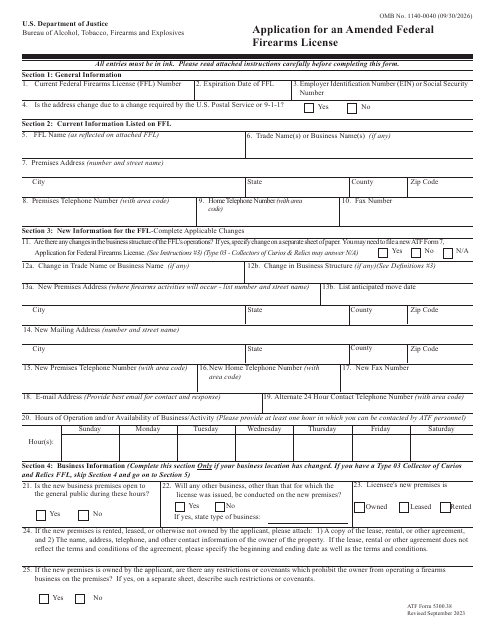

This is a form for Federal Firearms Licensees (FFLs) who move the licensed premises to a different location during the term of an existing Federal Firearms License (FFL). The form serves to certify that they will conduct their firearms business or activity at a new location in compliance with state and local law.