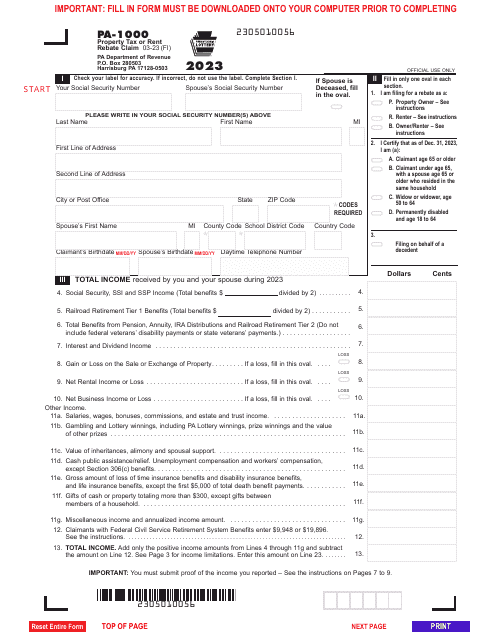

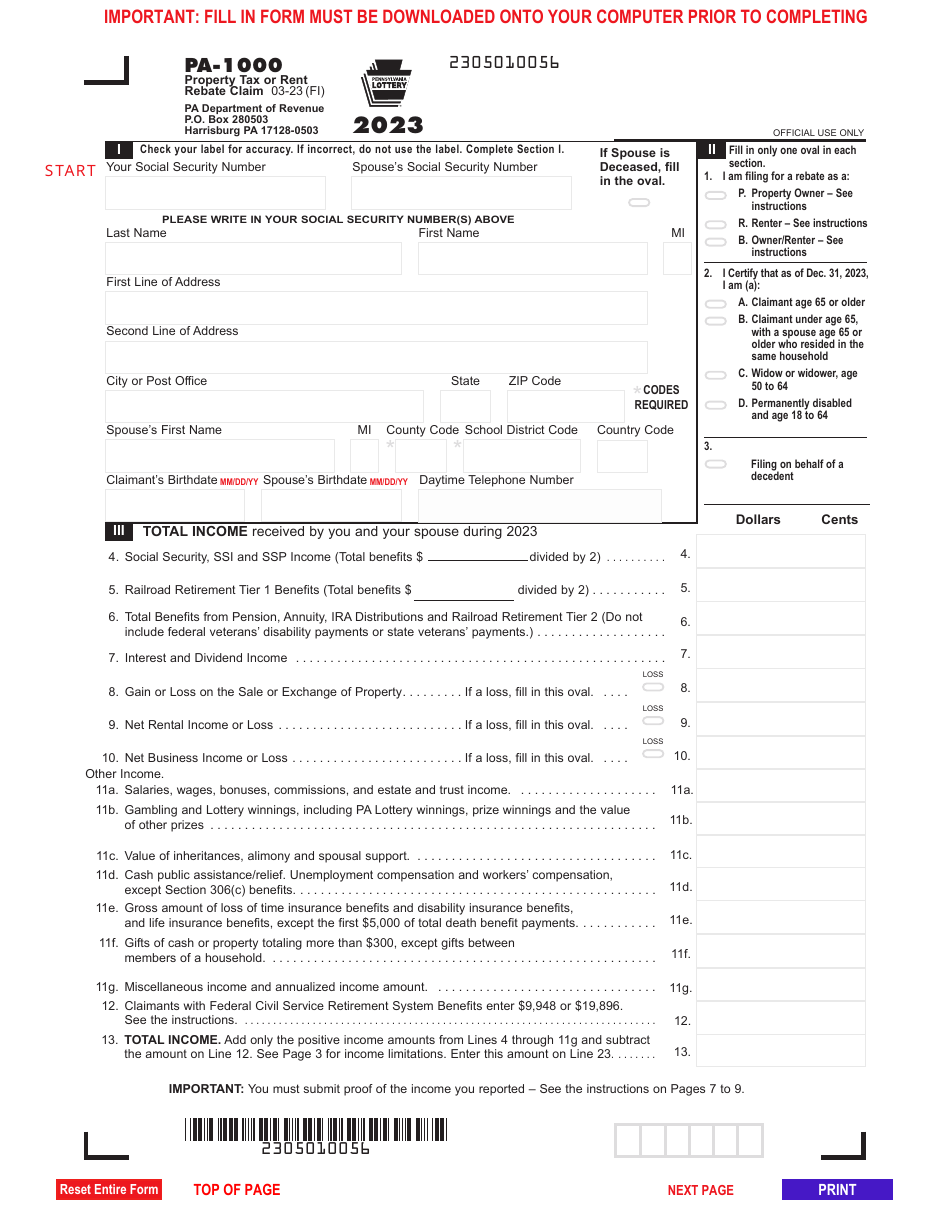

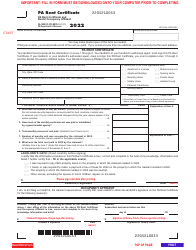

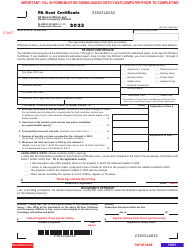

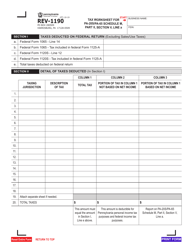

Form PA-1000 Property Tax or Rent Rebate Claim - Pennsylvania

What Is Form PA-1000?

Form PA-1000, Property Tax or Rent Rebate Claim , is a legal document filled out by Pennsylvania residents who wish to refund a portion of rent or property tax paid on their residence. You may file this claim if you owned or rented property and you or your landlord paid property taxes on this residence in 2019.

You are eligible for a property tax or rent rebate if you or your spouse residing in the same household are age 65 or older, you are a widow or widower, age 50 to 64, or you are permanently disabled, age 18 to 64. Additionally, your annual household income must be $35,000 and less if you are a property owner or $15,000 and less if you are a renter.

This form was released by the Pennsylvania Department of Revenue in March 1, 2023 , with all previous editions obsolete. You can download a fillable Form PA-1000 through the link below.

Form PA-1000 Instructions

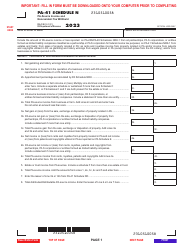

State the following details in a PA-1000 Form:

- Indicate your and your spouse's social security numbers, full names, address, telephone number, and dates of birth. If your spouse is deceased, fill in the oval;

- Choose the reason for filing and certify your eligibility to submit the claim. You may state you are filing on behalf of a decedent;

- Provide a detailed breakdown of the income you and your spouse received during 2019. List the amount of social security benefits, pension, and annuities you received. Count interest and dividend income. Calculate the total amount of salaries, wages, gambling and lottery winnings, inheritances, and alimony you have received during the reporting year. You also need to report the insurance benefits and cash gifts of more than $300. Add the positive income amounts and submit proof of the income your report;

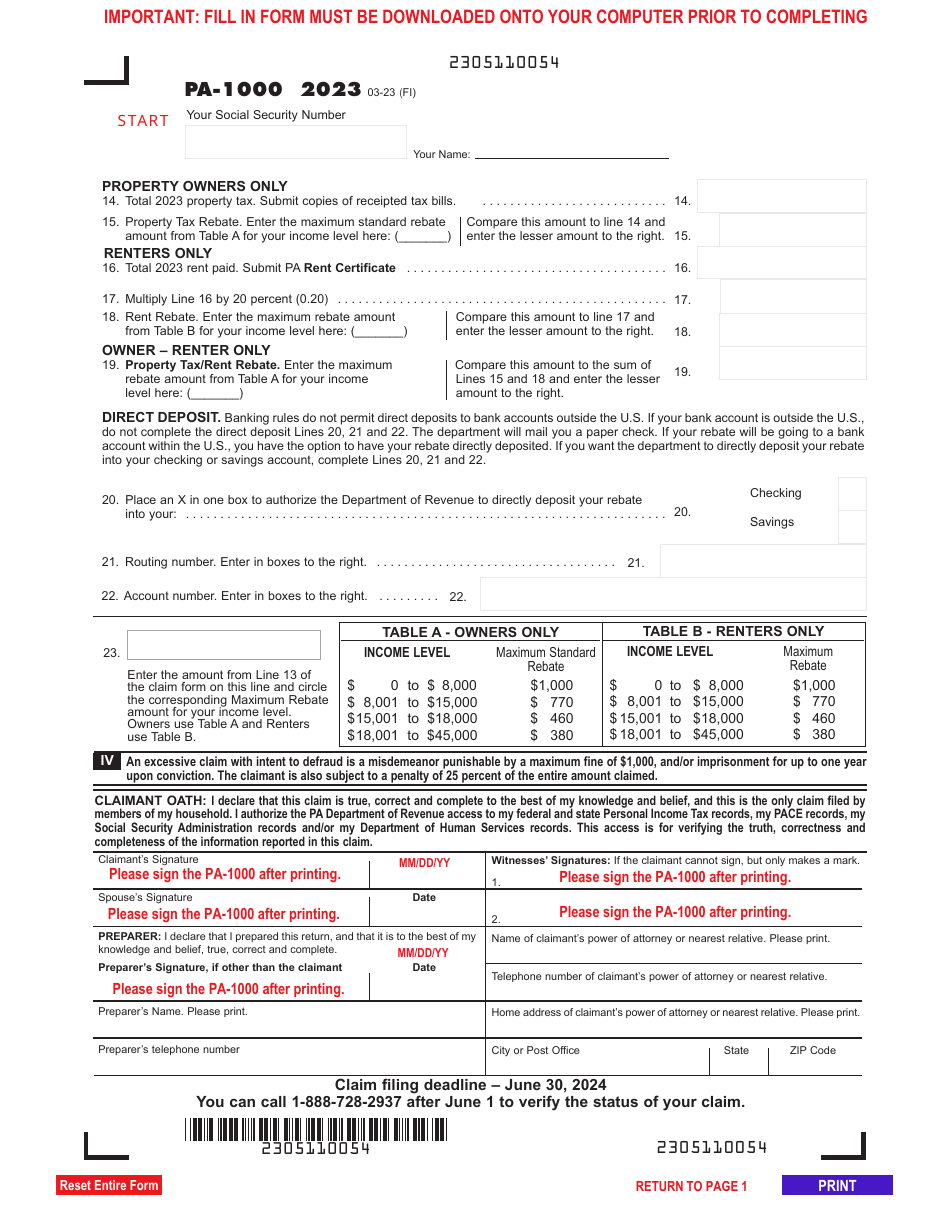

- If you file as a property owner, state your total 2019 property tax and property tax rebate. Attach copies of receipted tax bills;

- If you file as a renter, indicate how much rent you paid and the rent rebate amount;

- If you file as an owner/renter, enter the maximum rebate amount;

- Add your checking or savings account details to receive a direct deposit;

- State your total income amount and circle the appropriate rebate amount for your income level using the tables in the form;

- Print out the form, sign, and date it. The claim must also be signed by your spouse and two witnesses.

In addition to your claim, you also need to send photocopies of documentation that proves this claim - proof of your and your spouse's age, death certificate, proof of permanent disability and reported income, and documents that show property taxes and rents you or your landlord paid. In case you need more in-depth details to file your claim, you may use the official Form PA-1000 Instructions also provided by the Pennsylvania Department of Revenue.

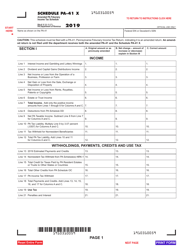

PA-1000 Related Forms

Below you may find documentation to be attached to your claim and general guidelines that will help you to learn more about the Pennsylvania Property Tax/Rent Rebate Program:

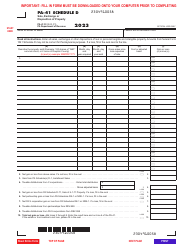

- Form PA-1000 Schedule A, must be completed if you were a property owner for less than the entire year or you are filing on behalf of a deceased owner;

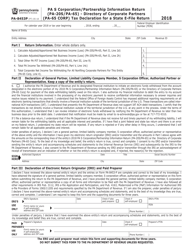

- Form PA-1000 Schedule F/G, is submitted when there are more owners on your deed than just you, your spouse, and minor children. It will also allow you to calculate the annualized income that will be included in the household income;

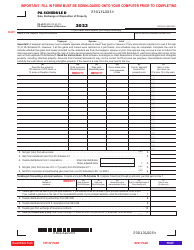

- Form PA-1000 Schedule B/D/E, is filled out by widows and widowers, renters who received cash public assistance during any part of the reporting year, and claimants who used part of their households for a purpose other than a personal residence;

- PA-1000 PS, Physician's Statement, is provided by the physician who certifies permanent and total disability of the patient unable to present an alternative proof of such disability;

- Form PA-1000 RC, PA Rent Certificate, is a document signed by the landlord to provide proof of paid rent;

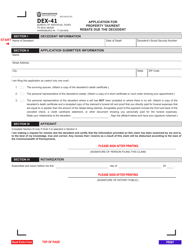

- Form DEX-41, Application For Refund/Rebate Due the Decedent, is completed by the decedent's personal representative who wishes to claim a rebate;

- Form DFO-03, Property Tax/Rent Rebate Preparation Guide, was released in 2019 to provide potential claimants with additional information and instructions on how to complete Form PA-1000.