Low Income Housing Tax Credit Templates

Are you looking for affordable housing options? The Low-Income Housing Tax Credit (LIHTC) program might be the solution for you. Also known as the low income housing tax credit, this initiative helps individuals and families with limited incomes find quality housing at more affordable prices.

Finding affordable housing can be a challenge, especially in high-cost areas. However, the low income housingtax credit program provides valuable incentives for property owners to develop and maintain rental units for low-income individuals and families. By offering tax credits to these property owners, the government encourages the creation of more affordable housing options for those in need.

Whether you're a property owner or a potential tenant, familiarizing yourself with the low income housing tax credit program is crucial. Property owners can benefit from tax incentives while providing much-needed affordable housing units, while tenants can take advantage of reduced rental rates that fit within their budget.

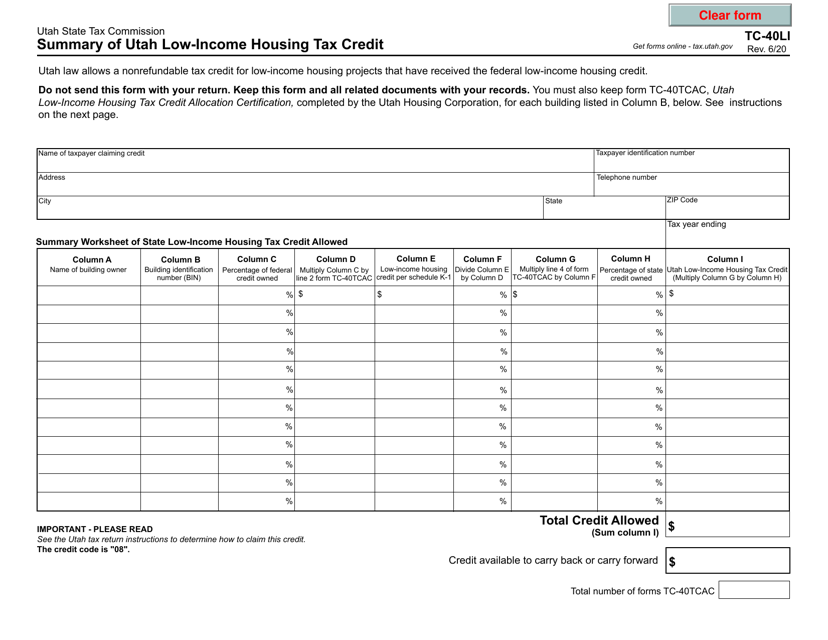

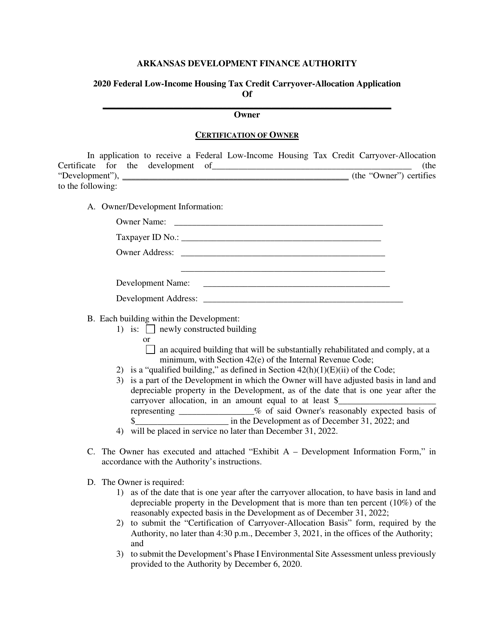

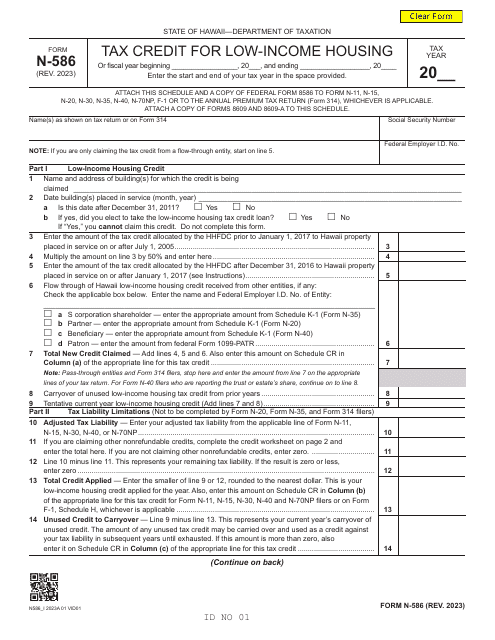

Don't let the high cost of housing deter you from finding a place to call home. Explore the various documents related to the low income housing tax credit program, such as federal low-income housing tax credit applications, lease riders for low income units, owner certification instructions, and more. These documents provide valuable information on how to navigate the application process and understand the requirements for participating in the program.

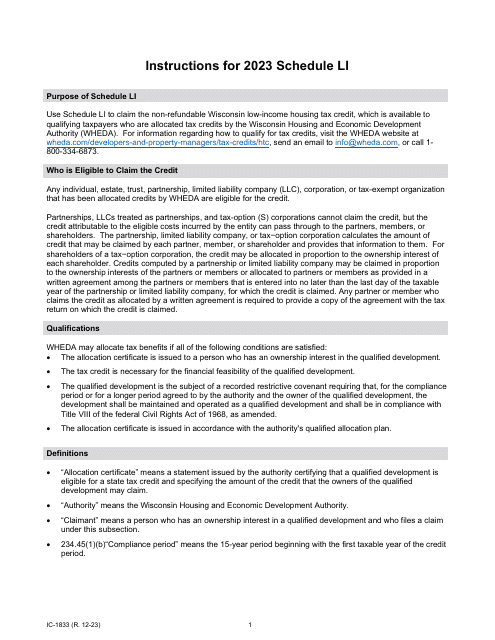

If you're a property owner, consider filing a director review application for LIHTC projects to receive additional guidance and support from relevant authorities. Additionally, certain states may have their own specific forms and guidelines for low income housing tax credit applications, such as the IC-833 Schedule LI in Wisconsin.

The low income housing tax credit program offers an array of benefits for both property owners and tenants. As a property owner, you can enjoy tax credits and incentives while fulfilling a vital social responsibility by offering affordable housing options. Tenants, on the other hand, can benefit from reduced rental rates and the opportunity to live in safe and comfortable communities.

Take advantage of the opportunities provided by the low income housing tax credit program and explore the various documents and resources available. Whether you're interested in applying for low income housing or developing affordable housing units, these documents will guide you through the process and help you make informed decisions.

Invest in the future of affordable housing by embracing the low income housing tax credit program. With the help of these documents, you can play a role in providing stable and affordable homes for individuals and families with limited incomes.

Documents:

11

This Form is used for applying for federal low-income housing tax credit carryover-allocation in Arkansas.

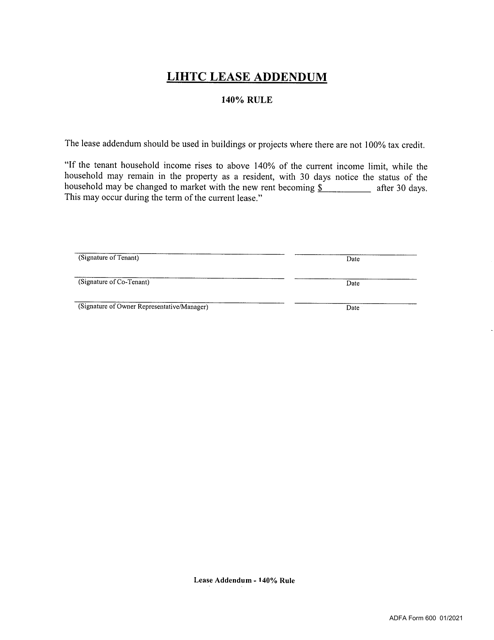

This form is used for adding a lease addendum to LIHTC (Low-Income Housing Tax Credit) properties in Arkansas, specifically for the 140% rule.

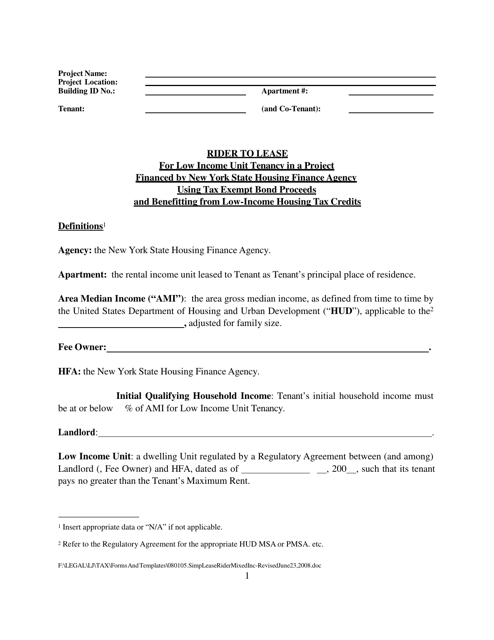

This document is a rider or addendum that is used in the leasing agreement for low-income housing units in a project financed by the New York State Housing Finance Agency. The project is funded using tax-exempt bonds and also benefits from low-income housing tax credits. It outlines specific terms and conditions related to the tenancy of low-income tenants in these units.

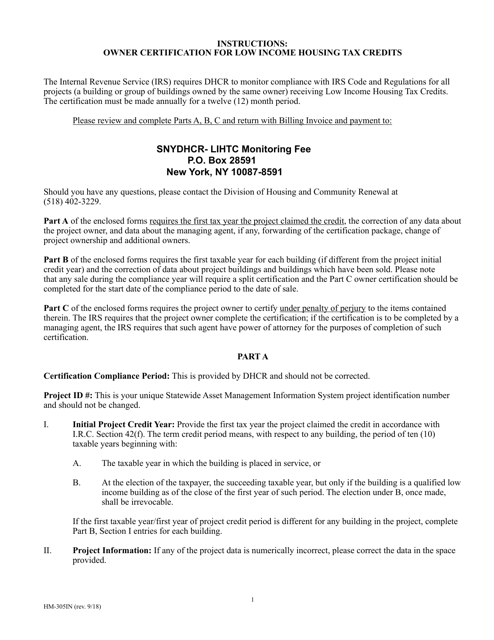

This document provides instructions for owners certifying low-income housing tax credits in New York.

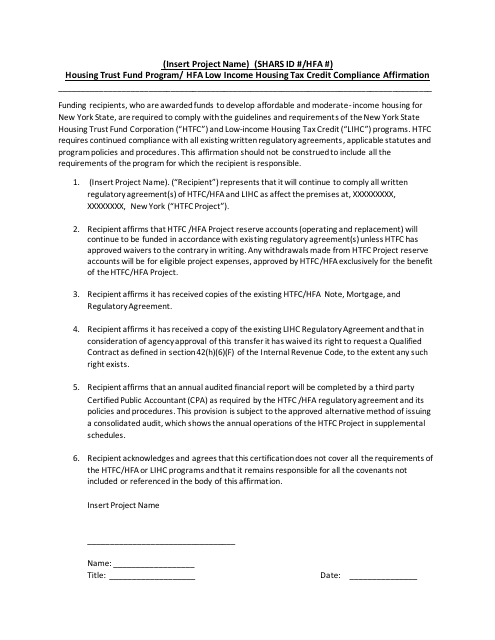

This document is used for affirming compliance with the Low Income Housing Tax Credit program in New York's Housing Trust Fund Program.