Low Income Housing Templates

Are you looking for affordable housing options? Our website provides a wealth of information on low incomehousing programs and resources that can help you secure affordable housing in your area. We understand that finding suitable housing can be challenging, especially if you have a limited income. That's why we are here to assist you in navigating the various low income housing options available.

Whether you are a tenant looking for affordable rental units or a landlord interested in participating in low income housing programs, we have the resources to guide you through the process. Our extensive collection of documents includes forms, instructions, and guidelines specific to low income housing programs in different states.

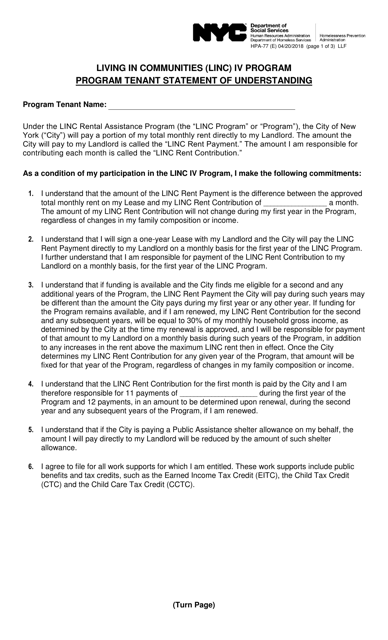

If you are a tenant, you may be interested in filling out the "Tenant Statement of Understanding" form, which outlines the terms and conditions of the Low-Income Housing Credit program. This program provides tax credits to property owners who offer affordable housing to low-income individuals and families.

If you are a landlord, you may find the "Actual Development Cost Certificate" form useful. This form is required for developers to certify the actual cost of developing low income housing projects, ensuring transparency and accountability in the program.

In addition to these specific documents, we also provide general information on low income housing programs, eligibility requirements, and how to apply. Our goal is to empower you with the knowledge and resources needed to access affordable housing options in your community.

Don't let limited income hinder your ability to find quality housing. Browse through our extensive collection of low income housing documents and get started on your journey to secure affordable housing today.

Documents:

92

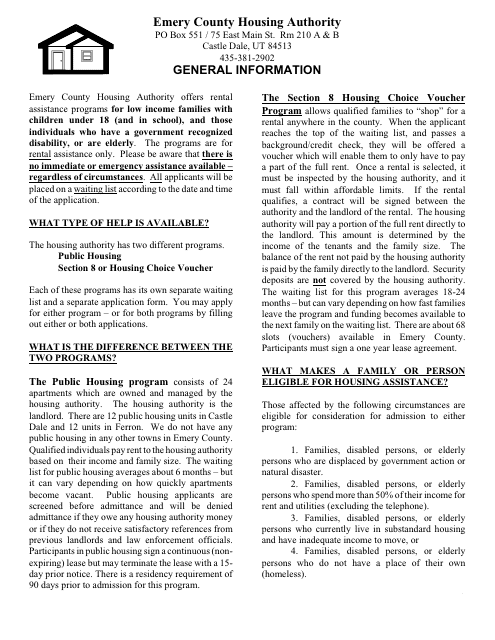

This form is used for applying for Section 8 rental assistance in Emery County, Utah.

This document is an addition to the exemption application for housing for low-income persons in the state of Kansas. It provides additional information or updates to the original application.

This Form is used for giving consent to release demographic data for LIHTC program.

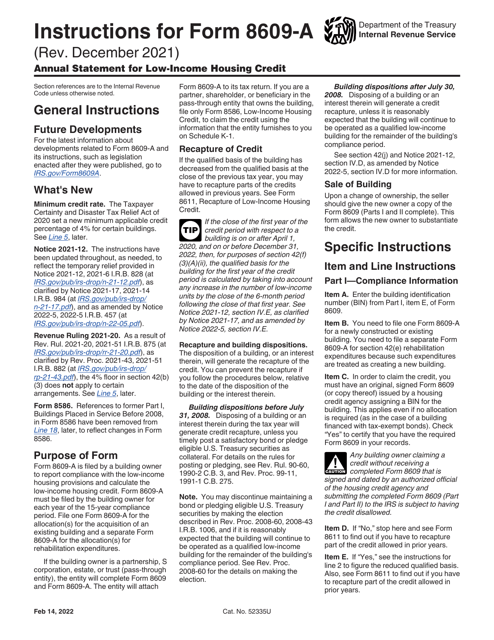

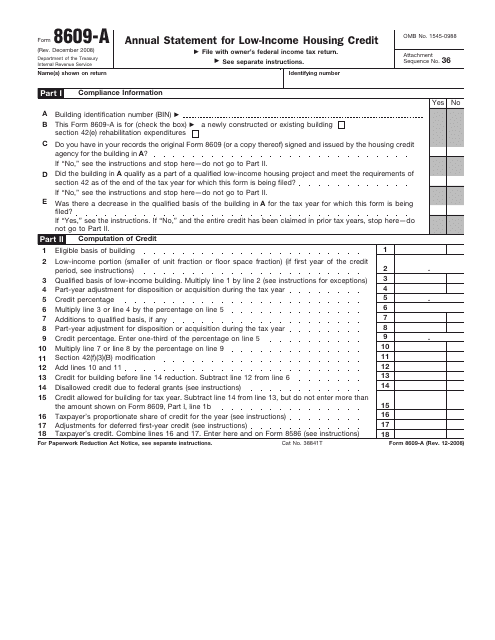

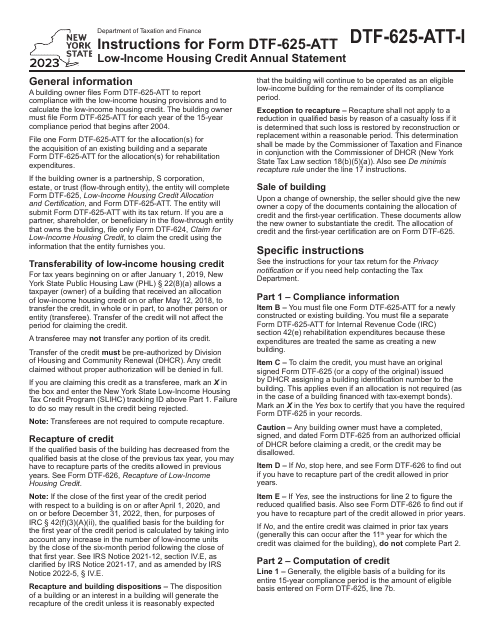

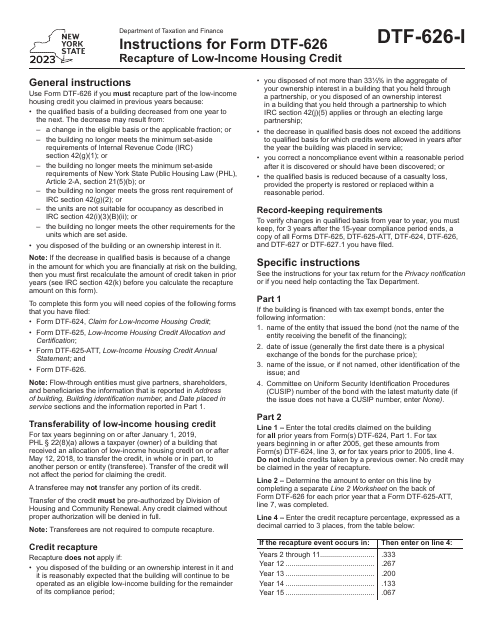

This document is used for reporting the annual statement for the Low-Income Housing Credit, as required by the IRS.

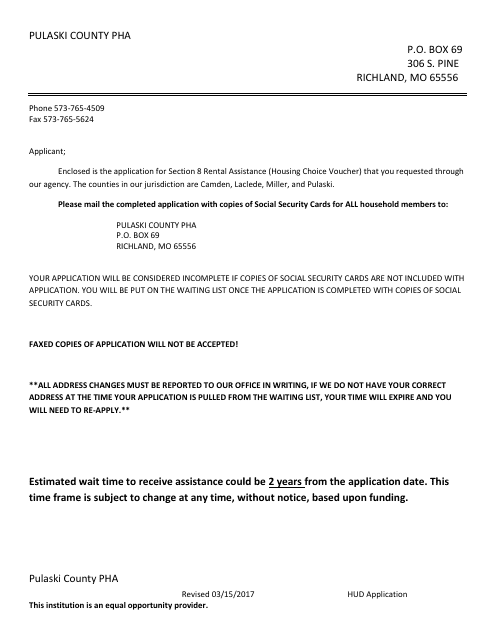

This form is used for applying for Section 8 rental assistance in Pulaski County, Missouri.

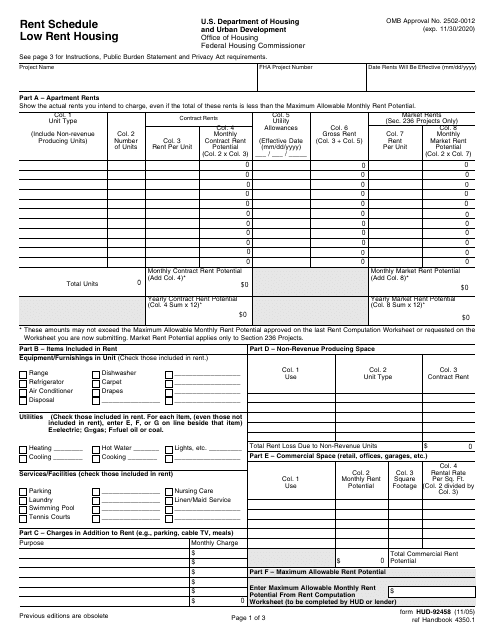

This form is used for providing a schedule of low rent housing costs for the Department of Housing and Urban Development (HUD). It helps in determining the rent amount for affordable housing.

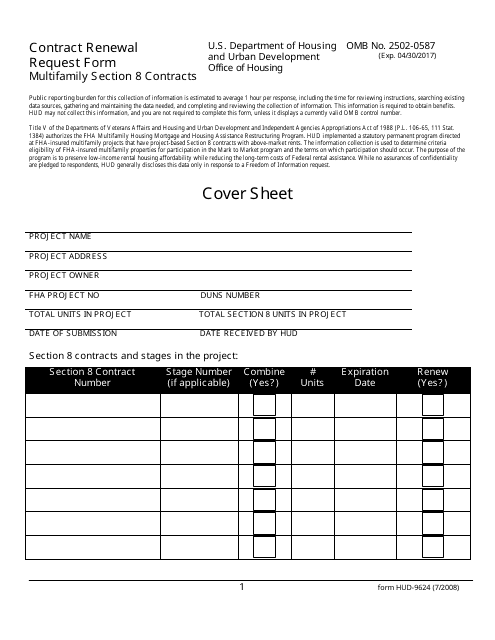

This form is used for requesting the renewal of Multifamily Section 8 contracts for housing assistance.

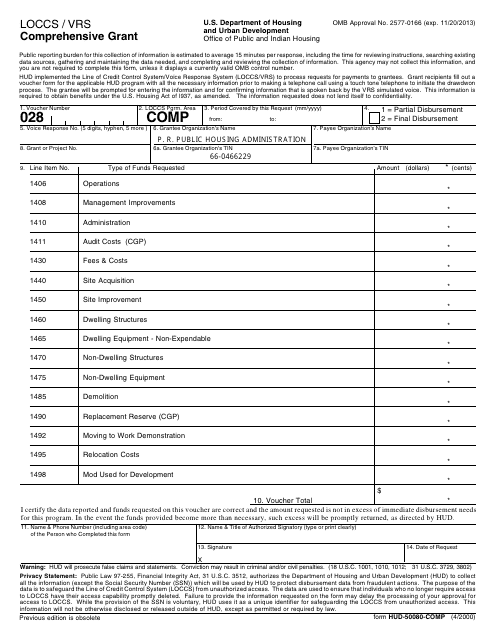

This form is used for reporting on the Loccs/Vrs comprehensive grant.

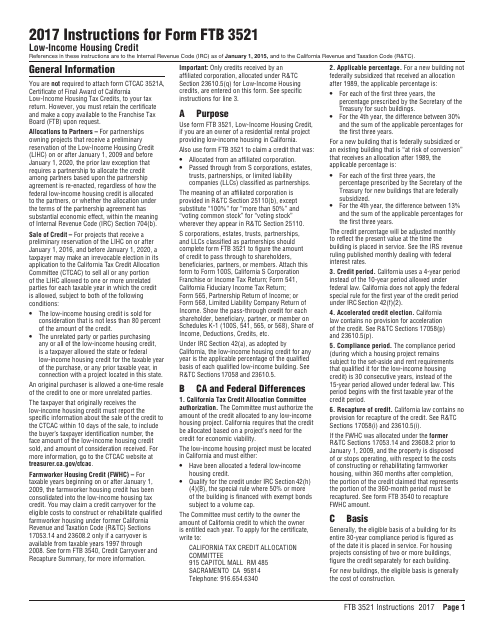

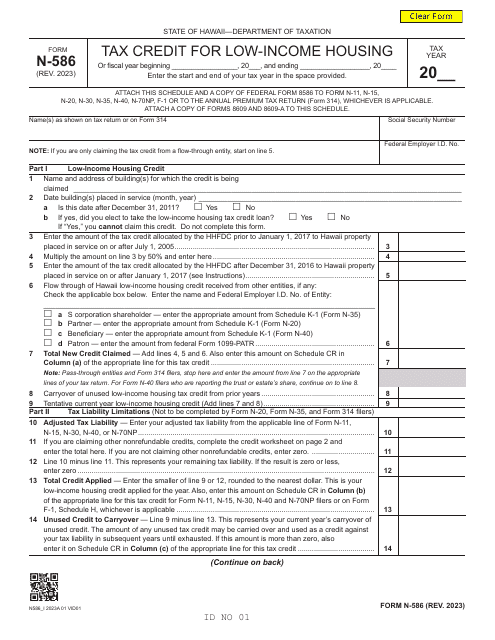

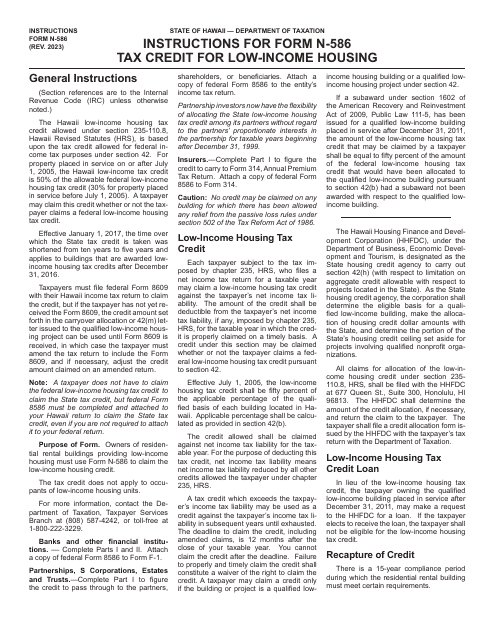

This Form is used for claiming the Low-Income Housing Credit in the state of California. It provides instructions on how to complete and submit the form to the California Franchise Tax Board.

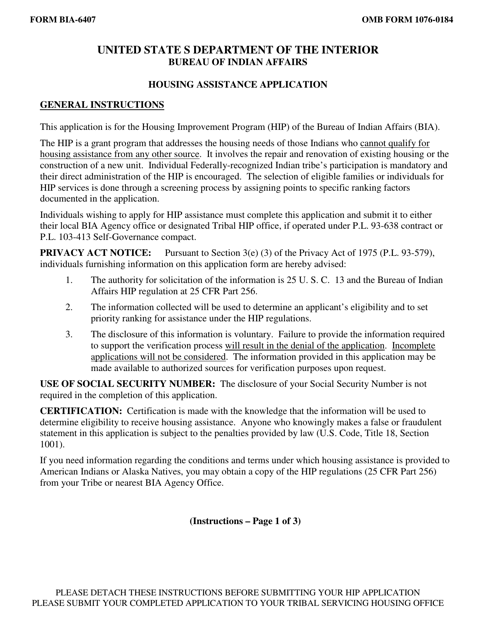

This document provides instructions for completing the BIA Form 6407 Housing Assistance Application used to apply for housing assistance.

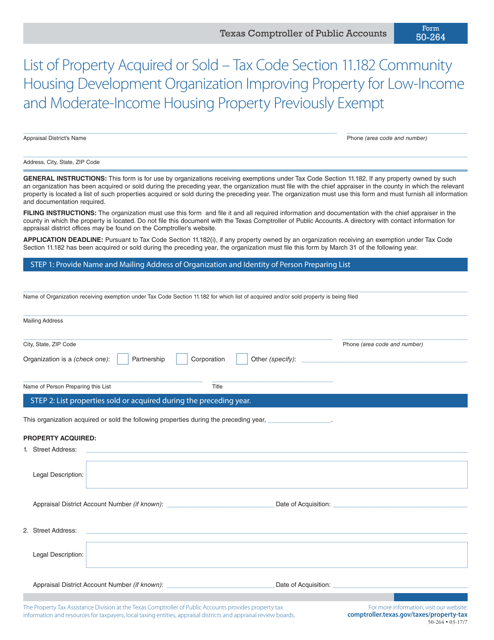

This form is used for reporting the list of properties that have been acquired or sold. It is specifically related to Tax Code Section 11.182 and pertains to the improvement of property for low-income and moderate-income housing. This document is applicable in the state of Texas.

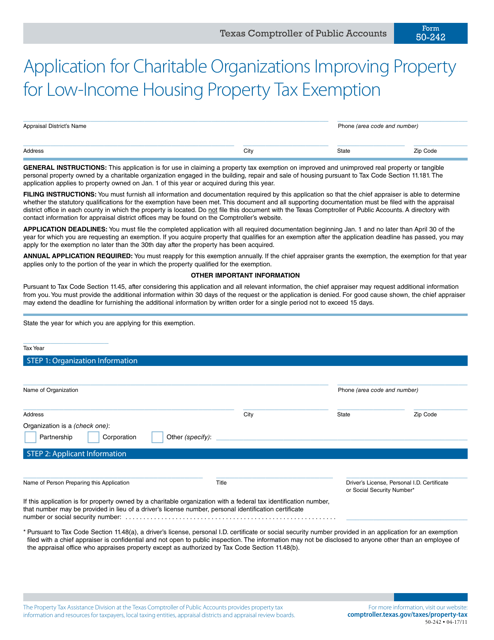

This Form is used for applying for a property tax exemption in Texas for charitable organizations that improve property for low-income housing.

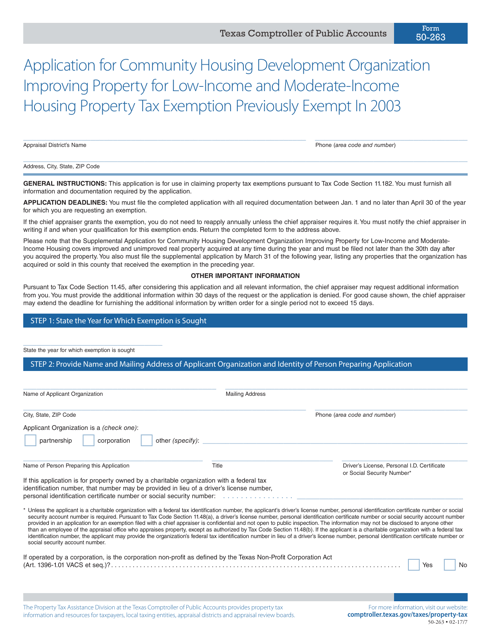

This form is used for applying for a property tax exemption for a Community Housing Development Organization (CHDO) that is improving property for low-income and moderate-income housing in Texas.

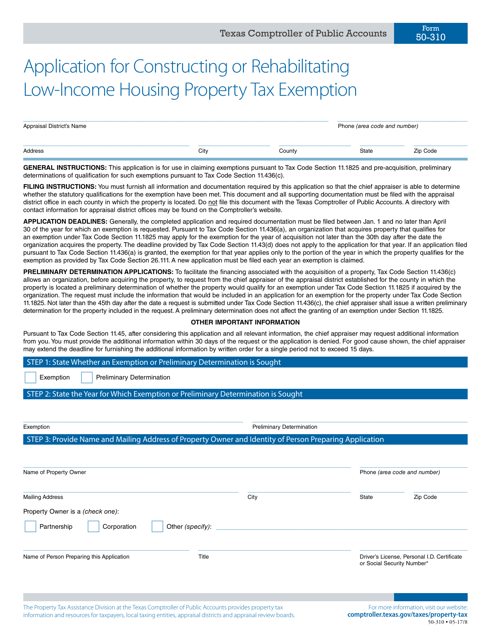

This form is used for applying for a property tax exemption in Texas for constructing or rehabilitating low-income housing.

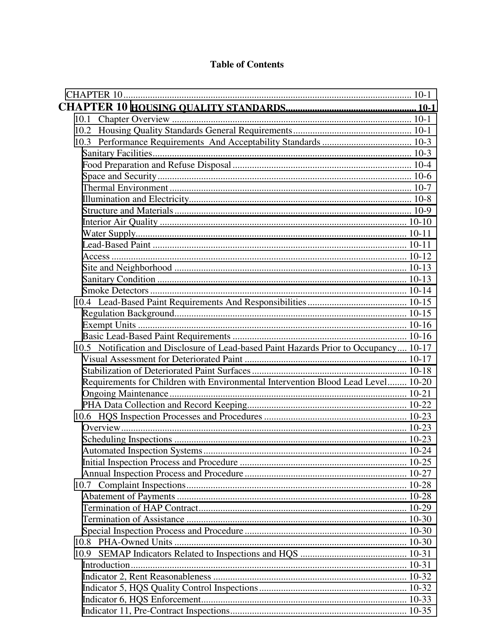

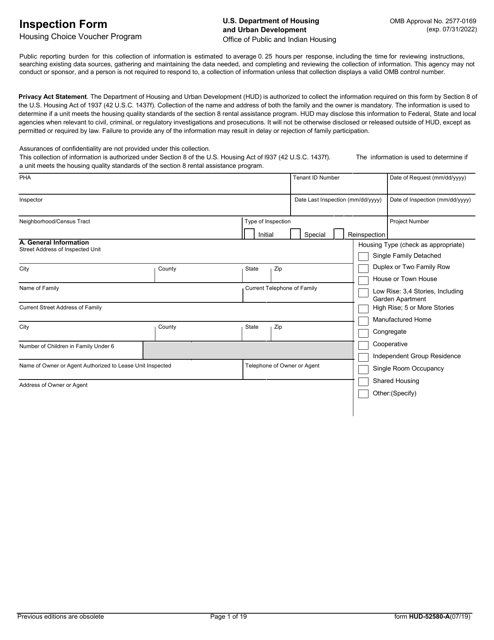

This document provides guidance on the Housing Quality Standards for the Housing Choice Voucher Program. It outlines the requirements and standards for rental properties to ensure they meet safe and decent housing standards.

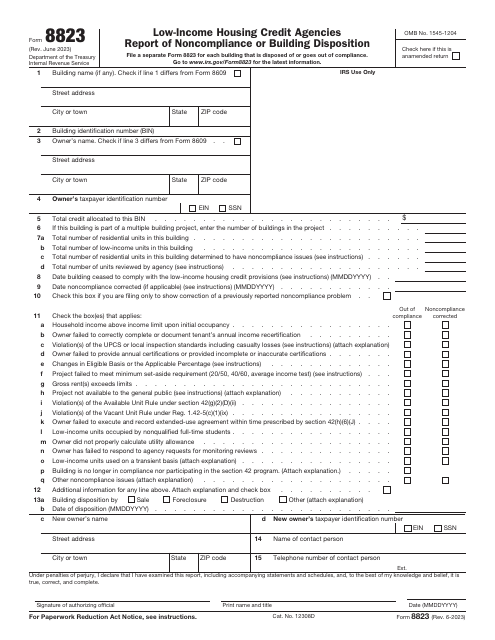

This is a formal document a housing credit agency is supposed to use to inform the tax authorities about certain noncompliance issues discovered during the inspection of a building and its units or specific instances of building disposition

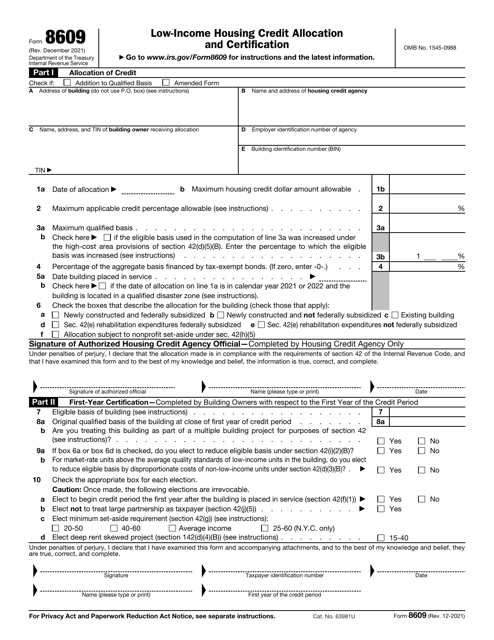

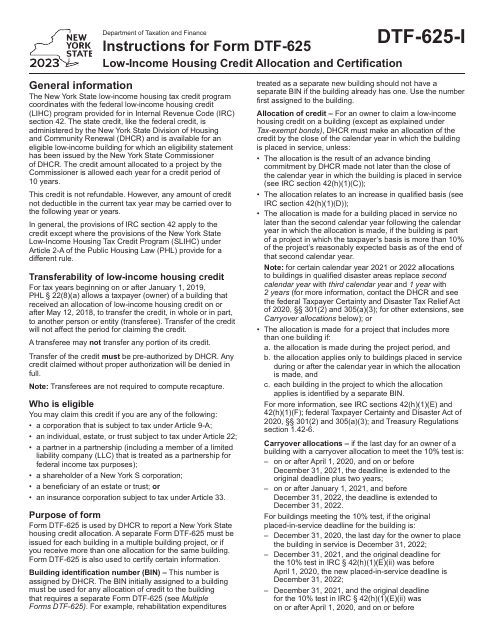

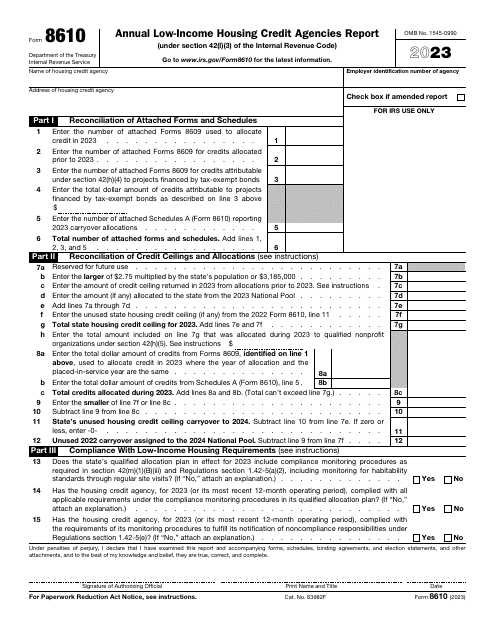

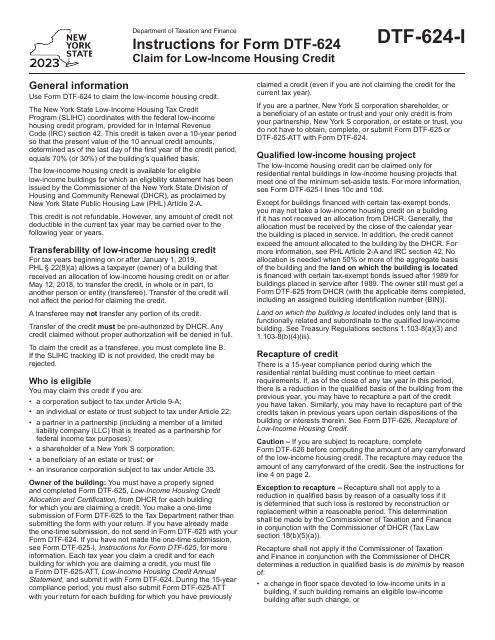

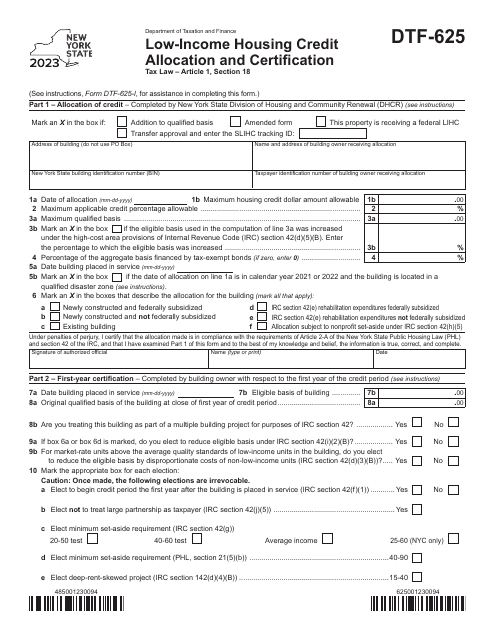

This is a formal IRS statement a housing credit agency is supposed to complete to inform the fiscal authorities about the total amount of housing credits their entity has allocated during the twelve months outlined in the form.

This form is used for the Living in Communities (Linc) IV Program in New York City. It is a Tenant Statement of Understanding that outlines the tenant's responsibilities and obligations.

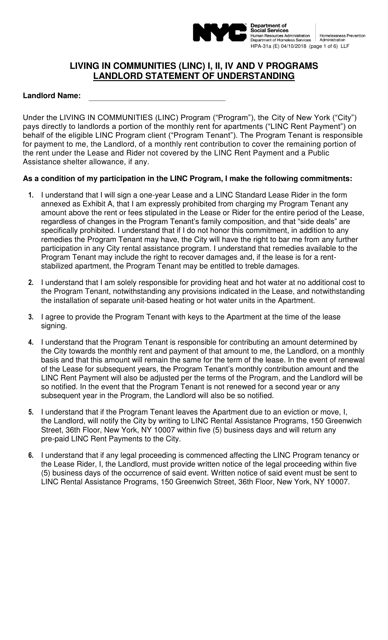

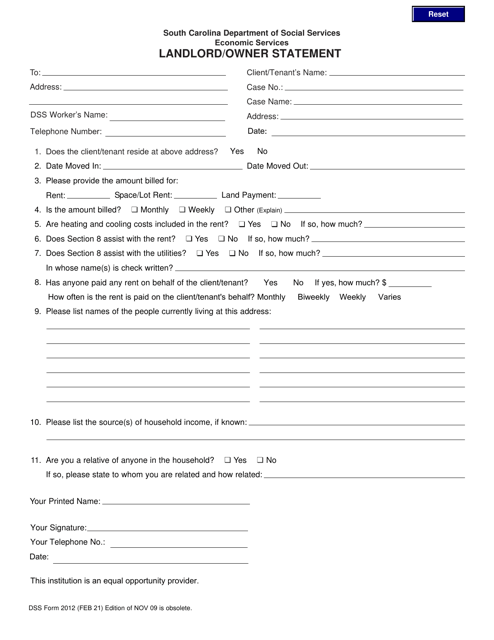

This form is used for the Landlord Statement of Understanding in the Living in Communities (Linc) I, II, IV, and V Programs in New York City.

This Form is used for conducting inspections under the Housing Choice Voucher Program.

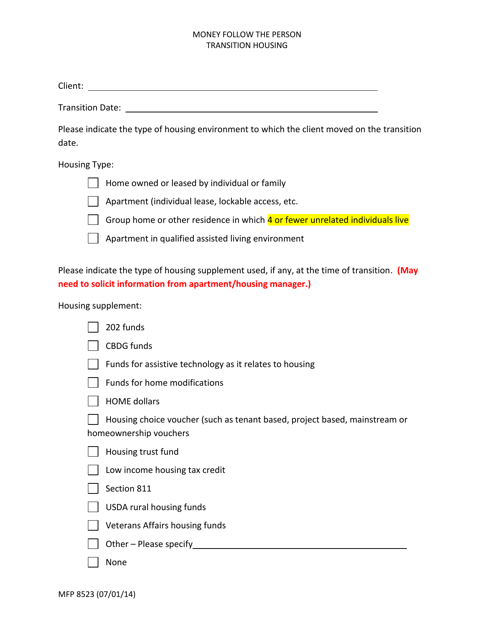

This Form is used for the Money Follows the Person Transition Housing program in Arkansas. It allows individuals to apply for assistance in transitioning from long-term care facilities to community-based housing.

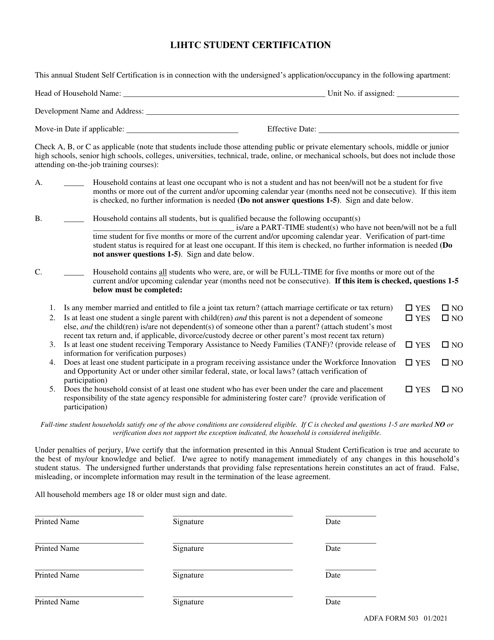

This form is used for LIHTC (Low-Income Housing Tax Credit) student certification in Arkansas.

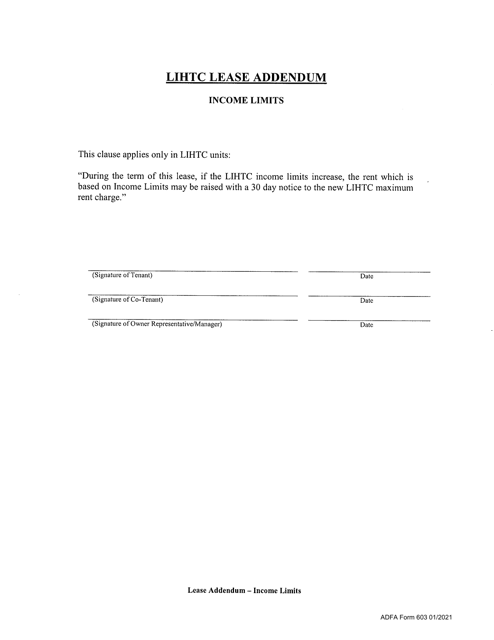

This document is a form used for adding an income limit provision to a Low-Income Housing Tax Credit (LIHTC) lease in Arkansas. It helps ensure that tenants meet the income requirements for affordable housing.